Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PROLOR Biotech, Inc. | v342315_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - PROLOR Biotech, Inc. | v342315_ex99-1.htm |

Merger Overview April 25 2013 NYSE: OPK NYSE Mkt : PBTH

Safe Harbor Statement This presentation contains " forward - looking statements," as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as "expects," "plans," "projects," "will," "may," "anticipates," "believes," "should," "intends," "estimates," and other words of similar meaning, including statements regarding the benefits resulting from the acquisition of PROLOR, including whether the Phase 3 clinical trials for hGH - CTP will be commenced or completed on a timely basis or at all, that earlier clinical results may not be reproducible or indicative of future results, that hGH - CTP and/or any of PROLOR’s compounds under development may fail, may not achieve the expected results or effectiveness and may not generate data that would support the approval or marketing of products for the indications being studied or for other indications, that currently available products, as well as products under development by others, may prove to be as or more effective than PROLOR’s products for the indications being studied, as well as other non - historical statements about our expectations, beliefs or intentions regarding our business, technologies and products, financial condition, strategies or prospects . Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward - looking statements . These factors include those described in OPKO’s and PROLOR’s filings with the Securities and Exchange Commission, the ability to obtain regulatory approvals for the transaction on the proposed terms and schedule ; the failure of OPKO’s or PROLOR’s stockholders to approve the transaction ; the risk that a condition to closing of the merger may not be satisfied ; the time required to consummate the proposed merger ; the focus of management on merger - related issues ; the risk that the businesses will not be integrated successfully ; the risk that any potential synergies from the transaction may not be fully realized or may take longer to realize than expected ; new information arising out of clinical trial results ; and the risk that the safety and/or efficacy results of existing clinical trials will not support continued clinical development, as well as risks inherent in funding, developing and obtaining regulatory approvals of new, commercially - viable and competitive products and treatments . In addition, forward - looking statements may also be adversely affected by general market factors, competitive product development, product availability, federal and state regulations and legislation, the regulatory process for new products and indications, manufacturing issues that may arise, patent positions and litigation, among other factors . The forward - looking statements contained in this presentation may become outdated over time . OPKO and PROLOR do not assume any responsibility for updating any forward - looking statements .

Additional Information and Where to Find It This presentation is being made pursuant to and in compliance with Rules 165 and 425 of the Securities Act of 1933 and does not constitute an offer of any securities for sale or a solicitation of an offer to buy any securities. In connection with the proposed transaction, PROLOR and OPKO expect to file a proxy statement/prospectus as part of a registration statement regarding the proposed transaction with the Securities and Exchange Commission, or SEC. Investors and security holders are urged to read the proxy statement/prospectus regarding the proposed transaction when it becomes available, as well as other documents filed with the SEC, because they will contain important information. You will be able to obtain a copy of the proxy statement/prospectus, as well as other filings containing information about PROLOR and OPKO, without charge, at the SEC’s website ( www.sec.gov ). You may also obtain copies of all documents filed with the SEC, without charge, by directing a request to Shachar Shlosberger, PROLOR Biotech, Inc., 7 Golda Meir Street, Weizmann Science Park, Nes - Ziona , Israel 74140 , telephone ( 866 ) 644 - 7811 or OPKO Health, Inc., 4400 Biscayne Blvd., Miami, Florida, telephone ( 305 ) 575 - 4100 .

Participants in the Merger Solicitation PROLOR, OPKO and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from PROLOR and OPKO shareholders in connection with the proposed transaction. Information about PROLOR’s directors and executive officers is set forth in its proxy statement for its 2012 Annual Meeting of Stockholders, which was filed with the SEC on April 24 , 2012 , and its Annual Report on Form 10 - K for the year ended December 31 , 2012 , filed on March 15 , 2013 . These documents are available free of charge at the SEC’s website at www.sec.gov, or by going to PROLOR’s Investor Relations page on its corporate website at www.prolor - biotech.com. Information about OPKO’s directors and executive officers is set forth in its proxy statement for its 2012 Annual Meeting of Stockholders, which was filed with the SEC on April 27 , 2012 , and its Annual Report on Form 10 - K for the year ended December 31 , 2012 , filed on March 18 , 2013 . These documents are available free of charge at the SEC’s website at www.sec.gov, or by going to OPKO’s Investor Relations page on its corporate website at www.opko.com. Additional information regarding the interests of participants in the solicitation of proxies in connection with the transaction will be included in the proxy statement/prospectus that PROLOR and OPKO intend to file with the SEC.

OPKO Corporate Overview ( 1 ) A U.S. public company listed on NYSE (NYSE: OPK) A multi - national biopharmaceutical and diagnostics company, 549 employees Developing a range of solutions to diagnose, treat and prevent various conditions, including point - of - care tests, laboratory developed tests , molecular diagnostics tests, and proprietary pharmaceuticals and vaccines Market capitalization: ~$2.2 bn pre - merger, ~2.7 bn post merger In Jan 2013 raised $175 million in convertible debt Chairman and largest shareholder is Dr. Phillip Frost Headquartered in Miami, with facilities in Florida, Massachusetts, Tennessee, California, Illinois, Ontario, Brazil, Chile, Mexico, Spain and Israel 5

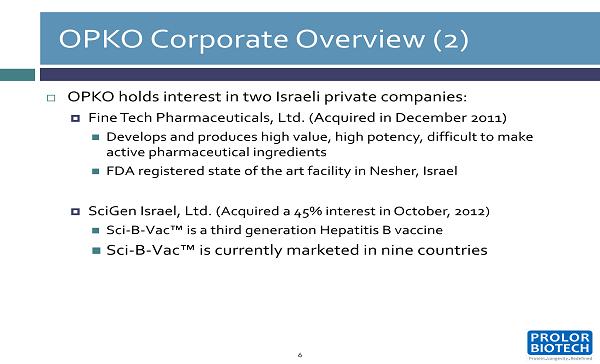

OPKO Corporate Overview ( 2 ) OPKO holds interest in two Israeli private companies: Fine Tech Pharmaceuticals, Ltd. (Acquired in December 2011 ) Develops and produces high value, high potency, difficult to make active pharmaceutical ingredients FDA registered state of the art facility in Nesher , Israel SciGen Israel, Ltd. ( Acquired a 45 % interest in October, 2012 ) Sci - B - Vac is a third generation Hepatitis B vaccine Sci - B - Vac is currently marketed in nine countries 6

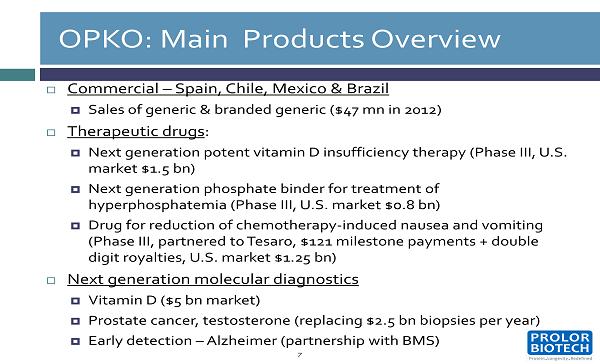

OPKO: Main Products Overview Commercial – Spain, Chile, Mexico & Brazil Sales of generic & branded generic ($ 47 mn in 2012 ) Therapeutic drugs : Next generation potent vitamin D insufficiency therapy (Phase III, U.S. market $ 1.5 bn ) Next generation phosphate binder for treatment of hyperphosphatemia (Phase III, U.S. market $ 0.8 bn ) Drug for reduction of chemotherapy - induced nausea and vomiting (Phase III, partnered to Tesaro , $ 121 milestone payments + double digit royalties, U.S. market $ 1.25 bn ) Next generation molecular diagnostics Vitamin D ($ 5 bn market) Prostate cancer, testosterone (replacing $ 2.5 bn biopsies per year) Early detection – Alzheimer (partnership with BMS) 7

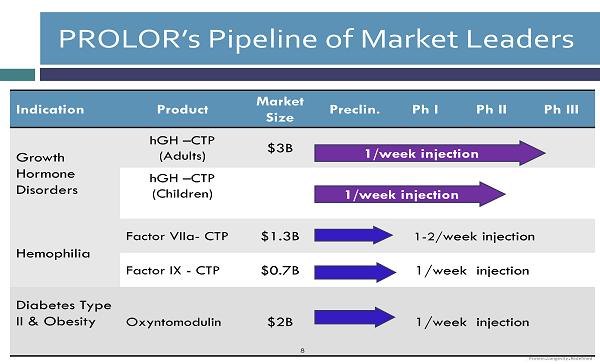

Indication Product Market Size Preclin. Ph I Ph II Ph III Growth Hormone Disorders hGH – CTP (Adults) $3B hGH – CTP (Children) Hemophilia Factor VIIa - CTP $1.3B 1 - 2/ week injection Factor IX - CTP $0.7B 1/week injection Diabetes Type II & Obesity Oxyntomodulin $2B 1/week injection PROLOR’s Pipeline of Market Leaders 1 /week injection 8 1 /week injection

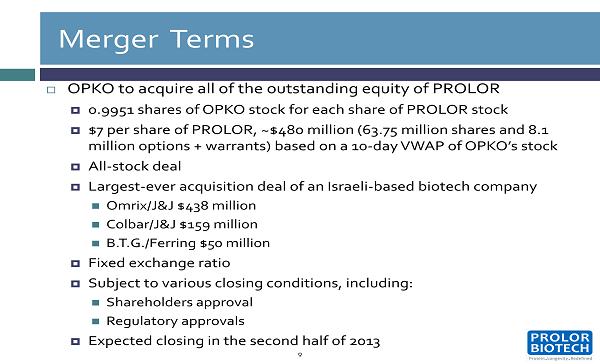

Merger Terms OPKO to acquire all of the outstanding equity of PROLOR 0.9951 shares of OPKO stock for each share of PROLOR stock $ 7 per share of PROLOR, ~$ 480 million ( 63.75 million shares and 8.1 million options + warrants) based on a 10 - day VWAP of OPKO’s stock All - stock deal Largest - ever acquisition deal of an Israeli - based biotech company Omrix /J&J $ 438 million Colbar /J&J $ 159 million B.T.G./ Ferring $ 50 million Fixed exchange ratio Subject to various closing conditions, including: Shareholders approval Regulatory approvals Expected closing in the second half of 2013 9

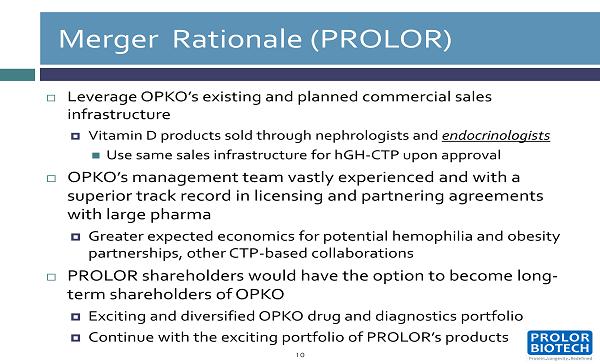

Merger Rationale (PROLOR) Leverage OPKO’s existing and planned commercial sales infrastructure Vitamin D products sold through nephrologists and endocrinologists Use same sales infrastructure for hGH - CTP upon approval OPKO’s management team vastly experienced and with a superior track record in licensing and partnering agreements with large pharma Greater expected economics for potential hemophilia and obesity partnerships, other CTP - based collaborations PROLOR shareholders would have the option to become long - term shareholders of OPKO Exciting and diversified OPKO drug and diagnostics portfolio Continue with the exciting portfolio of PROLOR’s products 10

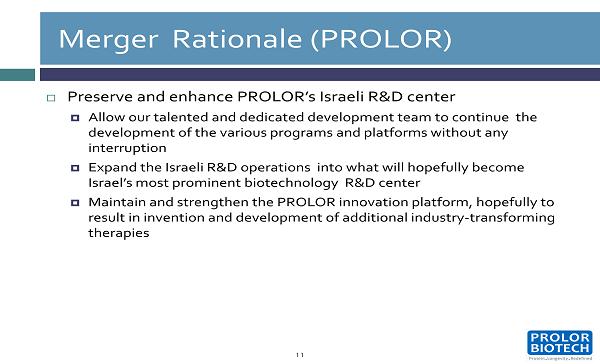

Merger Rationale (PROLOR) Preserve and enhance PROLOR’s Israeli R&D center Allow our talented and dedicated development team to continue the development of the various programs and platforms without any interruption Expand the Israeli R&D operations into what will hopefully become Israel’s most prominent biotechnology R&D center Maintain and strengthen the PROLOR innovation platform, hopefully to result in invention and development of additional industry - transforming therapies 11

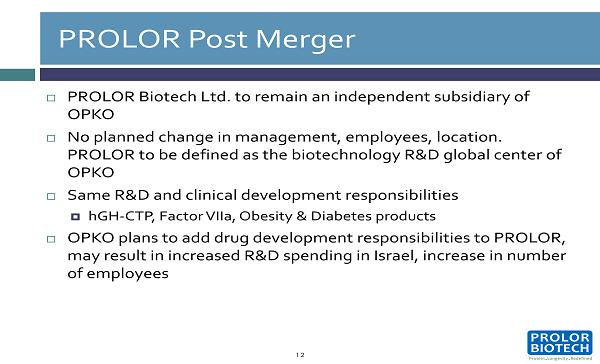

PROLOR Post Merger PROLOR Biotech Ltd. to remain an independent subsidiary of OPKO No planned change in management, employees, location. PROLOR to be defined as the biotechnology R&D global center of OPKO Same R&D and clinical development responsibilities hGH - CTP, Factor VIIa , Obesity & Diabetes products OPKO plans to add drug development responsibilities to PROLOR, may result in increased R&D spending in Israel, increase in number of employees 12

13 Thank You