Attached files

| file | filename |

|---|---|

| EX-31.2 - PROLOR Biotech, Inc. | v214352_ex31-2.htm |

| EX-32.2 - PROLOR Biotech, Inc. | v214352_ex32-2.htm |

| EX-32.1 - PROLOR Biotech, Inc. | v214352_ex32-1.htm |

| EX-23.1 - PROLOR Biotech, Inc. | v214352_ex23-1.htm |

| EX-31.1 - PROLOR Biotech, Inc. | v214352_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

|

¨

|

TRANSITION REPORT PURSUANT TO SECTIONS 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

COMMISSION FILE NUMBER 001-34676

PROLOR BIOTECH, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Nevada

|

20-0854033

|

|

(State or other jurisdiction of

incorporation or organization)

|

(IRS Employer

Identification No.)

|

3 Sapir Street, Weizmann Science Park

Nes-Ziona, Israel 74140

(Address of principal executive offices) (zip code)

Registrant’s Telephone Number, Including Area Code: (866) 644-7811

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of Each Exchange On Which Registered

|

|

Common Stock, par value $0.00001 per share

|

NYSE Amex

|

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Accelerated filer x

|

|

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

|

Smaller reporting company ¨

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 if the Act).

Yes ¨ No x

The aggregate market value of the registrant’s outstanding common stock held by non-affiliates of the registrant computed by reference to the price at which the common stock was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was $260,112,782 (based on a closing price of $6.89 per share for the registrant’s common stock on the NYSE Amex on June 30, 2010).

As of March 9, 2011, the registrant had 54,217,106 shares of common stock outstanding.

The registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A for the 2010 annual meeting of stockholders is incorporated by reference in Part III of this Form 10-K to the extent stated herein.

INDEX AND CROSS REFERENCE SHEET

|

PART I

|

3

|

|

|

Item 1.

|

Business

|

3

|

|

Item 1A.

|

Risk Factors

|

13

|

|

Item 1B.

|

Unresolved Staff Comments

|

25

|

|

Item 2.

|

Properties

|

25

|

|

Item 3.

|

Legal Proceedings

|

25

|

|

Item 4.

|

(Removed and Reserved)

|

26

|

|

PART II

|

26

|

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

26

|

|

Item 6.

|

Selected Financial Data

|

27

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operation

|

27

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

35

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

36

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

36

|

|

Item 9A.

|

Controls and Procedures

|

36

|

|

Item 9B.

|

Other Information

|

36

|

|

PART III

|

37

|

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

37

|

|

Item 11.

|

Executive Compensation

|

37

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

37

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

37

|

|

Item 14.

|

Principal Accounting Fees and Services

|

37

|

|

PART IV

|

37

|

|

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

37

|

|

SIGNATURES

|

||

i

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”), Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”), about our expectations, beliefs or intentions regarding, among other things, our product development efforts, business, financial condition, results of operations, strategies or prospects. You can identify forward-looking statements by the fact that these statements do not relate strictly to historical or current matters. Rather, forward-looking statements relate to anticipated or expected events, activities, trends or results as of

the date they are made. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking statements. Risks and uncertainties, the occurrence of which could adversely affect our business, include the following:

|

|

·

|

our limited operating history;

|

|

|

·

|

our lack of any commercialized products or technologies;

|

|

|

·

|

our product candidates are at an early stage of product development and may never be commercialized;

|

|

|

·

|

that we may be unable to develop product candidates that will achieve commercial success in a timely and cost-effective manner, or ever;

|

|

|

·

|

our need to raise additional capital to meet our business requirements in the future, and such capital raising may be costly or difficult to obtain and could dilute current stockholders’ ownership interests;

|

|

|

·

|

if we fail to obtain necessary funds for our operations, we will be unable to maintain and improve our patented technology, and we will be unable to develop and commercialize our products and technologies;

|

|

|

·

|

our dependence on key members of our management and advisory team;

|

|

|

·

|

our potential inability to enforce employees’ covenants not to compete and therefore may be unable to prevent our competitors from benefiting from the expertise of some of our former employees;

|

|

|

·

|

our current lack of sales, marketing or distribution capabilities;

|

|

|

·

|

potential product liability claims if our product candidates cause harm to patients;

|

|

|

·

|

our product candidates will remain subject to ongoing regulatory requirements even if they receive marketing approval, and if we fail to comply with these requirements, we could lose these approvals, and the sales of any approved commercial products could be suspended;

|

|

|

·

|

clinical trials are very expensive, time-consuming and difficult to design and implement and, as a result, we may suffer delays or suspensions in future trials which would have a material adverse effect on our ability to generate revenues;

|

|

|

·

|

the manufacture of our product candidates is an exacting and complex process, and if we or one of our materials suppliers encounters problems manufacturing its products, our business could suffer;

|

|

|

·

|

our reliance on third parties to implement our manufacturing and supply strategies;

|

|

|

·

|

our inability to successfully integrate any acquisitions of technologies or products;

|

|

|

·

|

our inability to successfully grow and expand our business;

|

|

|

·

|

our inability to obtain adequate insurance;

|

|

|

·

|

our holding company structure and our dependence on cash flow from our wholly-owned subsidiaries to meet our obligations;

|

|

|

·

|

our inability to maintain an effective system of internal controls;

|

|

|

·

|

the impact of potential political, economic and military instability in the State of Israel, where key members of our senior management and our research and development facilities are located;

|

|

|

·

|

recent disruptions in the financial markets and global economic conditions;

|

1

|

|

·

|

our dependence on our license of core technology from Washington University;

|

|

|

·

|

our failure to obtain or maintain or protect our patents, licensing agreements and other intellectual property;

|

|

|

·

|

the cost of potential litigation required to protect our intellectual property or to defend against claims alleging that we have violated the intellectual property rights of others;

|

|

|

·

|

our inability to enforce confidentiality agreements, which could result in third parties using our intellectual property to compete against us;

|

|

|

·

|

uncertainty regarding international patent protection;

|

|

|

·

|

our inability to protect intellectual property rights of the third parties from whom we license certain of our intellectual property or with whom we have entered into other strategic relationships;

|

|

|

·

|

our inability to obtain required regulatory approvals in the United States to market our proposed product candidates;

|

|

|

·

|

the impact of government regulations and delays associated with obtaining required regulatory approvals in the United States necessary to market our proposed product candidates;

|

|

|

·

|

the impact of competition and continuous technological change;

|

|

|

·

|

the impact of healthcare reform, which could adversely impact how much or under what circumstances healthcare providers will prescribe or administer our products;

|

|

|

·

|

compliance with federal anti-kickback laws and regulations;

|

|

|

·

|

the volatility of our common stock;

|

|

|

·

|

that we do not anticipate paying dividends on our common stock;

|

|

|

·

|

a lack of security analyst coverage of our company;

|

|

|

·

|

potential dilution of your ownership interest because of future issuances of additional shares of our common stock and our preferred stock;

|

|

|

·

|

that our principal stockholders have significant voting power and may take actions that may not be in the best interest of other stockholders;

|

|

|

·

|

sales by stockholders who had previously been subject to restrictions on the sale of their shares and who may now sell those shares into the public market;

|

|

|

·

|

the other factors referenced in this prospectus, including, without limitation, under “Risk Factors;” and

|

|

|

·

|

other risks detailed from time to time in the reports filed by us with the SEC.

|

We believe these forward-looking statements are reasonable; however, you should not place undue reliance on any forward-looking statements, which are based on current expectations. Furthermore, forward-looking statements speak only as of the date they are made. If any of these risks or uncertainties materialize, or if any of our underlying assumptions are incorrect, our actual results may differ significantly from the results that we express in, or imply by, any of our forward-looking statements. These and other risks are detailed in this Annual Report on Form 10-K, in the documents that we incorporate by reference into this Annual Report on Form 10-K and in other documents that we file with the Securities and Exchange Commission. We do not undertake any obligation to publicly update or revise these

forward-looking statements after the date of this Annual Report on Form 10-K to reflect future events or circumstances. We qualify any and all of our forward-looking statements by these cautionary factors.

2

PART I

|

Item 1.

|

Business

|

Unless the context otherwise requires, all references in this Annual Report on Form 10-K to the “Company”, “Prolor”, “we,” “us” and “our” refer to PROLOR Biotech, Inc., a Nevada corporation (formerly Modigene Inc.), including its direct and indirect wholly-owned subsidiaries, Modigene, Inc., a Delaware corporation, which we refer to as Modigene Delaware, and ModigeneTech Ltd., which we refer to as ModigeneTech.

History

We were originally incorporated under the laws of the State of Delaware in August 2003 as LDG, Inc., referred to as LDG, which was engaged in the graphics design, marketing and advertising business. On February 26, 2007, LDG, Inc. changed its name to Modigene Inc, and on May 9, 2007, its wholly-owned subsidiary Modigene Acquisition Corp. merged with and into Modigene Delaware. Modigene Delaware survived the merger, following which the original business of LDG was abandoned in its entirety, and we have operated the business of Modigene Delaware and its wholly-owned subsidiary ModigeneTech.

On June 10, 2009, we changed our name from Modigene Inc. to PROLOR Biotech, Inc., and on June 12, 2009 the trading symbol for our common stock on the OTCBB changed from MODG to PBTH. On March 29, 2010 we listed for trading on the NSYE AMEX under the trading symbol PBTH, and on May 27, 2010 we listed for trading on the Tel-Aviv Stock Exchange.

Overview

We are a development stage biopharmaceutical company utilizing patented technology to develop longer-acting, proprietary versions of already-approved therapeutic proteins that currently generate billions of dollars in annual global sales. We have obtained certain exclusive worldwide rights from Washington University in St. Louis, Missouri to use a short, naturally-occurring amino acid sequence (peptide) that has the effect of slowing the removal from the body of the therapeutic protein to which it is attached. This Carboxyl Terminal Peptide (CTP) can be readily attached to a wide array of existing therapeutic proteins, stabilizing the therapeutic protein in the bloodstream and extending its life span without additional toxicity or loss of desired biological activity. We are using

the CTP technology to develop new, proprietary versions of certain existing therapeutic proteins that have longer life spans than therapeutic proteins without CTP. We believe that our products will have greatly improved therapeutic profiles and distinct market advantages.

We believe our products in development will provide several key advantages over our competitor’s existing products:

|

|

·

|

significant reduction in the number of injections required to achieve the same or superior therapeutic effect from the same dosage;

|

|

|

·

|

extended patent protection for proprietary new formulations of existing therapies;

|

|

|

·

|

faster commercialization with greater chance of success and lower costs than those typically associated with a new therapeutic protein; and

|

|

|

·

|

manufacturing using industry-standard biotechnology-based protein production processes.

|

Merck & Co. has developed the first novel protein containing CTP, named ELONVA®, a long-acting CTP-modified version of the fertility drug follicle stimulating hormone (FSH). On January 28, 2010, Merck received marketing authorization from the European Commission for ELONVA® with unified labeling valid in all European Union Member States. Merck licensed the CTP technology directly from Washington University (prior to the formation of Modigene Delaware) for application only to Follicle Stimulating Hormone (FSH) and three other hormones, human Chorionic Gonadotropin (hCG), Luteinizing Hormone (LH) and Thyroid-Stimulating Hormone (TSH).

3

Our internal product development program is currently focused on extending the life span of the following biopharmaceuticals, in an effort to provide patients with improved therapies that may enhance their quality of life:

|

|

·

|

Human Growth Hormone (hGH)

|

|

|

·

|

Factor IX

|

|

|

·

|

Anti-Obesity Peptide Oxyntomodulin

|

|

|

·

|

Factor VIIa

|

|

|

·

|

Interferon β and Erythropoietin (EPO)

|

|

|

·

|

Atherosclerosis and rheumatoid arthritis long-acting therapies

|

We believe that the CTP technology will be broadly applicable to these as well as other best-selling therapeutic proteins in the market and will be attractive to potential partners because it will allow them to extend proprietary rights for therapeutic proteins with near-term patent expirations.

Discovery, Development and Clinical Experience with CTP Technology

Our core technology was developed by Washington University in St. Louis, while investigating the female hormone hCG, which facilitates pregnancy by maintaining production of progesterone and stimulating development of the fetus.

hCG has a long life span of up to 2 days, meaning that the body is slow to break it down. LH is another female hormone having a chemical composition (amino acid sequence) very close to that of hCG. LH has a very short life span of 20 minutes. Scientists at Washington University discovered that the only difference between hCG and LH is a short amino-acid sequence present in hCG and not in LH which they called “CTP” for Carboxyl-Terminal Peptide. This is shown schematically below. When produced in mammalian cells, this CTP is heavily modified by sugars being added (a process called glycosylation). Through numerous experiments, it was confirmed that CTP was responsible for the longer life span of hCG as compared to

LH. Washington University then performed additional experimentation adding CTP to different therapeutic proteins and the results showed that the CTP-modified proteins had dramatically increased life span.

Prolor’s core technology is the use of a short, naturally occurring amino acid sequence (CTP) to slow the removal of therapeutic proteins from the body without increasing toxicity or altering the overall biological activity

Our scientific founder, Dr. Fuad Fares, was a post-doctoral student at Washington University and worked on these findings and experiments. When Dr. Fares returned to Israel in 2001, he formed ModigeneTech to license the CTP technology from Washington University for certain therapeutic indications.

Prior to Dr. Fares’ completion of our initial license agreement with Washington University, the Dutch biotech company Organon, now part of Merck & Co., licensed the CTP solution to be used in conjunction with four endocrine proteins: FSH, hCG, TSH and LH. Organon’s goal was to develop a longer-lasting version of their FSH product, marketed as Follistim® and required to be injected on a daily basis. There have been several attempts to create a long-lasting version of FSH utilizing existing technologies that compete with our CTP technology, including a PEGylated version, all of which have been abandoned or terminated.

4

In July 2008, Schering-Plough, now part of Merck, announced successful top-line data from its Phase III ENGAGE trial demonstrating that women receiving a single injection of FSH-CTP (now branded ELONVA®) achieved the same pregnancy rates as women receiving seven consecutive daily injections of FSH, a primary endpoint of the study. This 1,509 patient trial was the largest double-blind fertility trial ever conducted. On January 28, 2010, Merck received marketing authorization from the European Commission for ELONVA® with unified labeling valid in all European Union Member States. We are now the exclusive licensee for the utilization of CTP technology in all therapeutic proteins, peptides and their modified forms except for human FSH, LH, TSH and hCG.

|

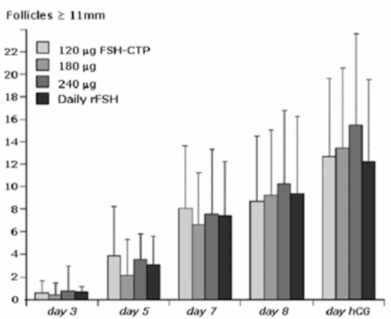

Stimulation of egg follicle growth in women preparing for IVF. Standard treatment of daily injection of rFSH (rightmost bar in each day’s group) is compared to a single injection of FSH-CTP in one of three dose levels. At the days shown, large (growing) follicles were detected by ultrasound. There were at least as many large follicles stimulated by each of the FSH-CTP doses as with the control group.

|

Opportunity Background

Overview of Therapeutic Proteins

Therapeutic proteins are proteins that are either extracted from human cells or engineered and produced in the laboratory for pharmaceutical use. The majority of therapeutic proteins are recombinant human proteins manufactured using non-human cell lines that are engineered to contain certain human genetic sequences which cause them to produce the desired protein. Recombinant proteins are an important class of therapeutics used to replace deficiencies in critical blood borne growth factors and to strengthen the immune system to fight cancer and infectious disease. Therapeutic proteins are also used to relieve patients’ suffering from many conditions, including various cancers (treated by monoclonal antibodies and interferons), heart attacks, strokes, cystic fibrosis and

Gaucher’s disease (treated by enzymes and blood factors), diabetes (treated by insulin), anemia (treated by erythopoietins), and hemophilia (treated by blood clotting factors).

The U.S. Food and Drug Administration (FDA) has approved 75 therapeutic proteins, also known as biopharmaceuticals, and there are more than 500 additional proteins under development. To date, much of the growth has been in sales of erythopoietins (used to treat anemia) and insulins (used to treat diabetes). Many of the proteins currently on the market will lose the protection of certain patent claims over the next 15 years. In addition, many marketed proteins are facing increased competition from next-generation versions or from other therapeutic proteins approved for the same disease indications.

5

Because proteins are broken down in the gastrointestinal system, therapeutic proteins must be administered by injection. Once in the bloodstream, therapeutic proteins are broken down by enzymes and cellular activity, as well as filtered out of the blood by the kidneys. Therefore, injections must be given frequently to achieve effective therapeutic levels. We believe that a large market opportunity exists for new versions of proven therapeutic proteins that remain active longer, thereby reducing the number of required injections and optimizing therapeutic results and patient acceptability. However, existing approaches to creating modified therapeutic proteins are generally based on the addition of synthetic, non-protein elements that result in problems such as loss of

desired biological activity, toxicity of the modified protein and increased manufacturing complexity and cost. Despite these challenges, several longer-lasting modified therapeutic proteins currently on the market have been demonstrated to be successful. Each of these improved therapeutics was custom-designed with great effort.

Attempts to Extend the Life Span of Therapeutic Proteins

Several strategies have been devised in recent years to extend the life span of therapeutic proteins by slowing their clearance from the body. These strategies have included two main techniques:

|

|

·

|

Increasing the size of the therapeutic protein. This is achieved either by attaching large polymeric chains to the protein (PEGylation) or by attaching other large, non-active proteins that have longer life spans compared to the target therapeutic protein.

|

|

|

·

|

Altering the physical structure of the therapeutic protein. This is achieved by adding carbohydrate structures to the therapeutic protein (glycosylation) through modifications of the original genetic sequence of the protein. These additional “sugar chains” slow the clearance of the therapeutic protein from the bloodstream.

|

Limitations of Existing Life Span Extension Solutions

There are several fundamental issues with the existing technologies that attempt to create longer-lasting versions of therapeutic proteins. If the size of the protein is increased by way of attaching large polymeric chains or another protein, the end result is a very large protein. Because most therapeutic proteins work by binding to specific receptors, the new “bulkiness” may prevent them from achieving the desired result. The smaller the protein, the more significant the effect of the size increase may be. Successful attempts at increasing the size of therapeutic proteins, while preserving substantial activity, have been relatively few, and have been with proteins that are already large. Moreover, the biological activity of the modified protein

has been significantly less than that of the unmodified protein and therefore requires a higher injected dose as compared to the unmodified protein’s usual dosage. One typical method to achieve the desired size increase is to add long polymers of polyethylene glycol (PEG) to a protein; however, this method has historically resulted in the creation of foreign structures to which the immune system may adversely react. When this happens, the immune system works to remove the modified protein from the bloodstream, defeating the purpose of the original modification. It can also lead to additional negative effects, such as reaction at the injection site.

Another technique, glycosylation, requires custom alterations (point mutations) to the protein’s genetic structure to increase its life span. The resulting modified protein is entirely new and often generates unexpected adverse reactions, resulting in potentially toxic effects. To date, creating a protein with a longer life span that is not toxic has been a lengthy trial and error process.

Although the existing modification technologies have been tried on almost all therapeutic proteins, only three “blockbuster” modified proteins have been commercially successful: two developed by Amgen Inc. and one independently developed by Schering-Plough Corporation and Roche Pharmaceuticals. Each of these three longer-lasting therapeutic proteins has become a widely used therapeutic:

|

|

·

|

utilizing PEGylation, Schering-Plough and Roche independently developed PEG-INTRON and PEGASYS, therapeutic proteins with a longer life span than that of regular Alpha interferon (used for treating Hepatitis B and C);

|

6

|

|

·

|

utilizing PEGylation, Amgen developed Neulasta, an anti-neutropenia therapeutic protein with a longer life span than that of regular G-CSF; and

|

|

|

·

|

utilizing additional glycosylation, Amgen developed Aranesp, an anti-anemia therapeutic protein with a longer life span than that of regular EPO.

|

Our Solution

Our solution to creating proprietary, enhanced longevity protein therapeutics is CTP, a short, naturally-occurring amino acid sequence that has the effect of slowing the removal and/or breakdown of the therapeutic protein to which it is attached. Through our license agreement with Washington University, we have secured exclusive, worldwide rights to use the CTP technology with respect to all natural and non-natural therapeutic proteins and peptides (other than LH, TSH, FSH and hCG, which are licensed to an affiliate of Schering-Plough Corp.), including hGH, EPO, interferon β and GLP-1. Using standard recombinant DNA techniques, the CTP peptide can be readily attached in one or more copies to a

wide array of existing therapeutic proteins. When these proteins are produced in mammalian cells, the CTP portion undergoes a natural process in which special carbohydrate chains are attached (O-linked glycosylation). This additional CTP piece, along with its carbohydrate chains, stabilizes the therapeutic protein in the bloodstream and greatly extends its life span, without additional toxicity or loss of its desired biological activity. This is quite distinct from other methods used to extend protein life span, which require the addition to the therapeutic drug of large proteins or of synthetic, non-protein elements that may result in problems such as loss of desired biological activity or toxicity of the modified protein, as well as increased manufacturing complexity and cost. Moreover, CTP-modified proteins can be manufactured using established and widely used mammalian protein expression systems (cell lines). Therefore, we

believe that the technology risks are minimized, while the benefits of the CTP technology can be substantial.

There are two existing biopharmaceuticals that utilize CTP technology. The first product is hCG, of which CTP is naturally a part. Besides being present normally in high amounts during pregnancy, it is also given therapeutically to women or men as a fertility treatment (sold by Merck-Serono, Merck & Co. and Ferring). The second product is ELONVA® (FSH-CTP), which is approved for marketing in Europe as described above. The data from the use in humans of these two products give us confidence that the CTP technology may be able to address the major problems faced by the other attempted approaches to increase protein lifespan. Data from these products reassures us that CTP can be used safely in humans and that it is effective in extending the serum

lifetime and activity in humans.

We believe the clinical development program for our drugs will be faster, less expensive and more predictable than those conducted for existing therapeutic proteins. We can base the design of our studies, the inclusion criteria, clinical endpoints and sample sizes, on the knowledge gained from development of the predecessor drugs, with the assurance that these have been accepted by regulatory authorities in the past. In addition there are usually surrogate markers for clinical efficacy that have been defined and accepted by the medical community. These can provide easier and faster ways of learning at an early stage the correct dosing range and frequency. In some cases, they can even be used as definitive clinical trial endpoints. We believe that these

factors drive will down the time and costs associated with clinical trials.

Research & Development: Our Development Programs

We are currently pursuing the development and commercialization of six products: Human Growth Hormone, Factor IX, anti-obesity peptide Oxyntomodulin, Factor VIIa, Interferon β, Erythropoietin, and anti-atherosclerosis and rheumatoid arthritis therapeutics.

Human Growth Hormone (hGH)

Market Opportunity

Growth hormone deficiency (GHD) is a pituitary disorder resulting in short stature in children and other physical ailments in both children and adults. GHD occurs when the production of growth hormone, secreted by the pituitary gland, is disrupted. Since growth hormone plays a critical role in stimulating body growth and development, and is involved in the production of muscle protein and in the breakdown of fats, a decrease in the hormone affects numerous body processes.

Recombinant hGH is used for the long-term treatment of children and adults with growth failure due to inadequate secretion of endogenous growth hormone. The primary indications it treats in children are growth hormone deficiency, kidney disease, Prader-Willi Syndrome and Turner’s Syndrome. In adults, the primary indications are replacement of endogenous growth hormone and the treatment of AIDS-induced weight loss.

7

In addition to its current use, hGH has been proven to promote a number of lifestyle benefits including weight loss, increased energy levels, enhanced sexual performance, improved cholesterol, younger, tighter, thicker skin and reduced wrinkles and cellulite. We expect the hGH market to expand significantly as hGH moves beyond therapeutic treatment to include the treatment of lifestyle issues.

Current Products

Prior to the advent of recombinant versions, growth hormone was purified from human cadavers. For the past 20 years, recombinantly produced protein has been supplied to the market by an increasing number of companies. Current products on the U.S. market are Nutropin (Genentech), Genotropin (Pfizer), Humatrope (Eli Lilly), Norditropin (Novo Nordisk), Serostim (Merck-Serono) and Omnitrope (Novartis).

Our hGH-CTP Program

Patients using hGH receive daily injections six or seven times a week. This is particularly burdensome for pediatric patients. We believe a significant market opportunity exists for a longer-lasting version of hGH that would require fewer injections.

We reported positive top-line results from a Phase I study of our longer-acting version of hGH. The study was designed to measure the potential durability (half-life), overall drug exposure (AUC) and biological efficacy, as well as the safety and tolerability of our longer-acting CTP-modified human growth hormone (hGH-CTP).

The Phase I study enrolled 24 healthy adults who were randomized to receive one of three doses of hGH-CTP (4mg, 7mg or 21mg) or placebo. The study results showed that safety and tolerability endpoints were met at all doses in all participants. The potential clinical efficacy of hGH-CTP was assessed by measuring the extent to which hGH-CTP induced insulin-like growth factor-1 (IGF-1) in subjects. This biomarker is the clinically accepted primary indicator of hGH biological activity and is used by endocrinologists to optimize dosing for hGH-deficient adults. Based on this measure, the study results suggest that the daily injections required by patients using conventional hGH could potentially be replaced with just two monthly injections of hGH-CTP.

Following the positive results of our Phase I clinical trial in hGH-CTP, on July 21, 2010 we received regulatory approval and initiated a Phase II clinical trial in growth hormone deficient adults. The trial is designed as a dose-finding study, and the primary efficacy end point is defined as the mean time interval of IGF-I (insulin-like growth factor 1) levels that lay within ±1.5 SDS (standard deviation from the mean IGF-1 levels in the population) after the last dose administration expressed in hours. The other primary outcomes measured are safety and tolerability.

Factor IX

Market Opportunity

Hemophilia is a group of hereditary genetic disorders that impair the body's ability to control blood clotting or coagulation. People with hemophilia do not produce adequate amounts of Factor VIII or Factor IX proteins, which are necessary for effective blood clotting. In severe hemophiliacs, even a minor injury can result in blood loss lasting days or weeks, and complete healing may not occur, leading to the potential for debilitating permanent damage to joints and other organs and premature death. According to the World Health Organization, more than 400,000 people worldwide have hemophilia, corresponding to an incidence of 15 to 20 in every 100,000 males born worldwide. Hemophilia B is associated with inadequate Factor IX and occurs at an incidence of about 1 in

20,000–34,000 male births. Hemophilia B is largely an inherited disorder but, in approximately 30% of cases, there is no family history; and the condition is the result of a spontaneous gene mutation. The availability of recombinant Factor VIII and Factor IX has enabled many hemophiliacs to live near-normal lives, but frequent injections are required.

8

Current Products Produced by Others

Recombinant Factor IX is offered to Hemophilia B patients by Pfizer, under the brand name BeneFIX® (“BeneFIX”).

Our Factor IX-CTP Program

We reported top-line results from an animal efficacy study we conducted of Factor IX-CTP. This was a comparative study in Factor IX depleted mice, comparing the quality and duration activity of Factor IX-CTP with that of BeneFIX and included an untreated control group. Factor IX-CTP showed superior efficacy and duration of activity during the 60 hour study.

Our Business Strategy

Our goal is to become a leader in the development and commercialization of longer-lasting, proprietary versions of already approved therapeutic proteins that currently generate billions of dollars in annual global sales, through the utilization of our CTP technology. Key elements of our strategy are to:

|

|

·

|

Develop and commercialize improved versions of biopharmaceuticals that dramatically reduce the number of injections required to achieve the same therapeutic effect from the existing drugs. Based on the clinical track record of our CTP technology, as evidenced by the results of Merck’s FSH-CTP European marketing approval, we believe that the addition of CTP to therapeutic proteins significantly enhances the lifespan of those proteins, without any adverse effects. We expect these modified proteins to offer significant advantages, including less frequent dosing and possibly improved efficacy, over the original versions of the drugs now on the market, as well as to meet or exceed the pharmacokinetic profile of next-generation versions of the drugs now on the market.

|

|

|

·

|

Leverage extensive existing clinical and regulatory experience with the original drugs to bring our improved versions of these biopharmaceuticals to market more quickly, at lower costs and with a clearer path to regulatory approval. Because there is a large knowledge base on the original products, the preclinical, clinical and regulatory requirements needed to obtain marketing approval are very well defined. In particular, clinical study designs, inclusion criteria and endpoints can be used that have already been accepted by regulatory authorities. There typically exist accepted surrogate markers for clinical efficacy, which can sometimes even be used as definitive trial endpoints, but at the least are highly informative of proper dose range and frequency. All of these

factors drive down the time and costs associated with clinical trials, which represent up to 90% of product development costs for a typical therapeutic protein. In addition to lowering the costs and time to market, we believe the strategy of targeting drugs with proven safety and efficacy provides a better prospect of clinical success of our proprietary development portfolio as compared to de novo protein drug development. The possibility of delays due to regulatory safety concerns is also reduced as the FDA gains comfort with the safety profile of CTP-modified proteins (CTP is naturally present in the body, on the approved drug hCG and on FSH-CTP). We estimate that the average time to market and cost of clinical trials for our products could be up to 50% less than that required to develop a new therapeutic protein.

|

|

|

·

|

Seek attractive partnership opportunities. We believe that the CTP technology is applicable to most therapeutic proteins and peptides that have been approved to date by the FDA, including many of the best-selling therapeutic proteins in the market. We believe that the proprietary rights provided by CTP technology, together with the clinical and compliance benefits, will be attractive to potential partners, either the originator of the therapeutic protein or their prospective competitors. We will seek to build a portfolio of commercially attractive partnerships in a blend of co-developments and licenses. Where possible, we will seek partnerships that allow us to participate significantly in the commercial success of each of the compounds.

|

9

|

|

·

|

Leverage our core competencies. We believe that our CTP technology improves the drug properties of therapeutic proteins. We will continue to use our CTP technology to develop improved versions of protein drugs with proven safety and efficacy and to improve the therapeutic profiles of new drugs that will be developed by our partners. We will also continue to conduct exploratory drug development research in therapeutic peptides and Fab fragments of monoclonal antibodies, where our CTP technology, intellectual property and internal expertise provide us with opportunities.

|

Our Partnering Strategy

In addition to commercializing the three therapeutic proteins and one peptide discussed above, there are many additional product candidates we can pursue in an opportunistic fashion. We plan to pursue partnering deals with biotechnology companies that have a strategic interest in using our solution to develop longer-lasting versions of their existing therapeutic proteins or peptides, or those in development. We anticipate such partnerships will provide significant revenues in the form of license fees, milestone payments and royalties on sales, which will help to subsidize our research and development costs.

Intellectual Property

We license from Washington University the intellectual property that is necessary to conduct our business. In 2001, we initially licensed from Washington University core intellectual property pursuant to a non-exclusive license agreement, and, in 2004, we amended this license to make us the exclusive licensee of the two key CTP patents in connection with 11 therapeutic proteins. Pursuant to the prior license agreement, Modigene Delaware issued a total of 221,979 shares of its common stock to Washington University (378,796 shares of our common stock on a post-merger basis). In February 2007, we entered into a new license agreement, which we refer to as the License Agreement, with Washington University that superseded the prior license agreement. Pursuant to the new

License Agreement, Washington University granted us the exclusive license to three CTP patents and expanded the field of use to all natural and non-natural therapeutic proteins and peptides (other than LH, FSH, TSH and hCG). Under the License Agreement, we have the right to sub-license the licensed patents. The License Agreement terminates in 2018 when the last of the patents licensed to us under the License Agreement expires, unless terminated earlier. Under the License Agreement, we were required to pay an initial fee of $100,000 in installments over the 18 months following the effective date of the License Agreement. In addition, we are required to pay annual license maintenance fees of $30,000 (payable until the first commercial sale); royalty fees of 1.5% to 5% from net revenues (with certain required minimum royalties after the first commercial sale of $10,000, $20,000 and $40,000 for the first, second, and third year and beyond,

respectively), and sub-licensing fees of 7.5% to 20% on sub-licensing payments. Pursuant to the License Agreement, we will also be responsible for milestone payments of $15,000 for each molecule at investigational new drug application (IND) filing, $30,000 at the initiation of a Phase II clinical trial and $40,000 at the initiation of a Phase III clinical trial.

Pursuant to our License Agreement with Washington University, we have obtained an exclusive license to the key CTP patents that have been issued by the U.S. Patent and Trademark Office – U.S. #5,712,122, U.S. #5,759,818 and U.S. #6,225,449. We believe these patents provide broad and comprehensive coverage of the CTP technology, and we intend to aggressively enforce our intellectual property rights if necessary. In addition, unrelated to the patents from Washington University, we have filed, and will likely continue to file, patent applications covering specific CTP-modified molecules and CTP innovations, such as configurations, compositions and methods. Two of these patents, covering hGH (#7,553,940) and EPO (#7,553,941), have been issued by the U.S. Patent Office

in June 2009.

Competition

The pharmaceutical industry is highly competitive. We face significant competition from pharmaceutical companies and biotechnology companies that are researching and developing therapeutic proteins with enhanced life spans. Several pharmaceutical companies, such as Amgen, Eli Lilly and Company (through its acquisition of Applied Molecular Evolution), Nektar Therapeutics, ConjuChem Inc., Flamel Technologies S.A., , Nautilus Biotech S.A. and Ambrx Inc. have marketed products or are involved with the development of therapeutic proteins with enhanced life spans.

These companies, as well as potential entrants into our market, have longer operating histories, larger customer or use bases, greater brand recognition and significantly greater financial, marketing and other resources than we do. Many of these current or potential competitors can devote substantially greater resources to the development and promotion of their products than we can.

10

Additionally, there has been consolidation within the pharmaceutical industry and larger, well-established and well-financed entities may continue to acquire, invest in or form joint ventures to gain access to additional technology or products. Any of these trends would increase the competition we face and could adversely affect our business and operating results.

Government Regulation

Regulation by governmental authorities in the United States and other countries will be a significant factor in the production and marketing of our products and our ongoing research and development activities. All of our products require rigorous preclinical and clinical testing, subject to regulatory clearance or approval, and regulatory approval by governmental agencies prior to commercialization and are subject to pervasive and continuing regulation upon approval. The lengthy process of conducting clinical trials, seeking approval and the subsequent compliance with applicable statutes and regulations, if approval is obtained, are very costly and require the expenditure of substantial resources.

In the United States, the Public Health Service Act and the Federal Food, Drug, and Cosmetic Act, as amended, and the regulations promulgated thereunder, and other federal and state statutes and regulations govern, among other things, the safety and effectiveness standards for our products and the raw materials and components used in the production of, testing, manufacture, labeling, storage, record keeping, approval, advertising and promotion of our products on a product-by-product basis.

Preclinical tests include in vitro (i.e., laboratory) and in vivo (i.e., animal) evaluation of the product candidate, its chemistry, formulation and stability, and animal studies to assess potential safety and efficacy. Certain preclinical tests must be conducted in compliance with good laboratory practice regulations. Violations of these regulations can, in some cases, lead to invalidation of the studies, requiring them to be replicated. After laboratory analysis and preclinical testing, we intend to file an IND with the FDA to begin human testing. Typically, a manufacturer conducts a three-phase human clinical testing program which itself is subject to

numerous laws and regulatory requirements, including adequate monitoring, reporting, record keeping and informed consent. In Phase 1, small clinical trials are conducted to determine the safety and proper dose ranges of our product candidates. In Phase 2, clinical trials are conducted to assess safety and gain preliminary evidence of the efficacy of our product candidates. In Phase 3, clinical trials are conducted to provide sufficient data for the statistically valid evidence of safety and efficacy. The time and expense required for us to perform this clinical testing can vary and is substantial. We cannot be certain that we will successfully complete Phase 1, Phase 2 or Phase 3 testing of our product candidates within any specific time period, if at all. Furthermore, the FDA, the Institutional Review Board responsible for approving and monitoring the clinical trials at a given site, the Data Safety Monitoring Board,

where one is used, or the Company may suspend the clinical trials at any time on various grounds, including a finding that subjects or patients are exposed to unacceptable health risk.

We cannot take any action to market any new drug or biologic product in the United States until our appropriate marketing application has been approved by the FDA. The FDA has substantial discretion over the approval process and may disagree with our interpretation of the data submitted. The process may be significantly extended by requests for additional information or clarification regarding information already provided. As part of this review, the FDA may refer the application to an appropriate advisory committee, typically a panel of clinicians. Satisfaction of these and other regulatory requirements typically takes several years, and the actual time required may vary substantially based upon the type, complexity and novelty of the product. Government

regulation may delay or prevent marketing of potential products for a considerable period of time and impose costly procedures on our activities. We cannot be certain that the FDA or other regulatory agencies will approve any of our products on a timely basis, if at all. Success in preclinical or early stage clinical trials does not assure success in later-stage clinical trials. Even if a product receives regulatory approval, the approval may be significantly limited to specific indications or uses and these limitations may adversely affect the commercial viability of the product. Delays in obtaining, or failures to obtain regulatory approvals, would have a material adverse effect on our business.

Even after we obtain FDA approval, we may be required to conduct further clinical trials (i.e., Phase 4 trials) and provide additional data on safety and effectiveness. We are also required to gain separate clearance for the use of an approved product as a treatment for indications other than those initially approved. In addition, side effects or adverse events that are reported during clinical trials can delay, impede or prevent marketing approval. Similarly, adverse events that are reported after marketing approval can result in additional limitations being placed on the product’s use and, potentially, withdrawal of the product from the market. Any adverse event, either before or after marketing approval, can result in product liability claims against us.

11

In addition to regulating and auditing human clinical trials, the FDA regulates and inspects equipment, facilities, laboratories and processes used in the manufacturing and testing of such products prior to providing approval to market a product. If after receiving FDA approval, we make a material change in manufacturing equipment, location or process, additional regulatory review may be required. We also must adhere to current Good Manufacturing Practice (cGMP) regulations and product-specific regulations enforced by the FDA through its facilities inspection program. The FDA also conducts regular, periodic visits to re-inspect our equipment, facilities, laboratories and processes following the initial approval. If, as a result of these inspections, the FDA determines

that our equipment, facilities, laboratories or processes do not comply with applicable FDA regulations and conditions of product approval, the FDA may seek civil, criminal or administrative sanctions and/or remedies against us, including the suspension of our manufacturing operations.

The requirements that we and our collaborators must satisfy to obtain regulatory approval by government agencies in other countries prior to commercialization of our products in such countries can be rigorous, costly and uncertain. In the European countries, Canada and Australia, regulatory requirements and approval processes are similar in principle to those in the United States. Additionally, depending on the type of drug for which approval is sought, there are currently two potential tracks for marketing approval in the European countries: mutual recognition and the centralized procedure. These review mechanisms may ultimately lead to approval in all European Union countries, but each method grants all participating countries some decision-making authority in product

approval. Foreign governments also have stringent post-approval requirements including those relating to manufacture, labeling, reporting, record keeping and marketing. Failure to substantially comply with these on-going requirements could lead to government action against the product, the Company and/or its representatives.

The levels of revenues and profitability of biopharmaceutical companies may be affected by the continuing efforts of government and third party payers to contain or reduce the costs of health care through various means. For example, in certain foreign markets, pricing or profitability of therapeutic and other pharmaceutical products is subject to governmental control. In the United States, there have been, and we expect that there will continue to be, a number of federal and state proposals to implement similar governmental control. In addition, in the United States and elsewhere, sales of therapeutic and other pharmaceutical products are dependent in part on the availability and adequacy of reimbursement from third party payers, such as the government or private insurance

plans. Third party payers are increasingly challenging established prices, and new products that are more expensive than existing treatments may have difficulty finding ready acceptance unless there is a clear therapeutic benefit. We cannot assure you that any of our products will be considered cost effective, or that reimbursement will be available or sufficient to allow us to sell them competitively and profitably.

We are also subject to various federal, state, and international laws pertaining to health care “fraud and abuse,” including anti-kickback laws and false claims laws. The federal Anti-kickback law, which governs federal healthcare programs (e.g., Medicare, Medicaid), makes it illegal to solicit, offer, receive or pay any remuneration in exchange for, or to induce, the referral of business, including the purchase or prescription of a particular drug. Many states have similar laws that are not restricted to federal healthcare programs. Federal and state false claims laws prohibit anyone from knowingly and willingly presenting, or causing to be presented for payment to third party payers (including Medicare and Medicaid), claims for reimbursed drugs or services that are

false or fraudulent, claims for items or services not provided as claimed, or claims for medically unnecessary items or services. If the government or a whistleblower were to allege that we violated these laws there could be a material adverse effect on us, including our stock price. Even an unsuccessful challenge could cause adverse publicity and be costly to respond to, which could have a materially adverse effect on our business, results of operations and financial condition. A finding of liability under these laws can have significant adverse financial implications for the Company and can result in payment of large penalties and possible exclusion from federal healthcare programs. We will consult counsel concerning the potential application of these and other laws to our business and our sales, marketing and other activities and will make good faith efforts to comply with them. However, given their broad reach and the

increasing attention given by law enforcement authorities, we cannot assure you that some of our activities will not be challenged or deemed to violate some of these laws.

We are also subject to numerous federal, state, local, and international laws and regulations relating to safe working conditions, manufacturing practices, environmental protection, import and export controls, fire hazard control, the experimental use of animals and the use and disposal of hazardous or potentially hazardous substances. We believe that our procedures comply with the standards prescribed by federal, state, or local laws, rules, and/or regulations; however, the risk of injury or accidental contamination cannot be completely eliminated. Currently, we have no costs with respect to environmental law compliance. At our current stage of product development, we cannot accurately estimate what our future costs relating to environmental law compliance may be.

We have currently received no approvals to market our products from the FDA or other foreign regulators.

12

We currently employ 15 full-time and two part-time employees, including six with Ph.D. degrees and three with M.Sc. degrees, focused on research and development, and three focused on general management and business development. None of our employees is represented by a labor union, and we consider our employee relations to be good. We also utilize a number of consultants to assist with research and development and commercialization activities. We believe that our future success will depend in part on our continued ability to attract, hire and retain qualified personnel. All of our employees are located in Israel, and all of our research and development activities are conducted at the offices of Modigenetech, Ltd., our Israeli subsidiary.

|

Item 1A.

|

Risk Factors

|

Risks Related to Our Company and Our Business

We have a limited operating history, and we do not expect to become profitable in the near future.

We are a development stage biopharmaceutical company with a limited operating history. We are not profitable and have incurred losses since our inception. We have not generated any revenue since our inception, and we continue to incur research and development and general and administrative expenses related to our operations. We expect to continue to incur losses for the foreseeable future, and these losses will likely increase as we move toward the commercialization of any of our products in development. If our product candidates fail in clinical trials or do not gain regulatory clearance or approval, or if our product candidates do not achieve market acceptance, we may never become profitable. Even if we achieve profitability in the future, we may not be able to sustain

profitability in subsequent periods. Accordingly, it is difficult to evaluate our business prospects. Moreover, our prospects must be considered in light of the risks and uncertainties encountered by an early-stage company and in highly regulated and competitive markets, such as the biopharmaceutical market, where regulatory approval and market acceptance of our products are uncertain. There can be no assurance that our efforts will ultimately be successful or result in revenues or profits.

We have not yet commercialized any products or technologies, and we may never become profitable.

We have not yet commercialized any products or technologies, and we may never be able to do so. We do not know when or if we will complete any of our product development efforts, obtain regulatory approval for any product candidates incorporating our technologies or successfully commercialize any approved products. Even if we are successful in developing products that are approved for marketing, we will not be successful unless these products gain market acceptance. The degree of market acceptance of these products will depend on a number of factors, including:

|

|

·

|

the timing of regulatory approvals in the countries, and for the uses, we seek;

|

|

|

·

|

the competitive environment;

|

|

|

·

|

the establishment and demonstration in the medical community of the safety and clinical efficacy of our products and their potential advantages over existing therapeutic products;

|

|

|

·

|

the adequacy and success of distribution, sales and marketing efforts; and

|

|

|

·

|

the pricing and reimbursement policies of government and third-party payors, such as insurance companies, health maintenance organizations and other plan administrators.

|

Physicians, patients, thirty-party payors or the medical community in general may be unwilling to accept, utilize or recommend any of our products or products incorporating our technologies. As a result, we are unable to predict the extent of future losses or the time required to achieve profitability, if at all. Even if we successfully develop one or more products that incorporate our technologies, we may not become profitable.

Our product candidates are at an early stage of product development and may never be commercialized.

All of our product candidates are at early stages of product development and may never be commercialized. Initially, we plan to develop product candidates through studies, testing and clinical lead product candidate selection, and then to license them to other companies. The progress and results of any future pre-clinical testing or future clinical trials are uncertain, and the failure of our product candidates to receive regulatory approvals will have a material adverse effect on our business, operating results and financial condition to the extent we are unable to commercialize any products. None of our product candidates has received regulatory approval for commercial sale. In addition, all of our product candidates are in the early stages of development, and we face the risks

of failure inherent in developing therapeutic proteins based on new technologies. Our product candidates are not expected to be commercially available for several years, if at all.

13

In addition, our product candidates must satisfy rigorous standards of safety and efficacy before they can be approved by the U.S. Food and Drug Administration, or the FDA, and international regulatory authorities for commercial use. The FDA and foreign regulatory authorities have full discretion over this approval process. We will need to conduct significant additional research, involving testing in animals and in humans, before we can file applications for product approval. Typically, in the pharmaceutical industry, there is a high rate of attrition for product candidates in pre-clinical testing and clinical trials. Also, satisfaction of regulatory requirements typically takes many years, is dependent upon the type, complexity and novelty of the product and requires

the expenditure of substantial resources. Success in pre-clinical testing and early clinical trials does not ensure that later clinical trials will be successful. For example, a number of companies in the pharmaceutical industry, including biotechnology companies, have suffered significant setbacks in advanced clinical trials, even after promising results in earlier trials and in interim analyses. In addition, delays or rejections may be encountered based upon additional government regulation, including any changes in FDA policy, during the process of product development, clinical trials and regulatory approvals.

In order to receive FDA approval or approval from foreign regulatory authorities to market a product candidate or to distribute our products, we must demonstrate through pre-clinical testing and through human clinical trials that the product candidate is safe and effective for the treatment of a specific condition.

We might be unable to develop product candidates that will achieve commercial success in a timely and cost-effective manner, or ever.

Even if regulatory authorities approve our product candidates, they may not be commercially successful. Our product candidates may not be commercially successful because physicians, government agencies and other third-party payors may not accept them. A product approval, assuming one issues, may limit the uses for which the product may be distributed thereby adversely affecting the commercial viability of the product. Third parties may develop superior products or have proprietary rights that preclude us from marketing our products. We also expect that most of our product candidates will be very expensive, if approved. Patient acceptance of and demand for any product candidates for which we obtain regulatory approval or license will depend largely on many

factors, including but not limited to the extent, if any, of reimbursement of therapeutic protein and treatment costs by government agencies and other third-party payors, pricing, the effectiveness of our marketing and distribution efforts, the safety and effectiveness of alternative products, and the prevalence and severity of side effects associated with our products. If physicians, government agencies and other third-party payors do not accept our products, we will not be able to generate significant revenue.

It is highly likely that we will need to raise additional capital to meet our business requirements in the future, and such capital raising may be costly or difficult to obtain and could dilute current stockholders’ ownership interests.

It is highly likely that we will need to raise additional funds through public or private debt or equity financings to meet various objectives including, but not limited to:

|

|

·

|

pursuing growth opportunities, including more rapid expansion;

|

|

|

·

|

acquiring complementary businesses;

|

|

|

·

|

making capital improvements to improve our infrastructure;

|

|

|

·

|

hiring qualified management and key employees;

|

|

|

·

|

research and development of new products;

|

|

|

·

|

responding to competitive pressures;

|

|

|

·

|

complying with regulatory requirements such as licensing and registration; and

|

|

|

·

|

maintaining compliance with applicable laws.

|

Any additional capital raised through the sale of equity or equity-linked securities may dilute our current stockholders’ ownership in us and could also result in a decrease in the market price of our common stock. The terms of those securities issued by us in future capital transactions may be more favorable to new investors and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect.

Furthermore, any debt or equity financing that we may need may not be available on terms favorable to us, or at all. If we are unable to obtain required additional capital, we may have to curtail our growth plans or cut back on existing business, and we may not be able to continue operating if we do not generate sufficient revenues from operations needed to stay in business.

14

We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we issue, such as convertible notes and warrants, which may adversely impact our financial condition.

If we fail to obtain necessary funds for our operations, we will be unable to maintain and improve our patented technology, and we will be unable to develop and commercialize our products and technologies.

Our present and future capital requirements depend on many factors, including:

|

|

·

|

the level of research and development investment required to develop our product candidates, and maintain and improve our patented technology position;

|

|

|

·

|

the costs of obtaining or manufacturing therapeutic proteins for research and development and at commercial scale;

|

|

|

·

|

the results of preclinical and clinical testing, which can be unpredictable in therapeutic protein development;

|

|

|

·

|

changes in product candidate development plans needed to address any difficulties that may arise in manufacturing, preclinical activities, clinical studies or commercialization;

|

|

|

·

|

our ability and willingness to enter into new agreements with strategic partners and the terms of these agreements;

|

|

|

·

|

our success rate in preclinical and clinical efforts associated with milestones and royalties;

|

|

|

·

|

the costs of investigating patents that might block us from developing potential product candidates;

|

|

|

·

|

the costs of recruiting and retaining qualified personnel;

|

|

|

·

|

the time and costs involved in obtaining regulatory approvals;

|

|

|

·

|

the costs of filing, prosecuting, defending, and enforcing patent claims and other intellectual property rights; and

|

|

|

·

|

our need or decision to acquire or license complementary technologies or new therapeutic protein targets.

|

If we are unable to obtain the funds necessary for our operations, we will be unable to maintain and improve our patented technology, and we will be unable to develop and commercialize our products and technologies, which would materially and adversely affect our business, liquidity and results of operations.

We depend on key members of our management and advisory team and will need to add and retain additional leading experts.

We are highly dependent on our executive officers and other key management and technical personnel. Our failure to retain our Chief Executive Officer, Abraham (Avri) Havron, or our President, Shai Novik, or any other key management and technical personnel could have a material adverse effect on our future operations. Our success is also dependent on our ability to attract, retain and motivate highly trained technical, marketing, sales and management personnel, among others, to produce our product candidates and, if our product candidates are produced and approved for marketing, to market our products and to continue to produce enhanced releases of our products. We presently do not maintain “key person” life insurance policies on any of our personnel.

Our success also depends on our ability to attract, retain and motivate personnel required for the development, maintenance and expansion of our activities. There can be no assurance that we will be able to retain our existing personnel or attract additional qualified employees. The loss of key personnel or the inability to hire and retain additional qualified personnel in the future could have a material adverse effect on our business, financial condition and results of operation.

Under current U.S. and Israeli law, we may not be able to enforce employees’ covenants not to compete and therefore may be unable to prevent our competitors from benefiting from the expertise of some of our former employees.

We have entered into non-competition agreements with our key employees. These agreements prohibit our key employees, if they cease working for us, from competing directly with us or working for our competitors for a limited period. Under applicable U.S. and Israeli law, we may be unable to enforce these agreements. If we cannot enforce our non-competition agreements with our employees, then we may be unable to prevent our competitors from benefiting from the expertise of our former employees, which could materially adversely affect our business, results of operations and ability to capitalize on our proprietary information.

15

We do not currently have sales, marketing or distribution capabilities, and we may be unable to effectively sell, market and distribute our product candidates in the future, and the failure to do so would have an adverse effect on our business and results of operations.

If we are unable to develop sales, marketing and distribution capabilities or enter into agreements with third parties to perform these functions, we will not be able to successfully commercialize any of our product candidates. We do not currently have sales, marketing or distribution capabilities. In order to successfully commercialize any of our product candidates, we must either internally develop sales, marketing and distribution capabilities or make arrangements with third parties to perform these services.

If we do not develop a marketing and sales force with technical expertise and supporting distribution capabilities, we will be unable to market any of our product candidates directly. To promote any of our potential products through third parties, we will have to locate acceptable third parties for these functions and enter into agreements with them on acceptable terms, and we may not be able to do so. In addition, any third-party arrangements we are able to enter into may result in lower revenues than we could achieve by directly marketing and selling our potential products.

We may suffer losses from product liability claims if our product candidates cause harm to patients.

Any of our product candidates could cause adverse events, such as immunologic or allergic reactions. These reactions may not be observed in clinical trials, but may nonetheless occur after commercialization. If any of these reactions occur, they may render our product candidates ineffective or harmful in some patients, and our sales would suffer, materially adversely affecting our business, financial condition and results of operations.

In addition, potential adverse events caused by our product candidates could lead to product liability lawsuits. If product liability lawsuits are successfully brought against us, we may incur substantial liabilities and may be required to limit commercialization of our product candidates. Our business exposes us to potential product liability risks, which are inherent in the testing, manufacturing, marketing and sale of pharmaceutical products. We may not be able to avoid product liability claims. Product liability insurance for the pharmaceutical and biotechnology industries is generally expensive, if available at all. We do not currently have any product liability insurance because we are not yet conducting trials on humans. When we begin human trials, we will endeavor to obtain sufficient product liability

insurance. If we are unable to obtain sufficient insurance coverage on reasonable terms or to otherwise protect against potential product liability claims, we may be unable to commercialize our product candidates. A successful product liability claim brought against us in excess of our insurance coverage, if any, may cause us to incur substantial liabilities, and, as a result, our business, liquidity and results of operations would be materially adversely affected.