Attached files

| file | filename |

|---|---|

| 8-K - COVER PAGE - WESCO INTERNATIONAL INC | wcc-03312013x8xkpressrelea.htm |

| EX-99.1 - EARNINGS RELEASE - WESCO INTERNATIONAL INC | wcc-03312013xexhibit991x8x.htm |

Prepared for WESCO Investor Day 2011. The information contained herein is confidential in nature and considered proprietary to WESCO. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO. The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial Data WESCO First Quarter April 18, 2013

2 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 Safe Harbor Statement Note: All statements made herein that are not historical facts should be considered as “forward- looking statements” within the meaning of the Private Securities Litigation Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially. Such risks, uncertainties and other factors include, but are not limited to: adverse conditions in the global economy; increase in competition; debt levels, terms, financial market conditions or interest rate fluctuations; risks related to acquisitions, including the integration of EECOL; disruptions in operations or information technology systems; expansion of business activities; litigation, contingencies or claims; product, labor or other cost fluctuations; and other factors described in detail in the Form 10-K for WESCO International, Inc. for the year ended December 31, 2012 and any subsequent filings with the Securities & Exchange Commission. Any numerical or other representations in this presentation do not represent guidance by management and should not be construed as such. The following presentation may also include a discussion of certain non-GAAP financial measures. Information required by Regulation G with respect to such non-GAAP financial measures can be obtained via WESCO’s website, www.wesco.com.

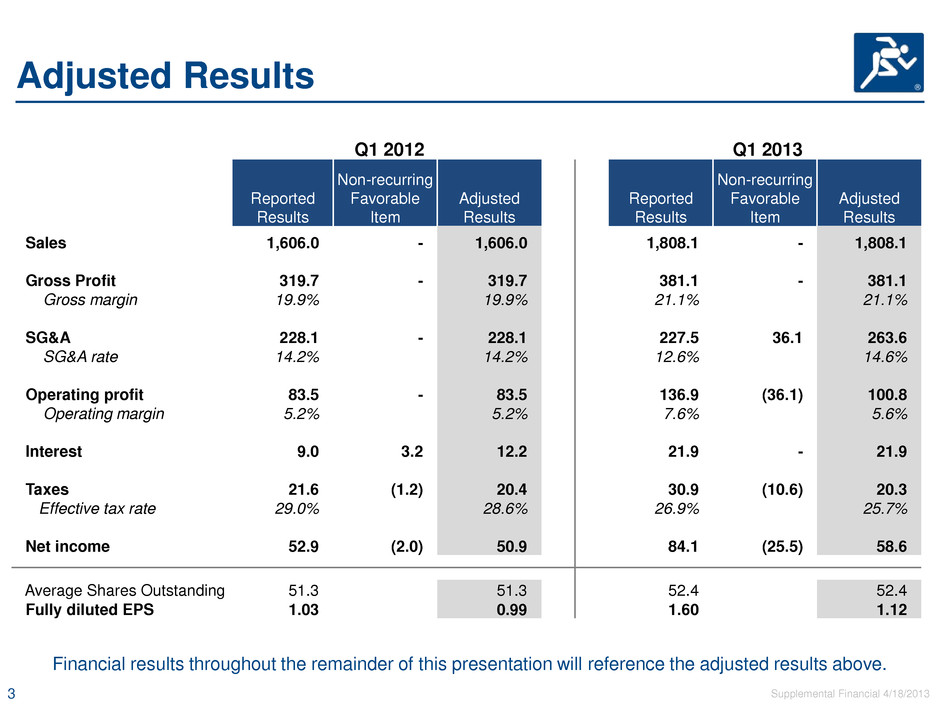

3 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 Adjusted Results Q1 2012 Q1 2013 Reported Results Non-recurring Favorable Item Adjusted Results Reported Results Non-recurring Favorable Item Adjusted Results Sales 1,606.0 - 1,606.0 1,808.1 - 1,808.1 Gross Profit 319.7 - 319.7 381.1 - 381.1 Gross margin 19.9% 19.9% 21.1% 21.1% SG&A 228.1 - 228.1 227.5 36.1 263.6 SG&A rate 14.2% 14.2% 12.6% 14.6% Operating profit 83.5 - 83.5 136.9 (36.1) 100.8 Operating margin 5.2% 5.2% 7.6% 5.6% Interest 9.0 3.2 12.2 21.9 - 21.9 Taxes 21.6 (1.2) 20.4 30.9 (10.6) 20.3 Effective tax rate 29.0% 28.6% 26.9% 25.7% Net income 52.9 (2.0) 50.9 84.1 (25.5) 58.6 Average Shares Outstanding 51.3 51.3 52.4 52.4 Fully diluted EPS 1.03 0.99 1.60 1.12 Financial results throughout the remainder of this presentation will reference the adjusted results above.

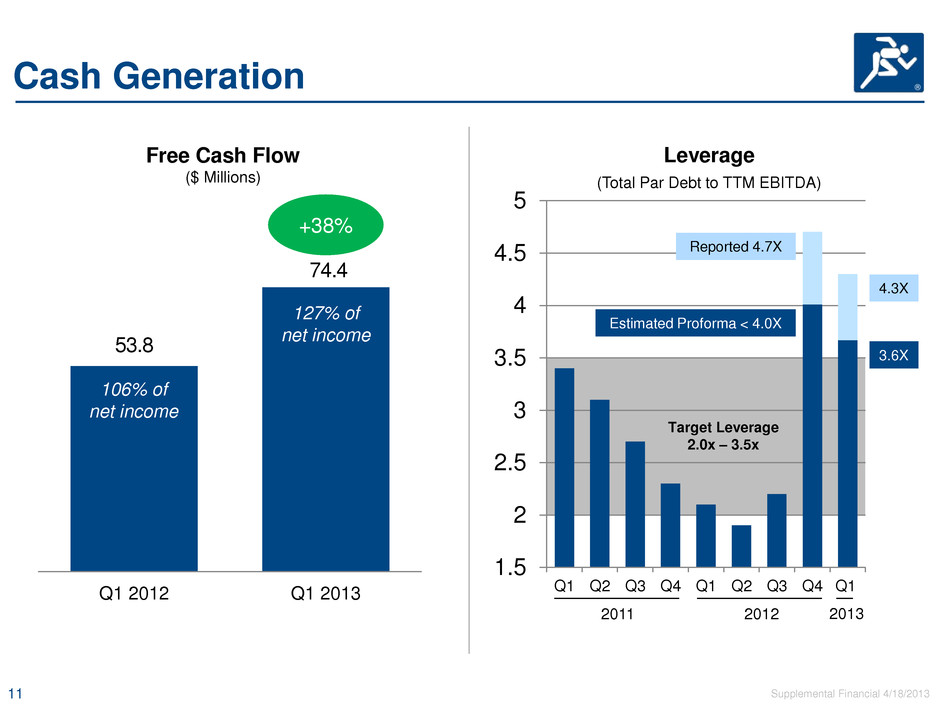

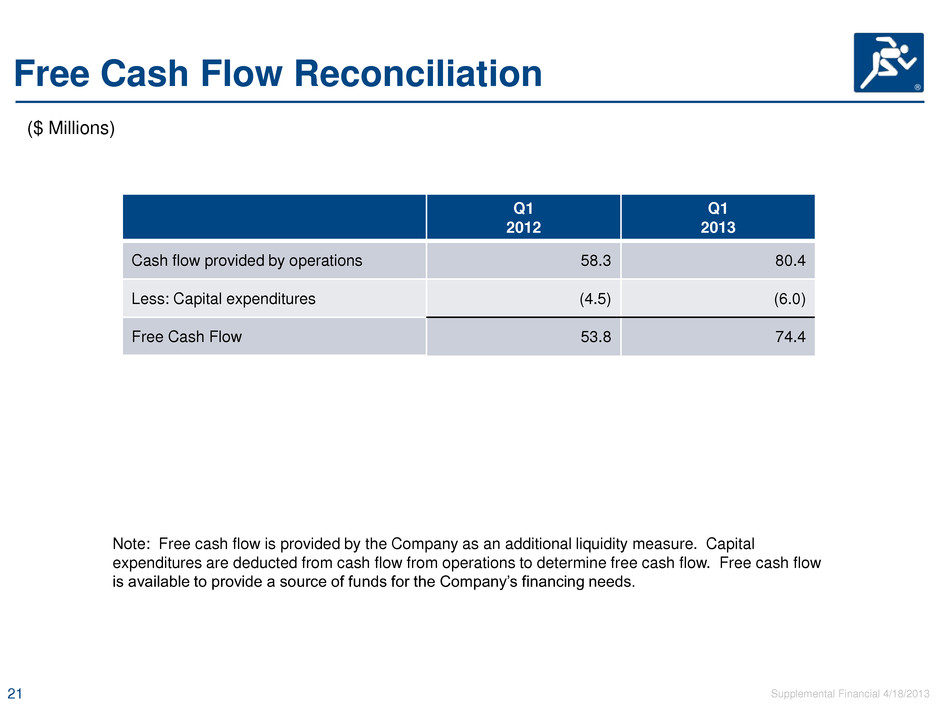

4 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 Q1 2013 Highlights • Sales of $1.81 billion, up 12.6% YOY − Achieved record quarterly sales − 16 points from acquisitions; EECOL sales of $227 million, up approximately 7% YOY − (3.4) points organic, or approximately (1.8) points normalized for one less workday in 2013 • Gross margin 21.1%, up 120 bps YOY − Achieved record gross margin − Core gross margin expansion of 30 bps YOY • SG&A 14.6% of sales, up 40 bps YOY − Core SG&A expenses flat YOY and sequentially • Operating margin 5.6%, up 40 bps YOY • Net income of $58.6 million, up 15.1% YOY • EPS of $1.12, up 13.1% YOY − EECOL contributed approximately $0.22 of EPS accretion • Free cash flow of $74.4 million, 127% of net income • Financial leverage reduced to approximately 3.6x on a proforma basis

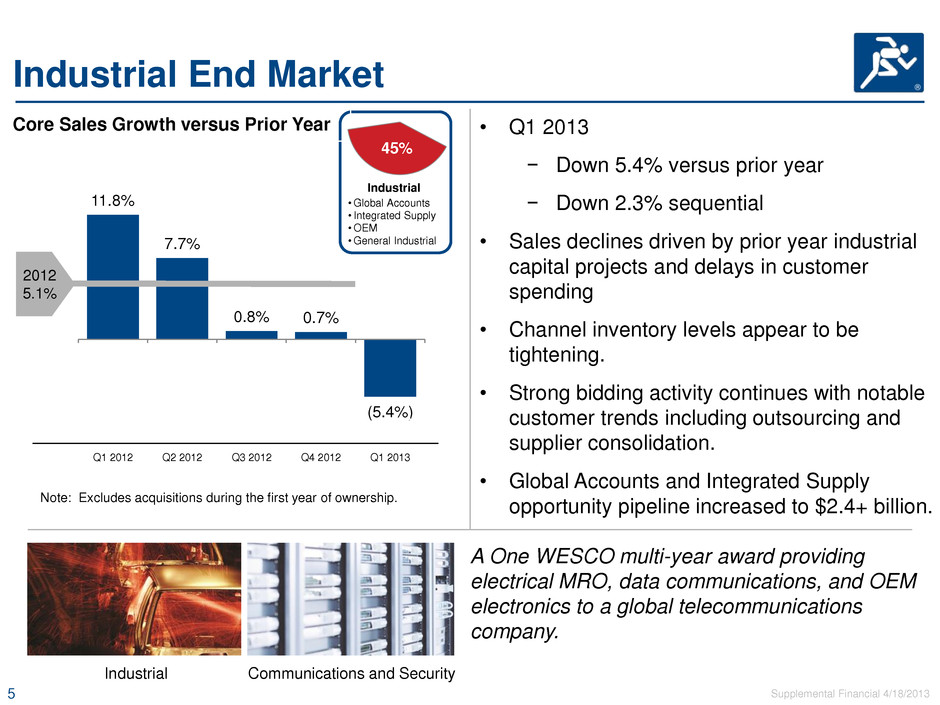

5 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 Industrial End Market Core Sales Growth versus Prior Year • Q1 2013 − Down 5.4% versus prior year − Down 2.3% sequential • Sales declines driven by prior year industrial capital projects and delays in customer spending • Channel inventory levels appear to be tightening. • Strong bidding activity continues with notable customer trends including outsourcing and supplier consolidation. • Global Accounts and Integrated Supply opportunity pipeline increased to $2.4+ billion. A One WESCO multi-year award providing electrical MRO, data communications, and OEM electronics to a global telecommunications company. Industrial Communications and Security 11.8% 7.7% 0.8% 0.7% (5.4%) Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 45% Industrial • Global Accounts • Integrated Supply •OEM •General Industrial 12% Note: Excludes acquisitions during the first year of ownership. 2012 5.1%

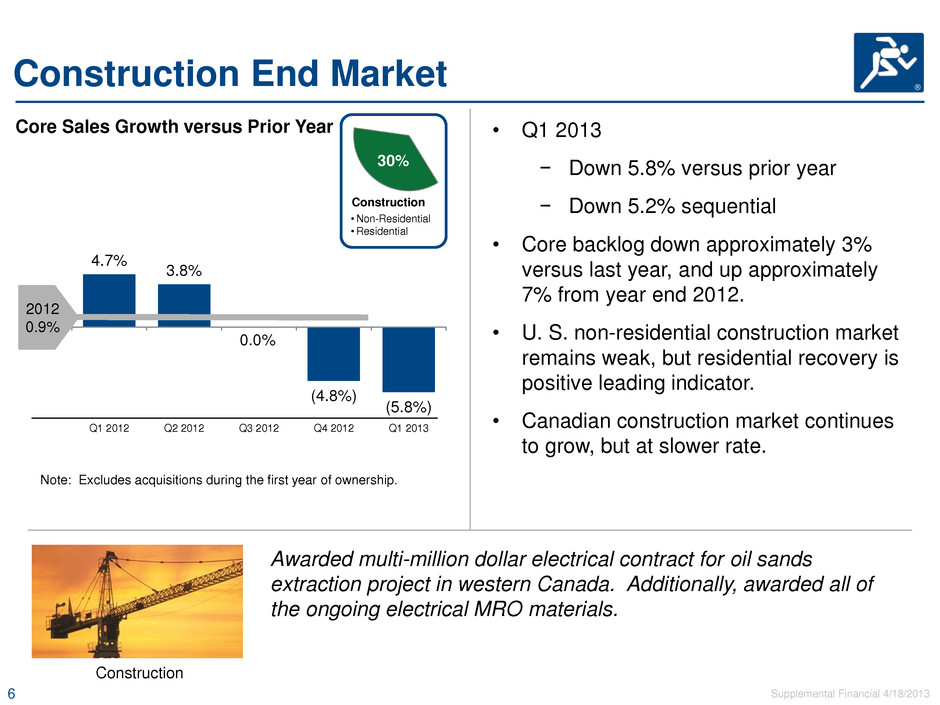

6 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 4.7% 3.8% 0.0% (4.8%) (5.8%) Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Construction End Market Core Sales Growth versus Prior Year Construction •Non-Residential •Residential 30% • Q1 2013 − Down 5.8% versus prior year − Down 5.2% sequential • Core backlog down approximately 3% versus last year, and up approximately 7% from year end 2012. • U. S. non-residential construction market remains weak, but residential recovery is positive leading indicator. • Canadian construction market continues to grow, but at slower rate. Awarded multi-million dollar electrical contract for oil sands extraction project in western Canada. Additionally, awarded all of the ongoing electrical MRO materials. Construction Note: Excludes acquisitions during the first year of ownership. 2012 0.9%

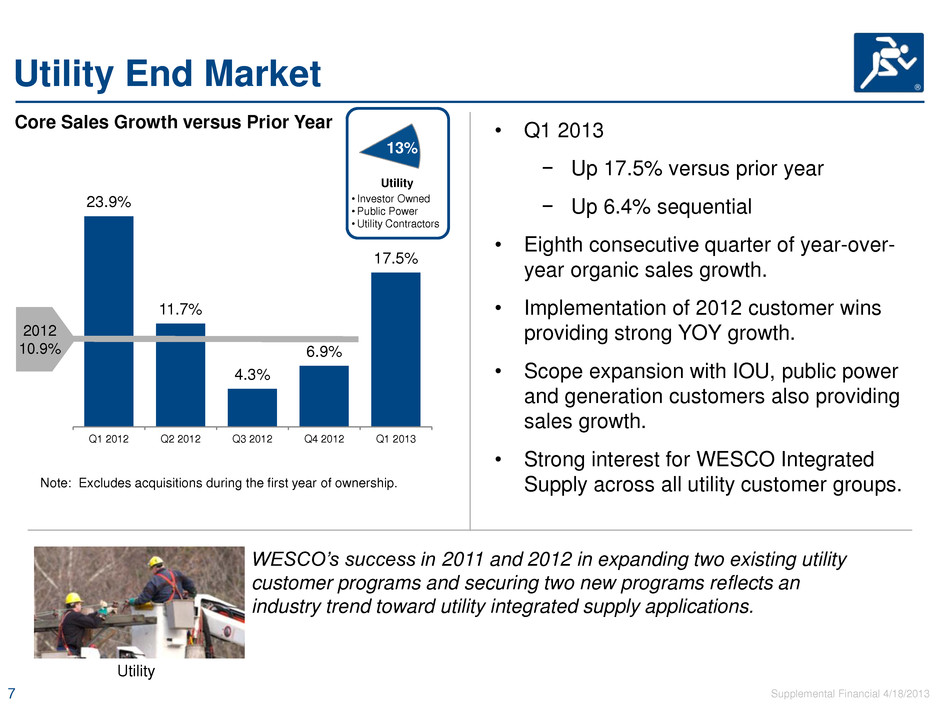

7 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 Utility End Market Core Sales Growth versus Prior Year 13% Utility • Investor Owned •Public Power •Utility Contractors • Q1 2013 − Up 17.5% versus prior year − Up 6.4% sequential • Eighth consecutive quarter of year-over- year organic sales growth. • Implementation of 2012 customer wins providing strong YOY growth. • Scope expansion with IOU, public power and generation customers also providing sales growth. • Strong interest for WESCO Integrated Supply across all utility customer groups. WESCO’s success in 2011 and 2012 in expanding two existing utility customer programs and securing two new programs reflects an industry trend toward utility integrated supply applications. Utility 23.9% 11.7% 4.3% 6.9% 17.5% Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Note: Excludes acquisitions during the first year of ownership. 2012 10.9%

8 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 CIG End Market • Q1 2013 − Down 8.5% versus prior year − Down 5.3% sequential • Bidding activity remains active in CIG verticals. • Federal contracts continue but awards have slowed due to budget constraints and uncertainty associated with sequestration. • Government opportunity pipeline remains healthy at over $500 million. Signed multi-year cooperative agreement with a group purchasing organization used by public agencies eliminating need for multiple bid solicitations. A One WESCO win that includes electrical, data communications, security and lighting product categories. Government Core Sales Growth versus Prior Year CIG •Commercial • Institutional •Government 12% 5.4% 14.3% 0.0% Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 (3.3%) (8.5%) Note: Excludes acquisitions during the first year of ownership. 2012 3.8%

9 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 Q1 2013 Results versus Outlook Q1 Outlook Q1 Actual Sales Growth of 12% to 14% (1)% to 1% excluding EECOL (2)% to flat organic Growth of 12.6% (1.6)% excluding EECOL (3.4)% organic, (1.8)% normalized Gross Margin At or above 20.6% 21.1% Operating Margin At or above 5.5% 5.6% Effective Tax Rate Approximately 27% to 29% 25.7%

10 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 0.99 1.12 (0.12) 0.25 Q1 2012 Core Acquisitions Q1 2013 EPS Roadmap ($) (3)% organic +30 bps GM Flat SG&A Share Count Growth EECOL ~0.22 Conney/Trydor ~0.03 +13%

11 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 1.5 2 2.5 3 3.5 4 4.5 5 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Cash Generation 53.8 74.4 Q1 2012 Q1 2013 Target Leverage 2.0x – 3.5x 2011 2012 (Total Par Debt to TTM EBITDA) Leverage 2013 Reported 4.7X Estimated Proforma < 4.0X 4.3X 3.6X Free Cash Flow ($ Millions) +38% 127% of net income 106% of net income

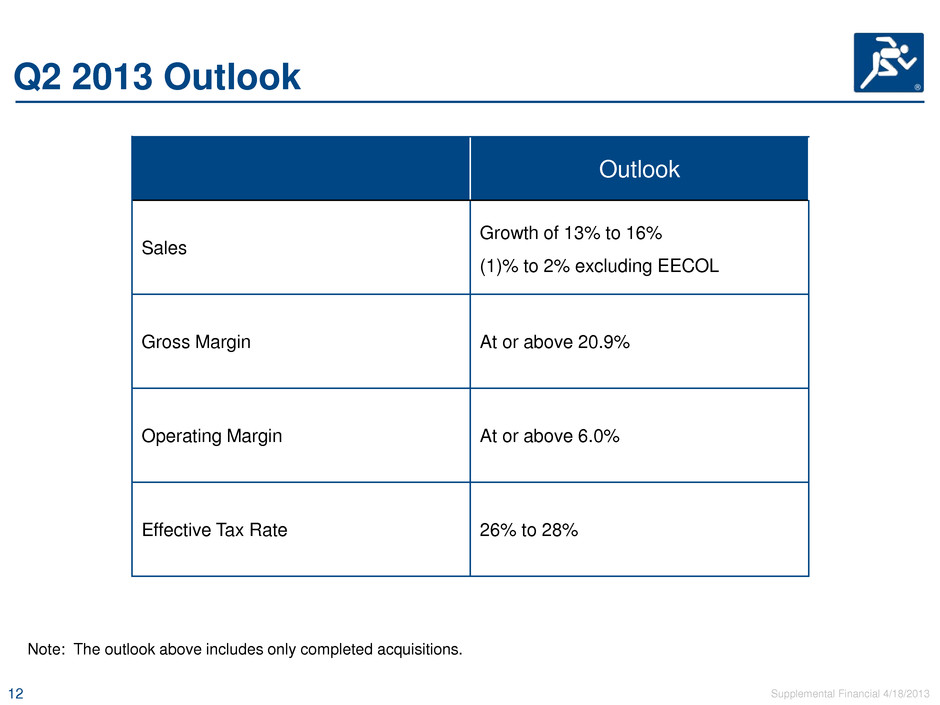

12 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 Q2 2013 Outlook Outlook Sales Growth of 13% to 16% (1)% to 2% excluding EECOL Gross Margin At or above 20.9% Operating Margin At or above 6.0% Effective Tax Rate 26% to 28% Note: The outlook above includes only completed acquisitions.

13 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 Appendix

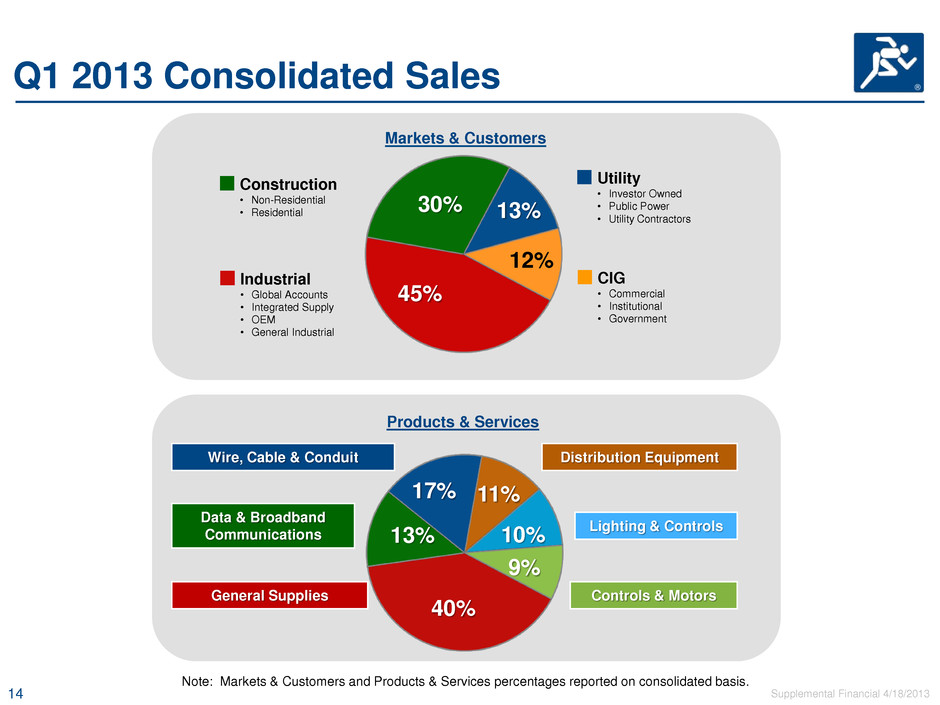

14 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 Q1 2013 Consolidated Sales 45% 30% 13% 12% Markets & Customers 40% 13% 17% 11% 10% 9% Products & Services Controls & Motors Lighting & Controls General Supplies Data & Broadband Communications Wire, Cable & Conduit Distribution Equipment Utility • Investor Owned • Public Power • Utility Contractors CIG • Commercial • Institutional • Government Industrial • Global Accounts • Integrated Supply • OEM • General Industrial Construction • Non-Residential • Residential Note: Markets & Customers and Products & Services percentages reported on consolidated basis. Mix change (vs. FY 2012 Proforma) Industrial +1 pt. Construction -2 pts. Utility +1 pt. CIG – Mix change (vs. FY 2012 Proforma) General Supplies +2 pts. Data & Broadband Communications – Wire, Cable & Conduit – Distribution Equipment -2 pts. Lighting & Controls – Controls & Motors –

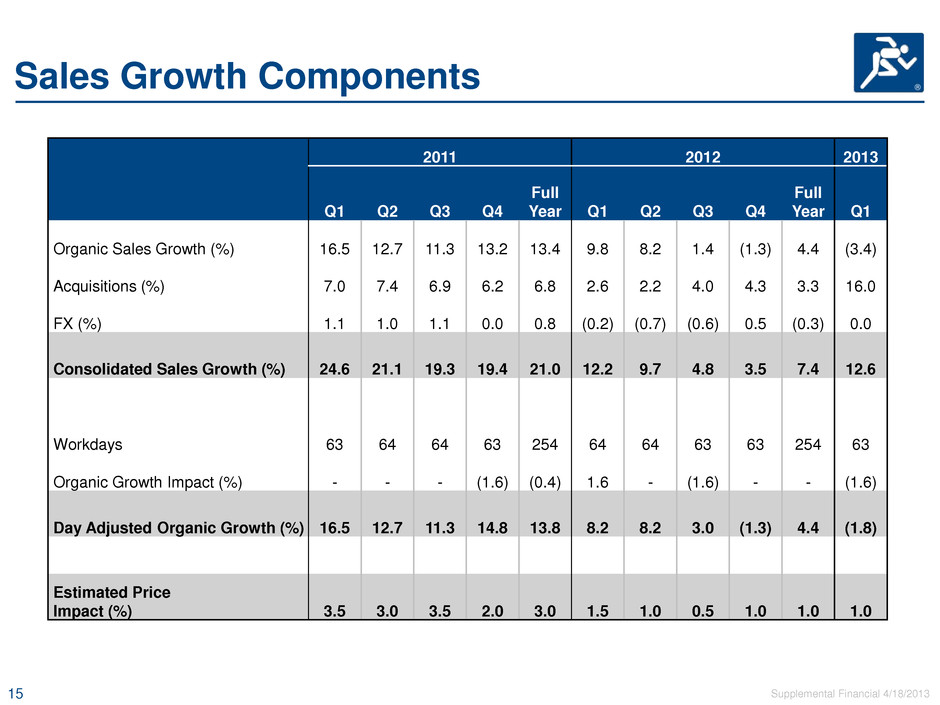

15 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 Sales Growth Components 2011 2012 2013 Q1 Q2 Q3 Q4 Full Year Q1 Q2 Q3 Q4 Full Year Q1 Organic Sales Growth (%) 16.5 12.7 11.3 13.2 13.4 9.8 8.2 1.4 (1.3) 4.4 (3.4) Acquisitions (%) 7.0 7.4 6.9 6.2 6.8 2.6 2.2 4.0 4.3 3.3 16.0 FX (%) 1.1 1.0 1.1 0.0 0.8 (0.2) (0.7) (0.6) 0.5 (0.3) 0.0 Consolidated Sales Growth (%) 24.6 21.1 19.3 19.4 21.0 12.2 9.7 4.8 3.5 7.4 12.6 Workdays 63 64 64 63 254 64 64 63 63 254 63 Organic Growth Impact (%) - - - (1.6) (0.4) 1.6 - (1.6) - - (1.6) Day Adjusted Organic Growth (%) 16.5 12.7 11.3 14.8 13.8 8.2 8.2 3.0 (1.3) 4.4 (1.8) Estimated Price Impact (%) 3.5 3.0 3.5 2.0 3.0 1.5 1.0 0.5 1.0 1.0 1.0

16 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 Outstanding at December 31, 2012 Outstanding at March 31, 2013 Debt Maturity Schedule AR Revolver (V) 445 447 2014 Inventory Revolver (V) 218 191 2016 Real Estate Mortgage (F) 26 - 2019 Term Loans (V) 850 840 2019 2029 Convertible Bonds (F) 345 345 2029 (No Put) Other (V) 35 34 N/A Total Par Debt 1,919 1,857 Capital Structure Key Financial Metrics Q1 2012 YE 2012 Q1 2013 Cash 64 86 117 Capital Expenditures 5 23 6 Free Cash Flow (1) 54 265 74 Liquidity (2) 572 299 374 ($ Millions) V = Variable Rate Debt 1 = Operating cash flow less capital expenditures F = Fixed Rate Debt 2 = Asset-backed credit facilities total availability plus invested cash

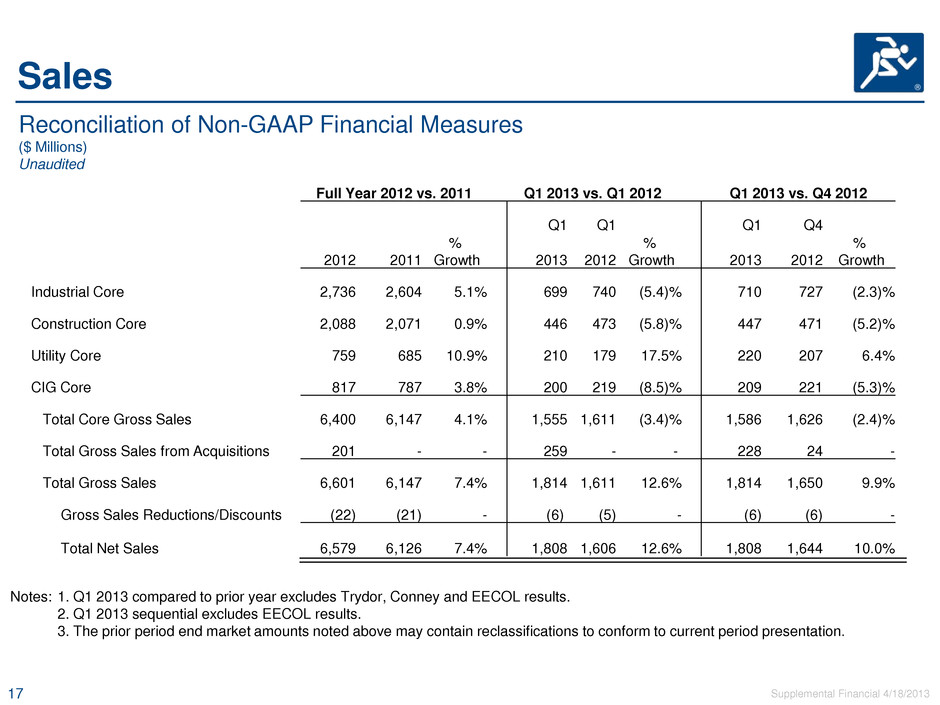

17 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 Notes: 1. Q1 2013 compared to prior year excludes Trydor, Conney and EECOL results. 2. Q1 2013 sequential excludes EECOL results. 3. The prior period end market amounts noted above may contain reclassifications to conform to current period presentation. Reconciliation of Non-GAAP Financial Measures ($ Millions) Unaudited Sales Full Year 2012 vs. 2011 Q1 2013 vs. Q1 2012 Q1 2013 vs. Q4 2012 Q1 Q1 Q1 Q4 2012 2011 % Growth 2013 2012 % Growth 2013 2012 % Growth Industrial Core 2,736 2,604 5.1% 699 740 (5.4)% 710 727 (2.3)% Construction Core 2,088 2,071 0.9% 446 473 (5.8)% 447 471 (5.2)% Utility Core 759 685 10.9% 210 179 17.5% 220 207 6.4% CIG Core 817 787 3.8% 200 219 (8.5)% 209 221 (5.3)% Total Core Gross Sales 6,400 6,147 4.1% 1,555 1,611 (3.4)% 1,586 1,626 (2.4)% Total Gross Sales from Acquisitions 201 - - 259 - - 228 24 - Total Gross Sales 6,601 6,147 7.4% 1,814 1,611 12.6% 1,814 1,650 9.9% Gross Sales Reductions/Discounts (22) (21) - (6) (5) - (6) (6) - Total Net Sales 6,579 6,126 7.4% 1,808 1,606 12.6% 1,808 1,644 10.0%

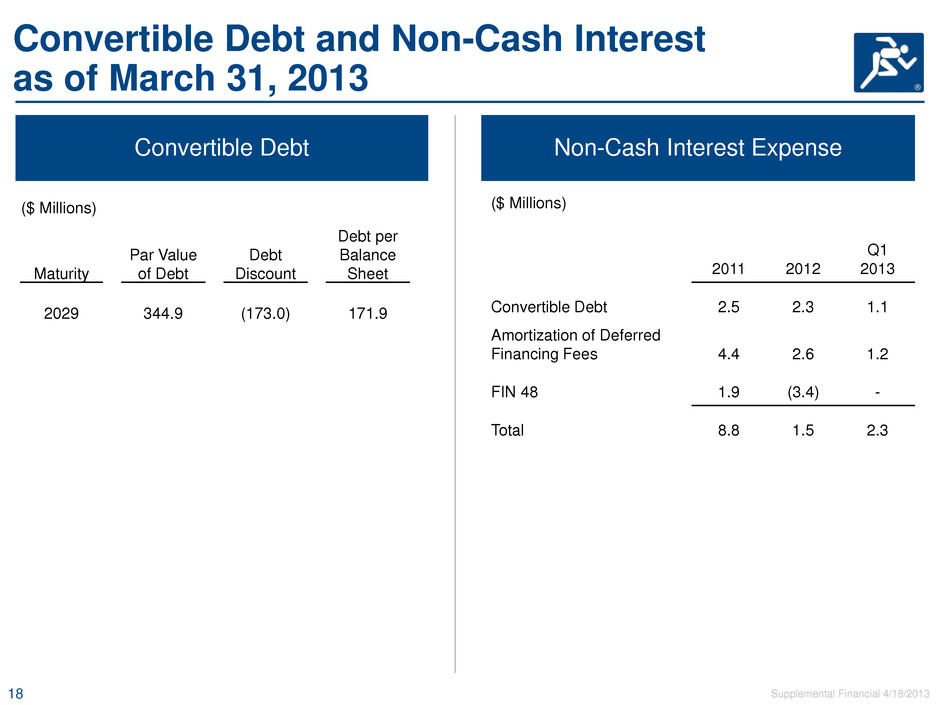

18 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 Convertible Debt Non-Cash Interest Expense ($ Millions) Maturity Par Value of Debt Debt Discount Debt per Balance Sheet 2029 344.9 (173.0) 171.9 ($ Millions) 2011 2012 Q1 2013 Convertible Debt 2.5 2.3 1.1 Amortization of Deferred Financing Fees 4.4 2.6 1.2 FIN 48 1.9 (3.4) - Total 8.8 1.5 2.3 Convertible Debt and Non-Cash Interest as of March 31, 2013

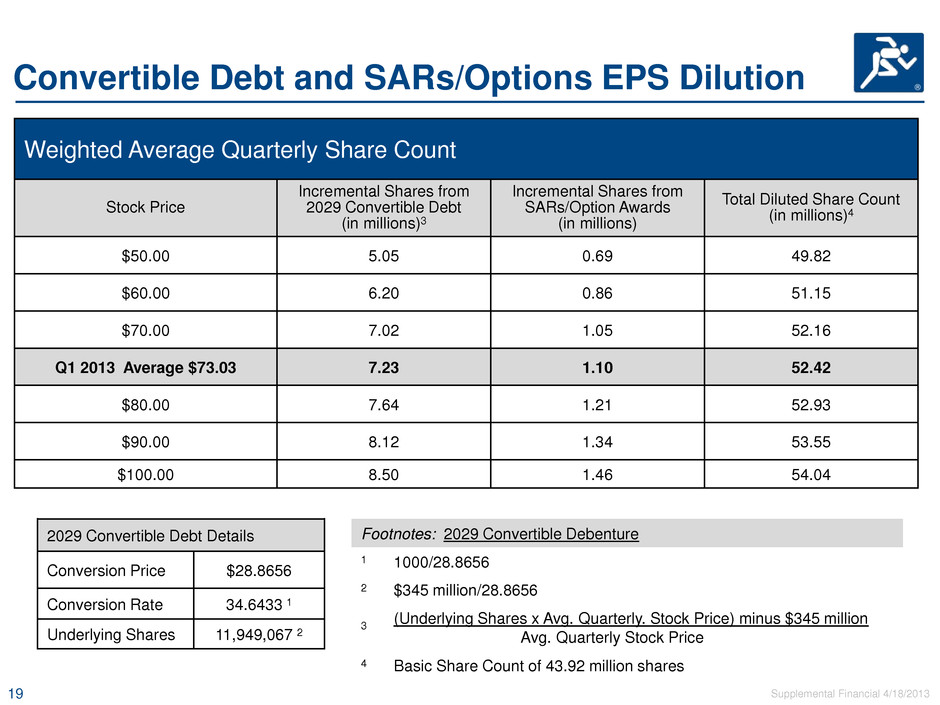

19 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 Convertible Debt and SARs/Options EPS Dilution Weighted Average Quarterly Share Count Stock Price Incremental Shares from 2029 Convertible Debt (in millions)3 Incremental Shares from SARs/Option Awards (in millions) Total Diluted Share Count (in millions)4 $50.00 5.05 0.69 49.82 $60.00 6.20 0.86 51.15 $70.00 7.02 1.05 52.16 Q1 2013 Average $73.03 7.23 1.10 52.42 $80.00 7.64 1.21 52.93 $90.00 8.12 1.34 53.55 $100.00 8.50 1.46 54.04 2029 Convertible Debt Details Conversion Price $28.8656 Conversion Rate 34.6433 1 Underlying Shares 11,949,067 2 Footnotes: 2029 Convertible Debenture 1 1000/28.8656 2 $345 million/28.8656 3 (Underlying Shares x Avg. Quarterly. Stock Price) minus $345 million Avg. Quarterly Stock Price 4 Basic Share Count of 43.92 million shares

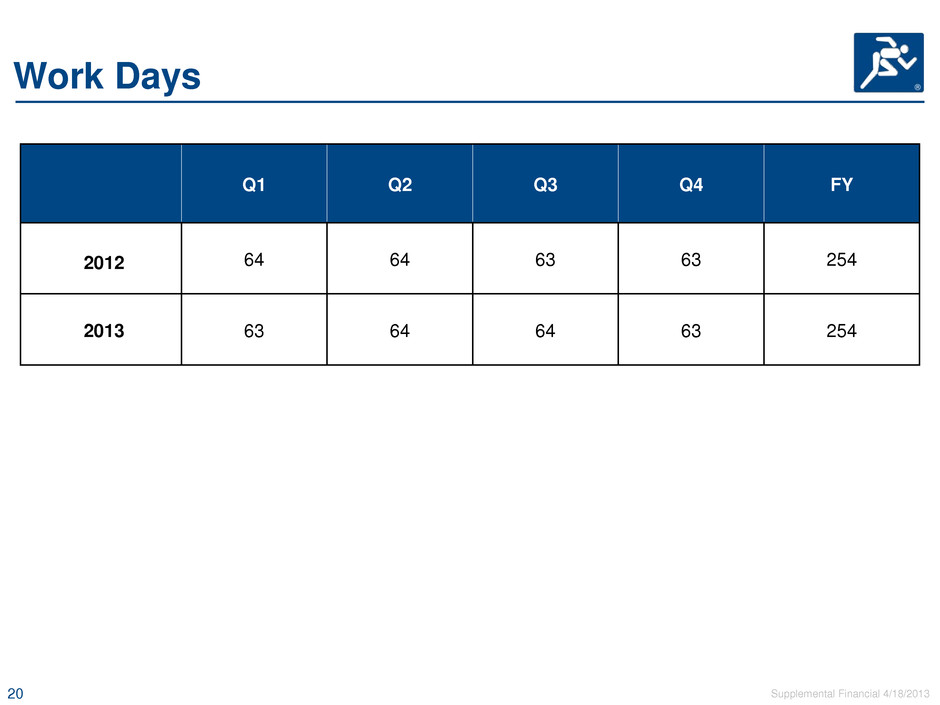

20 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 Work Days Q1 Q2 Q3 Q4 FY 2012 64 64 63 63 254 2013 63 64 64 63 254

21 The information contained herein is confidential in nature and considered proprietary to WESCO Distribution, Inc. It is intended for the exclusive use of the employees, contractors and agents of client companies. We request that no oral or written disclosure of such information be made without the prior written approval by WESCO Distribution, Inc. Supplemental Financial 4/18/2013 Free Cash Flow Reconciliation Q1 2012 Q1 2013 Cash flow provided by operations 58.3 80.4 Less: Capital expenditures (4.5) (6.0) Free Cash Flow 53.8 74.4 Note: Free cash flow is provided by the Company as an additional liquidity measure. Capital expenditures are deducted from cash flow from operations to determine free cash flow. Free cash flow is available to provide a source of funds for the Company’s financing needs. ($ Millions)