Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - DONEGAL GROUP INC | d523198dex992.htm |

| EX-99.3 - EX-99.3 - DONEGAL GROUP INC | d523198dex993.htm |

| 8-K - FORM 8-K - DONEGAL GROUP INC | d523198d8k.htm |

Annual Meeting of

Stockholders

April 18, 2013

Exhibit 99.1 |

Forward-Looking Statements

2

The Company bases all statements made in this presentation that are not historic facts on

its current expectations. These statements are forward-looking in nature (as

defined in the Private Securities Litigation Reform Act of 1995) and involve a number

of risks and uncertainties. Actual results could vary materially. Factors that could

cause actual results to vary materially include: the Company’s ability to

maintain profitable operations, the adequacy of the loss and loss expense reserves of

the Company’s insurance subsidiaries, business and economic conditions in the areas

in which the Company operates, interest rates, competition from various insurance and other

financial businesses, terrorism, the availability and cost of reinsurance, adverse and

catastrophic weather events, legal and judicial developments, changes in regulatory

requirements, the Company’s ability to integrate and manage successfully the

companies it may acquire from time to time and other risks the Company describes from

time to time in the periodic reports it files with the Securities and Exchange

Commission. You should not place undue reliance on any such forward-looking

statements. The Company disclaims any obligation to update such statements or to

announce publicly the results of any revisions that it may make to any forward-looking statements

to reflect the occurrence of anticipated or unanticipated events or circumstances after the

date of such statements.

Reconciliations of non-GAAP data are available in the Investors section of

the Company’s website at www.donegalgroup.com in the

Company’s news releases regarding quarterly financial results.

|

President’s Report |

Corporate Objective

Create value for shareholders, policyholders,

agents, employees and the communities we

serve by outperforming the property and

casualty insurance industry over time in terms

of service, profitability and book value growth |

Multi-faceted Strategy to Achieve Strategic

Goals

•

Conservative underwriting

•

Pricing discipline and premium adequacy

•

Prudent organic and acquisition growth

•

Best-in-class technology

•

Effective and growing agency distribution

system

5 |

Multi-faceted Strategy to Achieve Strategic

Goals

•

Superior claims service

•

Efficient operations

•

Conservative investing

•

Strong enterprise risk management

•

Recruiting, development and retention

of quality personnel

6 |

2012

Financial

Results |

Financial Results

8

2011

•

Total Revenues

$475,018,000

$514,983,000

•

Premiums Earned

$431,470,000

$475,002,000

•

Investment Income

$20,858,000

$20,168,000

•

Net Income

$453,000

$23,093,000

•

Statutory Combined Ratio

107.9%

99.8%

2012 |

Balance Sheet Strength

9

December 31,

•

Total

Assets

•

Stockholders’

Equity

•

Book

Value

per

Share

$15.01

$15.63

$400,034,000

$383,452,000

$1,336,889,000

$1,290,793,000

2012

2011 |

10

Investment Portfolio

* Excluding investments in affiliates

Short-Term

Securities

5%

Treasury

2%

Agency

7%

Corporate

10%

Mortgage

-Backed

Securities (MBS)

16%

Taxable Munis

2%

Equity

1%

$769 Million

in Invested

Assets*

Tax-Exempt Municipals

57% |

Fixed

Maturity Investment Ratings December 31, 2012

11

U.S. Treasury and U.S. Agency Securities

$201,358,000

27.3%

Aaa or AAA

53,203,000

7.2%

Aa or AA

379,372,000

51.5%

A

89,338,000

12.1%

BBB

13,339,000

1.9%

Total

$736,610,000

100.0% |

Growth of Book Value

12

Book Value Plus Cumulative Dividends

$-

$5.00

$10.00

$15.00

$20.00

Book Value

Dividends Paid |

1

st

Quarter

2013

Financial

Results |

1

st

Quarter Financial Results

14

1

st

Qtr 2012

1

st

Qtr 2013

•

Total Revenues

$125,348,000

$133,873,000

•

Premiums Earned

$114,692,000

$124,702,000

•

Investment Income

$5,090,000

$4,815,000

•

Net Income

$8,010,000

$6,475,000

•

Statutory Combined Ratio

96.9%

98.0% |

Balance Sheet Strength

15

December 31,

March 31,

2012

2013

•

Total

Assets

$1,336,889,000

$1,352,033,000

•

Stockholders’

Equity $400,034,000

$404,722,000

•

Book Value per Share

$15.63 $15.72 |

Technological Capabilities

16 |

Acquisitions and

Affiliations |

Regional Focus: Serving 22 States

Through 2,500 Independent Agencies

•

10 M&A transactions

–

Experienced consolidation team

•

Acquisition criteria:

–

Serving attractive geography

–

Favorable regulatory, legislative

and judicial environments

–

Similar personal/commercial

business mix

–

Premium volume

up to $100

million

18 |

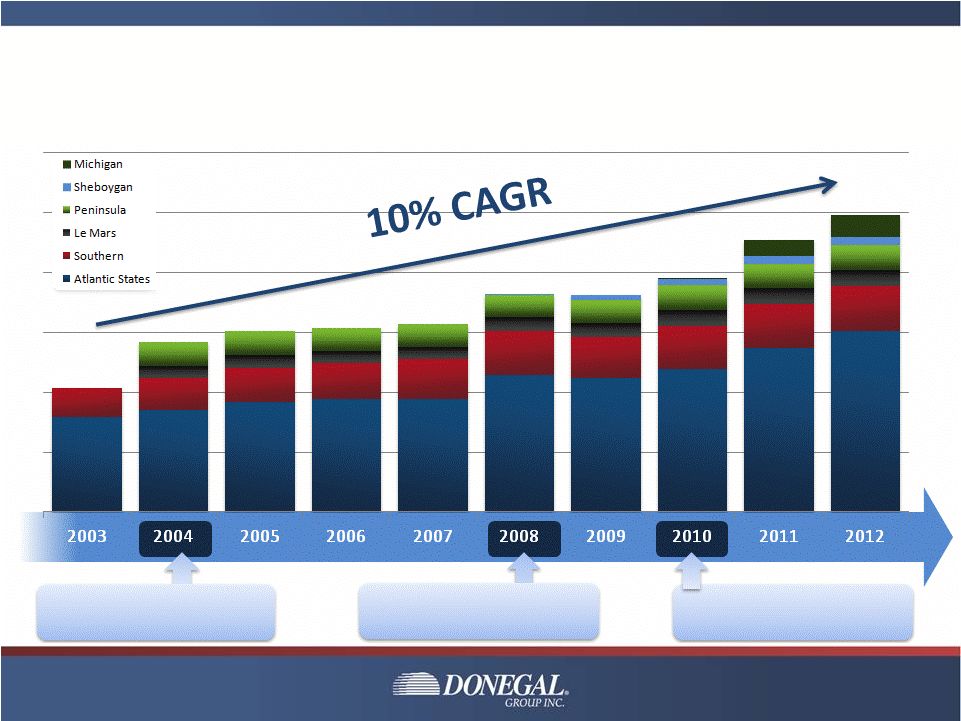

Acquisitions Have Made Meaningful

Contribution to Long-term Growth

19

$283

$302

$207

$307

$314

$365

$363

$392

$454

$496

Net Written Premiums

(dollars in millions)

January 2004

Acquired Le Mars and

Peninsula

December 2008

Acquired Sheboygan Falls

Implemented Pooling Change

December 2010

Acquired Michigan

Implemented 25% Quota Share |

Union

Community Bank (48% owned by Donegal Group Inc.)

•

Financial results:

–

$509.8

million in assets at year-end 2012

–

$9.8 million in 2012 net income, up from $4.8 million in 2011

–

$2.3 million in net income for first quarter of 2013

•

Excellent capital ratios at March 31, 2013:

20

Tier 1 capital to average total assets

15.34%

Tier 1 capital to risk-weighted assets

22.17%

Risk-based capital to risk-weighted assets

24.25% |

Recognition

21

Affirmed October 2012

Affirmed October 2012 |

Annual Meeting

of Stockholders

April 18, 2013 |