Attached files

| file | filename |

|---|---|

| EX-99.1 - TRUIST FINANCIAL CORP | exhibit991.htm |

| EX-99.2 - TRUIST FINANCIAL CORP | exhibit992.htm |

| 8-K - TRUIST FINANCIAL CORP | earn8k1q2013.htm |

Exhibit 99.3

2 Non - GAAP Information This presentation contains financial information and performance measures determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”) . BB&T’s management uses these “non - GAAP” measures in their analysis of the corporation’s performance and the efficiency of its operations . Management believes that these non - GAAP measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods as well as demonstrating the effects of significant gains and charges in the current period . The company believes that a meaningful analysis of its financial performance requires an understanding of the factors underlying that performance . BB&T’s management believes that investors may use these non - GAAP financial measures to analyze financial performance without the impact of unusual items that may obscure trends in the company’s underlying performance . These disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non - GAAP performance measures that may be presented by other companies . In this presentation, these measures are generally marked as “non - GAAP” and are accompanied with disclosure regarding why BB&T’s management believes such measures are useful to investors . Below is a listing of the types of non - GAAP measures used in this presentation : □ Tangible common equity and Tier 1 common equity ratios are non - GAAP measures. BB&T uses the Tier 1 common equity definition used in the SCAP assessment to calculate these ratios. The Basel III Tier I common equity ratio is also a non - GAAP measure and reflects management’s best estimate of the propo sed regulatory requirements, which are subject to change. BB&T’s management uses these measures to assess the quality of capital and believes that investors may find them use ful in their analysis of the corporation. □ Asset quality ratios have been adjusted to remove the impact of acquired loans and foreclosed property covered by FDIC loss s har ing agreements from the numerator and denominator of these ratios. Management believes that their inclusion may result in distortion of these ratios, such that they may not b e c omparable to other periods presented or to other portfolios that were not impacted by purchase accounting. □ Fee income and efficiency ratios are non - GAAP in that they exclude securities gains (losses), foreclosed property expense, amort ization of intangible assets, merger - related and restructuring charges, the impact of FDIC loss share accounting and other selected items. BB&T’s management uses these measu res in their analysis of the Corporation’s performance. BB&T’s management believes these measures provide a greater understanding of ongoing operations and enhance comparability of res ults with prior periods, as well as demonstrating the effects of significant gains and charges. □ Return on average tangible common shareholders’ equity is a non - GAAP measure that calculates the return on average common shareh olders’ equity without the impact of intangible assets and their related amortization. This measure is useful for evaluating the performance of a business consistently, whe the r acquired or developed internally. □ Core net interest margin is a non - GAAP measure that adjusts net interest margin to exclude the impact of interest income and fun ding costs associated with loans and securities acquired in the Colonial acquisition. BB&T’s management believes that the exclusion of the generally higher yielding assets acquired in the Colonial transaction from the calculation of net interest margin provides investors with useful information related to the relative performance of the remainder of BB&T’s ear nin g assets. □ Net income available to common shareholders and diluted EPS have been adjusted to exclude the impact of the $281 million tax adj ustment that was recorded in the first quarter of 2013. BB&T management believes these adjustments increase comparability of period to period results and uses these measures t o a ssess performance and believes investors may find them useful in their analysis of the corporation. A reconciliation of these non - GAAP measures to the most directly comparable GAAP measure is included on the Investor Relations s ection of BB&T’s website and as an appendix to this presentation. Forward - Looking Information This presentation contains forward - looking statements with respect to the financial condition, results of operations and businesses of BB&T . Statements that are not historical or current facts or statements about beliefs and expectations are forward - looking statements . Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “may,” “will,” “should,” and other similar expressions are intended to identify these forward - looking statements . Forward - looking statements involve certain risks and uncertainties and are based on the beliefs and assumptions of the management of BB&T, and the information available to management at the time that this presentation was prepared . Factors that may cause actual results to differ materially from those contemplated by such forward - looking statements include, among others, the following : ( 1 ) general economic or business conditions, either nationally or regionally, may be less favorable than expected, resulting in, among other things, a deterioration in credit quality and / or a reduced demand for credit or other services ; ( 2 ) disruptions to the credit and financial markets, either nationally or globally, including the impact of a downgrade of U . S . government obligations by one of the credit rating agencies and the adverse effects of the ongoing sovereign debt crisis in Europe ; ( 3 ) changes in the interest rate environment may reduce net interest margins and / or the volumes and values of loans made or held as well as the value of other financial assets held ; ( 4 ) competitive pressures among depository and other financial institutions may increase significantly ; ( 5 ) legislative, regulatory, or accounting changes, including changes resulting from the adoption and implementation of the Dodd - Frank Wall Street Reform and Consumer Protection Act of 2010 , and changes in accounting standards, may adversely affect the businesses in which BB&T is engaged ; ( 6 ) local, state or federal taxing authorities may take tax positions that are adverse to BB&T ; ( 7 ) reduction in BB&T’s credit ratings ; ( 8 ) adverse changes may occur in the securities markets ; ( 9 ) competitors of BB&T may have greater financial resources and develop products that enable them to compete more successfully than BB&T and may be subject to different regulatory standards than BB&T ; ( 10 ) costs or difficulties related to the integration of the businesses of BB&T and its merger partners may be greater than expected ; ( 11 ) unpredictable natural or other disasters could have an adverse effect on BB&T in that such events could materially disrupt BB&T’s operations or the ability or willingness of BB&T’s customers to access the financial services BB&T offers ; ( 12 ) expected cost savings associated with completed mergers and acquisitions may not be fully realized or realized within the expected time frames ; ( 13 ) deposit attrition, customer loss and/or revenue loss following completed mergers and acquisitions, may be greater than expected ; and ( 14 ) BB&T faces system failures and cyber - security risks that could adversely affect BB&T’s business and financial performance . These and other risk factors are more fully described in BB&T’s Annual Report on Form 10 - K for the year ended December 31 , 2012 under the section entitled Item 1 A . “Risk Factors” and from time to time, in other filings with the Securities and Exchange Commission . You are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date of this presentation . Actual results may differ materially from those expressed in or implied by any forward - looking statements . Except to the extent required by applicable law or regulation, BB&T undertakes no obligation to revise or update publicly any forward - looking statements for any reason .

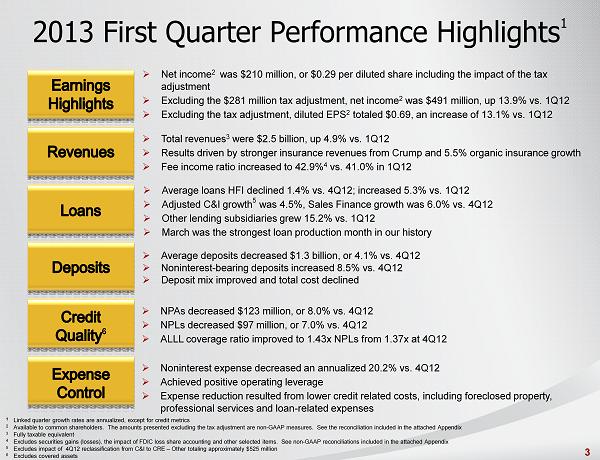

3 2013 First Quarter Performance Highlights 1 1 Linked quarter growth rates are annualized, except for credit metrics 2 Available to common shareholders. The amounts presented excluding the tax adjustment are non - GAAP measures. See the reconcilia tion included in the attached Appendix 3 Fully taxable equivalent . 4 Excludes securities gains (losses), the impact of FDIC loss share accounting and other selected items. See non - GAAP reconciliat ions included in the attached Appendix 5 Excludes impact of 4Q12 reclassification from C&I to CRE – Other totaling approximately $525 million 6 Excludes covered assets » Net income 2 was $210 million, or $0.29 per diluted share including the impact of the tax adjustment » Excluding the $281 million tax adjustment, net income 2 was $491 million, up 13.9% vs. 1Q12 » Excluding the tax adjustment, diluted EPS 2 totaled $0.69, an increase of 13.1% vs. 1Q12 » Average loans HFI declined 1.4% vs. 4Q12; increased 5.3% vs. 1Q12 » Adjusted C&I growth 5 was 4.5%, Sales Finance growth was 6.0% vs. 4Q12 » Other lending subsidiaries grew 15.2% vs. 1Q12 » March was the strongest loan production month in our history » Average deposits decreased $1.3 billion, or 4.1% vs. 4Q12 » Noninterest - bearing deposits increased 8.5% vs. 4Q12 » Deposit mix improved and total cost declined 6 » NPAs decreased $123 million, or 8.0% vs. 4Q12 » NPLs decreased $97 million, or 7.0% vs. 4Q12 » ALLL coverage ratio improved to 1.43x NPLs from 1.37x at 4Q12 » Total revenues 3 were $2.5 billion, up 4.9% vs. 1Q12 » Results driven by stronger insurance revenues from Crump and 5.5% organic insurance growth » Fee income ratio increased to 42.9% 4 vs. 41.0% in 1Q12 » Noninterest expense decreased an annualized 20.2% vs. 4Q12 » Achieved positive operating leverage » Expense reduction resulted from lower credit related costs, including foreclosed property, professional services and loan - related expenses

Diverse Sources of Revenue 4 Revenue Growth through the Cycle 2 2012 vs. 2007 31.8% 7.4% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% BB&T Peer Median 1 Based on segment revenues, excluding other, treasury and corporate for 1Q13. 2 Adjusted for large acquisitions (BB&T/ Colonial/ BankAllantic /Crump, US Bancorp/FBOP/Downey/PFF/Mellon 1st Business Bank/First Community Bank/MB Financial/Park National, PNC/ NatCity /Sterling/Yardville/RBC, Huntington/Sky Financial/Fidelity, Fifth Third/First Charter/R&G/ Vantiv , M&T/Wilmington Trust/Provident/Partner's Trust, KeyCorp/U.S.B. Holding, Comerica/Sterling, Regions/Morgan Keegan, SunTrust/GB&T, Zions/Vineyard) and select one - time items. Peers include: CMA, FITB, HBAN, KEY, MTB, PNC, RF, STI, USB and ZION Source : Deutsche Bank Community Banking 47% Residential Mortgage Banking 11% Dealer Financial Services 7% Specialized Lending 8% Financial Services 12% Insurance Services 15% Revenue Mix 1

5 Loan Growth Outlook $107.5 $109.2 $112.7 $113.6 $113.2 $100 $105 $110 $115 1Q12 2Q12 3Q12 4Q12 1Q13 Average Loans Held for Investment ($ in billions) » Excluding 4Q12 reclass 2 , C&I loans increased 4.5% and CRE - Other was down 4.7% » Despite challenging market conditions, EOP loans HFI were approximately $1.0 billion higher than the 1Q13 average balance » Loan momentum and pipelines improved late in the first quarter; March was strongest loan production month in our history » Average total loan growth is expected to be in the 2% to 4% range annualized for 2Q13 contingent on the economy □ C&I, CRE and Consumer pipelines improving □ Auto demand improving significantly; double - digit growth expected in 2Q13 □ Other Lending Subsidiaries expected to grow low double - digits in 2Q13 1 Excludes loans held for sale. 2 Average balances reflect reclassifications from C&I to CRE - Other with an impact of approximately $525 million. 3 Other lending subsidiaries consist of AFCO/CAFO/Prime Rate, Lendmark, BB&T Equipment Finance, Grandbridge Real Estate Capital , Sheffield Financial and Regional Acceptance. C&I 2 $37,916 ($106) (1.1) % CRE - Other 2 11,422 390 14.3 CRE - ADC 1,238 (160) (46.4) Direct Retail 15,757 (10) (0.3) Sales Finance 7,838 114 6.0 Revolving Credit 2,279 (1) (0.2) Residential Mortgage 23,618 (202) (3.4) Other Lending Subsidiaries 3 9,988 (63) (2.5) Subtotal $110,056 ($38) (0.1)% Covered loans 3,133 (344) (40.1) Total $113,189 ($382) (1.4)% 1Q13 v. 4Q12 Annualized % Increase (Decrease) Average Loans 1 ($ in millions) 1Q13 v. 4Q12 $ Increase (Decrease) 1Q13 Average Balance

6 Improved Deposit Mix and Cost » Strong organic growth in noninterest - bearing deposits, up 8.5% vs. 4Q12 » Grew net new retail accounts in 1Q13 » Successfully reduced interest - bearing deposit cost to 36 bps during 1Q13 and management expects deposit cost to move below 30 bps in 2013 » Management currently expects stronger growth in noninterest - bearing deposit balances during 2Q13 Noninterest - bearing deposits $32,518 $ 669 8.5% Interest checking 20,169 332 6.8 Money market & savings 48,431 466 3.9 Subtotal $101,118 $ 1,467 6.0% Certificates and other time deposits 28,934 (2,790) (35.7) Foreign office deposits – Interest - bearing 385 (2) (2.1) Total deposits $130,437 ($1,325) (4.1)% Average Deposits ($ in millions) 1Q13 vs. 4Q12 Annualized % Increase (Decrease) 1Q13 vs. 4Q12 $ Increase (Decrease) 1Q13 Average Balance $124.6 $125.3 $128.7 $131.8 $130.4 0.49% 0.44% 0.42% 0.38% 0.36% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% $90.0 $100.0 $110.0 $120.0 $130.0 $140.0 1Q12 2Q12 3Q12 4Q12 1Q13 Average Deposits ($ in billions) Total Interest - Bearing Deposit Cost

2013 Initiatives » Expand corporate banking in key national markets with continued expansion of vertical lending teams » Expand advisor capacity of wealth management and the broker - dealer in targeted markets » Fully realize Crump life insurance opportunities through Institutional sales initiative and BB&T Life Sales Strategy » Expand the mortgage correspondent lending network » Invest in retail mortgage lending in targeted geographies » Execute commercial expansion in Texas » Realize substantial revenue opportunities in legacy Colonial markets 7

1.33% 1.09% 0.97% 0.85% 0.80% 0.70% 0.80% 0.90% 1.00% 1.10% 1.20% 1.30% 1.40% 1Q12 2Q12 3Q12 4Q12 1Q13 Total Nonperforming Assets as a Percentage of Total Assets 8 Broad - based Credit Improvement 1 » 8.0% reduction in NPAs vs. 4Q12 □ Commercial NPLs down 8.0% □ Lowest NPAs since 2Q08 » Foreclosed real estate declined 17.8% » Management expects NPAs to improve at a modest pace in 2Q13 assuming no significant economic deterioration » 1Q13 net charge - offs were $275 million, down 6.8% vs. 4Q12 » Lowest charge - offs since 3Q08 » Broke through 1% charge - off level » Expect charge - offs to trend lower in coming quarters 1 Excludes covered assets. 1.28% 1.22% 1.08% 1.04% 0.98% 0.90% 1.00% 1.10% 1.20% 1.30% 1.40% 1Q12 2Q12 3Q12 4Q12 1Q13 Net Charge - offs / Average Loans

9 » Delinquency rates improved across the board with 30 - 89 days at 0.83% and 90 days and greater at 0.12% of total loans and leases Broad - based Credit Improvement 1 1 Excludes covered assets. 2 Excludes mortgage loans past due that are government guaranteed, and mortgage loans guaranteed by GNMA that BB&T does not hav e t he obligation to repurchase. Includes past due mortgage loans held for sale. 1.51x 1.52x 1.59x 1.60x 1.65x 1.11x 1.21x 1.24x 1.37x 1.43x 1.00 1.25 1.50 1.75 1Q12 2Q12 3Q12 4Q12 1Q13 ALLL Coverage Ratios ALLL to Net Chargeoffs ALLL to NPLs HFI x x x x $870 $907 $1,028 $1,068 $956 $157 $147 $152 $167 $138 $0 $200 $400 $600 $800 $1,000 $1,200 1Q12 2Q12 3Q12 4Q12 1Q13 Past Due Loans 2 ($ in millions) 30 - 89 days past due 90 days + past due and still accruing » ALLL coverage ratios have consistently increased as credit trends have improved » The reserve release was $28 million for 1Q13 vs. $39 million last quarter

3.93% 3.95% 3.94% 3.84% 3.76% 3.41% 3.45% 3.51% 3.42% 3.43% 3.00% 3.50% 4.00% 4.50% 1Q12 2Q12 3Q12 4Q12 1Q13 Net Interest Margin Reported NIM Core NIM 1 10 Margin Remains Strong » Margin expected to decline approximately 10 bps in 2Q13 driven by: □ Lower rates on new earning assets □ Runoff of covered assets □ Tighter credit spreads Offset by: □ Lower funding cost □ Favorable funding and asset mix change » Expect modest margin decline in 2H13 » Well positioned for rising rates » Deposit mix changes (higher DDA) have contributed to asset sensitivity, slightly offset by an increase in fixed rate loans and slower prepayments on mortgages 1 Excludes covered assets. See non - GAAP reconciliations included in the attached Appendix. - 0.18% 1.12% 2.27% 3.55% - 0.13% 0.93% 2.04% 3.16% - 1.00% 0.00% 1.00% 2.00% 3.00% 4.00% Down 25 Up 50 Up 100 Up 200 Rate Sensitivities Sensitivities as of 3/31/13 Sensitivities as of 12/31/12

11 Fee Income Growth 41.0% 42.4% 42.4% 44.1% 42.9% 32.0% 36.0% 40.0% 44.0% 48.0% 1Q12 2Q12 3Q12 4Q12 1Q13 Fee Income Ratio 1 1 Excludes securities gains (losses), the impact of FDIC loss share accounting and other selected items. See non - GAAP reconciliat ions included in the attached Appendix. 2 Linked quarter percentages are annualized. 1Q13 1Q13 v. 4Q12 2 Increase (Decrease) 1Q13 v. 1Q12 Increase (Decrease) Insurance income $ 365 3.4% 34.7% Mortgage banking income 180 (89.5) (16.7) Service charges on deposits 138 (29.9) 0.7 Investment banking and brokerage fees and commissions 94 (16.6) 5.6 Bankcard fees and merchant discounts 59 (13.3) 9.3 Checkcard fees 47 (16.6) 9.3 Trust and investment advisory revenues 48 8.6 6.7 Income from bank - owned life insurance 28 (14.0) (6.7) FDIC loss share income, net (59) (158.9) 3.5 Securities gains (losses), net 23 NM NM Other income 78 (57.9) 50.0 Total noninterest income $ 1,001 (7.6)% 14.9% » Mortgage banking produced record originations in the first quarter; however, spreads decreased 82 bps to 1.65% resulting in lower gains on sale » 2Q13 Mortgage banking income is expected to be similar to 1Q13 » Service charges declined $11 million due to seasonality and fewer processing days » FDIC loss share income offset improved primarily due to $23 million higher offset to the provision for covered loans and reduced accretion » Other income was $13 million lower due to lower income on other investments Noninterest Income ($ in millions)

12 Noninterest Expense and Efficiency 1Q13 1Q13 v. 4Q12 2 Increase (Decrease) 1Q13 v. 1Q12 Increase (Decrease) Personnel expense $ 817 (3.0)% 11.9% Occupancy and equipment expense 171 (2.4) 11.8 Loan - related expense 58 (83.3) (7.9) Foreclosed property expense 18 NM (80.4) Regulatory charges 35 - (14.6) Professional services 36 (88.2) 2.9 Software expense 38 - 18.8 Amortization of intangibles 27 (14.5) 22.7 Merger - related and restructuring charges, net 5 NM (58.3) Other expense 209 (9.5) 2.0 Total noninterest expense $ 1,414 (20.2) % 2.1% 1 Excludes securities gains (losses), foreclosed property expense, amortization of intangible assets, merger - related and restructu ring charges, the impact of FDIC loss share accounting, and other selected items. See non - GAAP reconciliations included in the attached Appendix. 2 Linked quarter percentages are annualized. 52.0% 53.9% 55.2% 55.3% 56.4% 59.0% 57.9% 61.6% 58.8% 57.5% 50.0% 55.0% 60.0% 65.0% 1Q12 2Q12 3Q12 4Q12 1Q13 Efficiency Ratio Reported GAAP 1 Noninterest Expense ($ in millions) » Personnel expense decreased slightly vs. 4Q12 due to lower production - related incentives and commissions offset by seasonally higher social security and unemployment due to annual resets » FTEs/headcount down slightly from 4Q12 » Foreclosed property expense down $30 million from 4Q12, due to substantially lower balances » Loan - related expense decreased $15 million compared to 4Q12 due to lower expenses related to mortgage loan repurchase expense » Professional services declined $10 million due largely to lower credit - related legal expenses » Other expenses decreased $5 million primarily due to lower franchise taxes » Achieved positive operating leverage » The tax rate this quarter is 27.1% excluding tax adjustment » The 2Q13 effective tax rate is expected to be similar to the adjusted 1Q13 rate

13 Capital Strength 1 9.4% 9.1% 8.9% 9.1% 9.2% 8.0% 9.0% 10.0% 1Q12 2Q12 3Q12 4Q12 1Q13 Basel I Tier 1 Common Ratio 3 1 Regulatory capital information is preliminary. Risk - weighted assets are determined based on regulatory capital requirements. Un der the regulatory framework for determining risk - weighted assets each asset class is assigned a risk - weighting of 0%, 20%, 50% or 100% based on the underlying risk of the specific asset class. In additio n, off balance sheet exposures are first converted to a balance sheet equivalent amount and subsequently assigned to one of the four risk - weightings. Tier 1 common equity ratio is a non - GAAP measure. BB&T use s the Tier 1 common equity definition used in the SCAP assessment to calculate these ratios. BB&T's management uses these measures to assess the quality of capital and believes that investors m ay find them useful in their analysis of the Corporation. These capital measures are not necessarily comparable to similar capital measures that may be presented by other companies. 2 The Basel III Tier I common equity ratio is also a non - GAAP measure and reflects management’s best estimate of the proposed regu latory requirements, which are subject to change. 3 In the first quarter of 2013, BB&T revised its calculations of risk - weighted assets and has adjusted the affected ratios previou sly presented. » BB&T currently estimates Tier 1 common under Basel III 2 to be: □ 7.8% under the U.S. proposed rules (NPR) □ Basel III estimate does not include any mitigating actions which will result in lower risk weighted assets and higher capital ratios » Focused on CCAR resubmission: □ Dividends remain our priority » The primary drivers for the revision to RWA: □ Unfunded lending commitments □ Mortgage loans - driven by more conservative interpretation of regulatory guidance

14 Community Banking Segment Comments 4 Highlighted Metrics 1Q13 1Q12 ($ in millions) Inc/(Dec) 4Q12 Inc/(Dec) 1Q12 1Q13 ($ in billions) Net Interest Income Noninterest Income 1 Loan Loss Provision Noninterest Expense 2 Income Tax Expense Segment Net Income $ (33) (22) (50) (34) 11 $ 18 $ (32) 19 (174) (56) 82 $ 135 Noninterest - bearing Deposit Growth 3 Noninterest - bearing / Total Deposits C&I Portfolio / Total Commercial Loans Direct Retail Loan Growth 3 Commercial Loan Production ($) » The commercial loan pipeline increased approximately 27% compared with 4Q12 » Average direct retail loans increased $1.1 billion, or 7.5%, compared with 1Q12 and grew 1.6% compared with 4Q12 » Average dealer floorplan loans increased by $118.5 million, or 34.8%, compared with 1Q12 and grew 61.7% compared with 4Q12 » Total deposits, excluding time deposits increased $8.0 billion, or 10.4%, compared with 1Q12 and 11.2% compared to 4Q12 » Common quarter net income drivers include: □ Reduced foreclosed property costs □ Reduced loan charge - offs and provision expense □ Reduced regulatory costs due to improved credit metrics □ Higher mortgage banking referral income □ Higher net checkcard income 22.3% 26.9% 67.2% 7.5% $ 3.3 23.5% 23.3% 66.8% 7.2% $ 3.4 1 Noninterest Income includes intersegment net referral fees. 2 Noninterest Expense includes amortization of intangibles and allocated corporate expense. 3 Current quarter over first three months of prior year. 4 Linked quarter growth rates annualized. $ 814 327 80 697 134 $ 230

15 Net Interest Income Noninterest Income 1 Loan Loss Provision Noninterest Expense 2 Income Tax Expense Segment Net Income Retail Originations Correspondent Purchases Total Production Loan Sales Loans Serviced for others (EOP) 30+ Days Delinquent (HFI only) % Non - Accrual (HFI only) Net Charge - Offs (HFI only) Residential Mortgage Banking Segment Retains and services mortgage loans originated by the Community Banking segment as well as those purchased from various correspondent originators Comments Highlighted Metrics Inc/(Dec) 3Q12 Inc/(Dec) 4Q11 4Q12 1 Noninterest Income includes intersegment net referral fees. 2 Noninterest Expense includes amortization of intangibles and allocated corporate expense. ($ in billions) 1Q13 1Q12 ($ in millions) Inc/(Dec) 4Q12 Inc/(Dec) 1Q12 1Q13 $ 3.2 5.5 $ 8.7 $7.9 $ 76.8 3.60% 1.07% 0.55% » Record quarterly residential mortgage loan production of $8.7 billion, up 5.0% vs. 1Q12 » Retail mortgage originated $3.2 billion in loans, up 4.0% vs. 1Q12 » Purchase mortgages increased 15.1% compared with 1Q12 » The 1Q13 production mix was 67.8% refinance / 32.2% purchase » Loan sales increased $0.3 billion or 4.3% vs. 1Q12 » Gain on sale margins declined 8.7% in 1Q13 vs. 1Q12 » Total loans serviced exceeded $103 billion » Delinquency, non - accrual and charge - off metrics continued to improve vs. 1Q12 $ 108 161 19 87 62 $ 101 $ 7 (45) (37) (26) 10 $ 15 $ 19 (33) 41 (12) (16) $ (27 ) $ 3.0 5.2 $ 8.2 $7.6 $ 70.3 3.67% 1.49% 0.78%

Highlighted Metrics 16 Net Interest Income Noninterest Income 1 Loan Loss Provision Noninterest Expense 2 Income Tax Expense Segment Net Income Primarily originates indirect to consumers on a prime and nonprime basis for the purchase of automobiles and other vehicles through approved dealers both in BB&T’s market and nationally (through Regional Acceptance Corporation) Dealer Financial Services Segment Comments 1Q13 1Q12 1 Noninterest Income includes intersegment net referral fees. 2 Noninterest Expense includes amortization of intangibles and allocated corporate expense. ($ in billions) Loan Originations Loan Yield Operating Margin Net Charge - offs ($ in millions) Inc/(Dec) 4Q12 Inc/(Dec) 1Q12 1Q13 $ 1.5 8.2% 39.2% 1.8% » Originations - 1Q13 was a record quarter for DFS, finishing with $1.5 billion in retail originations, up 40.5% annualized vs. 4Q12 & up 11.3% over 1Q12 » DFS experienced record production in Regional’s point - of - sale channel, Dealer Finance’s Retail (Auto and Recreational Lending) channel, and combined retail production (RAC and DF) » The increase in provision over 1Q12 was due primarily to normalization of credit performance in the RAC portfolio » Growing in new markets – Texas and Alabama, with additional expansion planned in 2013 $ 164 2 67 34 25 $ 40 $ 1.3 8.7% 60.8% 1.6% $ (2) - - (2) - $ - $ 8 - 40 (1) (12) $ (19)

Highlighted Metrics 17 Specialized Lending Segment Provides specialty lending including: commercial finance, mortgage warehouse lending, tax - exempt governmental finance, equipment leasing, commercial mortgage banking, insurance premium finance, dealer - based equipment financing, and direct consumer finance Net Interest Income Noninterest Income 1 Loan Loss Provision Noninterest Expense 2 Income Tax Expense Segment Net Income Loan Originations Loan Yield Operating Margin Net Charge - offs Comments 1 Noninterest Income includes intersegment net referral fees. 2 Noninterest Expense includes amortization of intangibles and allocated corporate expense. ($ in billions) ($ in millions) Inc/(Dec) 4Q12 Inc/(Dec) 1Q12 1Q13 1Q13 1Q12 » Average loans grew 11.1% vs. 1Q12, driven by Sheffield, Commercial Finance, Equipment Finance, and Premium Finance » Average commercial property and casualty premium financings grew 9.5% when compared to 1Q12. This growth was primarily the function of a gradual hardening in the property and casualty insurance market » Grandbridge l oans held for investment increased 35.2% vs. 4Q12 on an annualized basis. The lending pipeline shows favorable growth prospects for 2Q13 » Equipment Finance’s recent national expansion is proceeding well and the pipeline for new business opportunities continues to grow $ 4.6 5.7% 33.2% 1.1% $ 142 54 51 80 13 $ 52 $ 5.0 6.1% 39.6% 0.5% $ (6) (12) 27 (11) (13) $ (21) $ 13 1 25 (4) (2) $ (5)

18 1 Noninterest Income includes intersegment net referral fees. 2 Noninterest Expense includes amortization of intangibles and allocated corporate expense. 3 Current quarter over first three months of prior year. Insurance Segment Comments Net Interest Income Noninterest Income 1 Loan Loss Provision Noninterest Expense 2 Income Tax Expense Segment Net Income Same Store Sales Growth 3 Noninterest Income Growth 3 Number of Stores Operating Margin Provides property and casualty, life, and health insurance to business and individual clients. It also provides workers compensation and professional liability, as well as surety coverage and title insurance Highlighted Metrics ($ in millions) Inc/(Dec) 4Q12 Inc/(Dec) 1Q12 1Q13 1Q13 1Q12 » Higher year - over - year noninterest income was driven by organic and strategic growth » Higher noninterest expense versus 4Q12 was impacted by seasonal fringe benefit costs » BB&T Insurance continues to experience strong retention rates » Continue to focus on the successful execution of synergies presented by Crump Insurance acquisition » Strong strategic emphasis is being placed on preparation for healthcare reform and the impending impact on the Employee Benefits business » Commercial P&C premiums continue to firm 5.5% 35.7% 205 11.4% $ 2 366 - 326 12 $ 30 5.5% 8.2% 164 11.4% $ - (2) - 15 (9) $ (8) $ - 96 - 85 4 $ 7

Highlighted Metrics 19 Financial Services Segment Comments Average Loan Balances Average Deposits Total Assets Invested Operating Margin Provides trust services, wealth management, investment counseling, asset management, estate planning, employee benefits, corporate banking, and capital market services to individuals, corporations, governments, and other organizations 1 Noninterest Income includes intersegment net referral fees. 2 Noninterest Expense includes amortization of intangibles and allocated corporate expense. Net Interest Income Noninterest Income 1 Loan Loss Provision Noninterest Expense 2 Income Tax Expense Segment Net Income ($ in millions) Inc/(Dec) 4Q12 Inc/(Dec) 1Q12 1Q13 1Q13 1Q12 » Higher net interest income driven by: □ Corporate Banking which generated 31.5% growth in loans vs. 1Q12 □ BB&T Wealth which generated 19.7% loan growth and 22.5% transaction deposit growth vs. 1Q12 » Corporate Banking continues to focus on expanding its national coverage model » Total assets invested increased 10.8% vs. 1Q12 to $102.8 billion » Decline in noninterest income from 4Q12 was driven by lower client derivative and investment banking & brokerage income » Decline in noninterest expense from 4Q12 was driven by lower personnel and occupancy expense $ 8.3 $31.5 $102.8 38.0% $ 114 183 8 176 42 $ 71 $ 6.4 $29.2 $92.8 34.4% $ (5) (24) 16 (11) (14) $ (20) $ 4 (1) (8) (1) 4 $ 8 ($ in billions)

20

21

22 Capital Measures 1 (Dollars in millions, except per share data) As of / Quarter Ended March 31 2013 Dec 31 2012 Sept 30 2012 June 30 2012 March 31 2012 Selected Capital Information Risk - based capital Tier 1 $ 14,432 $ 14,373 $ 13,593 $ 12,383 $ 15,207 Total 18,300 18,243 17,638 16,527 19,438 Risk - weighted assets 2 134,218 134,451 133,545 129,661 126,954 Average quarterly tangible assets 174,214 175,015 172,100 170,042 167,771 Risk - based capital ratios Tier 1 10.8% 10.7% 10.2 % 9.6 % 12.0% Total 13.6 13.6 13.2 12.7 15.3 Leverage capital ratio 8.3 8.2 7.9 7.3 9.1 Equity as a percentage of total assets 11.7 11.5 11.3 10.6 10.2 Book value per common share $27.15 $ 27.21 $ 26.88 $ 26.19 $ 25.51 Selected non - GAAP Capital Information Tangible common equity as a percentage of tangible assets 7.1% 6.9 % 6.8 % 6.9 % 7.1 % Tier 1 common equity as a percentage of risk - weighted assets 9.2 9.1 8.9 9.1 9.4 Tangible book value per common share $17.56 $ 17.52 $ 17.02 $ 16.92 $ 17.12 1 Regulatory capital information is preliminary. During the first quarter of 2013 BB&T revised its calculation of risk weighte d a ssets and has adjusted the affected amounts and ratios previously presented. 2 Risk - weighted assets are determined based on regulatory capital requirements. Under the regulatory framework for determining ri sk - weighted assets each asset class is assigned a risk - weighting of 0%, 20%, 50% or 100% based on the underlying risk of the specific asset class. In addition, off - balance sheet exposures are first converted to a balance sheet equivalent amount and subsequently assigned to one of the four risk - weightings.

23 Non - GAAP Reconciliations (Dollars in millions, except per share data) As of / Quarter Ended March 31 2013 Dec 31 2012 Sept 30 2012 June 30 2012 March 31 2012 Calculations of Tier 1 common equity and tangible assets and related measures: Tier 1 equity $14,432 $ 14,373 $ 13,593 $ 12,383 $ 15,207 Less: Preferred Stock 2,116 2,116 1,679 559 - Qualifying restricted core capital elements - - 5 - 3,250 Tier 1 common equity $12,316 $ 12,257 $ 11,909 $ 11,824 $ 11,957 Total assets $180,837 $ 183,872 $ 182,021 $ 178,529 $ 174,752 Less: Intangible assets, net of deferred taxes 7,264 7,273 7,239 6,950 6,402 Plus: Regulatory adjustments, net of deferred taxes 275 212 81 239 327 Tangible assets $173,848 $ 176,811 $ 174,863 $ 171,818 $ 168,677 Total risk - weighted assets 1, 2 $134,218 $ 134,451 $ 133,545 $ 129,661 $126,954 Tangible common equity as a percentage of tangible assets 7.1% 6.9 % 6.8 % 6.9% 7.1 % Tier 1 common equity as a percentage of risk - weighted assets 2 9.2 9.1 8.9 9.1 9.4 Tier 1 common equity $12,316 $ 12,257 $ 11,909 $ 11,824 $ 11,957 Outstanding shares at end of period (in thousands) 701,440 699,728 699,541 698,795 698,454 Tangible book value per common share $17.56 $ 17.52 $ 17.02 $ 16.92 $ 17.12 1 Risk - weighted assets are determined based on regulatory capital requirements. Under the regulatory framework for determining ri sk - weighted assets each asset class is assigned a risk - weighting of 0%, 20%, 50% or 100% based on the underlying risk of the specific asset class. In addition, off - balance sheet exposures are first converted to a balance sheet equivalent amount and subsequently assigned to one of the four risk - weightings. 2 Regulatory capital information is preliminary. During the first quarter of 2013 BB&T revised its calculation of risk weighte d a ssets and has adjusted the affected amounts and ratios previously presented.

Non - GAAP Reconciliations Basel III Estimates Based on Proposed U.S. Rules (Dollars in millions) March 31 2013 Tier 1 common equity under Basel I definition $ 12,316 Adjustments: Other comprehensive income related to AFS securities, defined benefit pension and other postretirement employee benefit plans (445) Other adjustments (67) Estimated Tier 1 common equity under Basel III definition $ 11,804 Estimated risk - weighted assets under Basel III definition $ 150,719 Estimated Tier 1 common equity as a percentage of risk - weighted assets under Basel III definition 7.8% 24

25 Non - GAAP Reconciliations Applicable ratios are annualized. 1 Excludes mortgage loans guaranteed by GNMA that BB&T does not have the obligation to repurchase. 2 Excludes mortgage loans guaranteed by the government. As of / Quarter Ended March 31 2013 Dec 31 2012 Sept 30 2012 June 30 2012 March 31 2012 Asset Quality Ratios (including amounts related to covered loans and covered foreclosed property) Loans 30 - 89 days past due and still accruing as a percentage of total loans and leases 1,2 0.91 % 1.02 % 1.02 % 0.97 % 1.02 % Loans 90 days or more past due and still accruing as a percentage of total loans and leases 1,2 0.43 0.52 0.53 0.67 0.75 Nonperforming loans and leases as a percentage of total loans and leases 1.09 1.17 1.31 1.45 1.67 Nonperforming assets as a percentage of: Total assets 0.91 0.97 1.10 1.24 1.50 Loans and leases plus foreclosed property 1.39 1.51 1.70 1.93 2.35 Net charge - offs as a percentage of average loans and leases 1.00 1.02 1.05 1.21 1.28 Allowance for loan and lease losses as a percentage of loans and leases held for investment 1.73 1.76 1.80 1.91 2.02 Ratio of allowance for loan and lease losses to: Net charge - offs 1.69 X 1.69 X 1.69 X 1.57 X 1.54 X Nonperforming loans and leases held for investment 1.54 1.46 1.33 1.29 1.18

26 Non - GAAP Reconciliations Applicable ratios are annualized. 1 Excludes mortgage loans guaranteed by GNMA that BB&T does not have the obligation to repurchase. 2 Excludes mortgage loans guaranteed by the government. As of / Quarter Ended March 31 2013 Dec 31 2012 Sept 30 2012 June 30 2012 March 31 2012 Asset Quality Ratios (excluding amounts related to covered loans and covered foreclosed property) Loans 30 - 89 days past due and still accruing as a percentage of total loans and leases 1,2 0.83 % 0.93 % 0.90 % 0.83 % 0.82 % Loans 90 days or more past due and still accruing as a percentage of total loans and leases 1,2 0.12 0.15 0.13 0.13 0.15 Nonperforming loans and leases as a percentage of total loans and leases 1.12 1.20 1.35 1.50 1.74 Nonperforming assets as a percentage of: Total assets 0.80 0.85 0.97 1.09 1.33 Loans and leases plus foreclosed property 1.23 1.33 1.51 1.72 2.12 Net charge - offs as a percentage of average loans and leases 0.98 1.04 1.08 1.22 1.28 Allowance for loan and lease losses as a percentage of loans and leases held for investment 1.65 1.70 1.73 1.86 1.97 Ratio of allowance for loan and lease losses to: Net charge - offs 1.65 X 1.60 X 1.59 X 1.52 X 1.51 X Nonperforming loans and leases held for investment 1.43 1.37 1.24 1.21 1.11

27 Non - GAAP Reconciliations Quarter Ended Efficiency and Fee Income Ratios March 31 2013 Dec 31 2012 Sept 30 2012 June 30 2012 March 31 2012 Efficiency ratio – GAAP 57.5% 58.8 % 61.6 % 57.9 % 59.0 % Effect of securities gains (losses), net 0.5 - - - (0.2) Effect of merger - related and restructuring charges, net (0.2) (0.5) (1.7) (0.1) (0.5) Effect of mortgage repurchase expense adjustments - - (1.1) - - Effect of FDIC loss share accounting 0.5 (0.1) - 0.2 0.1 Effect of affordable housing investments write - down - - - - (1.0) Effect of foreclosed property expense (0.8) (1.9) (2.2) (2.9) (3.9) Effect of leveraged lease sale/write - downs - - - - (0.6) Effect of amortization of intangibles (1.1) (1.0) (1.4) (1.2) (0.9) Efficiency ratio – reported 56.4 55.3 55.2 53.9 52.0 Fee income ratio – GAAP 40.7 % 40.3 % 38.8 % 39.2 % 37.1 % Effect of securities gains (losses), net (0.5) - - - 0.2 Effect of affordable housing investments write - down - - - - 1.1 Effect of FDIC loss share accounting 2.7 3.8 3.6 3.2 2.6 Fee income ratio – reported 42.9 44.1 42.4 42.4 41.0

28 Non - GAAP Reconciliations (Dollars in millions) Quarter Ended March 31 Dec 31 Sept 30 June 30 March 31 Return on Average Tangible Common Shareholders' Equity 2013 2012 2012 2012 2012 Net income available to common shareholders $ 210 $ 506 $ 469 $ 510 $ 431 Plus: Amortization of intangibles, net of tax 17 17 19 18 14 Tangible net income available to common shareholders $ 227 $ 523 $ 488 $ 528 $ 445 Average common shareholders' equity $ 19,138 $ 19,160 $ 18,757 $ 18,302 $ 17,772 Less: Average intangible assets 7,464 7,463 7,341 7,031 6,510 Average tangible common shareholders' equity $ 11,674 $ 11,697 $ 11,416 $ 11,271 $ 11,262 Return on average tangible common shareholders' equity 7.87 % 17.80 % 17.01 % 18.85 % 15.88 %

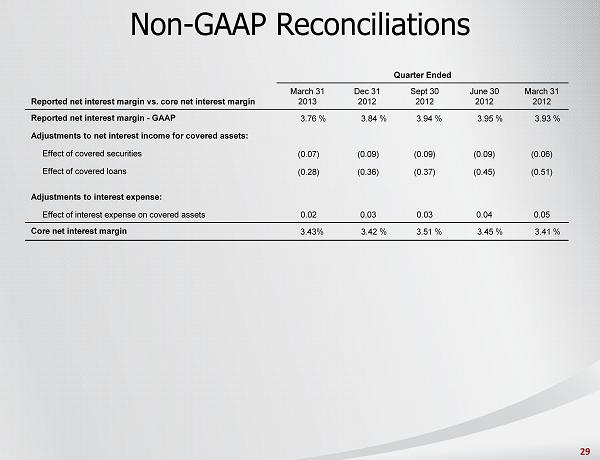

29 Non - GAAP Reconciliations Quarter Ended Reported net interest margin vs. core net interest margin March 31 2013 Dec 31 2012 Sept 30 2012 June 30 2012 March 31 2012 Reported net interest margin - GAAP 3.76 % 3.84 % 3.94 % 3.95 % 3.93 % Adjustments to net interest income for covered assets: Effect of covered securities (0.07) (0.09) (0.09) (0.09) (0.06) Effect of covered loans (0.28) (0.36) (0.37) (0.45) (0.51) Adjustments to interest expense: Effect of interest expense on covered assets 0.02 0.03 0.03 0.04 0.05 Core net interest margin 3.43% 3.42 % 3.51 % 3.45 % 3.41 %

30 Non - GAAP Reconciliations (Dollars in millions, except per share data) Net Income Available to Common Shareholders Quarter Ended March 31, 2013 Net income available to common shareholders - GAAP $ 210 Effect of tax adjustment 281 Net income available to common shareholders – adjusted $ 491 Diluted EPS Diluted EPS – GAAP $ 0.29 Effect of tax adjustment 0.40 Diluted EPS – adjusted $ 0.69

31