Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - DOVER Corp | a201304178-kexhibit991.htm |

| 8-K - 8-K - DOVER Corp | a201304178-k.htm |

First Quarter 2013 Earnings Conference Call April 17, 2013 - 9:00am CT

Forward Looking Statements We want to remind everyone that our comments may contain forward-looking statements that are inherently subject to uncertainties. We caution everyone to be guided in their analysis of Dover by referring to our Form 10-K for a list of factors that could cause our results to differ from those anticipated in any such forward- looking statements. We would also direct your attention to our internet site, www.dovercorporation.com, where considerably more information can be found. 2

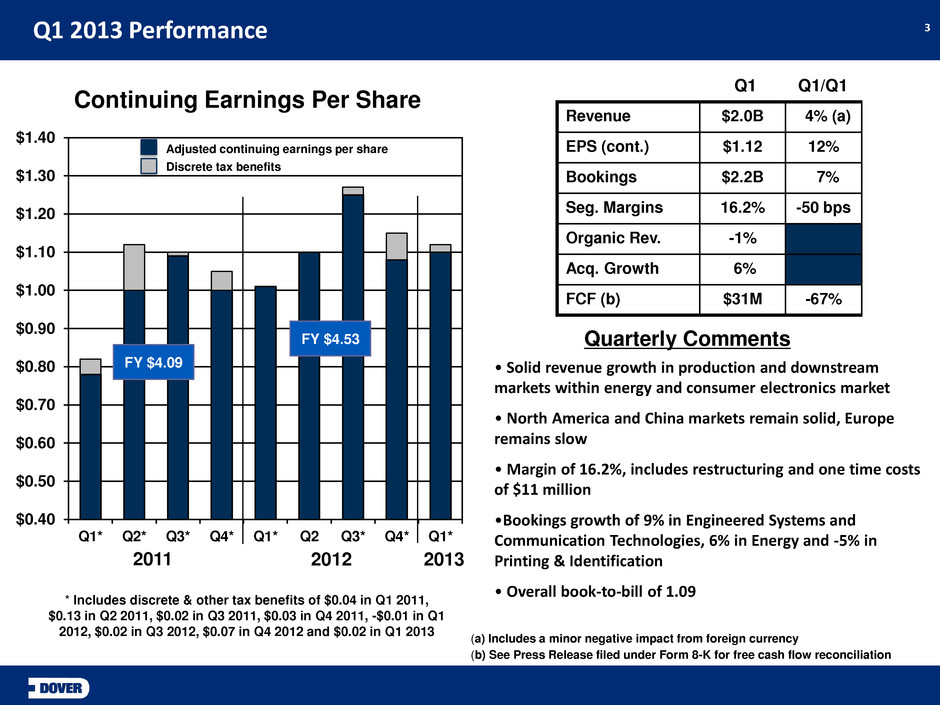

$0.40 $0.50 $0.60 $0.70 $0.80 $0.90 $1.00 $1.10 $1.20 $1.30 $1.40 Q1* Q2* Q3* Q4* Q1* Q2 Q3* Q4* Q1* Revenue $2.0B 4% (a) EPS (cont.) $1.12 12% Bookings $2.2B 7% Seg. Margins 16.2% -50 bps Organic Rev. -1% Acq. Growth 6% FCF (b) $31M -67% Q1 2013 Performance Continuing Earnings Per Share • Solid revenue growth in production and downstream markets within energy and consumer electronics market • North America and China markets remain solid, Europe remains slow • Margin of 16.2%, includes restructuring and one time costs of $11 million •Bookings growth of 9% in Engineered Systems and Communication Technologies, 6% in Energy and -5% in Printing & Identification • Overall book-to-bill of 1.09 Q1 Q1/Q1 2011 * Includes discrete & other tax benefits of $0.04 in Q1 2011, $0.13 in Q2 2011, $0.02 in Q3 2011, $0.03 in Q4 2011, -$0.01 in Q1 2012, $0.02 in Q3 2012, $0.07 in Q4 2012 and $0.02 in Q1 2013 FY $4.09 (b) See Press Release filed under Form 8-K for free cash flow reconciliation 3 Quarterly Comments Discrete tax benefits 2012 Adjusted continuing earnings per share FY $4.53 2013 (a) Includes a minor negative impact from foreign currency

4 Revenue Q1 2013 Communication Technologies Energy Engineered Systems Printing & Identification Total Dover Organic 4% - -5% -1% -1% Acquisitions - 6% 11% - 6% Currency - - - -1% < -1% Total 4% 6% 6% -2% 4%

$613 $664 $254 $238 $401 $373 $540 $561 $207 $204 $0 $300 $600 $900 DCT Q4 DCT Q1 DE Q4 DE Q1 DES Q4 DES Q1 DPI Q4 DPI Q1 $607 $755 $253 $237 $364 $379 $550 $621 $210 $224 $0 $250 $500 $750 $1,000 DCT Q4 DCT Q1 DE Q4 DE Q1 DES Q4 DES Q1 DPI Q4 DPI Q1 Sequential Results – Q4 12 → Q1 13 Fluid Solutions ↓ 7% ↑ 4% Refrigeration & Industrial ↑ 4% ↑ 13% ↑ 20% ↓ 6% $ in millions 5 Bookings ↑ 6% ↓ 6% Revenue

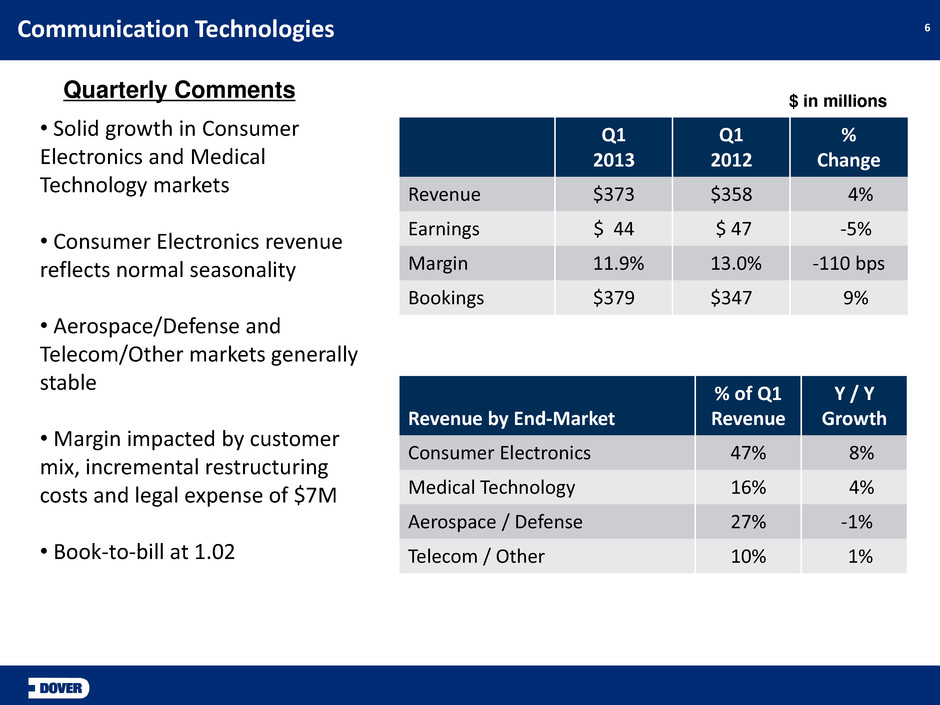

6 Communication Technologies • Solid growth in Consumer Electronics and Medical Technology markets • Consumer Electronics revenue reflects normal seasonality • Aerospace/Defense and Telecom/Other markets generally stable • Margin impacted by customer mix, incremental restructuring costs and legal expense of $7M • Book-to-bill at 1.02 $ in millions Q1 2013 Q1 2012 % Change Revenue $373 $358 4% Earnings $ 44 $ 47 -5% Margin 11.9% 13.0% -110 bps Bookings $379 $347 9% Quarterly Comments Revenue by End-Market % of Q1 Revenue Y / Y Growth Consumer Electronics 47% 8% Medical Technology 16% 4% Aerospace / Defense 27% -1% Telecom / Other 10% 1%

7 Energy • Revenue and earnings growth driven by production and downstream markets and acquisitions; drilling continues to be soft as anticipated •Oil prices remain supportive of continued investment in production and international markets are robust • Operating margin of 24.9% reflects strong execution • Bookings growth led by the production market • Book-to-bill at a strong 1.11 $ in millions Quarterly Comments Q1 2013 Q1 2012 % Change Revenue $561 $532 6% Earnings $140 $132 6% Margin 24.9% 24.9% flat Bookings $621 $586 6% Revenue by End-Market % of Q1 Revenue Y / Y Growth Drilling 19% -9% Production 55% 12% Downstream 26% 5%

8 Engineered Systems • Revenue growth driven by recent acquisitions •Results in refrigeration impacted by non-repeating project in prior year period • Margin performance reflects impact of Anthony acquisition • Bookings grow seasonally • Book-to-bill at a strong 1.13 $ in millions Quarterly Comments Q1 2013 Q1 2012 % Change Revenue $868 $822 6% Earnings $117 $122 -4% Margin 13.5% 14.9% -140 bps Bookings $978 $896 9% Revenue by End-Market % of Q1 Revenue Y / Y Growth Fluids 24% 13% Refrigeration & Food Equipment 42% 9% Industrial 34% -3%

Printing & Identification • Stable revenue in fast moving consumer goods partially offsets a sluggish industrial market, particularly in bar coding • Operating margin increase reflects the benefits of prior restructuring, cost initiatives and a favorable product mix • Several new product introductions are scheduled in the coming months •Book-to-bill at 1.00 $ in millions Quarterly Comments Q1 2013 Q1 2012 % Change Revenue $238 $244 -2% Earnings $ 30 $ 26 14% Margin 12.5% 10.7% 180 bps Bookings $237 $250 -5% 9 Revenue by End-Market % of Q1 Revenue Y / Y Growth Fast Moving Consumer Goods 60% flat Industrial 40% -6%

Q1 2013 Overview Q1 2013 Net Interest Expense $30 million, essentially flat with last year, in-line with expectations Corporate Expense $34.0 million, down $3 million from last year. Effective Tax Rate (ETR) Q1 normalized rate was 27.8%, excluding $0.02 cents of discrete tax benefits(a) Capex $47 million, in-line with expectations Share Repurchases Repurchased 4 million shares ($290M) in quarter under the November $1 billion program. 10 (a) See press release filed under form 8-K for reconciliation

FY 2013 Guidance – Revenue Growth by Segment 11 Segment 2012 Revenue Mix 2013F Organic Growth 2013F Acquisition Growth* Total Communication Technologies 19% 9% - 11% - 9% - 11% Energy 27% 3% - 5% ≈ 2% 5% - 7% Engineered Systems 42% 2% - 4% ≈ 8% 10% - 12% Printing & Identification 12% 1% - 2% - 1% - 2% Total ≈ $8.1 B 3% - 5% ≈ 4% 7% - 9% * Acquisitions already completed

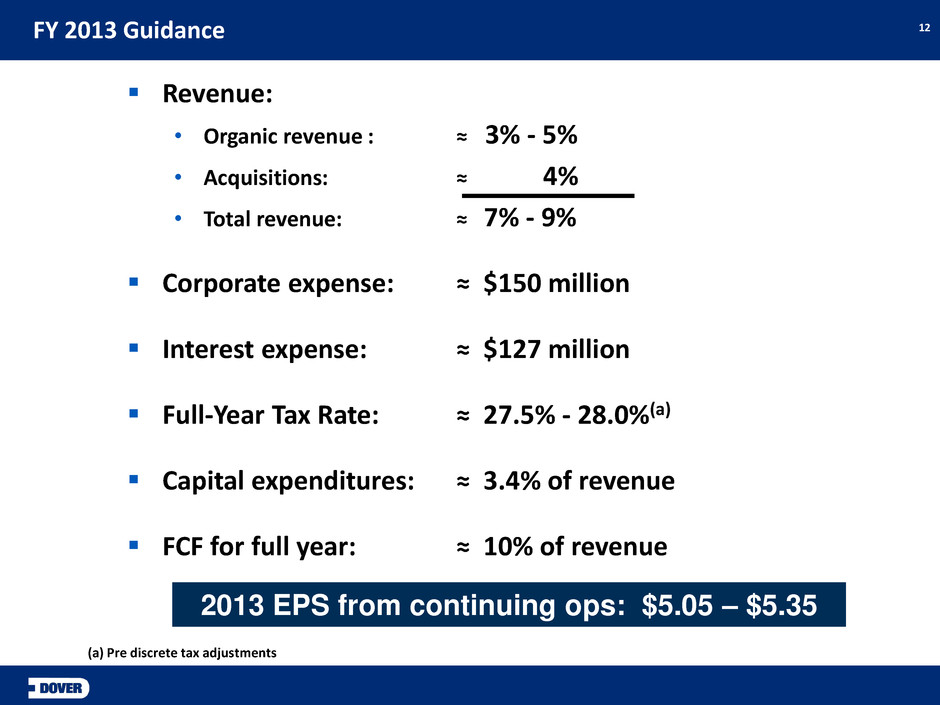

FY 2013 Guidance Revenue: • Organic revenue : ≈ 3% - 5% • Acquisitions: ≈ 4% • Total revenue: ≈ 7% - 9% Corporate expense: ≈ $150 million Interest expense: ≈ $127 million Full-Year Tax Rate: ≈ 27.5% - 28.0%(a) Capital expenditures: ≈ 3.4% of revenue FCF for full year: ≈ 10% of revenue 12 2013 EPS from continuing ops: $5.05 – $5.35 (a) Pre discrete tax adjustments

2012 EPS – Continuing Ops $4.53 • Less 2012 tax benefits (1): ($0.09) 2012 Adjusted EPS – Continuing Ops $4.44 • Volume, mix, price (inc. FX): $0.28 - $0.46 • Net benefits of productivity: $0.12 - $0.22 • Acquisitions: $0.13 - $0.16 • Investment / Compensation: ($0.12 - $0.18) • Corporate expense: (0.05) • Interest / Shares / Tax Rate (net): $0.25 - $0.30 2013 EPS – Continuing Ops $5.05 - $5.35 2013 EPS Guidance Bridge - Cont. Ops (1) Negligible amounts in Q1 2012 & Q2 2012, $0.02 in Q3 2012 and $0.07 in Q4 2012 13