Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

(Mark One)

| x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

or

| ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 333-173702

Excel Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

27-3955524

|

|

|

(State or other jurisdiction of

|

(I.R.S. Employer)

|

|

|

incorporation or organization)

|

Identification No.)

|

|

595 Madison Avenue, Suite 1101, New York, NY

|

10022

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

212-377-0100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

None

|

N/A

|

Securities registered pursuant to Section 12(g) of the Act: N/A

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12-months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

|

|

Non-Accelerated filer o

(Do not check if smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

The number of shares of Common Stock held by non-affiliates as of June 29, 2012 was 7,546,000 shares, all of one class of common stock, par value $0.0001 per share, having an aggregate market value of approximately $1,282,820 based upon the closing price of registrant’s common stock on such date of $0.17 per share as quoted on the Over the Counter Bulletin Board. For purposes of the foregoing calculation, all directors, executive officers, and 5% beneficial owners have been deemed affiliated.

As of April 16, 2013, there were 65,201,223 shares of common stock, par value $0.0001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

TABLE OF CONTENTS

|

PART I

|

|||

|

Item 1.

|

Business

|

4

|

|

|

Item 1A.

|

Risk Factors

|

10

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

22

|

|

|

Item 2.

|

Properties

|

23

|

|

|

Item 3.

|

Legal Proceedings

|

23

|

|

|

Item 4.

|

Mine Safety Disclosures

|

23

|

|

|

PART II

|

|||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

24

|

|

|

Item 6.

|

Selected Financial Data

|

24

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

24

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

27

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

28

|

|

|

Item 9

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

29

|

|

|

Item 9A.

|

Controls and Procedures

|

29

|

|

|

Item 9B.

|

Other Information

|

29

|

|

|

PART III

|

|||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

30

|

|

|

Item 11.

|

Executive Compensation

|

32

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

32

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

33

|

|

|

Item 14.

|

Principal Accountant Fees and Services

|

33

|

|

|

PART IV

|

|||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

34

|

|

|

Signatures

|

36

|

||

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements,” all of which are subject to risks and uncertainties. Forward-looking statements can be identified by the use of words such as “expects,” “plans,” “will,” “forecasts,” “projects,” “intends,” “estimates,” and other words of similar meaning. One can identify them by the fact that they do not relate strictly to historical or current facts. These statements are likely to address our growth strategy and financial results. One must carefully consider any such statement and should understand that many factors could cause actual results to differ from our forward looking statements. These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known and some that are not. No forward looking statement can be guaranteed and actual future results may vary materially.

Information regarding market and industry statistics contained in this Report is included based on information available to us that we believe is accurate. It is generally based on industry and other publications that are not produced for purposes of securities offerings or economic analysis. We have not reviewed or included data from all sources, and cannot assure investors of the accuracy or completeness of the data included in this Report. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of our services. We do not assume any obligation to update any forward-looking statement. As a result, investors should not place undue reliance on these forward-looking statements.

PART I

Item 1. Business.

Corporate History

We were incorporated in November 2010 as Ruby Worldwide, Ltd. for the purpose of commencing a licensing business. In November 2010 we amended our Articles of Incorporation to amend our authorized capital from a non-stock corporation to its present authorized capital of 200,000,000 shares of common stock, $.0001 par value and 10,000,000 shares of preferred stock, $.0001 par value. In January 2011 we again amended our Articles of Incorporation to change our corporate name from Ruby Worldwide, Ltd. to Excel Corporation (the “Company”).

On January 14, 2013, we entered into an Agreement of Merger and Plan of Reorganization (the “Merger Agreement”) with Excel Business Solutions, Inc., a Delaware corporation (“EBSI”), and ECB Acquisition Corp., our newly formed, wholly-owned Delaware subsidiary (“Acquisition Sub”). Upon closing of the transaction contemplated under the Merger Agreement (the “Merger”), Acquisition Sub merged with and into EBSI, and EBSI, as the surviving corporation, became a wholly-owned subsidiary of the Company.

Pursuant to the terms and conditions of the Merger Agreement, at the closing of the Merger, each share of EBSI’s common stock issued and outstanding immediately prior to the closing of the Merger was converted into the right to receive an aggregate of 33,532.446 shares of common stock, par value $0.0001 per share, of the Company, with fractional shares of the Company’s common stock rounded up or down to the nearest whole share.

Following the closing of the Merger, there were 65,201,223 shares of common stock issued and outstanding. Moreover, we are contractually obligated to issue 1,863,669 additional shares of common stock to certain holders of preferred stock of our subsidiary, XL Fashions, Inc. (“XL”), in exchange for their preferred stock pursuant to certain executed exchange agreements. Following the issuance of 1,863,669 shares to such holders, approximately 50% of our issued and outstanding shares will be held by the former stockholders of EBSI and approximately 50% will be held by the former stockholders of the Company.

Principal Services

Our business and main focus is now comprised of the merchant acquirer business we acquired with EBSI and our historical licensing business.

Merchant Acquisition Business

EBSI is a merchant acquirer (as described below) with the intention of providing credit and debit card processing services to merchants in a variety of industries. EBSI also plans to engage in financing the acquisition of existing merchant credit card portfolios. As of the date of this report, EBS has begun servicing a limited number of merchants. As a result of the Merger, EBSI became a wholly-owned subsidiary of the Company and the Company succeeded to the business of EBSI.

4

Overview

In the Payment Processing Industry, EBSI acts as a merchant acquirer. Our primary business will be to provide bankcard payment processing services to merchants in the United States. This entails establishing a contractual relationship with a processor. The processer, in turn, facilitates the exchange of information and funds between merchants and cardholders' financial institutions, providing end-to-end electronic payment processing services to merchants, including merchant set-up and training, transaction authorization and electronic draft capture, clearing and settlement, merchant accounting, merchant assistance and support and risk management. We will primarily target small and mid-sized merchants as clients. Such clients will be solicited directly through an internal sales effort and by recruiting Independent Sales Organizations (“ISOs”). ISOs are sales agents authorized by contract with one or more credit card processors to sell processing and acquiring services on their behalf. ISOs navigate the merchant’s application for processing and acquiring services through the process of approvals, credit checks, guarantees, etc. that are required before the merchant can be approved to accept consumer credit cards for payment.

In addition, we plan to be in the business of acquiring recurring monthly residual income streams derived from credit card processing fees paid by retail stores in the United States (the “Residual Portfolios”). Small and medium-sized retail merchants typically buy their credit card processing and acquiring services from ISOs in the U.S. Consistent with being a merchant acquirer, we will not act as a credit card processor, but simply as a purchaser of revenue streams resulting from the relationships between processors and ISOs and other ISOs. In addition, we may also seek to acquire servicing rights with respect to Residual Portfolios acquired from ISOs. EBSI has entered into a non-binding Letter of Intent with RBL Capital Group, LLC (“RBL”) to serve as a facility to fund the acquisition of such residual income streams. RBL may underwrite each prospective portfolio and subsequently provide funding for the purchase of the respective portfolio.

Our purchases of Residual Portfolios are expected to range in size and complexity from one-time events involving a single portfolio to multiple events over an extended period covering the entire current and possibly future portfolios of an ISO. Our aim is to acquire merchant Residual Portfolios by acquiring them directly from the ISOs that originated the contracts with the merchants. In a Residual Portfolio purchase, we buy the rights to the residual revenue streams owned by the ISO for a negotiated amount. Prior to acquisition of the Residual Portfolio from the ISO, our company and the ISO notify the processor that we plan to acquire the rights to the Residual Portfolio and that all future residual payments should be paid to us. Processors are required to approve all such acquisitions as a condition of closing.

The Industry

The payment processing industry provides merchants with credit, debit, gift and loyalty card and other payment processing services, along with related information services. The industry continues to grow as a result of wider merchant acceptance, increased consumer use of bankcards and advances in payment processing and telecommunications technology. According to The Nilson Report, February 2012, combined consumer and commercial credit, debit, and prepaid cards generated $3.595 trillion in purchase volume in 2011, up 10.4% from 2010. The proliferation of bankcards has made the acceptance of bankcard payments a virtual necessity for many businesses, regardless of size, in order to remain competitive. This use of bankcards, enhanced technology and security initiatives, efficiencies derived from economies of scale and the availability of more sophisticated products and services to all market segments has led to a highly competitive and specialized industry.

The detailed network of a credit card transaction includes several aspects: credit card associations (i.e. Visa and MasterCard); card issuers; merchants; merchant acquirers; processors; and the consumers who are buying the goods and merchants that are selling them. The card issuers distribute cards to consumers, bill them and collect payment from them. The processor is responsible for delivering the transaction to the appropriate card issuer so that the customer is billed and the merchant receives funds for the purchase. The merchant acquirer recruits merchants to accept cards and provides the front-end service of routing the transaction to the network’s processing facilities. Merchant acquirers often delegate the actual processing to third-party service providers.

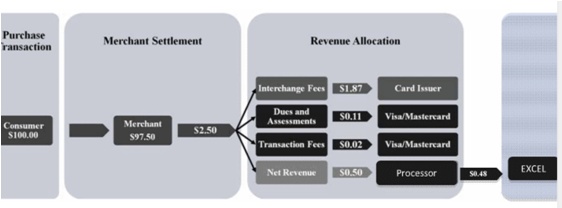

Merchant acquirer revenue is primarily comprised of credit and debit card fees charged to merchants, net of association fees, otherwise known as Interchange, for payment processing services, including authorization, capture, clearing, settlement and information reporting of electronic transactions. Fees are calculated on either a percentage of the dollar volume of the transaction or a fixed fee or a hybrid of the two and are recognized at the time of the transaction. For example, funds from a $100 transaction, using Visa or MasterCard, may be allocated as depicted.

5

Bankcard processing revenue from contracted merchants is typically recurring in nature. The industry average term of a merchant contract is three years.

We anticipate the uptrend in credit card use to continue. As consumers age, we expect that they will continue to use the payment technology to which they have grown accustomed. Young consumers have become accustomed to using bankcards and other electronic payment methods for purchase. As these consumers, who have witnessed the wide adoption of card products, technology and the Internet, comprise a greater percentage of the population and increasingly enter the work force, it can be expected that purchases using card-based payment methods will comprise an increasing percentage of total consumer spending.

The proliferation of credit and debit cards has made the acceptance of bankcards a necessity for businesses, both large and small, in order to remain competitive. As a result, many of these small to medium-sized businesses are seeking to provide customers with the ability to pay for merchandise and services using credit or debit cards, including those in industries that have historically accepted cash and checks as the only forms of payment for their products. Previously, larger acquiring banks have marketed credit card processing services to national and regional merchants and have not focused on small to medium-sized merchants, as small to medium-sized merchants have often been perceived as too difficult to identify and expensive to service. These merchants generally have a lower volume of credit card transactions, are difficult to identify and have traditionally been underserved by credit card processors.

Market researchers expect dramatic growth in card-not-present transactions due to the rapid growth of the Internet. According to Forrester Research, US online sales were $155 Billion in 2009 and projected to be nearly $250 Billion in 2014. This growth is based on the continued shift of sales away from traditional brick and mortar stores to online and catalog purchases and the trend is projected to continue. Furthermore, where concerns around secure transactions had once been in the forefront, as those concerns continue to subside, the reluctance to use bankcards will further diminish and the uptrend in bankcard volume will likely be bolstered.

Our Services

We will sell electronic payment processing services, which include credit and debit card processing, check approval, and ancillary processing equipment and software services to merchants who accept credit cards, debit cards, checks, and other non-cash forms of payment. In addition, we will acquire monthly residual streams currently in place between ISOs and processors.

Sales and Marketing

Our in-house sales effort will focus on soliciting small to medium-sized merchants. These merchants may be underserved by the large processors in terms of pricing and customer service and may therefore be better suited to receive service from a merchant acquirer. As a result of our processing relationships, we believe that we will be able to provide competitively priced credit and debit card processing while providing a high level of customer service.

We will utilize our extensive relationships with management’s network of ISOs to reach merchants in an array of industries and geographic locations. ISOs either cultivate new or existing relationships with merchants in order to sell them payment processing services.

Much of our efforts will include expanding our base of ISOs because we believe it is a cost effective solution to expanding our reach. We intend to aggressively advertise in industry publications as well as use social media outlets to recruit ISOs to bolster our sales efforts as well as those ISOs who would be interested in selling their residual portfolio streams.

6

Government Regulations

The industry in which we operate is subject to extensive governmental regulation. In particular, there are numerous laws and regulations restricting the purchase, sale, and sharing of personal information about consumers. Although, as the merchant acquirer, we do not expect to have possession of consumer level data and, therefore, do not believe that we will be subject to these regulations, the laws in this area are new and continuing to evolve. Accordingly, it is difficult to determine whether and how existing and proposed privacy laws will apply to our business. The electronic payment processor is subject to regulation by federal, state and professional governing bodies. Prospective financial institution customers, including commercial banks and credit unions, operate in markets that are subject to rigorous regulatory oversight and supervision.

Competition

The payment processing industry is highly competitive. The merchant acquirer competes with ISOs for the acquisition of merchant agreements. Several large processors including First National Bank of Omaha, Chase Paymentech, L.P., Bank of America Merchant Services and Wells Fargo frequently solicit merchants directly or through their own network of ISOs. In many cases, larger competition has demonstrated to not be as nimble in adjusting to changes in the market and we believe will not be as able as we will be to provide superior service that many small and mid-sized business owners require.

When competing for the acquisition of existing residual stream portfolios, pricing will be the determining factor. Other than straightforward cash acquisitions and offering favorable contractual terms, the ability to offer publicly traded stock as part of the purchase price will be a valuable competitive advantage. ISOs considering the sale of their residual stream may ultimately prefer to seek financing using their portfolio as collateral rather than directly selling the asset.

Licensing Business

We are a United States based company focused on bringing national and international brands to the retail marketplace. We act as agent for licensing brands of corporations, people, government agencies, etc. (“Licensors”) in a broad range of product categories. We intend to obtain agent rights to license select brands where the brand name can be leveraged into new categories. Our objective is to develop a diversified portfolio of iconic consumer brands by creating and facilitating relationships between Licensors and retail businesses, wholesale businesses, manufacturers, etc. (“Licensees”) who would sell products under the Licensor’s brand. We expect to organically grow the existing portfolio and enter into joint ventures or other partnerships with the goal of leveraging the experience of our management and that of our licensees to facilitate sales of branded products.

Upon acquiring the rights to a license from a Licensor, we expect that such a license will typically require us to pay royalties based upon net sales with guaranteed minimum royalties in the event that net sales do not reach specified targets. Licenses for brands also typically require a licensee to pay to the brand owner certain minimum amounts for the advertising and marketing of the respective license brand. We intend to seek royalties from Licensees for brands where we are the agent. In addition, we will seek agent fees on minimum royalties and advertising and marketing fees which would offset any expenses we incur while acting as an agent.

We intend to seek the rights to license brands and enter into license relationships with domestic and/or international partners that have demonstrated ability to produce quality products that have been successfully marketed and sold domestically and/or internationally in a broad range of products categories

In June 2011, we organized a New York Limited Liability Company under the name “V7 LLC” together with Michael Vick, an NFL football player that is the current quarterback of the Philadelphia Eagles and his partner Brian Sher, through his company Lauren George Productions, Inc. V7 LLC filed “Intent to Use” applications for the V7 mark in the US Trademark Office in International Classes 3, 18, and 25, which are for cosmetics and cleaning preparations, leather goods and clothing, footwear and headgear, respectively. We had the right to utilize the V7 mark in all of such classes. V7 LLC is the owner of the mark “V7”. We own 20% of V7 LLC, M&M Licensing owns 20% and Michael Vick and Lauren George Productions own 48% and 12%, respectively. On May 29, 2012, V7 LLC entered into a license agreement with M&M Licensing, Inc. whereby M&M Licensing was granted the exclusive right, limited to the states of Connecticut, Delaware, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, Virginia and the District of Columbia and online through M&M Licensing’s affiliate Modell’s Online, Inc., to sell apparel bearing the V7 mark. As of December 31, 2012, this agreement was no longer in effect.

On September 2, 2011, we entered into a license agreement with Entertainment Industry Foundation for use of the mark “Stand Up To Cancer” for men’s, women’s and children’s apparel in all sizes including hats and bags. As of December 31, 2012, this agreement was no longer in efffect.

7

In October 2011, we purchased assets of the business known as “Billy Martin’s,” including the intellectual property (IP), goodwill and fixtures and equipment for a purchase price of $150,000, consisting of $30,000 cash and a promissory note in the original principal amount of $120,000 (the “BM Note”), and a 20% share of the net profits generated from the sale of clothing and other products. The Company is currently in default under the BM Note because it has not made the payment of $30,000 that was required in October 2012. The Company believes it will renegotiate this deal so that it will be relieved of further obligation, though it will no longer hold any rights to the assets/IP of the business.

On January 2, 2012, the Company entered into an agreement with Lifeguard Licensing Corp, (“LLC”) in which LLC owns rights to trademarks, packaging, designs, images, copyrights and other intellectual property. LLC, pursuant to the agreement, designated the Company as the licensing agent to negotiate and service license agreements with respect to commercial exploitation of the property within the defined territory. The term of the agreement is for one year commencing on the effective date. LLC may terminate the agreement upon written notice if the Company does not meet certain terms set forth in the agreement. The Company’s compensation will be calculated at 25%, 20% and 15% of Net Revenues (as defined in the agreement) for the initial term, second renewal term, and third renewal term, respectively. In addition to the Company’s compensation, LLC will reimburse the Company for out of pocket expenses.

On February 4, 2012, the Company entered into an agreement with Soupman, Inc. (“Soupman”). Pursuant to the agreement, the Soupman has designated the Company as the exclusive licensing agent in the Territory, as defined in the agreement. As licensing agent, the Company will negotiate and service licensing agreements on behalf of Soupman. As compensation, the Company will receive 25% of all licensing revenue from agreements executed pursuant to the terms of the agreement and five percent (5%) of other licensing revenue as defined in the agreement. All payments from license agreements are made payable to Soupman and after such payment, the Company will be paid the commission as indicated above. The initial term of the agreement is for one year and automatically renews provided that the Company has submitted to Soupman a minimum of five potential license applications. Subsequent to the second year, the agreement will terminate unless extended by written agreement.

On February 21, 2012, the Company entered into an agreement with Camuto Consulting, Inc. (“Camuto”), in which the Camuto engaged the Company as the licensing agent to identify and secure licenses as applicable. The agreement is for a one year term and expires February 28, 2013. Compensation to the licensing agent pursuant to the agreement is as follows: (i) commissions payable at 6.5% on royalties earned and received by Camuto during the first term of solicited agreements with eligible licensees that are executed; and (ii) commissions payable at 5% on royalties earned and received by Camuto during any renewal term of solicited agreements with eligible licensees that are executed.

On March 12, 2012, the Company entered into an agreement with Hickory Farms, Inc. (“HFI”) in which HFI owns rights to trademarks, packaging, designs, images, copyrights and other intellectual property. HFI has designated the Company as the licensing agent to negotiate and service license agreements only, with respect to commercial exploitation of the property within the defined territory. This excludes any wholesale sales of HFI product of which the Company will not receive any commissions. The Company’s compensation will be calculated at 25%, 15% and 10% of Net Revenues (as defined in the agreement) for the initial term, first renewal term, and second renewal term, respectively. In addition to the Company’s compensation, HFI will reimburse the Company for out of pocket expenses. As of December 31, 2012, the agreement was no longer in effect.

On May 3, 2012, the Company entered into an agreement with Benedetto Arts, LLC (“BA”), in which BA will utilize the Company as an independent contractor for the solicitation of licensing opportunities. As compensation for its services, the Company will receive a commission based on 20% of Gross Revenue (as defined in the agreement). The term of the Agreement is for one year commencing on May 3, 2012 with an option to extend if both parties agree. In addition, if the Company does not deliver three business opportunities from the May 3, 2012 date, BA has the right to terminate the Agreement.

Target Market

We are a company focused on bringing national and international brands to the mass marketplace by acquiring the agent rights to Licensors’ brands and creating relationships between Licensor and Licensees.

The target market for our portfolio of clients’ brands will consist primarily of young lifestyle customers who are physically active and participate in more than one sporting activity or have aspirations to appear physically active. These are consumers that are both brand and quality conscious.

Through our different client licensed brands, we intend to target consumers who want to be ahead of the latest styles and trends as well as consumers that connect with the heritage and tradition of an age-old brand and value its authenticity. In all cases, we will be targeting consumers that look for top performance, high quality and comfortable products that are affordably priced.

8

Sales Cycle

Many product lines are seasonal in nature. It can be assumed that any sales bearing our clients’ brands will vary as a result of seasons, holidays, weather, and the timing of product shipments. Accordingly, a portion of our revenue from agent fees on the license royalty revenue will likely be subject to seasonal fluctuations. The results of operations in any quarter therefore may not necessarily be indicative of the results that may be achieved for a full fiscal year or any future quarter.

Product Selection

As an agent, Licensees will develop and design their own products. However, we anticipate that from a selection offered by Licensees, our senior executives will be instrumental in creating a focused product program to be shown to U.S. and International customers. We also anticipate that Licensees will source the products, primarily from non-U.S. and non- European sources, and will negotiate manufacturing and quality control standards for the products.

We do not own or operate any manufacturing facilities. We expect that products will be distributed through the following distribution channels:

|

●

|

With licensor approval, mass merchants;

|

|

|

●

|

Department stores;

|

|

●

|

Sporting goods chains;

|

|

|

●

|

Specialty stores;

|

|

●

|

Chain stores;

|

|

|

●

|

Internet merchants;

|

|

●

|

With licensor approval, discount stores; and

|

|

|

●

|

Other media oriented retailers.

|

Industry Regulations/Standards

We are subject, both directly and indirectly, to various laws and regulations relating to our business. We are subject to local laws and regulations in the U.S. If any of the laws are amended, compliance could become more expensive and directly affect our income.” We intend to comply with such laws, but new restrictions may arise that could materially adversely affect us.

Research and Development

We do not currently have a budget specifically allocated for research and development purposes.

Competition

Agent fees on royalties paid to us under licensing agreements between Licensor and Licensee will generally be based on a percentage of Licensee’s net sales of licensed products. The sale of branded goods is subject to extensive competition by numerous domestic and foreign companies. Factors which shape the competitive environment include quality of construction and design, brand name, style and color selection, price and the ability to respond quickly to the retailer on a national basis. In recognition of the increasing trend towards consolidation of retailers and greater emphasis by retailers on the manufacture of private label merchandise, in the United States our business plan will focus on creating strategic alliances with major retailers for their sale of products bearing our clients’ brands through the licensing of client trademarks directly to manufacturers, distributors and retailers. Therefore, our degree of success is dependent on the strength of our clients’ brands, consumer acceptance of and desire for our clients’ brands, our Licensees' ability to design, manufacture and sell products bearing our clients’ brands and to respond to ever-changing consumer demands, and any significant failure by Licensees to do so could have a material adverse effect on our business prospects, financial condition, results of operations and liquidity. We cannot control the level of resources that Licensees commit to supporting our clients’ brands, and Licensees may choose to support other brands to the detriment of our clients.

Employees

As of April 16, 2013, we have 6 full-time employees, including the executive staff. We will also utilize independent consultants to assist with accounting and compliance matters.

9

Item 1A. Risk Factors.

Risks Relating to Our Merchant Acquisition Business

We have limited operating history in the merchant processing and acquisition business and have generated no revenue. There is no guarantee that we will become profitable and that makes it difficult to predict future results and raises substantial doubt as to our ability to successfully develop profitable business operations and continue as a going concern.

We only recently decided to operate in the merchant processing and acquisition industry through the acquisition of EBSI, and have no revenue from this business to date (as EBSI had no existing business at the time of the acquisition). We anticipate that we will operate at a loss for some time. We may never become profitable. In the future, we may experience under-capitalization, delays, lack of funding, and many of the others problems, delays, and expenses encountered by any early stage business, many of which are beyond our control. These include, but are not limited to:

|

●

|

inability to establish profitable strategic relationships with credit and debit card processing providers and the ability to secure the approvals of existing processors and other entities necessary to execute an acquisition of a merchant credit and debit card residual portfolio,

|

|

●

|

inability to identify suitable revenue streams for acquisition and/or to effectively and efficiently integrate acquired assets into our operations,

|

|

|

●

|

inability to raise sufficient capital to fund our anticipated business plan, or

|

|

|

●

|

competition from larger and more established transaction processing and acquiring companies, banks, large ISOs, and internet-based providers of similar services that may compete with us now or in the future.

|

In addition, our independent registered public accountants have included a going concern explanatory paragraph in their opinion of our 2012 and 2011 financial statements.

We may not be able to raise the additional capital necessary to execute our business strategy and that could result in the curtailment or cessation of our operations.

Our ability to raise additional capital is uncertain and dependent upon numerous factors beyond our control, including but not limited to economic conditions, regulatory factors, continued high unemployment, reduced retail sales, increased taxation, reductions in consumer confidence, changes in levels of consumer spending, changes in preferences in how consumers pay for goods and services, weak housing markets and availability or lack of availability of credit. If we are unable to obtain additional financing, or if the terms thereof are too costly, we may be forced to curtail or cease operations until such time as alternative additional financing is arranged, which would have a material adverse impact on our planned operations.

We may need even more financing earlier than we anticipate if we:

|

●

|

expand faster than our internally generated cash flow can support,

|

|

|

●

|

purchase merchant portfolios from a large number of ISOs,

|

|

|

●

|

need to increase merchant portfolio purchase prices in response to competition,

|

|

|

●

|

acquire complementary products, businesses, technologies or residual ISO commissions.

|

We remain at risk regarding our ability to conduct successful operations.

The results of our operations will depend, among other things, upon our ability to acquire and successfully integrate into our operations merchant credit and debit card processing and acquisition contracts, operations, and other support tasks. Our operations may be affected by many factors, some known by us, some unknown, and some that are beyond our control. Any of these problems, or a combination thereof, could have a materially adverse effect on our viability as an entity and might cause the investment of our shareholders to be impaired or lost. Our strategic relationships are in various stages of development. Unanticipated obstacles can arise at any time that may result in lengthy and costly delays or in a determination that further development of the business plan and ongoing operations are not feasible.

The execution of our business plan to acquire merchant credit and debit card processing and acquisition contracts may take longer than anticipated and could be additionally delayed for reasons outside our control. Therefore, we may not be able to timely identify, negotiate, acquire and integrate merchant credit and debit card processing and acquisition contracts, operations and other support tasks on a cost-effective basis, or that such opportunities may not achieve market acceptance such that, in combination with existing or future merchant credit and debit card processing and acquisition contracts under management, they will sustain us or allow us to achieve profitable operations.

10

The Company has limited experience in the merchant credit and debit card processing and acquisition industry, which could hinder our ability to attract and engage with potential strategic partners and ISO targets.

We may not be successful in executing our planned activities to the levels that we are seeking. We do not know whether or when we will be able to develop efficient capabilities to acquire, integrate and finance merchant credit and debit card processing and acquisition contracts in sufficient quantities to enable us to successfully execute on our anticipated business plan. Even if we are successful in developing our capabilities and processes, we do not know whether we will sustain our business or continue to satisfy the requirements of our potential strategic relationships and ISO targets, the inability of which could have a material adverse effect on our financial condition and operations.

Unauthorized disclosure of merchant and cardholder data, whether through breach of our computer systems or otherwise, could expose us to liability and protracted and costly litigation.

We collect and store sensitive data about merchants, including names, addresses, social security numbers, driver’s license numbers and checking account numbers.. Any loss of cardholder data by us or our merchants could result in significant fines and sanctions by the card networks or governmental bodies, which could have a material adverse effect upon our financial position and/or results of operations. Our computer systems could be in the future, subject to penetration by hackers and our encryption of data may not prevent unauthorized use. In this event, we may be subject to liability, including claims for unauthorized purchases with misappropriated bankcard information, impersonation or other similar fraud claims. We could also be subject to liability for claims relating to misuse of personal information, such as unauthorized marketing purposes. These claims also could result in protracted and costly litigation. In addition, we could be subject to penalties or sanctions from the card networks.

Although we generally require that our agreements with our service providers who have access to merchant and customer data include confidentiality obligations that restrict these parties from using or disclosing any customer or merchant data except as necessary to perform their services under the applicable agreements, these contractual measures may not prevent the unauthorized use or disclosure of data. In addition, our agreements with financial institutions most likely will require us to take certain protective measures to ensure the confidentiality of merchant and consumer data. Any failure to adequately enforce these protective measures could result in protracted and costly litigation.

If we fail to comply with the applicable requirements of the Visa and MasterCard bankcard networks, Visa or MasterCard could seek to fine us, suspend us or terminate our registrations. Fines could have an adverse effect on our operating results and financial condition, and if these registrations are terminated, we will not be able to conduct our business.

If we are unable to comply with Visa and MasterCard bankcard network requirements (including Payment Card Industry Data Security Standard, or PCI-DSS, compliance), Visa or MasterCard could seek to fine us, suspend us or terminate our registrations. We may receive notices of non-compliance and fines, which have typically related to excessive chargebacks by a merchant or data security failures on the part of a merchant. If we are unable to recover fines from our merchants, we would experience a financial loss. The termination of our registration, or any changes in the Visa or MasterCard rules that would impair our registration, could require us to stop providing Visa and MasterCard payment processing services, which would make it impossible for us to conduct our business.

We could in the future face chargeback liability when our merchants refuse or cannot reimburse chargebacks resolved in favor of their customers, reject losses when our merchants go out of business, and merchant fraud. We cannot accurately anticipate these liabilities, which may adversely affect our results of operations and financial condition.

In the event a billing dispute between a cardholder and a merchant is not resolved in favor of the merchant, the transaction is normally “charged back” to the merchant and the purchase price is credited or otherwise refunded to the cardholder. If we or our clearing banks are unable to collect such amounts from the merchant’s account, or if the merchant refuses or is unable, due to closure, bankruptcy or other reasons, to reimburse us for the chargeback, we bear the loss for the amount of the refund paid to the cardholder. The risk of chargebacks is typically greater with those merchants that promise future delivery of goods and services rather than delivering goods or rendering services at the time of payment. We may experience significant losses from chargebacks in the future. Any increase in chargebacks not paid by our merchants may adversely affect our financial condition and results of operations.

We have potential liability for fraudulent bankcard transactions initiated by merchants. Merchant fraud occurs when a merchant knowingly uses a stolen or counterfeit bankcard or card number to record a false sales transaction, processes an invalid bankcard or intentionally fails to deliver the merchandise or services sold in an otherwise valid transaction. We plan to establish systems and procedures designed to detect and reduce the impact of merchant fraud, but we these measures may not be effective. It is possible that incidents of fraud could increase in the future. Failure to effectively manage risk and prevent fraud would increase our chargeback liability. Increases in chargebacks could have an adverse effect on our operating results and financial condition.

11

Increased merchant attrition that we cannot offset with increased bankcard processing volume from same store sales growth or new accounts would cause our revenues to decline.

We may experience attrition in merchant bankcard processing volume resulting from several factors, including business closures, transfers of merchants’ accounts to our competitors and account closures that we initiate due to heightened credit risks relating to, or contract breaches by, merchants, and when applicable same store sales contraction. We cannot predict the level of attrition in the future, and it could increase. Increased attrition in merchant bankcard processing volume may have an adverse effect on our financial condition and results of operations. If we are unable to establish accounts with new merchants or otherwise increase our bankcard processing volume in order to counter the effect of this attrition, our revenues will decline.

We rely on various financial institutions to provide clearing services in connection with our settlement activities. If we are unable to maintain clearing services with these financial institutions and are unable to find a replacement, our business may be adversely affected.

We rely on various financial institutions to provide clearing services in connection with our settlement activities. If we are unable to maintain clearing services with these financial institutions or are unable to find such a replacement for them, we may no longer be able to provide processing services to certain customers which could negatively impact our revenue and earnings.

If we cannot pass increases in bankcard network interchange fees, assessments and transaction fees along to our merchants, our operating margins will be reduced.

We expect to pay interchange fees and other network fees set by the bankcard networks to the card issuing bank and the bankcard networks for each transaction we process. From time to time, the bankcard networks increase the interchange fees and other network fees that they charge payment processors and the sponsor banks. We expect that our potential sponsor bank will pass any increases in interchange fees on to us. If we are unable to pass these fee increases along to our merchants through corresponding increases in our processing fees in the future, our operating margins will be reduced.

Current or future bankcard network rules and practices could adversely affect our business.

We plan to be registered with the Visa and MasterCard networks through our bank sponsors as an ISO with Visa and a Member Service Provider with MasterCard. The rules of the bankcard networks are set by their boards, which may be strongly influenced by card issuers, and some of those card issuers are our competitors with respect to these processing services. Many banks directly or indirectly sell processing services to merchants in direct competition with us. These banks could attempt, by virtue of their influence on the networks, to alter the networks’ rules or policies to the detriment of non-members like us. The bankcard networks or issuers who maintain our future registrations or arrangements or the bankcard network or issuer rules allowing us to market and provide payment processing services may not remain in effect. The termination of our registration or our status as an ISO or Member Service Provider, or any changes in card network or issuer rules that limit our ability to provide payment processing services, could have an adverse effect on our bankcard processing volumes, revenues or operating costs. In addition, if we were precluded from processing Visa and MasterCard bankcard transactions, we would lose substantially all of our revenues.

Any new laws and regulations, or revisions made to existing laws, regulations, or other industry standards affecting our business may have an unfavorable impact on our operating results and financial condition.

Our business is impacted by laws and regulations that affect the bankcard industry. The number of new and proposed regulations has increased significantly, particularly pertaining to interchange fees on bankcard transactions, which are paid to the bank card issuer. In July 2010, Congress passed The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), which significantly changed financial regulation. Changes included restricting amounts of debit card fees that certain issuer banks can charge merchants and allowing merchants to offer discounts for different payment methods. The impact which the Dodd-Frank Act will have on our operating results is difficult to determine, as the changes are not directed at us and final regulations on interchange fees are still to be set by the Federal Reserve Board. When final, these regulations could adversely affect our operating results and financial condition.

Governmental regulations designed to protect or limit access to consumer information could adversely affect our ability to effectively provide our services to merchants.

Governmental bodies in the United States and abroad have adopted, or are considering the adoption of, laws and regulations restricting the transfer of, and safeguarding, non-public personal information. For example, in the United States, all financial institutions must undertake certain steps to ensure the privacy and security of consumer financial information. While our operations are subject to certain provisions of these privacy laws, we will limit our use of consumer information solely to providing services to other businesses and financial institutions. We will also limit sharing of non-public personal information to that necessary to complete the transactions on behalf of the consumer and the merchant and to that permitted by federal and state laws. In connection with providing services to the merchants and financial institutions that use our services, we will be required by regulations and contracts with our merchants to provide assurances regarding the confidentiality and security of non-public consumer information. These contracts may require periodic audits by independent companies regarding our compliance with industry standards and best practices established by regulatory guidelines. The compliance standards relate to our infrastructure, components, and operational procedures designed to safeguard the confidentiality and security of non-public consumer personal information shared by our clients with us. Our ability to maintain compliance with these standards and satisfy these audits will affect our ability to attract and maintain business in the future. The cost of such systems and procedures may increase in the future and could adversely affect our ability to compete effectively with other similarly situated service providers.

12

Our systems and our third-party providers’ systems may fail due to factors beyond our control, which could interrupt our service, cause us to lose business and increase our costs.

We depend on the efficient and uninterrupted operation of computer network systems, software, data center and telecommunications networks, as well as the systems of third parties. Our systems and operations or those of our third-party providers could be exposed to damage or interruption from, among other things, fire, natural disaster, power loss, telecommunications failure, unauthorized entry and computer viruses. Our property and business interruption insurance may not be adequate to compensate us for all losses or failures that may occur. Defects in our systems or those of third parties, errors or delays in the processing of payment transactions, telecommunications failures or other difficulties could result in:

|

●

|

loss of revenues;

|

|

●

|

loss of merchants, although our contracts with merchants do not expressly provide a right to terminate for business interruptions;

|

|

●

|

loss of merchant and cardholder data;

|

|

●

|

harm to our business or reputation;

|

|

●

|

exposure to fraud losses or other liabilities;

|

|

●

|

negative publicity;

|

|

●

|

additional operating and development costs; and/or

|

|

●

|

diversion of technical and other resources.

|

We do not own or maintain a processing network and expect to depend on outsourced suppliers for this and other essential service; our inability to obtain and retain such outsourced services would require us to discontinue our operations.

We do not own or maintain a computer system or software or communications network necessary to process debit or credit card transactions. We expect to depend on outsourced vendors for these and other key functions, including credit card transaction processing, check guarantee and gift and loyalty card processing and provision of point of sale processing equipment. We will therefore be dependent on the continued capabilities of these vendors to provide such services on terms acceptable to us. Should any one of these vendors experience difficulties in providing processing services for any reason, or if we can no longer engage vendors to provide such services, we would be required to discontinue operations.

We may experience software defects, undetected errors, and development delays, which could damage customer relations, decrease our potential profitability and expose us to liability.

We rely on technologies and software supplied by third parties that may contain undetected errors, viruses or defects. Defects in software products and errors or delays in processing of electronic transactions could result in additional costs, diversion of technical and other resources from our other efforts, loss of credibility with current or potential customers, harm to our reputation, or exposure to liability claims. In addition, the sophisticated software and computing systems that we rely on often encounter development delays and the underlying software may also contain undetected errors, viruses, or defects that could have a material adverse effect on our business, financial condition and results of operations.

Many of our merchants depend upon the ability to utilize the Internet for the conduct of a significant portion of their business; disruption to that system could make it impossible for them to continue to conduct their current businesses.

Possible disruption to the normal functioning of the Internet through, for example, power failure or terrorist sabotage, could make it impossible for aspects of the lending, electronic payment processing, and web hosting to function. In the event of a major disruption, and assuming that such disruptions would be long-lived, the merchants would be required to make extensive changes in the way they do business. These merchants may not have the time and resources to make these changes, which could have a material adverse effect on our business, financial condition and results of operations.

13

Adverse conditions in markets in which we obtain a substantial amount of our bankcard processing volume could negatively affect our results of operations.

Adverse economic or other conditions in the states where we obtain a substantial amount of our bankcard processing volume could negatively affect our revenue and could materially and adversely affect our results of operations. As a result of any geographic concentration of our merchants, we will be exposed to the risks of downturns in these local economies and to other local conditions, which could adversely affect the operating results of our merchants in these markets.

None of our officers and directors have any meaningful accounting or financial reporting education or experience, which increases the risk we may be unable to comply with all rules and regulations.

Our ability to meet our ongoing reporting requirements on a timely basis will be dependent to a significant degree on advisors and consultants. Our officers and directors have no meaningful accounting or financial reporting education or experience. As such, there is risk about our ability to comply with all financial reporting requirements accurately and on a timely basis.

If we are unable to attract and retain qualified sales people, our business and financial results may suffer.

Our success partially depends on the skill and experience of our sales force. If we are unable to retain and attract sufficiently experienced and capable relationship managers, our business and financial results may suffer.

Any acquisitions or portfolio buyouts that we make could disrupt our business and harm our financial condition.

We expect to evaluate potential strategic acquisitions of complementary businesses, products or technologies. We may not be able to successfully finance or integrate any businesses, products or technologies that we acquire. Furthermore, the integration of any acquisition may divert management’s time and resources from our core business and disrupt our operations. We may spend time and money on projects that do not increase our revenue. To the extent we pay the purchase price of any acquisition in cash, it would reduce our cash reserves, and to the extent the purchase price is paid with our stock, it could be dilutive to our stockholders. While we, from time to time, may evaluate potential acquisitions of businesses, products and technologies, we have no present understandings, commitments or agreements with respect to any acquisitions.

We are subject to the business cycles and credit risk of our merchants, which could negatively impact our financial results.

A recessionary economic environment could have a negative impact on our merchants, which could, in turn, negatively impact our financial results, particularly if the recessionary environment disproportionately affects some of the market segments that represent a larger portion of our bankcard processing volume. If our merchants make fewer sales of their products and services, we will have fewer transactions to process, resulting in lower revenue. In addition, we have a certain amount of fixed and semi-fixed costs, including rent, processing contractual minimums and salaries, which could limit our ability to quickly adjust costs and respond to changes in our business and the economy.

In a recessionary environment our merchants could also experience a higher rate of business closures, which could adversely affect our business and financial condition. In the event of a closure of a merchant, we are unlikely to receive our fees for any transactions processed by that merchant in its final month of operation.

Our operating results are subject to seasonality, which could result in fluctuations in our quarterly revenue.

We expect to experience seasonal fluctuations in our revenues as a result of consumer spending patterns.

Our growth plans depend on completion of acquisitions of merchant portfolios, which require processor consents that we may be unable to obtain.

Our merchant portfolio acquisition strategy requires that processors consent to our acquisition of the ISOs’ merchant portfolios. If processors do not agree to the transfer of ownership of the merchant portfolios from the ISOs to us, our business model will be disrupted and we may no longer be able to continue business as currently contemplated.

14

Revenues generated by acquired portfolios may be less than anticipated, resulting in losses or a decline in profits.

In evaluating and determining the purchase price for a prospective acquisition, we plan to estimate the future revenues from that acquisition based on the historical transaction volume of the acquired provider of payment processing services or portfolio of merchant accounts. Following an acquisition, it is customary to experience some attrition in the number of merchants serviced by an acquired provider of payment processing services or included in an acquired portfolio of merchant accounts. Should the rate of post-acquisition merchant attrition exceed the rate we have forecasted, the revenues generated by the acquired providers of payment processing services or portfolio of accounts may be less than we estimated, which could result in losses or a decline in profits.

We may have significant impairment charges due to lack of acquisition performance after closing a transaction, which may result in a reduction of carrying value, if our revenues relating to these assets decline.

We will attempt to acquire ISO residual streams. A material decline in the revenues generated from any of our purchased portfolios could reduce the fair value of the portfolio or operations. In that case, we may be required to reduce the carrying value of the related asset. Additionally, changes in accounting policies or rules could affect the way in which we reflect these assets in our financial statements, or the way in which we treat the assets for tax purposes, either of which could have a material adverse effect on our financial condition.

We may fail to uncover all liabilities of acquisition targets through the due diligence process prior to an acquisition, exposing us to potentially large, unanticipated costs.

Prior to the consummation of any acquisition, we expect to perform a due diligence review of the provider of payment processing services or portfolio of merchant accounts that we propose to acquire. Our due diligence review, however, may not adequately uncover all of the contingent or undisclosed liabilities we may incur as a consequence of the proposed acquisition.

We may encounter delays and operational difficulties in completing the necessary links required by an acquisition, resulting in increased costs for and a delay in the realization of revenues from, that acquisition.

The acquisition of a residual stream will require the transfer of functions and links to [our systems and] those of our own third party service providers. If the transfer of these functions and links does not occur rapidly and smoothly, delays and errors may occur, resulting in a loss of revenues, increased merchant attrition and increased expenditures to correct the transitional problems, which could preclude our attainment of, or reduce, profits.

Special non-recurring costs associated with acquisitions could adversely affect our operating results in the periods following these acquisitions.

In connection with some acquisitions, we may incur non-recurring severance expenses, restructuring charges and change of control payments. These expenses, charges, and payments could adversely affect our operating results during the initial financial periods following an acquisition.

Our facilities, personnel and financial and management systems may not be adequate to effectively manage the future expansion we believe necessary to increase our revenues and remain competitive.

We anticipate that future expansion will be necessary in order to increase our revenues. In order to effectively manage our expansion, we may need to attract and hire additional sales, administrative, operations and management personnel. Our facilities, personnel, and financial and management systems and controls may not be adequate to support the expansion of our operations. If we fail to effectively manage our growth, our business could be harmed.

The payment processing industry is highly competitive and we compete with certain firms that are larger and have greater financial resources than we do. Such competition could increase, which would adversely influence our prices to merchants and, as a result, our operating margins.

The market for payment processing services is highly competitive. Other providers of payment processing services have established a sizable market share in the small- and medium-size merchant processing sector. The weakness of the current economic recovery could cause future growth in electronic payment transactions to slow compared to historical rates of growth. This competition may influence the prices we are able to charge. If the competition causes us to reduce the prices we charge, we will have to aggressively control our costs in order to maintain acceptable profit margins. In addition, some of our competitors are financial institutions, subsidiaries of financial institutions or well-established payment processing companies, including Heartland Payment Systems, Inc., Newtek Business Services, Inc., Global Payments Inc., First Data Corporation, Vantiv Inc., Calpian Inc., Fifth Third Processing Solutions, Chase Paymentech Solutions and Elavon, Inc. Our competitors that are financial institutions or subsidiaries of financial institutions do not incur the costs associated with being sponsored by a bank for registration with the card networks and can settle transactions more quickly for their merchants than we can for ours. These competitors have substantially greater financial, technological, management and marketing resources than we have. This may allow our competitors to offer more attractive fees to our current and prospective merchants, or other products or services that we do not offer. This could result in a loss of customers, greater difficulty attracting new customers, and a reduction in the price we can charge for our services.

15

In addition, many of our competitors may have the ability to devote more financial and operational resources than we can to the development of new technologies and services, including Internet payment processing services and mobile payment processing services that provide improved operating functionality and features to their product and service offerings. If successful, their development efforts could render our product and services offerings less desirable to customers, again resulting in the loss of customers or a reduction in the price we could demand for our offerings. Furthermore, we are facing competition from non-traditional competitors offering alternative payment methods, such as PayPal and Google. These non-traditional competitors have significant financial resources and robust networks and are highly regarded by consumers. If these non-traditional competitors gain a greater share of total electronic payments transactions, it could also have a material adverse effect on our business, financial condition and results of operation.

We expect to be subject to increased operating margin pressure, which could erode our margins and adversely affect our ability to retain merchants and attain and maintain profitability.

We expect to experience increasingly downward pricing pressure from merchants for merchant credit and debit card processing and acquiring services, similar to what many of our competitors have experienced. The services we plan to offer are a commodity and as such are not differentiable except using price. Low barriers to entry to becoming an ISO means that price competition in the industry is persistent and strong. Our management has noted this trend and does not anticipate that this trend will cease in the near future, if at all. Continued margin erosion could adversely affect our merchant retention and profitability.

There may be a decline in the use of cards as a payment mechanism for consumers or adverse developments with respect to the card industry in general.

If consumers do not continue to use credit or debit cards as a payment mechanism for their transactions or if there is a change in the mix of payments between cash, credit cards, and debit cards, which is adverse to us, it could have a material adverse effect on our business, financial condition, and results of operations. We believe future growth in the use of credit and debit cards and other electronic payments will be driven by the cost, ease-of-use, and quality of products and services offered to consumers and businesses.

Our risk management policies and procedures may not be fully effective in mitigating our risk exposure in all market environments or against all types of risk.

We operate in a rapidly changing industry. Accordingly our risk management policies and procedures may not be fully effective to identify, monitor, and manage our risks. If our policies and procedures are not fully effective or we are not always successful in capturing all risks to which we are or may be exposed, we may suffer uninsured liability, harm to our reputation or be subject to litigation or regulatory actions that could have a material adverse effect on our business, financial condition and results of operation.

Continued consolidation in the banking and retail industries could adversely affect our growth.

Historically, the banking industry has been the subject of consolidation, regardless of overall economic conditions, while the retail industry has been the subject of consolidation due to cyclical economic events. Since 2008, there have been multiple bank failures and government-encouraged consolidation. Larger banks and larger merchants with greater transaction volumes may demand lower fees which could result in lower revenues and earnings for us.

We may become subject to additional U.S., state or local taxes that cannot be passed through to our merchants, which could negatively affect our results of operations.

Companies in the payment processing industry, including us, may become subject to taxation in various tax jurisdictions on our net income or revenues. Application of these taxes is an emerging issue in our industry and taxing jurisdictions have not yet adopted uniform positions on this topic. If we are required to pay additional taxes and are unable to pass the tax expense through to our merchants, our costs would increase and our net income would be reduced.

16

Risks Relating to Our Licensing Business

If we fail to develop our clients’ brands cost-effectively, our business may be adversely affected.

Successful promotion of our clients’ brands will depend largely on the effectiveness of our marketing efforts and those of Licensees. Brand promotion activities may not yield increased revenue, and even if they do, any increased revenue may not offset the expenses incurred in building the brands. If we fail to successfully promote and maintain our clients’ brands, or incur substantial expenses in an unsuccessful attempt to promote and maintain our clients’ brands, we may fail to attract enough new customers or retain existing customers to the extent necessary to realize a sufficient return on our client brand-building efforts, and our business and results of operations could suffer.

The market in which we participate is competitive and, if we do not compete effectively, our operating results could be harmed.

The licensing business in general is highly competitive and fragmented. Our competitors will include numerous licensors, and our own clients’ private label programs. We will face competition on many fronts, including the following: (i) establishing and maintaining favorable brand recognition; (ii) Licensees’ ability in developing products that appeal to customers; and (iii) pricing products appropriately. Most of our competitors will be larger than us and have access to significantly greater financial, marketing and other resources than us. We believe that the principal competitive factors in the industry are: (1) brand name and brand identity, (2) timeliness, reliability and quality of service provided, (3) price, (4) the ability to anticipate consumer demands, and (5) market share. We may not be able to compete successfully. If we are unable to successfully compete in this market, our business, prospects, financial condition and results of operations will be materially adversely affected.

Some of our competitors will also offer a wider range of branded lines, have greater name recognition and more extensive customer bases than we do. These competitors may be able to respond more quickly to new or changing opportunities and customer desires, undertake more extensive promotional activities, offer terms that are more attractive to customers and adopt more aggressive pricing policies than we can. Moreover, current and potential competitors have established or may establish cooperative relationships among themselves or with third parties to enhance their visibility. Our current and potential competitors may have significantly more financial, technical, marketing and other resources than we do and may be able to devote greater resources to the development, promotion, sale and support of their products. Our current and potential competitors may have more extensive customer bases and broader customer relationships than we have. In addition, these companies may have longer operating histories and greater name recognition than we have and may be able to acquire more desirable brands or licensees that we can. These competitors may be better able to exploit branded merchandise. If we are unable to compete with such companies, the demand for our licensed products could be insufficient to allow us to profit from our activities.

We may not be able to anticipate consumer preferences and trends, which could negatively affect acceptance of products by retailers and consumers and result in a significant decrease in net sales.

The products sold under our clients’ brand names must appeal to a broad range of consumers, whose preferences cannot be predicted with certainty and are subject to rapid change. Products sold under clients’ brands will need to successfully meet constantly changing consumer demands. If branded products are not successfully received by retailers and consumers, our business, financial condition, results of operations and prospects may be harmed.

If a third party asserts that we are infringing its intellectual property, whether successful or not, it could subject us to costly and time-consuming litigation or require us to obtain expensive licenses, and our business may be adversely affected.

The licensing industry is characterized by the existence of a large number of patents, trademarks and copyrights and by frequent litigation based on allegations of infringement or other violations of intellectual property rights. Third parties may assert patent, trademark, copyright and other intellectual property infringement claims against us in the form of lawsuits, letters or other forms of communication. These claims, whether or not successful, could:

|

●

|

divert management’s attention;

|

|

|

●

|

result in costly and time-consuming litigation;

|

|

●

|

require us to enter into royalty or licensing agreements, which may not be available on acceptable terms, or at all; or

|

|

|

●

|

require us to modify our agreements for brands, trademarks, copyrights and/or patents to avoid infringement.

|

17

As a result, any third-party intellectual property claims against us could increase our expenses and adversely affect our business. In addition, many of our agreements with Licensors will likely require us to indemnify them for third-party intellectual property infringement claims, which would increase the cost to us resulting from an adverse ruling on any such claim. Even if we have not infringed any third parties’ intellectual property rights, our legal defenses may not be successful, and even if we are successful in defending against such claims, our legal defense could require significant financial resources and management time. Finally, if a third party successfully asserts a claim that our products infringe its proprietary rights, royalty or licensing agreements might not be available on terms we find acceptable or at all and we may be required to pay significant monetary damages to such third party.

The downturn in the economy has negatively affected consumer purchases of discretionary items and can adversely affect Licensee sales.