Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Delek US Holdings, Inc. | a8kinvestorpresentation4-1.htm |

Delek US Holdings, Inc. April 2013

Safe Harbor Provision 2 Delek US Holdings is traded on the New York Stock Exchange in the United States under the symbol “DK” and, as such, is governed by the rules and regulations of the United States Securities and Exchange Commission. This presentation may contain forward-looking statements that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning our current estimates, expectations and projections about our future results, performance, prospects and opportunities and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under United States securities laws. Investors are cautioned that the following important factors, among others, may affect these forward-looking statements. These factors include but are not limited to: risks and uncertainties with the respect to the quantities and costs of crude oil, the costs to acquire feedstocks and the price of the refined petroleum products we ultimately sell; management's ability to execute its strategy through acquisitions and transactional risks in acquisitions; our competitive position and the effects of competition; the projected growth of the industry in which we operate; changes in the scope, costs, and/or timing of capital projects; losses from derivative instruments; general economic and business conditions, particularly levels of spending relating to travel and tourism or conditions affecting the southeastern United States; potential conflicts of interest between our majority stockholder and other stockholders; and other risks contained in our filings with the United States Securities and Exchange Commission. Forward-looking statements should not be read as a guarantee of future performance or results and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Delek US undertakes no obligation to update or revise any such forward-looking statements.

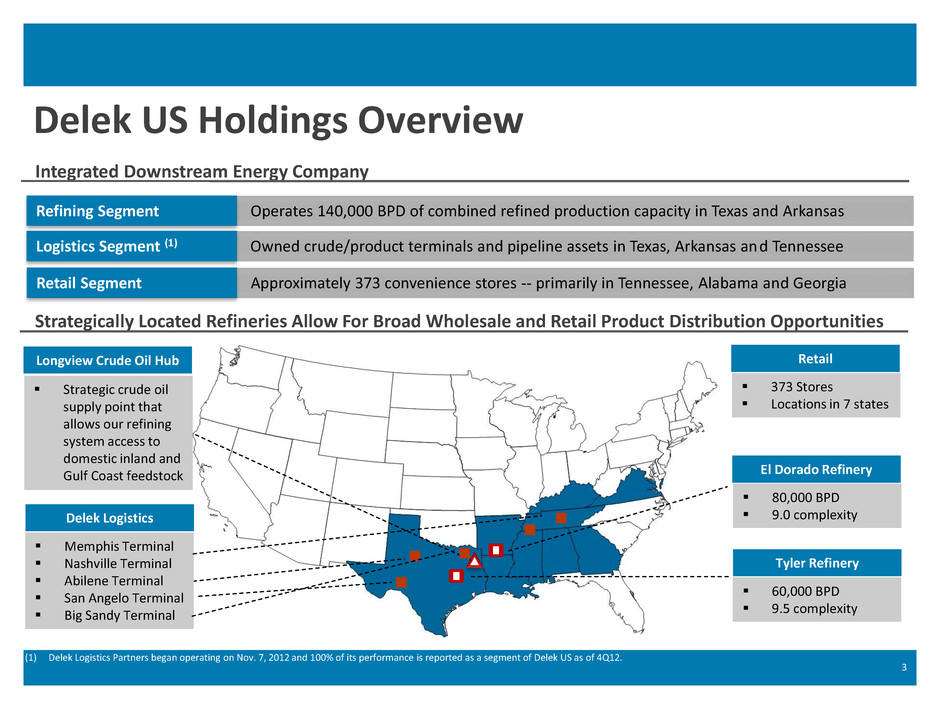

Delek US Holdings Overview Integrated Downstream Energy Company Operates 140,000 BPD of combined refined production capacity in Texas and Arkansas Refining Segment ) Owned crude/product terminals and pipeline assets in Texas, Arkansas and Tennessee Logistics Segment (1) Approximately 373 convenience stores -- primarily in Tennessee, Alabama and Georgia Retail Segment 3 60,000 BPD 9.5 complexity (1) Delek Logistics Partners began operating on Nov. 7, 2012 and 100% of its performance is reported as a segment of Delek US as of 4Q12. Tyler Refinery 80,000 BPD 9.0 complexity El Dorado Refinery Strategically Located Refineries Allow For Broad Wholesale and Retail Product Distribution Opportunities Longview Crude Oil Hub Strategic crude oil supply point that allows our refining system access to domestic inland and Gulf Coast feedstock 373 Stores Locations in 7 states Retail Delek Logistics Memphis Terminal Nashville Terminal Abilene Terminal San Angelo Terminal Big Sandy Terminal

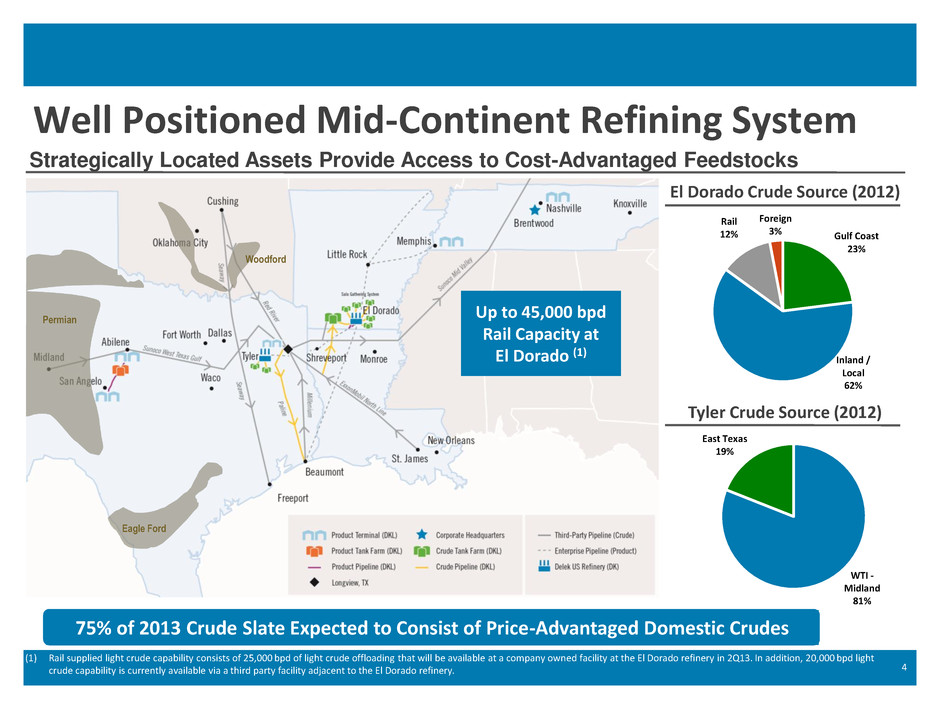

WTI - Midland 81% East Texas 19% Gulf Coast 23% Inland / Local 62% Rail 12% Foreign 3% Well Positioned Mid-Continent Refining System 4 Strategically Located Assets Provide Access to Cost-Advantaged Feedstocks Tyler Crude Source (2012) El Dorado Crude Source (2012) Permian Eagle Ford Woodford 75% of 2013 Crude Slate Expected to Consist of Price-Advantaged Domestic Crudes Up to 45,000 bpd Rail Capacity at El Dorado (1) (1) Rail supplied light crude capability consists of 25,000 bpd of light crude offloading that will be available at a company owned facility at the El Dorado refinery in 2Q13. In addition, 20,000 bpd light crude capability is currently available via a third party facility adjacent to the El Dorado refinery.

Refining Segment Operational Update

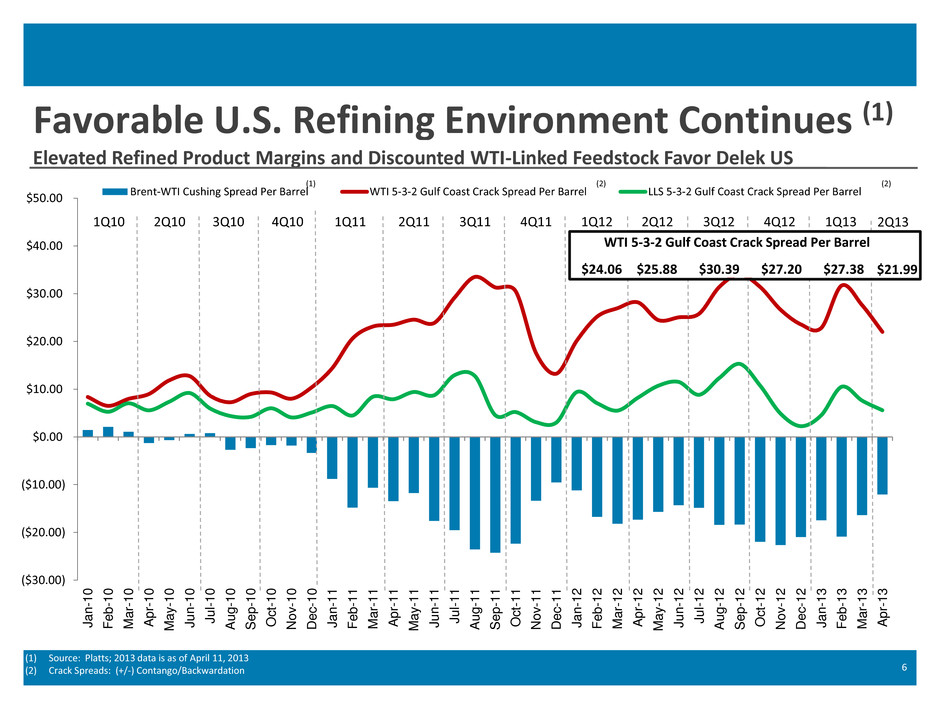

($30.00) ($20.00) ($10.00) $0.00 $10.00 $20.00 $30.00 $40.00 $50.00 J a n -1 0 F e b -1 0 M a r- 1 0 A pr -1 0 M a y -1 0 J u n -1 0 J u l- 1 0 A u g -1 0 S e p -1 0 O c t- 1 0 No v -1 0 De c -1 0 J a n -1 1 F e b -1 1 M a r- 1 1 A pr -1 1 M a y -1 1 J u n -1 1 J u l- 1 1 A u g -1 1 S e p -1 1 O c t- 1 1 No v -1 1 De c -1 1 J a n -1 2 F e b -1 2 M a r- 1 2 A pr -1 2 M a y -1 2 J u n -1 2 J u l- 1 2 A u g -1 2 S e p -1 2 O c t- 1 2 No v -1 2 De c -1 2 J a n -1 3 F e b -1 3 M a r- 1 3 A pr -1 3 Brent-WTI Cushing Spread Per Barrel WTI 5-3-2 Gulf Coast Crack Spread Per Barrel LLS 5-3-2 Gulf Coast Crack Spread Per Barrel Favorable U.S. Refining Environment Continues (1) 6 Elevated Refined Product Margins and Discounted WTI-Linked Feedstock Favor Delek US (1) Source: Platts; 2013 data is as of April 11, 2013 (2) Crack Spreads: (+/-) Contango/Backwardation 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 (1) (2) (2) WTI 5-3-2 Gulf Coast Crack Spread Per Barrel $24.06 $25.88 $30.39 $27.20 $27.38 $21.99 2Q13

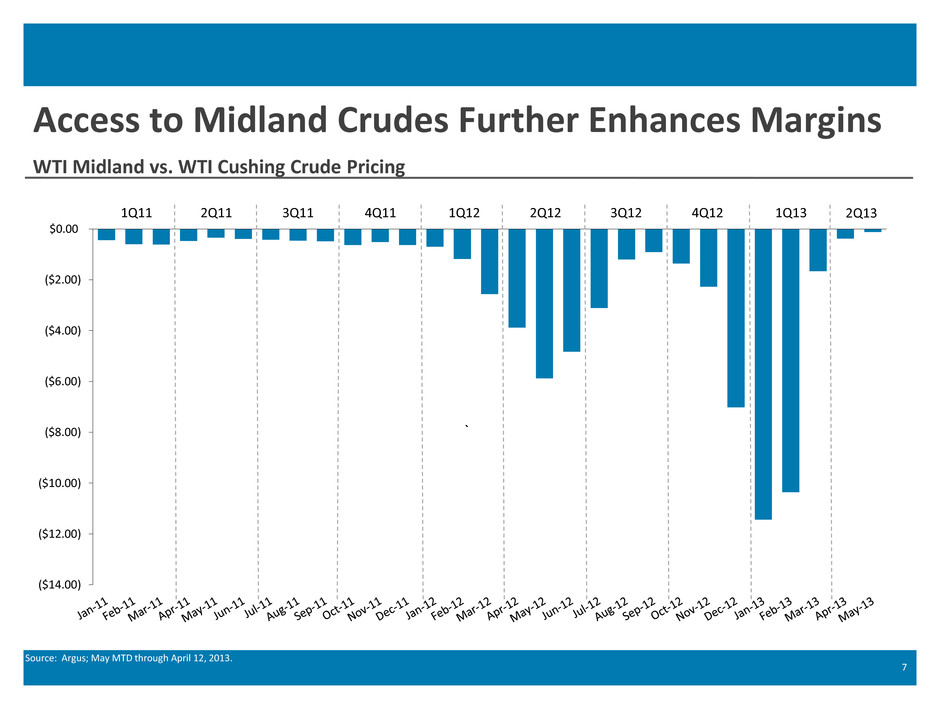

WTI Midland vs. WTI Cushing Crude Pricing ($14.00) ($12.00) ($10.00) ($8.00) ($6.00) ($4.00) ($2.00) $0.00 ` Access to Midland Crudes Further Enhances Margins 7 Source: Argus; May MTD through April 12, 2013. 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13

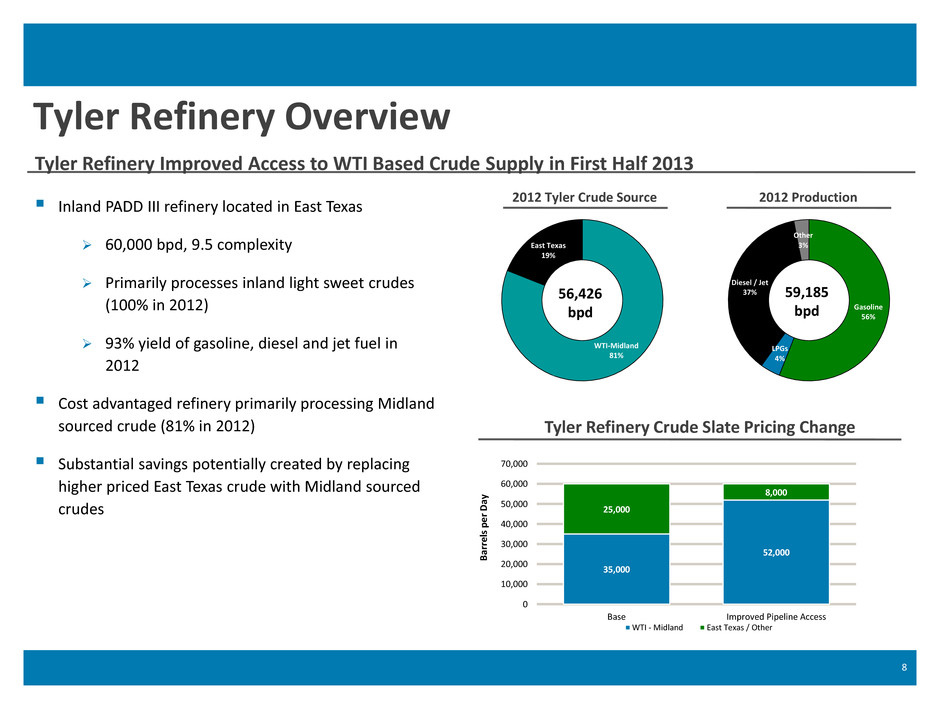

35,000 52,000 25,000 8,000 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 Base Improved Pipeline Access WTI - Midland East Texas / Other Gasoline 56% LPGs 4% Diesel / Jet 37% Other 3% WTI-Midland 81% East Texas 19% Tyler Refinery Overview 8 Inland PADD III refinery located in East Texas 60,000 bpd, 9.5 complexity Primarily processes inland light sweet crudes (100% in 2012) 93% yield of gasoline, diesel and jet fuel in 2012 Cost advantaged refinery primarily processing Midland sourced crude (81% in 2012) Substantial savings potentially created by replacing higher priced East Texas crude with Midland sourced crudes 2012 Tyler Crude Source 2012 Production 56,426 bpd 59,185 bpd Tyler Refinery Improved Access to WTI Based Crude Supply in First Half 2013 Tyler Refinery Crude Slate Pricing Change B ar re ls p e r D ay

$0 $100 $200 $300 $5 $10 $15 $20 $25 $30 $35 $40 Improved Pipeline Access at Tyler Potential Annual Savings from Improved Pipeline Access (1) 9 (1) 17,000 bpd equates to 6,205,000 barrels per year for annual savings. (2) Current crude differential is based on Argus data month to date as of April 12, 2013.; East TX = WTI Cushing + 60% of LLS WTI Cushing differential. Improved pipeline access in April will increase Midland sourced barrels by 17,000 at Tyler refinery Substantial Savings Created ) 87% of crude supplied from Midland; remaining expected to price near WTI Creates a Midland based Crude Slate A n n u al C o st R ed u ct io n ($mm) Current: ~$59mm East Texas vs. Midland Spread ($/bbl) $/bbl Annualized Savings Current $9.46 (2) $59mm 2012 $14.59 $91mm

We Anticipate El Dorado’s Crude Slate Will Be Weighted Toward WTI-Linked Crude in First Half 2013 Gasoline 47% Diesel 38% Asphalt 10% Other 5% Rail 12% Foreign 3% Gulf 23% Inland/Local 62% El Dorado Refinery Overview 10 Inland PADD III refinery located in Southern Arkansas 80,000 bpd, 9.0 complexity (configured to run medium sour crude) Supply flexibility that can source West Texas, locally produced, and/or Gulf Coast crude 85% yield of gasoline and diesel in 2012 Associated gathering system positioned for Brown Dense development in Northern Louisiana and Southern Arkansas Pipeline access will increase Midland crude throughput by 25,000 bpd at El Dorado Replaces more expensive crude supplies including Gulf Coast crude Rail capabilities improved access to advantaged crudes 2012 El Dorado Crude Source 2012 Production 65,375 bpd 71,372 bpd

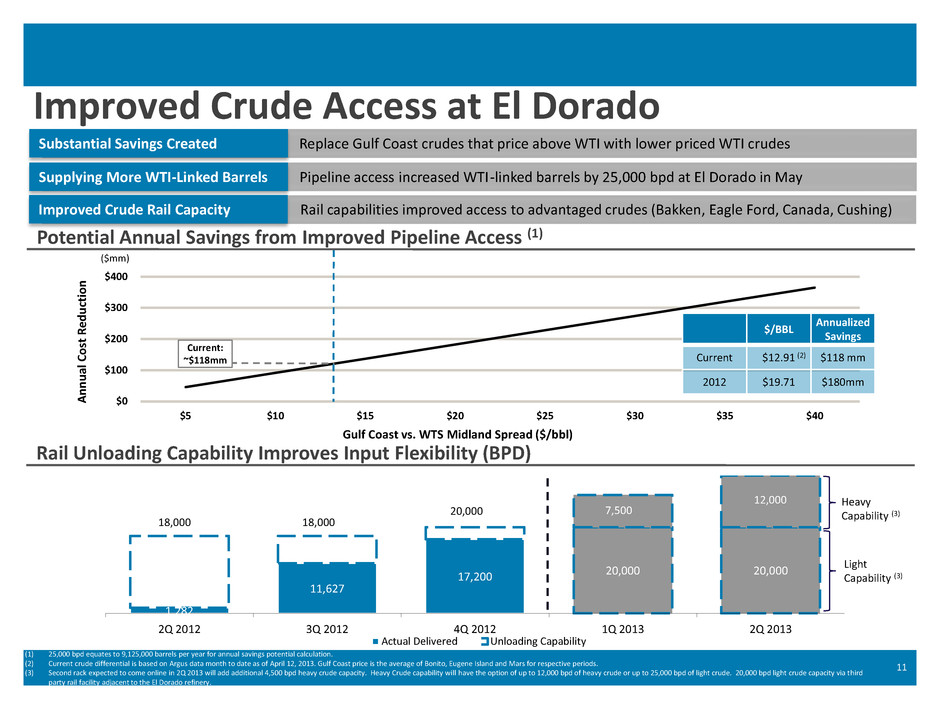

$0 $100 $200 $300 $400 $5 $10 $15 $20 $25 $30 $35 $40 Improved Crude Access at El Dorado Potential Annual Savings from Improved Pipeline Access (1) 11 (1) 25,000 bpd equates to 9,125,000 barrels per year for annual savings potential calculation. (2) Current crude differential is based on Argus data month to date as of April 12, 2013. Gulf Coast price is the average of Bonito, Eugene Island and Mars for respective periods. (3) Second rack expected to come online in 2Q 2013 will add additional 4,500 bpd heavy crude capacity. Heavy Crude capability will have the option of up to 12,000 bpd of heavy crude or up to 25,000 bpd of light crude. 20,000 bpd light crude capacity via third party rail facility adjacent to the El Dorado refinery. Replace Gulf Coast crudes that price above WTI with lower priced WTI crudes Substantial Savings Created ) Pipeline access increased WTI-linked barrels by 25,000 bpd at El Dorado in May Supplying More WTI-Linked Barrels Gulf Coast vs. WTS Midland Spread ($/bbl) A n n u al C o st R e d u ctio n ($mm) Current: ~$118mm $/BBL Annualized Savings Current $12.91 (2) $118 mm 2012 $19.71 $180mm ) Rail capabilities improved access to advantaged crudes (Bakken, Eagle Ford, Canada, Cushing) Improved Crude Rail Capacity 1,282 11,627 17,200 20,000 20,000 2Q 2012 3Q 2012 4Q 2012 1Q 2013 2Q 2013 Actual Delivered Unloading Capability Light Capability (3) Heavy Capability (3) 18,000 18,000 20,000 7,500 Rail Unloading Capability Improves Input Flexibility (BPD) 12,000

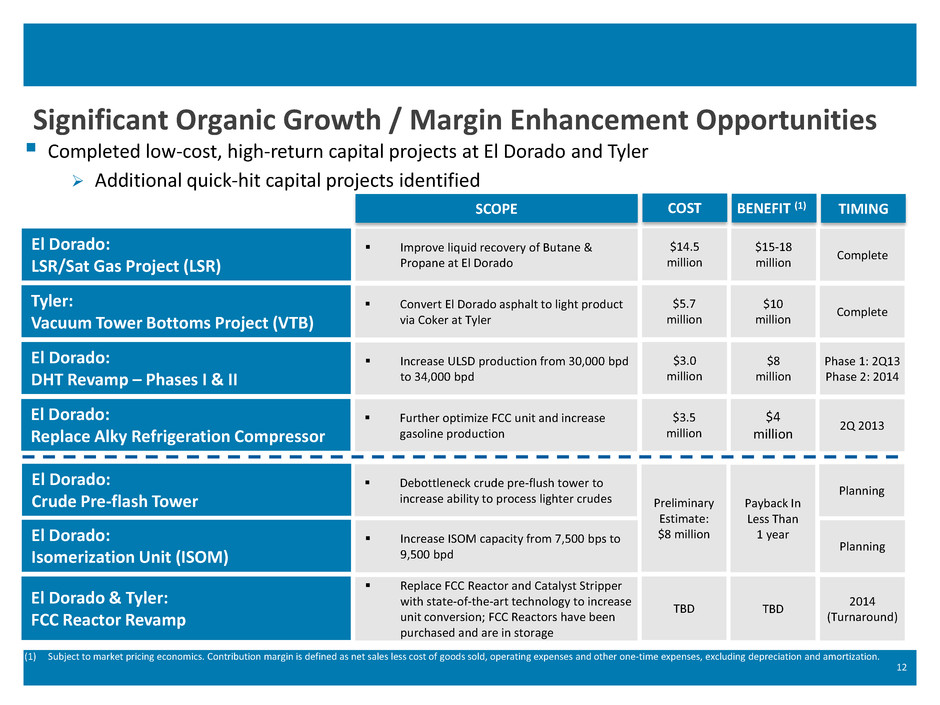

Significant Organic Growth / Margin Enhancement Opportunities 12 El Dorado: LSR/Sat Gas Project (LSR) Improve liquid recovery of Butane & Propane at El Dorado Tyler: Vacuum Tower Bottoms Project (VTB) Convert El Dorado asphalt to light product via Coker at Tyler (1) Subject to market pricing economics. Contribution margin is defined as net sales less cost of goods sold, operating expenses and other one-time expenses, excluding depreciation and amortization. El Dorado: DHT Revamp – Phases I & II Increase ULSD production from 30,000 bpd to 34,000 bpd El Dorado: Replace Alky Refrigeration Compressor Further optimize FCC unit and increase gasoline production Completed low-cost, high-return capital projects at El Dorado and Tyler Additional quick-hit capital projects identified SCOPE COST BENEFIT (1) TIMING $14.5 million $5.7 million $3.0 million $3.5 million $15-18 million $10 million $8 million $4 million Complete Complete Phase 1: 2Q13 Phase 2: 2014 2Q 2013 El Dorado: Crude Pre-flash Tower Debottleneck crude pre-flush tower to increase ability to process lighter crudes El Dorado: Isomerization Unit (ISOM) Increase ISOM capacity from 7,500 bps to 9,500 bpd Preliminary Estimate: $8 million Payback In Less Than 1 year Planning Planning El Dorado & Tyler: FCC Reactor Revamp Replace FCC Reactor and Catalyst Stripper with state-of-the-art technology to increase unit conversion; FCC Reactors have been purchased and are in storage TBD TBD 2014 (Turnaround)

Logistics and Retail Operational Update

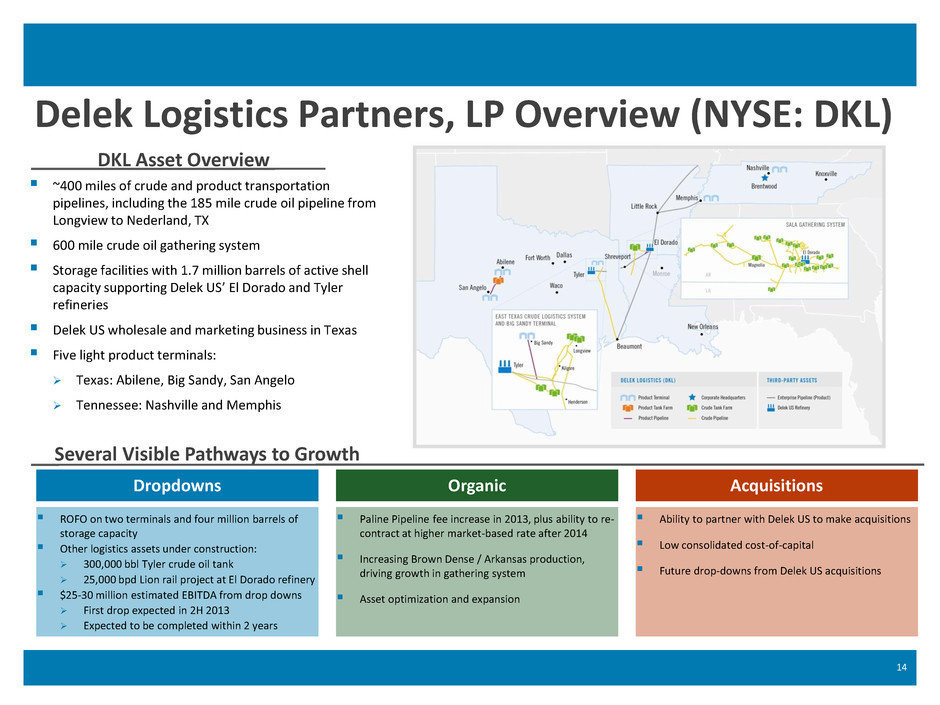

Delek Logistics Partners, LP Overview (NYSE: DKL) 14 DKL Asset Overview ~400 miles of crude and product transportation pipelines, including the 185 mile crude oil pipeline from Longview to Nederland, TX 600 mile crude oil gathering system Storage facilities with 1.7 million barrels of active shell capacity supporting Delek US’ El Dorado and Tyler refineries Delek US wholesale and marketing business in Texas Five light product terminals: Texas: Abilene, Big Sandy, San Angelo Tennessee: Nashville and Memphis Several Visible Pathways to Growth Dropdowns Organic Acquisitions ROFO on two terminals and four million barrels of storage capacity Other logistics assets under construction: 300,000 bbl Tyler crude oil tank 25,000 bpd Lion rail project at El Dorado refinery $25-30 million estimated EBITDA from drop downs First drop expected in 2H 2013 Expected to be completed within 2 years Paline Pipeline fee increase in 2013, plus ability to re- contract at higher market-based rate after 2014 Increasing Brown Dense / Arkansas production, driving growth in gathering system Asset optimization and expansion Ability to partner with Delek US to make acquisitions Low consolidated cost-of-capital Future drop-downs from Delek US acquisitions

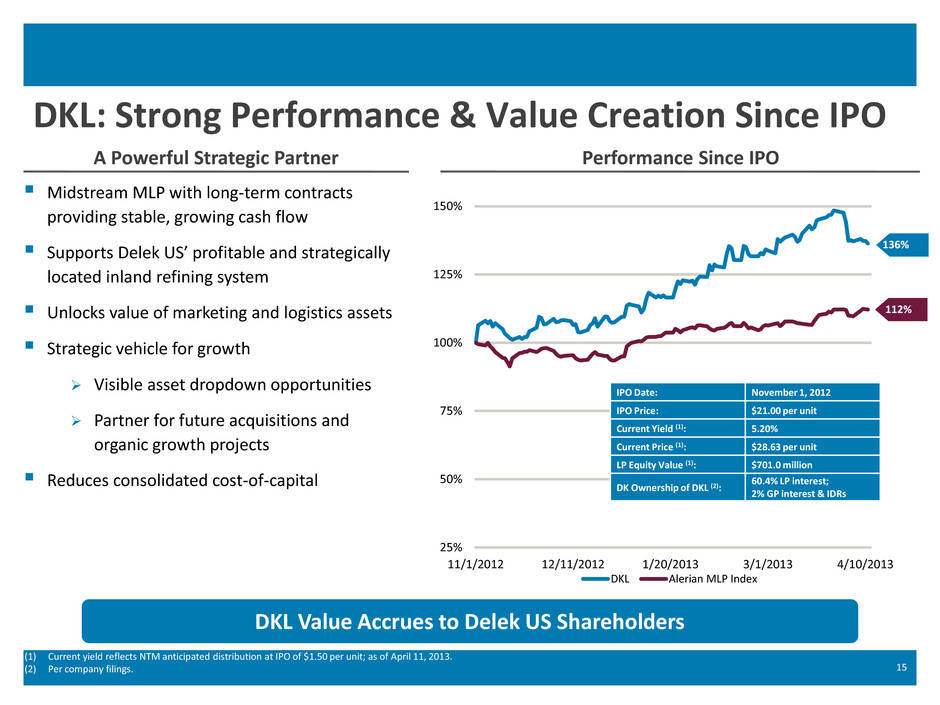

Midstream MLP with long-term contracts providing stable, growing cash flow Supports Delek US’ profitable and strategically located inland refining system Unlocks value of marketing and logistics assets Strategic vehicle for growth Visible asset dropdown opportunities Partner for future acquisitions and organic growth projects Reduces consolidated cost-of-capital 25% 50% 75% 100% 125% 150% 11/1/2012 12/11/2012 1/20/2013 3/1/2013 4/10/2013 DKL Alerian MLP Index DKL: Strong Performance & Value Creation Since IPO Performance Since IPO 15 (1) Current yield reflects NTM anticipated distribution at IPO of $1.50 per unit; as of April 11, 2013. (2) Per company filings. 136% 112% A Powerful Strategic Partner DKL Value Accrues to Delek US Shareholders IPO Date: November 1, 2012 IPO Price: $21.00 per unit Current Yield (1): 5.20% Current Price (1): $28.63 per unit LP Equity Value (1): $701.0 million DK Ownership of DKL (2): 60.4% LP interest; 2% GP interest & IDRs

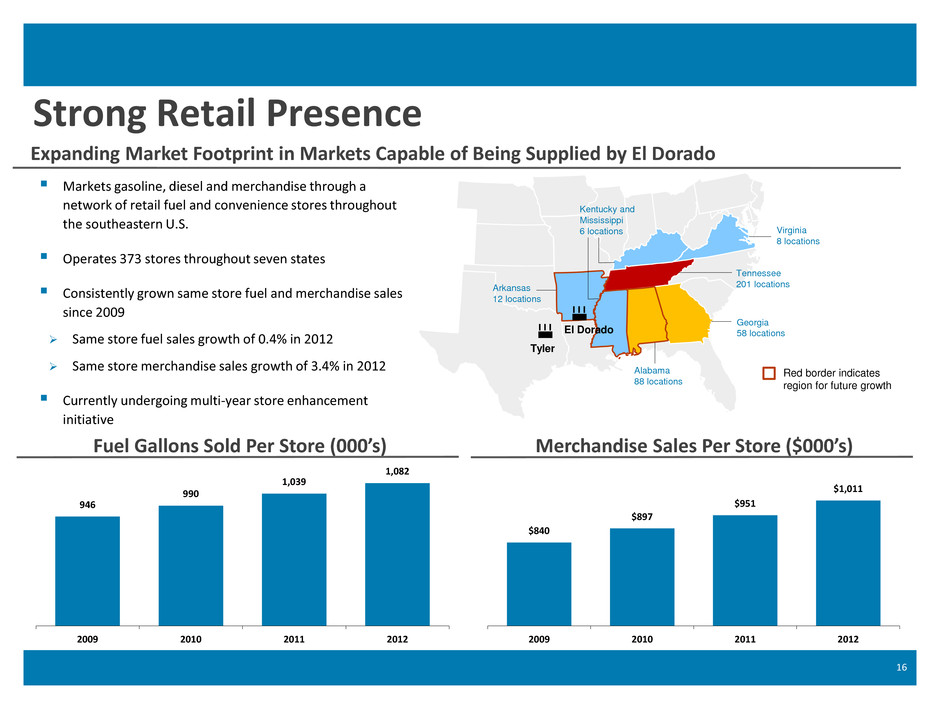

946 990 1,039 1,082 2009 2010 2011 2012 $840 $897 $951 $1,011 2009 2010 2011 2012 Strong Retail Presence 16 Expanding Market Footprint in Markets Capable of Being Supplied by El Dorado Fuel Gallons Sold Per Store (000’s) Merchandise Sales Per Store ($000’s) Tennessee 201 locations Virginia 8 locations Kentucky and Mississippi 6 locations Arkansas 12 locations Tyler Georgia 58 locations El Dorado Red border indicates region for future growth Alabama 88 locations Markets gasoline, diesel and merchandise through a network of retail fuel and convenience stores throughout the southeastern U.S. Operates 373 stores throughout seven states Consistently grown same store fuel and merchandise sales since 2009 Same store fuel sales growth of 0.4% in 2012 Same store merchandise sales growth of 3.4% in 2012 Currently undergoing multi-year store enhancement initiative

Financial Update

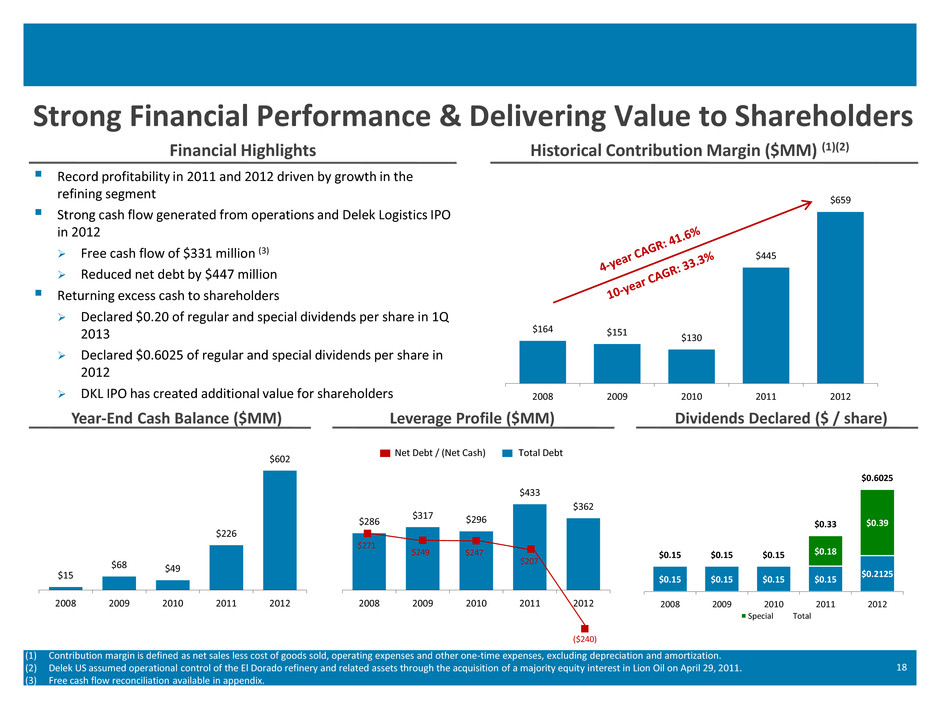

Financial Highlights $164 $151 $130 $445 $659 2008 2009 2010 2011 2012 Record profitability in 2011 and 2012 driven by growth in the refining segment Strong cash flow generated from operations and Delek Logistics IPO in 2012 Free cash flow of $331 million (3) Reduced net debt by $447 million Returning excess cash to shareholders Declared $0.20 of regular and special dividends per share in 1Q 2013 Declared $0.6025 of regular and special dividends per share in 2012 DKL IPO has created additional value for shareholders $286 $317 $296 $433 $362 2008 2009 2010 2011 2012 Year-End Cash Balance ($MM) Strong Financial Performance & Delivering Value to Shareholders 18 (1) Contribution margin is defined as net sales less cost of goods sold, operating expenses and other one-time expenses, excluding depreciation and amortization. (2) Delek US assumed operational control of the El Dorado refinery and related assets through the acquisition of a majority equity interest in Lion Oil on April 29, 2011. (3) Free cash flow reconciliation available in appendix. $15 $68 $49 $226 $602 2008 2009 2010 2011 2012 Leverage Profile ($MM) $271 $249 $247 $207 ($240) Net Debt / (Net Cash) Total Debt Dividends Declared ($ / share) Historical Contribution Margin ($MM) (1)(2) $0.15 $0.15 $0.15 $0.15 $0.2125 $0.18 $0.39 $0.15 $0.15 $0.15 $0.33 $0.6025 2008 2009 2010 2011 2012 Special Total

Going Forward

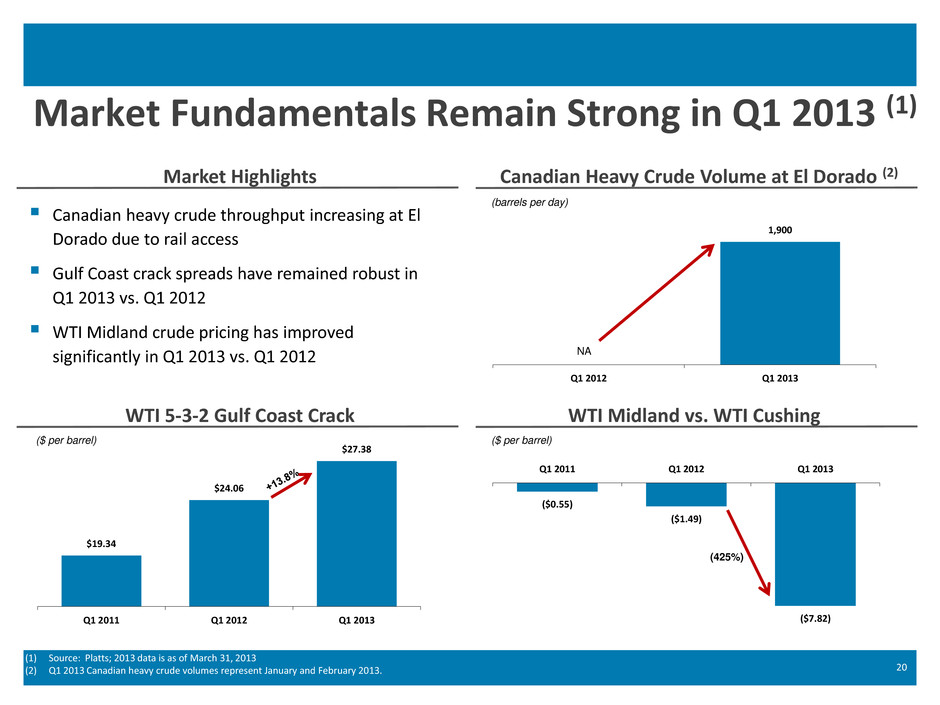

$19.34 $24.06 $27.38 Q1 2011 Q1 2012 Q1 2013 Market Fundamentals Remain Strong in Q1 2013 (1) 20 Canadian heavy crude throughput increasing at El Dorado due to rail access Gulf Coast crack spreads have remained robust in Q1 2013 vs. Q1 2012 WTI Midland crude pricing has improved significantly in Q1 2013 vs. Q1 2012 (1) Source: Platts; 2013 data is as of March 31, 2013 (2) Q1 2013 Canadian heavy crude volumes represent January and February 2013. 0 1,900 Q1 2012 Q1 2013 NA (barrels per day) ($ per barrel) ($0.55) ($1.49) ($7.82) Q1 2011 Q1 2012 Q1 2013 (425%) ($ per barrel) WTI 5-3-2 Gulf Coast Crack WTI Midland vs. WTI Cushing Canadian Heavy Crude Volume at El Dorado (2) Market Highlights

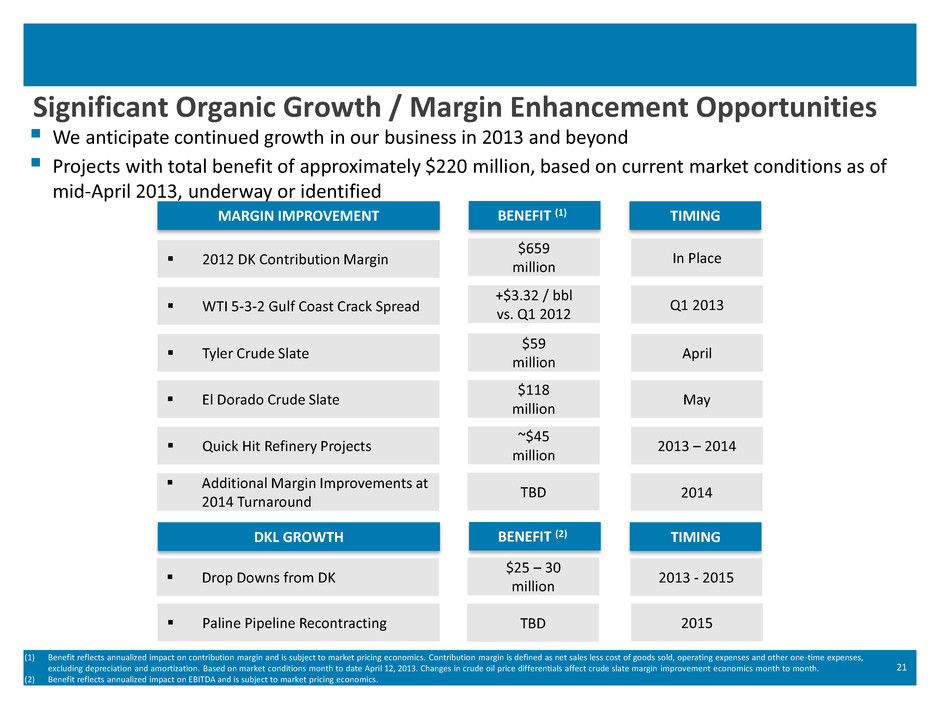

Significant Organic Growth / Margin Enhancement Opportunities 21 Tyler Crude Slate El Dorado Crude Slate (1) Benefit reflects annualized impact on contribution margin and is subject to market pricing economics. Contribution margin is defined as net sales less cost of goods sold, operating expenses and other one-time expenses, excluding depreciation and amortization. Based on market conditions month to date April 12, 2013. Changes in crude oil price differentials affect crude slate margin improvement economics month to month. (2) Benefit reflects annualized impact on EBITDA and is subject to market pricing economics. Quick Hit Refinery Projects Additional Margin Improvements at 2014 Turnaround We anticipate continued growth in our business in 2013 and beyond Projects with total benefit of approximately $220 million, based on current market conditions as of mid-April 2013, underway or identified MARGIN IMPROVEMENT BENEFIT (1) TIMING $59 million $118 million ~$45 million TBD April May 2013 – 2014 2014 Drop Downs from DK Paline Pipeline Recontracting 2013 - 2015 2015 $25 – 30 million TBD DKL GROWTH BENEFIT (2) TIMING $659 million In Place 2012 DK Contribution Margin +$3.32 / bbl vs. Q1 2012 Q1 2013 WTI 5-3-2 Gulf Coast Crack Spread

22 Large, Complementary Logistics, Marketing and Retail Systems Significant Organic Growth / Margin Improvement Opportunities Focus on Shareholder Returns Strong Balance Sheet Strategically Positioned Refining Platform Questions and Answers

Appendix Additional Data

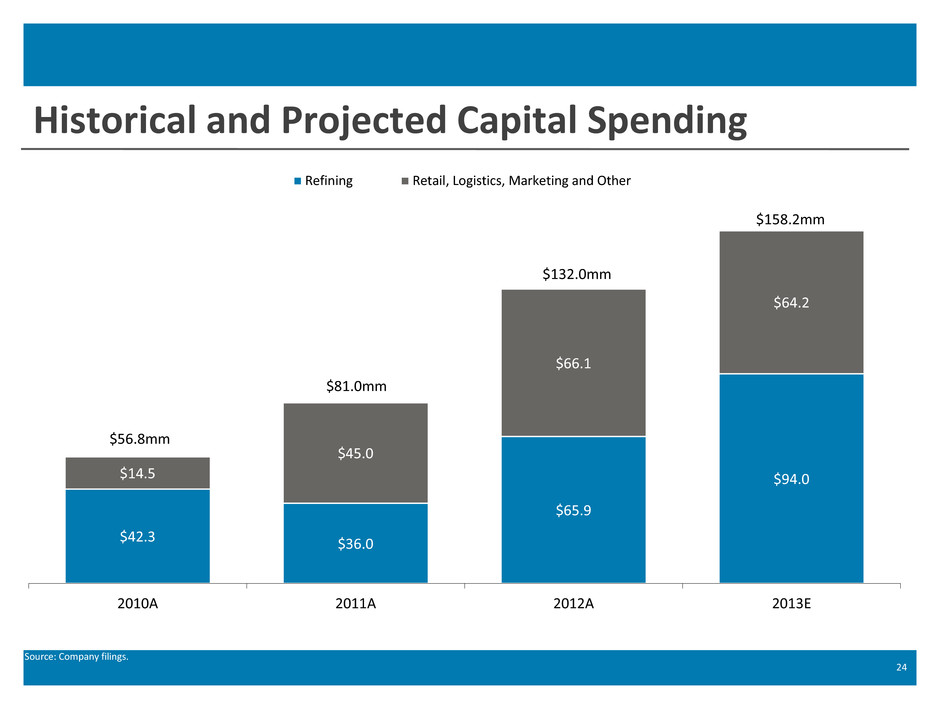

$42.3 $36.0 $65.9 $94.0 $14.5 $45.0 $66.1 $64.2 2010A 2011A 2012A 2013E Refining Retail, Logistics, Marketing and Other Historical and Projected Capital Spending 24 $56.8mm $81.0mm $132.0mm $158.2mm Source: Company filings.

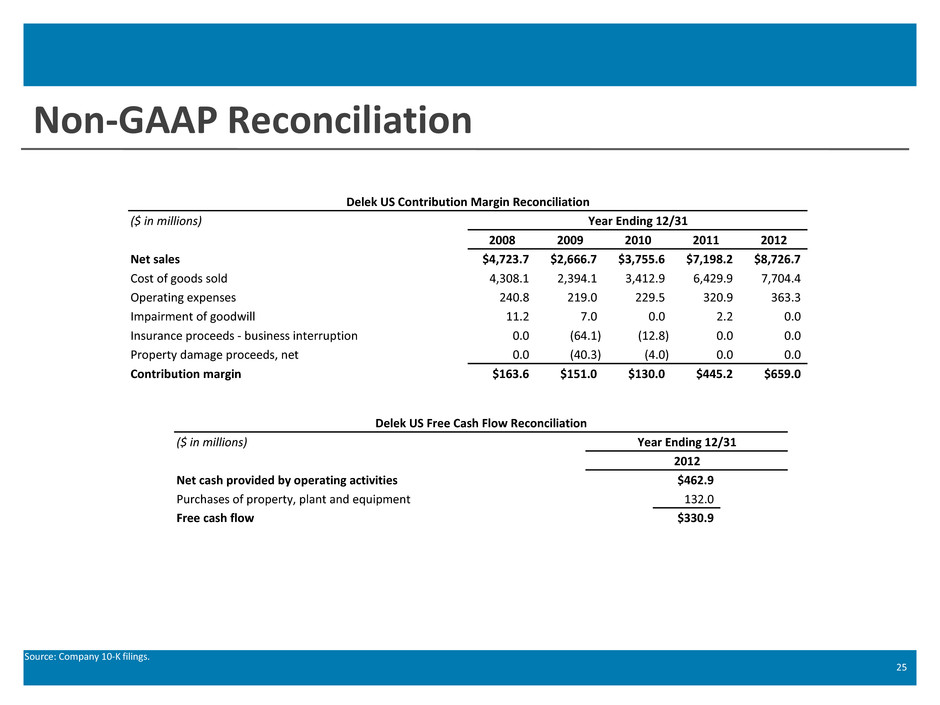

Non-GAAP Reconciliation 25 Source: Company 10-K filings. Delek US Free Cash Flow Reconciliation ($ in millions) Year Ending 12/31 2012 Net cash provided by operating activities $462.9 Purchases of property, plant and equipment 132.0 Free cash flow $330.9 Delek US Contribution Margin Reconciliation ($ in millions) Year Ending 12/31 2008 2009 2010 2011 2012 Net sales $4,723.7 $2,666.7 $3,755.6 $7,198.2 $8,726.7 Cost of goods sold 4,308.1 2,394.1 3,412.9 6,429.9 7,704.4 Operating expenses 240.8 219.0 229.5 320.9 363.3 Impairment of goodwill 11.2 7.0 0.0 2.2 0.0 Insurance proceeds - business interruption 0.0 (64.1) (12.8) 0.0 0.0 Property damage proceeds, net 0.0 (40.3) (4.0) 0.0 0.0 Contribution margin $163.6 $151.0 $130.0 $445.2 $659.0