Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - CALPINE CORP | d517809dex992.htm |

| 8-K - FORM 8-K - CALPINE CORP | d517809d8k.htm |

2013

Investor Day April 10, 2013

Exhibit 99.1 |

2

2

Forward-Looking Statements

The information contained in this presentation includes certain estimates, projections

and other forward-looking information that reflect Calpine’s current

views with respect to future events and financial performance. These estimates,

projections and other forward-looking information are based on assumptions that Calpine believes, as of

the date hereof, are reasonable. Inevitably, there will be differences between such

estimates and actual results, and those differences may be material.

There can be no assurance that any estimates, projections or forward-looking

information will be realized. All such estimates, projections and

forward-looking information speak only as of the date hereof. Calpine undertakes

no duty to update or revise the information contained herein other than as required by

law. You are cautioned not to place undue reliance on the estimates, projections

and other forward-looking information in this presentation as they are based

on current expectations and general assumptions and are subject to various risks,

uncertainties and other factors, including those set forth in Calpine’s Annual

Report on Form 10-K for the year ended December 31, 2012, and in other

documents that Calpine files with the SEC. Many of these risks, uncertainties and

other factors are beyond Calpine’s control and may cause actual results to differ

materially from the views, beliefs

and estimates expressed herein. Calpine’s reports and other information filed with

the SEC, including the risk factors identified in its Annual Report on Form

10-K for the year ended December 31, 2012, can be found on the SEC’s website

at www.sec.gov and on Calpine’s website at www.calpine.com.

Reconciliation to U.S. GAAP Financial Information

The following presentation includes certain “non-GAAP financial

measures” as defined in Regulation G under the

Securities Exchange Act of 1934, as amended. Schedules are included herein that

reconcile the non-GAAP financial measures included in the following

presentation to the most directly comparable financial measures calculated and

presented in accordance with U.S. GAAP.

Safe Harbor Statement |

3

Agenda

3

•

Welcome and Safe Harbor

Bryan Kimzey

VP, Investor Relations

•

Value Proposition

Jack Fusco

Chief Executive Officer

•

Operations & Development Overview

Thad Hill

President, Chief Operating Officer

•

Introductory Q&A

Jack Fusco

Thad Hill

Chief Executive Officer

President, Chief Operating Officer

•

Commercial Operations: National Trends

Caleb Stephenson

VP, Commercial Analytics

•

Commercial Operations: Regional Trends

Steve Pruett

SVP, Commercial Operations

•

Commercial Operations Q&A

Steve Pruett

Caleb Stephenson

Todd Thornton

SVP, Commercial Operations

VP, Commercial Analytics

VP, Commercial Development

Break

•

Power Operations Panel

John Adams

Ron Macklin

Tom Long

Ron Hall

SVP, Power Operations

VP, Outage Services

VP, Development & Optimization Engineering

VP, Engineering & Construction

•

Regulatory Panel

Thad Miller

Yvonne McIntyre

Steve Schleimer

Mark Smith

William Taylor

EVP, Chief Legal Officer

VP, Governmental & Regulatory Affairs (Federal)

VP, Governmental & Regulatory Affairs (North)

VP, Governmental & Regulatory Affairs, Legal (West)

VP, Governmental & Regulatory Affairs (Texas)

•

Financial Overview

Zamir Rauf

EVP, Chief Financial Officer

•

Executive Q&A |

2013

Investor Day: Value Proposition

Jack Fusco

Chief Executive Officer

April 10, 2013 |

5

Thank You:

A Milestone Achievement

5

Jack Fusco

Voted Best IR by a CEO

or Chairman (Mid-Cap)

Calpine IR

Nominee for Best IR –

Utilities Sector

Jack Fusco

Voted Best CEO –

Elec. Utilities

Buy-

and Sell-Side

Calpine IR

Top 3 for Best IR –

Elec. Utilities

Buy-

and Sell-Side

2013

All-America

Executive

Team

Thank you

for recognizing

our commitment to

our shareholders

and to

providing the investing

community with

disclosures and access |

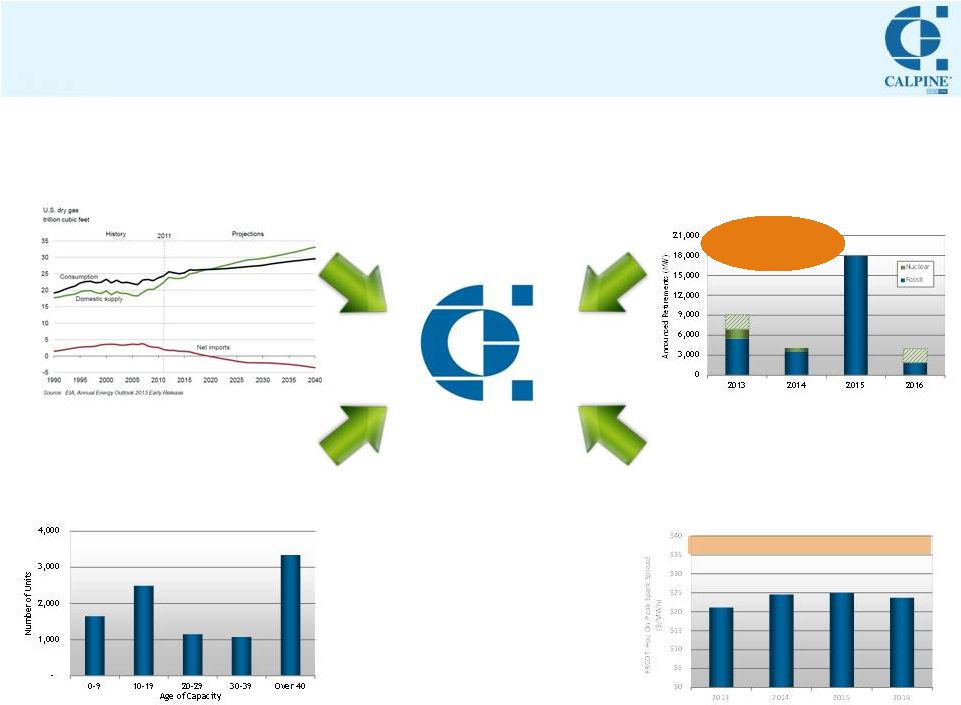

Calpine: Positioned to Benefit from Secular Trends

6

Stricter Environmental

Regulation

•

State and federal pressures: Primarily

focused on health concerns; resurgent

climate change debate

Insufficient New Capacity

in Key Markets

Sustained Low

Natural Gas Prices

Aging Power Generation

Infrastructure

•

Prices must rise to incent economic new

investment where needed

•

“New norm”: 100+ years supply of affordable,

domestic natural gas

•

America’s fleet continues to age; investments in

improvements / maintenance less economic

~240,000 MW

Source: Energy Velocity. Excludes renewable and hydro units.

Source: SNL. Shaded nuclear represent potential

retirements, including plants currently not in operation.

Est. CCGT new build requirement

Source: Calpine, Broker quotes. As of 3/26/13.

32 GW of

retirements

announced

through 2016 |

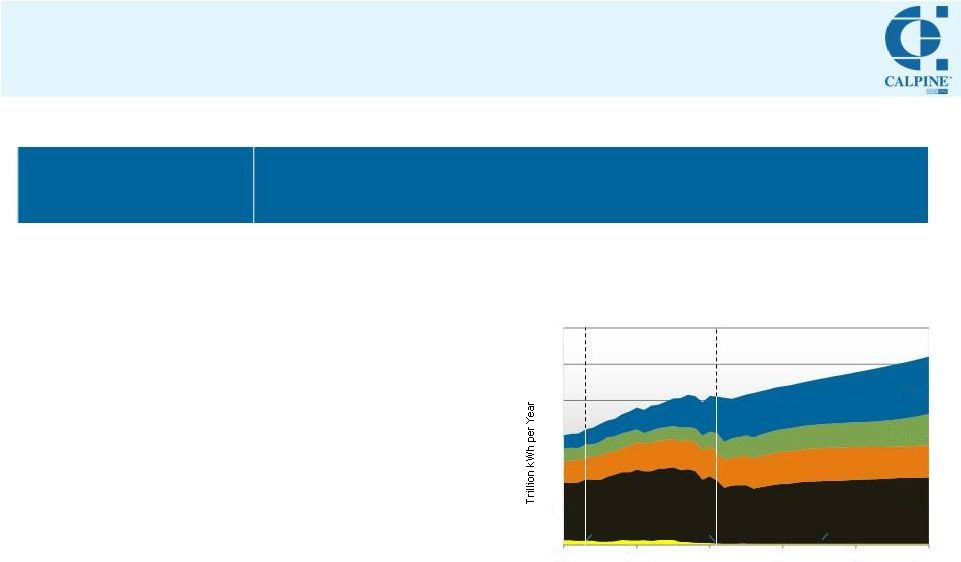

7

Myths Around Over-Reliance on Natural Gas

in the Power Sector

7

•

There is abundant excess

capacity in the current fleet,

and sufficient time exists to

develop new resources.

•

The level of mid-stream

investment is dramatic

and growing.

•

Even with natural

gas gaining share,

the US will be

multi-fuel for a

long, long time.

Source: U.S. Energy Information Association, December 2012.

Coal

Nuclear

Renewables

Natural gas

2

3

4

5

6

1990

2000

2010

2020

2030

2040

0

1

1993

2011

History

Projections

30%

16%

17%

35%

1%

13%

11%

19%

53%

4%

25%

13%

19%

42%

1%

Oil and other liquids

US Electricity Generation: Multi-Fuel

•

America’s natural gas

fleet cannot meet

reliability needs.

•

Pipeline infrastructure

cannot support new

natural gas demand.

•

The US will become

over-dependent on

natural gas.

Myth

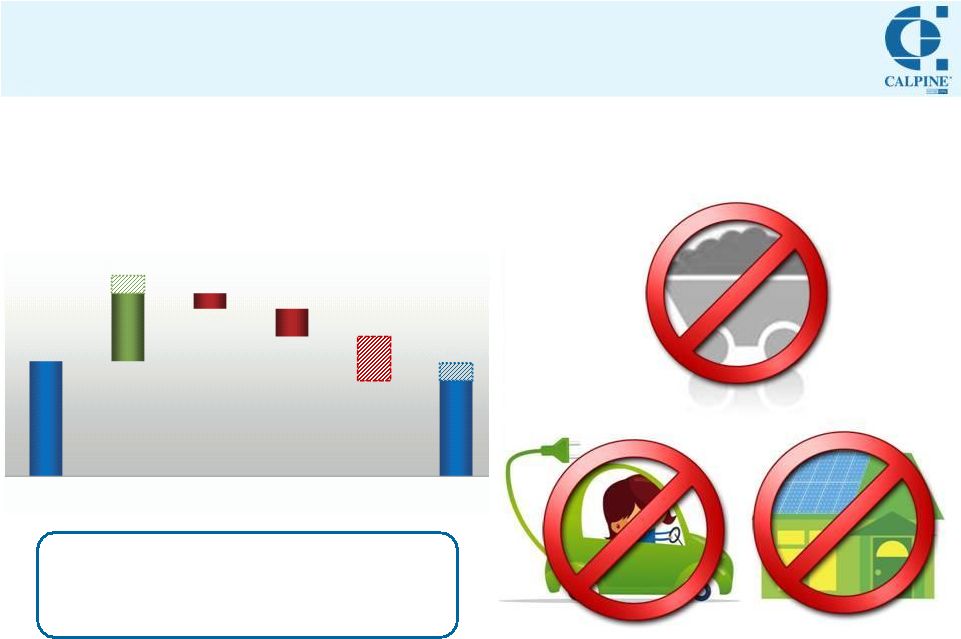

Truth |

8

Coal

Electric

Vehicles

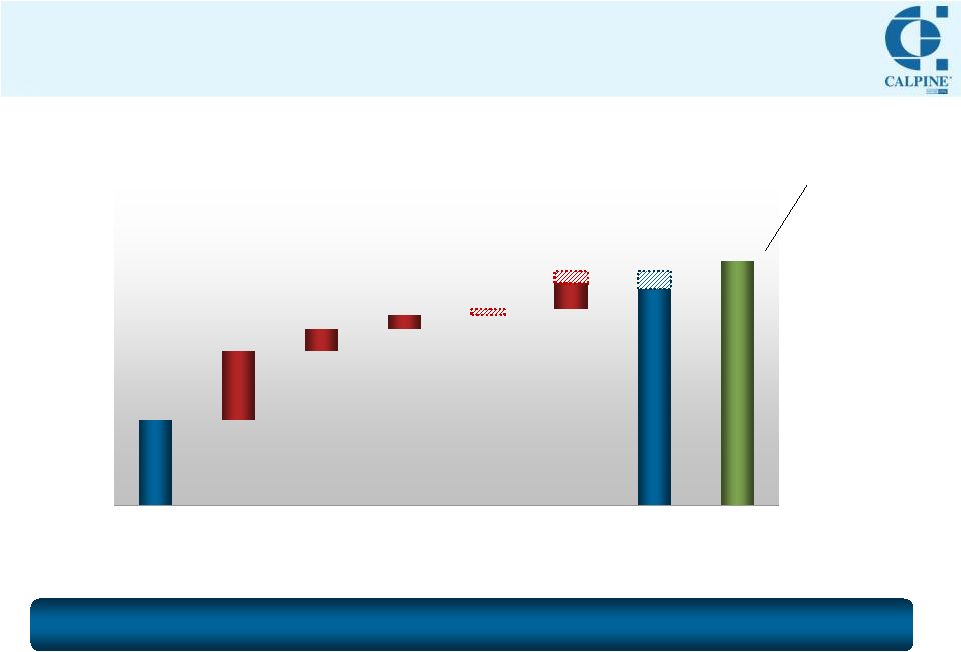

Calpine: Strong Generator of Cash, Disciplined in Deployment

8

($ millions)

We will be discerning and disciplined in

our capital allocation decisions.

Rooftop

Solar

1

Represents Cash and Cash Equivalents as of 12/31/12, less estimated cash needed to

maintain minimum liquidity of $1 billion. 2

A non-GAAP financial measure. Reconciliations of Adjusted EBITDA and Adjusted

Free Cash Flow to Net Income (Loss), the most comparable U.S. GAAP measure, are included herein.

Announced Capital Management

Further Capital Management:

•

Organic growth

•

Acquisition and divestiture opportunities

•

Additional share repurchases

$1,040

$865 -

$1,025

$615 -

$775

$(140)

$(250)

$(400)

Excess Cash:

Dec 2012

1

Adj. FCF

2

Scheduled Debt

Amortizations

Growth

CapEx

(Net)

Share

Repurchases

Excess Cash:

Dec 2013E |

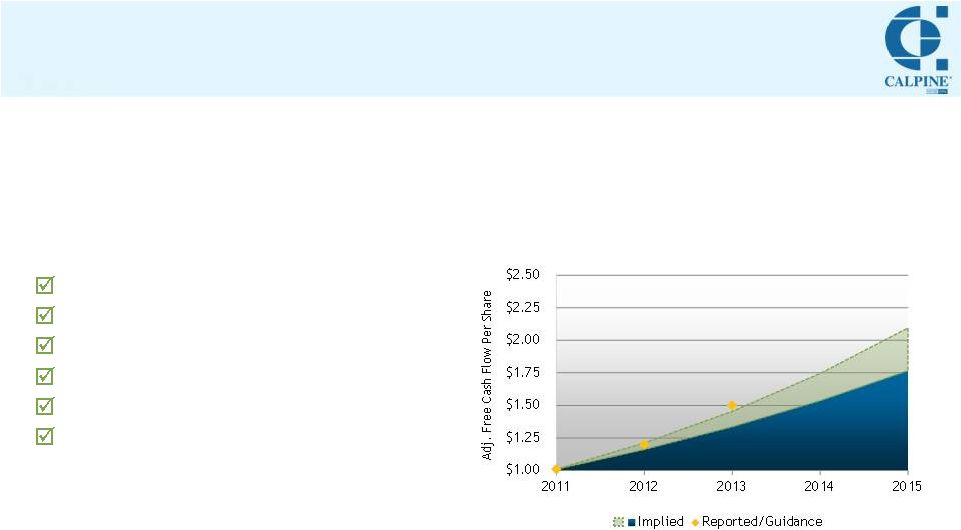

9

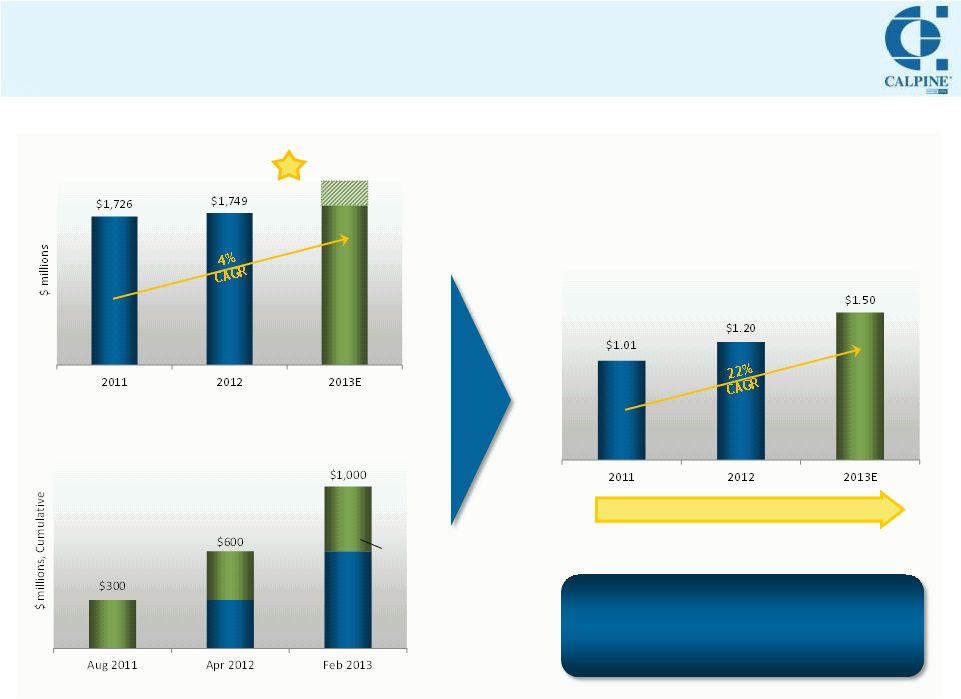

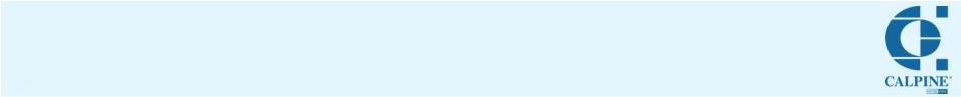

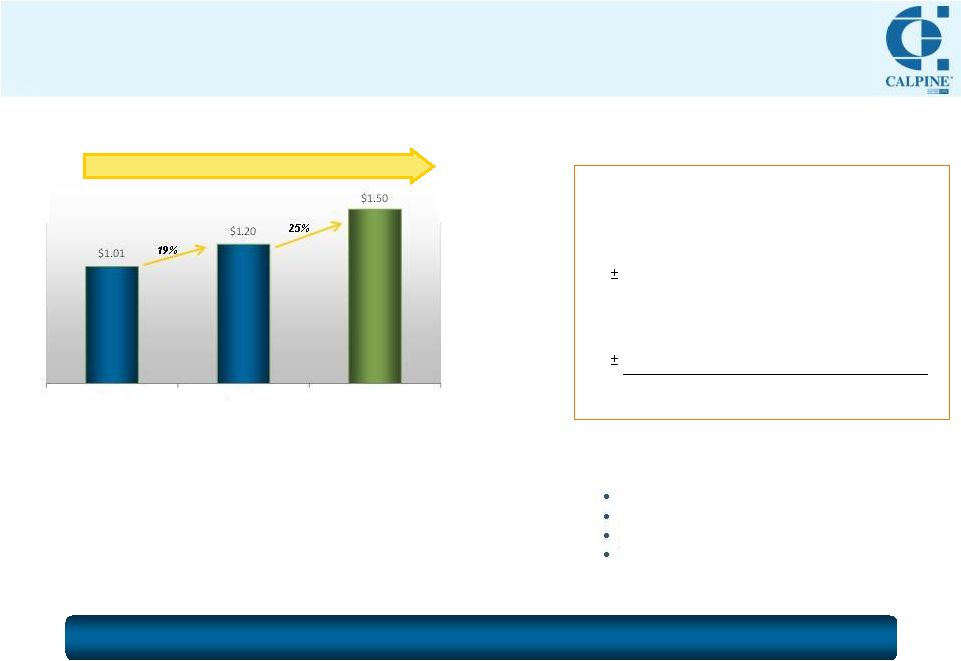

Delivering Shareholder Value

9

Demonstrating Strong Financial Performance

Adjusted EBITDA

¹

Returning Capital to Shareholders

Announced Share Repurchase Authorizations

Raising Guidance:

$1,800 -

$1,960

Enhancing Value Per Share

Adjusted Free Cash Flow Per Share

¹

Modest

gains

in

Adj.

EBITDA

¹

translate into

meaningful

gains

in

Adj.

FCF

1

/Share

+$300

+$400

1

A non-GAAP financial measure. Reconciliations of Adjusted EBITDA and Adjusted

Free Cash Flow to Net Income (Loss), the most comparable U.S. GAAP measure, are included herein.

2

As of 04/05/13.

Update: Invested

$58MM year-to-date

²

Targeting 15 –

20% CAGR |

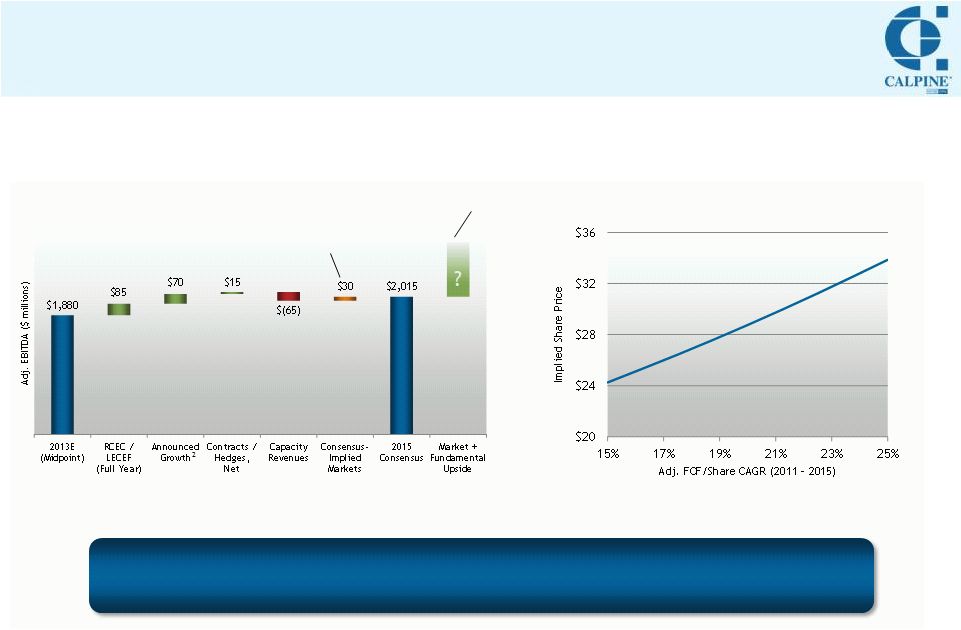

10

Significant Valuation Upside Remains

10

2015 Consensus Adj. EBITDA¹: Conservative

Adj. FCF / Share¹

Growth Represents

Total Shareholder Return

1

A non-GAAP financial measure. Reconciliations of Adjusted EBITDA and Adjusted

Free Cash Flow to Net Income (Loss), the most comparable U.S. GAAP measure, are included herein.

2

Represents estimated 2015 Adj. EBITDA from Deer Park and Channel expansions (scheduled

to come online in 2014) and Garrison (scheduled to come online mid-2015).

Below current

forwards

Not in consensus

Note: Chart holds Price to Adj. FCF/Share Multiple constant at 13.7,

consistent with current trading levels based upon 2013E Adj. FCF/Share.

Adj. EBITDA¹

outlook and opportunistic capital allocation

drive meaningful valuation upside potential |

2013

Investor Day: Operations and Development

Overview

Thad Hill

President, Chief Operating Officer

April 10, 2013 |

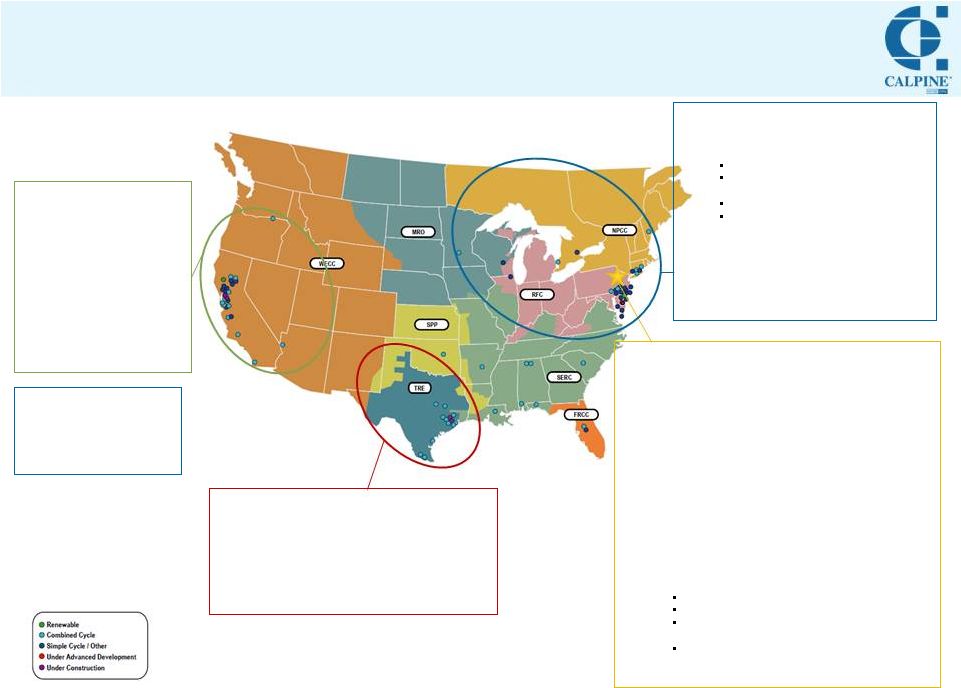

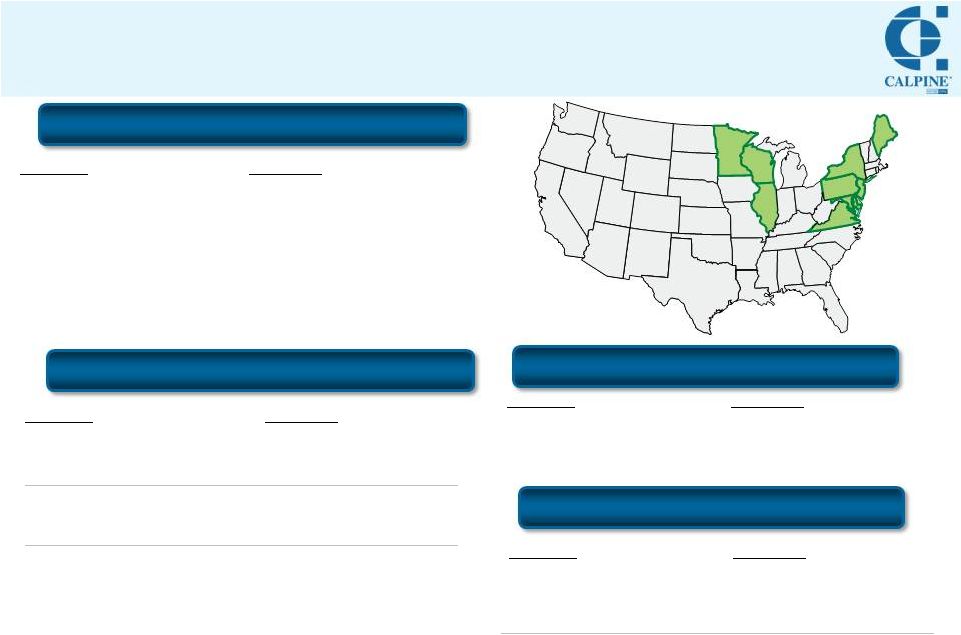

12

Shaping Our Footprint to Match our Regional Strategy

Note: Capacity shown here represents Calpine’s net interest.

12

West

Asset management and

regulatory engagement

Texas

Capitalize on demand-

driven market recovery

North

Capitalize on

supply-driven

market recovery

and organic growth

opportunities

Southeast

Monetize value

through long-term

contracts or asset

divestitures

Calpine: 27,321 MW + 1,472 MW Under Construction

April 2013 |

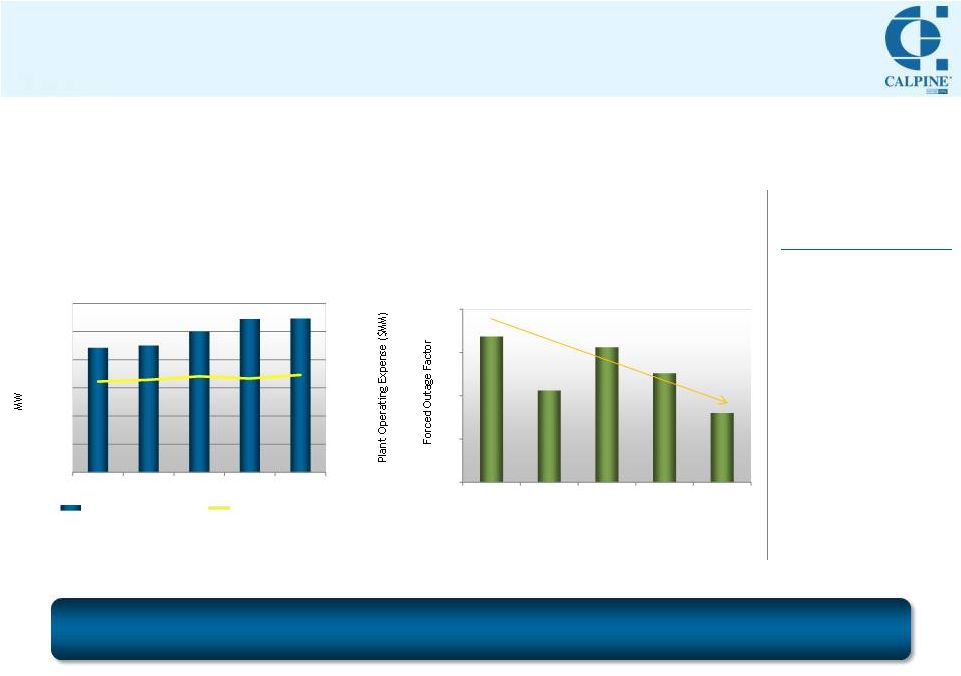

13

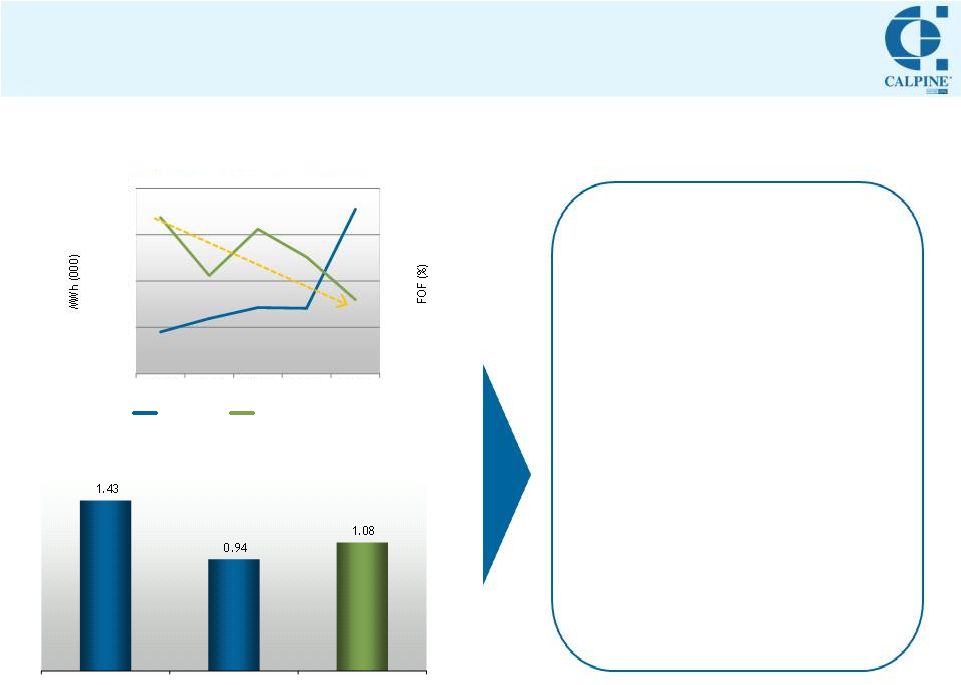

Optimizing Fleet Performance

13

Significantly Reduced

Forced Outage Factor

-53%

Goals for 2013

•

Safety First to

Zero: No lost

time incidents

•

Better than 2.5%

FOF

•

Complete

maintenance

program:

13 Majors and

20 Hot Gas Paths

Maintaining Plant Operating Expense

While Expanding Fleet

1

Objective: Premier wholesale power company

1 Plant Operating Expense excluding major maintenance expense, non-cash

stock-based compensation, non-cash loss on disposal of assets and other costs. Both Plant Operating Expense and

Capacity (MW) shown here exclude deconsolidated power plants, plants owned but not

operated by us and plants classified as discontinued operations in the respective periods.

1

$0

$200

$400

$600

$800

$1,000

$1,200

0

5,000

10,000

15,000

20,000

25,000

30,000

2008

2009

2010

2011

2012

Avg. MW in Operation

0%

1%

2%

3%

4%

2008

2009

2010

2011

2012

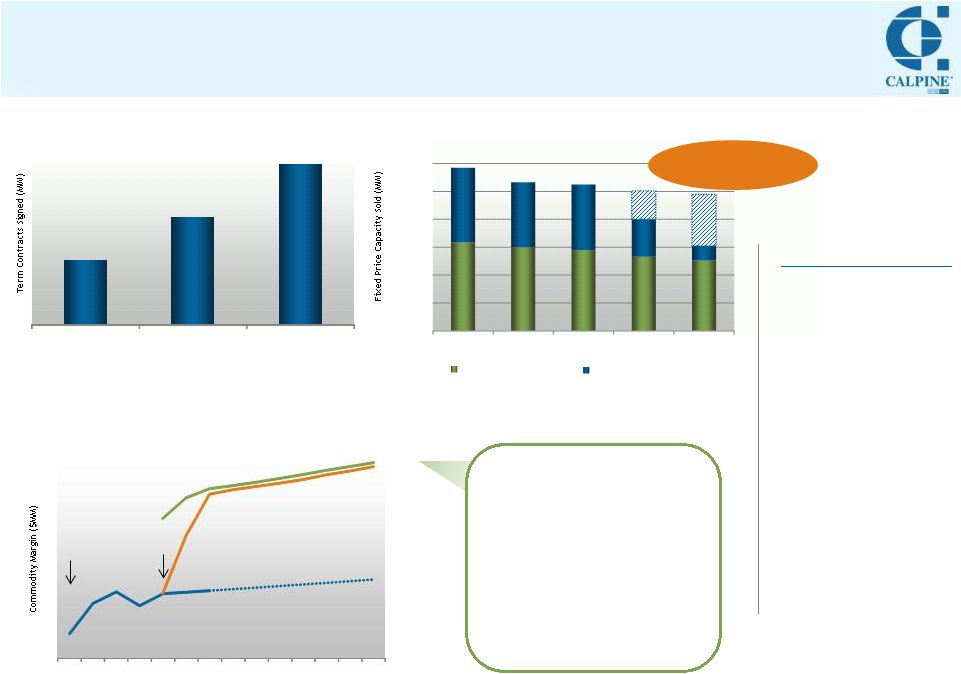

Plant Operating Expense |

14

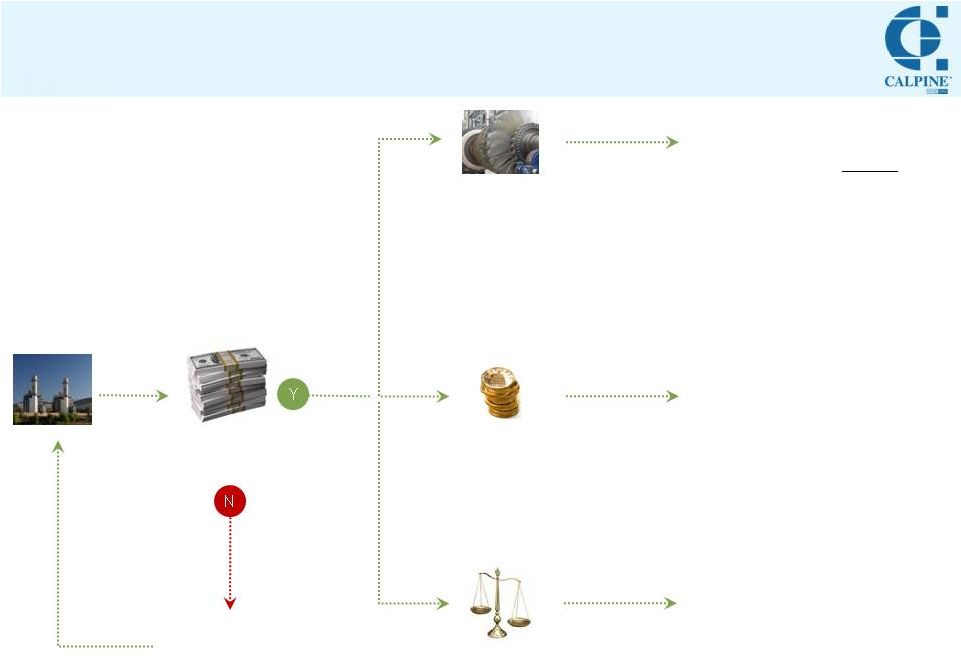

Adding Value Through Commercial Origination

14

Continued Contracting Success

•

Focus on

demonstrating

further value from

SE portfolio

•

Create

commercial

solutions to bridge

CA structural gaps

•

Continue to

expand public

power origination

efforts (TX, North)

•

Commercially

optimize portfolio

Contracts: Effective Form

of Asset Monetization

Illustrative Contract Economics

Mgmt.

dialogue

initiated

Contract

commenced

Capturing Future Value

Represents >$5B

(notional) of fixed

payments

Goals for 2013

Note: Market projection represents extrapolation of current market prices.

Shaded bars represent projected capacity lifted in 2016/2017 and

2017/2018 RPM capacity auctions based upon amounts cleared in

2015/2016 auction. Toll/PPA capacity includes contracts at Los

Medanos and Gilroy, which are subject to CPUC approval.

Why do customers pay?

•

Avoided cost of new build

•

Capacity obligations

beyond energy

•

Regulatory requirements

•

Sometimes regulators or

customers want some

portion of PPAs

Market /

Projection

T-4

T-2

T

T+2

T+4

T+6

T+8

Fundamentals

Contract

2013

2017

Toll / PPA Capacity

Regulatory Capacity

0

2,500

5,000

7,500

10,000

12,500

15,000

2014

2015

2016

840

1,402

2,095

2010

2011

2012 |

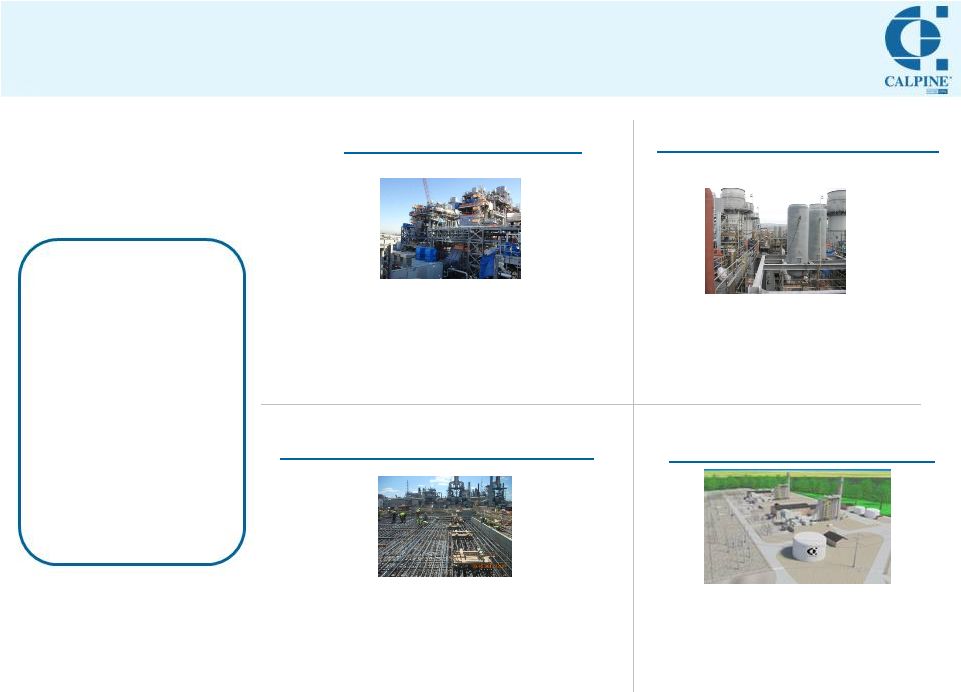

15

Calpine Development Pipeline:

Pursuing Disciplined Growth

2013

2014

2015

2016

2017

Russell City

Combined-cycle power plant under

10-year contract with PG&E

464 MW

1

Los Esteros

Conversion of existing plant from simple-

cycle to combined-cycle technology

under 10-year contract with PG&E

120 MW

Deer Park Expansion

Expansion of existing CCGT in Texas

leveraging existing site and equipment

260 MW

2

Channel Expansion

Expansion of existing CCGT in Texas

leveraging existing site and equipment

260 MW

2

Garrison (Phase 1)

Greenfield CCGT leveraging existing

equipment and advantaged site

309 MW

Deepwater

Brownfield CCGT leveraging existing

infrastructure and advantaged site

350 MW

Texas Upgrade Program

Turbine modernizations and other

upgrades; Requires market reform

300 MW

Mankato Expansion

Response to PUC resource acquisition

plan; Expansion of existing CCGT

leveraging existing site and equipment

345 MW

Total

584 MW

520 MW

309 MW

650 MW

345 MW

Goals for 2013

•

Complete CA

construction

projects

•

Keep Deer Park,

Channel,

Garrison on track

•

Originate

attractive-return

growth

opportunities

—

New cogen

—

Public power

•

Build set of site

options with first

mover advantage

1

Represents Calpine share.

2

Represents

incremental

baseload

capacity

at

annual

average

conditions.

Incremental

summer

peaking

capacity

is

approximately

200

MW

per

unit,

supplemented

by

incremental

efficiencies

across the balance of the plant.

NEW

NEW

NEW |

16

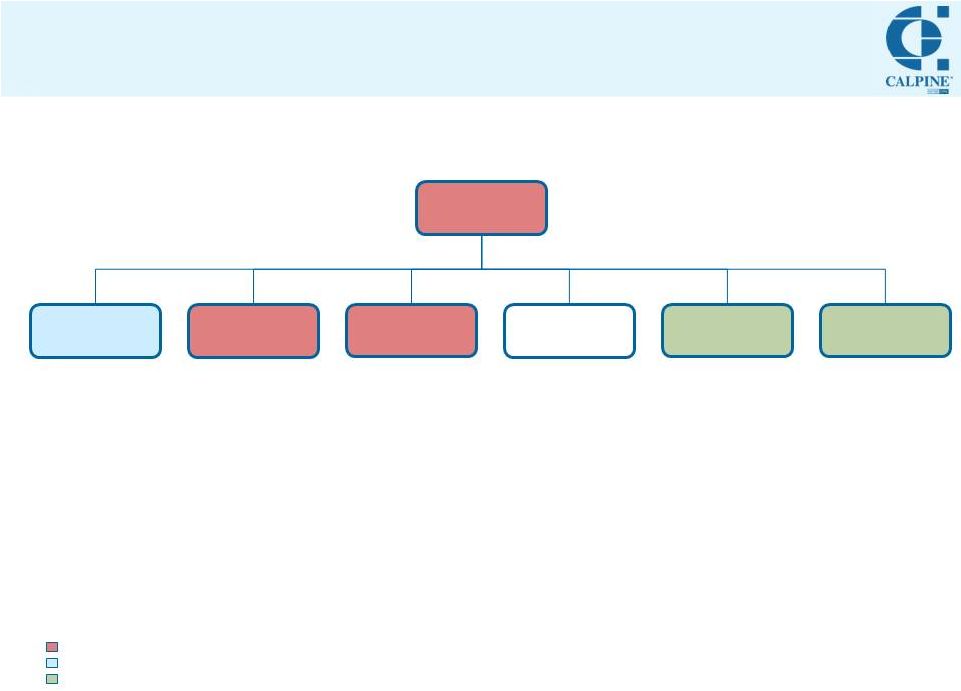

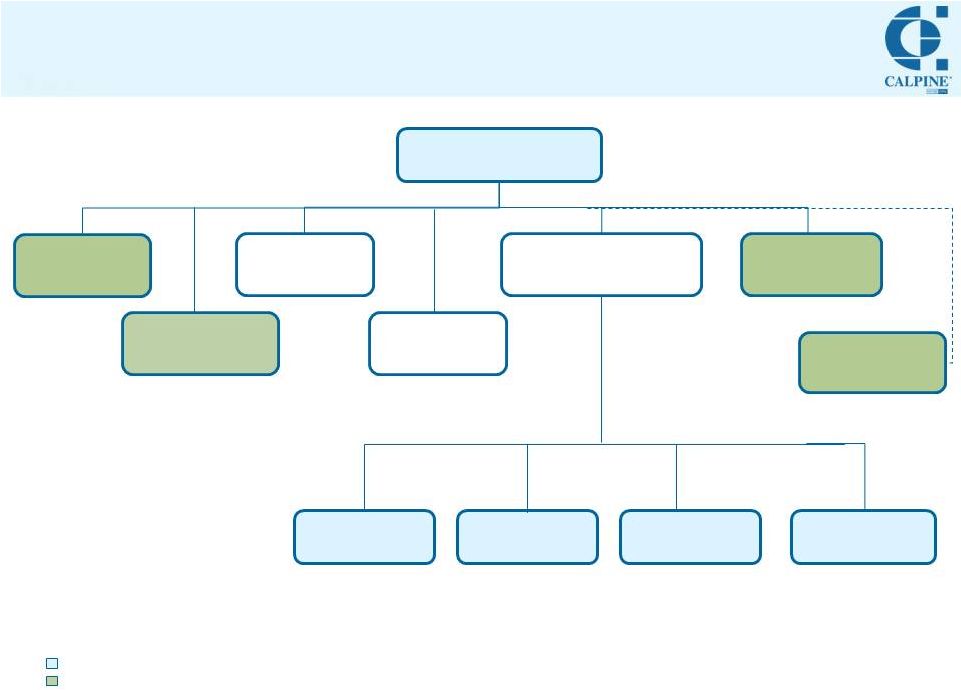

Operations Organization

16

COO

Power

Operations

Commercial

Analytics

Commercial

Operations

Human

Resources

West Strat.

Origination

Development

Hether

Benjamin-Brown

Todd Thornton

Steve Pruett

John Adams

Caleb Stephenson

Alex Makler

Presenter

Panelist

In Attendance

Thad Hill |

2013

Investor Day: National Trends

Impacting Our Portfolio

Caleb Stephenson

Vice President, Commercial Analytics

April 10, 2013 |

18

18

Important Trends Impacting Our Portfolio

National

Caleb Stephenson

Regional

Steve Pruett

Texas

•

Inefficiency of forward

curves, plus

•

Regulatory shifts

(including our new VMP)

PJM

•

Retiring coal + Demand

Response = Flattish

capacity, but

•

Real upside in energy

Southeast

•

Capturing significant

origination opportunity

with load serving entities

California

•

Near-term: SONGS +

AB32

•

Medium-term:

Increasing importance of

capacity versus energy

Load Trends

•

Cheer up! Energy efficiency not the

end of load growth

•

Regional diversity: Texas load

growth outlook remains robust

The

“New Build”

Spark

Spread

•

Spark spreads needed to motivate

new construction likely higher than

some think

•

Operational realities matter

Gas Price

Immunity

•

Generation volumes inversely

related to gas prices; margin fairly

neutral

Energy

Capacity

Views of Value |

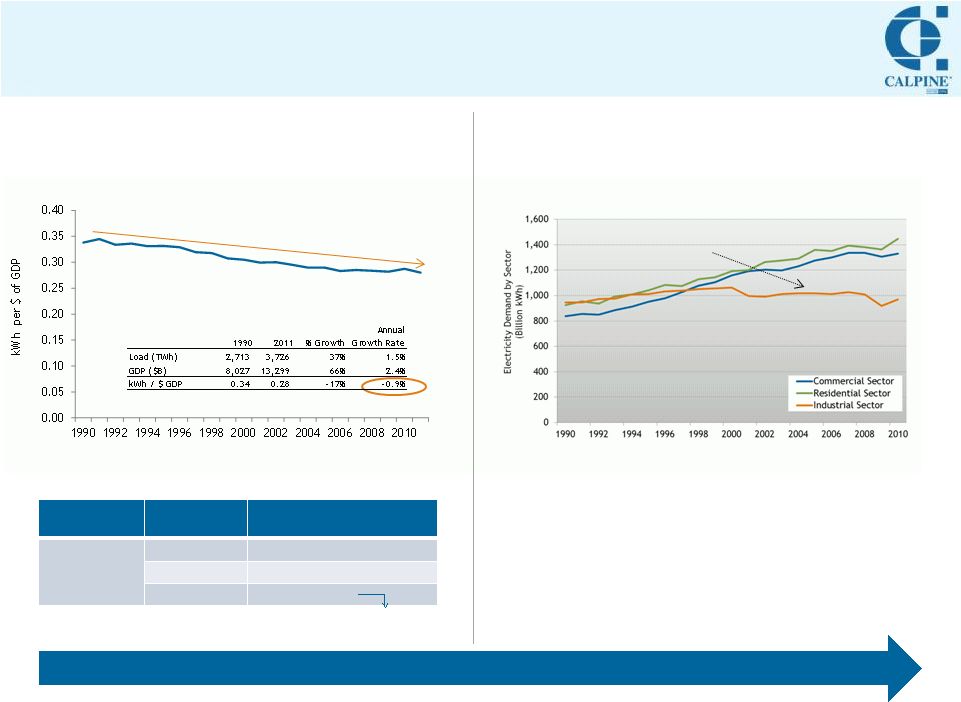

Energy

Efficiency

Isn’t

New;

Additional

Efficiency

Improvements

Needed

Just

to

Keep

Pace

with

Historical

Trend

19

Long History of Energy Efficiency

GDP Growth > Load Growth = More Efficient Electricity Use

More Efficiency Needed Just to Maintain Trend

Beating Past Efficiency Trend May Not be Easy

Significant portion of past efficiency gains driven by structural

shift away from industrial load... Will this continue?

Flattening load growth entirely would require efficiency gains equivalent to GDP

growth –

>2.5x

historical efficiency gains

Residential Load has Tended to be Resilient

Efficiency improvements often offset by new demand;

Challenged so far by slow recovery of housing starts

•

Average new home size up >10% from 1990s

•

More and larger appliances

•

Light bulb standards aside, some low-hanging fruit already captured

Electricity needed to produce $1 of GDP has decreased

by ~1% per year

Sustaining GDP

Growth of …

…

and Load

Growth of …

…

Requires an Ongoing

Efficiency Gain of …

2.4%

1.5%

0.9% (consistent with history)

1.0%

1.4% (>1.5x history)

0%

2.4% (>2.5x history)

We’re not convinced load growth has reached a regime change: Much still

seems driven by regional economies … Industrial load now a smaller share of

electricity consumption (and economy)

Sources: Retail sales total and by sector from EIA , GDP Data from BEA ($ 2005), Calpine

Analysis |

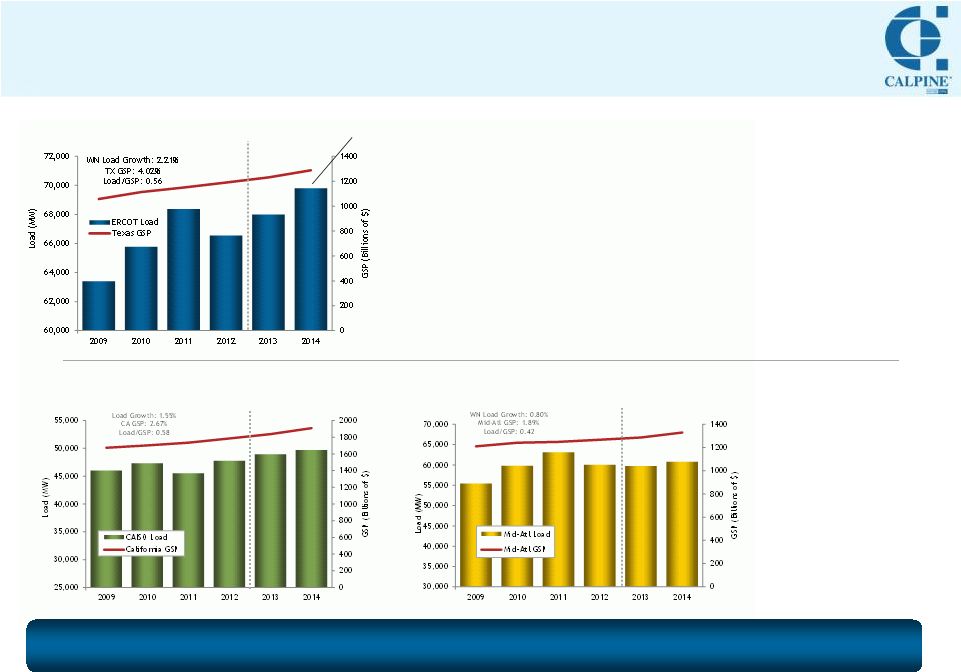

20

Regionally Diverse Growth Trends:

Texas Among Highest Growth Regions

20

Forecast

Forecast

Forecast

Notes:

Historical

peak

load

data

is

not

weather

normalized

(WN).

All

growth

rates

are

compound

annual

growth

between

2009

–

2014.

Sources: Historical data from ERCOT, CAISO, & PJM (unrestricted peak load) .

Load Forecasts from ERCOT, CEC, & PJM. GSP data from Moody's Analytics ($ 2005). Mid-Atlantic GSP is sum of PA, NJ, DE, &

MD. Weather-normalized load growth rates reflect Calpine analysis.

Texas

California

Mid-Atlantic

Rather than having fundamentally changed, regional load growth trends appear to remain

primarily a function of regional economic strength

Population, industry and commercial trends positive for

continued strong load growth

•Feb

2013: In past year, employment increase in TX more than 2x gain

in national payroll growth (Bloomberg) •Greater Houston Port Bureau survey: Businesses in Houston Port

region will invest $35 billion in capital and maintenance between 2012

–

2015 (Houston Chronicle)

Economic and load growth

expectations in California

and Mid-Atlantic are less

robust

ERCOT forecasts annual

load growth of ~2,000 MW

through 2016 |

21

Factors

Sometimes

Overlooked

Factors

Typically

Considered

Conventional Underestimation of New Build Spark Requirements

21

•

Headline construction costs per headline kW

•

Cost of capital

•

Fixed operating costs

•

Total

construction

costs

per

operable

kW

•

Cost

and

return

of

capital

•

Fixed,

variable,

and

maintenance

reserve

operating

costs

•

Operational realities such as:

—

Off peak and weekend operations

—

Imperfect plant availability

—

Higher fuel costs due to realized versus baseload heat rates, use of duct-fired

capacity not just baseload capacity, and local gas delivery costs

Spark spread required to incent merchant new build is an important

benchmark for evaluating power market upside, particularly in regions without

capacity markets. People often underestimate this benchmark, thereby not

appreciating full fundamental potential of existing assets.

Issue:

Typical approach

is to calculate annual revenue requirements and divide by the

number of on-peak hours during the year to determine the spark spread level

necessary to cover revenue requirements.

A more

careful

approach

recognizes

the

costs

of

operational

“frictions”

and

generally

results in higher new build benchmark. |

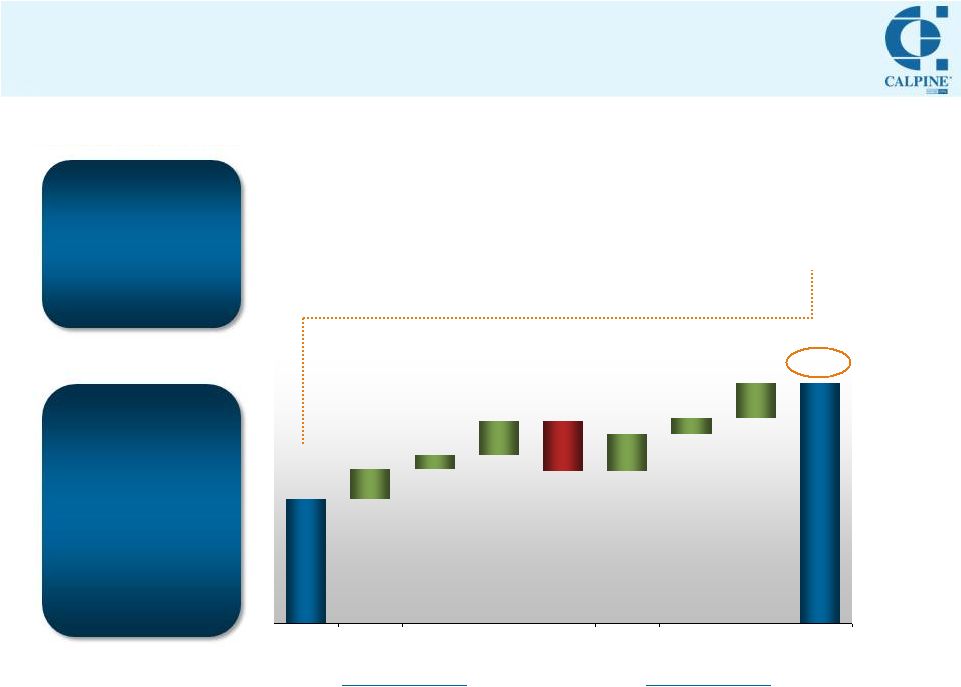

22

$29

$2

$1

$3

$(4)

$3

$1

$3

$38

Simple

Estimate

Interest During

Construction

Seasonal

Capacity

(less than

Nameplate)

Return of

Capital

Off Pk and

Wknd Margins

Plant

Availability

less than 100%

Add'l Realized

Fuel Costs

Variable Costs

and

Maintenance

Reserve

Improved

Estimate

Impact of

Refinements to

the Math

Operational Frictions Drive Higher Required Spark Spread

22

Illustrative ERCOT Estimate

Operational Realities

Starting Point:

Illustrative Simple

Math

Construction

Costs

Return on

Capital

Fixed

O&M

Total Margin

Needed

On-Peak

Hours

Simple New

Build Spark

$893/kW

10%

$30/kW-Yr

$119/kW-Yr

4,100

$29/MWh

÷

=

=

x

+

Sources: EIA , Calpine Analysis |

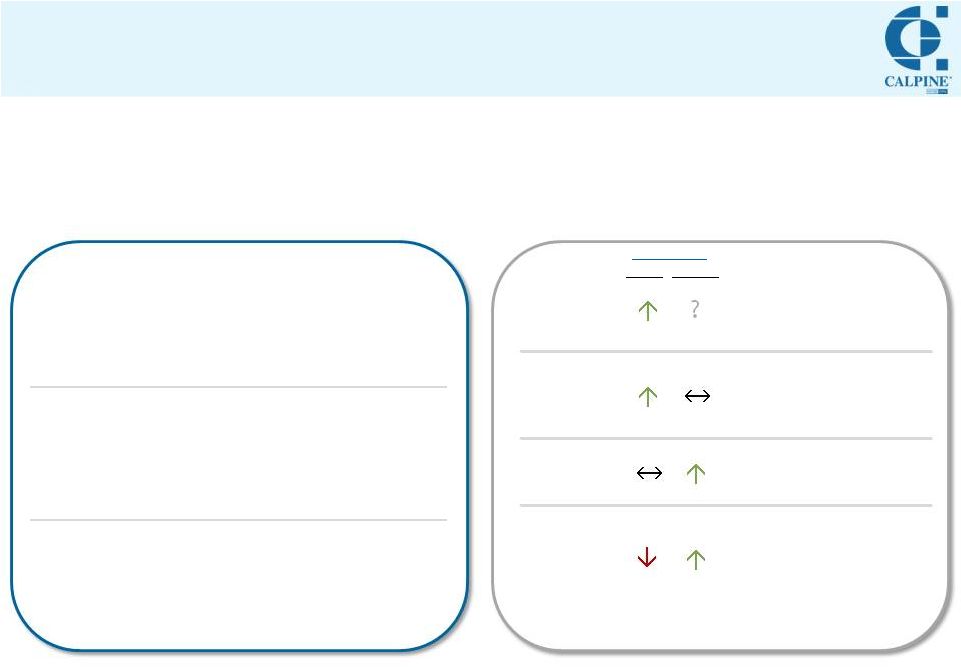

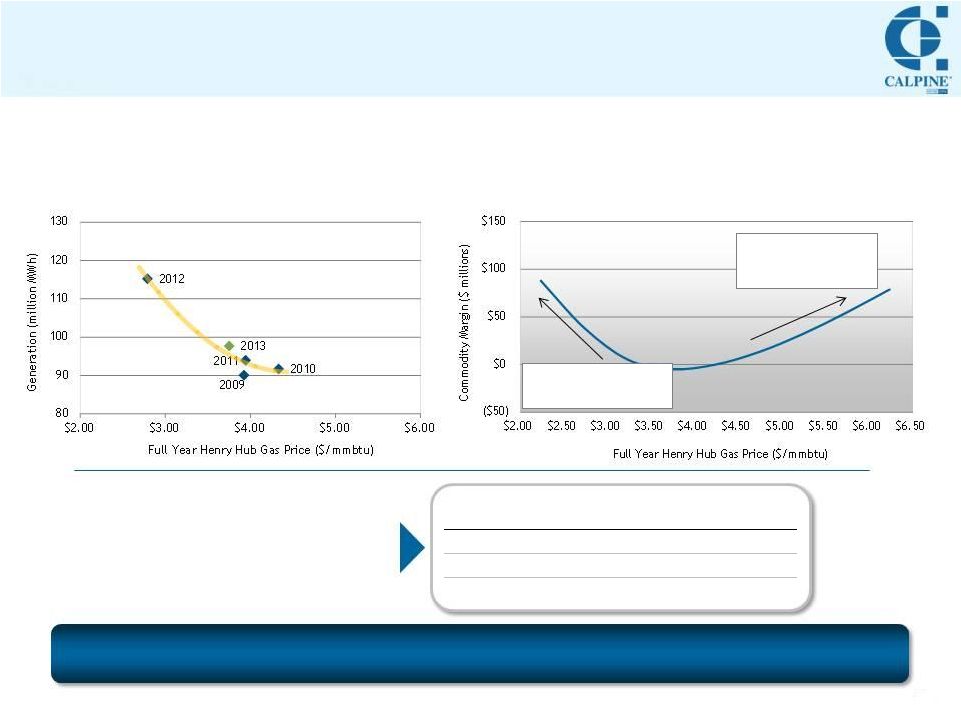

Calpine: Generation Volumes Inversely Related to Gas Prices;

Margin Fairly Neutral

NON-EQUITY Volume

Projection (MM MWh)

Recommended Premium to

On-Peak Spark Spread

<100

5% -

15%

100 –

110

(5)% -

5%

110 –

120…

(15)% -

(5)%

Realized margin per

MWh (relative to on-peak

spark spreads) varies

with total volume

1

Historical volumes adjusted to reflect only those plants currently owned by us.

All periods exclude deconsolidated plants. 2013E as of 03/26/13. 2

Relates to our summary level modeling tips. Refer to slide 35 for complete tips

and further detail. Calpine Margin Not Particularly Sensitive

to Natural Gas Prices

Modeled Impacts of Changes in Gas Price

on Unhedged Portfolio

As gas prices decline, volumes

increase as gas units take

market share from coal units

As gas prices rise, margin

increases as fuel cost

advantage over less

efficient generators widens

Calpine Dispatch

Sensitive to Natural Gas Prices

Volumes¹

vs. Natural Gas Price Trend

Though volumes can move substantially with changes in gas prices,

unhedged

Commodity

Margin

is

relatively

immune

to

changes

in

gas

prices.

Modeling Tip

Application²:

23 |

24

24

APPENDIX |

25

Further

Detail

on

Illustrative

“New

Build

Spark

Spread”

Estimates

25

Sources: EIA for illustrative ERCOT construction cost per kW, Calpine analysis.

In reality, the “new build spark”

varies for each particular project.

Construction costs, project risks, and operating expectations all need to be

factored in.

/+ $100 per kW Construction Cost

/+ 1% Capital Return Rate

/+ $10 Fixed O&M Costs

/+ 100 btu/KWh Heat Rate Chg

1% Availability

/+ $1 Variable or Maintenance Costs

Change in Required On Peak Spark Spread ($/MWh)

$(3.00)

$(2.00)

$(1.00)

$-

$1.00

$2.00

$3.00

-

-

-

-

+/

-

Illustrative Math

Illustrative Sensitivities

634

$

A

Headline Construction Costs ($MM)

710

B

Headline (Gross) Plant Capacity (MW)

893

$

C=A/B

Headline Construction Costs ($ per kW)

10%

D

Return on Capital

89

$

E=CxD

Capital Return ($ per kW-Year)

30

$

F

Fixed O&M ($ per kW-Year)

119

$

G=E+F

Total Margin Needed ($ per kW-Year)

4,100

H

Total On Peak Hours

29.10

$

I=Gx1000/H

Simple Required On Peak Spark Level ($ per MWh)

697

$

A

680

B

Net Annual Average

Plant Capacity (MW)

1,026

$

C=A/B

Total

Construction Costs ($ per kW)

11%

D

Return

Of

and

On

Capital

113

$

E=CxD

Capital Return ($ per kW-Year)

30

$

F

Fixed O&M ($ per kW-Year)

143

$

G=E+F

Total Margin Needed ($ per kW-Year)

15

$

H

Estimated Off Peak and Weekend Net Margin ($ per kW-Year)

128

$

I=G-H

Remaining Margin to be Recovered During On Peak Hours

92%

J

Plant Availability

3,772

K=4,117xJ

Available On Pk Hours

33.89

$

L=Ix1000/K

Required On Peak Margin per MWh

7.1

M

Realized HR After Effects of Cycling, Use of Duct-Firing, and Degradation (MMBtu per

MWh) 0.45

$

N=(M-7.0)x$4.50

Adder to Cover Realized Heat Rate above 7 HR (at $4.50 Gas Price)

0.72

$

O=0.10*7.2 HR

Adder to Cover Local Fuel Delivery Costs ($0.10 per MMBtu, Converted $ per MWh)

2.50

$

P

Adder to Cover Variable Costs and Major Maintenance Reserve

37.56

$

Q=L+N+O+P

Improved Required On Peak Spark Spread Level ($ per MWh)

SIMPLE MATH

IMPROVED MATH (Changes/Additions in italics)

Total

Construction

Costs

($MM)

-

Includes

Interest

During

Construction |

2013

Investor Day: Regional Trends

Impacting Our Portfolio

Steve Pruett

Sr. Vice President, Commercial Operations

April 10, 2013 |

27

27

Important Trends Impacting Our Portfolio

National

Caleb Stephenson

Regional

Steve Pruett

Texas

•

Inefficiency of forward

curves, plus

•

Regulatory shifts

(including our new VMP)

PJM

•

Retiring coal + Demand

Response = Flattish

capacity, but

•

Real upside in energy

Southeast

•

Capturing significant

origination opportunity

with load serving entities

California

•

Near-term: SONGS +

AB32

•

Medium

-term:

Increasing importance of

capacity versus energy

Load Trends

•

Cheer up! Energy efficiency not the

end of load growth

•

Regional

diversity: Texas load

growth outlook remains robust

The

“New Build”

Spark

Spread

•

Spark spreads needed to motivate

new construction

likely higher than

some think

•

Operational realities matter

Gas Price

Immunity

•

Generation volumes

inversely

related to gas prices; margin fairly

neutral

Energy

Capacity

Views of Value |

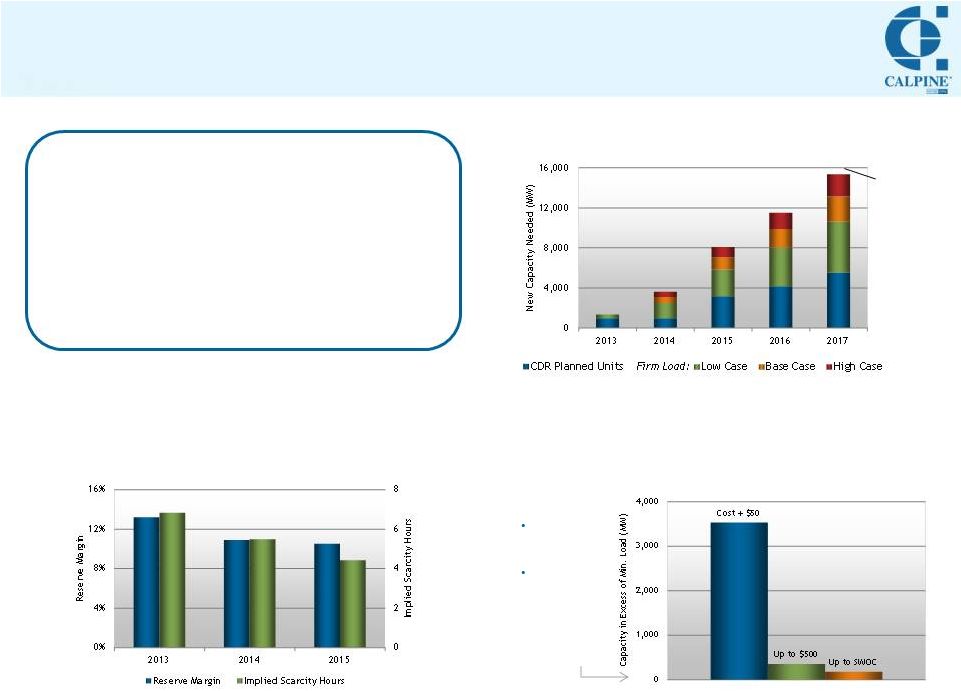

28

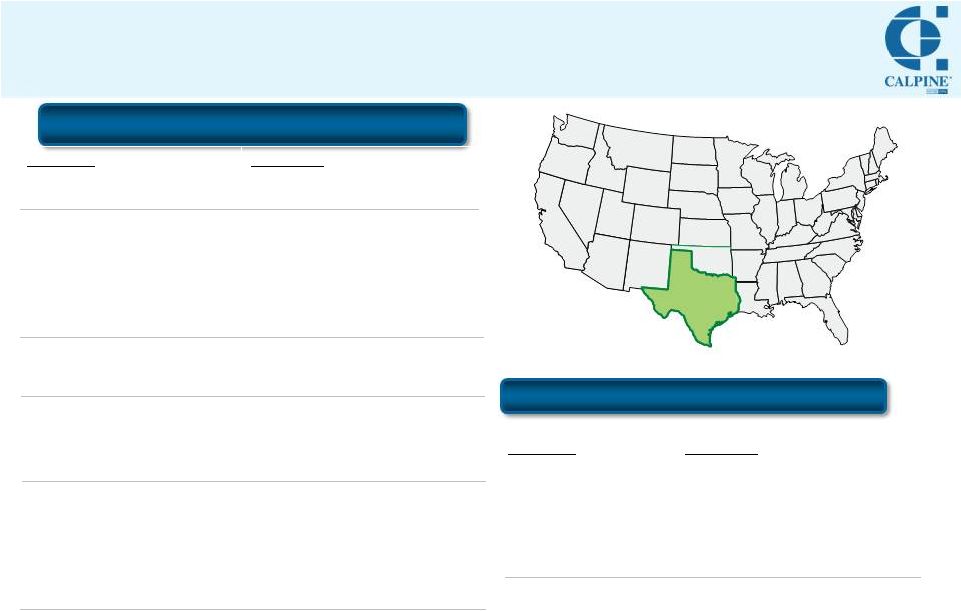

Market Overview: Texas

Addressing Need for New Generation

28

Substantial New Capacity Needed

to Meet Current Reserve Margin Target

Source: Calpine, ERCOT. Represents capacity necessary to meet target

reserve margin of 13.75%. Reflects annual growth of 1.53% / 2.32% / 3.00% for

Low/Base/High Case. CDR Planned Units exclude wind.

Tightening Reserve Margins Should Suggest

More Scarcity, Yet Forward Curves Reflect Less

Source:

ERCOT,

Calpine.

As

of

3/26/13.

Reflects

Jul

-

Aug

of

each

year

and

SWOC

of

$5,000

/

$7,000

/ $9,000 in 2013/2014/2015. Assumes market heat rate (absent scarcity) of 12,000

btu/kWh. Voluntary Mitigation Plan: Protects Bidding

Despite Potentially Volatile Market

Another

1,000 –

1,500 MW

required to

meet

potentially

higher

target

Day Ahead :

Full bidding

discretion

Real Time:

Approved

bidding

parameters

for capacity

above min

load (chart)

Texas Summary:

•

Generation needed: Regulatory reform

necessary to attract more capacity

•

Inefficient forward market not providing

signals

•

Meanwhile, Calpine actively managing its

position in a volatile market

-

VMP approved

How it Works: |

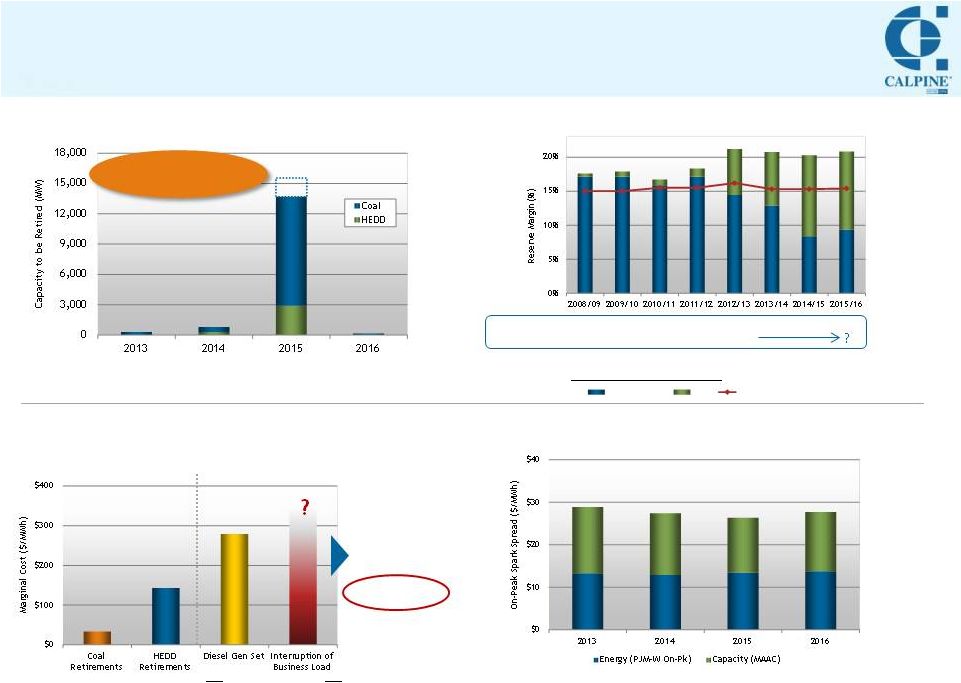

Market

Overview: PJM Retirements + DR = Flattish Capacity, but Energy Upside

Significant Retirements on the Horizon…

…Yet Forward Curves Remain Suppressed

Source: Calpine, PJM, Energy Velocity, SNL. HEDD: High-Energy Demand

Days (New Jersey regulation).

Source: Calpine, Broker quotes. As of 3/26/13. Assumes market heat rate of

8,000 btu/kWh. RPM Capacity prices shown for MAAC and reflect annual

weighted average capacity price, converted into on-peak spark spread

equivalent assuming 50% on-peak capacity factor. 2016 reflects price for 2015/2016 auction, as

2016/2017 rates have not yet been established.

Source: PJM.

…Being Replaced by Demand Response

Capacity in Excess of

Reliability Requirement

7.2%

53.2%

53.6%

57.6%

25.7%

% Commitment

Repurchased:

Replacing Retiring Units with Higher-Cost

DR Should Increase Energy Prices…

Demand Response

Potential impact of

increased DR calls

on summer prices:

+$18/MWh

Source

(DR

Prices):

EIA,

MJ

Bradley.

Diesel

Gen

Set

represents

1500

hp

engine.

See

footnotes in Appendix for additional assumptions for price impact.

(40 hrs. @ $500/MWh)

Retiring Units

Price-Setting Units?

15 –

17GW of

retirements expected

by 2016

29

Generation

DR

Installed Reserve Margin |

30

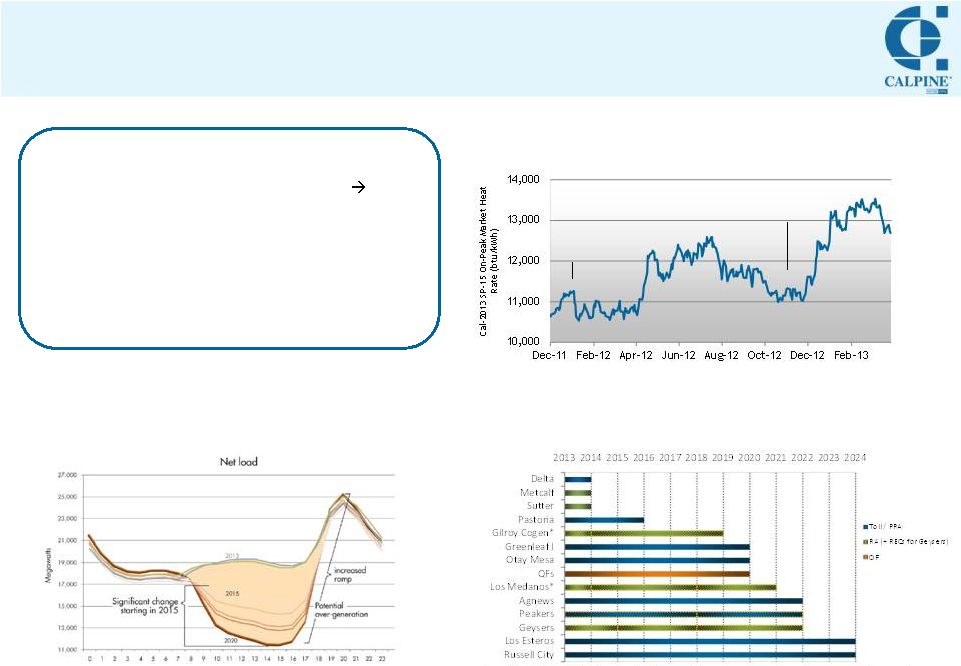

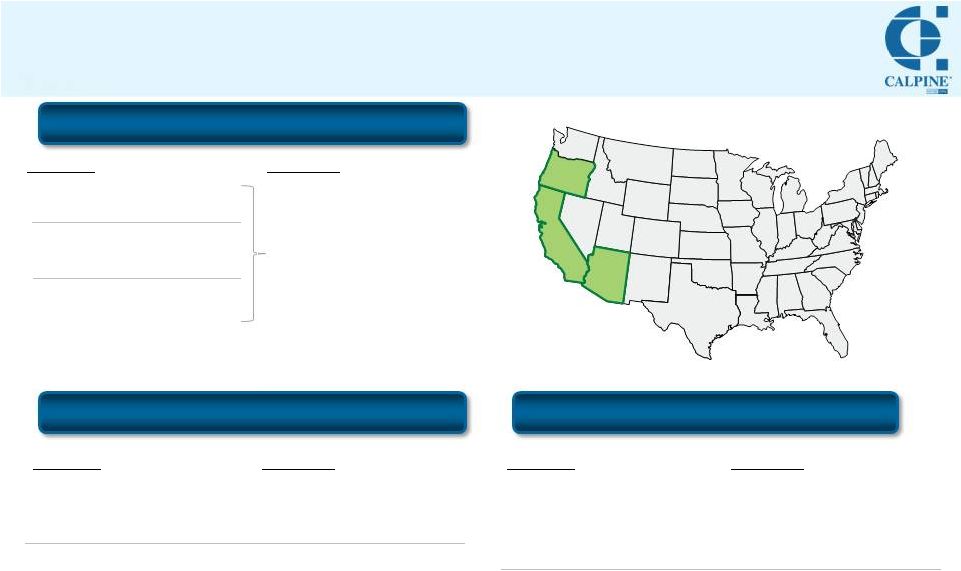

Market Overview: California

Increasing Need for Flexible Generation

30

Source: CAISO.

Mid-Term: Renewable Integration Increases

Need for Flexible Generation

Hour of Day

California Summary:

•

Near-term: AB32 + SONGS + Dry summer

Price

volatility

•

Mid-term: Regulatory reform needed to

adequately compensate flexible generation; key

for integration of renewables

•

Good news: Calpine has been effective at

securing capacity contracts

Near-Term: Carbon Regulation and Nuclear

Outage Impacting Market

SONGS

Outage

First Carbon

Auction (AB32)

Source: Calpine, Broker quotes.

Origination Team Successful at

Capturing Value through Contracts

Where full plant output has been contracted, capacities shown here represent summer

peaking capacity as reported in 2012 10-K; actual contract amounts may vary

depending upon contract terms. Contract expiration may occur within the final

year shown. Sutter, Los Medanos and Gilroy Cogen for 2013 represents summer

only. * Indicates contracts subject to CPUC approval in a contested proceeding.

857 MW

500 MW

578 MW

675

650

250 MW

749 MW

515

120 MW

50 MW

608 MW

169 MW

560

28 MW

329 MW

309 MW

619 MW

280 MW

560

Years Contracted: |

31

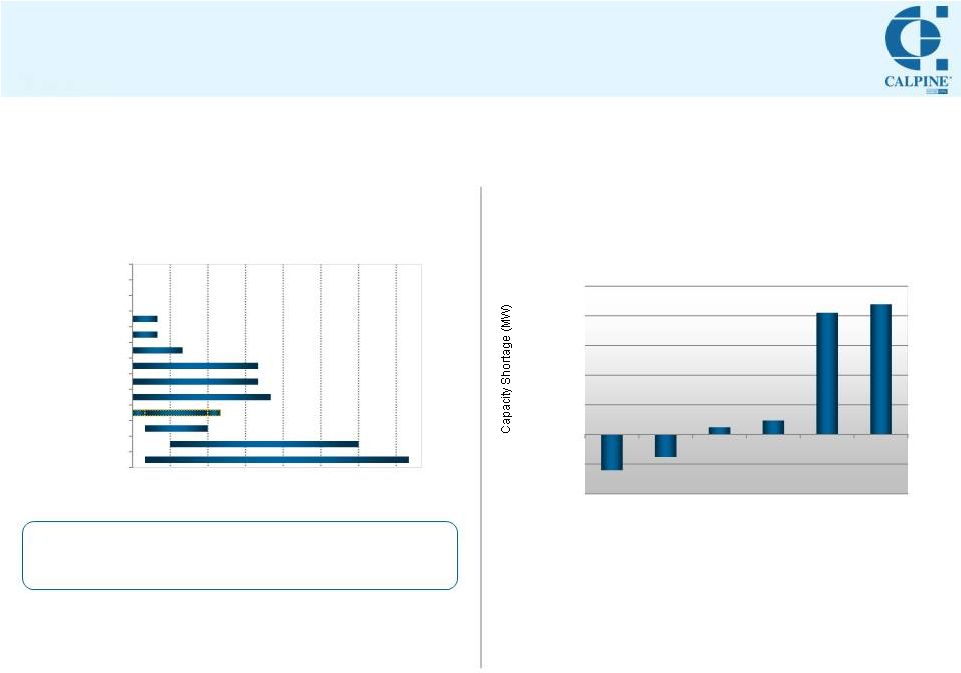

Market Overview: Southeast

Realizing Opportunities with Load Serving Entities

31

Capturing Value: Continued Progress

Upcoming Generation Shortages

Projected in Southeast Region

Utility IRPs + New Capacity –

Projected Retirements

= Significant Deficit

Source:

Calpine,

TVA

IRP,

DUK/PGN

IRP,

Southern

10K,

SCE&G

IRP,

SNL.

Assumes

15%

reserve margin across all utilities.

Recent Updates:

•

•

Years Contracted:

340 MW

225 MW

117 MW

795 MW

485 MW

135 MW

200 MW

200

400

260 MW

160

-

280 MW

Where full plant output has been contracted, capacities shown here represent summer

peaking capacity as reported in 2012 10-K; actual contract amounts may vary

depending upon contract terms.

Contract

expiration

may

occur

within

the

final

year

shown.

Oneta

–

OMPA

represents

summer only.

50 MW

Columbia

Pine Bluff

Hog Bayou

Osprey

Santa Rosa

Auburndale

Decatur

Carville

Morgan

Oneta -

SPS

Oneta -

OMPA

Oneta -

PSO

Oneta -

WFEC

(6,000)

(3,000)

0

3,000

6,000

9,000

12,000

15,000

2013

2014

2015

2016

2017

2018

2013

2016

2019

2022

2025

2028

2031

2034

Decatur: 10-year PPA with TVA

Morgan: Planning to offer capacity into PJM for 2016/2017

|

32

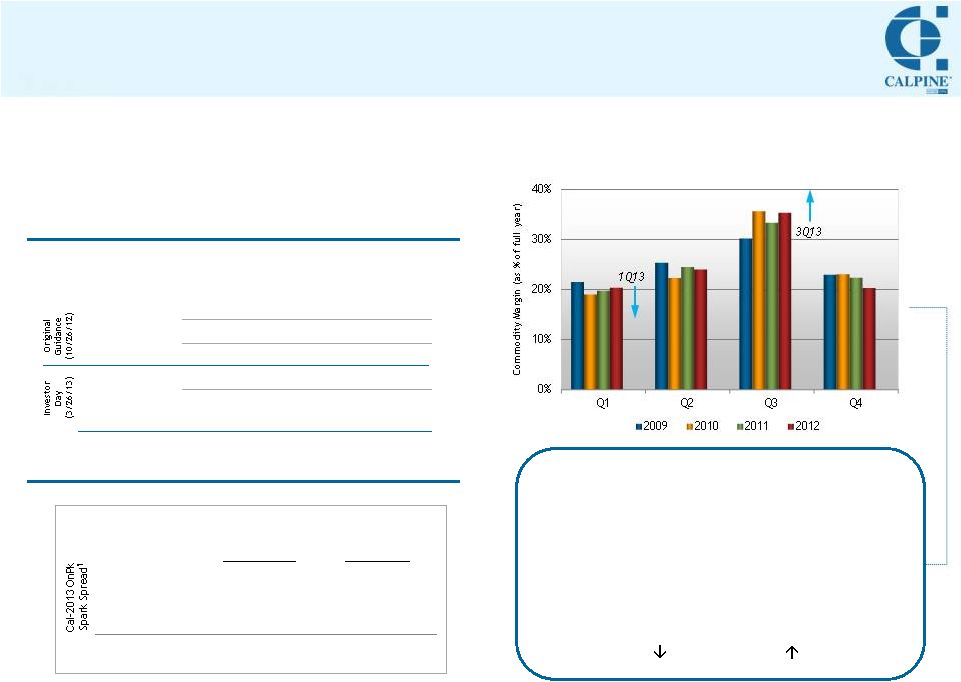

Maximizing Shareholder Value Through Hedging

32

Portfolio Changes and Hedges Have Shifted

Quarterly Distribution of Earnings

Hedging Objective

Calpine hedges in order to achieve full and fair

value for our assets and maximize return on assets

for our shareholders

Bal-2013

2014

2015

% Hedged

49%

32%

31%

Gas Position

Neutral

Long

Long

% Hedged

68%

33%

31%

Gas Position

Modestly

Short

Neutral

Long

1

Spark spread in NP-15 and ERCOT based upon 7,000 btu/kWh market heat rate and in

PJM-W based upon 8,000 btu/kWh market heat rate. NP-15 adjusted to deduct cost of carbon cap-and-trade,

without which, spark spreads would have been $13.10 and $16.51 as of 10/26/12 and

3/26/13, respectively. Position Updates (Summary)

Note: See complete updates to standard hedge disclosures in Appendix.

3Q12 Call

(10/26/12)

Investor Day

(3/26/13)

NP-15

$8.48

$10.94

ERCOT

$20.75

$21.15

PJM-W

$13.36

$13.29

Nat Gas (HH)

$3.93

$3.90

•

4Q12 Portfolio Changes:

—

Sold Broad River, Riverside (contracted)

—

Acquired Bosque (merchant)

•

Addition of Russell City and Los Esteros (Summer 2013)

•

Changes in hedging profile

—

More open in 2013

—

Seasonal (versus annual) hedges

•

Result:

1Q13

vs 1Q12 / 3Q13

vs 3Q12

2013 Considerations: |

33

33

APPENDIX |

34

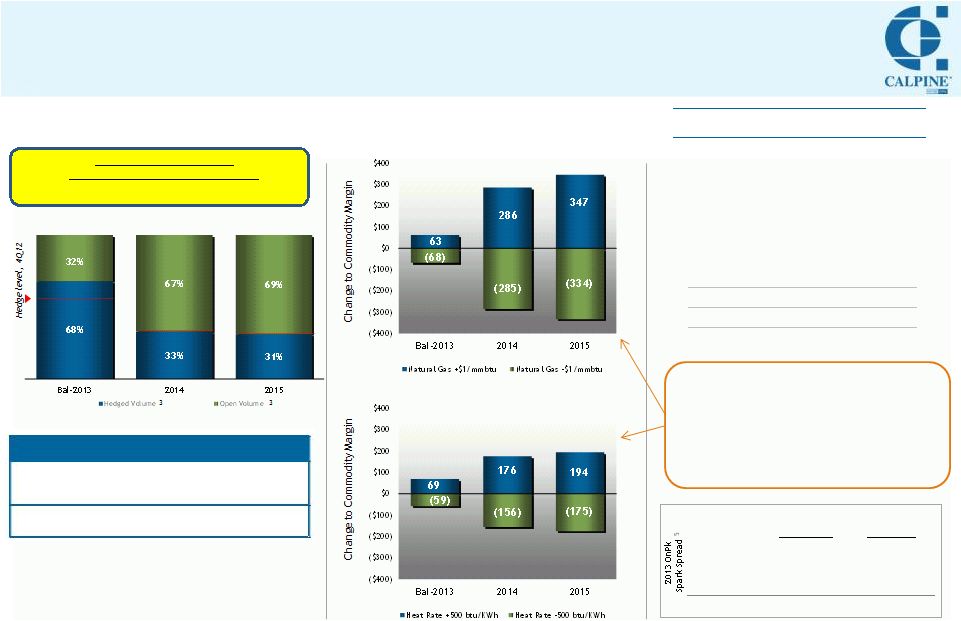

Energy Margin

1

:

Positioned to Respond to Favorable Secular Trends

34

•

Power position

—

2013: Hedges added; still have Q3

length

—

2014/2015: Remain very open

•

Effective gas position

Reminder:

—

Market heat rates tend to show

inverse relationships with gas prices

in some markets

—

±500

btu/kWh sensitivity shown here, but inverse relationship historically

much stronger at lower gas prices

volumes

and

gas

price

exposures.

Sensitivities

are

assumed

to

occur

across

the

portfolio

and

the

sensitivities

on

strategic

options

only

capture

intrinsic

value.

Volumes

are

on

a

delta

hedge

basis.

Delta

volumes

are

the

expected

volume

based

on

the

probability

of

economic

dispatch

at

a

future

date

based

on

current

market

prices

for

that

future

date.

This

is

lower

than

the notional volume, which is plant capacity, less known performance and operating

constraints. Volumes assume addition of Los Esteros and 75% of Russell City (2013); announced expansions at Deer Park and

Channel (2014); as well as addition of Garrison and retirement of certain plants in New

Jersey related to NOx compliance (2015). Represents Calpine’s forecasted

average annual capacity of net ownership interest with peaking capacity, excluding equity plants. Capacity additions/deletions are reflected in anticipated month of completion.

Spark spread in NP-15 and ERCOT based upon 7,000 btu/kWh market heat rate and in

PJM-W based upon 8,000 btu/kWh market heat rate. NP-15 adjusted to deduct cost of carbon cap-and-trade, without which,

spark spreads would have been been $13.10 and $16.51 as of 10/26/12 and 03/26/13,

respectively. Energy Hedge Profile

2

2013

2014

2015

Hedged Margin

($/MWh)

2

$20

$27

$26

Avg. MW in

Operation

2,4

27,209

27,761

27,934

$ Energy Margin

1,2

as % of

Total Commodity Margin (by year):

75%

77%

78%

Use in conjunction with modeling tips in appendix

Natural Gas Price Sensitivity

2

(assuming no change in heat rate)

Market

Heat

Rate

Sensitivity

2

(assuming no change in gas price)

Summary

Sensitivities

2013

Modestly short

2014

Neutral

2015

Long

3Q12 Call

(10/26/12)

Investor Day

(3/26/13)

NP-15

$8.48

$10.94

ERCOT

$20.75

$21.15

PJM-W

$13.36

$13.29

Nat Gas (HH)

$3.93

$3.90

Energy

Margin

+

Regulatory

&

Other

Margin

=

Total

Commodity

Margin.

Estimated as of 03/26/13. Hedged margin excludes unconsolidated

projects

and

includes

the

current

mark-to-market

adjustments

of

all

executed

transactions.

Changing

market

heat

rates

will

change

delta

1

2

3

4

5 |

35

Although Calpine’s fleet can be difficult to model,

simplifying techniques may help

35

1.

Estimate annual generation (MWh) based on market outlook relative to

disclosed historical generation with adjustments for asset acquisitions,

asset

divestitures

and

plants

reaching

commercial

operations

as

well

as

changes in gas and coal price environments.

•

Note:

Estimated

generation

in

this

step

should

exclude

volumes

from

unconsolidated investments (Greenfield, Whitby). Margin from these

plants is captured in step 7 below.

2.

Estimate hedged energy margin based on disclosed % hedged (blue bars) and

disclosed hedge margin ($/MWh).

•

Note:

2013

hedged

margin

($/MWh)

is

full

year

average

including

YTD

settlements.

2013

hedge

profile

is

for

balance

of

year

only (applicable

for steps 3 and 4 as well).

3.

Estimate Geysers unhedged energy margin using MWh estimate (historically,

~6 million MWhs), assume the Geysers unhedged % is the same as the entire

portfolio, and apply NP-15 ATC prices.

4.

Estimate gas fleet unhedged energy margin based on rough assumptions:

•

Dispatched generation tends to capture a premium to the block on-peak

spark

spread

for

open

volume.

This

premium

varies

significantly

with,

and is inversely related to, dispatch volumes. For 2013, this

relationship is captured within our guidance. For years past 2013,

depending upon your volume assumption in step 1 above, use the

following rules of thumb for applying the premium:

•

For this exercise, hedge profile is assumed to be relatively flat across

all regions, and disclosed regional steam adjusted plant heat rates

should be considered when calculating spark spreads.

Note: Tips are provided to help investors consider simplifying techniques to

apply the information disclosed to date in their modeling efforts. These tips

are naturally less precise than models based on detailed operational, contract,

and hedge position data might be.

1

Excluding major maintenance expense, non-cash loss on disposal of assets, and

stock-based compensation.

2

Excluding stock-based compensation.

5.

Adjust margin to capture items such as ancillary services and storage

positions

(benefit

of

small

tens

of

millions),

as

well

as

carbon

costs

in

California.

•

To consider Calpine's AB32 costs, apply our combined-cycle average

emissions rate of 876 lb/MWh for the California combined-cycle plants

and assume that ~50% of those costs are passed on to our

customers per contractual arrangements.

6.

The sum of steps 2 through 5 above will provide you with an estimate of our

Energy Margin. To estimate the contribution of Reliability and Other Margin

(regulatory capacity and REC revenue) and arrive at an estimate of Total

Commodity Margin, simply divide the Energy Margin by the disclosed

percentages of Energy Margin as a % of total Commodity Margin.

7.

Add estimated margin from unconsolidated investments (Greenfield, Whitby)

by multiplying Calpine capacity (net interest) by $110/kw-yr in all periods

shown.

•

Since these margins from unconsolidated investments are not included in

Commodity Margin, but are included in Adjusted EBITDA, it is necessary

to additionally estimate expenses related to unconsolidated investments

for purposes of calculating Adjusted EBITDA.

8.

When

modeling

operating

costs

for

the

consolidated

power

plants,

use

2012

reported

plant

operating

expense

and

sales,

general

and

administrative expense and other operating expense and apply an

inflationary factor for 2013 and subsequent periods, with adjustments for

asset acquisitions, asset divestitures and plants reaching commercial

operations.

NON-EQUITY Volume

Projection (MM MWh)

Recommended Premium to

On-Peak Spark Spread

<100

5% -

15%

100 –

110

(5)% -

5%

110 –

120…

(15)% -

(5)%

1

1

2 |

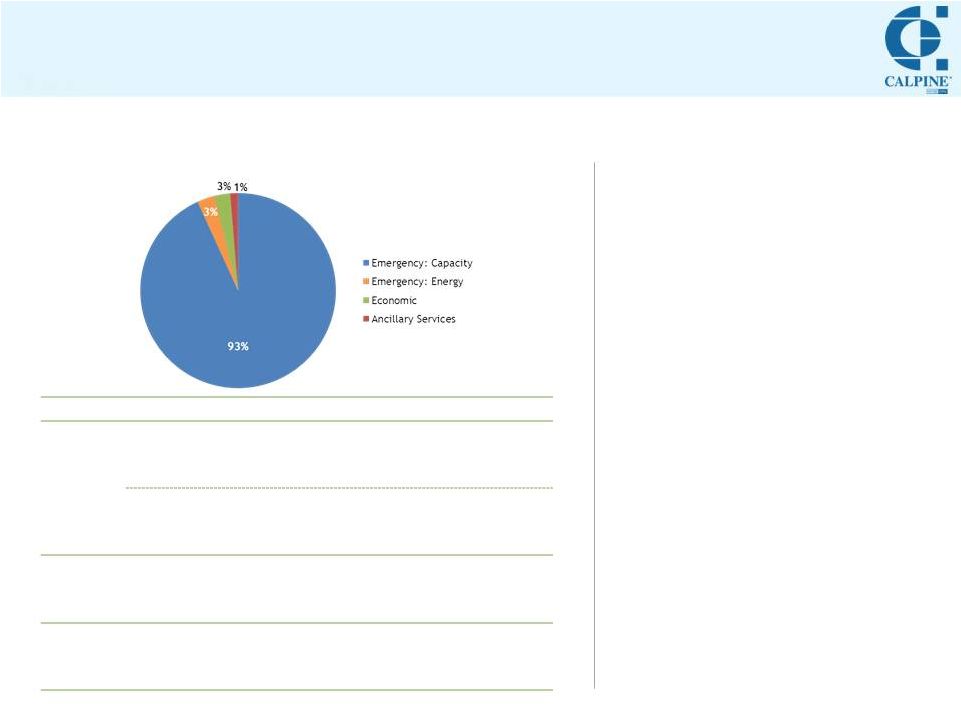

36

Reliability & Other Margin Detailed

1

Estimated as of 03/26/13. Excludes unconsolidated projects.

2

Amounts shown as percentages of projected 2013 Regulatory & Other Margin.

Excludes unconsolidated projects. 3 Represents volumetric position.

Reliability &

Other Margin

Hedge

Profile

1

Reliability &

Other Margin

Components

2

Substantially hedged

36

RECs

24%

Regulatory

Capacity

76%

100%

94%

92%

6%

8%

Bal-2013

2014

2015

Hedged Dollars

Open Dollars

REC Sales: % Volume

3

2013

100%

2014

97%

2015

95% |

37

Closer Look at Demand Response in PJM

37

Demand Response in PJM: An Overview

Economic Products as Percent of Total DR Revenue ($9.2 MM in 2012)

Footnotes for Summer Pricing Impact of

Increased DR Dispatch:

Source: Calpine, Energy Velocity.

Summer represents July and August.

Estimate reflects average summer price impact

of the market clearing on the cost of DR (at

assumed $500/MWh) instead of the cost of a gas

turbine (at assumed production cost of

$45/MWh) for 40 incremental hours.

Product

Description

Pricing

Emergency:

Capacity

•

Three types: Annual, Extended

Summer, Limited

•

Receives annual RPM payments set

by Base Residual Auction (if

cleared)

Emergency:

Energy

•

If cleared RPM auction, required

to offer into DA/RT energy

market; can only be called upon

in emergency situations

•

Sets price if needed to avoid

scarcity event

—

Received ~$1,500/MWh in

2012

Economic

•

Offered into day-ahead and/or

real-time markets voluntarily

•

LMP must be > Net Benefits Test

to be dispatched

•

Paid full LMP

—

Often dispatched at

<$100/MWh

Ancillary

Services

•

Quick-response products to

support grid stability

•

Based upon hourly market prices

Source: PJM. |

2013

Investor Day: Power Operations

John Adams

Sr. Vice President, Power Operations

April 10, 2013 |

39

Power Operations Organization

39

West: Rob Parker

Geysers: Mike Rogers

Central: Dave Plauck

Southeast: Rick Colgan

North: Bill Ferguson

Panelist

In Attendance

John Adams

West Region

Geysers

Central Region

Southeast Region

North Region

Outage Services

Ron Macklin

Engineering

Dev. & Opt.

Tom Long

Engineering &

Construction

Supply Chain &

Asset Management

Ron Hall

Andre Walker

Safety

Wendi Martin

Environmental

Services

Derek Furstenwerth

Strategic

Procurement

Murray Sanderford

Sr. Vice President,

Power Operations |

40

Committed to Best-in-Class Operations

40

Increasing Generation While

Improving Operations…

According to EEI Safety Survey (2011). Includes generation companies only.

1

Success Drivers:

1

…and Maintaining Focus on Safety

Generation

Forced Outage Factor

0.0

1.0

2.0

3.0

4.0

80,000

90,000

100,000

110,000

120,000

2008

2009

2010

2011

2012

3-Yr. Avg.

2012

EEI Top Quartile

—

Predictive and preventive

maintenance

—

Transformer reliability and spares

—

Summer and winter preparation

—

Fleetwide Root Cause Analysis

program

—

Enhanced training

—

Master purchasing agreements:

Volume discounts and parts

consistency

—

Turbine expertise

—

Expanded borescope program

—

Outage planning certainty

—

Optimized parts management

•

Fleet Programs

•

Supply Chain Services

•

Outage Services |

41

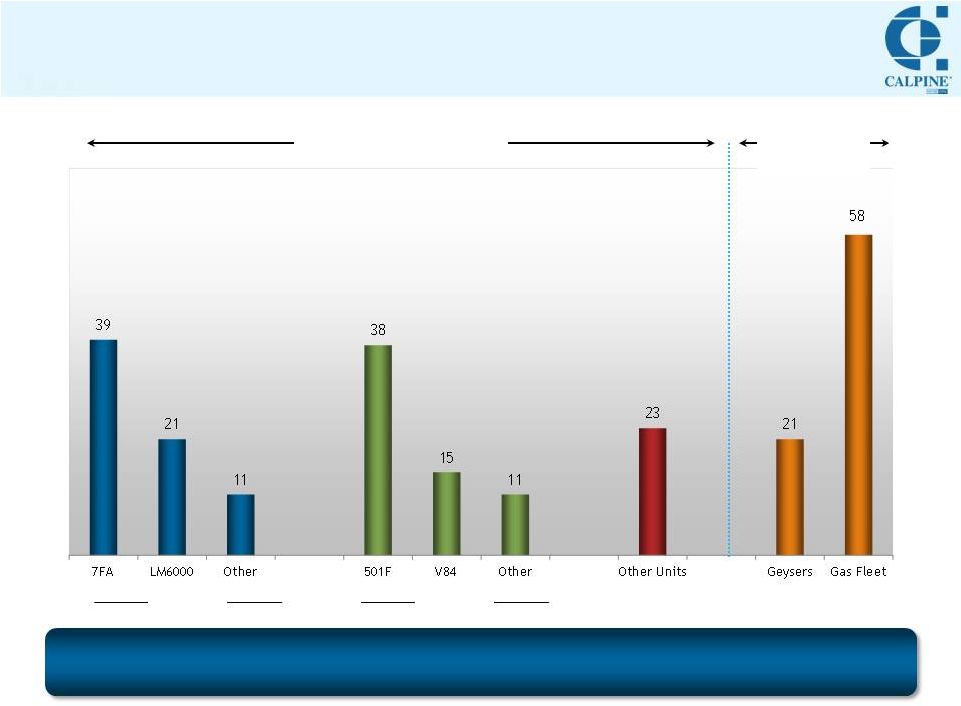

Leveraging Technological Expertise

41

GE

Siemens

Combustion Turbines (158)

Steam

Turbines (79)

Use of similar technology across fleet provides scale, reduces costs

and facilitates sharing of best practices |

42

42

MAJOR MAINTENANCE

Ron Macklin

Vice President, Outage Services |

43

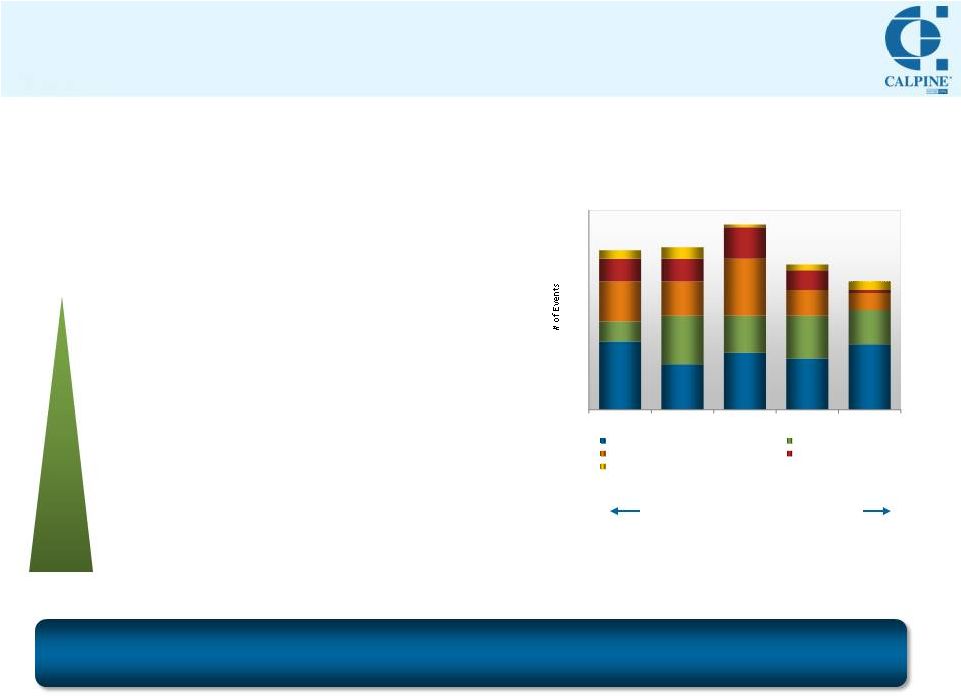

Calpine’s Outage Services

43

Economies of scale + Proprietary knowledge = Competitive Advantage

Preventive Maintenance Supporting

Lower Equipment Failure Expense

•

Calpine Outage Services: Manages Major Maintenance

program

-

Technical, outage, planning, asset, finance and safety

expertise servicing largest modern CCGT fleet in world

and largest co-generation fleet in US

•

Outage Services mission:

-

Eliminate forced outage / equipment failure

-

Provide CCGT maintenance to Calpine fleet

-

Provide technical expertise

-

Exercise cost control and demonstrate accurate

forecasting

•

Scale produces a market

-

Inventory of assets

-

Competition between suppliers

-

Long-term contracts for percent of contracts |

44

Outage Services: Scheduled Maintenance Program

44

Committed to preserving fleet value through diligent maintenance

2014 -2018 Major Maintenance Schedule

Maintenance Intervals:

•

Combustion Inspection

(Manways open)

-

GE turbine: 12,000/24,000 hrs

-

Siemens turbine: 8,000/16,000/24,000 hrs

•

Hot

Gas

Path

Inspection

(Turbine cover lifted)

-

GE &

Siemens turbines: 24,000 hrs

•

Major Inspection

(Rotor removal, all covers off)

-

GE &

Siemens turbines: 48,000 hrs

5-year average: $350MM

Major maintenance expense and

Capex

Lower $

Higher

$

Rigorous &

Ongoing Maintenance Program

0

10

20

30

40

50

60

70

2014

2015

2016

2017

2018

Combustion inspection

Hot gas path

Major inspection

Steam Turbine Major inspection

Steam Turbine Minor inspection |

45

45

TURBINE TECHNOLOGY

Tom Long

Vice President, Development and Optimization Engineering |

46

•

Technology developing; totally new

platforms

•

Original Siemens G-class and GE H-class

abandoned

•

Units

are

lower

heat

rate,

but

less

flexible:

Cannot meet cycling needs as effectively

Calpine F-Class Fleet: Modern and Competitive

46

F-Class:

Advanced Classes:

•

Technology evolution continuing—but not

revolutionary: OEM’s continue to invest

•

Will continue to be the workhorse of industry

•

All Calpine units upgradable

F-Class Will Continue to Be Industry’s Workhorse

—

Efficient

—

Cyclable

—

Reliable

•

GE 7FA

•

Siemens 501F

•

G-, H-

& J-Class

•

GE, Siemens, Mitsubishi

—

Target customer: Baseload

operations in high gas price

environments (e.g. Korea, Japan,

some regulated U.S. utilities) |

47

5,781

7,240

6,982 -

7,147

636

200

130

0 -

50

235 -

350

Manufacturer

Quoted "New"

HR (LHV)¹

LHV to HHV

Natural Gas

Aux Load

Long-term

Degradation

Ambient

Conditions

(v ISO)

Cycling/

Min Load

Potential

Realized HR

CPN Framed

CCGT Fleet HR-

Non Cogen

(2012)

Making Sense of the Numbers:

Calpine’s Fleet Remains Competitive

47

Calpine’s modern fleet remains competitive as new technology is introduced

Potential to

improve efficiency

given ability to

upgrade with

appropriate market

signals (Fleet only

~25% upgraded)

“Real World”

Operations Necessitate Adjustments

to Published Efficiencies

2

1

LHV: Lower heating value. HHV: Higher heating value. HR: Heat Rate. HR based on

OEM promotional material and ISO ratings. ISO Ratings = 59°F, 60% Relative Humidity, Sea Level

2

Varies from our published fleet-wide steam adjusted heat rate due to exclusion of

technologies other than combine-cycle gas turbines. (2x2x1 Plant)

1 |

48

48

CONSTRUCTION / NEW-BUILD

Ron Hall

Vice President, Engineering and Construction |

49

1

Source: Calpine Data, EIA, November 2010, “Updated Capital Cost Estimates for

Electricity Generation Plants”. Figures shown in 2010 real $. 2

Represents

incremental

baseload

capacity

at

annual

average

conditions.

Incremental

summer

peaking

capacity

is

approximately

200

MW

per

unit,

supplemented

by

incremental

efficiencies

across the balance of the plant.

Regional / Local impacts to construction costs:

•

Lateral

interconnection

costs

(gas,

water,

transmission)

•

Climate

impacts

(inside

versus

outside

STG)

•

Air

cooled

condenser

versus

wet

cooling

tower

•

Seismic

design

•

Zero-liquid

discharge

versus

other

means

•

Noise

and

visual

requirements

•

Availability

of

workforce:

Labor

wages

&

productivity

•

Environmental

restrictions

/

limitations

•

Location

adjustments

Cost of Typical CCGT Plant for various locations

Calpine advantages that lower overall construction costs:

•

Organic

growth:

Existing

plants

with

upgrade

flexibility

–

Oversized steam turbines

–

Combustion turbine upgrades

–

Chillers/Foggers/Power augmentation

•

Surplus

equipment

–

F-class combustion turbines & steam turbines

•

Re-powering

/

Expansion

sites

–

Interconnection capability

–

Site infrastructure (water & gas supply, buildings,

substation)

49

Projected Combined-Cycle Construction Costs

Garrison Energy Center (309 MW)

•

Surplus CTG

•

Gray market STG

•

Competitive EPC pricing

Channel & Deer Park Energy Centers

(260 MW each)

•

Surplus CTG

•

Excess capacity STG

•

Existing infrastructure

advantage

$893

$916

$980

$1,005

$1,164

$1,292

$1,650

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

Texas

Southeast (AL/FL/GA/LA)

Base 2x1 540 MW NGCC

Mid West

Mid Atlantic

California

New York

2

1 |

50

Russell City Energy Center

Hayward, CA

•

464 MW

1

2x2x1 CCGT

•

Siemens FD3 CTGs, GE D-11 STG

•

10 year contract to PG&E

•

Commissioning in progress

•

COD Summer 2013

•

120 MW 4x4x1 CCGT Conversion

•

GE LM 6000 CTGs, MHI STG

•

10 year contract to PG&E

•

Commissioning in progress

•

COD Summer 2013

Los Esteros Critical Energy Facility

San Jose, CA

Deer Park and Channel Energy Centers

Houston, TX

•

260 MW

2

incremental capacity at each site

•

Siemens FD3 CTGs

•

Leveraging existing sites and

equipment

(~ $400/kW savings)

•

Foundations currently being poured

•

COD Summer 2014

Garrison Energy Center

Dover, DE

•

309 MW CCGT greenfield site

•

New GE 7F.04 CTG, A10 STG

•

Leveraging existing equipment and

advantaged site (~ $250/kW savings)

•

Now under construction

•

COD Summer 2015

50

Calpine Construction Projects

1

Represents Calpine share.

2

Represents

incremental

baseload

capacity

at

annual

average

conditions.

Incremental

summer

peaking

capacity

is

approximately

200

MW

per

unit,

supplemented

by

incremental

efficiencies

across the balance of the plant.

Calpine

Construction

Philosophy

•

Owner-furnished

equipment

•

Efficient Calpine

team

•

Deep expertise

•

Leverage best EPC’s |

2013

Investor Day: Regulatory Panel

Thad Miller

Executive Vice President,

Chief Legal Officer

April 10, 2013 |

52

Texas & SE

52

52

Legal and Regulatory Team

EVP, Chief Legal Officer

Thad Miller

Legal

Governmental &

Regulatory

Affairs

Corporate

Communications

Internal Audit/

Compliance

Insurance

Panelist

William Taylor

Environmental

In Attendance

West

North

FERC & ISOs

Federal

Steve Schleimer

Mark Smith

Norma Dunn

Joe Ronan

Derek Furstenwerth

Yvonne McIntyre

Shonnie Daniel

Randy Jones |

53

Overarching Regulatory Themes

Key Fronts for Continued Progress

53

Moving toward fairer, more transparent and stable price signals

•

In CA, seeking to

•

eliminate discrimination between old and new generation

•

obtain appropriate compensation for flexibility attributes of CCGTs

•

In TX, advocating to

•

adopt a capacity market to incent investment, assuring long term

viability of competition

•

in the interim, reduce impediments to scarcity pricing in energy-only market

design •

In PJM, refining MOPR, DR rules to assure a level playing field

Allowing markets (not regulators) to choose “winners”

•

Challenging NJ/MD efforts to exert buyer-side market power subsidizing new plants

•

Opposing legislative/regulatory actions denying ratepayers benefits of lower wholesale

prices through uneconomic

•

utility self-builds (CA, OR, VA, NV, MN)

•

offshore wind (ME, MD) and intermittent renewables (CA)

Role

of

DR

must

align

with

environmental

and

competitive

markets

goals

•

Protect environmental ground gained by limiting DR from behind-the-meter,

uncontrolled, inefficient generator sets to replace retiring coal plants or

otherwise supplant gas generation •

If DR to be compensated similar to generators, assure comparable

performance requirements

and non-performance penalties

Market

Structure/

Rules

Non-

Competitive/

Subsidized

Generation

Demand

Response |

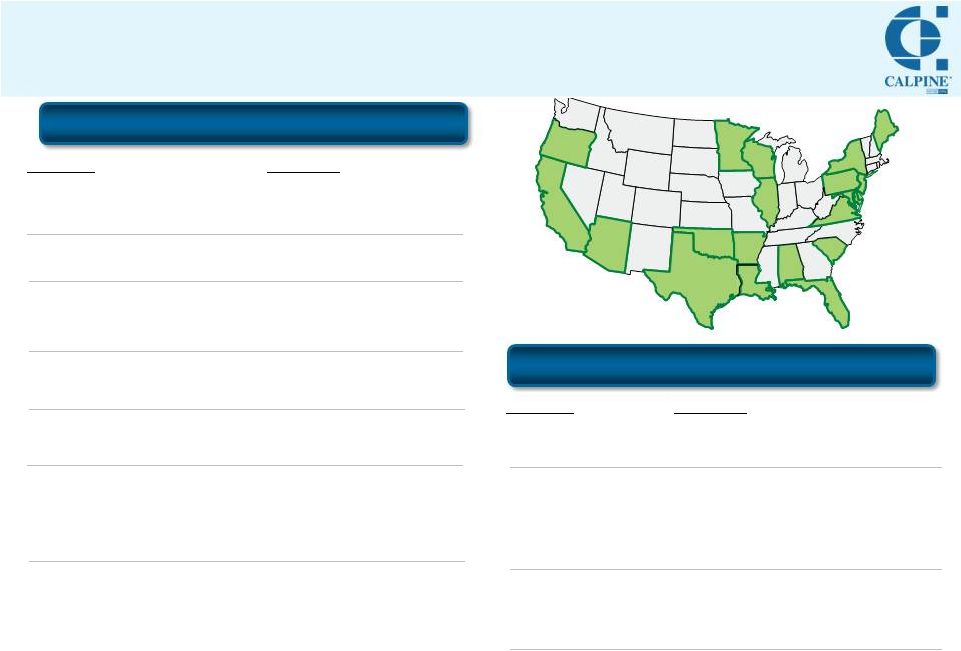

54

54

Advocating for Competitive Markets and Responsible Regulation

As of 4/10/2013

West (CAISO)

•

Assure incremental

compensation for gas

generation with flexibility

attributes critical to

integration of intermittent

renewables

•

End discrimination against

existing (vs. new) generation

and ensure adequate

compensation for existing

generation

•

Support and refine GHG Cap-

and-Trade

Multi-regional

•

o

success in OK,

progress in MN, battles

in CA/OR/NV/VA

Texas (ERCOT)

•

•

o

Safe harbor allows more rational bidding

•

o

PUCT active consideration likely this year

Federal

•

Congress –

inaction likely to continue

o

Climate

Change:

resurgent

o

GHG and other EPA rules:

Unlikely to be blocked

o

PTC:

extended thru ’13

o

Cybersecurity:

Multiple proposals; Executive Order

interim measure

•

EPA –

activism to continue

o

MATS:

In effect, court case slogs on

o

CSAPR:

o

Coal

Ash:

o

316(b)

(OTC):

o

GHG

(new sources):

Rule final this year

o

GHG (existing sources):

Proposed rule on hold

•

CFTC Derivatives Rules

o

CPN qualifies for end-user exemption

•

FERC –

new leadership?

o

Trending positive on support for capacity markets

Rulings on ISO-NE, NY-ISO capacity market rules

NERC letter to ERCOT on resource adequacy

Ruling on CAISO application for “forward

backstop mechanism”

made right noises on

PJM MOPR ruling pending

o

Gas/Electric Interdependency review underway

North (PJM, MISO, ISO-NE, NY-ISO)

•

Continue to refine rules to promote fair and

transparent market precluding

NJ, MD court cases

FERC approval of MOPR fix pending

PJM rules tightened

Challenging dirty DR

•

Oppose MISO capacity transportability into PJM

•

Assure ISO-NE concerns on gas/electric

interdependency lead to market-based solution

not mandate

No

Sandy

surge

but

dialogue

Overturned,

EPA

appealing

to

USSC

Rule

delayed

Final

rule

expected

‘13

Oppose uneconomic

utility self-builds

o

Some

implemented

and

considering

others

affecting operating reserves

Support

interim

changes

to

allow

scarcity

pricing

Approval of Calpine’s Voluntary Mitigation Plan

Support transition to capacity market to assure

long-term reliability

o

Opposed by PJM/some MISO stakeholders

o

FERC to hold conference

o

State exercise of buyer-side market power

o

Special treatment for DR resources |

55

55

APPENDIX |

56

Initiatives

•

FERC Rule on DR

•

FERC Review of

Gas/Electric

Coordination Issues

•

Cybersecurity

•

Dodd-Frank & CFTC

Regulation

Comments

•

Appealed to court asserting unfairly

overcompensates DR relative to

generation and threatens reliability

•

ISO-NE and MISO concerned about gas

transport insufficiency

•

ISO-NE actively examining energy and

capacity market rules changes to help

alleviate problem

•

Executive order issued: government-

private sector information sharing

program and cybersecurity best practices

framework

•

CPN continues

to

qualify for end-user

exemption

56

Environmental Regulation

Initiatives

•

GHG Performance Standards

•

Mercury and Air Toxics Standards

(MATS)

•

Cross-State Air Pollution Rule

(CSAPR)

•

Revised PM-2.5 Ambient Air

Quality Standard

•

Coal Combustion Residuals

Management Rule

•

Cooling Water Intake Structures

(Once-through-cooling Rule)

•

National Emissions Standards for

Hazardous Air Pollutants for

Reciprocating Internal Combustion

Engines (RICE-NESHAP)

Comments

•

Final rule for new sources

expected ‘13

•

Existing sources on hold

•

Effective 4/15

•

Challenged in court but no stay

•

Vacated by Court; remanded to

EPA for revisions; EPA likely to

appeal

•

CAIR in effect

•

Reset PM-2.5 NAAQS based on

latest science; effective by ‘15

•

Regulates bottom ash/sludge/

slag as waste

•

Final rule timing uncertain

•

Reduces impingement/

entrainment impacts on aquatic

life

•

Final rule by mid-’13;

compliance starts mid-2015

•

Final rule contradicts national

environmental goals

•

Being challenged in court

Market Regulation

Regulatory and Legislative Overview: Federal

Continuing the March Toward Responsible Environmental Policy

|

57

Regulatory and Legislative Overview: North Region

Discouraging Non-competitive Resources

57

Non-Competitive/Subsidized Generation

Market Structure/Rules

Demand Response

Initiatives

•

New Jersey (LCAPP) & Maryland

(RFP process) subsidized

generation

•

Utility self-build

•

Renewables

Comments

•

Both trials underway

•

May issue decision prior to May

auction

•

Challenging competitiveness of

rate based assets in VA, MN

•

Offshore Wind: MD law passed,

but with significant safeguards; NJ

still examining policies

•

Canadian Hydro: CT proposal to

count as “Tier 1”

renewable

Initiatives

•

Capacity Markets

Comments

•

PJM: Strengthening MOPR

process

•

ISO-NE: FERC approved strong

buyer-side market power rules

over objections of states; price

floor going away in next auction

•

NY-ISO: FERC approves

generators’

complaint over

implementation of buyer-side

market power rules

Initiatives

•

Treatment and impact of

increasing role of demand

response

Comments

•

Court challenge to RICE NESHAP

(dirty DR) filed

•

ISO-NE/PJM continue to

strengthen DR rules

Other Regional Issues

Initiatives

•

Regional Greenhouse Gas

Initiative (RGGI)

•

“Seams”

Issues

Comments

•

Tighter GHG caps proposed

across region

•

PA and NJ key states out of

program, creating “leakage”

•

MISO/PJM addressing

operational improvements and

capacity portability by MISO

into PJM |

58

Regulatory and Legislative Overview: Texas Region

Incentivizing New Capacity

58

Market Structure/Rules

Other Regional Issues

Initiatives

•

PUCT Resource Adequacy

Proceedings

•

PUCT Scarcity Pricing

Proceedings

•

Capacity, Demand and Reserves

(CDR) forecast

•

Demand Response Proceeding

•

Calpine’s Voluntary Mitigation

Plan (VMP)

•

ERCOT Scarcity Pricing

Proceedings

Comments

•

Required v. target reserve margin

•

Energy-only v. capacity market

•

Increased System Wide Offer Cap

•

Considering interim operating reserve

demand curve proposals:

•

PUCT/ERCOT review of inputs for bi-

annual CDR to establish appropriate

reserve margin target

•

PUCT considering how to

incorporate/increase DR (economic

and reliability response) without

adverse impact to market

•

PUCT approved plan (3/28) provides:

•

Limiting mitigation to resources that

contribute to real-time non-

competitive constraints

•

Reducing deployment of Regulation-

Up service

Initiatives

•

2013 Legislative Agenda

•

PUCT Commissioner

update

Comments

•

PUCT Sunset review

•

Proposed legislation requiring cost-

benefit analysis before changing

market structure

•

Environmental legislation authorizing

TX to assume authority from EPA for

GHG permitting

•

Pablos replacement not likely until

after end of regular legislative

session (May 27)

o

establishing “price adder”

to

existing real-time scarcity price

o

adding operating reserves with

$350/MWh floor (Non-Spin Res.)

o

informal bidding guidance for

other market participants

o

creates safe harbor against market

power abuse charges

o

guidelines for CPN’s bidding behavior |

59

Initiatives

•

CPUC: Long Term Planning &

Procurement (LTPP)

•

CPUC: Resource Adequacy (RA)

•

CAISO: Forward Capacity

Procurement Initiatives

Comments

•

Pursuing new products that:

Regulatory and Legislative Overview: West Region

Properly Compensating Existing, Flexible Generation

59

Market Structure/Rules

Non-Competitive/Subsidized Generation

Other Regional Issues

Initiatives

•

Utility self-build (or BOT)

•

Subsidized renewables and

generation alternatives (DR,

Storage, etc.)

Comments

•

Regulators continue to support

uneconomic/unneeded projects

at expense of existing generation

and ratepayer

•

Policies continue to increase

renewable investment and drive

need for system flexibility for

integration of renewables

•

GHG reduction policies focus on

uneconomic alternatives to

conventional generation

Initiatives

•

California Air Resources Board

(CARB) GHG Cap-and-Trade

Program (AB32)

•

Water Resources Control Board:

Once-Through-Cooling (OTC)

Comments

•

Emissions market functioning

with two auctions already held

•

CARB staff reviewing rules

refinements to assure long term

viability of market

•

Replacement of OTC units: Part

of IOU procurement analysis

being discussed at CPUC & CEC

o

Provide incentive for procurement

of existing generation intermediate

term

o

Allow existing and new power

plants to compete on equal basis

(FERC ruling on CAISO forward

backstop creates pressure point)

o

Compensate flexible gas

generation critical to integration of

intermittent renewables |

2013

Investor Day: Financial Overview

Zamir Rauf

Exec. Vice President, Chief Financial Officer

April 10, 2013 |

61

Note: Debt balances as of 12/31/12.

1 Includes net debt of unconsolidated projects.

2 Figures

based

upon

TTM

(2012)

Adjusted

EBITDA.

Calculation

excludes

project

debt

associated

with

Russell

City

and

Los

Esteros

while

under

construction,

as

well

as

effective

corporate

debt

(equivalent

capital spend) for Garrison, Deer Park and Channel projects.

3 A non-GAAP financial measure. Reconciliations of Adjusted EBITDA and

Adjusted Free Cash Flow to Net Income (Loss), the most comparable U.S. GAAP measure, are included herein.

Capital Structure Optimization

Opportunistically managing maturities and streamlining capital structure

while

delivering

interest

savings

and

increasing

Adj.

FCF /share

Recent Activities:

Delivered

~ $0.08

Adj.

FCF /Share

Savings

•

Oct 2012:

—

Issued term loan to refinance 10% of Sr. Secured

Notes ($590 MM) and retire BRSP ($218 MM)

—

~$25 MM annual interest savings

•

Feb 2013:

—

Repriced all $2.5B of term loans

—

~$12 MM annual interest savings

Upcoming Opportunities:

•

8.0% CCFC bonds due 2016

—

$1 billion callable at 104 in Jun 2013

•

7.25% Senior Secured Notes due 2017

—

$1.08 billion callable at 103.6 in Oct 2013

•

10%

of

all

Senior

Secured

Notes

(7.25%

-

8.0%)

—

Currently callable at 103 in twelve month intervals

(next opportunity: Oct 2013)

CCFC

$978

Capital Leases

$217

Notes Payable/

Other

$47

Gross Debt:

$10,750

Less: Cash, Cash Equivalents & Rest. Cash:

$(1,537)

Net Debt

:

$9,405

Net

Debt

/

Adjusted

EBITDA

:

4.9x

Average Interest Rate:

2008

8.8%

2013

7.3%

Corporate Debt

Senior Secured Notes

$5,303

First Lien Term Loan

$2,463

Corporate Revolver

—

Total Corporate

Debt $7,766

Project Debt

$1,742

($ millions)

61

3

3

1

1

2 |

62

Strong Liquidity, No Near-Term Refinancing Risk

62

No

Near-Term

Maturities

Projected Scheduled Amortizations

& Estimated Cash Sweeps

($ millions)

Represents ~$1B of debt paydown

Minimum:

$1 billion

Strong Liquidity / Better Quality

Capital Allocation Flexibility

Project Debt

CCFC

Senior Secured Notes

Senior Secured Term Loans

Restricted Cash

Cash

and Cash Equivalents, Non-corporate

Cash

and Cash Equivalents, Corporate

Revolver / LC Availability

1

Debt maturity schedule shown here is not prepared on a U.S. GAAP basis and does not

conform to debt maturity schedule presented in Calpine’s Form 10-K. (Refer to the 2012 Form 10-K for further

information regarding U.S. GAAP-basis debt maturities). Assumptions used in

debt maturity charts shown here are as follows: (i) excludes letter of credit facilities; (ii) maturity balances assume cash

sweeps; and (iii) all other debt maturities are paid from operating cash flows at the

project level. Project debt in 2019 represents projected balance for OMEC. Put price in the PPA approximates the

projected debt balance.

1

$658

$567

$757

$1,058

$946

$1,153

$269

$306

$131

$248

$194

$253

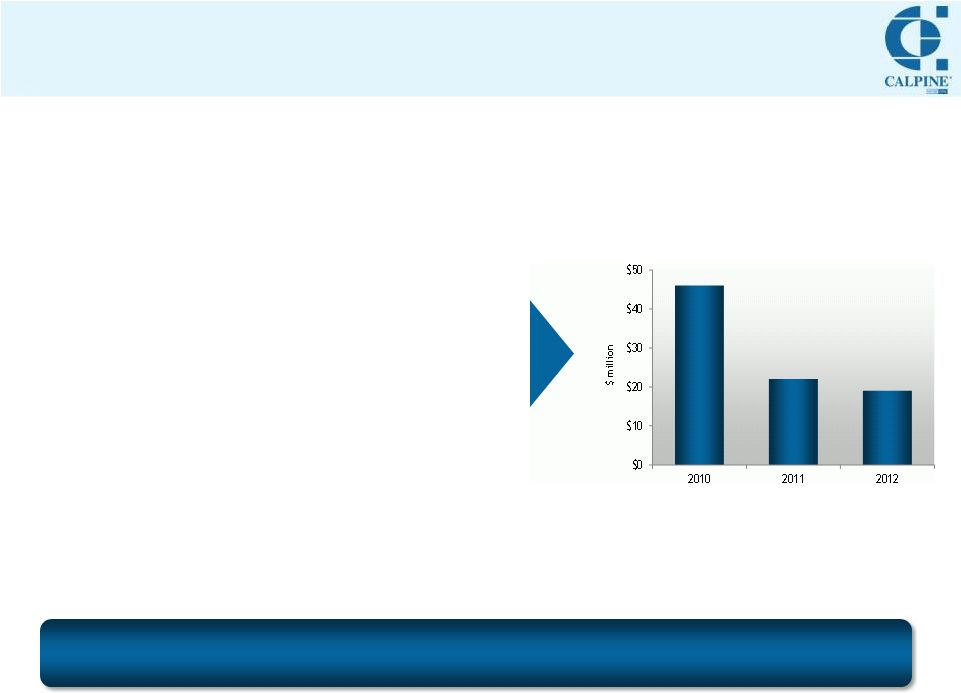

2010

2011

2012

Calpine

Peers

Environmental CapEx

Legacy Environmental Liabilities

Decommissioning Liabilities

Underfunded Pension Liability

Cash Taxes

Discretionary Capital Allocation

$1,000

$1,080

$1,368

$1,544

$1,421

$990

$1,800

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

$140

$180

$190

$200

$210

2013

2014

2015

2016

2017

$2,294

$2,013

$2,233 |

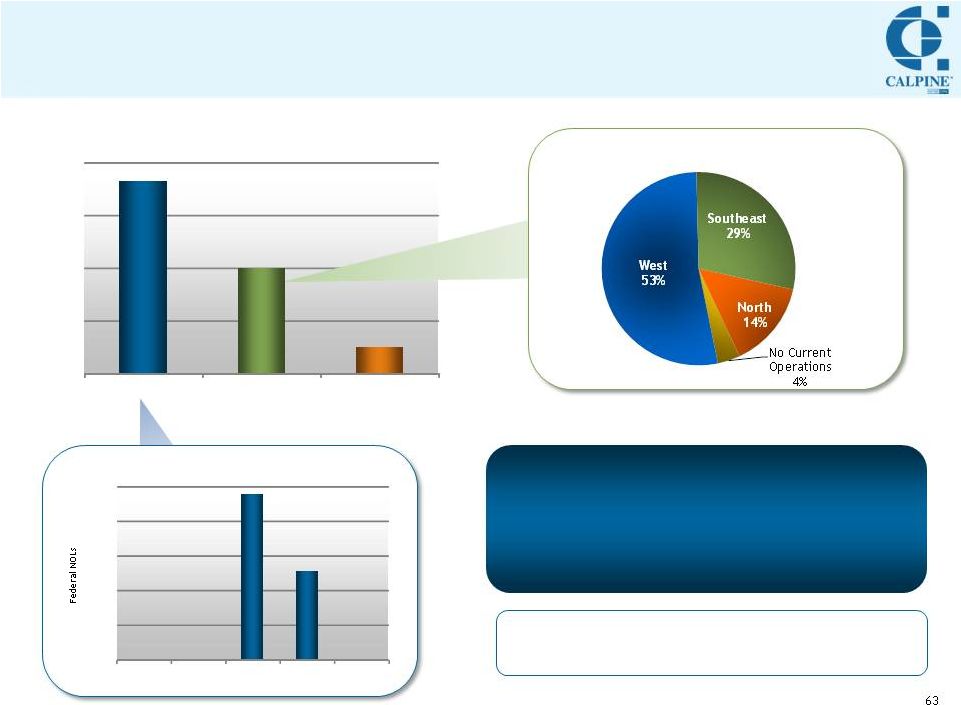

63

NOLs: Additional Source of Value

NOL Summary

NOL usage enhances excess liquidity

available for capital deployment

NOL Benefits

Cash tax savings since 2010

~$250 MM