Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER AND CHIEF FINANCIAL OFFICER - CALPINE CORP | cpn_exhibit321x12312015.htm |

| EX-23.1 - CONSENT OF PRICEWATERHOUSECOOPERS - CALPINE CORP | cpn_exhibit231x12312015.htm |

| EX-31.2 - SECTION 302 CERTIFICATION OF CFO - CALPINE CORP | cpn_exhibit312x12312015.htm |

| EX-12.1 - COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES - CALPINE CORP | cpn_exhibit121x12312015.htm |

| EX-21.1 - SUBSIDIARIES OF THE COMPANY - CALPINE CORP | cpn_exhibit211x12312015.htm |

| EX-31.1 - SECTION 302 CERTIFICATION OF CEO - CALPINE CORP | cpn_exhibit311x12312015.htm |

| EX-10.1.19 - AMENDMENT NO. 3 TO THE CREDIT AGREEMENT, DATED AS OF FEBRUARY 8, 2016 - CALPINE CORP | cpn_exhibit10119-calpiner.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

Form 10-K

[X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2015 | ||

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | ||

Commission File No. 001-12079

______________________

Calpine Corporation

(A Delaware Corporation)

I.R.S. Employer Identification No. 77-0212977

717 Texas Avenue, Suite 1000, Houston, Texas 77002

Telephone: (713) 830-2000

Not Applicable

(Former Address)

Securities registered pursuant to Section 12(b) of the Act:

Calpine Corporation Common Stock, $0.001 Par Value

Name of each exchange on which registered:

New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer, “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [X] | Accelerated filer [ ] | |

Non-accelerated filer [ ] | Smaller reporting company [ ] | |

(Do not check if a smaller reporting company) | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter: approximately $6,445 million.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: Calpine Corporation: 356,660,646 shares of common stock, par value $0.001, were outstanding as of February 10, 2016.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the documents listed below have been incorporated by reference into the indicated parts of this Report, as specified in the responses to the item numbers involved.

Designated portions of the Proxy Statement relating to the 2016 Annual Meeting of Shareholders are incorporated by reference into Part III to the extent described therein.

CALPINE CORPORATION AND SUBSIDIARIES

FORM 10-K

ANNUAL REPORT

For the Year Ended December 31, 2015

TABLE OF CONTENTS

Page | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

i

DEFINITIONS

As used in this annual report for the year ended December 31, 2015, the following abbreviations and terms have the meanings as listed below. Additionally, the terms “Calpine,” “we,” “us” and “our” refer to Calpine Corporation and its consolidated subsidiaries, unless the context clearly indicates otherwise. The term “Calpine Corporation” refers only to Calpine Corporation and not to any of its subsidiaries. Unless and as otherwise stated, any references in this Report to any agreement means such agreement and all schedules, exhibits and attachments in each case as amended, restated, supplemented or otherwise modified to the date of filing this Report.

ABBREVIATION | DEFINITION | |

2017 First Lien Notes | The $1.2 billion aggregate principal amount of 7.25% senior secured notes due 2017, issued October 21, 2009, and repaid in a series of transactions on November 7, 2012, October 31, 2013 and December 2, 2013 | |

2018 First Lien Term Loans | Collectively, the $1.3 billion first lien senior secured term loan dated March 9, 2011 and the $360 million first lien senior secured term loan dated June 17, 2011, in each case repaid on May 28, 2015 | |

2019 First Lien Notes | The $400 million aggregate principal amount of 8.0% senior secured notes due 2019, issued May 25, 2010, and repaid in a series of transactions on November 7, 2012, December 2, 2013 and July 22, 2014 | |

2019 First Lien Term Loan | The $835 million first lien senior secured term loan, dated October 9, 2012, among Calpine Corporation, as borrower, the lenders party thereto, Morgan Stanley Senior Funding, Inc., as administrative agent and Goldman Sachs Credit Partners L.P., as collateral agent | |

2020 First Lien Notes | The $1.1 billion aggregate principal amount of 7.875% senior secured notes due 2020, issued July 23, 2010, and repaid in a series of transactions on November 7, 2012, December 2, 2013 and July 22, 2014 | |

2020 First Lien Term Loan | The $390 million first lien senior secured term loan, dated October 23, 2013, among Calpine Corporation, as borrower, the lenders party thereto, Citibank, N.A., as administrative agent and Goldman Sachs Credit Partners L.P., as collateral agent | |

2021 First Lien Notes | The $2.0 billion aggregate principal amount of 7.5% senior secured notes due 2021, issued October 22, 2010, and repaid in a series of transactions on November 7, 2012, December 2, 2013 and July 22, 2014 | |

2022 First Lien Notes | The $750 million aggregate principal amount of 6.0% senior secured notes due 2022, issued October 31, 2013 | |

2022 First Lien Term Loan | The $1.6 billion first lien senior secured term loan, dated May 28, 2015, among Calpine Corporation, as borrower, the lenders party thereto, Morgan Stanley Senior Funding, Inc., as administrative agent and Goldman Sachs Credit Partners L.P., as collateral agent | |

2023 First Lien Notes | The $1.2 billion aggregate principal amount of 7.875% senior secured notes due 2023, issued January 14, 2011, and partially repaid in a series of transactions on November 7, 2012, December 2, 2013, December 4, 2014 and December 7, 2015 | |

2023 First Lien Term Loan | The $550 million first lien senior secured term loan, dated December 15, 2015, among Calpine Corporation, as borrower, the lenders party thereto, Morgan Stanley Senior Funding, Inc., as administrative agent and Goldman Sachs Credit Partners L.P., as collateral agent | |

2023 Senior Unsecured Notes | The $1.25 billion aggregate principal amount of 5.375% senior unsecured notes due 2023, issued July 22, 2014 | |

2024 First Lien Notes | The $490 million aggregate principal amount of 5.875% senior secured notes due 2024, issued October 31, 2013 | |

2024 Senior Unsecured Notes | The $650 million aggregate principal amount of 5.5% senior unsecured notes due 2024, issued February 3, 2015 | |

ii

ABBREVIATION | DEFINITION | |

2025 Senior Unsecured Notes | The $1.55 billion aggregate principal amount of 5.75% senior unsecured notes due 2025, issued July 22, 2014 | |

AB 32 | California Assembly Bill 32 | |

Adjusted EBITDA | EBITDA as adjusted for the effects of (a) impairment charges, (b) major maintenance expense, (c) operating lease expense, (d) gains or losses on commodity derivative mark-to-market activity, (e) adjustments to reflect only the Adjusted EBITDA from our unconsolidated investments, (f) adjustments to exclude the Adjusted EBITDA related to the noncontrolling interest, (g) stock-based compensation expense, (h) gains or losses on sales, dispositions or retirements of assets, (i) non-cash gains and losses from foreign currency translations, (j) gains or losses on the repurchase, modification or extinguishment of debt, (k) non-cash GAAP-related adjustments to levelize revenues from tolling agreements and (l) other extraordinary, unusual or non-recurring items | |

AOCI | Accumulated Other Comprehensive Income | |

Average availability | Represents the total hours during the period that our plants were in-service or available for service as a percentage of the total hours in the period | |

Average capacity factor, excluding peakers | A measure of total actual power generation as a percent of total potential power generation. It is calculated by dividing (a) total MWh generated by our power plants, excluding peakers, by (b) the product of multiplying (i) the average total MW in operation, excluding peakers, during the period by (ii) the total hours in the period | |

Bcf | Billion cubic feet | |

Btu | British thermal unit(s), a measure of heat content | |

CAA | Federal Clean Air Act, U.S. Code Title 42, Chapter 85 | |

CAIR | Clean Air Interstate Rule | |

CAISO | California Independent System Operator | |

Calpine Equity Incentive Plans | Collectively, the Director Plan and the Equity Plan, which provide for grants of equity awards to Calpine non-union employees and non-employee members of Calpine’s Board of Directors | |

Cap-and-Trade | A government imposed emissions reduction program that would place a cap on the amount of emissions that can be emitted from certain sources, such as power plants. In its simplest form, the cap amount is set as a reduction from the total emissions during a base year and for each year over a period of years the cap amount would be reduced to achieve the targeted overall reduction by the end of the period. Allowances or credits for emissions in an amount equal to the cap would be issued or auctioned to companies with facilities, permitting them to emit up to a certain amount of emissions during each applicable period. After allowances have been distributed or auctioned, they can be transferred or traded | |

CARB | California Air Resources Board | |

CCFC | Calpine Construction Finance Company, L.P., an indirect, wholly-owned subsidiary of Calpine | |

CCFC Notes | The $1.0 billion aggregate principal amount of 8.0% senior secured notes due 2016 issued May 19, 2009 by CCFC and CCFC Finance Corp and repaid on June 3, 2013 | |

CCFC Term Loans | Collectively, the $900 million first lien senior secured term loan and the $300 million first lien senior secured term loan entered into on May 3, 2013, and the $425 million first lien senior secured term loan entered into on February 26, 2014, between CCFC, as borrower, and Goldman Sachs Lending Partners, LLC, as administrative agent and as collateral agent, and the lenders party thereto | |

iii

ABBREVIATION | DEFINITION | |

CDHI | Calpine Development Holdings, Inc., an indirect, wholly-owned subsidiary of Calpine | |

CFTC | Commodities Futures Trading Commission | |

Champion Energy | Champion Energy Marketing, LLC, which owns a retail electric provider that serves residential, governmental, commercial and industrial customers in deregulated electricity markets in Texas, Illinois, Pennsylvania, Ohio, New Jersey, Maryland, Massachusetts and New York | |

Chapter 11 | Chapter 11 of the U.S. Bankruptcy Code | |

CO2 | Carbon dioxide | |

COD | Commercial operations date | |

Cogeneration | Using a portion or all of the steam generated in the power generating process to supply a customer with steam for use in the customer's operations | |

Commodity expense | The sum of our expenses from fuel and purchased energy expense, fuel transportation expense, transmission expense, environmental compliance expense and realized settlements from our marketing, hedging and optimization activities including natural gas and fuel oil transactions hedging future power sales, but excludes our mark-to-market activity | |

Commodity Margin | Non-GAAP financial measure that includes power and steam revenues, sales of purchased power and physical natural gas, capacity revenue, REC revenue, sales of surplus emission allowances, transmission revenue and expenses, fuel and purchased energy expense, fuel transportation expense, environmental compliance expense, and realized settlements from our marketing, hedging, optimization and trading activities, but excludes our mark-to-market activity and other revenues | |

Commodity revenue | The sum of our revenues from power and steam sales, sales of purchased power and physical natural gas, capacity revenue, REC revenue, sales of surplus emission allowances, transmission revenue and realized settlements from our marketing, hedging, optimization and trading activities, but excludes our mark-to-market activity | |

Company | Calpine Corporation, a Delaware corporation, and its subsidiaries | |

Corporate Revolving Facility | The $1.7 billion aggregate amount revolving credit facility credit agreement, dated as of December 10, 2010, as amended on June 27, 2013, July 30, 2014 and February 8, 2016, among Calpine Corporation, Goldman Sachs Bank USA, as administrative agent, Goldman Sachs Credit Partners L.P., as collateral agent, the lenders party thereto and the other parties thereto | |

CPUC | California Public Utilities Commission | |

CSAPR | Cross-State Air Pollution Rule | |

D.C. Circuit | U.S. Court of Appeals for the District of Columbia Circuit | |

Director Plan | The Amended and Restated Calpine Corporation 2008 Director Incentive Plan | |

Dodd-Frank Act | The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 | |

EBITDA | Net income (loss) attributable to Calpine before net (income) loss attributable to the noncontrolling interest, interest, taxes, depreciation and amortization | |

EIA | Energy Information Administration of the U.S. Department of Energy | |

EPA | U.S. Environmental Protection Agency | |

iv

ABBREVIATION | DEFINITION | |

Equity Plan | The Amended and Restated Calpine Corporation 2008 Equity Incentive Plan | |

ERCOT | Electric Reliability Council of Texas | |

EWG(s) | Exempt wholesale generator(s) | |

Exchange Act | U.S. Securities Exchange Act of 1934, as amended | |

FASB | Financial Accounting Standards Board | |

FDIC | U.S. Federal Deposit Insurance Corporation | |

FERC | U.S. Federal Energy Regulatory Commission | |

First Lien Notes | Collectively, the 2022 First Lien Notes, the 2023 First Lien Notes and the 2024 First Lien Notes | |

First Lien Term Loans | Collectively, the 2019 First Lien Term Loan, the 2020 First Lien Term Loan, the 2022 First Lien Term Loan and the 2023 First Lien Term Loan | |

FRCC | Florida Reliability Coordinating Council | |

GE | General Electric International, Inc. | |

Geysers Assets | Our geothermal power plant assets, including our steam extraction and gathering assets, located in northern California consisting of 14 operating power plants | |

GHG(s) | Greenhouse gas(es), primarily carbon dioxide (CO2), and including methane (CH4), nitrous oxide (N2O), sulfur hexafluoride (SF6), hydrofluorocarbons (HFCs) and perfluorocarbons (PFCs) | |

Greenfield LP | Greenfield Energy Centre LP, a 50% partnership interest between certain of our subsidiaries and a third party which operates the Greenfield Energy Centre, a 1,038 MW natural gas-fired, combined-cycle power plant in Ontario, Canada | |

Heat Rate(s) | A measure of the amount of fuel required to produce a unit of power | |

Hg | Mercury | |

IRC | Internal Revenue Code | |

IRS | U.S. Internal Revenue Service | |

ISO(s) | Independent System Operator(s) | |

ISO-NE | ISO New England Inc., an independent nonprofit RTO serving states in the New England area, including Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island and Vermont | |

KWh | Kilowatt hour(s), a measure of power produced, purchased or sold | |

LIBOR | London Inter-Bank Offered Rate | |

LTSA(s) | Long-Term Service Agreement(s) | |

Market Heat Rate(s) | The regional power price divided by the corresponding regional natural gas price | |

MATS | Mercury and Air Toxics Standard | |

v

ABBREVIATION | DEFINITION | |

MISO | Midwest ISO | |

MMBtu | Million Btu | |

MRO | Midwest Reliability Organization | |

MW | Megawatt(s), a measure of plant capacity | |

MWh | Megawatt hour(s), a measure of power produced, purchased or sold | |

NAAQS | National Ambient Air Quality Standards | |

NERC | North American Electric Reliability Council | |

NOL(s) | Net operating loss(es) | |

NOx | Nitrogen oxides | |

NPCC | Northeast Power Coordinating Council | |

NYISO | New York ISO | |

NYMEX | New York Mercantile Exchange | |

NYSE | New York Stock Exchange | |

OCI | Other Comprehensive Income | |

OMEC | Otay Mesa Energy Center, LLC, an indirect, wholly-owned subsidiary of Calpine that owns the Otay Mesa Energy Center, a 608 MW natural gas-fired, combined-cycle power plant located in San Diego county, California | |

OTC | Over-the-Counter | |

PG&E | Pacific Gas & Electric Company | |

PJM | PJM Interconnection is a RTO that coordinates the movement of wholesale electricity in all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia | |

PPA(s) | Any term power purchase agreement or other contract for a physically settled sale (as distinguished from a financially settled future, option or other derivative or hedge transaction) of any power product, including power, capacity and/or ancillary services, in the form of a bilateral agreement or a written or oral confirmation of a transaction between two parties to a master agreement, including sales related to a tolling transaction in which the purchaser provides the fuel required by us to generate such power and we receive a variable payment to convert the fuel into power and steam | |

PSD | Prevention of Significant Deterioration | |

PUCT | Public Utility Commission of Texas | |

PUHCA 2005 | U.S. Public Utility Holding Company Act of 2005 | |

PURPA | U.S. Public Utility Regulatory Policies Act of 1978 | |

vi

ABBREVIATION | DEFINITION | |

QF(s) | Qualifying facility(ies), which are cogeneration facilities and certain small power production facilities eligible to be “qualifying facilities” under PURPA, provided that they meet certain power and thermal energy production requirements and efficiency standards. QF status provides an exemption from the books and records requirement of PUHCA 2005 and grants certain other benefits to the QF | |

REC(s) | Renewable energy credit(s) | |

Report | This Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC on February 12, 2016 | |

Reserve margin(s) | The measure of how much the total generating capacity installed in a region exceeds the peak demand for power in that region | |

RFC | Reliability First Corporation | |

RGGI | Regional Greenhouse Gas Initiative | |

Risk Management Policy | Calpine’s policy applicable to all employees, contractors, representatives and agents, which defines the risk management framework and corporate governance structure for commodity risk, interest rate risk, currency risk and other risks | |

RMR Contract(s) | Reliability Must Run contract(s) | |

RPS | Renewable Portfolio Standard | |

RTO(s) | Regional Transmission Organization(s) | |

SEC | U.S. Securities and Exchange Commission | |

Securities Act | U.S. Securities Act of 1933, as amended | |

Senior Unsecured Notes | Collectively, the 2023 Senior Unsecured Notes, the 2024 Senior Unsecured Notes and the 2025 Senior Unsecured Notes | |

SERC | Southeastern Electric Reliability Council | |

SO2 | Sulfur dioxide | |

Spark Spread(s) | The difference between the sales price of power per MWh and the cost of natural gas to produce it | |

Steam Adjusted Heat Rate | The adjusted Heat Rate for our natural gas-fired power plants, excluding peakers, calculated by dividing (a) the fuel consumed in Btu reduced by the net equivalent Btu in steam exported to a third party by (b) the KWh generated. Steam Adjusted Heat Rate is a measure of fuel efficiency, so the lower our Steam Adjusted Heat Rate, the lower our cost of generation | |

Steamboat | Calpine Steamboat Holdings, LLC, an indirect, wholly-owned subsidiary of Calpine Corporation | |

TCEQ | Texas Commission on Environmental Quality | |

TRE | Texas Reliability Entity, Inc. | |

TSR | Total shareholder return | |

U.S. GAAP | Generally accepted accounting principles in the U.S. | |

VAR | Value-at-risk | |

VIE(s) | Variable interest entity(ies) | |

vii

ABBREVIATION | DEFINITION | |

WECC | Western Electricity Coordinating Council | |

Whitby | Whitby Cogeneration Limited Partnership, a 50% partnership interest between certain of our subsidiaries and a third party which operates Whitby, a 50 MW natural gas-fired, simple-cycle cogeneration power plant located in Ontario, Canada | |

viii

Forward-Looking Statements

This Report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Exchange Act. Forward-looking statements may appear throughout this Report, including without limitation, the “Management’s Discussion and Analysis” section. We use words such as “believe,” “intend,” “expect,” “anticipate,” “plan,” “may,” “will,” “should,” “estimate,” “potential,” “project” and similar expressions to identify forward-looking statements. Such statements include, among others, those concerning our expected financial performance and strategic and operational plans, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and that a number of risks and uncertainties could cause actual results to differ materially from those anticipated in the forward-looking statements. Such risks and uncertainties include, but are not limited to:

• | Financial results that may be volatile and may not reflect historical trends due to, among other things, seasonality of demand, fluctuations in prices for commodities such as natural gas and power, changes in U.S. macroeconomic conditions, fluctuations in liquidity and volatility in the energy commodities markets and our ability and extent to which we hedge risks; |

• | Laws, regulations and market rules in the markets in which we participate and our ability to effectively respond to changes in laws, regulations or market rules or the interpretation thereof including those related to the environment, derivative transactions and market design in the regions in which we operate; |

• | Our ability to manage our liquidity needs, access the capital markets when necessary and comply with covenants under our Senior Unsecured Notes, First Lien Notes, First Lien Term Loans, Corporate Revolving Facility, CCFC Term Loans and other existing financing obligations; |

• | Risks associated with the operation, construction and development of power plants, including unscheduled outages or delays and plant efficiencies; |

• | Risks related to our geothermal resources, including the adequacy of our steam reserves, unusual or unexpected steam field well and pipeline maintenance requirements, variables associated with the injection of water to the steam reservoir and potential regulations or other requirements related to seismicity concerns that may delay or increase the cost of developing or operating geothermal resources; |

• | Competition, including renewable sources of power and risks associated with marketing and selling power in the evolving energy markets; |

• | Structural changes in the supply and demand of power, resulting from the development of new fuels or technologies and demand-side management tools (such as distributed generation, power storage and other technologies); |

• | The expiration or early termination of our PPAs and the related results on revenues; |

• | Future capacity revenue may not occur at expected levels; |

• | Natural disasters, such as hurricanes, earthquakes, droughts, wildfires and floods, acts of terrorism or cyber attacks that may impact our power plants or the markets our power plants or retail operations serve and our corporate headquarters; |

• | Disruptions in or limitations on the transportation of natural gas or fuel oil and the transmission of power; |

• | Our ability to manage our customer and counterparty exposure and credit risk, including our commodity positions; |

• | Our ability to attract, motivate and retain key employees; |

• | Present and possible future claims, litigation and enforcement actions that may arise from noncompliance with market rules promulgated by the SEC, CFTC, FERC and other regulatory bodies; and |

• | Other risks identified in this Report. |

Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. Many of these factors are beyond our ability to control or predict. Our forward-looking statements speak only as of the date of this Report. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

1

Where You Can Find Other Information

Our website is www.calpine.com. Information contained on our website is not part of this Report. Information that we furnish or file with the SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to, or exhibits included in, these reports are available for download, free of charge, on our website as soon as reasonably practicable after such materials are filed with or furnished to the SEC. Our SEC filings, including exhibits filed therewith, are also available on the SEC’s website at www.sec.gov. You may obtain and copy any document we furnish or file with the SEC at the SEC’s public reference room at 100 F Street, NE, Room 1580, Washington, D.C. 20549. You may obtain information on the operation of the SEC’s public reference facilities by calling the SEC at 1-800-SEC-0330. You may request copies of these documents, upon payment of a duplicating fee, by writing to the SEC at its principal office at 100 F Street, NE, Room 1580, Washington, D.C. 20549.

2

PART I

Item 1. | Business |

BUSINESS AND STRATEGY

Business

We are a premier power producer with 84 power plants, including one under construction, located in competitive wholesale power markets primarily in the U.S. We measure our success by delivering long-term shareholder value. We accomplish this through our focus on operational excellence at our power plants and in our commercial activity and through our disciplined approach to capital allocation that includes investing in growth, returning money to shareholders, and prudently managing our balance sheet.

Our capital allocation philosophy seeks to maximize levered cash returns to equity on a per share basis while maintaining a strong balance sheet. We consider the repurchases of our own shares of common stock as an attractive investment opportunity, and we utilize the expected returns from this investment as the benchmark against which we evaluate all other capital allocation decisions. We believe this philosophy closely aligns our objectives with those of our shareholders.

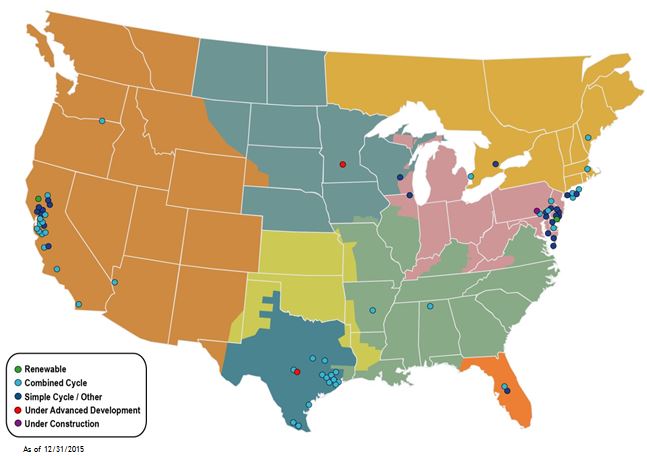

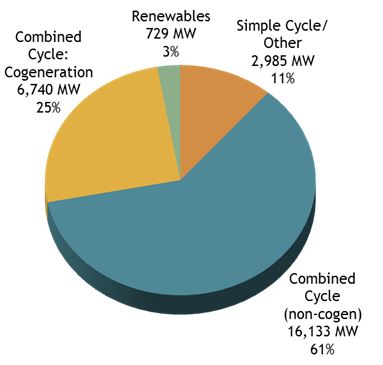

We are one of the largest power generators in the U.S. measured by power produced. We own and operate primarily natural gas-fired and geothermal power plants in North America and have a significant presence in major competitive wholesale power markets in California (included in our West segment), Texas (included in our Texas segment) and the Northeast and Mid-Atlantic regions (included in our East segment) of the U.S. Since our inception in 1984, we have been a leader in environmental stewardship. We have invested in clean power generation to become a recognized leader in developing, constructing, owning and operating an environmentally responsible portfolio of flexible and reliable power plants. Our portfolio is primarily comprised of two types of power generation technologies: natural gas-fired combustion turbines, which are primarily efficient combined-cycle plants, and renewable geothermal conventional steam turbines. We are among the world’s largest owners and operators of industrial gas turbines as well as cogeneration power plants. Our Geysers Assets located in northern California represent the largest geothermal power generation portfolio in the U.S. as well as the largest single producing power generation asset of all renewable energy in the state of California.

We sell power, steam, capacity, renewable energy credits and ancillary services to our customers, which include utilities, independent electric system operators, industrial and agricultural companies, retail power providers, municipalities and other governmental entities, power marketers as well as retail commercial, industrial and residential customers. Effective after the October 1, 2015 acquisition, we entered the retail market in scale through our retail subsidiary, Champion Energy. We purchase primarily natural gas and some fuel oil as fuel for our power plants and engage in related natural gas transportation and storage transactions. We purchase electric transmission rights to deliver power to our customers. Additionally, consistent with our Risk Management Policy, we enter into natural gas, power, environmental product, fuel oil and other physical and financial contracts to hedge certain business risks and optimize our portfolio of power plants. Seasonality and weather can have a significant impact on our results of operations and are also considered in our hedging and optimization activities.

Subsequent to the completion of our purchase of Granite Ridge Energy Center on February 5, 2016, our portfolio, including partnership interests, consists of 84 power plants, including one under construction, located throughout 19 states in the U.S. and in Canada, with an aggregate current generation capacity of 27,282 MW and 760 MW under construction. Our fleet, including projects under construction, consists of 68 natural gas-fired combustion turbine-based plants, one fuel oil-fired steam-based plant, 14 geothermal steam turbine-based plants and one photovoltaic solar plant. In 2015, our fleet of power plants produced approximately 115 billion KWh of electric power for our customers. In addition, we are one of the largest consumers of natural gas in North America. In 2015, we consumed 878 Bcf or approximately 9% of the total estimated natural gas consumed for power generation in the U.S. We are actively working to build a pipeline of development and growth options for our generation capacity including both natural gas and renewables including geothermal. We also are actively seeking to continue to grow our wholesale and retail sales efforts.

We believe our unique fleet compares favorably with those of our major competition on the basis of environmental stewardship, scale and geographical diversity. The discovery and exploitation of natural gas from shale combined with our modern and efficient combined-cycle power plants has created short-term and long-term advantages. In the short-term, we are often the lowest cost resource to dispatch compared to other fuel types as demonstrated in recent years when we realized meaningfully higher capacity factors than we have historically given our ability to displace other fuel types and older technologies. In the long-term, when compared on a full life-cycle cost, we believe our power plants will be even more competitive when considering the greater non-fuel operating costs and potential environmental liabilities associated with other technologies.

3

The environmental profile of our power plants reflects our commitment to environmental leadership and stewardship. We have invested the capital necessary to develop a power generation portfolio that has substantially lower air emissions compared to our major competitors’ power plants that use other fossil fuels, such as coal. In addition, we strive to preserve our nation’s valuable water and land resources. To condense steam, our combined-cycle power plants use cooling towers with a closed water cooling system or air cooled condensers and do not employ “once-through” water cooling, which uses large quantities of water from adjacent waterways, negatively impacting aquatic life. Since our plants are modern and efficient and utilize cleaner burning natural gas, we do not require large areas of land for our power plants nor do we require large specialized landfills for the disposal of coal ash or nuclear plant waste. We believe that the Clean Power Plan, which requires a 32% reduction in GHG emissions from existing power plants, including our natural gas-fired power plants, from 2005 levels by 2030, will impact our competitors who use other fossil fuels or older, less efficient technologies, providing us with a net competitive advantage.

Our scale provides the opportunity to have meaningful regulatory input, to leverage our procurement efforts for better pricing, terms and conditions on our goods and services, and to develop and offer a wide array of products and services to our customers. Finally, geographic diversity helps us manage and mitigate the impact of weather, regulatory and regional economic differences across our markets to provide more consistent financial performance.

Our principal offices and retail affiliate are located in Houston, Texas with regional offices in Dublin, California and Wilmington, Delaware, an engineering, construction and maintenance services office in Pasadena, Texas and government affairs offices in Washington D.C., Sacramento, California and Austin, Texas. We operate our business through a variety of divisions, subsidiaries and affiliates.

Strategy

Our goal is to be recognized as the premier power generation company in the U.S. as measured by our employees, shareholders, customers and policy-makers as well as the communities in which our facilities are located. We seek to achieve sustainable growth through financially disciplined power plant development, construction, acquisition, operation and ownership. Our strategy to achieve this is reflected in the following five major initiatives listed below and subsequently described in further detail:

•Focus on remaining a premier operating company;

•Focus on managing and growing our portfolio;

•Focus on our customer relationships;

•Focus on advocacy and corporate responsibility; all of which culminate in

•Focus on enhancing shareholder value.

1. | Focus on Remaining a Premier Operating Company — Our objective is to be the “best-in-class” in regards to certain operational performance metrics, such as safety, availability, reliability, efficiency and cost management. |

• | During 2015, our employees achieved a total recordable incident rate of 0.73 recordable injuries per 100 employees which places us in the first quartile performance for power generation companies with 1,000 or more employees. |

• | Our entire fleet achieved a forced outage factor of 2.3% and a starting reliability of 98.3% during the year ended December 31, 2015. |

• | During 2015, our outage services subsidiary completed 15 major inspections and nine hot gas path inspections. |

• | For the past 15 years on average, our Geysers Assets have reliably generated approximately six million MWh of renewable power per year. |

2. | Focus on Managing and Growing our Portfolio — Our goal is to continue to grow our presence in core markets with an emphasis on acquisitions, expansions or modernizations of existing power plants. We intend to take advantage of favorable opportunities to continue to design, develop, acquire, construct and operate the next generation of highly efficient, operationally flexible and environmentally responsible power plants where such investment meets our rigorous financial hurdles, particularly if power contracts and financing are available and attractive returns are expected. Likewise, we actively seek to divest non-core assets where we can find opportunities to do so accretively. In addition, we believe that modernizations and expansions to our current assets offer proven and financially disciplined opportunities to improve our operations, capacity and efficiencies. During 2015 and through the filing of this Report, we strategically repositioned |

4

our portfolio by adding capacity in our core regions and by divesting positions in non-core markets through the following transactions:

• | In June 2015, our Garrison Energy Center commenced commercial operations, bringing online approximately 309 MW of combined-cycle, natural gas-fired capacity with dual-fuel capability. |

• | During the second quarter of 2015, we began construction of our 760 MW York 2 Energy Center and expect commercial operations to commence during the second quarter of 2017. |

• | In July 2015, the sale of our Osprey Energy Center to Duke Energy Florida, Inc. for approximately $166 million, excluding working capital and other adjustments, was approved by the FERC and the Florida Public Service Commission. In accordance with the asset sale agreement, the sale will be consummated in January 2017 upon the conclusion of a 27-month PPA. This sale represents a strategic disposition of a power plant in a wholesale power market dominated by regulated utilities. |

• | On October 1, 2015, we acquired Champion Energy for approximately $240 million, excluding working capital adjustments. The addition of this well-established retail sales organization is consistent with our stated goal of getting closer to our end-use customers and provides us a valuable sales channel for directly reaching a much greater portion of the load we seek to serve. |

• | On February 5, 2016, we completed the purchase of Granite Ridge Energy Center, a power plant with a nameplate capacity of 745 MW (summer peaking capacity of 695 MW), for approximately $500 million, excluding working capital adjustments. The addition of this modern, efficient, natural gas-fired, combined-cycle power plant will increase capacity in our East segment, specifically the constrained New England market. |

In addition, our significant ongoing projects under construction, growth initiatives and modernizations are discussed below:

• | Garrison Energy Center — We are in the early stages of development of a second phase of the Garrison Energy Center that will add approximately 430 MW of dual-fuel, combined-cycle capacity to our existing Garrison Energy Center. PJM has completed its feasibility study of the project and the system impact study is underway. |

• | York 2 Energy Center — York 2 Energy Center is a 760 MW dual-fuel, combined-cycle project that will be co-located with our York Energy Center in Peach Bottom Township, Pennsylvania. Once complete, the power plant will feature two combustion turbines, two heat recovery steam generators and one steam turbine. The project’s capacity cleared PJM’s 2017/2018 and 2018/2019 base residual auctions. The project is now under construction, and we expect COD during the second quarter of 2017. PJM has completed the interconnection study process for an additional 68 MW of planned capacity at the York 2 Energy Center. This incremental 68 MW of planned capacity cleared the 2018/2019 base residual auction. |

• | Guadalupe Peaking Energy Center — In April 2015, we executed an agreement with Guadalupe Valley Electric Cooperative (“GVEC”) that will facilitate the construction of a 418 MW natural gas-fired peaking power plant to be co-located with our Guadalupe Energy Center. Under the terms of the agreement, construction of the Guadalupe Peaking Energy Center (“GPEC”) may commence at our discretion, so long as the power plant reaches COD by June 1, 2019. When the power plant begins commercial operation, GVEC will purchase a 50% ownership interest in GPEC. Once built, GPEC will feature two fast-ramping combustion turbines capable of responding to peaks in power demand. This project represents a mutually beneficial response to our customer’s desire to have direct access to peaking generation resources, as it leverages the benefits of our existing site and development rights and our construction and operating expertise, as well as our customer’s ability to fund its investment at attractive rates, all while affording us the flexibility of timing the plant’s construction in response to market pricing signals. |

• | Mankato Power Plant Expansion — By order dated February 5, 2015, the Minnesota Public Utilities Commission concluded a competitive resource acquisition proceeding and selected a 345 MW expansion of our Mankato Power Plant, authorizing execution of a 20-year PPA between Calpine and Xcel Energy. The PPA was executed in April 2015 and remains subject to approval by the North Dakota Public Service Commission. Commercial operation of the expanded capacity may commence as early as 2019, subject to requisite regulatory approvals and applicable contract conditions. |

• | PJM and ISO-NE Development Opportunities — We are currently evaluating opportunities to develop additional projects in the PJM and ISO-NE market areas that feature cost advantages such as existing infrastructure and favorable transmission queue positions. These projects are continuing to advance entitlements (such as permits, zoning and transmission) for their potential future development when economical. |

• | Turbine Modernization — We continue to move forward with our turbine modernization program. Through December 31, 2015, we have completed the upgrade of 13 Siemens and eight GE turbines totaling approximately |

5

210 MW and have committed to upgrade three additional turbines. In addition, we have begun a program to update our dual-fueled turbines at certain of our power plants in our East segment.

3. | Focus on our Customer Relationships — We continue to focus on providing products and services that are beneficial to our customers. A summary of certain significant customer metrics and contracts entered into in 2015 are as follows: |

Champion Energy

• | In 2015, Champion Energy, our retail electric provider, served approximately 22 million MWh of customer load consisting of approximately 2.1 million annualized residential customer equivalents at December 31, 2015, concentrated in Texas, the Northeast and Mid-Atlantic where Calpine has a substantial power generation presence. |

West

• | We entered into a new PPA with Marin Clean Energy to provide up to 65 MW of power from our Delta Energy Center and other northern California power plants commencing in April 2015 and extending through December 2017. |

• | Our ten-year PPA with Southern California Edison for 225 MW of capacity and renewable energy from our Geysers Assets commencing in June 2017 was approved by the CPUC in the first quarter of 2015. |

• | We entered into a new ten-year PPA with Southern California Edison for 50 MW of capacity and renewable energy from our Geysers Assets commencing in January 2018. The PPA remains subject to approval by the CPUC. |

• | We entered into a new one-year resource adequacy contract with SCE for 238 MW from our Pastoria Energy Center commencing in January 2018. |

• | We entered into a new three-year PPA with the San Francisco Public Utilities Commission to provide, on average, approximately 43 MW of energy and renewable energy annually commencing in May 2016. |

Texas

• | We entered into a new three-year PPA with Brazos Electric Power Cooperative to provide 300 MW of energy from our Texas power plant fleet commencing in January 2016. |

• | We entered into a new three-year PPA with Pedernales Electric Cooperative to provide approximately 140 MW of energy from our Texas power plant fleet commencing in January 2017. |

• | We entered into a new two-year PPA with Guadalupe Valley Electric Cooperative to provide approximately 270 MW of energy from our Texas power plant fleet commencing in June 2017. The execution of this PPA will facilitate the construction of a 418 MW natural gas-fired peaking power plant to be co-located with our Guadalupe Energy Center. |

• | We extended our existing PPA with the South Texas Electric Cooperative to supply the Magic Valley Electric Cooperative’s full load requirements for ten years beyond 2021. Magic Valley Electric Cooperative’s peak summer load in 2015 was 490 MW. |

East

• | We entered into a new 20-year PPA with Xcel Energy to provide up to 345 MW of capacity and energy from our Mankato Power Plant expansion when commercial operations commence and transmission-related upgrades have been completed. |

• | We entered into a new ten-year PPA with the Tennessee Valley Authority to provide 615 MW of energy and capacity from our Morgan Energy Center commencing in February 2016. |

4. | Focus on Advocacy and Corporate Responsibility — We recognize that our business is heavily influenced by laws, regulations and rules at federal, state and local levels as well as by rules of the ISOs and RTOs that oversee the competitive markets in which we operate. We believe that being active participants in the legislative, regulatory and rulemaking processes may yield better outcomes for all stakeholders, including Calpine. Our two basic areas of focus are competitive wholesale power markets and environmental stewardship in power generation. Below are some recent examples of our advocacy efforts: |

Ensuring Competitive Market Structure/Rules

• | Provided leadership in stakeholder processes at PJM on a new “Capacity Performance” product and at ISO-NE on its Pay-For-Performance initiatives, resulting in implementation of the FERC approved PJM Capacity Performance product and ISO-NE Pay-For-Performance capacity structure. |

• | Our employees participated as invited panelists at FERC technical conferences regarding price formation and “out-of-market payments” in organized markets. |

6

Stopping Non-Competitive/Subsidized Generation

• | Successfully navigated a competitive generation supply bidding process in Florida, resulting in a contract for the acquisition of our Osprey Energy Center rather than a utility self-build as the most cost effective alternative for Florida ratepayers. |

• | Successfully advocated for a competitive generation supply bidding process in Minnesota and succeeded in obtaining an order requiring the local utility to enter into a long-term PPA for new additional capacity at our Mankato Power Plant. |

• | Provided leadership in the successful legal challenges against New Jersey for discriminatory behavior affecting FERC jurisdictional capacity auctions, resulting in a decision by the U.S. Circuit Court of Appeals for the Third Circuit striking New Jersey’s action as being in violation of U.S. law. Petitions for certiorari were filed with the U.S. Supreme Court, asking for review of the Third Circuit’s decision. In October 2015, the U.S. Supreme Court granted certiorari but has not scheduled the case for oral argument. |

• | Successfully advocated against proposed legislation in California requiring investor owned utilities to contract for 500 MW of new geothermal resources that would have discriminated against our existing geothermal fleet. |

Environmental

• | Filed a brief with the D.C. Circuit supporting the EPA’s MATS rules which were upheld by the Court. |

• | Filed a brief with the U.S. Supreme Court supporting the EPA’s CSAPR rules which were upheld by the Court in a decision citing our brief. |

• | Filed a brief with the U.S. Supreme Court supporting the EPA’s GHG air permit rules which were upheld in part by the Court citing our brief in its opinion. |

• | Filed a brief with the D.C. Circuit supporting the EPA’s opposition to motions for stay of the Clean Power Plan; the D.C. Circuit denied the motions. |

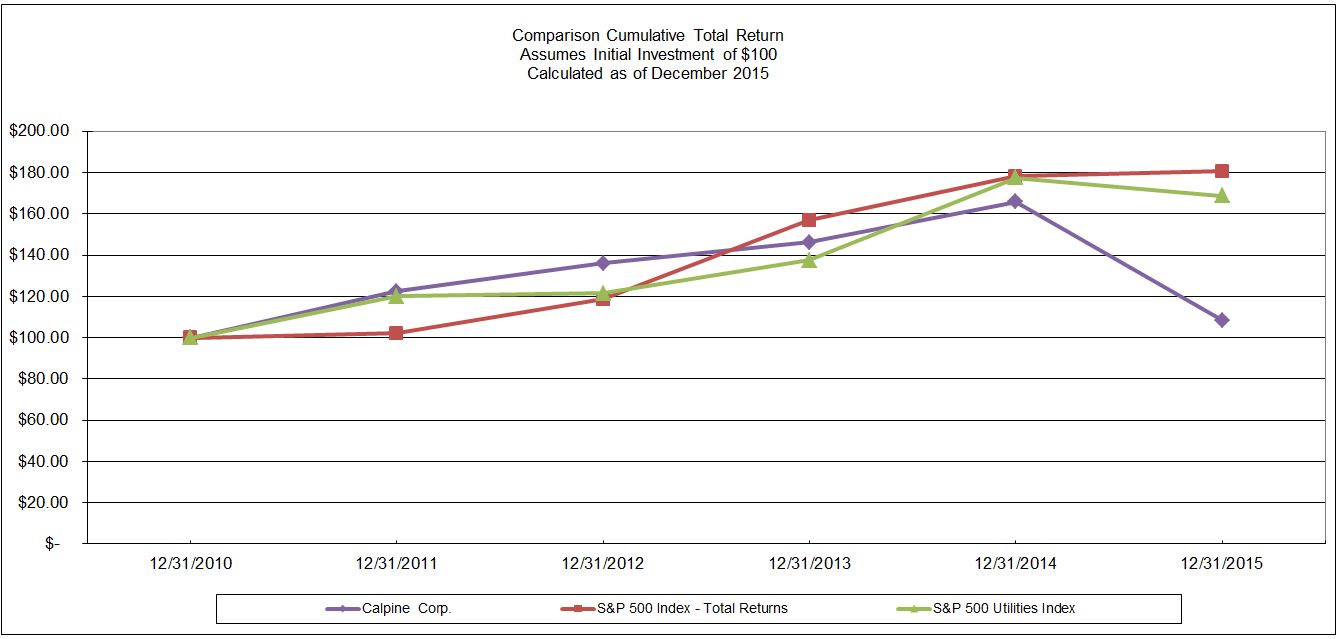

5. | Focus on Enhancing Shareholder Value — We continue to make significant progress to deliver financially disciplined growth, to enhance shareholder value through disciplined capital allocation including the return of capital to shareholders and to manage the balance sheet for future growth and success. We are committed to remaining financially disciplined in our capital allocation decisions. The year ended December 31, 2015 was marked by the following accomplishments: |

• | We continued to return capital to our shareholders in the form of share repurchases, having cumulatively repurchased approximately $2.8 billion or 29% of our previously outstanding shares as of the filing of this Report. |

• | Specifically during 2015, we repurchased a total of 26.6 million shares of our outstanding common stock for approximately $529 million at an average price of $19.87 per share. |

We further optimized our capital structure by refinancing, redeeming or amending several of our debt instruments during the year ended December 31, 2015, and through the filing of this Report, including the following transactions:

• | In February 2015, we issued $650 million in aggregate principal amount of 5.5% senior unsecured notes due 2024 in a public offering and used the net proceeds to replenish cash on hand used for the acquisition of Fore River Energy Center in the fourth quarter of 2014, to repurchase approximately $147 million of our 2023 First Lien Notes and for general corporate purposes. |

• | In May 2015, we repaid our 2018 First Lien Term Loans with the proceeds from the 2022 First Lien Term Loan which extended the maturity and reduced the interest rate on approximately $1.6 billion of corporate debt. |

• | In November 2015, we refinanced and upsized our Steamboat project debt which lowered the interest rate and extended the maturity by two years to November 22, 2019. |

• | In December 2015, we used cash on hand to redeem 10% of the original aggregate principal amount of our 2023 First Lien Notes, plus accrued and unpaid interest. |

• | In December 2015, we entered into our 2023 First Lien Term Loan and will use the proceeds to fund a portion of the purchase price for the Granite Ridge Energy Center, to repay project and corporate debt and for general corporate purposes. |

• | In December 2015, we entered into an agreement with one of the two lessors of our Pasadena Power Plant to purchase their 50% interest, which will result in a reduction of our project debt of approximately $50 million. The transaction is expected to close during the second quarter of 2016. |

7

• | On February 8, 2016, we amended our Corporate Revolving Facility, extending the maturity by two years to June 27, 2020, and increasing the capacity by an additional $178 million to $1,678 million through June 27, 2018, reverting back to $1,520 million through the maturity date. Further, we increased the letter of credit sublimit by $250 million to $1.0 billion and extended the maturity by two years to June 27, 2020. |

THE MARKET FOR POWER

Our Power Markets and Market Fundamentals

The power industry represents one of the largest industries in the U.S. and impacts nearly every aspect of our economy, with an estimated end-user market of approximately $390 billion in power sales in 2015 according to the EIA. Historically, vertically integrated power utilities with monopolies over franchised territories dominated the power generation industry in the U.S. Over the last 25 years, industry trends and legislative and regulatory initiatives, culminating with the deregulation trend of the late 1990’s and early 2000’s, provided opportunities for wholesale power producers to compete to provide power. Although different regions of the country have very different models and rules for competition, the markets in which we operate have some form of wholesale market competition. California (included in our West segment), Texas (included in our Texas segment) and the Northeast and Mid-Atlantic regions (included in our East segment), which are the markets in which we have our largest presence, have emerged as among the most competitive wholesale power markets in the U.S. We also operate, to a lesser extent, in competitive wholesale power markets in the Southeast and the Midwest. In addition to our sales of electrical power and steam, we produce several ancillary products for sale to our customers.

• | First, we are a provider of power to utilities, independent electric system operators, industrial and agricultural companies, retail power providers, municipalities and other governmental entities, power marketers as well as retail commercial, industrial and residential customers. Effective after the October 1, 2015 acquisition, we entered the retail market in scale through our retail subsidiary, Champion Energy. Our power sales occur in several different product categories including baseload (around the clock generation), intermediate (generation typically more expensive than baseload and utilized during higher demand periods to meet shifting demand needs), and peaking energy (most expensive variable cost and utilized during the highest demand periods), for which the latter is provided by some of our stand-alone peaking power plants/units and from our combined-cycle power plants by using technologies such as steam injection or duct firing additional burners in the heat recovery steam generators. Many of our units have operated more frequently as baseload units at times when low natural gas prices have driven their production costs below those of some competing coal-fired units. We also sell “full requirements” electricity for wholesale and retail customers, whereby we utilize our power plants as well as market purchases to serve the total electricity demand of the customer even as it varies across time. |

• | Second, we provide capacity for sale to utilities, independent electric system operators and retail power providers. In various markets, retail power providers (or independent electric system operators on their behalf) are required to demonstrate adequate resources to meet their power sales commitments. To meet this obligation, they procure a market product known as capacity from power plant owners or resellers. Most electricity market administrators have acknowledged that an energy only market does not provide sufficient revenues to enable existing merchant generators to recover all of their costs or to encourage the construction of new power plants. Capacity auctions have been implemented in the Northeast, Mid-Atlantic and certain Midwest regional markets to address this issue. California has a bilateral capacity program. Texas does not presently have a capacity market or a requirement for retailers to ensure adequate resources. |

• | Third, we sell RECs from our Geysers Assets in northern California, as well as from our small solar power plant in New Jersey. California has an RPS that requires load serving entities to have RECs for a certain percentage of their demand for the purpose of guaranteeing a certain level of renewable generation in the state or in neighboring areas. Because geothermal is a renewable source of energy, we receive a REC for each MWh we produce and are able to sell our RECs to load serving entities. New Jersey has a solar specific RPS which enables us to sell RECs from a 4 MW photovoltaic solar generation facility located in Vineland, New Jersey. |

• | Fourth, our cogeneration power plants produce steam, in addition to electricity, for sale to industrial customers for use in their manufacturing processes or heating, ventilation and air conditioning operations. |

• | Fifth, we provide ancillary service products to wholesale power markets. These products include the right for the purchaser to call on our generation to provide flexibility to the market and support operation of the electric grid. For example, we are sometimes paid to reserve a portion of capacity at some of our power plants that could be deployed quickly should there be an unexpected increase in load or to assure reliability due to fluctuations in the supply of power from variable renewable resources such as wind and solar generation. These ramping characteristics are becoming increasingly necessary in markets where intermittent renewables have large penetrations. |

8

In addition to the five products above, we are buyers and sellers of emission allowances and credits, including those under California’s AB 32 GHG reduction program, RGGI, the federal Acid Rain and CSAPR programs and emission reduction credits under the federal Nonattainment New Source Review program.

Although all of the products mentioned above contribute to our financial performance and are the primary components of our Commodity Margin, the most important are our sales of wholesale power and capacity. We utilize long-term customer contracts for our power and steam sales where possible. For power and capacity that are not sold under customer contracts or longer-dated capacity auctions, we use our hedging program and sell power into shorter term wholesale markets throughout the regions in which we participate.

When selling power from our natural gas-fired fleet into the short-term or spot markets, we attempt to maximize our operations when the market Spark Spread is positive. Assuming rational economic behavior by market participants, generating units generally are dispatched in order of their variable costs, with lower cost units being dispatched first and units with higher costs dispatched as demand, or “load,” grows beyond the capacity of the lower cost units. For this reason, in a competitive market, the price of power typically is related to the variable operating costs of the marginal generator, which is the last unit to be dispatched in order to meet demand. The factors that most significantly impact our operations are reserve margins in each of our markets, the price and supply of natural gas and competing fuels such as coal and oil, weather patterns and natural events, our operating Heat Rate, availability factors, and regulatory and environmental pressures as further discussed below.

Reserve Margins

Reserve margin, a measure of excess generation capacity in a market, is a key indicator of the competitive conditions in the markets in which we operate. For example, a reserve margin of 15% indicates that supply is 115% of expected peak power demand under normal weather and power plant operating conditions. Holding other factors constant, lower reserve margins typically lead to higher power prices because the less efficient capacity in the region is needed more often to satisfy power demand or voluntary or involuntary load shedding measures are taken. Markets with tight demand and supply conditions often display price spikes, higher capacity prices and improved bilateral contracting opportunities. Typically, the market price impact of reserve margins, as well as other supply/demand factors, is reflected in the Market Heat Rate, calculated as the local market power price divided by the local natural gas price.

During the last decade, the supply and demand fundamentals have varied across our regional markets. Key trends include lower weather normalized load growth in some regions due to increased energy efficiency as well as rooftop solar installations, new renewable and natural gas-fired supply additions, and significant retirements of older, less efficient fossil-fueled plants. Reserve margins by NERC regional assessment area for each of our segments are listed below:

2015(1) | ||

West: | ||

WECC | 29.7 | % |

Texas: | ||

TRE | 16.2 | % |

East: | ||

NPCC | 24.4 | % |

MISO | 18.0 | % |

PJM | 19.3 | % |

SERC | 27.7 | % |

FRCC | 28.5 | % |

___________

(1) | Data source is NERC weather-normalized estimates for 2015 published in May 2015. |

In recent years and in some regional markets such as PJM, the ability of customers to curtail load or temporarily utilize onsite backup generation instead of grid-provided electricity, known as “demand response,” has become a meaningful portion of “supply” and thus contributes to reserve margin estimates. While demand response reduces demand for centralized generation during peak times, it typically does so at a very high variable cost. To the extent demand response resources are treated like other sources of supply (e.g., their variable cost-based bids are allowed to affect the market clearing price for power), high resulting prices benefit lower-cost units like ours. Further, in many cases demand response has acted to discourage new investment in competing centralized generation plants (for example, by winning capacity auctions instead of new units). This may contribute to higher energy price volatility during peak energy demand periods.

9

The Price and Supply of Natural Gas

Approximately 96% of our generating capability’s fuel requirements are met with natural gas. We have approximately 725 MW of baseload capacity from our Geysers Assets and our expectation is that the steam reservoir at our Geysers Assets will be able to supply economic quantities of steam for the foreseeable future as our steam flow decline rates have become very small over the past several years. We also have approximately 391 MW of capacity from power plants where we purchase fuel oil to meet generation requirements, but generally do not expect fuel oil requirements to be material to our portfolio of power plants. In our East segment, where the supply of natural gas can be constrained under some weather circumstances, we have approximately 6,500 MW of dual-fueled capable power plants. Additionally, we have 4 MW of capacity from solar power generation technology with no fuel requirement.

We procure natural gas from multiple suppliers and transportation and storage sources. Although availability is generally not an issue, localized shortages (especially in extreme weather conditions in and around population centers), transportation availability and supplier financial stability issues can and do occur. When natural gas supply interruptions do occur, some of our power plants benefit from the ability to operate on fuel oil instead of natural gas.

The price of natural gas, economic growth and environmental regulations affect our Commodity Margin and liquidity. The impact of changes in natural gas prices differs according to the time horizon and regional market conditions and depends on our hedge levels and other factors discussed below.

Lower natural gas prices over the past six years have had a significant impact on power markets. Beginning in 2009, there was a significant decrease in NYMEX Henry Hub natural gas prices from a range of $6/MMBtu to $13/MMBtu during 2008 to an average natural gas price of $3.73/MMBtu, $4.26/MMBtu and $2.63/MMBtu during 2013, 2014 and 2015, respectively. Natural gas prices in some parts of the country were low enough that modern, combined-cycle, natural gas-fired generation was often less expensive on a marginal basis than coal-fired generation. The result was that natural gas displaced coal as a less expensive generation resource resulting in what the industry describes as coal-to-gas switching, the effects of which can be seen in our increased generation volumes. When coal-fired electricity production costs exceed natural gas-fired production costs, coal-fired units tend to set power prices. In these hours, lower natural gas prices tend to increase our Commodity Margin, since our production costs fall while power prices remain constant (depending on our hedge levels and holding other factors constant). Recent forward market natural gas prices suggest that coal-to-gas-switching will continue in 2016 (although future market conditions are uncertain and settled prices remain to be seen).

The availability of non-conventional natural gas supplies, in particular shale natural gas, has been the primary driver of reduced natural gas prices in the last several years. Access to significant deposits of shale natural gas has altered the natural gas supply landscape in the U.S. and could have a longer-term and profound impact on both the outright price of natural gas and the historical regional natural gas price relationships (basis differentials). The U.S. Department of Energy estimates that shale natural gas production has the potential of 3 trillion to 4 trillion cubic feet per year and may be sustainable for decades with enough natural gas to supply the U.S. for the next 90 years. Despite moderate increases in natural gas prices and some significant, weather induced regional price spikes in the winter of 2014, there is an emerging view that lower priced natural gas will be available for the medium to long-term future. Further, high levels of natural gas production relative to available pipeline export capacity in some locations such as the Marcellus shale production region have put additional, seasonal downward pressure on local natural gas prices. Overall, low natural gas prices and corresponding low power prices have challenged the economics of nuclear and coal-fired plants, leading to numerous announced and potential unit retirements.

Much of our generating capacity is located in California (included in our West segment), Texas (included in our Texas segment) and the Northeast and Mid-Atlantic (included in our East segment) where natural gas-fired units set power prices during many hours. When natural gas is the price-setting fuel (i.e., natural gas prices are above coal prices in our Texas or East segments), increases in natural gas prices may increase our unhedged Commodity Margin because our combined-cycle power plants in those markets are more fuel-efficient than conventional natural gas-fired technologies and peaking power plants. Conversely, decreases in natural gas prices may decrease our unhedged Commodity Margin. In these instances, our cost of production advantage relative to less efficient natural gas-fired generation is diminished on an absolute basis. Additionally, in the Northeast and Mid-Atlantic regions, we have generating units capable of burning either natural gas or fuel oil. For these units, on the rare occasions when the cost of consuming natural gas is excessively high relative to fuel oil, our unhedged Commodity Margin may increase as a result of our ability to use the lower cost fuel.

Where we operate under long-term contracts, changes in natural gas prices can have a neutral impact on us in the short-term. This tends to be the case where we have entered into tolling agreements under which the customer provides the natural gas and we convert it to power for a fee, or where we enter into indexed-based agreements with a contractual Heat Rate at or near our actual Heat Rate for a monthly payment.

10

Changes in natural gas prices or power prices may also affect our liquidity. During periods of high or volatile natural gas prices, we could be required to post additional cash collateral or letters of credit.

Despite these short-term dynamics, over the long-term, we expect lower natural gas prices to enhance the competitiveness of our modern, natural gas-fired fleet by making investment in other technologies such as coal, nuclear or renewables less economic and, in fact, making it more challenging for existing coal and nuclear resources to continue operating economically.

During the second half of 2014 and throughout 2015, global oil prices declined significantly. Brent crude oil (a commonly cited global oil index) spot prices fell from a 2014 high of $115 per barrel in June 2014 to a 2015 low of $35 per barrel in December 2015 (per the EIA). Since U.S. power and natural gas prices are generally not linked to oil prices, the oil market shift has not been material to our financial performance. The impact going forward will also likely not be material to our financial performance. While lower oil prices may lead to lower oil extraction and lower power demand in some parts of the U.S., such as North Dakota and Texas, lower oil prices are generally considered a boon to economic growth more broadly, which typically contributes to higher electricity demand.

Weather Patterns and Natural Events

Weather generally has a significant short-term impact on supply and demand for power and natural gas. Historically, demand for and the price of power is higher in the summer and winter seasons when temperatures are more extreme, and therefore, our unhedged revenues and Commodity Margin could be negatively impacted by relatively cool summers or mild winters. However, our geographically diverse portfolio mitigates the impact on our Commodity Margin of weather in specific regions of the U.S. Additionally, a disproportionate amount of our total revenue is usually realized during the summer months of our third fiscal quarter. We expect this trend to continue in the future as U.S. demand for power generally peaks during this time.

Operating Heat Rate and Availability

Our fleet is modern and more efficient than the average generation fleet; accordingly, we run more and earn incremental margin in markets where less efficient natural gas units frequently set the power price. In such cases, our unhedged Commodity Margin is positively correlated with how much more efficient our fleet is than our competitors’ fleets and with higher natural gas prices. Efficient operation of our fleet creates the opportunity to capture Commodity Margin in a cost effective manner. However, unplanned outages during periods when Commodity Margin is positive could result in a loss of that opportunity. We generally measure our fleet performance based on our availability factors, operating Heat Rate and plant operating expense. The higher our availability factor, the better positioned we are to capture Commodity Margin. The lower our operating Heat Rate compared to the Market Heat Rate, the more favorable the impact on our Commodity Margin.

Regulatory and Environmental Trends

We believe that, on balance, we will be favorably impacted by current regulatory and environmental trends, including those described below, given the characteristics of our power plant portfolio:

• | Economic pressures continue to increase for coal-fired power generation as state and federal agencies enact environmental regulations to reduce air emissions of certain pollutants such as SO2, NOX, GHG, Hg and acid gases, restrict the use of once-through cooling, and provide for stricter standards for managing coal combustion residuals. In October 2015, the EPA promulgated the Clean Power Plan which requires future reductions in GHG emissions from existing power plants of 32% from 2005 levels by 2030. We anticipate that older, less efficient fossil-fuel power plants that emit much higher amounts of GHG, SO2, NOX, Hg and acid gases, which operate nationwide, but more prominently in the eastern U.S., will be negatively impacted by current and future air emissions, water and waste regulations and legislation both at the state and federal levels which will require many coal-fired power plants to install expensive air pollution controls or reduce or discontinue operations. As a result, any retirements or curtailments could enhance our growth opportunities through greater utilization of our existing power plants and development of new power plants. The estimated capacity for fossil-fueled plants older than 50 years and the total estimated capacity for fossil-fueled plants by NERC region are as follows: |

11

Generating Capacity Older Than 50 years | Total Generating Capacity | |||||||

West: | ||||||||

WECC | 9,107 | MW | 131,421 | MW | ||||

Texas: | ||||||||

TRE | 3,909 | MW | 86,089 | MW | ||||

East: | ||||||||

NPCC | 8,873 | MW | 57,218 | MW | ||||

MRO | 4,460 | MW | 45,524 | MW | ||||

RFC | 21,202 | MW | 185,137 | MW | ||||

SERC | 25,684 | MW | 227,730 | MW | ||||

FRCC | 275 | MW | 59,707 | MW | ||||

Total | 73,510 | MW | 792,826 | MW | ||||

• | An increase in power generated from renewable sources could lead to an increased need for flexible power that many of our power plants provide to protect the reliability of the grid and premium compensation for that flexibility; however, risks also exist that renewables have the ability to lower overall wholesale power prices which could negatively impact us. Significant economic and reliability concerns for renewable generation have been raised, but we expect that renewable market penetration will continue, assisted by state-level renewable portfolio standards and federal tax incentives. The Consolidated Appropriations Act which extended the production tax credit for wind through the end of 2016 with gradual decreases thereafter until the tax credit expires completely in 2019 and extended the 30% investment tax credit for solar through the end of 2019 with gradual decreases through 2021 after which the investment tax credit declines to 10% was enacted in December 2015. In October 2015, the EPA promulgated the Clean Power Plan which requires future reductions in GHG emissions from existing power plants and provides flexibility in meeting the emissions reduction requirements including adding renewable generation. Increased renewable penetration has a particularly negative impact on inflexible baseload units and may lead to retirement of additional baseload units, which would benefit us; however, our energy margin may also decrease due to lower market clearing prices. To the extent market structures evolve to appropriately compensate units for providing flexible capacity to ensure reliability, our capacity revenue may increase. |

• | One small but growing source of competing renewable generation in some of our regional markets (primarily California) is customer-sited (primarily rooftop) solar generation. Levelized costs for solar installation have fallen significantly over the past several years, aided by federal tax subsidies and other local incentives, and are now in some regions lower than customer retail electric rates. To the extent on-site solar generation is compensated at the full retail rate (an increasingly controversial policy known as “net energy metering”), rooftop solar installations may continue to grow. Should net energy metered solar installations remain capped at relatively low levels of penetration or net energy metering policies be weakened (by rate structure reforms that charge customers fixed amounts regardless of the level of electricity consumed, thus lowering the variable portion of the rates), rooftop solar growth might diminish. Absent incentives and supportive policies, rooftop solar is currently generally not competitive with wholesale power. |

• | The regulators in our core markets remain committed to the competitive wholesale power model, particularly in ERCOT, PJM and ISO-NE where they continue to focus on market design and rules to assure the long-term viability of competition and the benefits to customers that justify competition. |

• | Utilities are increasingly focused on demand side management – managing the level and timing of power usage through load curtailment, dispatching generators located at commercial or industrial sites, and “smart grid” technologies that may improve the efficiencies, dispatch usage and reliability of electric grids. Scrutiny of demand side resources has increased recently as system operators evaluate their reliability (especially at high levels of penetration) and environmental authorities deal with the implications of relying on smaller, less environmentally efficient generation sources during periods of peak demand when air quality is already challenged. |

• | Environmental permitting requirements for new power plants, transmission lines and pipelines continue to increase in stringency and complexity, resulting in prolonged, expensive development cycles and high capital investments. |

We believe these trends are overall positive for our existing fleet. For a discussion of federal, state and regional legislative and regulatory initiatives and how they might affect us, see “— Governmental and Regulatory Matters.”

12

It is very difficult to predict the continued evolution of our markets due to the uncertainty of the following: