Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Gramercy Property Trust | d513647d8k.htm |

Exhibit 99.1

Moving Forward

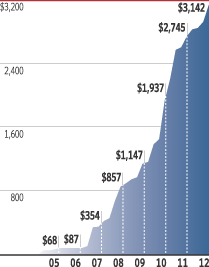

Chambers Street wants to thank you for the trust and confidence you have placed in us over the years. Your continued support has allowed us to grow our Company to over $3 billion in assets, while maintaining conservative leverage, with a high-quality portfolio of 129 properties located in more than 40 markets. We believe the Company is well positioned for further growth as we continue to pursue our long-term objectives. Please contact your financial advisor or our investor services group at (866) 650-0650 if you have any questions.

Sincerely,

Jack A. Cuneo

President and Chief Executive Officer

Chambers Street Properties

In connection with the Company’s 2013 annual meeting of shareholders, the Company will file with the Securities and Exchange Commission (the “SEC”) and furnish to the Company’s shareholders a proxy statement and other relevant documents. Shareholders are urged to read the proxy statement when it becomes available and any other documents to be filed with the SEC in connection with the Company’s 2013 annual meeting or incorporated by reference in the proxy statement because they will contain important information.

lnvestors will be able to obtain a free copy of documents filed with the SEC at the SEC’s website at http://www.sec.gov. ln addition, investors may obtain a free copy of the Company’s filings with the SEC from the Company’s website at: http://www.chambersstreet.com or by directing a request to: Mr. Martin A. Reid, Chambers Street, 47 Hulfish Street, Suite 210, Princeton, NJ 08542; Martin.Reid@CSPRElT.com or (609) 683-4900.

The Company and its trustees, executive officers and certain other members of management and employees of the Company may be deemed “participants” in the solicitation of proxies from shareholders of the Company in connection with the Company’s annual meeting. lnformation regarding such participants and a description of their direct or indirect interests, by security holdings or otherwise, can be found in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013, filed with the SEC on March 22, 2013, and in its preliminary proxy statement on Schedule 14A, filed with the SEC on April 1, 2013.

Forward-Looking Statements All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements can be identified by the use of forward looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “approximately,” “intends,” “plans,” “projects,” “estimates” or “anticipates,” or the negative of these words and phrases or similar words or phrases. Forward-looking statements can also be identified by discussions of strategy, trends, conditions, plans or intentions. These forward-looking statements are based on current expectations, estimates, and projections about future events. Such forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties, and other factors beyond our ability to control or predict such as global, national, regional and local economic conditions, adverse legislative and regulatory developments, adverse market conditions, our ability to raise debt and equity proceeds, our ability to efficiently invest proceeds and acquire properties, the operating performance of our tenants, joint venture partners and properties, our ability to comply with our debt covenants and contractual obligations, our ability to operate as a self-managed company and retain qualified personnel, our ability to pay distributions, and other risks and uncertainties detailed from time to time in our filings with the SEC, which may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied in such forward-looking statements. We disclaim any obligation or undertaking to publicly release any updates or revisions to any forward-looking statement contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions, or circumstances on which any such statement is based. Although we believe our current expectations are based on reasonable assumptions and expectation of future performance, we can give no assurance that expectations will be attained or that actual results will not differ materially. The risks included here are not exhaustive and undue reliance should not be placed on any forward-looking statements, which are based on current expectations. All written and oral forward-looking statements attributable to Chambers Street Properties or persons acting on their behalf are qualified in their entirety by these cautionary statements. Further, forward-looking statements speak only as of the date they are made, and the companies undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time unless otherwise required by law.

All property photos are of Chambers Street portfolio properties. © 2013 Chambers Street Properties. All rights reserved.

| Chambers Street Properties 47 Hulfish Street, Suite 210 Princeton, NJ 08542-3706

www.ChambersStreet.com |

|

The Top 10 of Our

270+ Valued Tenants

| 6.6% | Amazon.com | |||

| 4.8% | Barclays | |||

| 3.9% | Raytheon | |||

| 3.7% | U.S. Government | |||

| 2.4% | National Union Fire Insurance | |||

| 2.4% | JPMorgan Chase | |||

| 2.2% | Nuance Communications | |||

| 2.2% | Endo Health Solutions | |||

| 2.1% | Lord Abbett | |||

| 2.1% | Eisai | |||

| 67.6% | All Other |

As of December 31, 2012. Based on annualized base rent. Includes pro rata share of unconsolidated properties. Excludes investment in Asia.

The Top 10 of Our

25 Diverse Industries

| 13.5% | Financial Services | |||

| 11.1% | Pharma & Health Care Related | |||

| 10.9% | Consumer Products | |||

| 7.2% | Internet Retail | |||

| 6.0% | Defense & Aerospace | |||

| 5.0% | Logistics & Distribution | |||

| 5.0% | Insurance | |||

| 4.8% | Telecommunications | |||

| 3.7% | Government | |||

| 3.5% | Food Service & Retail | |||

| 29.3% | All Other |

As of December 31, 2012. Based on annualized base rent. Includes pro rata share of unconsolidated properties. Excludes investment in Asia.

The Top 10 of Our

25+ Global Locations

| 10% | New York City Metro | |

| 8% | Florida | |

| 7% | Texas | |

| 6% | New Jersey | |

| 6% | Washington, DC Metro | |

| 6% | Ohio | |

| 6% | South Carolina | |

| 5% | Germany | |

| 5% | United Kingdom | |

| 5% | North Carolina | |

| 36% | All Other |

As of December 31, 2012. Based on acquisition cost.

Includes pro rata share of unconsolidated properties.