Attached files

| file | filename |

|---|---|

| 8-K - GLOBAL TELECOM & TECHNOLOGY, INC. 8-K - GTT Communications, Inc. | a50592235.htm |

Exhibit 99

GTT Company Overview March 2013

Executive Summary

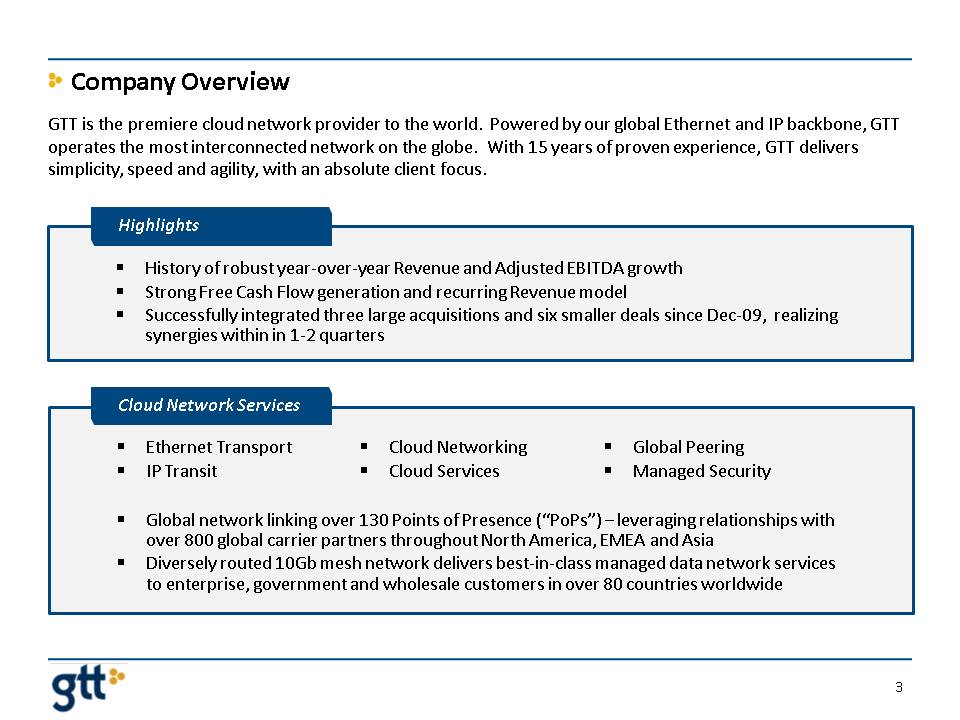

Global network linking over 130 Points of Presence (“PoPs”) – leveraging relationships with over 800 global carrier partners throughout North America, EMEA and AsiaDiversely routed 10Gb mesh network delivers best-in-class managed data network services to enterprise, government and wholesale customers in over 80 countries worldwide Company Overview History of robust year-over-year Revenue and Adjusted EBITDA growthStrong Free Cash Flow generation and recurring Revenue modelSuccessfully integrated three large acquisitions and six smaller deals since Dec-09, realizing synergies within in 1-2 quarters Highlights Ethernet TransportIP TransitCloud NetworkingCloud ServicesGlobal PeeringManaged Security Cloud Network Services GTT is the premiere cloud network provider to the world. Powered by our global Ethernet and IP backbone, GTT operates the most interconnected network on the globe. With 15 years of proven experience, GTT delivers simplicity, speed and agility, with an absolute client focus.

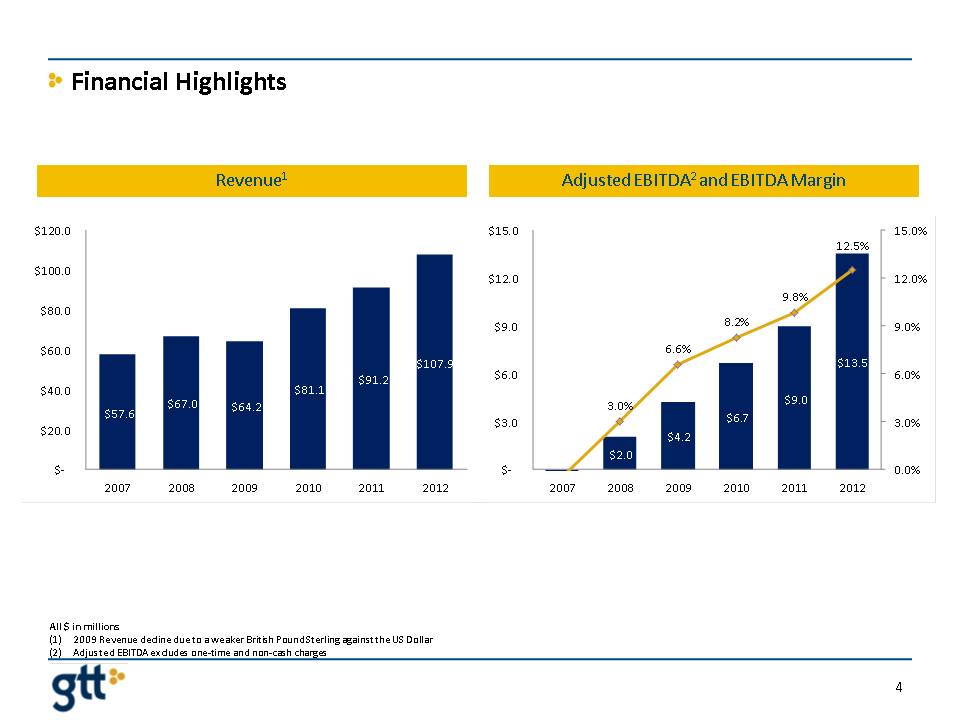

Financial Highlights All $ in millions2009 Revenue decline due to a weaker British Pound Sterling against the US DollarAdjusted EBITDA excludes one-time and non-cash charges Other Placeholder: 4 Revenue1 Adjusted EBITDA2 and EBITDA Margin

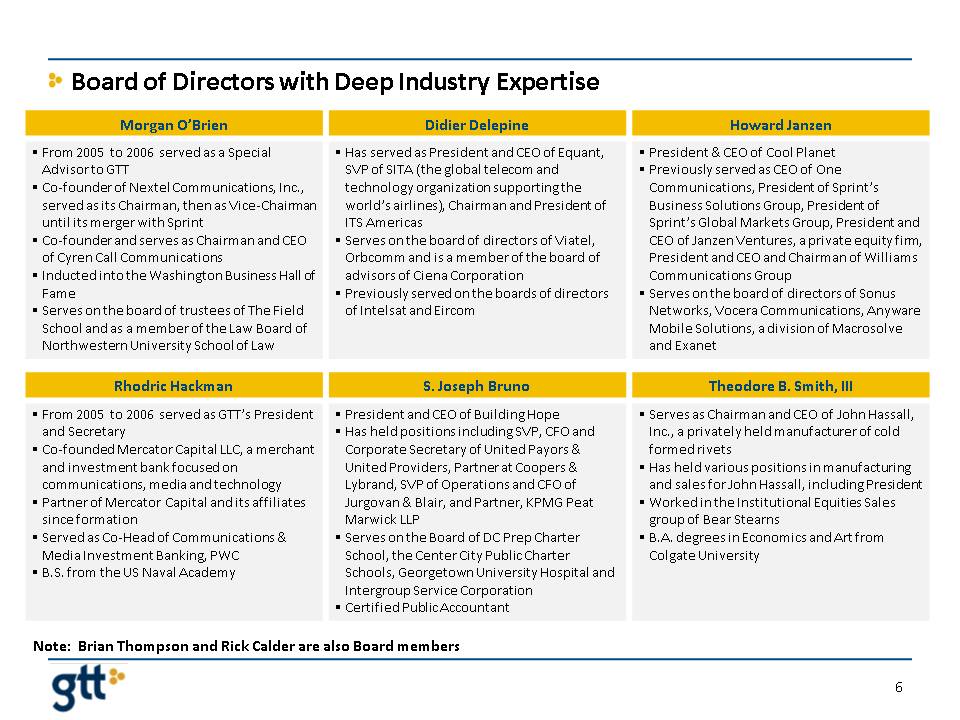

Morgan O’Brien Didier Delepine Howard Janzen From 2005 to 2006 served as a Special Advisor to GTT Co-founder of Nextel Communications, Inc., served as its Chairman, then as Vice-Chairman until its merger with Sprint Co-founder and serves as Chairman and CEO of Cyren Call Communications Inducted into the Washington Business Hall of Fame Serves on the board of trustees of The Field School and as a member of the Law Board of Northwestern University School of Law Has served as President and CEO of Equant, SVP of SITA (the global telecom and technology organization supporting the world’s airlines), Chairman and President of ITS Americas Serves on the board of directors of Viatel, Orbcomm and is a member of the board of advisors of Ciena Corporation Previously served on the boards of directors of Intelsat and Eircom President & CEO of Cool Planet Previously served as CEO of One Communications, President of Sprint’s Business Solutions Group, President of Sprint’s Global Markets Group, President and CEO of Janzen Ventures, a private equity firm, President and CEO and Chairman of Williams Communications Group Serves on the board of directors of Sonus Networks, Vocera Communications, Anyware Mobile Solutions, a division of Macrosolve and Exanet Rhodric Hackman S. Joseph Bruno Theodore B. Smith, III From 2005 to 2006 served as GTT’s President and Secretary Co-founded Mercator Capital LLC, a merchant and investment bank focused on communications, media and technology Partner of Mercator Capital and its affiliates since formation Served as Co-Head of Communications & Media Investment Banking, PWC B.S. from the US Naval Academy President and CEO of Building Hope Has held positions including SVP, CFO and Corporate Secretary of United Payors & United Providers, Partner at Coopers & Lybrand, SVP of Operations and CFO of Jurgovan & Blair, and Partner, KPMG Peat Marwick LLP Serves on the Board of DC Prep Charter School, the Center City Public Charter Schools, Georgetown University Hospital and Intergroup Service Corporation Certified Public Accountant Serves as Chairman and CEO of John Hassall, Inc., a privately held manufacturer of cold formed rivets Has held various positions in manufacturing and sales for John Hassall, including President Worked in the Institutional Equities Sales group of Bear Stearns B.A. degrees in Economics and Art from Colgate University

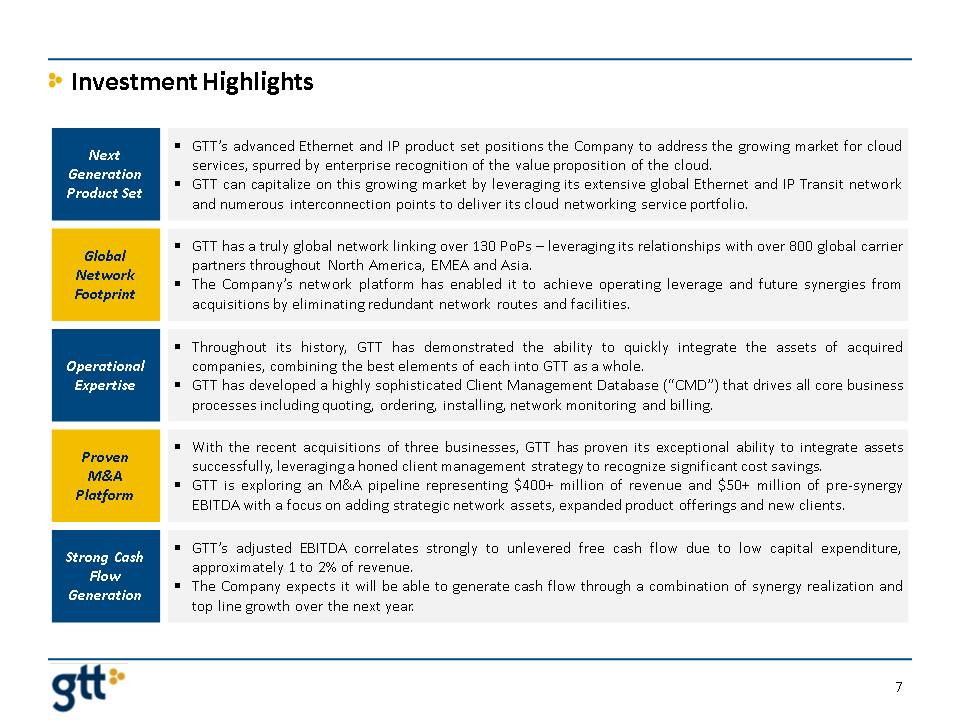

Investment Highlights Next Generation Product Set GTT’s advanced Ethernet and IP product set positions the Company to address the growing market for cloud services, spurred by enterprise recognition of the value proposition of the cloud. GTT can capitalize on this growing market by leveraging its extensive global Ethernet and IP Transit network and numerous interconnection points to deliver its cloud networking service portfolio. Global Network Footprint GTT has a truly global network linking over 130 PoPs – leveraging its relationships with over 800 global carrier partners throughout North America, EMEA and Asia. The Company’s network platform has enabled it to achieve operating leverage and future synergies from acquisitions by eliminating redundant network routes and facilities. Operational Expertise Throughout its history, GTT has demonstrated the ability to quickly integrate the assets of acquired companies, combining the best elements of each into GTT as a whole. GTT has developed a highly sophisticated Client Management Database (“CMD”) that drives all core business processes including quoting, ordering, installing, network monitoring and billing. Proven M&A Platform With the recent acquisitions of three businesses, GTT has proven its exceptional ability to integrate assets successfully, leveraging a honed client management strategy to recognize significant cost savings. GTT is exploring an M&A pipeline representing $400+ million of revenue and $50+ million of pre-synergy EBITDA with a focus on adding strategic network assets, expanded product offerings and new clients. Strong Cash Flow Generation GTT’s adjusted EBITDA correlates strongly to unlevered free cash flow due to low capital expenditure, approximately 1 to 2% of revenue. The Company expects it will be able to generate cash flow through a combination of synergy realization and top line growth over the next year.

Business Overview

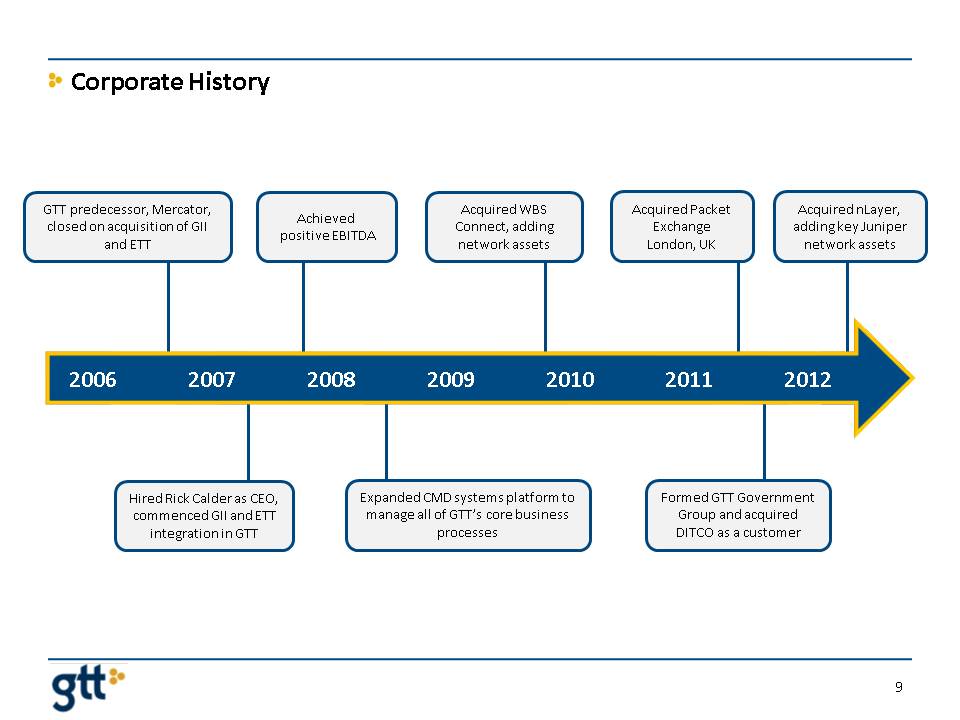

Corporate History GTT predecessor, Mercator, closed on acquisition of GII and ETT Hired Rick Calder as CEO, commenced GII and ETT integration in GTT Expanded CMD systems platform to manage all of GTT’s core business processes Acquired WBS Connect, adding network assets Acquired Packet ExchangeLondon, UK Acquired nLayer, adding key Juniper network assets Formed GTT Government Group and acquired DITCO as a customer Achieved positive EBITDA Other Placeholder: 9 (Gp:) 2007 (Gp:) 2008 (Gp:) 2009 (Gp:) 2012 (Gp:) 2010 (Gp:) 2011 (Gp:) 2006

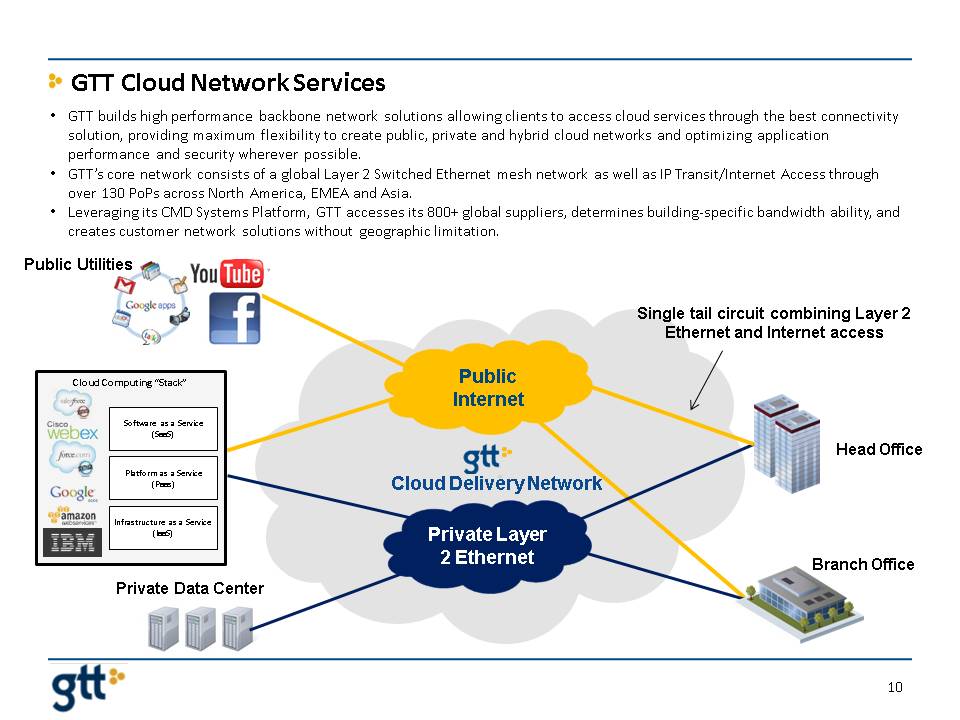

GTT Cloud Network Services GTT builds high performance backbone network solutions allowing clients to access cloud services through the best connectivity solution, providing maximum flexibility to create public, private and hybrid cloud networks and optimizing application performance and security wherever possible.GTT’s core network consists of a global Layer 2 Switched Ethernet mesh network as well as IP Transit/Internet Access through over 130 PoPs across North America, EMEA and Asia.Leveraging its CMD Systems Platform, GTT accesses its 800+ global suppliers, determines building-specific bandwidth ability, and creates customer network solutions without geographic limitation. Private Data Center Branch Office Head Office Public Utilities Single tail circuit combining Layer 2 Ethernet and Internet access Private Layer 2 Ethernet Public Internet Cloud Delivery Network Cloud Computing “Stack” Software as a Service(SaaS) Platform as a Service(Paas) Infrastructure as a Service(IaaS)

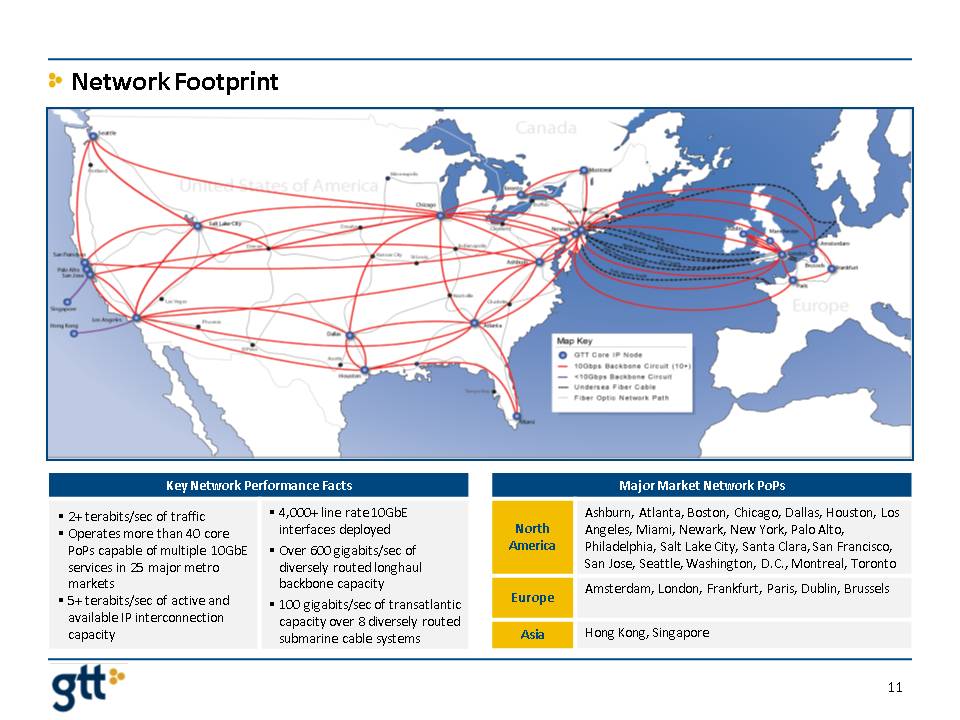

Network Footprint Key Network Performance Facts 2+ terabits/sec of traffic Operates more than 40 core PoPs capable of multiple 10GbE services in 25 major metro markets 5+ terabits/sec of active and available IP interconnection capacity 4,000+ line rate 10GbE interfaces deployed Over 600 gigabits/sec of diversely routed longhaul backbone capacity 100 gigabits/sec of transatlantic capacity over 8 diversely routed submarine cable systems North America Ashburn, Atlanta, Boston, Chicago, Dallas, Houston, Los Angeles, Miami, Newark, New York, Palo Alto, Philadelphia, Salt Lake City, Santa Clara, San Francisco, San Jose, Seattle, Washington, D.C., Montreal, Toronto Europe Amsterdam, London, Frankfurt, Paris, Dublin, Brussels Asia Hong Kong, Singapore

Growth Drivers

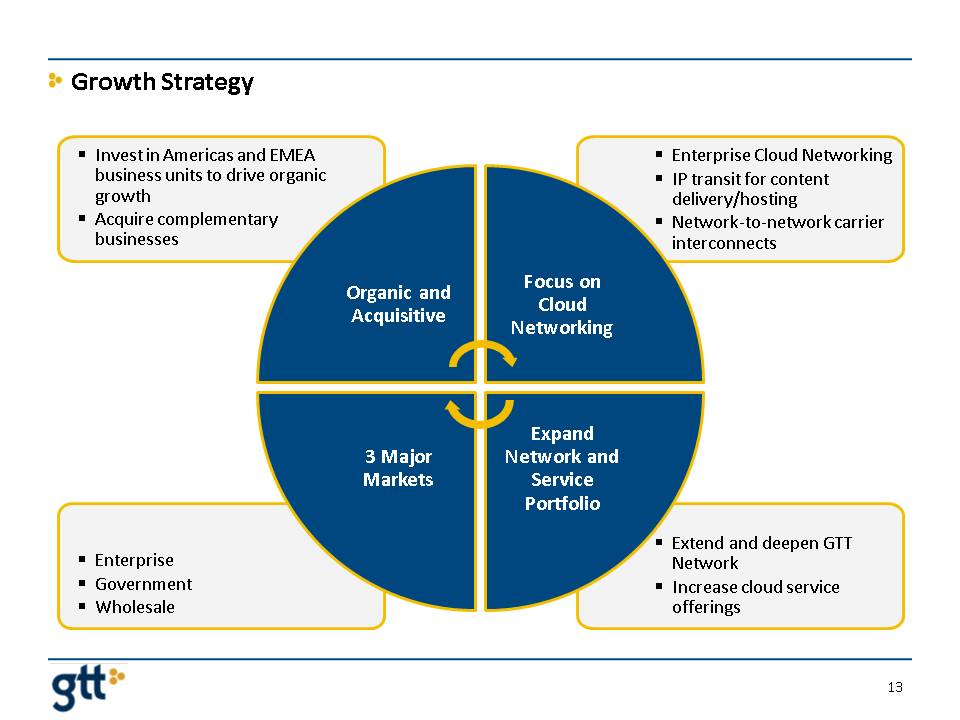

Growth Strategy (Gp:) Extend and deepen GTT NetworkIncrease cloud service offerings (Gp:) EnterpriseGovernmentWholesale (Gp:) Enterprise Cloud NetworkingIP transit for content delivery/hostingNetwork-to-network carrier interconnects (Gp:) Invest in Americas and EMEA business units to drive organic growthAcquire complementary businesses (Gp:) Organic and Acquisitive (Gp:) Focus on Cloud Networking (Gp:) Expand Network and Service Portfolio (Gp:) 3 Major Markets

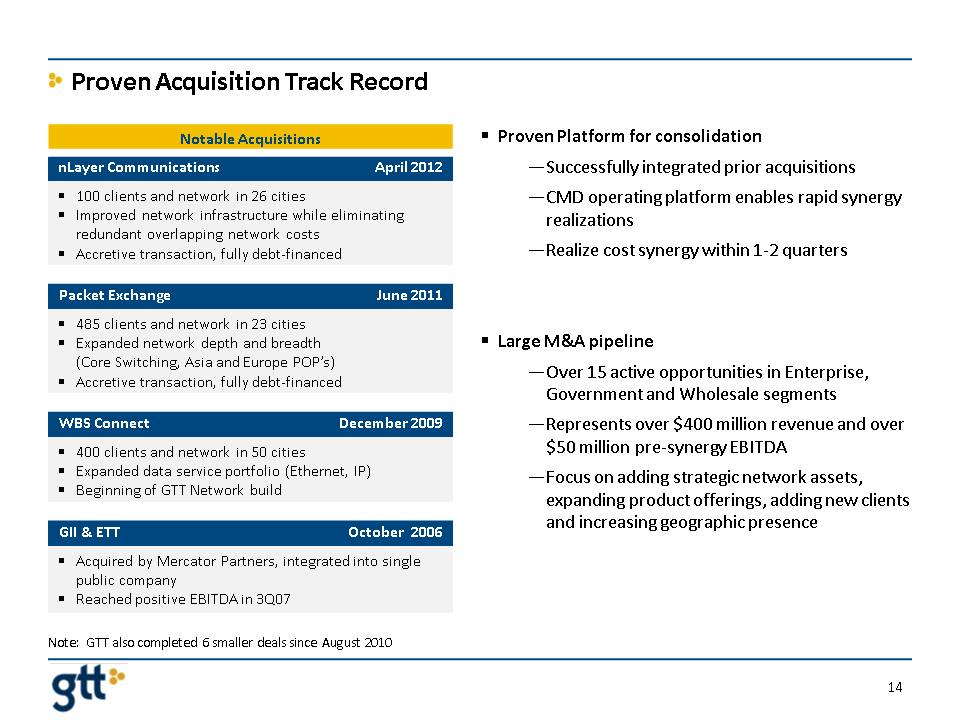

Proven Acquisition Track Record Proven Platform for consolidationSuccessfully integrated prior acquisitionsCMD operating platform enables rapid synergy realizationsRealize cost synergy within 1-2 quartersLarge M&A pipelineOver 15 active opportunities in Enterprise, Government and Wholesale segmentsRepresents over $400 million revenue and over $50 million pre-synergy EBITDAFocus on adding strategic network assets, expanding product offerings, adding new clients and increasing geographic presence Note: GTT also completed 6 smaller deals since August 2010

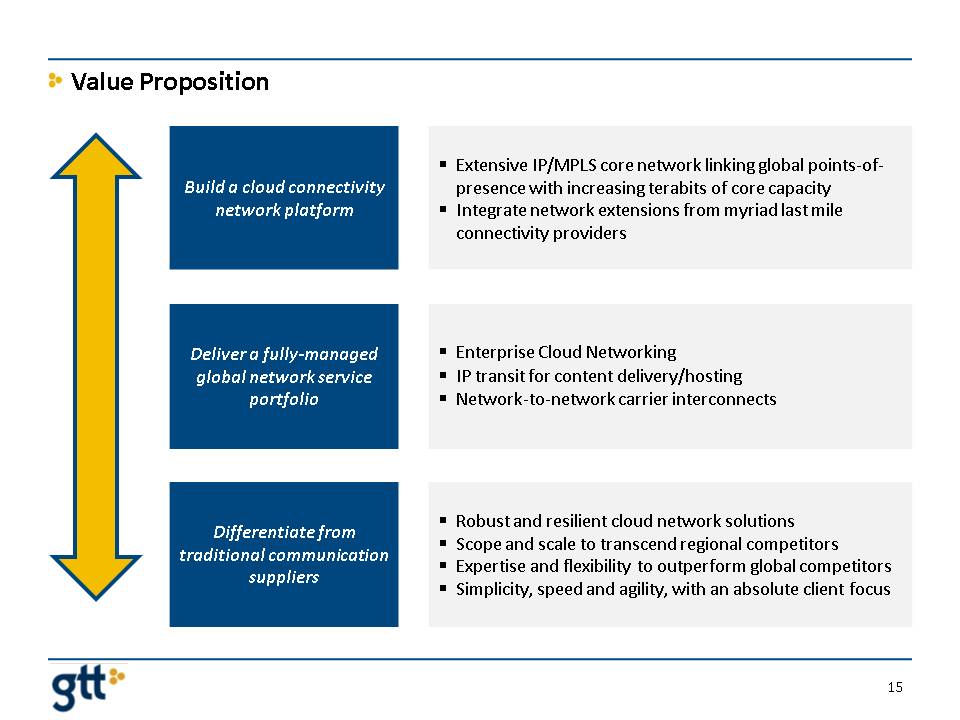

Build a cloud connectivity network platform Extensive IP/MPLS core network linking global points-of-presence with increasing terabits of core capacity Integrate network extensions from myriad last mile connectivity providers Deliver a fully-managed global network service portfolio Enterprise Cloud Networking IP transit for content delivery/hosting Network-to-network carrier interconnects Differentiate from traditional communication suppliers Robust and resilient cloud network solutions Scope and scale to transcend regional competitors Expertise and flexibility to outperform global competitors Simplicity, speed and agility, with an absolute client focus

Financial Overview

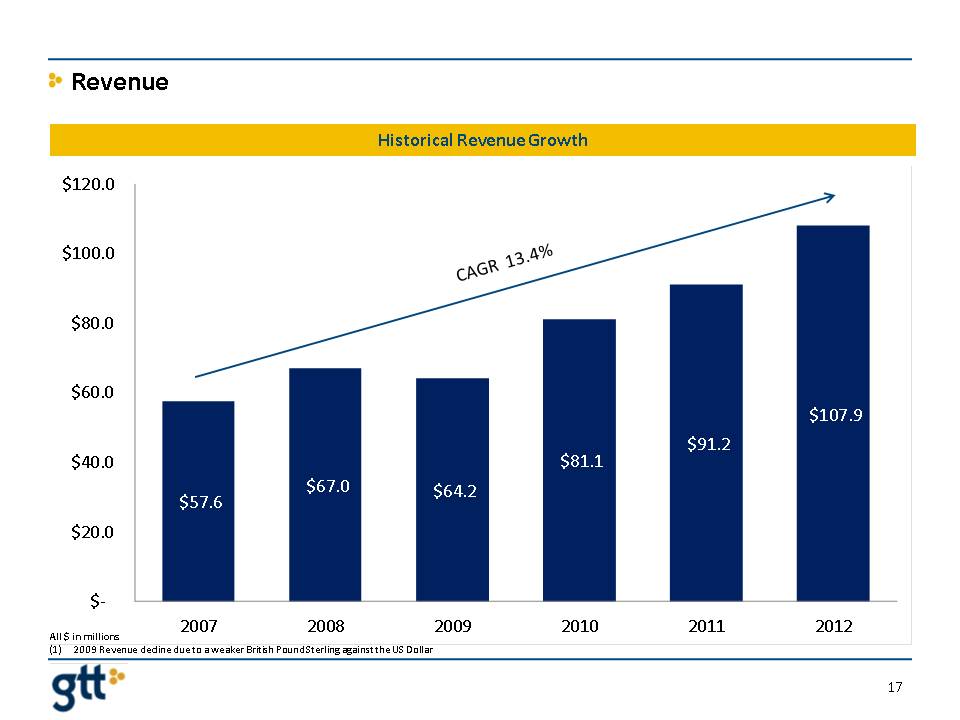

Revenue CAGR 13.4% All $ in millions2009 Revenue decline due to a weaker British Pound Sterling against the US Dollar

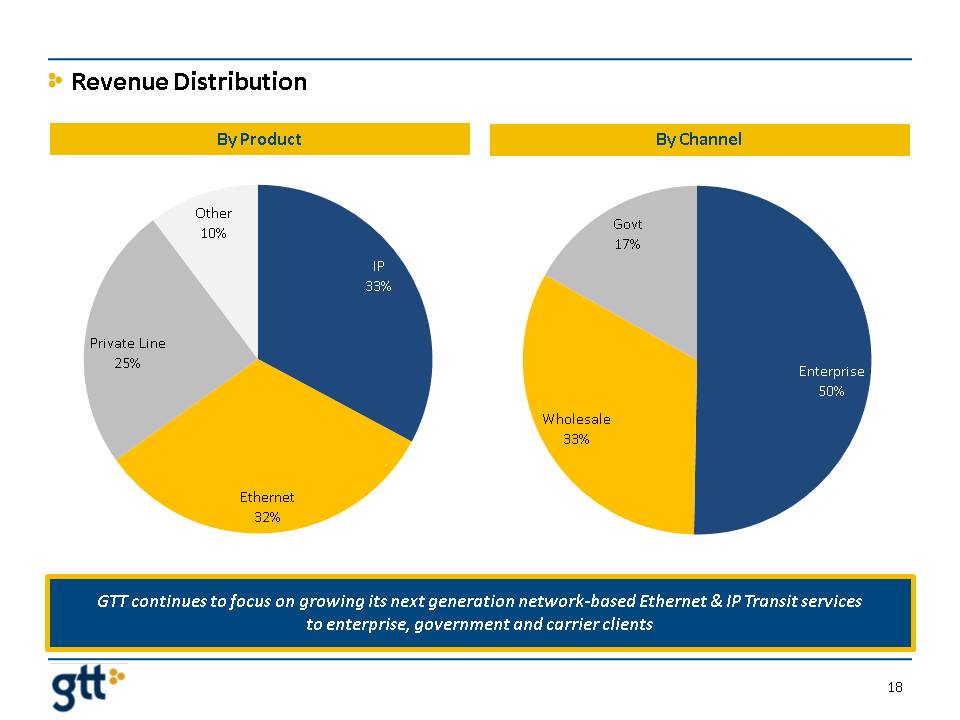

Revenue Distribution GTT continues to focus on growing its next generation network-based Ethernet & IP Transit services to enterprise, government and carrier clients

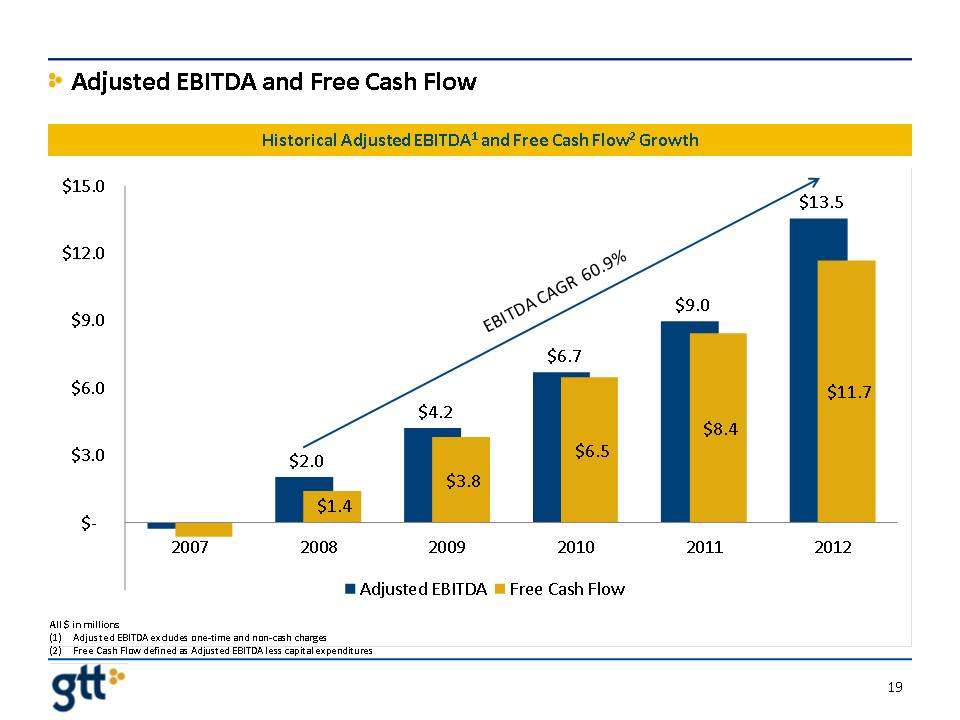

Adjusted EBITDA and Free Cash Flow All $ in millionsAdjusted EBITDA excludes one-time and non-cash chargesFree Cash Flow defined as Adjusted EBITDA less capital expenditures EBITDA CAGR 60.9%

GTT Stock PerformanceGTT Stock PerformanceOTCQB:GTLT

www.gt-t.net

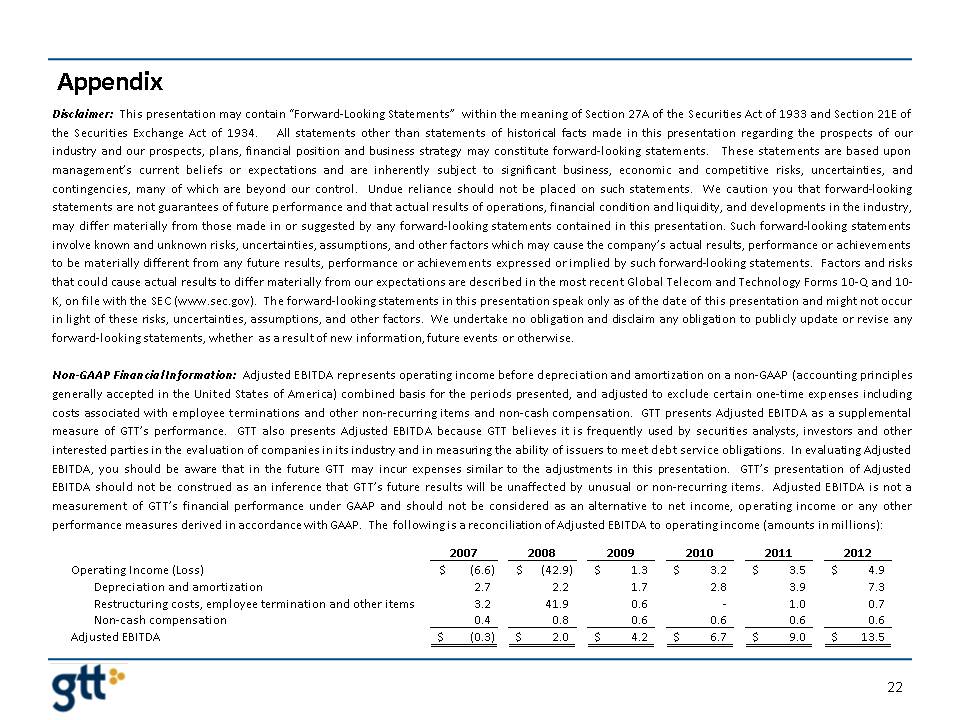

Appendix Disclaimer: This presentation may contain “Forward-Looking Statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical facts made in this presentation regarding the prospects of our industry and our prospects, plans, financial position and business strategy may constitute forward-looking statements. These statements are based upon management’s current beliefs or expectations and are inherently subject to significant business, economic and competitive risks, uncertainties, and contingencies, many of which are beyond our control. Undue reliance should not be placed on such statements. We caution you that forward-looking statements are not guarantees of future performance and that actual results of operations, financial condition and liquidity, and developments in the industry, may differ materially from those made in or suggested by any forward-looking statements contained in this presentation. Such forward-looking statements involve known and unknown risks, uncertainties, assumptions, and other factors which may cause the company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Factors and risks that could cause actual results to differ materially from our expectations are described in the most recent Global Telecom and Technology Forms 10-Q and 10-K, on file with the SEC (www.sec.gov). The forward-looking statements in this presentation speak only as of the date of this presentation and might not occur in light of these risks, uncertainties, assumptions, and other factors. We undertake no obligation and disclaim any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Non-GAAP Financial Information: Adjusted EBITDA represents operating income before depreciation and amortization on a non-GAAP (accounting principles generally accepted in the United States of America) combined basis for the periods presented, and adjusted to exclude certain one-time expenses including costs associated with employee terminations and other non-recurring items and non-cash compensation. GTT presents Adjusted EBITDA as a supplemental measure of GTT’s performance. GTT also presents Adjusted EBITDA because GTT believes it is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in its industry and in measuring the ability of issuers to meet debt service obligations. In evaluating Adjusted EBITDA, you should be aware that in the future GTT may incur expenses similar to the adjustments in this presentation. GTT’s presentation of Adjusted EBITDA should not be construed as an inference that GTT’s future results will be unaffected by unusual or non-recurring items. Adjusted EBITDA is not a measurement of GTT’s financial performance under GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP. The following is a reconciliation of Adjusted EBITDA to operating income (amounts in millions):