Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bristow Group Inc | d504544d8k.htm |

Howard Weil 41

st

Annual Energy

Conference

Bristow Group Inc.

March 17-21, 2013

Exhibit 99.1 |

2

Forward-looking statements |

3

Bristow is the leading provider of helicopter services

and is a unique investment in oil field services

•

~20 countries

•

556 aircraft

•

~3,400 employees

•

Ticker: BRS

•

Stock price

*

: $59.69/share

•

Market cap

*

: ~$2.2 billion

•

Quarterly dividend of $0.20/share

$67

Bristow flies crews and light cargo to production platforms, vessels and rigs

* Based on 36.6 million fully diluted weighted average shares outstanding for the

nine months ended 12/31/2012 and stock price as of March 14, 2013. |

4

Why Bristow?

$275

•

Bristow

is

the

largest

of

only

two

global

helicopter

providers

•

Bristow

is

stable

as

we

have

long

term

contracts

that

serve

mostly production

•

Bristow

is

growing

with

demand

not

dependent

on

economic

or commodity cycles

•

Bristow’s

asset

values

are

resilient

even

in

depressed

economic times as there is strong demand for helicopters

outside of E&P

•

Bristow

pays

a

quarterly

dividend

of

$0.20/share

after

a

33%

increase in June 2012 and has a $100 million share repurchase

reauthorization |

5

•

Safety is our primary core value

•

Bristow’s ‘Target Zero’

program is now the leading example

emulated industry-wide

•

Safety Performance accounts for 25% of management

incentive compensation

•

2011 National Ocean Industries Association (NOIA) Safety

in Seas Award Winner |

6

Our value proposition is based on three principles:

secular growth, financial safety, and balanced return

Long term value for our

shareholders

2. Prudent Balance

Sheet management

with ample liquidity

1. Growth not dependent

on economic or

commodity cycles

3. Capital Return

through dividends and

opportunistic share repurchases

Investment:

FY 2012 -

2016 |

7

1. Bristow services are utilized in every phase of

offshore oil and gas activity, especially production

•

Largest share of revenues (>60%) relates to

oil and gas production, providing stability and

growth opportunities

•

There are ~ 8,000 offshore production

installations worldwide —

compared with

>600 exploratory drilling rigs

•

~ 1,700 helicopters are servicing the

worldwide oil and gas industry of which

Bristow’s fleet is approximately one-third

•

Bristow revenues are primarily driven by

operating expenditures

Typical revenues by segment

Exploration

20%

Development

10%

Production

60%

Other 10%

ABANDONMENT

EXPLORATION

SEISMIC

DEVELOPMENT

PRODUCTION |

8

Fixed

monthly

65%

Variable

hourly

35%

Fixed

monthly

70%

Variable

hourly

30%

Bristow’s contract structure generates predictable

cashflow:

Significant operating leverage

Revenue sources

•

Two tiered contract structure includes both:

–

Fixed monthly standing charge to reserve helicopter capacity

–

Variable fees based on hours flown with fuel pass through

•

Bristow contracts earn 65% of revenue without flying

Operating income |

9

Bristow global operations deliver excellence

Safety

Reliability

Service

Performance

Fleet management improvements for availability ongoing. Global

Account Management instituted for best service. New consistent

operational reporting tools being designed and implemented to track

performance. Bristow Air Incident Rate (BAIR) instituted.

Service has been excellent. On average we’re receiving less than 1

complaint and almost 6 compliments for each 10,000 passengers

transported.

Our on-time departure and availability statistics averaging 95%*

and 99%* respectively during the same period highlighting

exceptional operational performance.

TRIR was 0.28*, which is world class. We continue to strive for

improvement.

* from April 1, 2012 to January 31, 2013 |

10

•

During an October 2012 flight to an offshore platform, an EC225 helicopter flown by

another operator performed a controlled ditching due to gear shaft failure.

UK and Norwegian CAAs issued safety directives, requiring operators to

suspend operations of similar aircraft.

•

We continue to actively support the ongoing efforts to determine

the root cause and the

development of acceptable mitigating measures to resume flight operations.

•

Bristow is not operating a total of 16 large EC225 aircraft until further notice:

12 in the UK, three in Australia and one in Norway. Globally across the

industry approximately 80 aircraft are affected.

•

Bristow has increased utilization of other in-region aircraft, has moved, or is

moving, available aircraft to mitigate the impact to our clients, and had

brought new a/c into the UK.

•

Currently no client contracts have been cancelled.

•

Bristow has the financial strength to handle this challenge. The

previously announced

order of ten new Sikorsky S-92 large helicopters is an example of our ability

to manage through this issue, and importantly, react quickly to provide

solutions for our clients in an already tight supply environment.

EC225 Fleet update |

11

Our growth tracker has been updated for FY14-

FY18 with 474 a/c opportunities (11% increase) |

12

•

Bristow uses specific

opportunities to create

our order book

•

Opportunities are

condensed to 288

realistic bids

•

82 high probability

targets are derived from

a view that we have an

~33% bid success rate

•

Our order book is then

managed using primarily

capital efficient a/c

options with our OEMs

* Orders and options are as of March 7, 2013

474 aircraft opportunities identified

82 high

probability targets

48

orders*

430 demand for new aircraft

288 realistic bid

opportunities

70 options

We manage our opportunities through the purchase of

118 a/c options and committed orders |

13

2. Bristow enjoys the strongest balance sheet in our

industry with ample liquidity, cash flow and asset value

Ample

Liquidity

Significant

Cash Flow

generation

•

BVA leads to a focus on cash and cash flows from

operations. Bristow generated 5% more operating cash

flow in FY12 compared to FY11

•

Bristow closed Q3 FY13 with more than $430 million of

liquidity

Prudent

Balance

Sheet

management

•

Adjusted Debt/Capital Ratio less than 44% with a BBB-

rating from Standard & Poor’s for secured debt

•

Operating lease strategy used to finance growth with a

very competitive cost of capital |

14

Our focus on returns has yielded much higher

operating cash flow generation . . .

Net cash provided by operating activities*

* See 10-Q for more information on cash flow provided by operating

activities |

15

. . . leading to a robust cash and liquidity position |

16

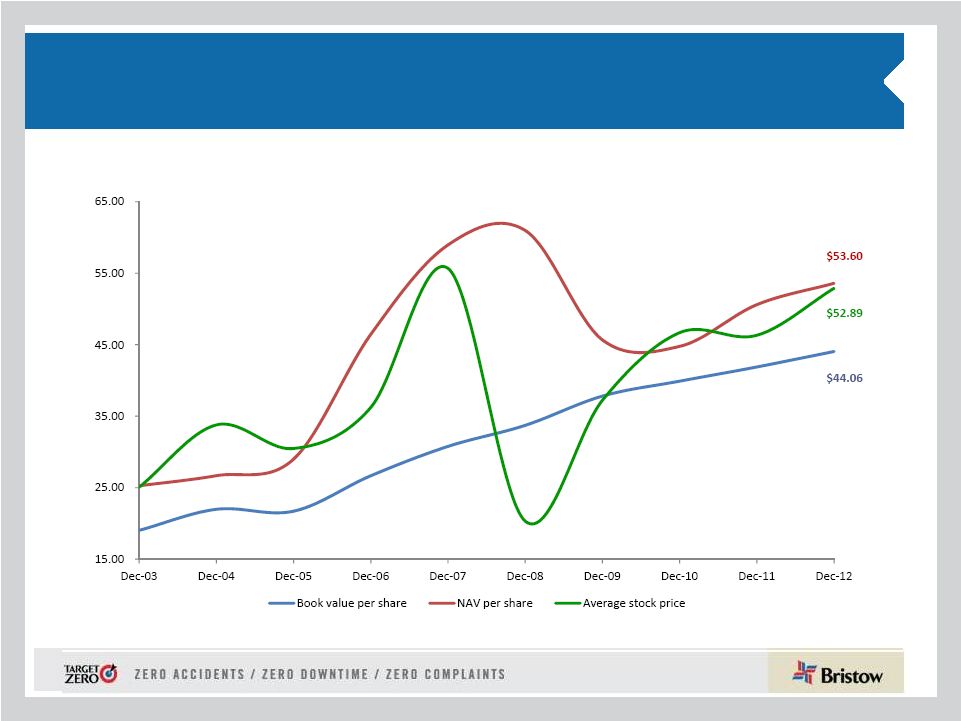

. . . And growth in our asset values

•

Our net asset value (NAV) primarily consists of the fair market

value of the fleet, which has resilient value through downturns

•

In the past two years, Bristow has increased our NAV per share

by almost 20% while maintaining prudent balance sheet

management and increasing BVA |

17

3. Bristow has a proven commitment to a balanced return

for our shareholders as demonstrated in the past year

Share

Repurchase

Regular

Dividend

•

FY12 quarterly dividend initiated at $0.15/share

•

Dividend increased by 33% to $0.20/share in

June 2012 quarter

•

Bristow has renewed its $100 million share

repurchase reauthorization with ~$1 million

repurchased in 3QFY13

•

Value is key to decision with net book value

and aircraft FMV being guide posts |

18

Bristow has also delivered consistent financial

performance over the past year

•

Annual adjusted EPS guidance has been raised to $3.60 -

$3.85 per share

from $3.25 -

$3.55 per share

* Assuming revenue earned in same regions and same mix

•

Eighth consecutive quarterly dividend since the end of FY11

•

Repurchased $1.2 million of shares in Q3 FY13 |

19

Conclusions

•

Safety continues to be our number one priority as we strive to

achieve Target Zero

•

We see continued improvement in revenue generation

through new contract awards across all business units

coupled with an ongoing effective cost management focus

•

Higher year-over-year EBITDAR and BVA demonstrate the

strength of our business model, especially with the investment

in Cougar

•

Our prudent balance sheet allows us to respond to and

successfully manage through industry challenges such as the

EC225 suspension of operations |

20

Bristow Group Inc. (NYSE: BRS)

2103 City West Blvd., 4

th

Floor

Houston, Texas 77042

t

713.267.7600

f

713.267.7620

bristowgroup.com

Contact us |

21

Appendix |

22

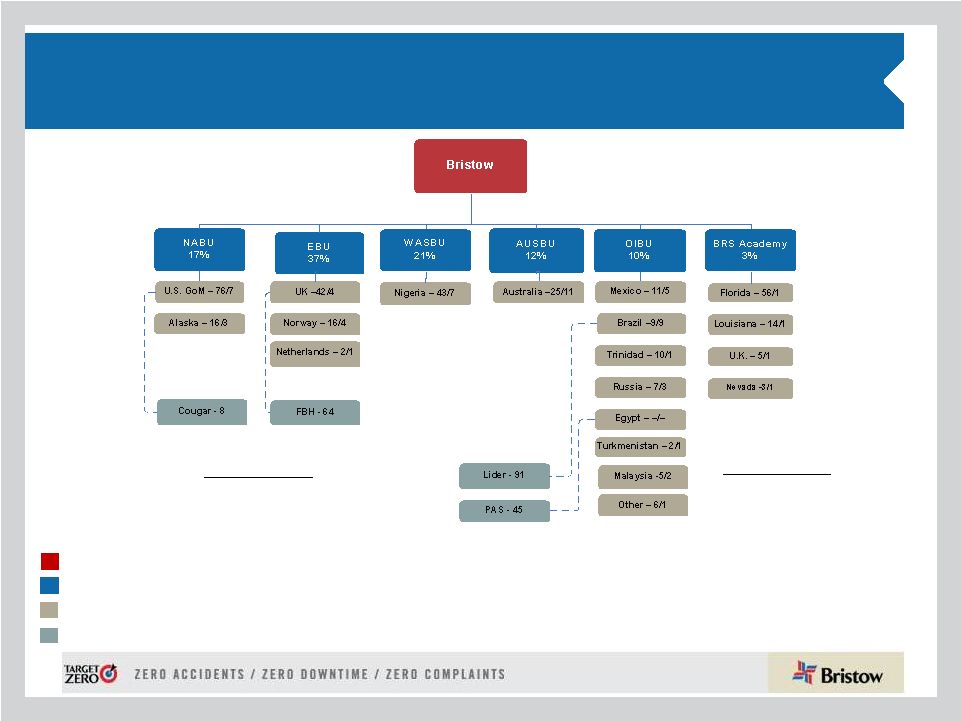

Organizational Chart -

as of December 31, 2012

Business

Unit

(%

of

FY13

Operating

Revenue)

Corporate

Region

( # of Aircraft / # of Locations)

Joint

Venture

(#

of

aircraft)

Key

Operated Aircraft

Bristow owned and/or operated

356 aircraft as of December 31,

2012

Affiliated Aircraft

Bristow affiliates and joint

ventures operated 200 aircraft

as of December 31, 2012 |

23

Aircraft Fleet –

Medium and Large

As of December 31, 2012

Next Generation Aircraft

Medium capacity 12-16 passengers

Large capacity 18-25 passengers

Mature Aircraft Models

Fair market value of our owned fleet is $2.0 billion and leased fleet is $400 million

2

1

Aircraft

Type

No. of PAX

Engine

Consl

Unconsl

Total

Ordered

Large Helicopters

AS332L Super Puma

18

Twin Turbine

20

-

20

-

AW189

16

Twin Turbine

-

-

-

6

EC175

16

Twin Turbine

-

-

-

5

EC225

25

Twin Turbine

20

-

20

3

Mil MI 8

20

Twin Turbine

7

-

7

-

Sikorsky S-61

18

Twin Turbine

2

-

2

-

Sikorsky S-92

19

Twin Turbine

42

7

49

18

91

7

98

32

LACE

89

Medium Helicopters

AW139

12

Twin Turbine

7

2

9

6

Bell 212

12

Twin Turbine

14

14

-

Bell 412

13

Twin Turbine

30

20

50

-

EC155

13

Twin Turbine

1

-

1

-

Sikorsky S-76A/A++

12

Twin Turbine

15

5

20

-

Sikorsky S-76C/C++

12

Twin Turbine

51

34

85

-

Sikorsky S-76D

12

Twin Turbine

10

104

75

179

16

LACE

45

1)

LACE does not include held for sale, training and fixed wing helicopters

2)

Order book is as of March 7, 2013 |

24

Aircraft Fleet –

Small, Training and Fixed

As of December 31, 2012 (continued)

Next Generation Aircraft

Mature Aircraft Models

Small capacity 4-7 passengers

Training capacity 2-6 passengers

1)

LACE does not include held for sale, training and fixed wing helicopters

2)

Order book is as of March 7, 2013 |

25

Operating lease strategy: lowering the cost and

amount of capital needed to grow

•

Of the 61 aircraft currently leased in our fleet, 31 are training and 30 are

commercial (22 LACE)

•

22 LACE aircraft represent approximately 14% of our commercial fleet

•

Our

goal

is

for

commercial

fleet

operating

leases

to

account

for

20-30%

of

our

LACE

Leased aircraft as of December 31, 2012

See

10-Q

Note

6

“Commitments

and

contingencies”

for

more

information

provided

on

operating

leases

Small

Medium

Large

Total

Leased LACE

Total LACE

% Leased

EBU

-

-

10

10

10

51

20%

WASBU

-

1

-

1

1

20

3%

NABU

1

11

2

14

8

39

20%

AUSBU

2

-

3

5

4

17

21%

OIBU

-

-

-

-

-

27

-

Total

3

12

15

30

22

154

14% |

26

Consolidated fleet changes and aircraft sales for

Q3 FY13

See 10-Q Note 6 “Commitments and contingencies”

for more information provided on operating leases

Small

Medium

Large

Total

EBU

-

2

2

4

WASBU

-

1

-

1

NABU

-

-

-

-

AUSBU

-

4

-

4

OIBU

-

8

-

8

Total

-

15

2

17

Held for sale aircraft in consolidated fleet

Small

Medium

Large

Training

Total

EBU

-

-

10

-

10

WASBU

-

1

-

-

1

NABU

1

11

2

-

14

AUSBU

2

-

3

-

5

OIBU

-

-

-

-

-

Academy

-

-

-

31

31

Total

3

12

15

31

61

Leased aircraft in consolidated fleet

# of A/C Sold

Received**

Q1 FY13

4

19.0

$

Q2 FY13

5

16.5

Q3 FY13

4

7.5

Totals

13

43.0

$

** Amounts stated in millions

Q1 FY13

Q2 FY13

Q3 FY13

YTD

Fleet Count Beginning

361

357

349

361

Delivered

-

B412EP

1

1

S-92

2

10

12

EC225

1

1

2

Total Delivered

2

1

12

15

Removed

Sales

(4)

(5)

(5)

(14)

Other*

(2)

(4)

-

(6)

Total Removed

(6)

(9)

(5)

(20)

357

349

356

356

* Includes destroyed aircraft, lease returns and commencements

Fleet changes |

27

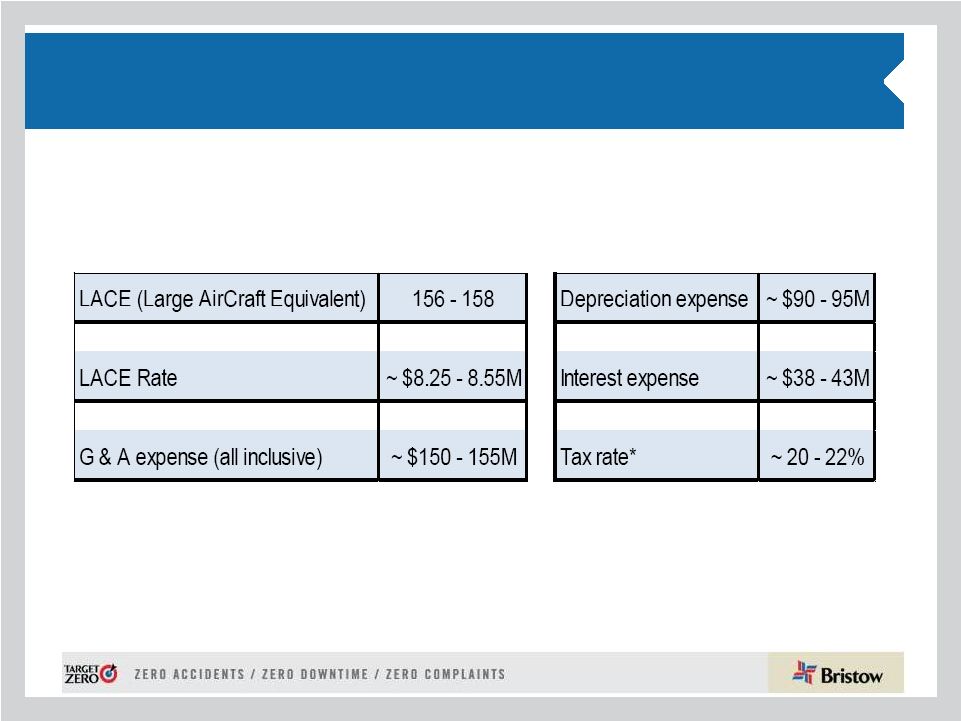

Operating revenue, LACE and LACE Rate by BU

1) $ in millions

2) LACE Rate is annualized

3) $ in millions per LACE |

28

Historical LACE and LACE Rate by BU

1) $ in millions

2) LACE Rate is annualized

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

EBU

42

43

48

46

44

46

46

45

47

45

51

WASBU

24

24

21

22

23

22

22

22

22

22

20

NABU

39

35

34

29

30

29

30

30

30

31

39

AUSBU

20

23

24

20

19

20

20

19

18

17

17

OIBU

33

33

33

38

39

38

38

34

32

28

27

Consolidated

157

158

159

154

154

154

155

149

147

142

154

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

EBU

$8.20

$8.50

$7.90

$8.40

$9.80

$9.60

$9.63

$10.09

$10.60

11.03

9.74

WASBU

9.70

9.40

10.70

9.90

9.10

10.30

11.17

11.46

12.35

12.24

13.71

NABU

5.40

6.10

6.00

6.60

5.80

6.30

5.89

5.79

7.05

7.11

5.84

AUSBU

6.80

6.00

6.00

7.50

8.60

7.10

6.96

7.78

8.48

9.29

9.55

OIBU

3.90

4.10

4.40

3.90

3.50

3.70

3.78

4.22

4.22

4.62

4.76

Consolidated

6.70

6.90

6.90

7.10

7.30

7.40

7.43

7.89

8.55

8.95

8.49

LACE

2011

2012

2011

2012

2013

2013

LACE Rate

1,2 |

29

Order and options book as of March 7, 2013 |

30

Adjusted EBITDAR margin* trend

*

Adjusted

EBITDAR

excludes

special

items

and

asset

dispositions

and

calculated

by

taking

adjusted

EBITDAR

divided

by

operating

revenue

Q1

Q2

Q3

Q4

Full Year

Q1

Q2

Q3

Q4

Full Year

EBU

31.2%

31.7%

31.9%

28.0%

30.8%

29.8%

31.5%

34.6%

34.4%

32.7%

WASBU

31.7%

36.8%

33.7%

39.1%

36.0%

33.7%

36.9%

35.8%

34.3%

35.2%

NABU

18.3%

20.0%

14.9%

17.7%

17.8%

20.8%

25.8%

15.9%

8.5%

18.5%

AUSBU

26.5%

36.7%

34.4%

31.3%

32.4%

33.2%

26.1%

27.0%

31.1%

29.3%

OIBU

34.4%

37.6%

25.9%

25.1%

31.0%

18.3%

40.2%

37.4%

59.4%

39.3%

Consolidated

24.7%

27.8%

24.7%

23.9%

25.3%

23.8%

27.5%

25.9%

29.6%

26.7%

Q1

Q2

Q3

Q4

Full Year

Q1

Q2

Q3

EBU

33.0%

31.4%

30.7%

36.1%

32.9%

32.2%

34.6%

39.5%

WASBU

29.5%

35.5%

37.2%

36.6%

35.0%

31.9%

26.5%

35.0%

NABU

14.3%

20.6%

14.8%

19.4%

17.3%

23.2%

20.7%

29.1%

AUSBU

20.2%

14.4%

23.5%

35.6%

24.3%

27.0%

28.0%

27.3%

OIBU

48.1%

19.1%

47.8%

42.9%

39.5%

36.2%

44.2%

55.7%

Consolidated

23.4%

24.0%

27.6%

31.2%

26.6%

26.3%

26.1%

31.5%

2010

2011

2012

2013

(fiscal year ended) |

31

Adjusted EBITDAR* reconciliation

* Adjusted EBITDAR excludes special items and asset dispositions

($ in millions)

Q1

Q2

Q3

Q4

YTD

Q1

Q2

Q3

Q4

YTD

Net income

$24.0

$33.7

$27.1

$28.7

$113.5

$20.9

$38.8

$42.3

$31.2

$133.3

Income tax expense

9.5

11.2

5.7

2.6

29.0

8.5

3.3

-11.8

7.1

7.1

Interest expense

10.0

10.6

11.0

10.8

42.4

11.1

11.5

13.8

9.9

46.2

Gain on disposal of assets

-6.0

-4.9

-2.4

-5.3

-18.7

-1.7

-1.9

0.0

-5.1

-8.7

Depreciation and amortization

18.2

18.5

20.7

17.4

74.7

19.3

21.0

21.3

27.7

89.4

Special items

2.5

-2.4

-1.2

1.0

0.0

0.0

0.0

-1.2

2.4

1.2

EBITDA Subtotal

58.2

66.7

60.8

55.1

240.9

58.1

72.7

64.4

73.3

268.5

Rental expense

7.0

6.9

7.2

6.3

27.3

6.6

6.1

8.7

7.7

29.2

Adjusted EBITDAR

$65.2

$73.6

$0.1

$61.3

$268.2

$64.7

$78.8

$73.1

$81.1

$297.7

($ in millions)

Q1

Q2

Q3

Q4

YTD

Q1

Q2

Q3

Net income

$21.2

$3.0

$26.5

$14.6

$65.2

$24.2

$30.4

$36.7

Income tax expense

6.6

-1.9

7.1

2.4

14.2

6.2

8.3

7.8

Interest expense

9.0

9.5

9.8

10.0

38.1

8.8

8.6

14.7

Gain on disposal of assets

-1.4

1.6

2.9

28.6

31.7

5.3

1.3

-7.4

Depreciation and amortization

22.7

25.4

22.7

25.3

96.1

21.4

23.3

24.9

Special items

0.0

24.6

0.0

3.4

28.1

2.2

-2.8

14.9

EBITDA Subtotal

58.1

62.1

68.9

84.3

273.4

68.0

69.2

91.6

Rental expense

9.0

9.1

12.8

15.1

46.0

16.3

15.3

17.6

Adjusted EBITDAR

$67.0

$71.2

$81.8

$99.5

$319.5

$84.3

$84.5

$109.2

3/31/2010

3/31/2011

3/31/2012

Fiscal year ended,

3/31/2013 |

32

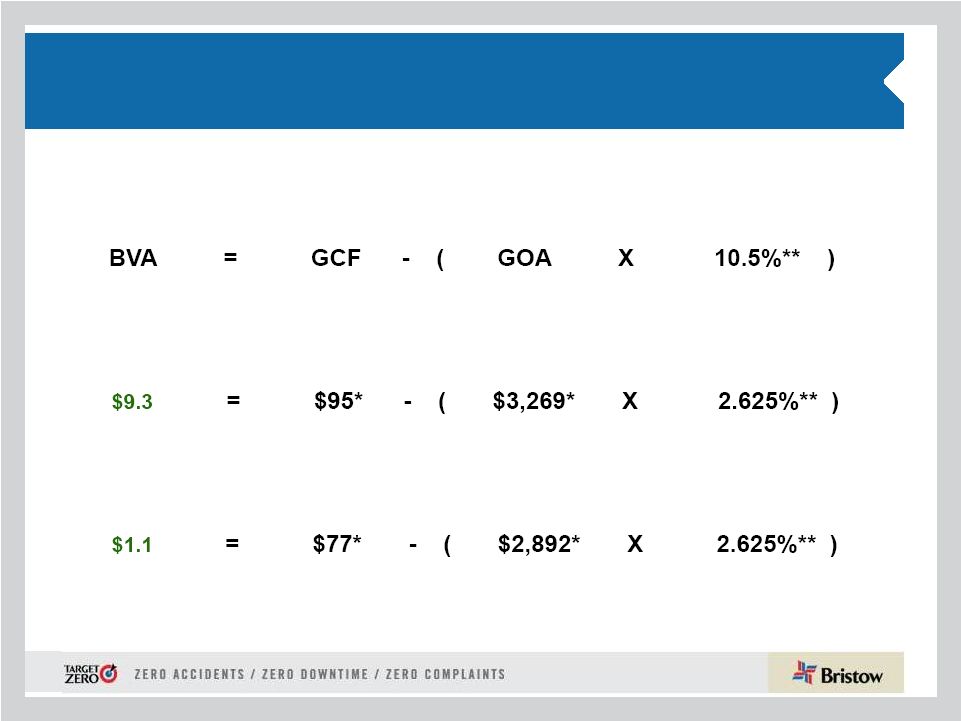

Bristow Value Added = Gross Cash Flow –

(Gross Operating Assets X Capital Charge)

Bristow Value Added calculation for Q3 FY13

Bristow Value Added calculation for Q3 FY12

Bristow Value Added (BVA)

Sample calculation for Q3 FY13 and Q3 FY12

* Reconciliation for these items follows right after

this slide ** Quarterly capital charge of 2.625% is based on

annual capital charge of 10.5% |

33

Gross Cash Flow Reconciliation

(in millions)

Gross Cash Flow Reconciliation

Q3 FY13

Q3 FY12

Net Income

$36

$26

Depreciation and Amortization

25

23

Interest Expense

15

10

Interest Income

(0)

(0)

Rent

18

13

Other Income/expense-net

15

0

Earnings of Discontinued Operations

-

-

Gain/loss on Asset Sale

(7)

3

Special Items

-

-

Tax Effect from Special Items

(3)

(1)

Earnings (losses) from Unconsolidated Affiliates, Net

(9)

(3)

Non-controlling Interests

0

1

Gross Cash Flow (before Lider)

$90

$71

Gross Cashflow -Lider prportional

5

6

Gross Cash Flow after Lider

$95

$77 |

34

Gross Operating Asset Reconciliation |

35

GAAP Reconciliation

Three Months Ended

Nine Months Ended

December 31,

December 31,

2012

2011

2012

2011

(In thousands)

Adjusted operating income

$

66,724

$

46,418

$

160,000

$

119,900

Gain (loss) on disposal of assets

7,396

(2,865)

819

(3,060)

Special items

—

—

622

(27,287)

Operating income

$

74,120

$

43,553

$

161,441

$

89,553

Adjusted EBITDAR

$

109,223

$

81,769

$

277,950

$

220,029

Gain (loss) on disposal of assets

7,396

(2,865)

819

(3,060)

Special items

(14,932)

—

(14,310)

(24,610)

Depreciation and amortization

(24,867)

(22,709)

(69,560)

(70,848)

Rent expense

(17,604)

(12,836)

(49,160)

(30,897)

Interest expense

(14,742)

(9,756)

(32,113)

(28,170)

Provision for income taxes

(7,788)

(7,118)

(22,310)

(11,779)

Net income

$

36,686

$

26,485

$

91,316

$

50,665

Adjusted net income

$

42,632

$

27,790

$

101,304

$

71,089

Gain (loss) on disposal of assets

(i)

6,101

(2,258)

658

(2,482)

Special items

(i)

(12,341)

—

(12,240)

(19,319)

Net income attributable to Bristow Group

$

36,392

$

25,532

$

89,722

$

49,288

Adjusted diluted earnings per share

$

1.17

$

0.76

$

2.77

$

1.93

Gain (loss) on disposal of assets

(i)

0.17

(0.06)

0.02

(0.07)

Special items

(i)

(0.34)

—

(0.33)

(0.53)

Diluted earnings per share

1.00

0.70

2.45

1.34

(i)

These amounts are presented after applying the appropriate tax effect to each item and dividing by

the weighted average shares outstanding during the related period to calculate the earnings

per share impact. |

36

Leverage Reconciliation

*Adjusted EBITDAR exclude gains and losses on dispositions of assets

Debt

Investment

Capital

Leverage

(a)

(b)

(c) = (a) + (b)

(a) / (c)

(in millions)

As of December 31, 2012

900.6

$

1,616.8

$

2,517.4

$

35.8%

Adjust for:

Unfunded Pension Liability

115.7

115.7

NPV of Lease Obligations

243.9

243.9

Letters of credit

2.6

2.6

Adjusted

1,262.7

$

(d)

1,616.8

$

2,879.5

$

43.9%

Calculation of debt to adjusted EBITDAR multiple

TTM Adjusted EBITDAR*:

FY 2013

377.4

$

(e)

\

= (d) / (e)

3.35:1 |

37

Net Asset Value (NAV) Comparison:

12/31/2003 to 12/31/2012 |

38

Bristow Group Inc. (NYSE: BRS)

2103 City West Blvd., 4

th

Floor

Houston, Texas 77042

t

713.267.7600

f

713.267.7620

bristowgroup.com

Contact Us |