Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TEMPUR SEALY INTERNATIONAL, INC. | d504903d8k.htm |

| EX-4.4 - EX-4.4 - TEMPUR SEALY INTERNATIONAL, INC. | d504903dex44.htm |

| EX-4.1 - EX-4.1 - TEMPUR SEALY INTERNATIONAL, INC. | d504903dex41.htm |

| EX-4.5 - EX-4.5 - TEMPUR SEALY INTERNATIONAL, INC. | d504903dex45.htm |

| EX-99.1 - EX-99.1 - TEMPUR SEALY INTERNATIONAL, INC. | d504903dex991.htm |

Tempur-Pedic International

Investor Presentation

March 2013

1

Exhibit 99.2 |

Note

Regarding Trademarks, Trade Names and Service Marks: Tempur, Tempur-Pedic,

TEMPUR-Cloud Collection, TEMPUR-Cloud Select,

TEMPUR-Cloud Supreme, TEMPUR-Cloud Supreme Breeze,

TEMPUR-Cloud Luxe, TEMPUR-Cloud Allura, TEMPUR-Cloud Luxe Breeze,

TEMPUR-Choice Collection, TEMPUR-Choice Supreme, TEMPUR-Choice Luxe, TEMPUR-Weightless Collection, TEMPUR-

Weightless Select, TEMPUR-Weightless Supreme, TEMPUR-Contour Collection,

TEMPUR-Contour, TEMPUR-Contour Select, TEMPUR-Contour Signature, TEMPUR-Rhapsody, TEMPUR-Rhapsody Breeze,

TEMPUR-Allura, GrandBed, TEMPUR-Simplicity Collection, TEMPUR Original

Collection, TEMPUR Sensation Collection, TEMPUR-Ergo Advanced System, TEMPUR-Ergo Premier, TEMPUR-Cloud Pillow,

TEMPUR-Neck Pillow, TEMPUR-Symphony Pillow, TEMPUR-Comfort Pillow,

TEMPUR-Rhapsody Pillow, and TEMPUR-Traditional Pillow are trademarks, trade names or service marks of Tempur-Pedic

International Inc. and its subsidiaries.

Sealy, Sealy Posturepedic, Stearns & Foster, and Optimum

are trademarks, trade names or service marks of Sealy Corporation and its subsidiaries. All other trademarks, trade names and service marks in

this presentation are the property of the respective owners.

Forward-Looking Statements

2

This presentation contains "forward-looking statements,”

within the meaning of federal securities laws, which include information concerning

one or more of the Company's plans, objectives, goals, strategies, and

other information that is not historical information. When used in this

release, the words "estimates," "expects,"

"anticipates," "projects," "plans," “proposed,”

"intends," "believes," and variations of such words or similar

expressions are intended to identify forward-looking statements. These

forward-looking statements include, without limitation, statements relating to Tempur-Pedic’s or Sealy’s

expectations regarding the opportunities and strengths of the combined company,

anticipated cost and revenue synergies, the strategic rationale for the

combination, including expectations regarding product offerings,

growth opportunities, value creation, and financial strength. All forward

looking statements are based upon current expectations and beliefs and

various assumptions. There can be no assurance that the Company will realize these

expectations or that these beliefs will prove correct.

Numerous factors, many of which are beyond the Company's control, could cause

actual results to differ materially from those expressed as forward-

looking statements. These risk factors include the ability to

successfully integrate Sealy into Tempur-Pedic’s operations and realize synergies from the

proposed transaction; general economic, financial and industry conditions,

particularly in the retail sector, as well as consumer confidence and the

availability of consumer financing; uncertainties arising from global events; the

effects of changes in foreign exchange rates on the combined company's

reported earnings; consumer acceptance of the combined company's

products; industry competition; the efficiency and effectiveness of the combined

company's advertising campaigns and other marketing programs; the combined

company's ability to increase sales productivity within existing retail

accounts and to further penetrate the combined company's domestic retail channel,

including the timing of opening or expanding within large retail accounts;

the combined company's ability to address issues in certain underperforming international markets; the combined company's ability to

continuously improve and expand its product line, maintain efficient, timely and

cost-effective production and delivery of its products, and manage its

growth; changes in foreign tax rates, including the ability to utilize tax loss

carry forwards; rising commodity costs; the effect of future legislative, regulatory

or tax changes; and the possibility that one or more former Sealy stockholders will

pursue their rights to an appraisal action in Delaware relating to the Sealy

merger. Additional information concerning these and other risks and

uncertainties are discussed in the Company's filings with the Securities and Exchange

Commission, including without limitation the Company's Annual Report on Form

10-K under the headings "Special Note Regarding Forward-Looking

Statements" and "Risk Factors." Any forward-looking statement

speaks only as of the date on which it is made, and the Company undertakes no

obligation to update any forward-looking statements for any reason, including

to reflect events or circumstances after the date on which such statements

are made or to reflect the occurrence of anticipated or unanticipated events or

circumstances. |

3

Best of Both |

Strong,

Established Management Team 4

Prior Experience

Years with

Name

Position

Prior Experience

Consumer

Products

Inter'l

Tempur or

Sealy

Mark Sarvary

President and CEO

President, Campbell Soup North America

CEO, J. Crew Group

5

President, Stouffer's Frozen Food Division at Nestle

David Montgomery

EVP and President,

President, Rubbermaid Europe

International

VP, Black & Decker Europe, Middle East, Africa

10

Larry Rogers

CEO of Sealy

President and CEO, Sealy Corporation

President, Sealy North America

33

President, Sealy International

Dale Williams

EVP and CFO

CFO, Honeywell Control Products

CFO, Saga Systems

10

CFO, GE Information Systems

Tim Yaggi

COO

Group President, Masco Corporation

Joined

EVP, Whirlpool Corporation

2013

Norelco (Philips) |

Strategic Benefits of Combination

Comprehensive Portfolio of Iconic Brands

The most iconic and globally recognized brands in the industry

Strong brand recognition across North America, South America, Europe, Asia, and

Australia Complementary Product Offering

Products for almost every consumer preference and price point

Tempur-Pedic’s visco-elastic mattresses, adjustable bases and

pillows Sealy’s innerspring and hybrid mattresses

Ability to leverage R&D to develop innovative new products

Truly Global Footprint

Tempur-Pedic: Strong presence in North America, Europe, and Asia

Sealy: Well represented in U.S., Canada, Mexico, Argentina, and Asia

Significant Value Creation

Cost synergy estimate in excess of $40 million by the third year

Attractive upside from revenue synergies across organizations

Strong Financial Characteristics

Significant cash flow characteristics will enable rapid deleveraging

Ability to invest in key growth areas

5 |

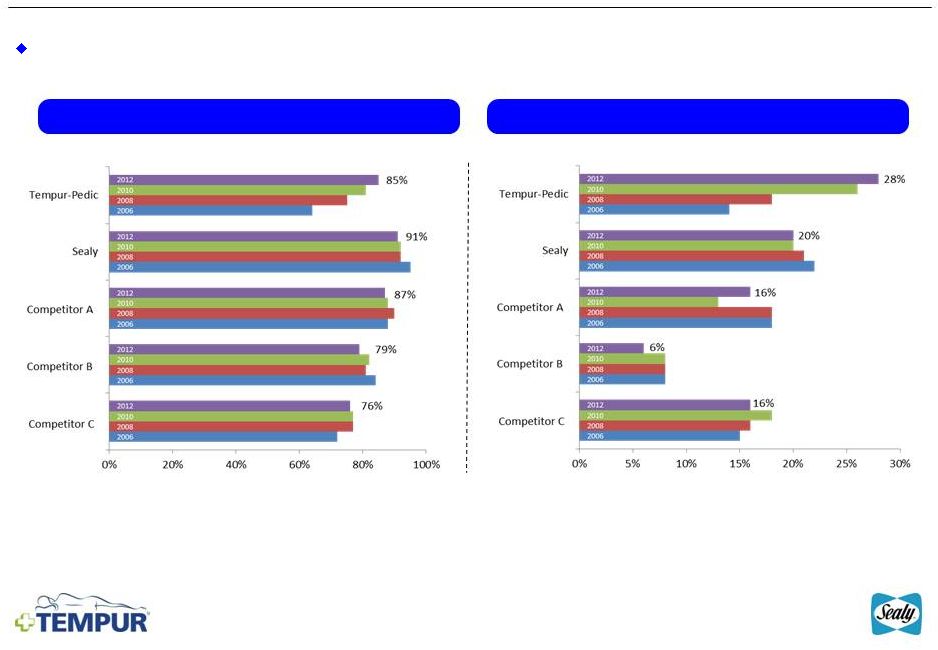

Comprehensive Portfolio of Iconic Brands

Source:

2012

Mattress

Industry

Consumer

Research

–

U.S.

Market

Total Brand Awareness

Future Purchase Interest

2004

2006

2008

2010

2012

2004

2006

2008

2010

2012

2004

2006

2008

2010

2012

2004

2006

2008

2010

2012

2004

2006

2008

2010

2012

2004

2006

2008

2010

2012

2004

2006

2008

2010

2012

2004

2006

2008

2010

2012

Leading Brand Awareness with Highest Intent to Purchase

6 |

Net

Sales Breakdown Geography

7

FY12 Total Net Sales $1.4 Billion

Mattresses

Pillows

Other

North America

International

FY12 Total Net Sales $1.3 Billion

United States

Canada

Other

Innerspring

Specialty

Other

15%

8%

77%

Product

FY12 Total Net Sales $1.4 Billion

FY12 U.S. Net Sales $1.0 Billion

2%

12%

86%

67%

11%

22%

69%

31%

Last 12-months ended December 31, 2012 for Tempur-Pedic and December 2, 2012 for Sealy. For a

discussion of performance, please refer to the 10Q and 10K filings. |

Range

Of Products 8

Innerspring

Hybrid

Visco

Foundations

Pillows

Accessories

Sealy

Stearns & Foster

Sealy Posturepedic

Sealy Posturepedic

Sealy Posturepedic

TEMPUR-Choice

TEMPUR-Rhapsody

Breeze

Optimum by Sealy

Posturepedic

TEMPUR-Cloud

Luxe

Sealy Foundation

TEMPUR-Ergo Premier Adjustable Base

TEMPUR-Neck

Pillow

TEMPUR-Traditional

Pillow

The CampusTopper

By Tempur-Pedic

TEMPUR Slippers |

9

1

Retail list price point for queen set. Note: TEMPUR-Choice Collection

expected availability 2Q 2013. Mattress Segmentation

$2,499-$7,999

$3,499-$3,999

$1,999-$4,999

$2,199-$2,699

$1,399

$1,399-$4,499

$1,299-$3,799

$599-$1,799

$399-$699

U.S.

Mattress

Brand

Portfolio

by

Retail

Price

Points

1 |

1

Last

12-months

ended

December

31,

2012

for

Tempur-Pedic

and

December

2,

2012

for

Sealy

(reflecting

simple

combination

of

both

companies’

results,

without

any

Regulation

S-X

Article

11

adjustments).

2

Management estimates.

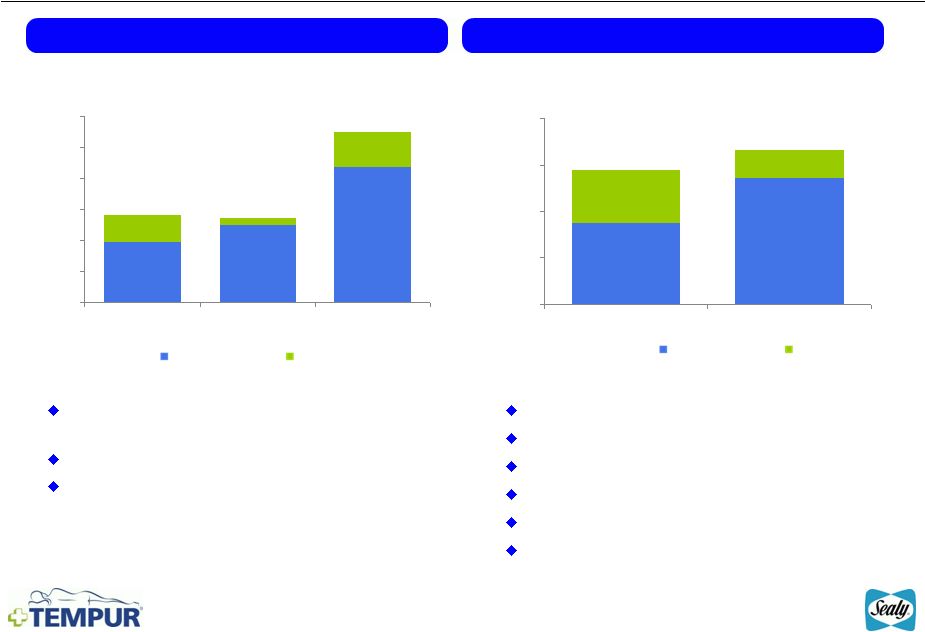

Highly Complementary Global and Channel Footprint

Last 12-Months Net Sales

Retail Doors

Broadens presence across price points and

technologies

World-class innovation capabilities

Highly complementary geographic footprint

Furniture and bedding retailers

Department stores

Warehouse / club stores

Company-owned flagship stores

Direct to consumer

Hospitality

$2.7

$1.4

$1.3

14,450

16,700

10

($ in billions)

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

TPX

ZZ

LTM

Broad Customer Base

2

Global

Scale

1

North America

Int’l

North America

Int’l

0

5,000

10,000

15,000

20,000

TPX

ZZ

1 |

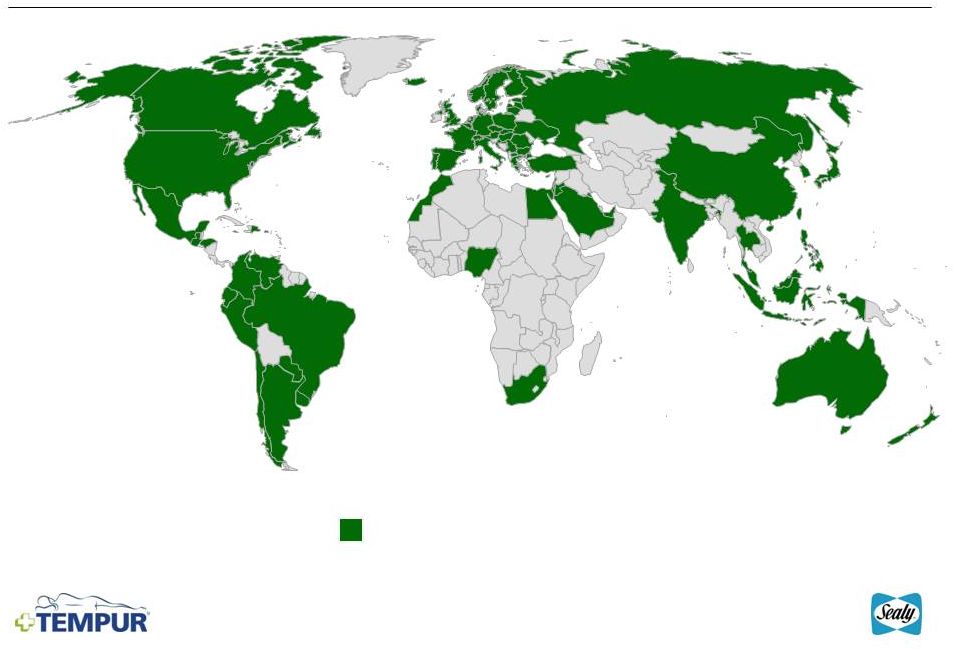

A

Truly Global Company Tempur-Pedic and/or Sealy Presence

Source: Company data. Presence includes subsidiaries, joint ventures, third party,

and licensee markets. 11 |

Attractive Upside from Cost Synergies

Cost Synergies

Sourcing/Manufacturing

Raw materials

Foundations

Adjustable Bases

Covers

Warehouse/Distribution

Improved route efficiency

Potential to integrate distribution

Backhaul/returns

Corporate Expenses

Streamline corporate administration

Professional fees

Indirect sourcing

In Excess of $40 Million Expected By Third Year

12

Note: Management estimates. |

Attractive Upside from Revenue Synergies

Revenue Synergies

Brands / Technology

Channels

Global Markets

New Product Categories

Increased investment and innovation in Sealy

and Tempur-Pedic brands

Leverage collective IP and technology

Leverage Sealy’s competency in Club,

Department Stores, and Hospitality

Leverage Tempur’s capabilities in Direct and

eCommerce

Utilize Tempur-Pedic’s and Sealy’s collective

strengths in International markets

Leverage brand portfolio to expand into new

categories (outside of mattresses)

13 |

Financial Overview |

15

Use of Non-GAAP Financial Measures

Tempur-Pedic International Inc. (the “Company”) has presented the

following non-GAAP financial measures in this presentation: adjusted

EBITDA of each of the Company and Sealy, and adjusted EBITDA of the combined company. The Company and Sealy each

define its non-GAAP adjusted EBITDA to exclude the following: (1) interest

expense, net; (2) provision for income taxes; and (3) depreciation

and

amortization

expense.

The

Company

and

Sealy

also

exclude

certain

unusual

items

and

other

adjustments

permitted in calculating its respective debt covenants in its debt agreements. The

reconciliations of these historical non-GAAP measures to each of

Tempur-Pedic’s and Sealy’s GAAP financial measures for the periods presented, are set forth on slide 17.

The

Company

believes

the

use

of

these

non-GAAP

financial

measures

are

useful

to

investors

in

comparing

the

results

of

operations

for

comparable periods by eliminating certain of the more significant effects of

adjusted EBITDA. These measures also reflect how the Company and Sealy

manage their businesses internally. In addition to the adjustments included in the calculation of the Company’s

non-GAAP

adjusted

EBITDA

eliminates

the

effects

of

financing,

income

taxes

and

the

accounting

effects

of

capital

spending

and

acquisitions.

As

with

the

items

eliminated

in

its

calculation

of

non-GAAP

adjusted

EBITDA,

these

items

may

vary

for

different

companies for reasons unrelated to the overall operating performance of a

company’s business. When analyzing Tempur-Pedic’s,

Sealy’s and the combined company’s operating performance, investors

should not consider these non-GAAP financial measures as a substitute

for comparable measures in accordance with GAAP. |

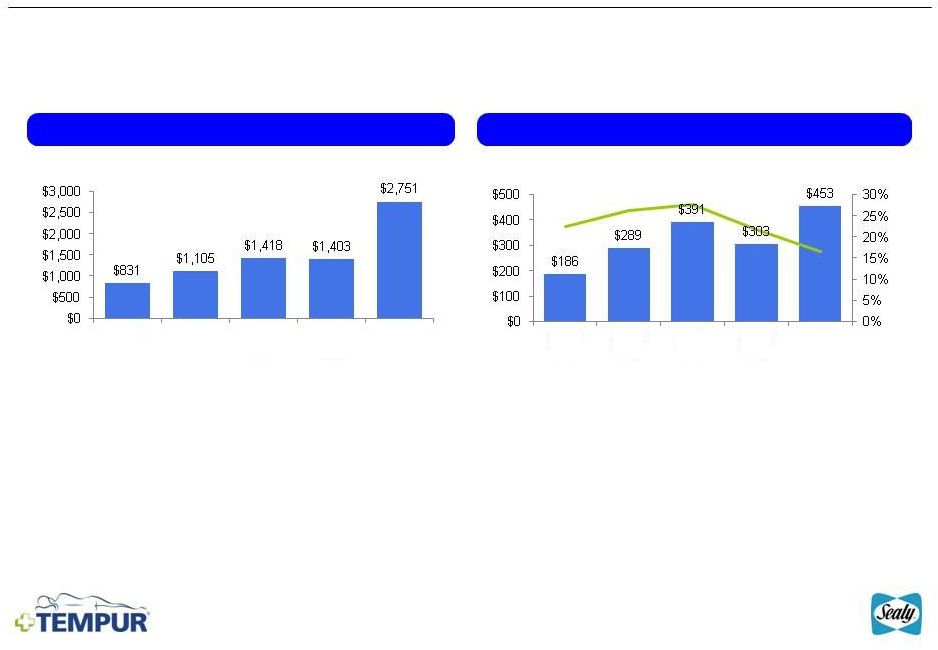

($

in millions) Adj. EBITDA & Adj. EBITDA Margin

2

Net Sales

1

1

16

($ in millions)

2

Adjusted EBITDA Margin reflects Adjusted EBITDA (slide 17) divided by the LTM combined net sales. 1

Last 12-months ended December 31, 2012 for Tempur-Pedic and December 2, 2012 for

Sealy (reflecting simple combination of both companies’ results, without any Regulation S-X Article 11 adjustments).

2009

TPX

2010

TPX

2011

TPX

2012

TPX

LTM

Combined

2009

TPX

2010

TPX

2011

TPX

2012

TPX

LTM

Combined

Tempur-Pedic

and

LTM

Combined

1

Financial

Overview |

17

Adjusted EBITDA Reconciliation

1

Last

12-months

ended

December

31,

2012

for

Tempur-Pedic

and

December

2,

2012

for

Sealy

(reflecting

simple

combination

of

both

companies’

results,

without

any

Regulation

S-X

Article

11

adjustments).

LTM Combined Adjusted EBITDA

($ in millions)

2

Includes Comfort Revolution acquisition costs, noncontrolling interest, and various

immaterial adjustments. Tempur-Pedic

1

Sealy

1

Combined

1

Net income (loss)

$106.8

($1.2)

$105.6

Interest expense

18.8

89.3

108.1

Income taxes

122.4

12.5

134.9

Depreciation and amortization

42.0

26.4

68.4

EBITDA

$290.0

$127.1

$417.1

Transaction costs

8.9

2.5

11.4

Integration costs

2.2

2.2

Refinancing charges

3.7

3.7

Non-cash compensation

8.1

8.1

Restructuring and impairment related charges

1.5

2.4

3.9

Discontinued operations

2.0

2.0

Other

2

4.3

4.3

Adjusted EBITDA

$302.6

$150.1

$452.7 |