Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - 4Licensing Corp | ex99_1.htm |

| 8-K - 4LICENSING CORPORATION 8-K 2-14-2013 - 4Licensing Corp | form8k.htm |

EXHIBIT 2.1

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT (the “Agreement”) is dated as of February 14, 2013 by and among Pinwrest Development Group,LLC, a limited liability company organized under the laws of the State of Delaware (“Purchaser”), on the one hand, and The Dodd Group LLC, a limited liability company organized under the laws of the State of Texas (“Seller”), Mark Dodd (“Dodd” or the “Series A Preferred Member”), Oak Stream Investors II, Ltd., Paramount Capital Investments (Private Equity), LLC, STELAC SPV VIII LLC, Greg S. Oliver and David B. Feldman, (individually, a “Series B Preferred Member” and collectively, the “Series B Preferred Members”) (the Series A Preferred Member and the Series B Preferred Members are sometimes collectively referred to as the “Members”), on the other hand.

W I T N E S S E T H :

WHEREAS, Seller engages in the business of exploiting certain intellectual property owned by Seller, including, without limitation, the intellectual property listed on Exhibit 1.1 (a)(ii) and the licensing of certain intellectual property rights pursuant to the agreements listed on Exhibit 1.1 (a)(iii) (the “Business”); and

WHEREAS, Purchaser desires to purchase and Seller desires to sell substantially all of the assets of Seller and the Business as a going concern (subject to certain exclusions as more specifically set forth herein), all upon the terms and conditions hereinafter set forth;

NOW, THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth, the parties hereto agree as follows:

ARTICLE 1.

SALE OF ASSETS AND ASSUMPTION OF CERTAIN LIABILITIES

|

|

1.1

|

Sale of Assets.

|

(a) Subject to the terms and conditions of this Agreement, Seller agrees to convey, sell, assign, transfer and deliver to Purchaser, and Purchaser agrees to purchase and acquire from Seller on the Closing Date (as hereinafter defined), the assets, properties, rights and Business as a going concern (all of such assets, properties and rights related to Seller being hereafter sometimes collectively referred to as “Seller Assets”). The Seller Assets include the following:

|

(i)

|

The furniture, fixtures and equipment listed on Exhibit 1.1 (a)(i) hereto used in the operation of the business;

|

|

(ii)

|

The Intellectual Property (as defined below) owned or licensed by Seller and listed on Exhibit 1.1 (a)(ii) (including all files relating thereto) and Seller's Know-How (as defined below); and

|

|

(iii)

|

The contracts and contract rights listed on Exhibit 1.1 (a)(iii);

|

(b) For purposes of this Agreement, the term “Intellectual Property” shall mean all rights, privileges and priorities provided under federal, state, foreign and multinational law relating to intellectual property, including without limitation all: (i) (A) patents and patent applications, inventions, discoveries, machines, manufactures, compositions, formulae, designs, methods, procedures, processes, new and useful improvements thereof and know-how relating thereto, whether or not patented or patentable; (B) copyrights and works of authorship, including computer applications, programs, software, files, databases, and related items; (C) trademarks, service marks, trade names, domain names, URLs, logos and trade dress and the goodwill of any business symbolized thereby; (D) trade secrets, drawings, lists and all other proprietary, nonpublic or confidential information, documents or materials in any media; and (ii) all registrations, applications, recordings and other legal protections or rights related to the foregoing.

(c) For purposes of this Agreement, the term “Know-How” shall mean all factual knowledge and proprietary information pertaining to the Intellectual Property and used or useful in the development of products utilizing the Intellectual Property of Seller, including, without limitation, information constituting trade secrets or confidential information, and all chemical, manufacturing, formulation processes relating to the exploitation of the Intellectual Property and any scientific research data or information with regard to the above.

(d) Seller represents and warrants that the Seller Assets include all the assets, property and rights (other than non-transferrable permits and other authorizations) necessary for the operation of the Business in the manner in which it has been conducted immediately prior to the Closing Date subject only to the Excluded Assets set forth below. Seller agrees to transfer all personal property to be transferred hereunder by bulk bills of sale in the form annexed hereto as Exhibit 1.1 (d), together with such other appropriate instruments of title as Purchaser or its counsel may reasonably request. Seller further agrees to execute and deliver documents of assignment substantially in the form of the assignments attached hereto as Exhibit 1.1 (d) which Purchaser deems reasonably necessary or desirable to transfer to Purchaser all right, title and interest in and to Seller's Intellectual Property.

(e) Notwithstanding the foregoing to the contrary, the following assets of Seller (collectively, the “Excluded Assets”) shall be excluded from this Agreement and shall not be assigned or transferred by Seller to Purchaser:

|

(i)

|

Claims for refunds or refunds of taxes and other charges imposed by an governmental authority;

|

2

|

(ii)

|

All securities, cash and cash equivalents on hand or in bank or other accounts except as provided in Section 2.2 (e);

|

|

(iii)

|

All accounts receivable for the Business prorated as of the Closing Date as provided in Section 2.2 herein;

|

|

(iv)

|

All organizational documents, minute books and other company governance documents of the Seller;

|

|

(v)

|

All employee records of Seller;

|

|

(vi)

|

Any claims and rights against third parties (including without limitation, claims against insurance carriers and actions under the U.S. Bankruptcy Code), to the extent that they relate to liabilities or obligations that are not assumed by Purchaser hereunder;

|

|

(vii)

|

The Lease (as defined below in Section 4.3); and

|

|

(viii)

|

All bank accounts of Seller.

|

(f) EXCEPT FOR THE REPRESENTATIONS AND WARRANTIES EXPRESSLY SET FORTH IN ARTICLE 4 OF THIS AGREEMENT, SELLER’S RIGHT, TITLE AND INTEREST IN THE SELLER ASSETS SHALL BE SOLD TO PURCHASER PURSUANT TO THIS AGREEMENT ON AN “AS IS, WHERE IS” BASIS. EXCEPT FOR THE REPRESENTATIONS AND WARRANTIES EXPRESSLY SET FORTH IN ARTICLE 4 OF THIS AGREEMENT, SELLER DOES NOT MAKE, HAS NOT MADE AND SHALL NOT BE DEEMED TO HAVE MADE, AND EXPRESSLY DISCLAIMS TO PURCHASER, ANY OTHER REPRESENTATION OR WARRANTY, EITHER EXPRESSED, IMPLIED, WRITTEN OR ORAL, WITH RESPECT TO THE SELLER ASSETS OR ANY COMPONENT THEREOF, INCLUDING, WITHOUT LIMITATION, ANY WARRANTY AS TO DESIGN, COMPLIANCE WITH ANY LAW, ROLE OR SPECIFICATION, QUALITY OF MATERIALS, WORKMANSHIP, MERCHANTABILITY, FITNESS FOR ANY PURPOSE, SAFETY, OR INTELLECTUAL PROPERTY INFRINGEMENT. FOR THE AVOIDANCE OF DOUBT, THIS SECTION 1.1 (f) DOES NOT AFFECT AND SHALL NOT BE DEEMED TO AFFECT SELLER'S REPRESENTATIONS AND WARRANTIES SET FORTH IN ARTICLE 4 OF THIS AGREEMENT.

1.2 Purchase Price. In consideration of Purchaser's purchase of the Assets, on the Closing Date, Purchaser shall pay Seller the sum of $2,100,000.00 which shall be payable to Seller in cash by federal wire transfer to the bank account of Seller (the “Purchase Price”).

3

1.3 Assumption of Liabilities.

(a) On the Closing Date, Purchaser shall assume only the liabilities of Seller listed on Exhibit 1.3 and shall cause all such assumed liabilities to be discharged when due.

(b) Notwithstanding anything in this Agreement to the contrary, Purchaser shall not assume, or in any way be liable or responsible for, any liabilities or obligations of Seller except as specifically provided in Exhibit 1.3 and except as otherwise provided in this Agreement or any other instrument or agreement executed in connection with the transactions contemplated under this Agreement. Without limiting the generality of the foregoing, Purchaser shall not assume the following:

|

|

(i)

|

any liability or obligation of Seller not relating to the Seller Assets;

|

|

|

(ii)

|

except as expressly provided in Section 9.7 of this Agreement, any liability or obligation of Seller arising out of or in connection with the negotiation and preparation of this Agreement and the consummation and performance of the transactions contemplated hereby;

|

|

|

(iii)

|

any liability or obligation of Seller arising out of a default by Seller or other event occurring prior to the Closing Date in connection with any contract or agreement acquired by Purchaser as part of the Assets or assumed by Purchaser as part of the assumed liabilities;

|

|

|

(iv)

|

any liability or obligation of Seller for taxes, including income, sales, payroll, franchise, or other taxes, or any interest or penalties thereon, applicable to or arising from any period before the Closing Date; and

|

|

|

(v)

|

except as otherwise provided in this Agreement, any liability or obligation of Seller, including, but not limited to liabilities relating to copyright, trademark or other intellectual property, tort liability, employment discrimination, wrongful termination, errors and omissions liability, employee payroll and employee benefits liability, liability under employment agreements or pertaining to covenants not to compete, obligations arising out of or relating to pension plans.

|

4

ARTICLE 2

CLOSING

2.1 Closing Date. The consummation of the purchase and sale referred to in Section 1.1 of this Agreement (the “Closing”) shall take place on or before February 14, 2013. Such time and date will hereinafter be referred to as the “Closing Date.”

2.2 Allocation of Income and Expense.

(a) The parties agree that the sale of the Seller Assets shall be effective as of the close of business on the Closing Date. All business and operations of Seller relating to the Seller Assets prior to and including the Closing Date shall be considered to have been conducted for the account of Seller, and all revenues, receivables, income, and expense with respect to the Seller Assets arising prior to and including the Closing Date shall, except as otherwise provided herein, be the property and responsibility of Seller. All business and operations relating to the Seller Assets after the Closing Date shall be considered to have been conducted for the account of Purchaser, and all revenues, receivables, income and expenses with respect to the Seller Assets arising after the Closing Date shall, except as otherwise provided herein, be the property and responsibility of Purchaser.

(b) Within ten (10) days after the Closing Date, Seller shall provide Purchaser with a final, updated schedule through the Closing Date of the accounts receivable (“Closing Accounts Receivables”) and accounts payable (“Closing Accounts Payable”) of Seller with respect to the Seller Assets.

(c) Seller shall collect for its own account the Closing Accounts Receivable and shall pay when due the Closing Accounts Payable.

(d) The parties further agree that Purchaser shall receive any and all income in respect of the operation of the Business after the Closing Date and shall pay all expenses in respect of the operation of the Business after the Closing Date. If Purchaser collects any Closing Accounts Receivable subsequent to the Closing Date, Purchaser shall remit such amounts to Seller.

(e) Notwithstanding anything herein to the contrary, Seller and Purchaser acknowledge and agree that in connection with that certain Exclusive Sales Agreement (the “Wilson Agreement”) dated as of July 7, 2011, executed by and between Seller and Wilson Sporting Goods Co. (“Wilson”) Seller has received the sum of $63,138.00 from Wilson on January 11, 2013. Seller and Purchaser further agree that on the Closing Date, Seller shall remit to Purchaser the sum of $15,000.00 representing the costs and expenses associated with the delivery to Wilson of goods which Wilson is entitled to order pursuant to the Wilson Agreement in respect of the $63,138.00 payment made by Wilson.

5

ARTICLE 3

CONDUCT OF BUSINESS: REVIEW

3.1 Conduct of Business.

(a) During the period from the date of this agreement through the Closing Date, Seller agrees to conduct the operations of the Business only in accordance with the ordinary and usual course of business. Seller shall preserve intact its business organization and use reasonable commercial effort to maintain satisfactory relationships with customers, suppliers, vendors and others having business relations with Seller. Seller shall keep in full force and effect at all times all insurance specified in Exhibit 4.9.

(b) During the period from the date of this Agreement to the Closing Date, Seller shall confer, as reasonably requested by Purchaser, with one or more designated representatives of Purchaser to report material operational matters and to report the general status of ongoing operations.

3.2 Review of Seller.

(a) Upon request therefor by Purchaser, Seller shall permit Purchaser and its representatives to have access, at such times and in such manner as reasonably designated by Seller, to all of the books and records and material contracts relating to the Business and the Seller Assets. Seller shall furnish to Purchaser such financial and operating data and other information and schedules with respect to the Business and Seller Assets as Purchaser or its representatives shall, from time to time, reasonably request.

(b) Purchaser will, and will cause its employees, officers, directors, shareholders, outside advisors, agents, affiliates and representatives to, treat any agreements, data and information obtained with respect to any Seller, and any of its affiliates or shareholders (the “Confidential Information”), confidentially and with commercially reasonable care and discretion, and will not use the Confidential Information (except for the purposes of consummating the transactions described in this Agreement) or disclose any such Confidential Information to third parties; provided, however, that the foregoing shall not apply to (i) information in the public domain or that becomes public through disclosure by any party other than Purchaser or its affiliates or representatives, so long as such other party is not in breach of a confidentiality obligation, (ii) information that may be required to be disclosed by applicable law, (iii) information that is disclosed by Purchaser, on a confidential basis, to any of its respective agents, accountants, attorneys and prospective lenders or investors in connection with or related to the consummation of the transactions contemplated hereby.

6

(c) In the event that the Closing fails to take place and this Agreement is terminated, Purchaser, upon the written request of Seller, will, and will cause its representatives to, promptly deliver to such Seller any and all documents or other materials furnished by any Seller to Purchaser in connection with this Agreement (including, without limitation, the Confidential Information) without retaining any copy thereof. In the event of such request, all other documents, whether analyses, compilations or studies, that contain or otherwise reflect the Confidential Information furnished by any Seller to Purchaser, shall be destroyed by Purchaser or shall be returned to such Seller, and Purchaser shall confirm to Seller in writing that all such materials have been returned or destroyed. No failure or delay by Seller in exercising any right, power or privilege hereunder shall operate as a waiver thereof, nor shall any single or partial exercise thereof preclude any other or further exercise thereof or the exercise of any right, power or privilege hereunder.

ARTICLE 4

REPRESENTATIONS OF SELLER

Seller hereby makes the following representations and warranties, each of which is true and correct in all material respects on the date hereof and each of which shall be true and correct in all material respects on the Closing Date. For purposes of this Agreement, any representations and warranties limited to “Seller’s Knowledge” or “to the knowledge of Seller” means the actual knowledge of Mark Dodd as of the Closing Date.

4.1 Existence and Good Standing. Seller is a limited liability company duly organized, validly existing and in good standing in the State of Texas and is qualified as a foreign limited liability company in each jurisdiction where the character or location of its assets or properties (whether owned, leased or licensed) or the nature of its activities make such qualification materially necessary to the Business as currently conducted. True, correct and complete copies of Seller's articles of organization, regulations and other organizational documents, as amended, have been made available to Purchaser.

4.2 Authorization.

(a) Seller has full power and authority to own or hold under lease or similar agreement the Seller Assets listed on the exhibits hereto. Seller has all requisite power and authority necessary to carry on the Business as now conducted and to own or lease and operate its assets and properties as and in the places where the Business is now conducted.

(b) Seller has full power and authority to make, execute, deliver and perform this Agreement and to carry out the transactions contemplated hereby. This Agreement constitutes a valid and binding obligation of Seller, enforceable in accordance with its terms except to the extent that enforceability may be limited by bankruptcy, insolvency, moratorium or other similar laws presently or hereafter in effect relating to or affecting the enforcement of creditors’ rights generally and by general principles of equity (regardless of whether enforcement is considered a proceeding in equity or at law). The Board of Managers of Seller has authorized the execution, delivery and performance of this Agreement by all necessary action. No further action is required on the part of any Member to authorize this Agreement or the other transactions contemplated hereby.

7

(c) , Seller’s execution and delivery of this Agreement, Seller's performance of the duties and obligations contained in this Agreement and the consummation of the transactions contemplated hereby:

|

|

(i)

|

do not and will not conflict with, or result in a breach of the terms of, or constitute a default under, or violation of, any agreement, license or other contract to which Seller is a party or by which Seller, or any of the Seller Assets are bound;

|

|

|

(ii)

|

To Seller’s Knowledge, do not and will not result in a violation of any law, rule, regulation, order, writ, judgment, decree, separation agreement, bill of divorce, equitable distribution allocation, determination or award presently in effect or having applicability to Seller which would have a material adverse change upon the Business or upon the Seller Assets being transferred hereby;

|

|

|

(iii)

|

To Seller’s Knowledge, do not and will not result in the acceleration of any obligation under any mortgage, lien, lease, agreement, instrument, court or administrative order, arbitration award, judgment or decree to which Seller is bound; and

|

|

|

(iv)

|

To Seller’s Knowledge, do not and will not give to others any rights of termination or cancellation in or with respect to any franchises, permits, licenses, leases or agreements of, or relating to the Seller Assets.

|

4.3 Seller Assets.

(a) Seller Assets. Seller has good, valid and marketable title to the Seller Assets (other than those denoted as leased) free and clear of any security interests, mortgages, liens, pledges, restrictions, charges or encumbrances. Seller has not received written notice of violation of any applicable law, regulation, ordinance, code, license or permit relating to the Seller Assets.

8

(b) Office Lease. Exhibit 4.3(b) contains a description of the office lease of Seller as lessee which is part of the Seller Assets and assumed liabilities (the “Lease”). The Lease is in full force and effect and Seller has prepaid all rents due in connection with the Lease through June 30, 2013. As amended, the Lease has a term through and including June 30, 2014 ("Lease Term"). Seller has not received written notice of a default or event of default by Seller under the Lease and to Seller’s Knowledge, there exists no event, occurrence, condition or act which, with the giving of notice, the lapse of time or the happening of any further event or condition would become a default by Seller under the Lease. In the event Purchaser does not wish to occupy the premises covered by the Lease past June 30, 2013, then Dodd shall personally pay and be obligated for all sums due, owing and payable under the Lease through the remainder of the Lease Term.

(c) Personal Property. Exhibit 1.1 (a)(i) contains an accurate and complete list of all personal property owned in whole or in part by Seller and used in connection with the Business comprising the Seller Assets being transferred and conveyed to Purchaser hereunder. Except as set forth in Exhibit 4.3 (c), Seller has good, valid and marketable title to all the personal property described in Exhibit 1.1 (a)(i) free and clear of all chattel mortgages, liens, security interests, charges, claims, restrictions or other encumbrances of any kind.

(d) Intellectual Property. Exhibit 1.1 (a) (ii) accurately lists all of the Seller Intellectual Property. Seller owns all right, title and interest in and to the Seller Intellectual Property. As of the Closing Date, Seller has paid all filing fees, examination fees and maintenance fees required to be paid with respect to the Seller Intellectual Property. To Seller's Knowledge, no use of the Seller Intellectual Property in products infringes on or otherwise violates the Intellectual Property rights of any third party. Seller has not received any written claim or allegation of infringement, misappropriation, or unfair competition from any third party with respect to any Seller Intellectual Property.

4.4 Employment Relations. Seller's only employee is Mark Dodd. Seller acknowledges and agrees that Mark Dodd is fully authorized to enter into the Dodd IP Agreement (as defined below in Section 9.1) and the Dodd Consulting Agreement (as defined below in Section 9.2). Neither the Dodd IP Agreement nor the Dodd Consulting Agreement constitutes a breach or violation of any of Mark Dodd's duties and obligations to Seller under the terms of any agreement between Mark Dodd (whether individually or as the Series A Member) and Seller, including, without limitation, the regulations and/or operating agreement of Seller.

4.5 Taxes. Seller has filed or caused to be filed, all federal, state, local and foreign tax returns and tax reports, including, without limitation, income tax, sales tax and FICA taxes, which may be required to be filed by, or with respect to, Seller or the Business and to Seller’s Knowledge all such tax returns or reports were true, correct and complete in all material respects. To Seller’s Knowledge, Seller has paid or will pay all taxes that have or will become due as shown on such tax returns, except where the failure to pay such taxes would not result in a material adverse change on Seller or the Business.

9

4.6 Litigation.

(a) Seller has not received written notice that there is any action, suit, proceeding in law or in equity by any person or entity, or any arbitration or any administrative or other proceeding or investigation by or before any governmental agency that is pending, or to Seller's Knowledge, threatened that would materially and adversely, affect Seller, the Seller Assets, or the operation of the Business.

(b) To Seller’s Knowledge, Seller is not subject to any judgment, order, writ, injunction or decree entered in any lawsuit or proceeding whether by any national, federal, state, county, municipal, administrative or governmental agency, court, board, bureau, or authority, domestic or foreign, against or affecting Seller, the Seller Assets, or the operation of the Business.

4.7 Brokers, Finders. Seller has not taken any action that would give any person a right to a finder’s fee or any type of brokerage commission in relation to, or in connection with any of the transactions contemplated by this Agreement.

4.8 Insurance. Exhibit 4.8 contains an accurate and complete list and description of the terms (including premiums, nature of coverage, effective dates and termination dates, deductibles, aggregate limits, per occurrence limits and material exclusions) of each and every insurance policy maintained by Seller with respect to the Seller Assets and the Business. The insurance policies listed on Exhibit 4.8 are in full force and effect.

4.9 Contracts. Other than the Lease, Exhibit 1.1(a)(iii) sets forth a list of all contracts relating to the Business which involve an annual expenditure or annual revenue of $5,000.00 or more, including purchase orders issued in the ordinary course of business (individually, a "Contract" and collectively, the "Contracts"). All such Contracts are included in the Seller Assets and Seller has provided to the Purchaser complete and correct copies of all such Contracts. To Seller’s Knowledge, the Contracts included in the Seller Assets are legally valid, binding and enforceable in accordance with their respective terms and are in full force and effect. Seller has not received written notice of any default, offset, counterclaim or defense under such Contracts, and to Seller’s Knowledge, no condition or event has occurred which with the passage of time or the giving of notice or both would constitute a default or breach under the terms of any such Contract. To Seller's Knowledge, (a) no other party to any such Contract is currently in default thereunder (which remains uncured), and (b) there exists no occurrence, condition, or act (including, without limitation, the purchase of the Seller Assets hereunder) which, with the giving of notice, the lapse of time or the happening of any other event or condition, would become a default or event of default under any such Contract.

4.10 Non-Contravention. To Seller’s Knowledge, Seller is not subject to, or a party to, any charter, by-law, mortgage, lien, lease, license, permit, agreement, contract, instrument, law, rule, ordinance, regulation, order, judgment or decree, or any other restriction of any kind or character which could prevent the consummation of the transactions contemplated by this Agreement, the compliance by Seller with the terms, conditions and provisions of this Agreement or any other agreement entered into by Seller in connection with the transactions contemplated hereby.

10

4.11 Completeness and Accuracy. All material information set forth on any exhibit or schedule hereto is true, correct and complete in all material respects. No representation or warranty of Seller contained in this Agreement contains or will contain any untrue statement of material fact, or omits or will omit to state any material fact necessary to make the statements made therein, in light of the circumstances under which they were made, not materially misleading.

4.12 No Other Representations or Warranties. Except as contained in this Article 4 herein, neither Seller nor other person has made or makes any other express or implied warranty or representation, either written or oral, on behalf of Seller.

ARTICLE 5

REPRESENTATIONS OF PURCHASER

Purchaser hereby makes the following representations and warranties, each of which is true and correct in all material respects on the date hereof and each of which shall be true and correct in all material respects on the Closing Date.

5.1 Existence and Good Standing. Purchaser is a limited liability company duly organized, validly existing and in good standing under the laws of the State of Delaware. Purchaser has full power and authority to make, execute, deliver and perform this Agreement, and this Agreement has been duly authorized and approved by all required company action of Purchaser. This Agreement constitutes a valid, binding obligation of Purchaser, enforceable in accordance with its terms.

5.2 Restrictive Documents. Purchaser is not subject to any charter, by-law, mortgage, lien, lease, agreement, instrument, order, law, rule, regulation, judgment or decree, or any other restriction of any kind or character, which would prevent consummation of the transactions contemplated by this Agreement, and no consent, authorization or approval is required on behalf of Purchaser in connection with the transaction contemplated hereby.

5.3 Legal Proceedings. There is no claim, action, suit, proceeding, investigation or inquiry pending before any governmental authority or, to Purchaser’s knowledge, threatened against Purchaser or any of Purchaser’s properties, assets, or operations that might prevent or delay the consummation of the transaction contemplated hereby. Purchaser is not a party to or subject to the provisions of any judgment, order, writ, injunction, decree or award of any court, arbitrator or governmental, regulatory or administrative official, body or authority that might affect the transaction contemplated hereby.

11

5.4 Due Diligence and Independent Investigation. Purchaser has conducted its own independent investigation, review and analysis of the Business and the Seller Assets, together with the results of operations, prospects, conditions (financial or otherwise) of the same and acknowledges that it has been provided adequate access to the personnel, assets, properties, premises, books and records and other documents and data of Seller for such purpose. Purchaser acknowledges and agrees that in making its decision to enter into this Agreement and to consummate the transactions contemplated hereby, Purchaser has relied on its own independent investigation and due diligence and on the representations and warranties of Seller set forth in Article 4 of this Agreement. Seller has not relied on any representations and warranties, express or implied, other than the representations and warranties of Seller set forth in Article 4 of this Agreement.

5.5 Brokers, Finders. No agent, broker, person or firm is, or will be, entitled to any commission or broker's or finder's fee from Purchaser in connection with any of the transactions contemplated herein.

ARTICLE 6

CONDITIONS TO PURCHASER'S

AND SELLER’S OBLIGATIONS

6.1 Conditions to Purchaser's Obligations. The obligation of Purchaser to purchase the Seller Assets is subject to the satisfaction or waiver on or prior to the Closing Date of the conditions set forth below in this Section 6.1.

(a) Truth of Representations and Warranties. The representations and warranties of Seller contained in this Agreement and/or in any exhibit, schedule, certificate or document delivered in connection herewith shall be true and correct in all material respects on the date hereof and to Seller’s Knowledge shall be true and correct in all material respects as of the Closing Date with the same effect as though such representations and warranties had been made on and as of such date.

(b) Performance of Agreements. Each and all of the covenants, obligations and agreements of Seller to be performed on or before the Closing Date pursuant to the terms hereof shall have been duly performed in all material respects.

(c) No Litigation Threatened. No action or proceeding shall have been instituted or, to Seller's Knowledge, shall have been threatened before any court or other governmental department, agency, commission, board, bureau, or instrumentality, domestic or foreign, or by any public authority in connection with the Business or the Seller Assets which questions the validity or legality of the transactions contemplated hereby, which, if successfully asserted would have a material adverse change on the Business or the Seller Assets.

12

(d) Completion of Business Review. Purchaser shall have completed its review of the Business as permitted pursuant to Section 3.2.

(e) Consents to Assignments. Purchaser shall have obtained such consents as Purchaser reasonably requires regarding the assignment of all contracts, licenses, agreements, leases or undertakings included in the Seller Assets which require such consent, and the assignment of all other obligations and property included in the Seller Assets, personal and intangible, to the extent required, except as may be otherwise required or permitted in this Agreement.

(f) Bills of Sale, Documents or Assignments. Seller shall have delivered to Purchaser such bills of sale, assignments, or other instruments of transfer and assignment together with such other documents as shall be reasonably necessary to complete the transaction contemplated by this Agreement.

(g) No Material Adverse Change. Prior to the Closing Date, there shall be no material adverse change in the financial or business condition of the Business or the Seller Assets. There shall have been no federal, state or local legislation or regulatory change materially affecting the Seller Assets or the financial condition of the Business.

6.2 Conditions to Seller's Obligations. The obligation of Seller to sell the Seller Assets is subject to the satisfaction or waiver on or prior to the Closing Date of the conditions set forth below.

(a) Truth of Representations and Warranties. The representations and warranties of Purchaser contained in this Agreement shall be true and correct in all material respects on and as of the Closing Date with the same effect as though such representations and warranties had been made on and as of such date.

(b) Purchase Price. Purchaser shall have paid the Purchase Price as provided in Section 1.2.

(c) No Litigation Threatened. No action or proceeding shall have been instituted or, to the best of Purchaser's knowledge, shall have been threatened before any court or other governmental department, agency, commission, board, bureau, or instrumentality, domestic or foreign, or by any public authority in connection with Purchaser's business or to restrain or prohibit any of the transactions.

(d) Assumption of Liabilities. Purchaser shall have executed an assignment and assumption by the terms of which Purchaser shall have assumed the liabilities of Seller provided for in Section 1.3.

13

(e) Documents and Instruments. Purchaser shall have delivered to Seller such documents and instruments reasonably necessary to complete the transaction contemplated by this Agreement.

ARTICLE 7

DOCUMENTS TO BE DELIVERED AT THE CLOSING

7.1 Documents to be Delivered by Seller. At the Closing, Seller shall deliver to Purchaser signed copies of the following documents:

(a) Bills of sale, assignments, assumptions and other documents relating to the transfer and assignment of the Seller Assets in the forms annexed hereto as Exhibit 1.1(d);

(b) A copy of the unanimous consent of the Board of Managers of Seller authorizing the execution, delivery and performance of this Agreement by Seller;

(c) The Dodd IP Agreement (as defined in Section 9.1) substantially in the form of Exhibit 9.1;

(d) The Dodd Consulting Agreement (as defined in Section 9.2) substantially in the form of Exhibit 9.2;

(e) The non-compete agreement with the Series A Member substantially in the form attached hereto as Exhibit 9.3; and

(f) A Form 8594 Asset Acquisition Statement in form and content acceptable to Seller and Purchaser.

7.2 Documents to be Delivered by Purchaser. At the Closing, Purchaser shall deliver to Seller the following:

(a) The Purchase Price;

(b) A copy of resolutions of the Management Committee of Purchaser authorizing the execution, delivery and performance of this Agreement by Purchaser, and a certificate of the Secretary or Assistant Secretary of Purchaser, dated the Closing Date, that such resolutions were duly adopted and are in full force and effect; and

14

(c) An assignment and assumption in the form annexed hereto as Exhibit 1.1(d);

(d) The Dodd IP Agreement substantially in the form of Exhibit 9.1;

(e) The Dodd Consulting Agreement substantially in the form of Exhibit 9.2;

(g) The non-compete agreement with the Series A Member substantially in the form attached hereto as Exhibit 9.3;

(h) Written evidence of the payment of the fees and expenses required by Purchaser pursuant to Section 9.7 hereof; and

(i) A Form 8594 Asset Acquisition Statement in form and content acceptable to Seller and Purchaser.

ARTICLE 8

SURVIVAL OF REPRESENTATIONS

INDEMNITY; ADDITIONAL AGREEMENTS

8.1 Survival of Representations.

(a) Notwithstanding any right of Purchaser fully to investigate the affairs of Seller and notwithstanding any knowledge of facts determined or determinable by Purchaser pursuant to such investigation or right of investigation, Seller acknowledges that Purchaser has the right to rely fully upon the representations, warranties, covenants and agreements of Seller contained in this Agreement and the exhibits or in any document or other papers delivered in connection with this Agreement. All such representations, warranties, covenants agreements shall survive for a period of one (1) year after the Closing hereunder.

(b) Notwithstanding any right of Seller fully to investigate the affairs of Purchaser and notwithstanding any knowledge of facts determined or determinable by Seller pursuant to such investigation or right of investigation, Purchaser acknowledges that Seller has the right to rely fully upon the representations, warranties, covenants and agreements of Purchaser contained in this Agreement and the exhibits or in any document or other papers delivered in connection with this Agreement. All such representations, warranties, covenants agreements shall survive for a period of one (1) year after the Closing hereunder.

8.2 Indemnification.

15

(a) Seller agrees to indemnify and hold harmless Purchaser, and its affiliates and their respective officers, directors, members, managers, employees, agents and representatives from and against any and all damages, losses or expenses suffered or paid, directly or indirectly, as a result of any and all claims, demands, suits, causes of action, proceedings, judgments and liabilities, (including reasonable counsel fees and expenses incurred in litigation or otherwise assessed, incurred or sustained by or against any of them) (i) with respect to or arising out of the failure of any representation or warranty made by the Seller in this Agreement or in any exhibit, schedule, certificate or other document delivered pursuant to this Agreement to be true and correct in all material respects as of the date of this Agreement and as of the Closing Date, (ii) with respect to any liability arising from any acts or omissions in the operation of the Business prior to the Closing Date and not expressly assumed by Purchaser.

(b) Purchaser agrees to indemnify and hold harmless Seller, its officers, directors, members, managers, employees, agents and representatives from any damages, losses or expenses in the aggregate, suffered or paid, directly or indirectly as a result of any and all claims, demands, suits, causes of action, proceedings, judgments and liabilities (including reasonable counsel fees and expenses incurred in litigation or otherwise, assessed, incurred or sustained by or against any of them) (i) with respect to or arising out of the failure of any representation or warranty made by Purchaser in this Agreement or in any exhibit, schedule, certificate or other document delivered pursuant to this Agreement to be true and correct in all material respects as of the date of this Agreement and as of the Closing Date, or (ii) with respect to any liability arising out any acts or omissions in the operation of the Business or related directly or indirectly to the Seller Assets from and after the Closing Date, and (iii) with respect to or arising out of any liabilities expressly assumed by Purchaser pursuant to this Agreement.

(c) Neither Seller nor Purchaser shall be required to indemnify the other(s) hereunder until such time as the aggregate amount of all bona fide Asserted Liabilities (hereinafter defined) has exceeded Ten Thousand Dollars ($10,000.00).

(d) The obligations to indemnify and hold harmless pursuant to this Section 8.2 shall survive the consummation of the transactions contemplated by this Agreement for a period of twenty-four (24) months from the Closing Date.

(e) (i) Promptly after receipt by any party hereto (the “Indemnitee”) of notice of any demand, claim or circumstance which, with the lapse of time, would or might give rise to a claim or the commencement (or threatened commencement) of any action, proceeding or investigation (an “Asserted Liability”) that may give rise to indemnification hereunder, the Indemnitee shall promptly give notice thereof (the “Claims Notice”) to any other party obligated to provide indemnification pursuant to Section 8.2 (the “Indemnifying Party”).

(ii) The Indemnifying Party shall compromise or defend at its own expense and by its own counsel (such counsel to be reasonably satisfactory to Indemnitee(s)), any Asserted Liability subject to the Indemnitee's right to approve any settlement agreement as provided below in this subparagraph 8.2 (e) (ii). The Indemnitee shall have the right to employ its own counsel in any case with respect to an Asserted Liability, but the fees and expenses of such counsel shall be at the expense of such Indemnitee. The Indemnifying Party shall not settle any Asserted Liability without the prior written approval of the Indemnitee if such settlement shall directly or indirectly restrict or otherwise impinge upon the Intellectual Property rights or agreements which are part of the Seller Assets being transferred and conveyed pursuant to this Agreement.

16

ARTICLE 9

OTHER COVENANTS

9.1 Grant of Intellectual Property Rights. Simultaneously with the execution of this Agreement, Purchaser shall enter into an agreement with Dodd, in his individual capacity, granting certain rights in the Intellectual Property to Dodd (the “Dodd IP Agreement”). Such Dodd IP Agreement shall be in the form of the agreement attached hereto as Exhibit 9.1.

9.2 Consulting Agreement. Simultaneously with the execution of this Agreement, Purchaser shall enter into a consulting agreement with Dodd (the “Dodd Consulting Agreement”) Such Dodd Consulting Agreement shall be in the form of the consulting agreement attached hereto as Exhibit 9.2.

9.3. Non-Compete Agreements. The Series A Member shall execute a non-compete agreement in the form attached hereto as Exhibit 9.3, which shall contain non-compete, non-solicit and no-hire provisions with respect to any business directly competing with the Purchaser which may be operated anywhere in the United States. Such agreements shall be for a term of two (2) years and shall be governed by Texas law. Notwithstanding the foregoing to the contrary, the non-compete agreements shall not in any manner restrict, hinder or interfere with Dodd’s license to be granted pursuant to Section 9.1 hereof and any business activities of any kind or character relating to such license, it being the intent of the parties hereto that such license and all activities relating to the same may be conducted by Dodd without any restriction, hindrance or interference of any kind.

9.4 Intellectual Property Claims.

(a) The parties acknowledge and agree that as of the date of this Agreement, there may be certain infringement, breach of contract, unfair competition and/or or other claims (such infringement, breach of contract, unfair competition and/or other claims to be hereafter collectively referred to as the “Claims”) which Seller, as the owner of the Intellectual Property listed on Exhibit 1.1 (a)(ii), might be able to assert against Under Armour, Inc. (“UA”) arising from the possible improper use and/or infringement of the Intellectual Property prior to the Closing Date (the “UA Claims”). Seller and the Members, agree that neither Seller nor any of the Members shall make any demand, take any action or initiate any legal or administrative proceeding (collectively, an “Action”) against UA with respect to the UA Claims. Seller and the Members further agree that such UA Claims will be transferred and conveyed to Purchaser as of the Closing Date.

17

(b) Seller and the Members agree that Purchaser shall have the sole and exclusive right, but not the obligation, to take any Action with respect to such UA Claims. Purchaser shall have sole authority to direct and/or settle any UA Claims. The costs and expenses associated with taking any Action with respect to such UA Claims shall be paid by Purchaser. Seller and the Members shall reasonably cooperate with Purchaser in the event that Purchaser elects to take any Action with respect to such UA Claims and Seller and the Members shall provide such reasonable assistance as may be requested by Purchaser. Purchaser shall reimburse Seller and the Members for any and all costs and expenses incurred by such parties in providing any assistance or cooperation to Purchaser with respect to such UA Claims.

(c) In the event that Purchaser takes any Action with respect to such UA Claims , any and all proceeds, payments or other amounts received by Purchaser shall be divided as follows among the parties.

(i) In the event that as a result of any Action taken by Purchaser with respect to such UA Claims, Purchaser at any time hereafter receives a lump sum payment from UA resulting from any acts or omissions by UA occurring prior to the Closing Date ("Lump Sum Award"), Purchaser shall pay one-third (1/3) of the Net Lump Sum Award (as defined below) to each of the Series A Preferred Member and the Series B Preferred Members, such sum to be divided among the Series B Preferred Members in proportion to their percentage ownership interests in the Series B class of membership interests in Seller. For purposes of this Agreement, the “Net Lump Sum Award” shall be defined as the Lump Sum Award less all applicable fees, costs and expenses (including, without limitation, attorneys’ fees) incurred by Purchaser with respect to such Action regarding the UA Claims.

(ii) In the event that as a result of any Action taken by Purchaser with respect to such UA Claims, Purchaser receives both a Lump Sum Award and Purchaser also enters into one or more license agreements with UA on or before June 30, 2014, Purchaser shall pay one-third (1/3) of the Net Lump Sum Award (as defined below) to each of the Series A Preferred Member and the Series B Preferred Members as provided above in subparagraph 9.4 (c) (i). In addition, Purchaser shall pay one-third (1/3) of the Net Purchaser Royalties (as defined below) to each of the Series A Preferred Member and the Series B Preferred Members, such sum to be divided among the Series B Preferred Members in proportion to their percentage ownership interests in the Series B class of membership interests in Seller.

(iii) In the event that as a result of any Action taken by Purchaser with respect to such UA Claims, Purchaser does not receive any Lump Sum Award but rather Purchaser only enters into one or more license agreements with UA on or before June 30, 2014, Purchaser shall pay one-third (1/3) of the Net Purchaser Royalties (as defined below) to each of the Series A Preferred Member and the Series B Preferred Members, such sum to be divided among the Series B Preferred Members in proportion to their percentage ownership interests in the Series B class of membership interests in Seller.

18

For purposes of this Agreement, the “Net Purchaser Royalties” shall be defined as the royalties paid by UA to Purchaser with respect to the first eighteen (18) months of the term of any license agreement between Purchaser and UA entered into prior to June 30, 2014 less all applicable fees, costs and expenses (including, without limitation, attorneys’ fees) incurred by Purchaser with respect to such Action regarding the UA Claims and not recouped by Purchaser from any Lump Sum Award. For the avoidance of doubt, any royalties paid by UA to Purchaser after the first eighteen (18) months of the term of any license agreement between Purchaser and UA entered into prior to June 30, 2014 shall belong exclusively to Purchaser. In addition, any royalties paid by UA to Purchaser with respect to any license agreement between Purchaser and UA entered into on or after June 30, 2014 or any renewal of a license agreement between Purchaser and UA originally entered into on or prior to June 30, 2014 but affecting the period on or after June 30, 2014 shall belong exclusively to Purchaser.

9.5 Public Announcements. No party hereto shall make or issue, or cause to be made or issued, any public announcement or written statement concerning this Agreement or the transactions contemplated hereby or thereby without the prior written consent of the other parties hereto, except to the extent that such announcement or statement is required by applicable law, in which case the disclosing party will consult with the non-disclosing parties prior to issuing or making such public announcement or written statement.

9.6 Taxes. Seller shall be responsible for any sales, use, excise, VAT or other transfer taxes , and any federal, state or local income taxes or other taxes incurred or owed as a result of the sale, transfer or conveyance of the Seller Assets.

9.7 Expenses. Purchaser shall pay or reimburse Seller for up to $10,000.00 of legal fees and expenses incurred by the Members and Seller in connection with the transactions contemplated hereby whether or not such transactions are consummated. Seller shall provide Purchaser with invoices and other supporting documentation evidencing such legal fees and expenses incurred with respect to the transactions contemplated by this Agreement. If Seller and/or the Members incur legal fees and expenses in excess of $10,000.00 with respect to the transactions contemplated by this Agreement, Seller and/or the Members shall be solely responsible for the payment of such legal fees and expenses in excess of $10,000.00. The obligation of Purchaser to pay and/or reimburse Seller for up to $10,000.00 of legal fees and expenses as provided in this Section 9.7 shall survive the Closing or the earlier termination of this Agreement.

19

ARTICLE 10

MISCELLANEOUS

10.1 GOVERNING LAW. THE INTERPRETATION AND CONSTRUCTION OF THIS AGREEMENT, AND ALL MATTERS RELATING HERETO, SHALL BE GOVERNED BY THE LAWS OF THE STATE OF TEXAS WITHOUT REGARD TO PRINCIPLES OF CONFLICTS OR CHOICE OF LAW OR ANY OTHER LAW THAT WOULD MAKE THE LAWS OF ANY OTHER JURISDICTION OTHER THAN THE STATE OF TEXAS APPLICABLE HERETO.

10.2 Notices. Any notice of other communications required or permitted hereunder shall be sufficiently given if delivered in person, sent by registered or certified mail, postage prepaid, return receipt requested, sent by overnight courier (e.g., Federal Express), or sent by telefax with a hard copy sent by regular mail, addressed as follows:

If to Seller:

The Dodd Group LLC

C/O Mark Dodd

802 Bandera Drive

Allen, Texas 75013

With copies to:

Oak Stream Investors II, Ltd.

5001 Spring Valley Road, Suite 1040E

Dallas, Texas 75244

Attn: Mr. Jack D. Furst

Paramount Capital Investments (Private Equity), LLC

4012 Wood Lake Drive

Plano, Texas 75093

Attn: C. Randall Hill

STELAC SPV VIII LLC

654 Madison Avenue, 11th Floor

New York, NY 10065

Attn: Carlos M. Lopez-Ona

20

Greg S. Oliver, CPA, J.D.

6509 Crestpoint Drive

Dallas, Texas 75254

David B. Feldman

5204 Stone Arbor Court

Dallas, Texas 75287

Jones, Allen & Fuquay, LLP

8828 Greenville Avenue

Dallas, Texas 75243

Attn: Mr. Martin R. Wiarda

Email: mwiarda@jonesallen.com

If to Purchaser:

Pinwrest Development Group, LLC

c/o 4Licensing Corporation

767 3rd Ave.

New York, NY 10017

Attn: Mr. Bruce Foster

Email: bfoster@4kidsent.com

With a copy to:

Newborn Law Group P.C.

55 Lovell Rd.

New Rochelle, NY 10804

Attention: Samuel R. Newborn, Esq.

Email: snewborn@newbornlg.com

Any notice or other communication delivered via the methods set forth above, shall be deemed effectively given (i) upon delivery in person or transmittal by telefax, (ii) three (3) days following deposit of registered or certified mail, postage prepaid, return receipt requested, or (iii) one (1) day following deposit with an overnight courier.

10.3 Counterparts. This Agreement may be executed in any number of counterparts with the same effect as if the signatures thereto were upon one instrument. Any such counterpart, to the extent delivered by fax or .pdf, .tif, .gif, .jpg or similar attachment to electronic mail (any such delivery, an “Electronic Delivery”), shall be treated in all manner and respects as an original executed counterpart and shall be considered to have the same binding legal effect as if it were the original signed version thereof delivered in person. No party hereto shall raise the use of Electronic Delivery to deliver a signature, or the fact that any signature or agreement or instrument was transmitted or communicated through the use of Electronic Delivery, as a defense to the formation of a contract, and each party forever waives any such defense, except to the extent such defense relates to lack of authenticity.

21

10.4 Amendments. This Agreement may only be modified or amended, by an agreement in writing signed by all the parties or their successors.

10.5 Assignability. Except as specifically provided herein, neither this Agreement, nor any right hereunder, may be assigned by any of the parties hereto. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective heirs, executors, administrators, successors and permitted assigns.

10.6 No Third-Party Beneficiaries Notwithstanding anything in this Agreement to the contrary, nothing in this Agreement is intended to or shall (a) confer on any person other than the parties hereto and their respective successors or permitted assigns, any rights (including third party beneficiary rights), remedies, obligations or liabilities under or by reason of this Agreement, or (b) constitute the parties hereto as partners or as participants in a joint venture. This Agreement shall not provide third parties with any remedy, claim, liability, reimbursement, cause of action or other right in excess of those existing without reference to the terms of this Agreement.

10.7 Exhibits. The following exhibits attached hereto shall be deemed an integral part of this Agreement:

Exhibit 1.1(a)(i) – Furniture, Fixtures and Equipment

Exhibit 1.1(a)(ii) – Intellectual Property

Exhibit 1.1(a)(iii) – Contract and Contract Rights

Exhibit 1.1(d) – Form of Bill of Sale and Assignment

Exhibit 1.3 - Assumed Liabilities

Exhibit 4.3(b) - Office Lease

Exhibit 4.3(c) - Liens and Security Interests

Exhibit 4.8 – Insurance

Exhibit 9.1 – Dodd IP Agreement

Exhibit 9.2 – Dodd Consulting Agreement

22

Exhibit 9.3 - Non-Compete Agreement

10.8 WAIVER OF JURY TRIAL. TO THE EXTENT ALLOWED BY APPLICABLE LAW, EACH PARTY TO THIS AGREEMENT HEREBY EXPRESSLY WAIVES ANY RIGHT TO TRIAL BY JURY OF ANY CLAIM, DEMAND, ACTION OR CAUSE OF ACTION (A) ARISING OUT OF THIS AGREEMENT, INCLUDING ANY PRESENT OR FUTURE AMENDMENT THEREOF OR (B) IN ANY WAY CONNECTED WITH OR RELATED OR INCIDENTAL TO THE DEALINGS OF THE PARTIES OR ANY OF THEM WITH RESPECT TO THIS AGREEMENT (AS HEREAFTER AMENDED) OR ANY OTHER INSTRUMENT, DOCUMENT OR AGREEMENT EXECUTED OR DELIVERED IN CONNECTION HEREWITH, OR THE TRANSACTIONS RELATED HERETO OR THERETO, IN EACH CASE WHETHER SUCH ACTION IS NOW EXISTING OR HEREAFTER ARISING, AND WHETHER SOUNDING IN CONTRACT OR TORT OR OTHERWISE AND REGARDLESS OF WHICH PARTY ASSERTS SUCH ACTION; AND EACH PARTY HEREBY AGREES AND CONSENTS THAT ANY SUCH ACTION SHALL BE DECIDED BY COURT TRIAL WITHOUT A JURY, AND THAT ANY PARTY TO THIS AGREEMENT MAY FILE AN ORIGINAL COUNTERPART OR A COPY OF THIS SECTION WITH ANY COURT AS WRITTEN EVIDENCE OF THE CONSENT OF THE PARTIES TO THE WAIVER OF ANY RIGHT THEY MIGHT OTHERWISE HAVE TO TRIAL BY JURY.

10.9 Attorneys’ Fees. In the event legal action is instituted by a party hereto to enforce the terms of this Agreement, the prevailing party in such legal action will be entitled to receive from the other party the prevailing party’s reasonable attorneys’ fees and court costs, including the costs of appeal, as may be determined and awarded by the court in which the action is brought. The right to attorneys’ fees shall survive the Closing or the earlier termination of this Agreement.

10.10 Entire Agreement. This Agreement, including the other documents referred to herein which form a part hereof, contains the entire understanding of the parties hereto with respect to the subject matter contained herein and therein. This Agreement supersedes all prior agreements and understandings between the parties with respect to such subject matter.

23

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed and delivered as of the day and year first above written.

|

THE DODD GROUP LLC (“Seller”)

|

||

|

By:

|

/s/ Mark Dodd | |

|

MARK DODD

|

||

|

Manager

|

||

|

PINWREST DEVELOPMENT GROUP, LLC

|

||

|

(“Purchaser”)

|

||

|

By:

|

/s/ Bruce R. Foster | |

|

Printed Name:

|

Bruce R. Foster |

|

Title:

|

CHAIRMAN |

AGREED TO AND ACCEPTED

INSOFAR AS CONCERNED:

|

SERIES A PREFERRED MEMBER:

|

|

| /s/ Mark Dodd | |

|

Mark Dodd

|

24

|

SERIES B PREFERRED MEMBERS:

|

||

|

OAK STREAM INVESTORS II, LTD.

|

||

|

By:

|

OAK STREAM RANCH, INC.

|

|

|

General Partner

|

||

|

By:

|

/s/ Jack D. Furst | |

|

JACK D. FURST

|

||

|

Chairman of the Board

|

||

|

|

PARAMOUNT CAPITAL INVESTMENTS

|

|

|

(PRIVATE EQUITY), LLC

|

||

|

By:

|

C. Randal Hill | |

|

C. RANDALL HILL

|

||

|

Chief Executive Officer

|

||

|

STELAC SPV VIII LLC

|

||

|

By:

|

STELAC CAPITAL PARTNERS LLC

|

|

|

Managing Member

|

||

|

By:

|

/s/ Carlos M. Lopez-Ona | |

|

CARLOS M. LOPEZ-ONA

|

||

|

Managing Partner

|

||

| /s/ Greg S. Oliver | ||

|

GREG S. OLIVER

|

||

| /s/ David B. Feldman | ||

|

DAVID B. FELDMAN

|

||

25

EXHIBIT 1.1(a)(i)

FURNITURE, FIXTURES AND EQUIPMENT

Various Fabric and Foam Samples

Variety of isoBLOX Sample Material Sheets

Property Stored at Production Facility (APM Molding)

1 (12”x12”) isoBLOX Injection Mold Cavity

1 (20”x20”) isoBLOX Injection Mold Cavity

26

EXHIBIT 1.1(a)(ii)

INTELLECTUAL PROPERTY

The Intellectual Property owned or licensed by Seller includes, but is not limited to:

|

a.

|

United States patents and patent applications including:

|

U.S. Patent 8,220,072

U.S. Patent Application Ser. No. 12/471,252

U.S. Patent Application Ser. No. 12/945,627

U.S. Patent Application Ser. No. 13/545,381

|

b.

|

Trademarks including, but not limited to:

|

|

·

|

U.S. Trademark Reg. 77/486,519: “ISOBLOX” standard character mark

|

|

·

|

U.S. Trademark Application Ser. No. 85825080: a stylized and/or design mark consisting of a green "X" composed of hinged, stretched hexagonal shapes; the word “iso” is in lower case letters and the word “BLOX” is in upper case letters

|

|

c.

|

Certain trade secrets relating to the technology described in the United States patents and patent applications listed above.

|

|

d.

|

The IsoBlox website, including any and all Intellectual Property Rights thereto owned or controlled by Seller and any asssets used in connection with such IsoBlox website.

|

|

e.

|

The URLwww.isoblox.com and any other URLs using the name isoblox.

|

27

EXHIBIT 1.1(a)(iii)

CONTRACT AND CONTRACT RIGHTS

1. The Exclusive Sales Agreement dated July 7, 2011 between IsoBlox LLC and Wilson Sporting Goods Co.

2. The License Agreement dated May 16, 2008 between THE DODD GROUP LLC and STX, LLC.

3. Reoccurring purchase orders which may be submitted by GREINER AEROSPACE or its affiliates after the Closing Date.

28

EXHIBIT 1.1(d)

FORM OF BILL OF SALE AND ASSIGNMENT

29

EXHIBIT 1.3

ASSUMED LIABILITIES

1. The Exclusive Sales Agreement dated July 7, 2011 between IsoBlox LLC and Wilson Sporting Goods Co.

2. The License Agreement dated May 16, 2008 between THE DODD GROUP LLC and STX, LLC.

3. Reoccurring purchase orders which may be submitted by GREINER AEROSPACE or its affiliates after the Closing Date.

30

EXHIBIT 4.3(b)

OFFICE LEASE

Commercial Lease Agreement dated as of December 1, 2008, executed by and between J. HUNTER & ASSOCIATES I, LP, as landlord and MARK DODD, as tenant, as amended and modified by that certain Commercial Lease Extension Renewal Agreement dated as of December 31, 2010, that certain Commercial Lease Extension Renewal Agreement dated as of December 31, 2011, that certain Amendment to Commercial Lease Agreement dated as of May 31, 2012 and that certain 2nd Amendment to Commercial Lease Agreement dated as of July 1, 2012.

31

EXHIBIT 4.3(c)

LIENS AND SECURITY INTERESTS

NONE.

32

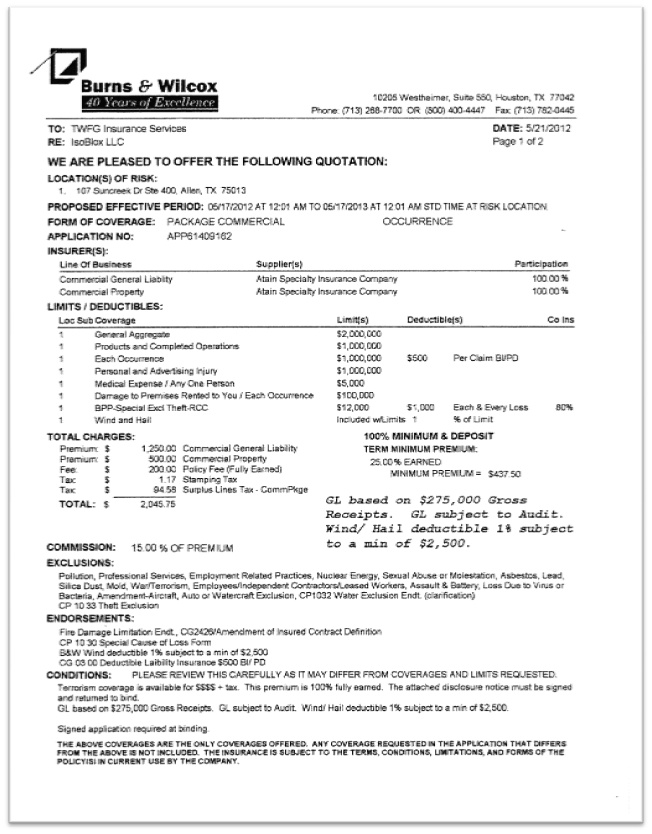

EXHIBIT 4.8

INSURANCE

[SEE ATTACHED]

33

34

EXHIBIT 9.1

DODD IP AGREEMENT

35

EXHIBIT 9.2

DODD CONSULTING AGREEMENT

36

EXHIBIT 9.3

NON-COMPETE AGREEMENT

37