Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ORMAT TECHNOLOGIES, INC. | zk1312775.htm |

| EX-99.1 - EXHIBIT 99.1 - ORMAT TECHNOLOGIES, INC. | exhibit_99-1.htm |

Exhibit 99.2

Jersey Valley Power Plant

Asset Impairment Analysis

Prepared for

Ormat Industries Ltd.

March 2013

2

Chapter A - Introduction

|

1.1

|

General

|

Giza Singer Even (Here and after "GSE") has been mandated by Ormat Industries Ltd. (“Ormat” or the “Company”) to assist Ormat's management with their asset impairment analysis in connection with the Jersey Valley power plant ("Jersey Valley" or the "Subject Asset") to meet the requirements under IFRS accounting standards ("the Report"). In order to prepare the Report, GSE and Ormat has retained the advisory services of Duff & Phelps, a world-class global independent financial advisory firm with strong expertise and capabilities in the area of valuation services ("D&P"). This Report was prepared by GSE in cooperation with a D&P valuation team.

The Report includes a description of the methodology and main assumptions and analyses used by the Company, D&P and GSE for assessing the value of Jersey Valley. Having said that, the description does not purport to provide a full and detailed breakdown of all the procedures that we applied in formulating the Report.

|

1.2

|

Reliance on Information Received from the Company

|

In formulating this Report, GSE and D&P assumed and relied on the accuracy, completeness, and up-to-datedness of the information received from the Company, including financial data and any forward-looking information. GSE is not responsible for independently verifying the information it has received, and accordingly, did not conduct an independent examination of this information, other than reasonability tests.

3

While preparing thus Report, we also addressed, among other things, forecasts that were submitted to us by the Company. These projections are uncertain suppositions and expectations regarding the future, partly based on information existing in the Company as of the date of the valuation ("Valuation Date"), as well as various assumptions and expectations pertaining to the Company and to numerous extraneous factors, including the situation in the market segment in which the Company operates, potential competitors, and the general market situation. It should therefore be emphasized that there is no certainty that these forecasts and expectations will fully or partially materialize. The assessments and forecasts of the Company's Management, apart from being based on these assumptions, relate to the Company's future intentions and goals as of the Valuation Date. These intentions and goals are materially influenced by the situation in the Company and in the market and need to be continuously adjusted to the various changes in the working assumptions, the Company's situation and the general economic situation. Any such change stands to influence the chance that these estimations will materialize. If the estimations of the Company's Management do not materialize, the actual results may vary materially from the results projected or inferred from these estimations, insofar as they were used in this opinion, noting that the Fair Value was appraised in this Report, as set out in the accounting standard chapter.

|

1.3

|

Forward-looking Information

|

In this Report, we also addressed forward-looking information that was submitted to us by the Company's management. Forward-looking information is uncertain information concerning the future, which is based on information available to the Company on the Valuation Date and includes management's estimations or intentions as of the Valuation Date. If management's projections do not materialize, the actual results may vary materially from the results estimated or implied from this information, insofar as they were used in this Report.

|

1.4

|

Limitations in the Application of the Report

|

An economic assessment is not an exact science, and is intended to reflect in a reasonable and fair manner the situation at a given time, based on known data, basic assumptions and forecasts. Changes in key variables and/or other information may alter the basis for the basic assumptions and alter the conclusions accordingly.

4

This Report does not constitute a due diligence study and does not purport to contain the information, investigations and tests or any other information contained in a due diligence study, including an examination of the Company's contracts and engagements.

We emphasize that this Report does not constitute legal advice or a legal opinion. The interpretation of various documents that we reviewed was done exclusively for the purpose of forming and providing this Report.

The information appearing in the Report does not presume to include all the information required by a potential investor, and is not meant to determine the value for a specific investor. Different investors may have different objectives and methods of examination based on other assumptions, and accordingly, the price they would be willing to pay will vary.

|

1.5

|

Personal and Financial Relationship with the Company

|

We hereby confirm that we have no personal interest in the Company, other than the fact that we receive a fee for providing this Report, and our professional fees are not contingent on the results of this Report.

It should be noted that from time to time, GSE prepares impairment analyses of certain assets operated by the Company, in connection with the Company's financial statements.

In connection with this Report, we should note that GSE will receive a letter of indemnity from the Company in the event that GSE is sued in a legal proceeding for the payment of any amount to the Company or to a third party for a cause of action that could stem, directly or indirectly, from this Report. In such case, the Company shall indemnify GSE for any expense that GSE shall incur or be required to pay for legal representation, legal advice, professional consulting, defense against legal proceedings, negotiations, etc. The Company shall also indemnify GSE for the amount that it shall be ordered to pay to a third party in a legal proceeding.

5

|

1.6

|

Reference to the Report

|

We consent that this Report will be included in the 2012 annual Report of Ormat Industries Ltd, and in a current Report on form 8-k of Ormat Technologies, Inc.

This Report may not be used for any other purpose without receiving explicit prior and written permission from GSE. Anyone using the Report, in whole or in part, other than for the purposes for which it was submitted, and without the prior written approval of GSE, may be sued therefore.

|

1.7

|

Limitation of Liability

|

This Report is intended for the use of the Company's Management and for the purpose described above, and it may not be used for any other purpose, including transferring the Report to a third party or citing it, without our prior written consent. In no event, whether we have given our consent or not, will we not assume any responsibility toward any third party which was forwarded the Report.

In the course of our work, we received information, explanations, data and representations from the Company and/or from D&P and/or someone on the Company's behalf (the “Information”). The responsibility for the information lies with whoever provided such information. The ambit of our work does not include an examination and/or verification of said Information. Consequently, our work shall not be considered and will not constitute a confirmation of the veracity, completeness or accuracy of the Information provided to us. In no event will we be liable for any loss, damage, cost or expenditure that might be caused in any manner or form from acts of fraud, misrepresentation, deception, submission of Information that is not true or complete or obstruction of information on the part of the Company and/or D&P and/or anyone on the Company's behalf, or any other reliance on the Information.

6

In general, forecasts tend to relate to future events and are based on reasonable assumptions made on the date of the forecast. Such assumptions may change over the forecasted period, and consequently forecasts made at the time of the valuation may differ from actual financial results and/or from estimates made at a later date. Therefore, these forecasts may not be treated with the same level of confidence attributed to data appearing in audited financial statements. We offer no opinion regarding the correctness of the forecasts made by the Company, D&P and/or by anyone on their behalf with the financial results that will actually be obtained.

The Report does not constitute a due diligence study and should not be relied on as such. Moreover, financial assessments do not presume to be an exact science, and their conclusions are often contingent on the subjective judgment exercised by the valuator. Although we believe that the value that we have set is reasonable based on the information submitted to us, another value appraiser may reach a different result.

|

1.8

|

Sources of Information and Valuation Procedures

|

Sources of Information

In the course of the Report, we relied upon financial and other information, including prospective financial information, obtained from the Company, D&P and from various public, financial, and industry sources. Our conclusion is dependent on such information being complete and accurate in all material respects. We will not accept responsibility for the accuracy and completeness of such provided information.

The principal sources of information used in performing our valuation include:

|

§

|

Discussions with the Company's management and with D&P, as follows:

|

|

·

|

Mrs. Yehudit Bronicki, CEO and Director, Ormat Industries Ltd. and Ormat Technologies, Inc.

|

7

|

·

|

Mr. Joseph Tenne, CFO, Ormat Industries Ltd. and Ormat Technologies, Inc.

|

|

·

|

Mr. Amit Gorka, V.P Corporate Controller, Ormat Industries Ltd. and Ormat Technologies, Inc.

|

|

·

|

Mr. Eyal Hen, Director of Finance, Ormat Technologies Inc.

|

|

·

|

Mr. Joseph Omoworare, Valuation Services Managing Director, Duff & Phelps

|

|

§

|

Historical cost and financial statement information provided by Ormat Technologies, Inc.

|

|

§

|

Ormat Technologies, Inc. Management’s financial projections for the Subject Assets for the Capacity Cases;

|

|

§

|

Power Purchase Agreement (“PPA”) related to Jersey Valley

|

|

§

|

Documentation provided by Management in regards to Amendments to the current PPA with NPC

|

|

§

|

Jersey Valley plant basis summary and carrying value, provided by Management, as of the Valuation Date

|

|

§

|

Other publicly available information from sources, but not limited to, Capital IQ, and SNL, deemed relevant to preparation of this Report

|

|

§

|

Financial models, analyses and Jersey Valley Asset Impairment Analysis Report prepared by D&P

|

Valuation Procedures

For the purpose of preparing this Report, the Company's management provided D&P and GSE with historical and forecasted performance characteristics for Jersey Valley, including generation output, additional capital expenditure requirements to support output, energy revenues, along with plant and operating expenses. D&P and GSE have adopted management forecasts and assumptions. To check the reasonability of said forecasts and assumptions, GSE and D&P have conducted several interviews and conversations with the management and have reviewed various relevant materials provided by the Company. Procedures, investigations, and financial analyses with respect to the preparation of this Report included, but were not limited to, the items summarized below:

|

·

|

Analysis of conditions in, and the economic outlook for, the geothermal / renewable energy sector

|

8

|

·

|

Analysis of general market data, including economic, governmental, and environmental forces

|

|

·

|

Analysis of the assumptions and estimates made by the Company's management pertaining to the two Capacity Cases;

|

|

·

|

Discussions concerning the history, current state, and future operations of the Subject Asset;

|

|

·

|

Discussions with the Company's management to obtain an explanation and clarification of data provided

|

|

·

|

Review of the documentation provided by the Company's management with regards to amendments to the current Power Purchase Agreement (“PPA”) with NPC

|

|

·

|

Review of certain Operating Reports for the geothermal facility;

|

|

·

|

Review of the latest GeothermEx memo on the status of Jersey Valley, as of the Valuation Date;

|

|

·

|

Analysis of financial and operating projections including revenues, operating margins (e.g., earnings before interest and taxes), working capital investments, production tax credits, and capital expenditures based on the Subject Asset’s historical operating results, industry results and expectations, and management representations as it relates to the Subject Assets for the two capacity generation cases

|

|

·

|

Estimation of an appropriate Weighted Average Cost of Capital (“WACC”)

|

|

1.9

|

The Accounting Standard

|

At the request of the Company, the valuation will be used for implementing International Accounting Standard No. 36 regarding asset impairment (hereinafter: the "Standard" or "IAS 36") in its financial statements.

9

The purpose of the Standard is to prescribe the procedures that an enterprise must apply to ensure that its assets are carried at no more than their recoverable amount. An asset is carried at more than its recoverable amount when the carrying value of the asset exceeds the amount to be recovered through use or sale of the asset. In this case, the asset value has been impaired, and the Standard requires the corporation to recognize an impairment loss. The Standard also specifies when a corporation should reverse an impairment loss and requires certain disclosures for impaired assets, and for investments in investee companies that are not subsidiaries, which are carried in the financial statements in an amount that significantly exceeds their market value or net sale price.

The Standard prescribes the accounting treatment and statement required in the event of asset impairment. If an enterprise prepares consolidated financial statements (including proportionate consolidation), the Standard will be applied to the accounting treatment of the impairment of all the assets appearing in the enterprise's consolidated balance sheet, including investments in investee companies that are not subsidiaries, goodwill stemming from the acquisition of subsidiaries and fair value adjustments. In effect, this Standard applies to investments in subsidiaries and jointly controlled companies, so that provisions for impairment loss, which are recognized in the consolidated financial statements with respect to assets of the subsidiary or the jointly-controlled Company, including goodwill and fair value adjustments, will be stated in the separate financial statements of the parent Company as a reduction of the investment account in the subsidiary or jointly-controlled company.

The Standard prescribes that the recoverable amount of an asset should be estimated whenever there are indications that an asset may be impaired.

The Standard requires recognizing the impairment loss of an asset (i.e. the value of the asset has declined) whenever the carrying amount of the asset exceeds its recoverable amount. An impairment loss will be recognized in the statement of profit and loss for those assets stated at cost and should be treated as a revaluation decrease, and only for those assets carried at a revalued amount in accordance with other accounting standards or in accordance with the provisions of any law.

10

The Standard prescribes that a recoverable amount shall be calculated as the Fair Value less costs to sell or Value in Use, whichever is higher:

|

1.

|

The Value in Use of the asset is the estimate of the present value of future cash flows to be derived from use and disposal of the asset at the end of its useful life.

|

|

2.

|

Fair value less costs to sell is the amount obtainable from the sale of an asset or Cash-Generating Unit in an arm’s length transaction between knowledgeable, willing parties, less the costs of disposal.

|

The Standard states that the best evidence of an asset’s Fair Value less costs to sell is a price in a binding sale agreement in an arm’s length transaction, adjusted for incremental costs that would be directly attributable to the disposal of the asset.

If there is no binding sale agreement but an asset is traded in an active market, Fair Value less costs to sell is the asset’s market price less the costs of disposal. The appropriate market price is usually the current bid price. When current bid prices are unavailable, the price of the most recent transaction may provide a basis from which to estimate Fair Value less costs to sell, provided that there has not been a significant change in economic circumstances between the transaction date and the date as at which the estimate is made.

If there is no binding sale agreement or active market for an asset, Fair Value less costs to sell is based on the best information available to reflect the amount that an entity could obtain, at the balance sheet date, from the disposal of the asset in an arm’s length transaction between knowledgeable, willing parties, after deducting the costs of disposal. In determining this amount, an entity considers the outcome of recent transactions for similar assets within the same industry. Fair Value less costs to sell does not reflect a forced sale, unless management is compelled to sell immediately.

11

|

1.10

|

Details of the Valuating Company

|

Giza Singer Even is a leading Israeli financial advisory and investment banking firm. Throughout its 25 years of operations, the firm has been involved in the largest transactions and privatization processes in Israel and has serviced the largest corporations in the Israeli capital market.

This Report has been prepared by a team headed by Eyal Szewach. Mr. Szewach holds a B.Sc in Electronics Engineering from the Technion – Israel Institute of Technology and a M.B.A in Finance from the Tel-Aviv University.

Sincerely yours,

Giza Singer Even

March 2013

12

Chapter B - Executive Summary

|

2.1

|

Description of the Company and Subject Assets

|

Ormat Technologies, Inc.

Ormat is a leading vertically-integrated company primarily engaged in the geothermal and recovered energy power business. The Company designs, develops, owns and operates geothermal and recovered energy-based power plants around the world. Additionally, the Company designs, manufactures and sells geothermal and recovered energy power units and other power-generating equipment, and provides related services. With more than four decades of experience in geothermal and recovered-energy generation, Ormat products and systems are covered by 82 U.S. patents.

Jersey Valley Facility

General

Jersey Valley is a binary geothermal plant and began start-up testing in December 2010. The Geothermal Power Plant (“Plant”) is located at the northern end of Dixie Valley, along the Pershing-Lander County line, in Nevada (the “Project Site”). Ormat's power solutions are utilized in the plant design; this includes two Ormat Energy Converters ("OEC"), a power generation unit that converts low, medium and high temperature heat into electrical energy. The electricity being produced is sold to NPC under a 20-year PPA.

The Jersey Valley lease area extends for several miles to the north and west, so there may be other geothermal systems yet to be discovered. If Ormat can resolve the injection limitations for the project, Management believes that the resource base within the leasehold at Jersey Valley is adequate to support the 12-MW power plant, though additional make-up drilling may be required during the life or the project.

Since December 2010, the Jersey Valley plant has been operating in start-up mode, using 77A-28 and 87-28RD as producers and the three northeast wells (14-27, 81-28, and 81A-28), as injectors. Ormat has Reported that, during early start-up operations, debris in the injection pipeline was inadvertently allowed to go down the three northeast injectors, resulting in lower-than-anticipated injection capacity at these wells. The injection limitations at these wells restricted the initial power output of the plant. Plant output has been as high as 11 net MW when injection well 18A-27 was in service.

13

Management has conducted acid frac stimulations of well 14-27, as of the Valuation Date, and believes that the generation targets of 10MW to 12MW are feasible. Ormat is also drilling a new well (14-34) about half a mile south of 18A-27, and it expects to use the new well for injection as well. Management anticipates that, once the acid frac jobs on the northeast injectors have been completed and the new 14-34 injector is available, the plant will be able to operate at its full capacity of 12 net MW.

While many scenarios and probabilities exist of the injection work to be done by Ormat at Jersey Valley, Management ultimately believes that it is probable that the work being undertaken will result in an increase in current capacity to levels in the 10 MW to 12 MW range. We considered the above mentioned analysis performed by Management and have incorporated the following conclusive assumptions made by Management into our analysis:

|

|

·

|

Probability of 10MW Case: 70%;

|

|

|

·

|

Probability of 12MW Case: 30%.

|

Power Purchase Agreement

Jersey Valley currently delivers power to NPC, a subsidiary of NV Energy Inc., collectively referred to here as the (“Parties”), under a 20 year PPA effective as of August 18, 2006. Per this contract, Ormat had initially agreed to build a 31.5 MW nominal nameplate geothermal plant to be located at the Project Site. The Parties amended the Agreement on May 21, 2007 (the "First Amendment") to reflect certain agreements between the Parties.

14

The Parties amended the Agreement again on Feb 11, 2011 (the "Second Amendment") to reflect certain agreements revised as follows:

|

|

·

|

Total nameplate capacity: 22.5 MW;

|

|

|

·

|

Total gross output capacity: 19.0 MW ;

|

|

|

·

|

Total capacity net of Station Usage: 12.0 MW.

|

The purpose of the Amendment is to provide Ormat an option to revise the Parties’ rights and obligations under the current PPA for the remainder of the contract, adjusted for the achievable generation at Jersey Valley.

|

2.2

|

Description of the Valuation Methodology

|

To estimate the Fair Value of Jersey Valley under IAS 36, a DCF analysis was utilized. Under IFRS - IAS 36, an asset is considered to be impaired if the carrying value of the asset is greater than its estimated Fair Value. The impairment is recorded in the amount by which the carrying value exceeds the Fair Value of the asset.

Based on the injection work to be done by Ormat at Jersey Valley, Management ultimately believes that it is probable that the work being undertaken will result in an increase in current capacity to levels in the 10 MW to 12 MW range. Therefore, we have incorporated two cases based on the conclusive assumptions made by Management, with the following probabilities:

|

|

·

|

Probability of 10MW Case: 70%;

|

|

|

·

|

Probability of 12MW Case: 30%.

|

The Fair Value of the assets of Jersey Valley as of the Valuation Date was therefore estimated by:

|

·

|

Determining operational characteristics of the Plant under two generation capacities (10MW and 12MW)

|

|

·

|

Forecasting revenues and variable operating costs as applicable, including energy prices for the electric output

|

|

·

|

Forecasting fixed expenses and capital expenditures as applicable for each case

|

15

|

·

|

Performing a DCF analysis for each generation case. The DCF for each generation case was then assigned a probability, based on the Company's estimates of its probability to materialize. The Fair Value was then calculated by summing the total weighted expected value of both cases.

|

|

2.3

|

Weighted Average Cost of Capital

|

The weighted average cost of capital was calculated by weighting the required returns on fixed income and common equity capital in proportion to their estimated percentages in an expected capital structure. The valuation model assumes a weighted average cost of capital (WACC) of 8.0%.

|

2.4

|

Valuation Conclusion

|

|

2.4.1

|

Fair Value

|

Based on probabilities provided by the Company's Management, The Fair Value of Jersey Valley is estimated at $31.3 million (after taking into account assumed disposal costs) as exemplified below:

|

Case

|

Probability weighted Valuation

|

Case Weighting

|

Expected Value

|

|||||||||

|

10MW Case

|

27,882 | 70.0 | % | 19,518 | ||||||||

|

12MW Case

|

39,258 | 30.0 | % | 11,777 | ||||||||

|

Total

|

100.0 | % | 31,295 | |||||||||

|

2.4.2

|

Disposal Costs

|

Based on discussions with the management we assumed disposal costs estimated at 1% of the Fair Value, totaling $0.3-0.4 million (according to the selected case). These costs are already factored in the table above.

|

2.4.3

|

Conclusion

|

We estimate that the fair value of Jersey Valley is $31.3 million.

16

|

2.4.4

|

Sensitivity Analysis

|

We have performed a sensitivity analysis for the value of Jersey Valley (Including disposal costs), with respect to the weighted average cost of capital as follows:

10MW case:

|

% Change in WACC

|

-1%

|

-0.5%

|

8%

|

+0.50%

|

+1%

|

|||||||||||||||

|

Fair Value (less costs to sell)

|

31.3 | 29.5 | 27.9 | 26.4 | 25.0 | |||||||||||||||

12MW case:

|

% Change in WACC

|

-1%

|

-0.5%

|

8%

|

+0.50%

|

+1%

|

|||||||||||||||

|

Fair Value (less costs to sell)

|

44.2 | 41.6 | 39.3 | 37.1 | 35.1 | |||||||||||||||

Combined (According to probabilities):

|

% Change in WACC

|

-1%

|

-0.5%

|

8%

|

+0.50%

|

+1%

|

|||||||||||||||

|

Fair Value (less costs to sell)

|

35.2 | 33.1 | 31.3 | 29.6 | 28.0 | |||||||||||||||

17

Chapter C - Description of the Company and Subject Assets

|

3.1

|

Ormat Technologies, Inc.

|

Ormat is the leading vertically-integrated company primarily engaged in the geothermal and recovered energy power business. The Company designs, develops, owns and operates geothermal and recovered energy-based power plants around the world. Additionally, the Company designs, manufactures and sells geothermal and recovered energy power units and other power-generating equipment, and provides related services. With more than four decades of experience in geothermal and recovered-energy generation, Ormat products and systems are covered by 82 U.S. patents.

|

3.2

|

Description of Subject Assets

|

General

Jersey Valley is a binary geothermal plant and began start-up testing in December 2010. The Geothermal Power Plant (“Plant”) is located at the northern end of Dixie Valley, along the Pershing-Lander County line, in Nevada (the “Project Site”). Ormat's power solutions are utilized in the plant design; this includes two Ormat Energy Converters ("OEC"), a power generation unit that converts low, medium and high temperature heat into electrical energy. The electricity being produced is sold to NPC under a 20-year PPA.

The Jersey Valley lease area extends for several miles to the north and west, so there may be other geothermal systems yet to be discovered. If Ormat can resolve the injection limitations for the project, Management believes that the resource base within the leasehold at Jersey Valley is adequate to support the 12-MW power plant, though additional make-up drilling may be required during the life or the project.

18

Since December 2010, the Jersey Valley plant has been operating in start-up mode, using 77A-28 and 87-28RD as producers and the three northeast wells (14-27, 81-28, and 81A-28), as injectors. Ormat has Reported that, during early start-up operations, debris in the injection pipeline was inadvertently allowed to go down the three northeast injectors, resulting in lower-than-anticipated injection capacity at these wells. The injection limitations at these wells restricted the initial power output of the plant. Plant output has been as high as 11 net MW when injection well 18A-27 was in service.

Management has conducted acid frac stimulations of well 14-27, as of the Valuation Date, and believes that the generation targets of 10MW to 12MW are feasible. Ormat is also drilling a new well (14-34) about half a mile south of 18A-27, and it expects to use the new well for injection as well. Management anticipates that, once the acid frac jobs on the northeast injectors have been completed and the new 14-34 injector is available, the plant will be able to operate at its full capacity of 12 net MW.

While many scenarios and probabilities exist of the injection work to be done by Ormat at Jersey Valley, Management ultimately believes that it is probable that the work being undertaken will result in an increase in current capacity to levels in the 10 MW to 12 MW range. We considered the above mentioned analysis performed by Management and have incorporated the following conclusive assumptions made by Management into our analysis:

|

|

·

|

Probability of 10MW Case: 70%;

|

|

|

·

|

Probability of 12MW Case: 30%.

|

19

Power Purchase Agreement

Jersey Valley currently delivers power to NPC, a subsidiary of NV Energy Inc., collectively referred to here as the (“Parties”), under a 20 year PPA effective as of August 18, 2006. Per this contract, Ormat had initially agreed to build a 31.5 MW nominal nameplate geothermal plant to be located at the Project Site. The Parties amended the Agreement on May 21, 2007 (the "First Amendment") to reflect certain agreements between the Parties.

The Parties amended the Agreement again on Feb 11, 2011 (the "Second Amendment") to reflect certain agreements revised as follows:

|

|

·

|

Total nameplate capacity: 22.5 MW;

|

|

|

·

|

Total gross output capacity: 19.0 MW ;

|

|

|

·

|

Total capacity net of Station Usage: 12.0 MW.

|

The purpose of the Amendment is to provide Ormat an option to revise the Parties’ rights and obligations under the current PPA for the remainder of the contract, adjusted for the achievable generation at Jersey Valley.

20

Chapter D – General Economic Outlook and Industry Analysis1

|

4.1

|

General Economic Outlook

|

|

4.1.1

|

Introduction

|

In performing our analysis, we considered the general economic outlook as of the Valuation Date and its potential impact on the Subject Assets. An assessment of the general economy can often identify underlying causes for fluctuations in the financial and operating performance of a company. This overview of the general economic outlook is based on our examination of various economic analyses and the consensus forecasts of Blue Chip Economic Indicators and Blue Chip Financial Forecasts (collectively, the “consensus”).

|

4.1.2

|

Economic Growth

|

The United States’ economy is continuing to recover from one of its worst recessions in history. The 2008-2009 recession was declared officially over in June 2009, and was of greater duration than those of 1974-1975 and 1981-1982. Real GDP (i.e., output adjusted for the impact of inflation) contracted by 3.1% in 2009 on a year-over-year basis. This was the biggest decline since 1946 and was primarily attributed to sharp decreases in residential and non-residential fixed investments, real personal consumption expenditures (“PCE”) and, to a lesser extent, business inventories. In fact, 2009 saw the largest liquidation ever on record of business inventories.

In comparison to post World War II periods, the current recovery falls short of the rebound observed in post-World War II recessions. Real GDP growth in the year following the recessions of 1957-58, 1973-75, and 1981-82 was on average 5.6%. In contrast, real GDP grew by 2.4% during 2010, aided by a rebuilding of business inventories and a recovery in consumer spending. This sub-par growth trend did not improve in 2011, with the U.S economy only expanding by 1.8%. This lower than expected growth was attributable to a series of events, which included but was not limited to, harsh winter weather, continued cutbacks by state and local governments, political turmoil in several North African and Middle Eastern countries, a major earthquake and tsunami in Japan, and a resurfacing of the European sovereign debt crisis.

1 Sources– D&P Jersey Valley Impairment Analysis - Aug 2012, the IMF, and capital IQ.

21

Following this weak overall trend, the U.S. economy expanded by 2.0% in the first quarter of 2012. Real GDP growth was primarily driven by a rise in real PCE, which stemmed from a surge in auto and light truck unit sales driven by mild winter weather. In the second quarter of 2012, real GDP grew by only 1.3%, as the outlook for U.S. economic growth continued to deteriorate. Consumer spending slowed down, while manufacturing output growth was marked by a significant deceleration from the first quarter.

During the third quarter of 2012, the economy appears to have grown at a rate of 1.7% in real terms, according to consensus estimates. This was partially supported by a rebound in real PCE, but hindered by a further deceleration in industrial production. The biggest contributor to third-quarter growth appears to be a build-up in business inventories, but this is not expected to be a sustainable.

Looking ahead, the consensus estimates real GDP will grow 2.1% during 2012, followed by 2.0% in 2013, still below the U.S. long-term trend. Concerns related to the “fiscal cliff” are expected to dampen growth of real PCE in the early part of 2013. In fact, the Congressional Budget Office (“CBO”) projected that if the scheduled spending cuts and tax increases are not addressed, real GDP will contract by 0.5% in 2013. Slower growth in business inventories are also expected to hinder GDP, primarily the result of the drought in the U.S. and concerns about the impending fiscal cliff.

22

Other potential risks to U.S. economic growth include regulatory uncertainties resulting from the November 2012 U.S. presidential elections (and related impact on fiscal policy), effects of a deteriorating Euro sovereign debt crisis, and weakened economic growth in China.

In its most recent semi-annual update to long-range projections, the consensus estimated a five-year average real GDP growth rate of 2.9% for the period of 2014-2018, with a 2.5% average growth for the subsequent five-year-period. This is consistent with the most recent Livingston Survey, published by the Federal Reserve Bank of Philadelphia (the “Philadelphia Fed”), which projects a long-run (ten-year) average real GDP growth rate of 2.7%.2

|

4.1.3

|

Inflation

|

The primary inflation index of the U.S., the consumer price index (“CPI”), expanded at an annualized rate of 3% in 2011, a substantially higher growth rate compared with the CPI growth rate in 2010, of 1.6%. During 2010 CPI was somewhat volatile, but ultimately registered an overall 1.6% increase, fueled by rising food, energy, and raw commodity prices. Price pressure from crude oil, which was exacerbated by the ongoing turmoil in North Africa and Middle East, persisted during the first half of 2011. This led to CPI’s annualized rise of 4.5% and 4.4% in the first and second quarters respectively. During the third quarter, the increase in CPI slowed down to an annualized 3.1%, but energy prices were still a large contributing factor. Further deceleration in CPI inflation was experienced during the fourth quarter at a surprisingly low annualized rate of 1.3%, largely due to the decline in gasoline and new vehicle prices. This contributed to an overall 2011 CPI inflation of 3.2%. A sudden rebound in oil prices during the first quarter of 2012 led to a 2.5% (annualized) rise in CPI. However, CPI inflation is set to decline in the second quarter due to a recent drop in prices of crude oil related products (driven by a slowing global economy), as well as energy services (attributable to plummeting natural gas prices and warm winter weather). The consensus estimates that CPI will rise by 2.2% and 2.1% in 2012 and 2013, respectively. In addition, the IMF estimates an average long-term inflation of 2%.

2 Source: “Livingston Survey – June 2012,” Federal Reserve Bank of Philadelphia, June 7, 2012.

23

|

4.1.4

|

Unemployment

|

In October 2009, the rate of unemployment peaked at 10.0%, the worst level since June 1983. In 2010 new jobs were created, led primarily by an increase in private sector payrolls, but restrained by layoffs of government employees, resulting in a 9.6% average unemployment rate. Conditions improved during the first half of 2011, driven primarily by private sector payroll expansion, lowering the average unemployment rate to 9.0%. A majority of first quarter job gains were eliminated during the second quarter of 2011 and the unemployment rate rose again to 9.1% in the third quarter of 2011. However, improvement in private sector employment in the fourth quarter resulted in a decline in the unemployment rate to 8.7%, leading to an overall 9.0% for 2011. Robust job creation continued in the first two months of 2012, primarily driven by a mild winter, leading to an average 8.3% unemployment rate in the first quarter of 2012, followed by 8.2% in the second quarter. Despite a general slowdown in job growth during the third quarter, the September 2012 unemployment rate declined to 7.8%, the lowest rate since January 2009. Nevertheless, this was largely a result of workers taking part-time jobs due a lack of full-time positions. Overall, the consensus expects an average unemployment rate of 8.2% in 2012 and 7.9% in 2013, projecting a below 6% rate only post-2017.

24

|

4.1.5

|

Interest Rate Environment and Global Economic Trends

|

U.S. Interest rates remain historically low as a flight to quality led U.S. Treasury yields to drop sharply in May 2011, continuing to decline through 2012. Poor labor markets, signs of a global economic slowdown, rising capital and liquidity requirements for banks, and most notably an escalation of the Euro-zone sovereign debt crisis, all contributed to investors becoming more risk averse. Based on these trends, the Federal Open Market Committee (“FOMC”) announced in September 2012 that it will continue to keep interest rates exceptionally low through mid-2015.

In August 2010, due to market uncertainty, the Federal Reserve (“Fed”) introduced a variety of quantitative easing measures (also known as “QE2”) to support the U.S. economy, completed in June 2011. In September 2011, the Fed announced plans to purchase $400 billion of Treasury securities (known as “Operation Twist”), with the intent to drive down long-term interest rates and revive the economy. In June 2012, citing weakness in labor markets and strains in global financial markets, the Fed announced plans to continue Operation Twist through the end of 2012. In an effort to support economic recovery, the Fed announced in September 2012 that it will increase the pace of mortgage-backed security purchases to $40 billion per month. This program, known as “QE3”, does not have a defined term and will continue until labor markets improve.

25

Geopolitical and economic uncertainty is still very high across the globe. Concerns about the possibility of a global sovereign debt crisis first surfaced in February-March 2010, due to investors’ reactions to swelling budget deficits in several Euro-zone member states, especially in Greece. The European Union (“EU”) and the International Monetary Fund (“IMF”) first approved a bailout package for Greece in May 2010. Both Ireland (November 2010) and Portugal (April 2011) were forced to request similar EU-IMF bailouts. In July 2011, the EU approved a second Greek bailout agreement. However, markets reacted negatively and the crisis spread to Spain and Italy, which were considered by markets as “too big to fail”. Accordingly, the European Central Bank (“ECB”) was forced to reenact its government bonds purchase program and to provide additional liquidity to banks. In turn, this led to discussions about a new fiscal and banking union, which would enable the issuance of Euro-zone bonds. In September, Germany ratified plans to create a European Stability Mechanism (“ESM”) fund, which will serve as the Euro-zone’s permanent bailout mechanism. The ECB also announced a new QE program, whose intent is to acquire certain sovereign debt securities in secondary markets.

Despite starting with a healthy 2.5% annualized real GDP growth in the first quarter of 2011, the Euro-zone expanded by only 1.0% and 0.3% respectively in the second and third quarters, due to higher energy prices and the sovereign debt crisis. To worsen matters, the Euro-zone contracted by an annualized 1.4% in the last quarter of 2011. For overall 2011, the Euro-zone economy grew by 1.4%, in real terms. The first and second quarter saw further deterioration, with the economy contracting by 0.7%. Softness has extended from the periphery to core countries. Faced with this weak environment, the ECB decided in July to cut its benchmark interest rate by 25 basis points to a record low. A contraction in Euro-zone real GDP of 0.5% is now projected for 2012, followed by dismal growth of 0.2% in 2013. The actual growth trajectory for 2012 and 2013 will be dependent on politicians and the ECB’s ability to control the ongoing sovereign debt crisis.

26

The United Kingdom economy grew by an annualized 2.0% in the first quarter of 2011, but only by 0.3% in the second quarter, partially due to the April 2011 royal wedding and the effects from the Japanese earthquake. Third quarter saw an annualized 2.1% real GDP growth, primarily as an offset to the stagnation seen in the prior quarter. Downside risks in the economy led the Bank of England (“BOE”) to announce a QE2 program in October 2011. Real GDP contracted by an annualized 1.4% in the fourth quarter, mainly due to weakened Euro-zone growth and high inflation, leading the BOE to expand the QE2 in February 2012. Overall, real GDP grew by 0.9% in 2011. The U.K. slipped back into recession during 2012, as real GDP contracted by an annualized 1.2% and 1.5% in the first and second quarters, partly due to the Queen’s Diamond Jubilee. Consequently, in July the BOE expanded the QE2 again, in an attempt to shield the economy from the Euro-zone debt crisis. Third-quarter growth appears to have recovered, but again an offset to the prior quarter. The consensus projects a decline in real GDP of 0.5% in 2012, followed by growth of 1.1% in 2013.

In March 2011, Japan was hit by a devastating earthquake and subsequent tsunami, which created significant economic and fiscal challenges. Real GDP contracted by an annualized rate of 7.9% and 1.3% in the first and second quarters of 2011 respectively, as consumer spending, business investment, and exports collapsed following the disaster. The third quarter rebounded significantly, with a 6.9% annualized real GDP growth rate. Nonetheless, concerns regarding the rising yen and subsequent decline in Japanese exports pushed the Bank of Japan (“BOJ”) to a new round of QE measures and currency market intervention. Despite these measures, real GDP grew only by an annualized 0.3% in the fourth quarter, contributing to an overall 2011 decline of 0.8%. In the first quarter of 2012, the economy showed some improvement with a 5.3% annualized real growth, but decelerated to 0.7% in the second quarter. The consensus projects real GDP to grow by 2.3% and 1.3% in 2012 and 2013, respectively.

27

|

4.2

|

U.S. Geothermal Market Update

|

|

4.2.1

|

Introduction

|

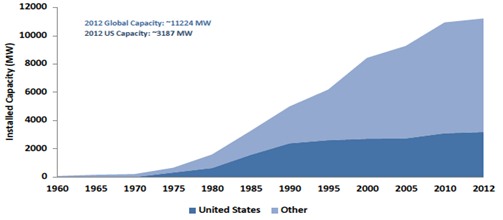

The development of geothermal energy resources for utility-scale electricity production in the United States has continued since the 1960’s, and in turn has positioned the US as a leader in the global geothermal industry. The US currently has approximately 3187 MW of installed geothermal capacity, more than any other country in the world, as depicted in the figure below.

US & Global Geothermal Installed Capacity (1960 – 2012)

Geothermal companies continue to increase the development of geothermal resources in the US. In 2010 geothermal energy accounted for 3% of renewable energy-based electricity consumption in the United States. While the majority of geothermal installed capacity in the US is concentrated in California and Nevada, geothermal power plants are also operating in Alaska, Hawaii, Idaho, Oregon, Utah, and Wyoming. While the recent economic downturn adversely impacted the rate of geothermal resource development, the geothermal industry has maintained steady growth in the US through 2012. Geothermal companies continue to explore and develop geothermal resources at a growing number of sites throughout the United States. Geothermal capacity in 2011 and 2012 was installed by four different geothermal companies. An increasing number of Geothermal projects are located in California and especially Nevada, where strong state policies and a geothermal friendly regulatory structure support strong industry growth.

28

|

4.2.2

|

Industry Growth Trends and Future Development

|

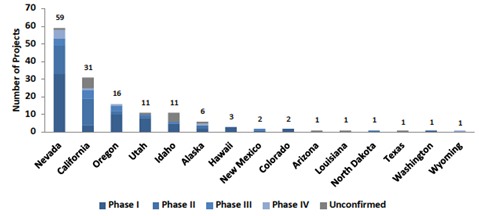

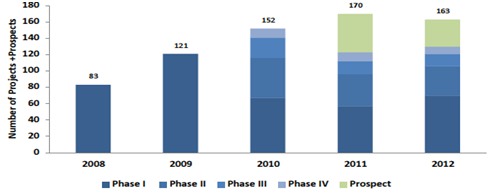

The number of developing geothermal projects Reported to GEA in 2012 (130 projects) represents an increase of approximately 6% from 2011 (123 projects). By the end of 2012, the geothermal industry is expected to develop 130 confirmed geothermal projects, which inclusive of projects not confirmed (i.e. “unconfirmed”) by the developing companies, is closer to 147 total projects. Geothermal companies increased installed capacity from 3102 MW to 3187 MW in 2011 and the first quarter of 2012. As the economy recovers and federal and state policy incentives driving investment in renewable energy resources remain in effect, the geothermal industry is expected to continue to bring geothermal capacity online in 2012 and subsequent years. As advanced geothermal projects enter or near the construction phase of development, geothermal companies in the US are also acquiring and developing early stage geothermal resources. Within the United States, most geothermal reservoirs are located in the western states, Alaska, and Hawaii. Wells, in these areas, can be drilled into underground reservoirs for the generation of electricity, with a high probability of success and longevity. According to development companies within the industry, new projects were identified under development in 15 states: Nevada, California, Utah, Idaho, Oregon, Alaska, Louisiana, Hawaii, New Mexico, Arizona, Colorado, Mississippi, Texas, Washington, and Wyoming in-spite of the economic downturn and risk-averse investors. As indicated in Figure 2 below, Nevada and California maintain to be leaders in geothermal power development.

29

Figure 2: Developing Projects by State and Phase, Source: GEA

Developers of geothermal facilities are progressively exploring new areas where little or no previous development has taken place. Of the 147 projects surveyed by the GEA, 116 (approximately 80%) are developing conventional hydrothermal resources in “unproduced” areas (CH Unproduced) where the geothermal resource has not been developed to support electricity generation via a power plant. Additionally, 18 are developing conventional hydrothermal projects in “produced” (CH Produced) areas, and five are expansions to existing conventional hydrothermal power plants (CH Expansion). The remaining projects are five geothermal and hydrocarbon coproduction (“Coproduction”) and three enhanced geothermal systems (“EGS”) projects.

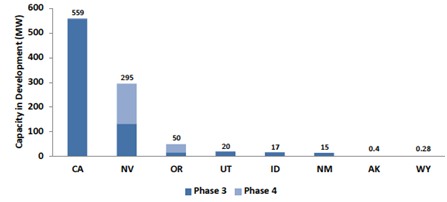

Currently, geothermal companies are developing 1779 - 1821 MW of confirmed Planned Capacity Additions (“PCA”) projects in the US. When accounting for unconfirmed projects, the range of PCA in development is approximately 1961 – 2023 MW. Of this, 949 – 956 MW are advanced-stage (Phase 3 – 4) geothermal projects. The figure below, details PCA projects by state that are in advanced stages of development, as of April, 2012.

30

Advanced-stage planned capacity additions by state: Source: GEA

The exploration for and development of new resources, as well as the application of new technologies, has the potential to expand the geographic extent of the industry. Projects featuring the development of conventional hydrothermal resources as well as EGS pilot projects are increasing in the western US. At the same time, the potential to generate geothermal electricity from low-temperature fluids left over as a byproduct from oil and gas production is being explored through demonstration scale projects in states along the Gulf of Mexico and in North Dakota.

31

|

4.2.3

|

Federal Incentives and Drivers of Development

|

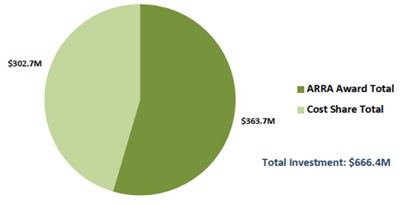

Increased progress in the development of geothermal projects has been fueled by federal incentives and funding which help offset the risk and high capital cost of development. Subject to certain criteria, geothermal power projects are eligible for the full Production Tax Credit (“PTC”) if placed in service by December 31, 2013. Additionally, the American Recovery and Reinvestment Act of 2009 (“ARRA”) has made projects eligible for the PTC also eligible for a grant in lieu of the tax credit from the Treasury Department. Section 1603 of the ARRA allows developers of geothermal power plants the option of applying for the Investment Tax Credit or an ITC cash grant. The grant is equivalent to a 30% tax credit for the eligible portions of their capital investment. Projects which are in construction by the end of calendar year 2011 and are placed in service by the end of calendar year 2013 may receive the 30% ITC or the ITC cash grant (after 2013 a 10% ITC is still available). Geothermal developers have cited the cash grant as a particularly important factor in sustaining development through the economic recession. Since 2009 approximately $262.9M and $4.6M in cash grants have been provided to utility-scale geothermal projects and geothermal heat pump projects respectively. Projects receiving cash grants span 19 different states. The ITC cash grant was included in the ARRA in response to the decreasing number of tax equity investors following the global credit crisis which began in 2008, as well as the fact that tax credits for many developers became less valuable in light of decreasing profits, and consequently shrinking tax burdens. Many geothermal developers are building several projects in the US, and the cash grant provides them an effective incentive that quickly reduces their debt -- an important factor in the present economic recession. In addition, four of the top five states with geothermal power under development have substantial renewable standards. Those states in order of geothermal development and their state renewable requirement are: 1) Nevada (25%), 2) California (33%), 3) Utah (20%), 4) Idaho (none), and 5) Oregon (25%). Department of Energy (“DOE”) federal stimulus legislation funding is also having an important influence on the US geothermal market. As part of the ARRA section 1705, the DOE has offered loan guarantees for eligible projects. In October 2009, the DOE also announced the results of its competitive solicitation under ARRA for geothermal technology projects. DOE announced awards that could result in up to $338 million in ARRA funding to geothermal research and development, and would require an additional $280 million in recipient cost-share. As of June 2010, ARRA awards administered through the DOE Geothermal Technologies Program (“GTP”) totaled nearly $363.5 million. Total cost share contributes an additional $362.4M, bringing the combined ARRA/cost share geothermal technology investment to more than $725.88M. The vast majority of projects that have yet to be completed indicate that much of this total will be spent in the coming year, boosting job growth within the geothermal sector.

32

Total DOE GTP ARRA/Cost-Share Geothermal Investment, Source: GEA

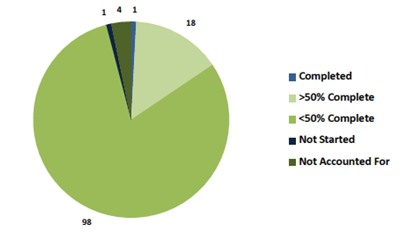

A review of GTP ARRA awards reveals that the impact of stimulus funding has not yet peaked for geothermal. As Reported by the GEA in 2011, of the 122 projects receiving ARRA funding through the DOE GTP: 1 has been completed, 18 are more than 50% complete, 98 are less than 50% complete, 1 has not been started, and 4 are unaccounted for on Recovery.gov.

Figure 5: ARRA Funded Geothermal Project Progress, Source: GEA

As indicated in Figure 5, about 98% of the projects receiving ARRA funding are either less than 50% complete. With the majority of ARRA funded projects still in early stages of development, GEA anticipates that much of this total will be spent in the coming years, boosting job growth within the geothermal sector.

33

|

4.2.4

|

Industry Outlook

|

As of the first quarter of 2012, the number of confirmed geothermal projects recorded by the GEA accounted for approximately 4116 - 4525 MW of geothermal resources in development, spread among 15 states in the western US. Including unconfirmed projects in resource development totals increases these levels to 4882 - 5366 MW. Figure 6 below, outlines the number of confirmed projects by year, with significant additions over the last two years.

Figure 6: Total confirmed projects +2011 and 2012 prospects, Source: GEA

As of the same period, companies developing geothermal resources have identified vendors in 39 different states (including the District of Columbia) supplying goods and services for the development of geothermal resources as well, which further shows signs of growth in the industry.

As indicated above, the outlook for the geothermal industry remains promising in the US and geothermal companies continue to explore and develop geothermal resources at a growing number of sites throughout the United States.

34

Chapter E - Valuation

|

5.1

|

Valuation methodology

|

|

5.1.1

|

General

|

In our estimation of Fair Value we consider the income approach. The income approach is a valuation technique that provides an estimation of the Fair Value of an asset based on market participant expectations about the cash flows that an asset would generate over its remaining useful life. The Income Approach begins with an estimation of the annual cash flows a market participant would expect the Subject Asset (or business) to generate over a discrete projection period. The estimated cash flows for each of the years in the discrete projection period are then converted to their present value equivalent using a rate of return appropriate for the risk of achieving the projected cash flows. The present value of the estimated cash flows are then added to the present value equivalent of the residual value of the asset (if any) or the business at the end of the discrete projection period to arrive at an estimate of Fair Value.

In some situations, the expected cash flow approach is a more effective measurement tool than the traditional approach. In developing a measurement, the expected cash flow approach uses all expectations about possible cash flows, taking into consideration assumed probabilities of future events and/or future scenarios, instead of the single cash flow scenario.

|

5.2

|

Application of the Income Approach in this analysis

|

To estimate the Fair Value of Jersey Valley under IAS 36, a DCF analysis was utilized. Under IFRS - IAS 36, an asset is considered to be impaired if the carrying value of the asset is greater than its estimated Fair Value. The impairment is recorded in the amount by which the carrying value exceeds the Fair Value of the asset. As requested by the Company, the analysis has been conducted using the expected cash flow approach. To estimate a value for the long-lived assets we conducted a valuation analysis pertaining to the Generation Capacity provided by Management.

35

The Fair Value of the assets of Jersey Valley as of the Valuation Date was therefore estimated by:

|

|

·

|

Determining operational characteristics of the Plant under two generation capacities (10MW and 12MW)

|

|

|

·

|

Forecasting revenues and variable operating costs as applicable, including energy prices for the electric output

|

|

|

·

|

Forecasting fixed expenses and capital expenditures as applicable for each case

|

|

|

·

|

Performing a DCF analysis for each generation case. The DCF for each generation case was then assigned a probability, based on the Company's estimates of its probability to materialize. The Fair Value was then calculated by summing the total weighted expected value of both cases.

|

|

5.3

|

Jersey Valley Valuation

|

Key assumptions

|

|

5.3.1

|

Operating Characteristics

|

Management provided the performance characteristics for both Capacity Cases considered, pertaining to the Jersey Valley project. We reviewed the assumptions under each case for reasonableness and also considered pertinent market conditions that could affect the Subject Assets. Assumptions provided by Management were considered reasonable and appropriate.

|

|

5.3.2

|

Production and Revenues

|

Management provided forecasted annual production estimates for each case which were considered to be reasonable and appropriate and in line with independent engineering Reports. The revenues were calculated according to forecasted production and electricity prices, which are based on the current PPA and are expected to increase after the expiration of the current PPA.

36

|

|

5.3.3

|

Production Penalties

|

Management provided forecasted annual production penalties related to the 10 MW capacity case for the Jersey Valley facility in comparison to its initial contracted generation obligation to NPC. The penalties were estimated by Management for the duration of the contracted period. Management does not anticipate penalties for the 12 MW case, since such production is in line with the Company’s contracted generation obligation to NPC

|

|

5.3.4

|

Operating Costs

|

The Company provided us with forecasted fixed and variable operating expenses, including costs such as plant operating expenses, utilities, insurance, royalties, and administrative expenses through year 2040 for the Subject Asset. Management's estimates and forecast of operating costs were based on its experience in the operations of the Jersey Valley plant and similar geothermal facilities. Variable costs were determined based on estimates of actual material, equipment and services required to operate the Plant subject to assumed production in the current generation capacity. Fixed operating costs, primarily labor, were based on the Company's experience in the operation of the Plant and similar facilities. To adjust these cost estimates to inflation, we have used a 2% long term inflation rate.

Property taxes, based on managements' guidance, were calculated as 0.5% of the property value.

|

|

5.3.5

|

Capital Expenditures

|

The Company provided us with forecasted capital expenditures for each case through year 2040 for the Subject Asset. Management's estimates and forecast of capital expenditures were based on its experience in the operations of the Jersey Valley plant and similar geothermal facilities. Both cases include a forecast of $2.56 million in CapEx in 2013, and the 12MW case reflected additional $3.0 million in incremental CapEx in 2014. To adjust these cost estimates to inflation, we have used a 2% long term inflation rate.

37

|

|

5.3.6

|

Depreciation

|

Positive cash flow is generated by the tax shield that arises from tax depreciation charges that reduce the amount of taxes paid. To arrive at Fair Value from a market participant view, the Plant has been valued assuming an asset purchase, which means that, for U.S. tax purposes, the price paid becomes the new tax basis of the acquired asset (i.e. the tax basis is adjusted to the value or price paid of the acquired asset). We calculated the depreciation step-up using a 5-year MACRS half-year schedule applicable to geothermal facilities.

As the concluded Fair Value includes the value of the future tax benefits, we used an iterative process to arrive at the Fair Value of the Plant, and used the Fair Value as the assumed tax basis

|

|

5.3.7

|

Tax

|

We utilized the corporate tax rate that a market participant that will operate the assets at their highest and best use would be expected to incur, and which is not necessarily the tax rate that is incurred by the Company or the Plant. The tax rate that we therefore used in our analysis is 35% (We note that there are no state taxes in Nevada).

|

|

5.3.8

|

Working Capital

|

In accordance with our assumptions in the past, we assumed 30 receivable days and 30 payable days to calculate the expected change in working capital.

38

|

5.4

|

Weighted Average Cost Of Capital (WACC)

|

|

|

5.4.1

|

General

|

In accordance with the Standard guidelines, the discount rate should reflect current market estimates of:

a. The time value of money

b. Specific risks with respect to which the cash flows were adjusted

The discount rate reflects, among other things, the business-operating risk inherent in the Company’s activities. Some of the risk is attributed to the nature of the market sector in which the Company operates, and some of it stems from specific characteristics of the Company. The Weighted Average Cost of Capital used in this analysis is 8.0% based on the following calculation, and in-line with the weighted average cost of capital used in previous analyses.

|

|

5.4.2

|

Cost of Equity

|

The following table presents the sum of the key parameters that we used in calculating the Cost of Equity (Ke):

Estimation of the Cost of Equity

|

Risk Free Rate (nominal)

|

2.95 | % | 1 | |||||

|

Market Risk Premium

|

6.0 | % | 2 | |||||

|

Re-levered Beta

|

1.22 | 3 | ||||||

|

Risk Premium

|

1.88 | % | 4 | |||||

|

Cost of Equity

|

12.14 | % |

Notes to the table:

|

|

1.

|

The nominal rate of return on a US government bond3 for a 30-year period.

|

|

|

2.

|

Average difference between the annual real return on stock indexes and the risk free interest in the U.S4.

|

|

|

3.

|

To determine the Company's beta, we examined a group of companies in the same field of business. We chose companies with similar features as the Company. Following is a list of peer companies used for calculating the beta5:

|

3 Source: Federal Reserve - www.federalreserve.gov/Releases/H15/Current.

39

Calculation of Levered Beta by Peer Companies:

|

Company

|

Unlevered Beta

|

D/V | ||||||

|

Calpine Corp.

|

0.74 | 53 | % | |||||

|

Ram Power Corp.

|

0.44 | 75 | % | |||||

|

US Geothermal Inc.

|

0.48 | 76 | % | |||||

|

Alterra power corp.

|

0.86 | 53 | % | |||||

|

Ormat Technologies Inc.

|

0.70 | 52 | % | |||||

|

Median

|

0.70 | 53 | % | |||||

|

|

4.

|

The specific risk premium, relevant to the size of the company in market of operation6.

|

|

|

5.4.3

|

WACC - Summary

|

Parameters for Calculating the WACC

|

Parameter

|

Value

|

Comments

|

||||||

|

Risk-free Rate

|

2.95 | % | ||||||

|

Relevered Beta

|

1.22 | 1 | ||||||

|

Market Risk Premium

|

6.0 | % | ||||||

|

Specific Risk Premium

|

1.9 | % | ||||||

|

The Cost of Equity

|

12.14 | % | ||||||

|

Cost of Debt

|

6.8 | % | 2 | |||||

|

Tax rate

|

35.0 | % | ||||||

| D/V | 53 | % | 3 | |||||

|

WACC

|

8.0 | % | 4 | |||||

Notes to the table:

|

|

1.

|

Re-levered beta based on the assumed D/E ratio and tax rate

|

|

|

2.

|

Based on the coupon rate set on the Company's bonds.

|

|

|

3.

|

The median Debt-to-Value ratio of comparable companies

|

|

|

4.

|

The WACC was rounded to 8%

|

6 Acording to data published in Ibbotson (December, 2012).

40

|

5.5

|

Valuation Conclusion

|

|

5.5.1

|

Fair Value

|

Based on probabilities provided by the Company's Management, The Fair Value of Jersey Valley is estimated at $31.3 million (after taking into account assumed disposal costs) as exemplified below:

|

Case

|

Probability weighted Valuation

|

Case Weighting

|

Expected Value

|

|||||||||

|

10MW Case

|

27,882 | 70.0 | % | 19,518 | ||||||||

|

12MW Case

|

39,258 | 30.0 | % | 11,777 | ||||||||

|

Total

|

100.0 | % | 31,295 | |||||||||

|

5.5.2

|

Disposal Costs

|

Based on discussions with the management we assumed disposal costs estimated at 1% of the Fair Value, totaling $0.3-0.4 million (according to the selected case). These costs are already factored in the table above.

|

5.5.3

|

Conclusion

|

We estimate that the fair value of Jersey Valley is $31.3 million.

|

5.5.4

|

Sensitivity Analysis

|

We have performed a sensitivity analysis for the value of Jersey Valley (Including disposal costs), with respect to the weighted average cost of capital as follows:

10MW case:

|

% Change in WACC

|

-1%

|

-0.5%

|

8%

|

+0.50%

|

+1%

|

|||||||||||||||

|

Fair Value (less costs to sell)

|

31.3 | 29.5 | 27.9 | 26.4 | 25.0 | |||||||||||||||

12MW case:

|

% Change in WACC

|

-1%

|

-0.5%

|

8%

|

+0.50%

|

+1%

|

|||||||||||||||

|

Fair Value (less costs to sell)

|

44.2 | 41.6 | 39.3 | 37.1 | 35.1 | |||||||||||||||

Combined (According to probabilities):

|

% Change in WACC

|

-1%

|

-0.5%

|

8%

|

+0.50%

|

+1%

|

|||||||||||||||

|

Fair Value (less costs to sell)

|

35.2 | 33.1 | 31.3 | 29.6 | 28.0 | |||||||||||||||

41

Chapter F – Exhibits

Discounted Cash Flow Analysis - 10MW Case

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

2020

|

2021

|

2022

|

2023

|

2024

|

2025

|

2026

|

2027

|

2028

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

Net Revenue

|

3,213 | 5,417 | 5,511 | 5,496 | 5,480 | 5,465 | 5,450 | 5,435 | 5,420 | 5,405 | 5,391 | 5,376 | 5,362 | 5,348 | 5,334 | 5,320 | ||||||||||||||||||||||||||||||||||||||||||||||||

|

Total Operating Costs

|

2,117 | 2,217 | 2,134 | 2,256 | 2,171 | 2,300 | 2,213 | 2,349 | 2,261 | 2,404 | 2,314 | 2,464 | 2,371 | 2,529 | 2,434 | 2,600 | ||||||||||||||||||||||||||||||||||||||||||||||||

|

Depreciation

|

6,144 | 9,831 | 5,999 | 3,699 | 3,635 | 1,827 | 160 | 192 | 98 | 59 | 163 | 196 | 100 | 60 | 166 | 200 | ||||||||||||||||||||||||||||||||||||||||||||||||

|

EBIT

|

(5,048 | ) | (6,631 | ) | (2,621 | ) | (459 | ) | (326 | ) | 1,338 | 3,077 | 2,894 | 3,061 | 2,943 | 2,915 | 2,717 | 2,891 | 2,759 | 2,734 | 2,521 | |||||||||||||||||||||||||||||||||||||||||||

|

Income Tax

|

(1,767 | ) | (2,321 | ) | (917 | ) | (161 | ) | (114 | ) | 468 | 1,077 | 1,013 | 1,071 | 1,030 | 1,020 | 951 | 1,012 | 966 | 957 | 882 | |||||||||||||||||||||||||||||||||||||||||||

|

After Tax Operating Profit

|

(3,281 | ) | (4,310 | ) | (1,704 | ) | (298 | ) | (212 | ) | 870 | 2,000 | 1,881 | 1,990 | 1,913 | 1,894 | 1,766 | 1,879 | 1,793 | 1,777 | 1,638 | |||||||||||||||||||||||||||||||||||||||||||

|

Plus: (Increase)/Decrease in Working Capital

|

— | (137 | ) | (7 | ) | 10 | (7 | ) | 11 | (7 | ) | 11 | (7 | ) | 12 | (7 | ) | 13 | (8 | ) | 13 | (8 | ) | 14 | ||||||||||||||||||||||||||||||||||||||||

|

Less: CapEx

|

(2,558 | ) | — | (500 | ) | — | — | — | (510 | ) | — | — | — | (520 | ) | — | — | — | (531 | ) | — | |||||||||||||||||||||||||||||||||||||||||||

|

Plus: Depreciation

|

6,144 | 9,831 | 5,999 | 3,699 | 3,635 | 1,827 | 160 | 192 | 98 | 59 | 163 | 196 | 100 | 60 | 166 | 200 | ||||||||||||||||||||||||||||||||||||||||||||||||

|

Free Cash Flow from Operations

|

305 | 5,383 | 3,788 | 3,411 | 3,416 | 2,708 | 1,643 | 2,084 | 2,081 | 1,984 | 1,530 | 1,974 | 1,971 | 1,866 | 1,404 | 1,852 | ||||||||||||||||||||||||||||||||||||||||||||||||

42

|

2029

|

2030

|

2031

|

2032

|

2033

|

2034

|

2035

|

2036

|

2037

|

2038

|

2039

|

2040

|

|||||||||||||||||||||||||||||||||||||

|

Net Revenue

|

5,306 | 5,293 | 5,279 | 5,266 | 7,165 | 7,164 | 7,163 | 7,163 | 7,162 | 7,161 | 7,161 | 7,160 | ||||||||||||||||||||||||||||||||||||

|

Total Operating Costs

|

2,502 | 2,675 | 2,575 | 2,757 | 2,657 | 2,847 | 2,740 | 2,939 | 2,829 | 3,036 | 2,923 | 3,139 | ||||||||||||||||||||||||||||||||||||

|

Depreciation

|

102 | 61 | 169 | 204 | 104 | 62 | 173 | 208 | 106 | 64 | 627 | 32 | ||||||||||||||||||||||||||||||||||||

|

EBIT

|

2,702 | 2,556 | 2,534 | 2,305 | 4,404 | 4,255 | 4,250 | 4,016 | 4,227 | 4,062 | 3,611 | 3,989 | ||||||||||||||||||||||||||||||||||||

|

Income Tax

|

946 | 895 | 887 | 807 | 1,541 | 1,489 | 1,488 | 1,406 | 1,480 | 1,422 | 1,264 | 1,396 | ||||||||||||||||||||||||||||||||||||

|

After Tax Operating Profit

|

1,756 | 1,661 | 1,647 | 1,498 | 2,863 | 2,766 | 2,763 | 2,611 | 2,748 | 2,640 | 2,347 | 2,593 | ||||||||||||||||||||||||||||||||||||

|

Plus: (Increase)/Decrease in Working Capital

|

(8 | ) | 14 | (8 | ) | 15 | (133 | ) | 16 | (9 | ) | 17 | (9 | ) | 17 | (9 | ) | 202 | ||||||||||||||||||||||||||||||

|

Less: CapEx

|

— | — | (541 | ) | — | — | — | (552 | ) | — | — | — | (563 | ) | — | |||||||||||||||||||||||||||||||||

|

Plus: Depreciation

|

102 | 61 | 169 | 204 | 104 | 62 | 173 | 208 | 106 | 64 | 627 | 32 | ||||||||||||||||||||||||||||||||||||

|

Free Cash Flow from Operations

|

1,850 | 1,737 | 1,267 | 1,717 | 2,834 | 2,844 | 2,375 | 2,835 | 2,845 | 2,721 | 2,402 | 2,827 | ||||||||||||||||||||||||||||||||||||

43

Discounted Cash Flow Analysis - 12MW Case

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

2020

|

2021

|

2022

|

2023

|

2024

|

2025

|

2026

|

2027

|

2028

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

Net Revenue

|

3,933 | 6,817 | 6,816 | 6,815 | 6,815 | 6,814 | 6,813 | 6,812 | 6,812 | 6,811 | 6,810 | 6,810 | 6,809 | 6,808 | 6,808 | 6,807 | ||||||||||||||||||||||||||||||||||||||||||||||||

|

Total Operating Costs

|

2,117 | 2,220 | 2,136 | 2,258 | 2,173 | 2,302 | 2,216 | 2,352 | 2,263 | 2,406 | 2,316 | 2,466 | 2,374 | 2,532 | 2,437 | 2,602 | ||||||||||||||||||||||||||||||||||||||||||||||||

|

Depreciation

|

8,442 | 14,108 | 9,165 | 5,599 | 5,304 | 2,835 | 332 | 192 | 98 | 59 | 163 | 196 | 100 | 60 | 166 | 200 | ||||||||||||||||||||||||||||||||||||||||||||||||

|

EBIT

|

(6,626 | ) | (9,511 | ) | (4,485 | ) | (1,042 | ) | (663 | ) | 1,677 | 4,265 | 4,269 | 4,451 | 4,346 | 4,332 | 4,148 | 4,335 | 4,217 | 4,205 | 4,005 | |||||||||||||||||||||||||||||||||||||||||||

|

Income Tax

|

(2,319 | ) | (3,329 | ) | (1,570 | ) | (365 | ) | (232 | ) | 587 | 1,493 | 1,494 | 1,558 | 1,521 | 1,516 | 1,452 | 1,517 | 1,476 | 1,472 | 1,402 | |||||||||||||||||||||||||||||||||||||||||||

|

After Tax Operating Profit

|

(4,307 | ) | (6,182 | ) | (2,915 | ) | (677 | ) | (431 | ) | 1,090 | 2,772 | 2,775 | 2,893 | 2,825 | 2,816 | 2,696 | 2,818 | 2,741 | 2,733 | 2,603 | |||||||||||||||||||||||||||||||||||||||||||

|

Plus: (Increase)/Decrease in Working Capital

|

— | (232 | ) | (7 | ) | 10 | (7 | ) | 11 | (7 | ) | 11 | (7 | ) | 12 | (7 | ) | 13 | (8 | ) | 13 | (8 | ) | 14 | ||||||||||||||||||||||||||||||||||||||||

|

Less: CapEx

|

(2,558 | ) | (3,000 | ) | (500 | ) | — | — | — | (510 | ) | — | — | — | (520 | ) | — | — | — | (531 | ) | — | ||||||||||||||||||||||||||||||||||||||||||

|

Plus: Depreciation

|

8,442 | 14,108 | 9,165 | 5,599 | 5,304 | 2,835 | 332 | 192 | 98 | 59 | 163 | 196 | 100 | 60 | 166 | 200 | ||||||||||||||||||||||||||||||||||||||||||||||||

|

Free Cash Flow from Operations

|

1,577 | 4,694 | 5,742 | 4,932 | 4,866 | 3,935 | 2,587 | 2,978 | 2,983 | 2,896 | 2,451 | 2,904 | 2,910 | 2,814 | 2,361 | 2,817 | ||||||||||||||||||||||||||||||||||||||||||||||||

44

|

2029

|

2030

|

2031

|

2032

|

2033

|

2034

|

2035

|

2036

|

2037

|

2038

|

2039

|

2040

|

|||||||||||||||||||||||||||||||||||||

|

Net Revenue

|

6,806 | 6,806 | 6,805 | 6,804 | 8,598 | 8,597 | 8,596 | 8,595 | 8,594 | 8,594 | 8,593 | 8,592 | ||||||||||||||||||||||||||||||||||||

|

Total Operating Costs

|

2,505 | 2,678 | 2,578 | 2,759 | 2,660 | 2,850 | 2,744 | 2,942 | 2,832 | 3,039 | 2,926 | 3,142 | ||||||||||||||||||||||||||||||||||||

|

Depreciation

|

102 | 61 | 169 | 204 | 104 | 62 | 173 | 208 | 106 | 64 | 627 | 32 | ||||||||||||||||||||||||||||||||||||

|

EBIT

|

4,200 | 4,067 | 4,058 | 3,841 | 5,834 | 5,685 | 5,680 | 5,446 | 5,656 | 5,491 | 5,040 | 5,418 | ||||||||||||||||||||||||||||||||||||

|

Income Tax

|

1,470 | 1,423 | 1,420 | 1,344 | 2,042 | 1,990 | 1,988 | 1,906 | 1,980 | 1,922 | 1,764 | 1,896 | ||||||||||||||||||||||||||||||||||||

|

After Tax Operating Profit

|

2,730 | 2,643 | 2,637 | 2,497 | 3,792 | 3,695 | 3,692 | 3,540 | 3,677 | 3,569 | 3,276 | 3,522 | ||||||||||||||||||||||||||||||||||||

|

Plus: (Increase)/Decrease in Working Capital

|

(8 | ) | 14 | (8 | ) | 15 | (158 | ) | 16 | (9 | ) | 17 | (9 | ) | 17 | (9 | ) | 321 | ||||||||||||||||||||||||||||||

|

Less: CapEx

|

— | — | (541 | ) | — | — | — | (552 | ) | — | — | — | (563 | ) | — | |||||||||||||||||||||||||||||||||

|

Plus: Depreciation

|