Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MARKWEST ENERGY PARTNERS L P | a13-6673_28k.htm |

Exhibit 99.1

|

|

2013 OPIS NGL Summit Miami, FL March 8-11, 2013 |

|

|

Forward-Looking Statements This presentation contains forward-looking statements and information. These forward-looking statements, which in many instances can be identified by words like “could,” “may,” “will,” “should,” “expects,” “plans,” “project,” “anticipates,” “believes,” “planned,” “proposed,” “potential,” and other comparable words, regarding future or contemplated results, performance, transactions, or events, are based on MarkWest Energy Partners, L.P. (“MarkWest” and the “Partnership”) current information, expectations and beliefs, concerning future developments and their potential effects on MarkWest. Although MarkWest believes that the expectations reflected in the forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct, and actual results, performance, distributions, events or transactions could vary significantly from those expressed or implied in such statements and are subject to a number of uncertainties and risks. Among the factors that could cause results to differ materially are those risks discussed in the periodic reports filed with the SEC, including MarkWest’s Annual Report on Form 10-K for the year ended December 31, 2012. You are urged to carefully review and consider the cautionary statements and other disclosures, including those under the heading “Risk Factors,” made in those documents. If any of the uncertainties or risks develop into actual events or occurrences, or if underlying assumptions prove incorrect, it could cause actual results to vary significantly from those expressed in the presentation, and MarkWest’s business, financial condition, or results of operations could be materially adversely affected. Key uncertainties and risks that may directly affect MarkWest’s performance, future growth, results of operations, and financial condition, include, but are not limited to: Fluctuations and volatility of natural gas, NGL products, and oil prices; A reduction in natural gas or refinery off-gas production which MarkWest gathers, transports, processes, and/or fractionates; A reduction in the demand for the products MarkWest produces and sells; Financial credit risks / failure of customers to satisfy payment or other obligations under MarkWest’s contracts; Effects of MarkWest’s debt and other financial obligations, access to capital, or its future financial or operational flexibility or liquidity; Construction, procurement, and regulatory risks in our development projects; Hurricanes, fires, and other natural and accidental events impacting MarkWest’s operations, and adequate insurance coverage; Terrorist attacks directed at MarkWest facilities or related facilities; Changes in and impacts of laws and regulations affecting MarkWest operations and risk management strategy; and Failure to integrate recent or future acquisitions. 2 |

|

|

MarkWest Operational Assets SOUTHWEST Granite Wash, Haynesville Shale, Woodford Shale, Gulf Coast 1.6 Bcf/d gathering capacity 917 MMcf/d processing 29 MBbl/d NGL fractionation capacity 1.5 Bcf/d transmission capacity including Arkoma Connector Pipeline NGL marketing and transportation NORTHEAST Huron/Berea Shale 652 MMcf/d processing 24 MBbl/d fractionation 285 MBbl NGL storage NGL marketing by truck, rail, & barge LIBERTY Marcellus Shale 525 MMcf/d gathering 1.2 Bcf/d processing 60 MBbl/d C3+ fractionator 90 MBbl NGL storage Under construction: 1.8 Bcf/d processing 115 MBbl/d C2 fractionation 50 MBbl/d Mariner West ethane pipeline project UTICA Utica Shale Joint Venture with EMG 60 MMcf/d processing Under construction: 725 MMcf/d processing 100 MBbl/d fractionation, storage, and marketing complex in Harrison County, Ohio 3 |

|

|

Growth Driven by Customer Satisfaction 4 Ranked #1 in Midstream Customer Satisfaction Survey for 2011 Since 2006, we have been ranked #1 or #2 by EnergyPoint Research |

|

|

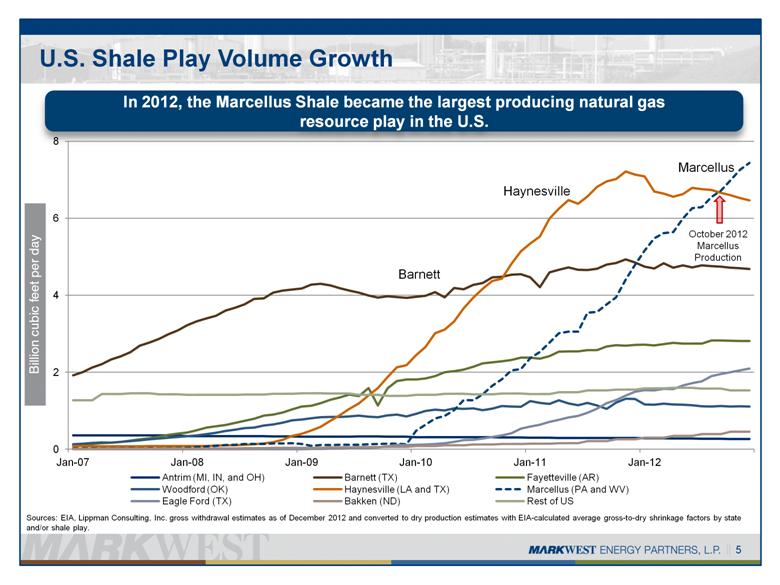

U.S. Shale Play Volume Growth 5 In 2012, the Marcellus Shale became the largest producing natural gas resource play in the U.S. Sources: EIA, Lippman Consulting, Inc. gross withdrawal estimates as of December 2012 and converted to dry production estimates with EIA-calculated average gross-to-dry shrinkage factors by state and/or shale play. Barnett Haynesville Marcellus |

|

|

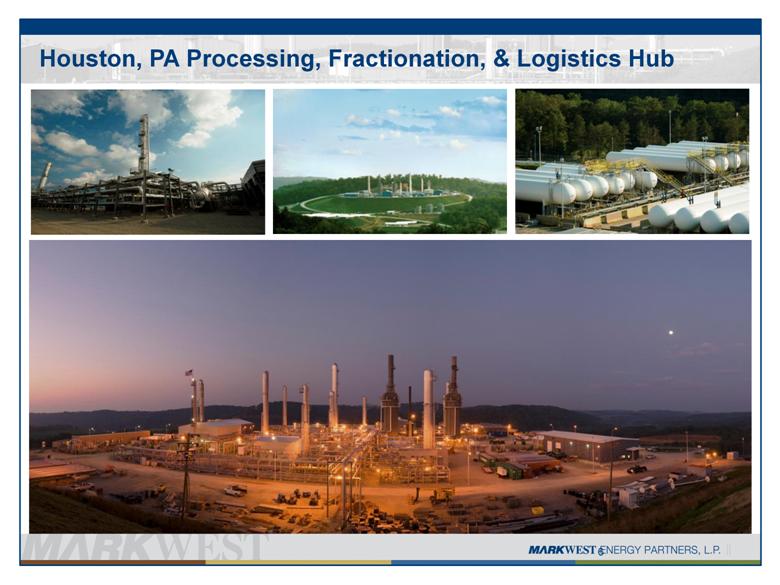

Houston, PA Processing, Fractionation, & Logistics Hub |

|

|

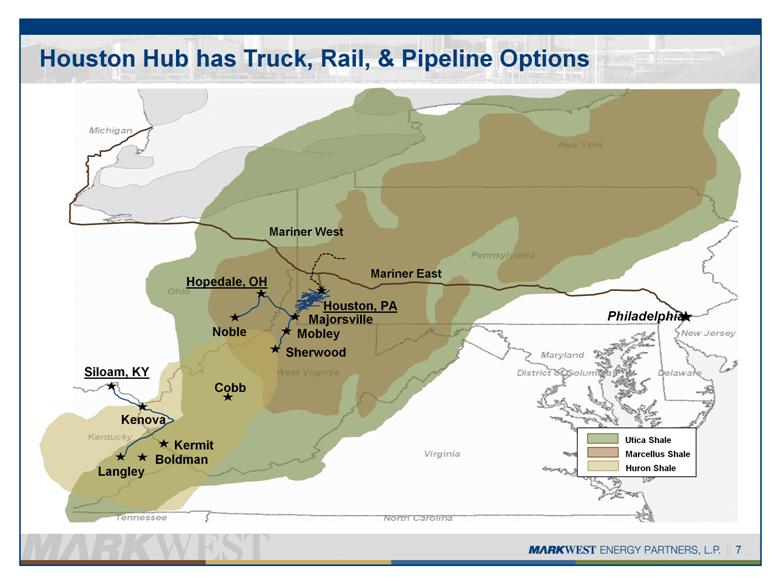

Houston Hub has Truck, Rail, & Pipeline Options 7 Mariner East Mariner West Siloam, KY Langley Kenova Cobb Kermit Boldman Houston, PA Mobley Majorsville Sherwood Philadelphia Utica Shale Marcellus Shale Huron Shale Hopedale, OH Noble |

|

|

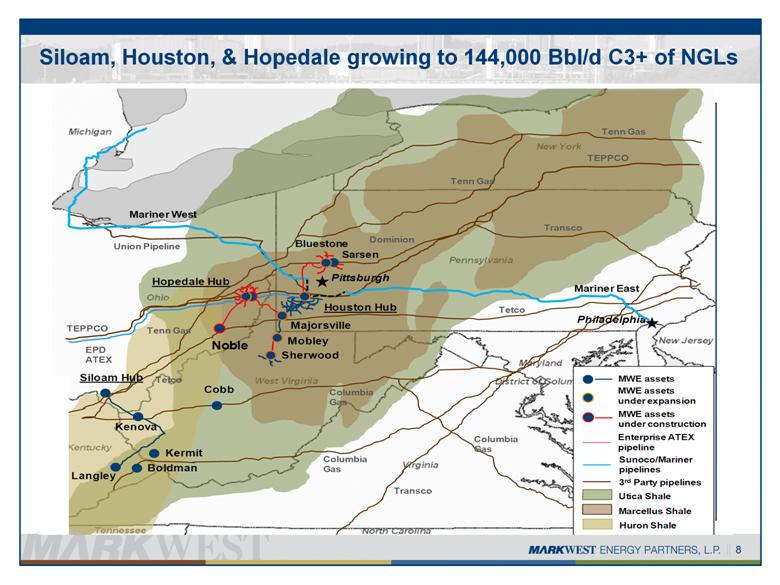

8 Siloam, Houston, & Hopedale growing to 144,000 Bbl/d C3+ of NGLs Tetco Tetco TEPPCO Mariner East Mariner West TEPPCO Union Pipeline Tenn Gas Tenn Gas Transco Tenn Gas Dominion Columbia Gas Columbia Gas Columbia Gas Transco Siloam Hub Langley Kenova Cobb Kermit Boldman Houston Hub Mobley Sherwood Majorsville Philadelphia Utica Shale Marcellus Shale Huron Shale 3rd Party pipelines MWE assets Bluestone Noble MWE assets under construction Sunoco/Mariner pipelines EPD ATEX Pittsburgh Enterprise ATEX pipeline MWE assets under expansion Hopedale Hub Sarsen |

|

|

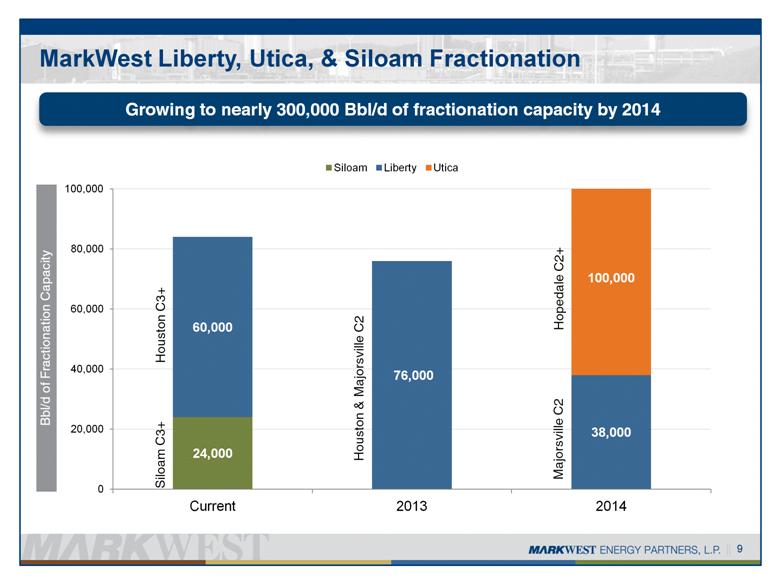

MarkWest Liberty, Utica, & Siloam Fractionation 9 Growing to nearly 300,000 Bbl/d of fractionation capacity by 2014 Siloam C3+ Houston C3+ Houston & Majorsville C2 Hopedale C2+ Majorsville C2 |

|

|

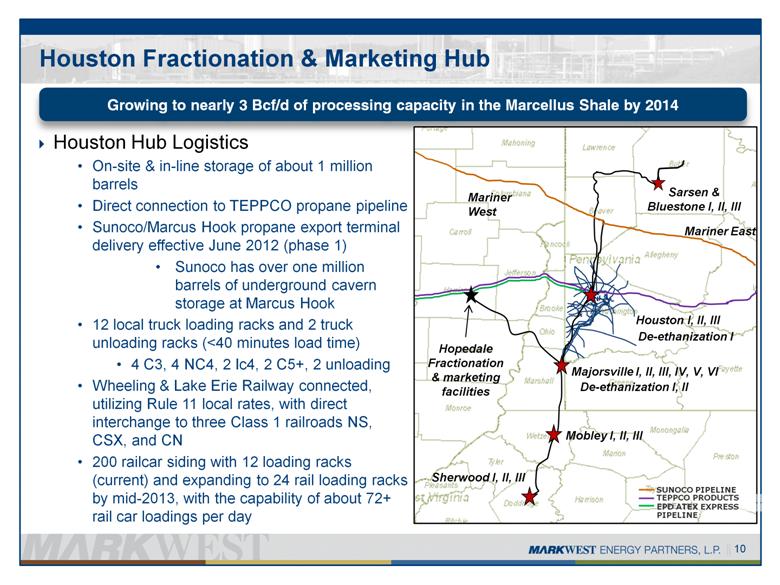

Houston Fractionation & Marketing Hub 10 Growing to nearly 3 Bcf/d of processing capacity in the Marcellus Shale by 2014 TEPPCO PRODUCTS PIPELINE SUNOCO PIPELINE EPD ATEX EXPRESS PIPELINE Mariner West De-ethanization I Houston I, II, III De-ethanization I, II Majorsville I, II, III, IV, V, VI Sarsen & Bluestone I, II, III Sherwood I, II, III Mobley I, II, III Hopedale Fractionation & marketing facilities Mariner East Houston Hub Logistics On-site & in-line storage of about 1 million barrels Direct connection to TEPPCO propane pipeline Sunoco/Marcus Hook propane export terminal delivery effective June 2012 (phase 1) Sunoco has over one million barrels of underground cavern storage at Marcus Hook 12 local truck loading racks and 2 truck unloading racks (<40 minutes load time) 4 C3, 4 NC4, 2 Ic4, 2 C5+, 2 unloading Wheeling & Lake Erie Railway connected, utilizing Rule 11 local rates, with direct interchange to three Class 1 railroads NS, CSX, and CN 200 railcar siding with 12 loading racks (current) and expanding to 24 rail loading racks by mid-2013, with the capability of about 72+ rail car loadings per day |

|

|

Hopedale Fractionation & Marketing Hub 11 Growing to nearly 800 MMcf/d of processing capacity in the Utica Shale by 2014 Cadiz II, Mobley Sherwood Houston Majorsville Seneca I, II Hopedale Fractionator TEPPCO PRODUCTS PIPELINE EPD ATEX EXPRESS PIPELINE Sarsen & Bluestone INTERCONNECT TO 3RD PARTY PIPELINE Cadiz I, II and De-ethanization SUNOCO PIPELINE Hopedale Hub (Q1 2014 Estimated In-Service) 235,000 barrels on-site storage Direct connection to TEPPCO propane pipeline 12 local truck loading racks and 2 truck unloading racks (<40 minutes load time) 4 C3, 4 NC4, 2 Ic4, 2 C5+, 2 unloading racks Wheeling & Lake Erie Railway connected, utilizing Rule 11 local rates, with direct interchange to three Class 1 railroads NS, CSX, and CN Ohio Central Railroad connection 200 railcar siding with 24 loading racks (Phase 1) and expanding to 400 railcar siding (Phase 2) |

|

|

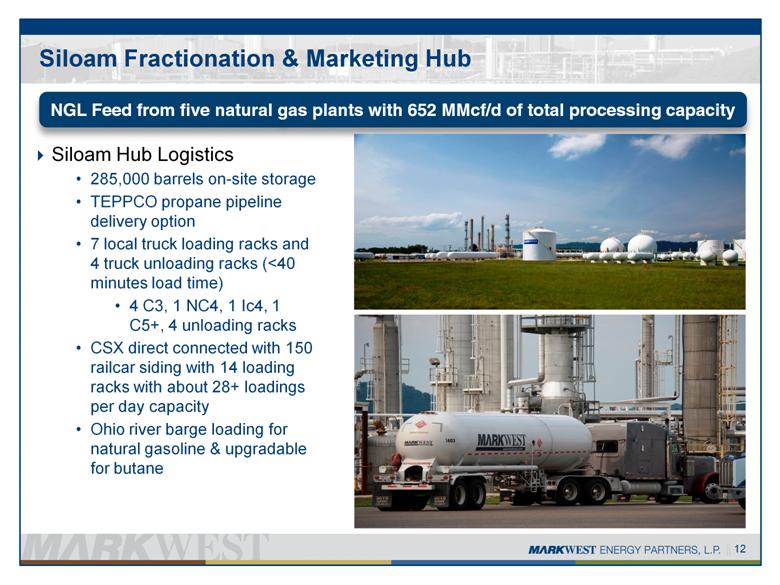

Siloam Fractionation & Marketing Hub 12 NGL Feed from five natural gas plants with 652 MMcf/d of total processing capacity Cadiz II, Siloam Hub Logistics 285,000 barrels on-site storage TEPPCO propane pipeline delivery option 7 local truck loading racks and 4 truck unloading racks (<40 minutes load time) 4 C3, 1 NC4, 1 Ic4, 1 C5+, 4 unloading racks CSX direct connected with 150 railcar siding with 14 loading racks with about 28+ loadings per day capacity Ohio river barge loading for natural gasoline & upgradable for butane |

|

|

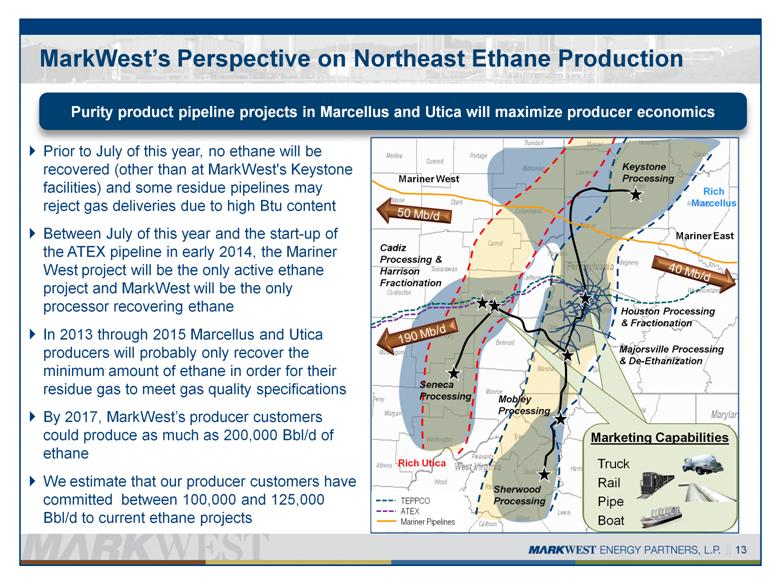

MarkWest’s Perspective on Northeast Ethane Production Prior to July of this year, no ethane will be recovered (other than at MarkWest's Keystone facilities) and some residue pipelines may reject gas deliveries due to high Btu content Between July of this year and the start-up of the ATEX pipeline in early 2014, the Mariner West project will be the only active ethane project and MarkWest will be the only processor recovering ethane In 2013 through 2015 Marcellus and Utica producers will probably only recover the minimum amount of ethane in order for their residue gas to meet gas quality specifications By 2017, MarkWest’s producer customers could produce as much as 200,000 Bbl/d of ethane We estimate that our producer customers have committed between 100,000 and 125,000 Bbl/d to current ethane projects 13 Purity product pipeline projects in Marcellus and Utica will maximize producer economics Image Source: BENTEK and MarkWest Mobley Processing Seneca Processing Cadiz Processing & Harrison Fractionation Rich Utica Rich Marcellus Sherwood Processing Marketing Capabilities Truck Rail Pipe Boat Majorsville Processing & De-Ethanization Houston Processing & Fractionation Keystone Processing 40 Mb/d TEPPCO ATEX Mariner Pipelines Mariner West Mariner East |

|

|

Northeast Propane Supply and Demand 14 The Targa and Enterprise Gulf Coast export facilities should create sufficient demand to offset growth in NGLs in 2013 and 2014 New PDH plants will also increase long-term propane demand MarkWest has led the Northeast propane export efforts and we have been exporting propane internationally since June 2012 MarkWest and Range Resources have committed to 25,000 Bbl/d of propane export capacity on Mariner East Important to watch whether producers in northern Utica counties like Carroll and Columbiana, OH, and northwestern PA can address the frac barrier challenges. If so, PADD I may no longer be a net importer in the winter and a new y-grade pipeline may have economic justification Exports in the Northeast are key to maintaining the supply short position of PADD I in the winter. Every month that PADD I is a net importer, Northeast producers make an additional $0.10 to $0.25 per wellhead Mcf Photo by Wheeling & Lake Eire Railway Co. MarkWest Houston Rail Yard |

|

|

Keys to Success Maintain stronghold in key resource plays with high-quality assets Execute growth projects that are well diversified across the asset base 15 EXECUTE, EXECUTE, EXECUTE!!! Provide best-in-class midstream services for our producer customers Preserve strong financial profile Deliver superior & sustainable total returns |

|

|

1515 ARAPAHOE STREET TOWER 1, SUITE 1600 DENVER, COLORADO 80202 PHONE: 303-925-9200 INVESTOR RELATIONS: 866-858-0482 EMAIL: INVESTORRELATIONS@MARKWEST.COM WEBSITE: WWW.MARKWEST.COM |