Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Clearwater Paper Corp | d495710d8k.htm |

Clearwater Paper Corporation

March 2013

Exhibit 99.1 |

1

Forward-Looking Statements

This presentation contains, in addition to historical information, certain forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995,

including

statements

regarding

our

strategies

to

grow

our

business,

optimize

profitability

and

build

a

high

performance

culture,

North

American

tissue

and

paperboard market demand, expected tissue capacity increases, production and shipments from our new

tissue machine and converting lines in Shelby, North Carolina, expected future savings from

cost synergies relating to our Cellu Tissue acquisition, the aggregate dollar value of shares authorized to be repurchased pursuant to the

stock repurchase program, uses and sufficiency of the company's cash, the company's future generation

of discretionary free cash flow, the execution period for the stock repurchase program,

shareholder returns, and the expected amount and timing of the additional return of capital to shareholders, efficiency projects and reductions to our

cost structure, future growth and market opportunities, including in the Midwestern and Eastern U.S.

regions and non-grocery channels, market segment dynamics, internal pulp production and

requirements, customer purchases of private label tissue, production capacity of operating divisions and the expected benefit thereof, our

capital allocation objectives, our EBITDA margins, our planned expansion into other product types, our

financial priorities, including plans to de-lever through EBITDA expansion and revenue

growth, our estimated Adjusted EBITDA run-rate, our implied enterprise value, equity value and share price, sales volumes, production, product

volumes

shipped,

pricing

for

our

products,

pulpcosts,

wood

fiber

costs

and

supply,

chemical

costs,

transportation

costs,

energy

costs,

including

natural

gas,

costs

and

timing of major maintenance and repairs, and our financial condition and results of operations.

Words such as “anticipate,” “expect,” “intend,” “will,” “plan,” “goals,”

“objectives,”

“target,”

“project,”

“believe,”

“schedule,”

“estimate,”

“may,”

and

similar

expressions

are

intended

to

identify

such

forward-looking

statements.

These

forward-

looking

statements

are

based

on

management’s

current

expectations,

estimates,

assumptions

and

projections

that

are

subject

to

change.

Our

actual

results

of

operations

may differ materially from those expressed or implied by the forward-looking statements contained

in this presentation. Important factors that could cause or contribute to such differences

include the risk factors described in Item 1A of Part I of our Form 10-K for the year ended December 31, 2012, as well as the following:

•

difficulties

with

the

optimization

and

realization

of

the

benefits

expected

from

our

new

through-air-dried

paper

machine

and

converting

lines

in

Shelby,

North

Carolina;

•

increased dependence on wood pulp;

•

changes in the cost and availability of wood fiber and wood pulp;

•

changes in costs for and availability of packaging supplies, chemicals, energy and maintenance and

repairs; •

changes in transportation costs and disruptions in transportation services;

•

competitive pricing pressures for our products, including as a result of increased capacity as

additional manufacturing facilities are operated by our competitors;

•

changes in customer product preferences and competitors' product offerings;

•

manufacturing or operating disruptions, including equipment malfunction and damage to our

manufacturing facilities; •

changes in the U.S. and international economies and in general economic conditions in the regions and

industries in which we operate; •

cyclical industry conditions;

•

reliance on a limited number of third-party suppliers for raw materials;

•

labor disruptions

•

our ability to generate cash;

•

fluctuations and volatility in the company's stock price; and

•

inability to successfully implement our expansion strategies.

Forward-looking statements contained in this presentation present management’s views only as

of the date of this presentation. We undertake no obligation to publicly update

forward-looking statements, whether as a result of new information, future events or otherwise. |

Agenda

2 |

3

Overview of Clearwater Paper |

4

•

We are a company formed in late 2008 with more than

60 years of operating history

•

Operate two business segments of similar size

–

Pulp and Paperboard: 39% of 2012 net sales

–

Consumer Products: 61% of 2012 net sales

•

Financial overview

–

2012 Net Sales: $1.9 billion

–

2012 Adjusted EBITDA¹: $227.8

million –

2008 to 2012 Adjusted EBITDA¹

CAGR: 32%

•

Approximately 3,860 employees

Introduction to Clearwater Paper

Note: As of 31-Dec-2012

¹

See Appendix for the definition of Adjusted EBITDA as well as the reconciliation to

the most comparable GAAP measure. |

Overview of Consumer Tissue Division

5

Clearwater

Paper

is

one

of

the

largest

North

American

manufacturers

of

private

label

tissue,

focused

on

high

value

tissue

products

across

all

categories,

retail

channels

and

geographies

Key Products

Overview of Facilities

2012 U.S. Tissue Industry Retail Channel Mix²

2012 Clearwater Paper Retail Channel Mix²

Clearwater Paper Tissue

Converting

Clearwater Paper Tissue

Parent Roll

Tissue Production¹: 585,000 tons

Tissue Conversion¹: 477,000 tons

Source: Company estimates, IRI Infoscan

¹

Represents 2012 production and conversion volumes including

machine-glazed. ²

Retail channel share by dollar amount sold.

Grocery

37%

Mass +

Supercenter

27%

Club

21%

Drug

7%

Dollar

4%

All Other

4% |

6

Clearwater Paper is Well Positioned to Capitalize on Favorable

Tissue Market Dynamics

Stable Growth -

The tissue market has grown an average of 2% annually since 1996,

consistent with population growth

Source: U.S. Tissue demand per RISI, U.S. Population per U.S. Census

Note: Projected U.S. Tissue Demand based on North American tissue demand estimates.

|

7

Private Label Continues to Capture Market Share in Tissue

Clearwater Paper ranks as one of the largest North American private label tissue

manufacturers

Source: SymphonyIRI InfoScan, 52 Weeks Ending Feb 3, 2013.

Based on volume of equalized cases. |

8

Significant Opportunity Still Exists for Clearwater Paper To Expand

Across the U.S. Private Label Market

•

Clearwater Paper led the development of private label tissue in

the Western U.S.

•

The Company is focused on growing the private label category and market share in

the Eastern U.S.

•

If Clearwater could replicate its West model across the U.S.:

–26% share in Midwest would be an incremental 28 million cases

–26% share in East would be an incremental 44 million cases

2012 Multi-Outlet1

West

Midwest

East

Total

Equalized Case Volumes (mm)

84

178

230

493

% of U.S. Population

23%

34%

43%

100%

% Private Label (PL)

33%

25%

25%

26%

% Clearwater Paper of PL

81%

40%

28%

38%

Source: SymphonyIRI InfoScan, 52 Weeks Ending Feb 3, 2013.

1

Multi-Outlet includes Grocery, Drug, Mass, Dollar and Military.

Based on volume of equalized cases. |

North American Market Demand Expected to Absorb Projected

Capacity Increases

9

Source: RISI and company estimates

Note: Projected capacity changes represents both virgin and recycled tissue capacity

changes. Please

see

Appendix

for

breakdown

of

specific

projects

reflected

in

the

capacity

changes.

(in thousands of short tons)

2012 Demand to Capacity

Ratio of 95%

2014E Demand to Capacity

Ratio of 96%

Healthy market dynamics remain intact |

Overview of Pulp and Paperboard Division

10

Clearwater

Paper

ranks

as

one

of

the

top

five

largest

paperboard

manufacturers

in

North

America

Key Products

Overview of Facilities

2012E North American Bleached

Paperboard Production by Product Type²

2012E North American Bleached Paperboard

Production by Market Share

Pulp Production¹: 842,000 tons

Paperboard Production¹: 771,000 tons

Clearwater Paper Pulp

Clearwater Paper SBS

Source: Company estimates, RISI

¹

Represents 2012 production volumes.

²

Represents ~6.0 million tons. |

11

Paperboard Demand Remains Stable and Pricing Outlook is

Favorable in the U.S.

Source: RISI, Projected GDP growth estimates represent Bloomberg median

estimates as of Feb-2013 ¹

Based on tons produced. Projections based on North American Packaging papers and

board demand estimates per RISI. ²

Average price per short ton of 16 pt. SBS folding carton C1S. Price estimates per

RISI. Bleached paperboard prices are expected to remain at attractive levels

through 2016 |

12

Clearwater Paper’s

Strategic Plan |

13

•

Lead private label quality

•

Expand geographically

•

Expand retail channel penetration

Our Macro Strategy to Create Shareholder Value

Grow our Tissue

Business

•

Improve sales mix

•

Reduce costs

•

Continue to improve quality |

14

Our 3 Year Strategy |

Key

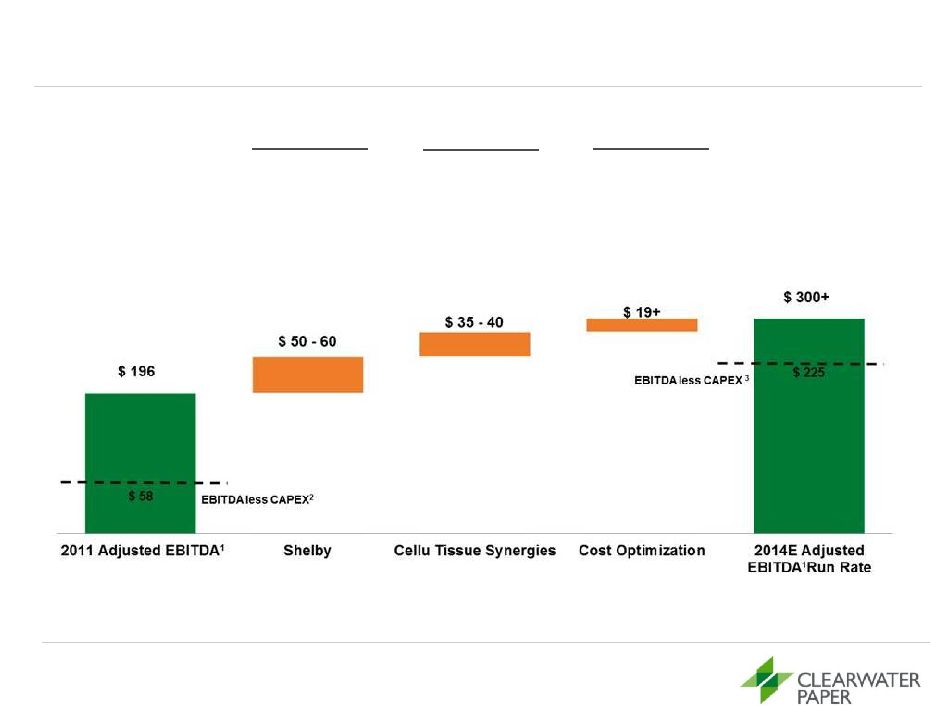

Initiatives Expected to Significantly Improve Earnings Power 15

($ in millions)

Shelby

Ramp-up

•

Expected

benefit from

full ramp-up of

TAD paper

machine, 5

converting

lines and LV

PM Upgrades

Realization of Full

Cellu Tissue

Synergies

•

Incremental

savings

expected from

Cellu Tissue

acquisition

Cost

Savings

Programs

•

Expected benefit

from lean

manufacturing

and cost

optimization

initiatives

Note: Assumes no change in prices or input costs from 2011.

¹

See Appendix for the definition of Adjusted EBITDA as well as the reconciliation to

the most comparable GAAP measure. 2

Defined as Adjusted EBITDA less Capex of $138 million.

3

Defined as Adjusted EBITDA less expected Capex of $75 million.

|

16

Clearwater Paper’s

Value Proposition |

Clearwater Paper Leads its Peer Groups in Value Creation…

17

Source: Bloomberg as of 22-Feb-2013

1

Small cap tissue peers include Cascades, Orchids, and Wausau.

²

Paperboard peers include International Paper, Graphic Packaging, Kapstone,

MeadWestvaco, RockTenn, Packaging Corp, and Sonoco. ³

Large cap consumer product peers include Kimberly-Clark and Procter &

Gamble. Note. Total Shareholder Return includes dividend reinvestment and

stock price performance. 365%+ Total Return Since Spin-off

Spin Date

(20)%

40%

100%

160%

220%

280%

340%

400%

460%

520%

Dec-2008

Aug-2009

May-2010

Jan-2011

Oct

-2011

Jun-2012

Feb-2013

Clearwater Paper

Small Cap Tissue¹

Paperboard²

Large Cap Consumer³

S&P 500

369.5%

343.5%

103.4%

91.4%

81.7% |

…Through a Proven Track Record of EBITDA Growth

18

($ in millions)

Source: RISI

1

See Appendix for the definition of Adjusted EBITDA as well as the reconciliation to

the most comparable GAAP measure. ²

Does not include amounts related to the Alternative Fuel Mixture Tax Credit, or

AFMTC. Adjusted EBITDA

1,2

•

We participate in the premier segments of the paper market: Bleached

Paperboard and Tissue

•

Strong integration across business groups creates synergistic value

|

…And Successful Execution on Its Previously Stated Goals

19

Stated Goal

Timeframe

Current Status

Complete New Paper Machine and

Corresponding Converting Lines at

Shelby, NC Facilities

2010 –

2013

Shelby TAD machine was on budget with startup in Q4 2012 with

expected full capacity run rate by end of 2013

Operating 4 new converting lines at Shelby

5

line expected in 2013

Successfully Integrate Cellu Tissue

Acquisition

2010 –

2013

Increased anticipated Cellu Tissue run-rate synergies from $15-

20 million per annum to $35-40 million per annum by end of 2012

Achieved $30 million in synergies in 2012, up from initial estimate

of $20 million

Expand the Geographic and Channel

Reach of Clearwater Paper

2010 –

Ongoing

Cellu Tissue acquisition and Shelby, NC Facilities give Clearwater

Paper a national footprint with expansion in the Eastern U.S.

Increase penetration in grocery, drug, club and mass retail

markets in the Eastern U.S.

Expansion into away-from-home, parent roll sales, and machine

glazed sales product types

Optimize the Paperboard Business

Ongoing

Enhanced access to fiber supply with Lewiston chipping facility

acquisition

Sold Lewiston sawmill

Installed chip screening at Lewiston pulp mill

Maintain a Prudent Capital Structure

Ongoing

Conservative capital structure with target leverage through the

cycle of 2.5x and ample liquidity

Clearwater Paper continues to de-lever through EBITDA

expansion

th |

…Which Has Led to Multiple Expansion Since the Spin

20

Source: Bloomberg, Capital IQ, market data as of 22-Feb-2013

1

Small cap tissue peers include Cascades, Orchids, and Wausau.

²

Paperboard peers include International Paper, Graphic Packaging, Kapstone,

MeadWestvaco, RockTenn, Packaging Corp and Sonoco. ³

Large cap consumer product peers include Kimberly-Clark and Procter &

Gamble. Spin Date

6.5x

6.1x

7.1x

11.1x

0x

2x

4x

6x

8x

10x

12x

Dec-2008

Jul-2009

Jan

-2010

Aug-2010

Feb-2011

Sep-2011

Mar

-2012

Oct-2012

Clearwater Paper

Small Cap Tissue¹

Paperboard²

Large Cap Consumer Products³

Strong

upward trend in multiple over time |

…And Multiple Growth Rate Higher than Industry

21

Source: Bloomberg, Capital IQ, market data as of 22-Feb-2013

Note: Represents current 1-year forward EBITDA multiple divided by forward

1-year EBITDA at 15-Jan-2009 less 100% (first reported IBES EBITDA estimate per Capital IQ).

1

Small cap tissue peers include Cascades, Orchids, and Wausau.

²

Paperboard peers include International Paper, Graphic Packaging, Kapstone,

MeadWestvaco, RockTenn, Packaging Corp and Sonoco. ³

Large cap consumer product peers include Kimberly-Clark and Procter &

Gamble. Change in 1-Year Forward EBITDA Multiple Since Clearwater

Spin 109.3%

1.4%

42.2%

23.9%

Clearwater Paper

Small Cap Tissue¹

Paperboard²

Large Cap Consumer Products ³ |

•

Attractive, growing and stable tissue market with increasing adoption of private

label products driving overall market growth

•

Strong competitive position in stable bleached paperboard market

•

Strategic capital investments, lean optimization initiatives and

ongoing

integration synergies driving revenue growth and margin expansion

•

Track record of robust adjusted EBITDA growth with a 32% CAGR

over 2008-

2012 poised to generate strong free cash flow

•

$100 million share buyback authorization in place with plans to complete by year

end 2013 with commitment to return 50% of discretionary free cash flow to

shareholders in 2014 and 2015

22

¹

Based on 2008 -2012 adjusted EBITDA.

The Value Proposition for Clearwater Paper Shareholders

1 |

23

Clearwater Paper’s

Outlook |

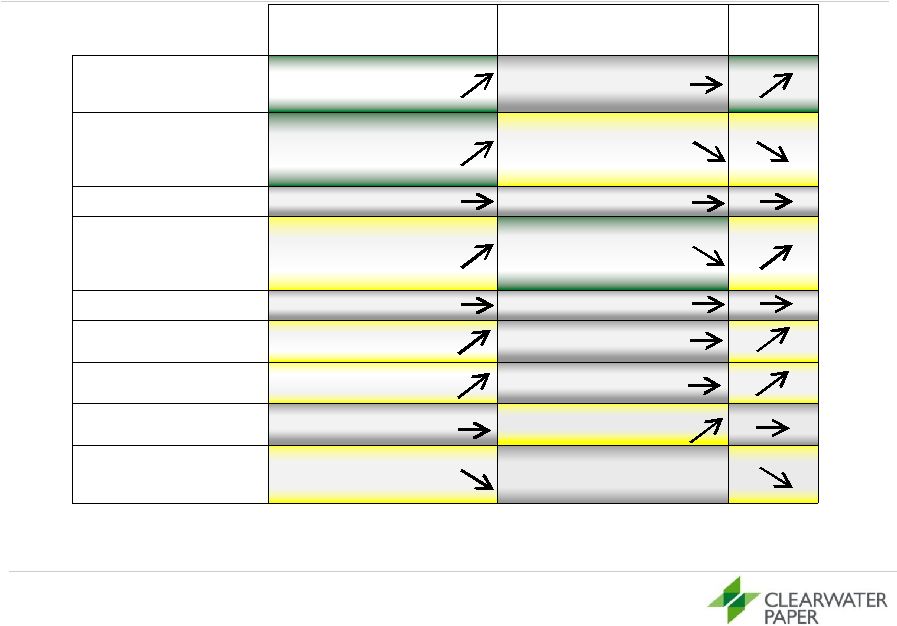

First Quarter 2013 Outlook (Compared to

Q4-2012)¹

24

Consumer Products

Pulp and Paperboard

Total

Company

Production volumes

Expecting Shelby paper

machine production of ~12k

tons

Stable

Shipment volumes

Approximately 134,000 tons;

up ~3,000 tons due to higher

retail and parent roll

shipments

Down ~14k tons due to

implementing consignment

program with a major

customer

Price/Mix

Stable

Stable

Pulp/Wood/Fiber

costs²

Expecting pulp costs up

slightly along with higher

purchased paper of ~4-5k

tons

Improving Idaho fiber supply

Chemical costs²

Stable

Stable

Transportation costs²

Expecting higher internal

transportation costs

Stable

Energy costs²

Consumption higher due to

Shelby TAD paper machine

Stable

Maintenance & repairs

Stable

Scheduled Arkansas outage

~$3 million

Operating Margins

1 to 3 points of downward

pressure due to higher pulp,

transportation and energy

Stable

1

This

information

is

based

upon

management’s

current

expectations

and

estimates,

which

are

in

part

based

on

market

and

industry

data.

Many

factors

are

outside

the

control

of management, including particularly input costs for commodity products, and

actual results may differ materially from the information set forth above. See “Forward-Looking

Statements”

on page 1.

2

Based on production costs |

2013

Outlook (Compared to 2012)¹

25

Consumer Products

Pulp and Paperboard

Production volumes

Expecting Shelby paper machine

production of ~55k tons

70k ton run rate by year end

Stable

Shipment volumes

Expecting shipments to be ~4.6

million cases (25k tons) higher

due mainly to higher TAD retail

Stable

Price/Mix

Higher % of TAD expected to

improve net sales avg.

Stable

Pulp/Wood/Fiber

costs²

Expecting pulp cost increase

partially offset by higher internal

pulp consumption

Improving Idaho fiber supply

Chemical costs²

Stable

Stable

Transportation costs²

Improved internal transportation

as regional balance improves

Stable

Energy costs²

Higher natural gas unit cost and

Shelby paper machine usage

Higher natural gas unit cost

Maintenance & repairs

Stable

Q1–Scheduled Arkansas outage

~$3 MM

Q3–Scheduled Idaho outage

~$11 MM

1

This information is based upon management’s current expectations and

estimates, which are in part based on market and industry data. Many factors are outside the control

of management, including particularly input costs for commodity products, and

actual results may differ materially from the information set forth above. See “Forward-Looking

Statements”

on page 1.

2

Based on production costs |

26

Appendix |

27

Reconciliation of GAAP to Non-GAAP:

Clearwater Paper EBITDA and Adjusted EBITDA

1

See last page of this Appendix for definitions of EBITDA and Adjusted EBITDA.

($ in millions)

2008

2009

2010

2011

2012

Net Earnings

$9.7

$182.5

$73.8

$39.7

$64.1

Income Tax Provision

5.6

93.2

2.4

31.2

47.5

Interest Expense

13.1

15.5

22.6

44.8

33.8

Earnings Before Interest and

Income Taxes

28.5

$291.2

$98.8

$115.7

$145.4

Depreciation & Amortization

47.0

47.4

47.7

76.9

79.3

EBITDA

1

$75.4

$338.6

$146.5

$192.7

$224.7

Alternative Fuel Mixture Tax

Credit

-

(170.6)

-

-

-

Debt Retirement Costs

-

6.2

-

-

-

Cellu Tissue Acquisition

Related Expenses

-

-

20.3

-

-

Lewiston, Idaho Sawmill Sale

Related Adjustments

-

-

-

2.9

-

Loss on sale of foam assets

-

-

-

-

1.0

Expenses Associated with

Metso Litigation

-

-

-

-

2.0

Adjusted EBITDA¹

$75.4

$174.3

$166.8

$195.5

$227.7 |

28

Reconciliation of GAAP to Non-GAAP:

Clearwater Paper Pro Forma Adjusted EBITDA

($ in millions)

1

See page 35 of this Appendix for definitions of EBITDA and Adjusted EBITDA.

Shelby

Cellu

Tissue

Synergies

Cost

Optimization

Pro Forma

Adjusted

EBITDA

Operating Income

$37.0

$35.0

$16.0

$210.0

Depreciation & Amortization

13.0

-

3.0

90.0

EBITDA

1

$50.0

$35.0

$19.0

$300.0

-

-

-

-

Adjusted EBITDA¹

$50.0

$35.0

$19.0

$300.0 |

29

Definitions of Non-GAAP Measures

Clearwater Paper Definitions of Non-GAAP Measures

EBITDA

is

a

non-GAAP

measure

that

Clearwater

Paper

management

uses

to

evaluate

the

cash

generating

capacity

of

Clearwater

Paper.

The

most

directly

comparable

GAAP

measure

is

net

earnings.

EBITDA,

as

defined

by

Clearwater

Paper

management,

is

net

earnings

adjusted

for

net

interest

expense,

income

taxes,

and

depreciation

and

amortization.

It

should

not

be

considered

as

an

alternative

to

net

earnings

computed

under

GAAP.

Adjusted

EBITDA

is

a

non-GAAP

measure

that

Clearwater

Paper

management

defines

as

EBITDA

adjusted

for

items

that

we

do

not

believe

are

indicative

of

our

core

operating

performance,

including

acquisition

and

disposition

related

expenses,

alternative

fuel

mixture

tax

credits

and

expenses

associated

with

the

Metso

litigation.

The

most

directly

comparable

GAAP

measure

is

net

earnings.

It

should

not

be

considered

as

an

alternative

to

net

earnings

computed

under

GAAP. |

North American Tissue Projected Capacity Change

30

Source: RISI and Other Industry

Company

Mill/Location

Conv/TAD

Capacity

Change

Date

Channel/Business/Products

Announced New Capacity

K.T.G. (USA)/Kruger

Memphis, Tennessee

TAD

70,000

2013:Q1

Retail/Brand/P.L.

Florelle Tissue

Brownville, New York

Conv

15,000

2013:Q3*

New PM from Elite Tissue Machine, China

First Quality Tissue

Anderson, South Carolina

ATMOS

75,000

2014:Q1*

Retail/P.L./BRT

Procter & Gamble

Box Elder, Utah (?)

TAD

80,000

2014:Q3*

Retail/Brand/Bounty

Announced Shutdowns

No announced shutdowns

Announced Rebuilds

Tak Investments

Franklin, Virginia

Conv

70,000

2013:Q1

Rebuild of a fine paper PM to tissue by

PMT Italia and other suppliers

Net Capacity Change

310,000

South Georgia Tissue

Snelling, Barnwell County, South

Carolina

32,000

2014:Q2*

New mill for parent rolls only; investment

incentives approved but not yet fully

committed

Potential Projects |