Attached files

| file | filename |

|---|---|

| 8-K - 8-K - JUNIPER PHARMACEUTICALS INC | march52013.htm |

Frank Condella, President + CEO Jonathan Lloyd Jones, VP + CFO March 6th | 2013 Cowen and Company 33rd Annual Health Care Conference COLUMBIA LABORATORIES Columbia Laboratories, Inc. (Nasdaq: CBRX)

Safe Harbor This presentation contains forward-looking statements, which statements are indicated by the words “may,” “will,” “plans,” “believes,” “expects,” “intends,” “anticipates,” “potential,” “should,” and similar expressions. Such forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those projected in the forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. Factors that might cause future results to differ include, but are not limited to, the following: Actavis’s and Merck Serono’s success in marketing CRINONE® for use in infertility in their respective markets; Columbia’s ability to timely regain compliance with the Nasdaq minimum closing bid price rule; successful development by Actavis of a next-generation vaginal progesterone product; difficulties or delays in manufacturing; the availability and pricing of third-party sourced products and materials; successful compliance with FDA and other governmental regulations applicable to manufacturing facilities, products and/or businesses; changes in the laws and regulations; the ability to obtain and enforce patents and other intellectual property rights; the impact of competitive products and pricing; the evaluation of potential strategic transactions; the strength of the United States dollar relative to international currencies, particularly the euro; competitive economic and regulatory factors in the pharmaceutical and healthcare industry; general economic conditions; and other risks and uncertainties that may be detailed, from time-to-time, in Columbia’s reports filed with the SEC. Columbia does not undertake any responsibility to revise or update any forward-looking statements contained herein. 2

Columbia Laboratories Overview ‣ Specialty pharmaceutical company ‣ Successful history of developing proprietary products for women’s health administered vaginally ‣ All products partnered or sold for commercialization ‣ Revenues predominantly from CRINONE® ๏Sales to Actavis (formerly Watson) (U.S.) ๏Sales to Merck Serono (RoW) ๏Royalties from Actavis (10% of U.S. net sales) ‣ Cashflow positive since Q3 2012 ‣ Healthy cash position; debt free 3

Revenue from Partners 4 Columbia Laboratories, Inc. ??????????????????????????? ???????????????????????? ????????????????????????? ???????????????????????????? ? ??????????????????????????????? ? US ? 60+countries? ???????????????? ????????????????????????? ??? ????????????????????????? ?????????????? ? ??????????? ???? ? ???????????????????????? ?

CRINONE Sold Worldwide Most Major Markets Covered 5 M E R C K S E R O N O AC TAV I S ( WAT S O N ) REST O F WORLD

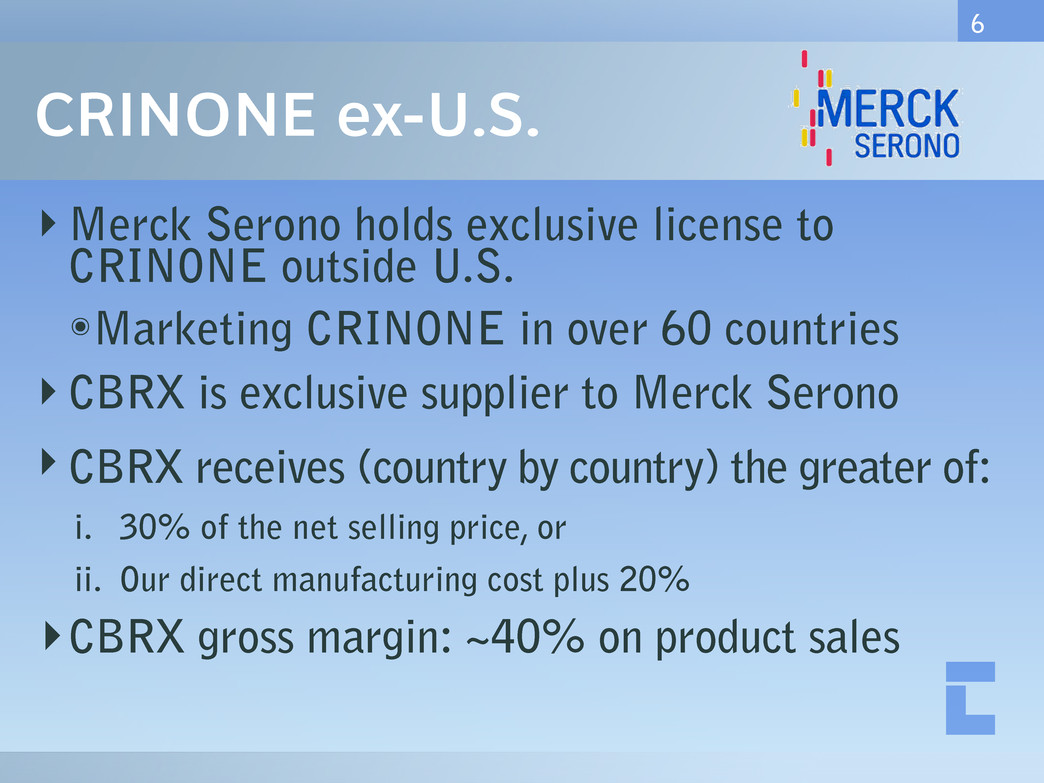

CRINONE ex-U.S. 6 ‣ Merck Serono holds exclusive license to CRINONE outside U.S. ๏Marketing CRINONE in over 60 countries ‣CBRX is exclusive supplier to Merck Serono ‣CBRX receives (country by country) the greater of: i. 30% of the net selling price, or ii. Our direct manufacturing cost plus 20% ‣CBRX gross margin: ~40% on product sales

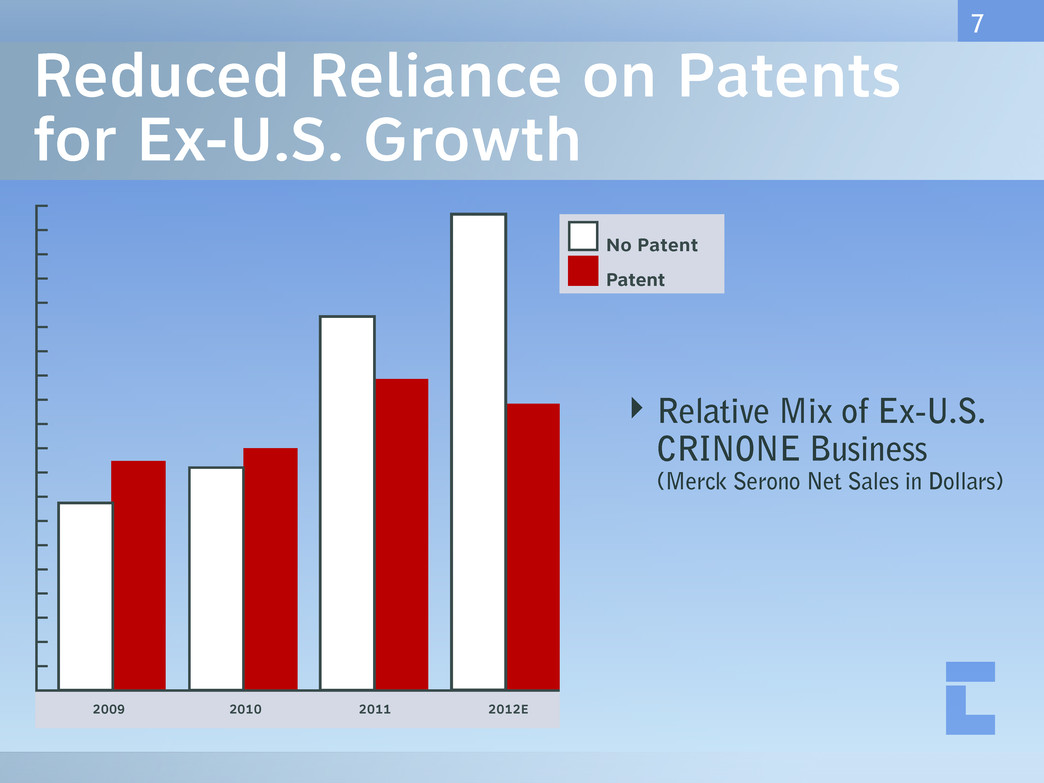

Reduced Reliance on Patents for Ex-U.S. Growth ‣ Relative Mix of Ex-U.S. CRINONE Business (Merck Serono Net Sales in Dollars) 7 Length of Cervix (mm)2009 2010 2011 2012E No Patent Patent

CRINONE: U.S. ‣Actavis markets CRINONE for infertility ‣CBRX supplies product at COGS +10% ‣CBRX receives royalty on sales (10%) ‣Actavis funding life-cycle management ๏Next-generation CRINONE under development ๏Actavis will likely manufacture next-gen in house 8

CRINONE Growing in Infertility ‣ In-market sales expected to continue to grow 9 Length of Cervix (mm) $0 $4.0 $8.0 $12.0 $16.0 $20.0 2010 2011 2012 Merck Serono Actavis 18% 35% Net Revenue Growth from Partner Sales Actavis assumed U.S. sales responsibility in July 2010.

Vaginal Progesterone for Preterm Birth Status NDA submitted Apr. 2011 Advisory Committee Jan. 2012 Transferred ownership of NDA to Actavis Feb. 2012 Complete response letter received from FDA Feb. 2012 ๏ Acknowledged statistical significance met at ≤ 326/7 weeks gestation (p=0.022) but did not meet the level of statistical significance generally expected to support the approval of the product in the U.S. market from a single trial ๏ Although not part of the requirements communicated during pre-Phase III meetings, FDA raised the issue of robustness in efficacy in the U.S. sub-cohort as compared to the overall efficacy of the trial ๏ Additional clinical work required to support approval SMFM Clinical Guideline on PTB issued Mar. 2012 ACOG Practice Bulletin on PTB issued Oct. 2012 FDA denied Actavis’s Formal Dispute Resolution Request Oct. 2012 Actavis decided not to continue to development 10

Recent Survey of OB/GYNs: Short Cervical Length, Preterm Birth & Progesterone ‣ Recently concluded a survey of 80 OB/GYNs ‣ Representative population: ๏ Each handles on average 252 pregnancies/year ๏ ~22% of pregnancies are at risk for PTB ๏ ~9% found to have SCL ‣ 44% of patients received TVU between weeks 16-19 gestation ‣ 57 of the 80 participants manage pregnancies with SCL ๏ 93% of these use some form of progesterone (n=53) ๏ Many still use injection for SCL despite 100% awareness of ACOG guidelines ๏ Of those using vaginal progesterone, there is a preference for vaginal capsules/suppositories over vaginal gel 11

Minimizing Operational Costs ‣Lean operating group ๏11 full-time employees ‣One-time transition costs in 2012/2013 ๏Relocating to Boston ๏Building new team ๏Overall lower operating costs expected 12

2012 Preview: Core Revenues 13 ‣ Net product revenues from Merck Serono increased 18% ‣ Net product revenues from Actavis increased 35% ‣ U.S. total prescription growth increased 24% from 2011 *Total Net Revenues for 2011 also included Other Revenues of $22.1M as follows: • $17M in amortization of the $34 million gain on the sale of the progesterone assets in July 2010 to Actavis, which amortization concluded in Q2 2011, and • The recognition of the $5M milestone payment from Actavis for the filing of NDA 22-139 Length of Cervix (mm) $0 $10 $20 $30 $21.0 $25.7 $40 Royalties Net Product Revenue 2011* 2012 23% Net Revenues (in millions)

2012 Results Preview: Cash ‣Increased cash on hand by nearly ~$4m in 2012 ‣Ended 2012 with $28.6m in cash, equivalents & short-term investments 14

Key Statistics Nasdaq: CBRX Recent market price* . $0.62 Shares outstanding** 87.5 million Market capitalization* $54.3 million Cash, equivalents & investments** $28.6 million Debt** . $0.0 million 15 *as at 2/28/2013 **as at 12/31/2012

Columbia Laboratories Capitalization Table @ 12/31/2012 Nasdaq: CBRX Shares Outstanding 87.5 million Average Preferred Shares @ $ 1.40 2.0 Warrants* @ $ 1.42 9.9 Options @ $ 1.90 4.0 Fully Diluted Shares 103.4 million 16 *All warrants have “cashless” exercise option

Summary ‣ Ongoing growth in product revenues from Actavis & Merck Serono ‣ Continuing to transition to lower-cost operating model ‣ Strong balance sheet; healthy cash position ‣ Debt free ‣ NOL of $153 million a significant tax asset, if fully realized 17

Columbia Laboratories 18 Investor Relations Contacts: Jonathan Lloyd Jones Chief Financial Officer Columbia Laboratories, Inc. T: 973 486 8818 jlloydjones@columbialabs.com Seth Lewis Senior Vice President The Trout Group T: 646 378 2952 slewis@troutgroup.com www.columbialabs.com