Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - United Airlines Holdings, Inc. | d494773d8k.htm |

J.P.

Morgan Aviation,

Transportation and

Defense Conference

United Continental Holdings, Inc.

March 4, 2013

Exhibit 99.1 |

Chairman, President and CEO

Jeff Smisek |

| Safe

Harbor Statement 3

Certain statements included in this presentation are forward-looking and thus reflect our current

expectations and beliefs with respect to certain current and future events and financial

performance. Such forward-looking statements are and will be subject to many risks and

uncertainties relating to our operations and business environment that may cause actual results

to differ materially from any future results expressed or implied in such forward-looking

statements. Words such as “expects,” “will,” “plans,”

“anticipates,” “indicates,” “believes,” “forecast,” “guidance,”

“outlook” and similar expressions are intended to identify forward-looking statements.

Additionally, forward-looking statements include statements which do not relate solely

to historical facts, such as statements which identify uncertainties or trends, discuss the

possible future effects of current known trends or uncertainties or which indicate that the

future effects of known trends or uncertainties cannot be predicted, guaranteed or assured. All forward-

looking statements in this report are based upon information available to us on the date of this report.

We undertake no obligation to publicly update or revise any forward-looking statement,

whether as a result of new information, future events, changed circumstances or otherwise, except

as required by applicable law. Our actual results could differ materially from these forward-looking statements due to numerous

factors including, without limitation, the following: our ability to comply with the terms of our

various financing arrangements; the costs and availability of financing; our ability to maintain

adequate liquidity; our ability to execute our operational plans; our ability to control our

costs, including realizing benefits from our resource optimization efforts, cost reduction

initiatives and fleet replacement programs; our ability to utilize our net operating losses; our ability

to attract and retain customers; demand for transportation in the markets in which we operate; an

outbreak of a disease that affects travel demand or travel behavior; demand for travel and the

impact that global economic conditions have on customer travel patterns; excessive taxation and

the inability to offset future taxable income; general economic conditions (including interest

rates, foreign currency exchange rates, investment or credit market conditions, crude oil prices, costs of

aircraft fuel and energy refining capacity in relevant markets); our ability to cost-effectively

hedge against increases in the price of aircraft fuel; any potential realized or unrealized gains

or losses related to fuel or currency hedging programs; the effects of any hostilities, act of

war or terrorist attack; the ability of other air carriers with whom we have alliances or

partnerships to provide the services contemplated by the respective arrangements with such carriers; the

costs and availability of aviation and other insurance; industry consolidation or changes in airline

alliances; competitive pressures on pricing and demand; our capacity decisions and the capacity

decisions of our competitors; U.S. or foreign governmental legislation, regulation and other

actions; labor costs; our ability to maintain satisfactory labor relations and the results of the

collective bargaining agreement process with our union groups; any disruptions to operations due

to any potential actions by our labor groups; weather conditions; the possibility that expected

merger synergies will not be realized or will not be realized within the expected time period; and other

risks and uncertainties set forth under Item 1A, Risk Factors, of the Company’s Annual

Report on Form 10-K, as well as other risks and uncertainties set forth from time to time in

the reports we file with the SEC.

|

4

U.S. airline industry continues to transform

Less fragmentation

Capacity discipline

Unbundled fares and value-add products

Stronger balance sheets

Return-focused management teams |

We’ve built the foundation for the new United

5 |

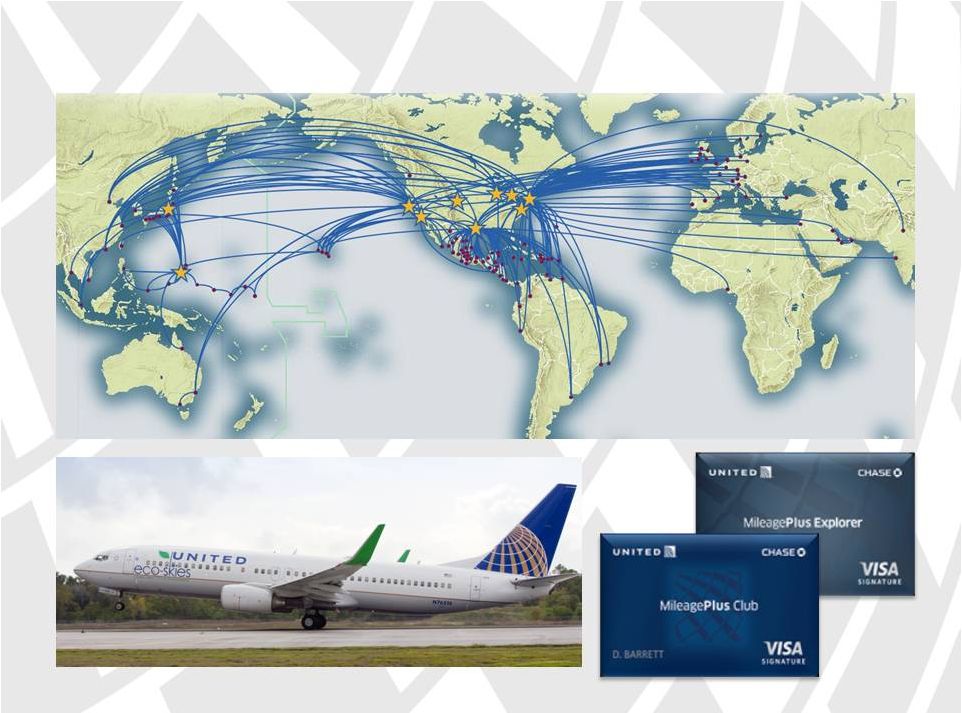

We’re leveraging United’s best-in-class assets

6 |

Deliver ROIC of

greater than

10%

Deliver great

customer

experience

Deliver

operational

reliability

7

We have three priorities for 2013 |

Arrival

:14

Performance

Jan

2013

Nov

Sep

Jul

May

Mar

Jan

2012

Goal: 80%

1.

Percentage of domestic mainline flights arriving within 14 minutes of scheduled

arrival 2.

Percentage of consolidated mainline flights which arrive to destinations,

excluding those canceled due to weather 8

Running a reliable airline is critical to the bottom line

A:14 performance above 80%

goal since September 2012

Year-to-date controllable

completion factor

at 99.6%

2

1 |

Giving

great customer service is core to United 9

Providing co-workers the tools

and training to give great service

Offering customers a friendly and

engaging experience on United

Going the extra mile for our

customers |

On

the ground Global Satellite

Wi-Fi

In the air

In our technology

We’re investing in the customer experience, making travel

easier and more comfortable than ever

10

New United Club

in ORD T-2 |

Customer Satisfaction Scores

11

Customers are experiencing United’s improved

operations, service levels and product offering

Customer satisfaction scores

increasing from summer low

Positive feedback from our

corporate advisory board

members on the improvements

Note: Net Promoter Score methodology: % of customers satisfied - % of customers dissatisfied

|

12

We’re taking action to recover our revenue premium

Jan 13

4Q12

3Q12

2Q12

1Q12

UAL

PRASM

Gap

vs.

Peers

1.

UAL year-over-year PRASM percentage points H/(L) vs. A4A ex-UAL

Recovering temporarily reduced

corporate market share

Using consolidated network

demand history to make better

revenue management decisions

Investing in united.com and

mobile app functionality

Growing ancillary revenue

1 |

13

Economy Plus

Global Satellite Wi-Fi

We’re growing ancillary revenue

2013 Goal: Grow ancillary revenue / passenger by 9%

Premium cabin upgrade

Improve how we offer existing

products and services

Introduce new value-add

products and services |

Source: SEC filings and investor updates

We’re managing all aspects of the business with discipline

(1.0%)

(1.5%)

(0.2%)

Consolidated Capacity

Year-over-Year % Change in ASMs

2011

2012

2013E

0%

14

Fleet Flexibility

Measured approach to aircraft

replacement

Expect fleet count to remain

roughly flat over next five years

1

1.

Capacity guidance from UAL Investor Update Jan. 24, 2013

|

Note: Results prior to 4Q 2010 pro forma; Debt outstanding includes on balance

sheet debt and capital leases; 2013E interest expense is midpoint of non-

operating expense guidance in January 24, 2013 Investor Update

Interest Expense

($B)

Debt Outstanding

($B)

12.4

13.2

12.7

15.1

15

We’ve strengthened the balance sheet by reducing debt

outstanding by 18% since 2010

0.8

0.9

1.0

2013E

~0.7

2012

2011

2010

Source: Earnings releases, SEC filings and January 2013 Investor Update. |

Return on Invested Capital (ROIC)

16

We’re managing United for returns

Note: Results prior to 4Q 2010 pro forma

Source: Earnings releases and SEC filings

Route analysis and

network optimization

Fleet decisions

Capital investments and

allocation

Executive compensation |

Deliver ROIC of

greater than

10%

Deliver great

customer

experience

Deliver

operational

reliability

17

By achieving these priorities in 2013, United will create

economic value and a solid base for future performance |