Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TEMPUR SEALY INTERNATIONAL, INC. | d494525d8k.htm |

1

******************************************************************************************

******************************************************************************************

******************************************************************************************

******************************************************************************************

******************************************************************************************

Exhibit 99.1 |

Note

Regarding Trademarks, Trade Names and Service Marks: Tempur, Tempur-Pedic,

TEMPUR-Cloud Collection, TEMPUR-Cloud Select,

TEMPUR-Cloud Supreme, TEMPUR-Cloud Supreme Breeze,

TEMPUR-Cloud Luxe, TEMPUR-Cloud Allura, TEMPUR-Cloud Luxe Breeze,

TEMPUR-Choice Collection, TEMPUR-Choice Supreme, TEMPUR-Choice Luxe, TEMPUR-Weightless Collection, TEMPUR-

Weightless Select, TEMPUR-Weightless Supreme, TEMPUR-Contour Collection,

TEMPUR-Contour, TEMPUR-Contour Select, TEMPUR-Contour Signature, TEMPUR-Rhapsody, TEMPUR-Rhapsody Breeze,

TEMPUR-Allura, GrandBed, TEMPUR-Simplicity Collection, TEMPUR Original

Collection, TEMPUR Sensation Collection, TEMPUR-Ergo Advanced System, TEMPUR-Ergo Premier, TEMPUR-Cloud Pillow,

TEMPUR-Neck Pillow, TEMPUR-Symphony Pillow, TEMPUR-Comfort Pillow,

TEMPUR-Rhapsody Pillow, and TEMPUR-Traditional Pillow are trademarks, trade names or service marks of Tempur-Pedic

International Inc. and its subsidiaries.

Sealy, Sealy Posturepedic, Stearns & Foster, and Optimum are trademarks, trade

names or service marks of Sealy Corporation and its subsidiaries. All other trademarks, trade names and service marks in

this presentation are the property of the respective owners.

Forward-Looking Statements

2

This presentation contains "forward-looking statements,”

within the meaning of federal securities laws, which include information concerning

one or more of the Company's plans, objectives, goals, strategies, and

other information that is not historical information. When used in this

release, the words "estimates," "expects,"

"anticipates," "projects," "plans," “proposed,”

"intends," "believes," and variations of such words or similar

expressions are intended to identify forward-looking statements. These

forward-looking statements include, without limitation, statements relating to the Company’s proposed

initiatives and product introductions; the Company’s growth potential and

strong brand; the proposed merger with Sealy Corporation, including

expectations regarding earnings accretion, cost synergies and revenue synergies,

and the ability to invest in key growth areas and rapidly delever the

combined company; and expectations regarding the Company’s net sales and

adjusted EPS for 2013. All forward looking statements are based upon current

expectations and beliefs and various assumptions. There can be no assurance that the Company will realize these expectations or that these

beliefs will prove correct.

Numerous factors, many of which are beyond the Company's control, could cause

actual results to differ materially from those expressed as forward-

looking

statements.

These

risk

factors

include

general

economic,

financial

and

industry

conditions,

particularly

in

the

retail

sector,

as

well

as

consumer

confidence and the availability of consumer financing; uncertainties arising from

global events; the effects of changes in foreign exchange rates on the

Company’s reported earnings; consumer acceptance of the Company’s

products; industry competition; the efficiency and effectiveness of the Company’s

advertising campaigns and other marketing programs; the Company’s ability to

increase sales productivity within existing retail accounts and to further

penetrate the Company’s retail channel, including the timing of opening or

expanding within large retail accounts; the Company’s ability to expand brand

awareness, distribution and new products; the Company’s ability to

continuously improve and expand its product line, maintain efficient, timely and cost-

effective production and delivery of its products, and manage its growth; the

effects of strategic investments on the Company’s operations; changes in

foreign tax rates and changes in tax laws generally, including the ability to

utilize tax loss carry forwards; changing commodity costs; and the effect of

future legislative or regulatory changes.

Additional information concerning these and other risks and uncertainties are

discussed in the Company's filings with the Securities and Exchange

Commission, including without limitation the Company's Annual Report on Form

10-K under the headings "Special Note Regarding Forward-Looking

Statements"

and

"Risk

Factors."

In

addition,

the

proposed

merger

with

Sealy

presents

risk

factors

including

the

ability

of

the

parties

to

complete

the

proposed merger in a timely manner or at all; satisfaction of the conditions

precedent to the proposed merger, the ability to secure regulatory approvals;

the possibility of litigation (including relating to the merger itself); and the

ability to successfully integrate Sealy into Tempur-Pedic’s operations and realize

synergies from the proposed transaction. Any forward-looking statement

speaks only as of the date on which it is made, and the Company undertakes no

obligation to update any forward-looking statements for any reason, including

to reflect events or circumstances after the date on which such statements

are made or to reflect the occurrence of anticipated or unanticipated events or

circumstances. |

Tempur-Pedic Overview |

Tempur

Vision People who sleep on TEMPUR material sleep better than

those who don’t

Our goal is to become the world’s

favorite mattress and pillow brand

To achieve our goal we will:

1.

Make sure everyone knows they would sleep better on TEMPUR material

2.

Make sure there is a TEMPUR mattress and pillow that appeals to everyone

3.

Make sure that TEMPUR mattresses are available to everyone

4.

Make sure TEMPUR material continues to deliver the best sleep

Make sure our cost structure is optimized to enable marketing and

product investments

4 |

Retail Price Point

$2,499-$7,999

$3,499-$3,999

$1,999-$4,999

$2,199-$2,699

$1,399

Tempur-Pedic “At-a-Glance”

Leading global specialty mattress manufacturer

Uniquely consumer focused and marketed

product that is consumer preferred

Additional products include: adjustable bases,

pillows, bed linens, slippers and cushions

Products are sold under the TEMPUR and

TEMPUR-PEDIC brand names

2012 Revenue: $1,403 million

2012 Adjusted EBITDA: $303 million

Company Highlights

By Product

Brand Portfolio

Sales Mix ¹

By Geography

5

Mattresses

Pillows

Other

1

Last 12-months ended December 31, 2012

North America

International

Note: TEMPUR-Choice Collection expected availability 2Q 2013.

|

6

Growth Driven by Successful Innovation

Contour

HD

Cloud

Net Sales ($ in billions)

Contour

HD

Cloud

Contour

HD

Cloud

Contour

HD

Cloud

Simplicity

Weightless

Original

Sensation

Original

Sensation

Original

Sensation

Cloud

Original

Sensation

Cloud

TEMPUR-CLOUD has been a major success in

North America and Internationally

Introduced in North America in November

2009 and in International markets beginning in

March 2011

Most successful innovation to date and quickly

became Tempur-Pedic’s top selling collection

TEMPUR-CLOUD

Other Innovations

TEMPUR-Sensation

TEMPUR-Weightless

TEMPUR-Breeze Technology

TEMPUR-Choice

1

TEMPUR-Ergo

Premier

Adjustable

1

Pillows and Slippers

Cloud North America

Late 2009, 2010

Cloud Int’l

2011

Weightless

Breeze Tech

Late 2012

Simplicity

2012

Tempur NA

Mattress

Collections

Tempur

International

Mattress

Collections

1

Expected availability 2Q 2013.

Source: Company filings, management estimates. For a discussion of the

Company’s performance, please refer to the Company’s 10Q and 10K filings.

Choice

2013

1

Original

Sensation

Cloud

Contour

HD

Cloud

Simplicity

Weightless

Choice

$0.8

$1.1

$1.4

$1.4

$0.0

$0.2

$0.4

$0.6

$0.8

$1.0

$1.2

$1.4

$1.6

2009

2010

2011

2012

2013E |

Diversified Global Platform With State-of-the-Art

Manufacturing Facilities

Subsidiary

Third Party

Global Footprint

Global Manufacturing Presence

In 2012 generated 69% of revenue from North

America and 31% from international operations

> $2.5B of sales capacity

across three existing

manufacturing facilities

Capacity utilization

approximately 45%

U.S. Facilities

Global Facilities

Manufacturing Facility

Virginia

New Mexico

R&D Facility

Virginia

Manufacturing Facility

Denmark

R&D Facility

Denmark

Virginia (540K sq ft)

New Mexico (800K sq ft)

Denmark (517K sq ft)

7 |

Strong,

Established Management Team Prior Experience

Years

Name

Position

Prior Experience

Consumer

Products

Inter'l

with

Tempur

Mark Sarvary

President and CEO

President, Campbell Soup North America

CEO, J. Crew Group

5

President, Stouffer's Frozen Food Division at Nestle

Rick Anderson

EVP and President,

VP,

Gillette

North

America Gillette / P&G

7

Matt Clift*

EVP, Global Operations

VP / GM Lexmark International

Lexmark / IBM

8

Lou Jones

EVP and General Counsel

General Counsel, Papa John's International

SVP, Blockbuster, Inc.

4

David Montgomery

EVP and President,

President, Rubbermaid Europe

International

VP, Black & Decker Europe, Middle East, Africa

10

Brad Patrick

EVP, Human Resources

SVP, Sara Lee Corporation

Gillette / P&G

3

Delta Air Lines

Dale Williams

EVP and CFO

CFO, Honeywell Control Products

CFO, Saga Systems

10

CFO, GE Information Systems

Tim Yaggi

COO

Group President, Masco Corporation

Joined

EVP, Whirlpool Corporation

2013

Norelco (Philips)

8

Note: Matt Clift is retiring in 2013. |

Net

Sales Net Sales decreased 1% Y/Y for the full year ended December 31,

2012 -4.0% in North America

+6.1%

Internationally,

+11.3%

approximately

on

a

constant

currency

basis¹

($ in millions)

1

For

a

discussion

of

the

Company’s

performance,

please

refer

to

the

Company’s

10Q

and

10K

filings.

9

The

references

to

“constant

currency

basis”

in

this

presentation

do

not

include

operational

impacts

that

could

result

from

fluctuations

in

foreign

currency

rates.

Certain

financial

results are adjusted based on a simple mathematical model that translates current

period results in local currency using the comparable prior year period’s currency conversion

rate. This approach is used for countries where the functional currency is the local

country currency. This information is provided so that certain financial results can be viewed

without the impact of fluctuations in foreign currency rates, thereby facilitating

period-to-period comparisons of business performance. Refer to ITEM 7A under Part II of the

Company’s 2012 Form 10-K. |

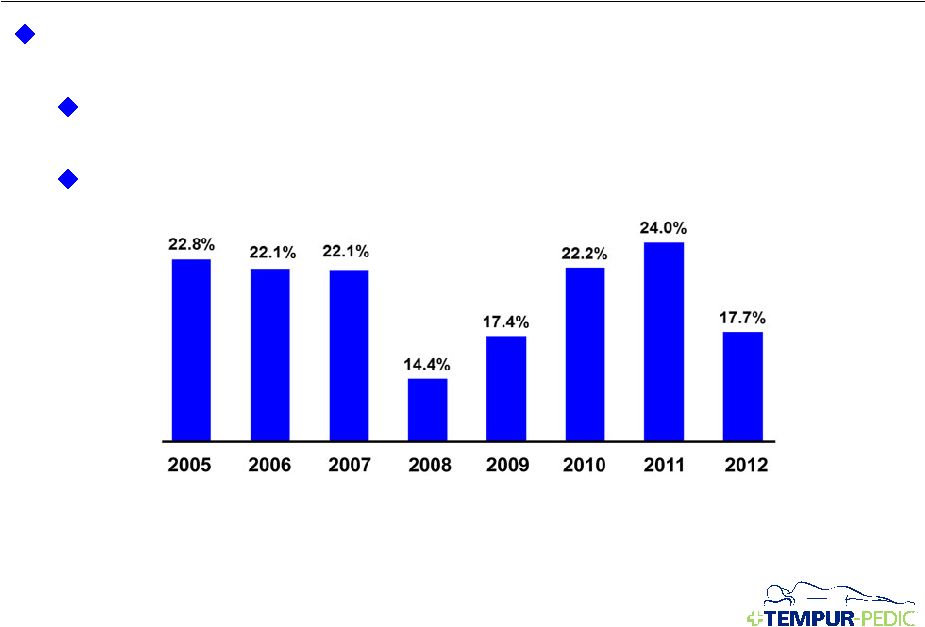

Gross

Margin Gross margin decreased 150bps Y/Y for the full

year ended December 31, 2012

as a result of:

Increased promotions and discounts, new product introductions and

unfavorable product mix

Offset partially by geographic mix

For a discussion of the Company’s performance, please refer to the

Company’s 10Q and 10K filings. 10 |

Operating Margin

Operating margin decreased 630 bps Y/Y for the full year ended

December 31, 2012,

primarily

as

a

result

of:

Increased Selling & Marketing expenses +320bps Y/Y (Advertising investment

+120bps Y/Y)

General, administrative and other (including R&D) expenses increased

+160bps

For a discussion of the Company’s performance, please refer to the

Company’s 10Q and 10K filings. 11 |

Tempur-Pedic

Well positioned in an attractive market

Executing on strategy to improve competitive position, market share and

shareholder value:

Product Innovation

Strengthening Brand

Restore Margins

Significant long term growth potential

Acquiring Sealy to enhance strategic position and broaden global

opportunity

Note: For a discussion of the Company’s performance, please refer to the

Company’s 10K and 10Q filings. 12 |

Sealy Overview |

Business Highlights

Sales Breakdown

Sealy is a leading bedding manufacturer in the U.S.

Manufactures a full line of bedding products under the

Sealy, Posturepedic, Stearns & Foster and Optimum brand

names

Stearns & Foster addresses growth at premium price

points, and achieved strong growth in 2012

Leading global brand with significant global scale

Top market position in Canada, Mexico and

Argentina

Continuing investments in vertical integration in

Mexico and South America

Expanding manufacturing and retail presence in

China

Owned and operated retail stores in South America

and Asia

Founded in 1881 and is based in Trinity, NC

FY 2012 Sales by Geography

Net Sales $1.3Bn

United States

77%

Canada

15%

Other

8%

FY 2012 U.S. Sales

U.S. Sales $1.0Bn

U.S. Innerspring

86%

U.S. Specialty

12%

U.S. Other

2%

Leading global bedding manufacturer with

broadest portfolio of established brands

14

Sealy “At-a-Glance”

Note: Sealy’s FY 2012 ended December 2, 2012. For a discussion of

the Sealy’s performance, please refer to Sealy’s 10Q and 10K filings. |

Strategic Rationale For The Acquisition

Comprehensive Portfolio of Iconic Brands

Tempur-Pedic,

Sealy,

Sealy

Posturepedic,

and

Stearns

&

Foster

are

among

the

most

highly

recognized

brands

in

North

America

Strong brand recognition across South America, Europe, and Asia with

Tempur-Pedic and Sealy Complementary Product Offering

Tempur-Pedic’s expertise in visco-elastic

Sealy’s expertise in innerspring

Ability to leverage more in R&D to strengthen existing products and develop

innovative new offerings Global Footprint

Tempur-Pedic: Strong presence around the world, particularly in North America,

Europe and Asia Sealy: Well represented in U.S., Canada, Mexico, Argentina

and Asia Significant Value Creation

Expected to be accretive in the first full year of operations

Cost synergy estimate in excess of $40 million by the third year

Attractive

upside

potential

from

revenue

synergies

across

organizations

–

hybrid

technologies,

cross-selling,

international

Strong Financial Characteristics

Combined adjusted EBITDA of $453 million for last 12

months¹ Ability to invest in key growth

areas Commitment

to

delever

–

Cash

flow

characteristics

will

enable

rapid

deleveraging

15

1

Last 12-months ended December 31, 2012 for Tempur-Pedic and December 2,

2012 for Sealy. See Appendix for Adjusted EBITDA reconciliation. |

Combined Comprehensive Portfolio of Iconic Brands

16 |

Appendix |

18

Use of Non-GAAP Financial Measures

Tempur-Pedic International Inc. (the “Company”) has presented the

following non-GAAP financial measures in this presentation: adjusted

EBITDA of each of the Company and Sealy, and adjusted EBITDA of the combined company. The Company and Sealy each

define its non-GAAP adjusted EBITDA to exclude the following: (1) interest

expense, net; (2) provision for income taxes; and (3) depreciation and

amortization expense. The Company and Sealy also exclude certain unusual items and other adjustments permitted in

calculating its respective debt covenants in its debt agreements. The

reconciliations of these historical non-GAAP measures to each of

Tempur-Pedic’s and Sealy’s GAAP financial measures for the periods

presented, are set forth on slide 19. The Company believes the use of these

non-GAAP financial measures are useful to investors in comparing the

results of operations for

comparable periods by eliminating certain of the more significant effects of

adjusted EBITDA. These measures also reflect how the Company and Sealy

manage their businesses internally. In addition to the adjustments included in the calculation of the Company’s

non-GAAP

adjusted

EBITDA

eliminates

the

effects

of

financing,

income

taxes

and

the

accounting

effects

of

capital

spending

and

acquisitions.

As

with

the

items

eliminated

in

its

calculation

of

non-GAAP

adjusted

EBITDA,

these

items

may

vary

for

different

companies for reasons unrelated to the overall operating performance of a

company’s business. When analyzing Tempur-Pedic’s,

Sealy’s and the combined company’s operating performance, investors

should not consider these non-GAAP financial measures as a substitute

for comparable measures in accordance with GAAP. |

19

Adjusted EBITDA Reconciliation

1

Last 12-months ended December 31, 2012 for Tempur-Pedic and December 2,

2012 for Sealy. LTM Combined Adjusted EBITDA

($ in millions)

2

Includes Comfort Revolution acquisition costs, noncontrolling interest, and various

immaterial adjustments. Tempur-Pedic

Sealy

Combined

Net income (loss)

$106.8

($1.2)

$105.6

Interest expense

18.8

89.3

108.1

Income taxes

122.4

12.5

134.9

Depreciation and amortization

42.0

26.4

68.4

EBITDA

$290.0

$127.1

$417.1

Transaction costs

8.9

2.5

11.4

Integration costs

2.2

2.2

Refinancing charges

3.7

3.7

Non-cash compensation

8.1

8.1

Restructuring and impairment related charges

1.5

2.4

3.9

Discontinued operations

2.0

2.0

Other ²

4.3

4.3

Adjusted EBITDA

$302.6

$150.1

$452.7

1

1

1 |

1

******************************************************************************************

******************************************************************************************

******************************************************************************************

******************************************************************************************

******************************************************************************************

Exhibit 99.1

™ |