Attached files

| file | filename |

|---|---|

| 8-K - 8-K - People's United Financial, Inc. | d491827d8k.htm |

| EX-99.1 - EX-99.1 - People's United Financial, Inc. | d491827dex991.htm |

Investor Presentation

February 2013

Investor Contact:

Peter Goulding, CFA

203-338-6799

peter.goulding@peoples.com

Exhibit 99.2 |

1

Certain statements contained in this release are forward-looking in nature. These include all

statements about People's United Financial's plans, objectives, expectations and other

statements that are not historical facts, and usually use words such as "expect,"

"anticipate," "believe," "should" and similar expressions. Such

statements represent management's current beliefs, based upon information available at the time

the statements are made, with regard to the matters addressed. All forward-looking statements

are

subject

to

risks

and

uncertainties

that

could

cause

People's

United

Financial's

actual

results

or

financial

condition

to

differ

materially

from

those

expressed

in

or

implied

by

such

statements.

Factors

of

particular importance to People’s United Financial include, but are not limited to: (1) changes

in general, national or regional economic conditions; (2) changes in interest rates; (3)

changes in loan default and charge-off rates; (4) changes in deposit levels; (5) changes in

levels of income and expense in non- interest income and expense related activities; (6)

residential mortgage and secondary market activity; (7) changes in accounting and regulatory

guidance applicable to banks; (8) price levels and conditions in the public securities markets

generally; (9) competition and its effect on pricing, spending, third-party relationships

and revenues; (10) the successful integration of acquisitions; and (11) changes in regulation

resulting from or relating to financial reform legislation. People's United Financial does not

undertake any obligation to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise.

Forward-Looking Statement |

2

Corporate Overview

Snapshot, as of December 31, 2012

People’s United Financial, Inc.

NASDAQ (PBCT)

Headquarters:

Bridgeport, CT

Chief Executive Officer:

Jack Barnes

Chief Financial Officer:

Kirk Walters

Market Capitalization (2/25/13):

$4.4 billion

Assets:

$30.3 billion

Loans:

$21.7 billion

Deposits:

$21.8 billion

Branches:

419

ATMs:

634

Standalone ATMs:*

83

Founded:

1842

* Includes 25 ATMs in Stop & Shop locations where a branch is not

present. |

3

Compelling Investment Opportunity

High quality Northeast footprint characterized by wealth and population density

Leading

market

position

in

the

best

commercial

banking

market

in

the

US

Significant

growth

runway

within

existing

markets

–

expanding

in

two

of

the

largest MSAs in the US (New York City, #1, Boston, #10)

Dividend yield of 5+%

Ability

to

maintain

pristine

credit

quality

–

no

credit

“events”

Improving profitability

High levels of liquidity

Capital deployment (organic growth, dividends, share repurchases, M&A)

– TCE/TA 10.2% vs. ~8.0% for peers |

4

Branch Map |

5

Deepening Market Presence

Connecticut

Massachusetts

Vermont

New York

New Hampshire

Maine

Leading

market

position

in

the

best

commercial

banking

market

in

the

US

#1 in Fairfield County, CT, 64 branches, $6.1BN, 18.2% market share

#5 deposit market share in New England

Source: SNL Financial

Branches

$BN

%

1

People's United

42

2.6

22.4

2

TD Bank

34

2.6

22.0

3

Merchants

33

1.2

10.6

4

RBS

21

0.9

7.3

5

KeyCorp

13

0.8

6.7

6

Northfield

13

0.5

4.3

7

Community

14

0.4

3.7

8

Union

13

0.4

3.4

9

Passumpsic

7

0.3

2.9

10

Berkshire Hills

7

0.3

2.8

Branches

$BN

%

1

RBS

80

6.8

24.3

2

TD Bank

72

5.4

19.3

3

B of A

29

4.9

17.5

4

People's United

29

1.4

4.9

5

Merrimack

18

1.0

3.6

6

BNH

23

0.9

3.2

7

Santander

20

0.8

2.9

8

NH Thrift

20

0.8

2.8

9

Northway

17

0.7

2.4

10

Centrix

6

0.7

2.3

Branches

$BN

%

1

B of A

262

54.6

25.0

2

RBS

254

30.9

14.1

3

Santander

229

18.9

8.6

4

TD Bank

157

10.8

5.0

5

Eastern Bank

99

6.8

3.1

6

Independent Bank

78

4.5

2.0

7

Middlesex

30

3.5

1.6

8

People's United

56

3.2

1.5

9

Boston Private

11

2.9

1.3

10

Century

28

2.4

1.1

Branches

$BN

%

1

JPM Chase

804

393.1

38.3

2

Citi

268

69.6

6.8

3

B of A

365

60.6

5.9

4

HSBC

164

57.3

5.6

5

Capital One

277

39.0

3.8

6

M&T

299

33.3

3.3

7

TD Bank

222

22.4

2.2

8

KeyCorp

269

18.3

1.8

9

Wells Fargo

87

18.0

1.8

10

First Niagara

212

16.1

1.6

35

People's United

98

2.5

0.2

Branches

$BN

%

1

TD Bank

55

3.7

16.4

2

KeyCorp

60

2.7

11.7

3

Bangor Bancorp

58

2.0

8.9

4

Camden National

50

1.8

8.1

5

B of A

19

1.4

6.0

6

First Bancorp

15

1.0

4.6

7

Machias

14

0.8

3.6

8

People's United

28

0.8

3.5

9

Bar Harbor

16

0.8

3.4

10

Norway

21

0.7

3.2

Branches

$BN

%

1

B of A

155

24.5

24.0

2

Webster

124

12.1

11.8

3

People's United

166

10.9

10.7

4

Wells Fargo

76

7.3

7.2

5

TD Bank

81

5.9

5.8

6

First Niagara

86

4.6

4.5

7

JPM Chase

52

4.5

4.4

8

Citi

20

3.0

2.9

9

Liberty

48

2.9

2.8

10

RBS

50

2.6

2.5 |

6

Large and Attractive Markets

NYC-Northern NJ-LI

Population: 19.0MM

Median HH Income: $60,595

Businesses: 749,000

Population Density (#/sq miles): 2,058

Unemployment Rate (%): 9.3

$100K+ Households (%): 30.2

Boston, MA

Population: 4.6MM

Median HH Income: $67,887

Businesses: 186,000

Population Density (#/sq miles): 1,013

Unemployment Rate (%): 6.6

$100K+ Households (%): 33.2

Hartford, CT

Population: 1.2MM

Median HH Income: $64,098

Businesses: 50,000

Population Density (#/sq miles): 755

Unemployment Rate (%): 8.1

$100K+ Households (%): 30.0

Bridgeport-Stamford, CT

Population: 919,000

Median HH Income: $80,531

Businesses: 45,000

Population Density (#/sq miles): 1,097

Unemployment Rate (%): 7.7

$100K+ Households (%): 41.5

New Haven, CT

Population: 862,000

Median HH Income: $58,775

Businesses: 34,000

Population Density (#/sq miles): 1,000

Unemployment Rate (%): 8.4

$100K+ Households (%): 27.0

Burlington, VT

Population: 212,000

Median HH Income: $56,090

Businesses: 10,000

Population Density (#/sq miles): 141

Unemployment Rate (%): 4.3

$100K+ Households (%): 21.3

Notes: The current national unemployment rate is 8.3%

The current national population density is 88 (#/sq miles)

The population densities of NYC, Boston, Bridgeport and New Haven MSAs

are over ten times the national average |

7

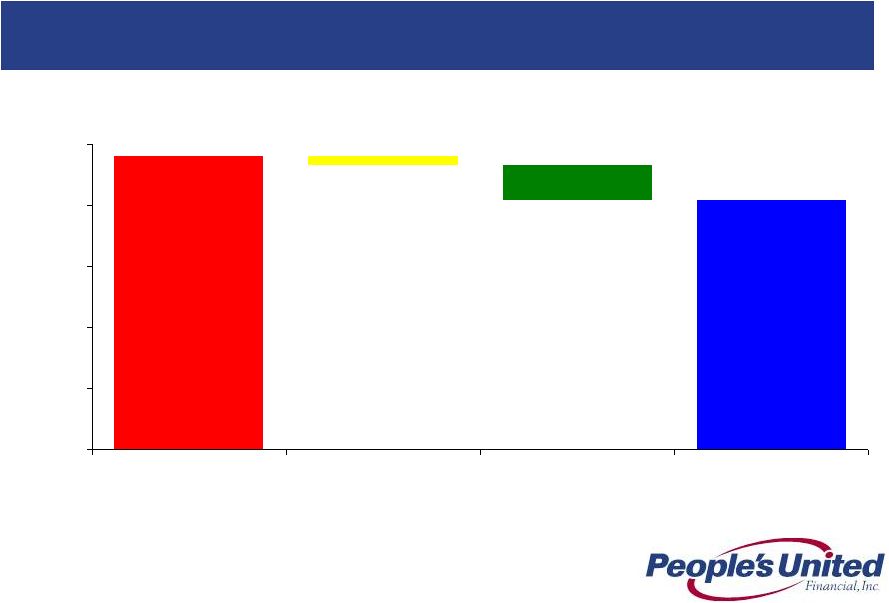

Strong Market Demographic Profile

Source: SNL Financial, US Census data for 2011

Weighted Average Median Household Income

$60,603

$53,648

$50,227

$0

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

$70,000

PBCT

Peer Median

US |

8

Total Deposits ($MM)

6,053

2,926

2,479

2,063

1,970

1,241

Market Total Deposits ($MM)

33,398

116,705

554,262

25,363

17,119

4,499

Branch Count

64

51

93

45

34

12

18.2

2.5

8.1

11.5

27.6

0.5

0.0

5.0

10.0

15.0

20.0

25.0

30.0

Bridgeport-

Stamford, CT

Boston, MA

NYC-Northern

NJ-LI

Hartford, CT

New Haven, CT

Burlington, VT

Deposit Market Share by MSA (%) *

We hold significant market share in several key northeast MSAs and are

building our presence in areas with substantial growth potential, such as

the Boston and New York City MSAs

Source: SNL Financial

* Excludes deposits from trust institutions and branches with over $750MM deposits

** Excludes five of the acquired Citizens branches located outside the NYC MSA

**

**

Large New Markets |

9

Unique opportunity based on People’s United’s excellent in-store

branch banking track record, longstanding relationship with Stop & Shop

and strong traditional branch network in the market

–

In

each

of

the

past

14

years,

People’s

United

has

ranked

as

the

#1

in-store

branch

operator

in

the

US

*

–

Exclusive provider of banking services to Stop & Shop on Long Island, Southern

New York and Connecticut; 140 in-store branches

Strong traditional branch network is crucial for successful in-store branch

banking –

37 traditional branches on Long Island and Westchester County

–

Our traditional branches offer the full suite of services

–

Provides a lift to traffic in both in-store and traditional branches

–

Opportunity to bring average acquired in-store deposit balances up from $4MM to

our average in-store deposit balances of $29MM

Adds additional source of core deposit funding

–

Expected core deposit growth within acquired in-store branches and surrounding

traditional branches will help fund continued New York metro loan

growth Transaction deepens People’s United’s presence on Long Island

and in Westchester County Acquisition of Select Citizens Bank Branches

Transaction Rationale

* Source:

SNL

Financial.

As

measured

by

average

deposits

per

in-store

branch

among

active

banks

with

at

least

$500MM

of

in-store

deposits |

10

People’s United Bank branches (includes 41 traditional branches in NY)

Recently acquired, in-store branches (53)

Source: SNL Financial

Suffolk

Putnam

Dutchess

Ulster

Orange

Rockland

Westchester

Kings

Queens

Richmond

Nassau

Bronx

New York

Recently acquired, traditional branches (4)

Expanding Long Island, NY and Hudson Valley Footprint

Branch Map |

11

59%

56%

45%

32%

34%

27%

30%

41%

44%

55%

68%

66%

73%

70%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Consumer

Checking Accounts

Opened

Savings Accounts

Opened

Business Checking

Accounts Opened

Home Equity

Loans

Mortgage Loans

Business Banking

Loans

Investment Sales

In-store Branches

Traditional Branches

On average, in-store locations are open 37% more hours per week than traditional

branches (56 hours vs. 41 hours) but are 30% less expensive to operate

Employees at in-store locations are extensively trained and certified to sell

and support all the Bank’s products and services

Mortgages, Home Equity Loans, Business Loans and Investments

In 2012, Connecticut in-store branches accounted for a significant portion of

the new branch business booked in the market

In-store Versus Traditional Branch Business

In-store Versus Traditional Branches

Connecticut |

12

Demand

$52

16%

NOW

$71

22%

Savings

$78

25%

Money

Market

$70

21%

CD

$53

16%

Deposits Acquired

Source: Company financials; financial data as of 12/31/2011

Cost of Deposits: 0.59%

Total Deposits: $324MM

Acquisition of Select Citizens Bank Branches

Attractive Deposit Base |

13

4Q12 Total Loan Portfolio

$21.7 BN

Loans by Business Line

CRE

$6.9

31%

C&I

$5.4

25%

Residential

Mortgage

$3.9

18%

Home Equity &

Other

$2.2

10%

PCLC

$1.6

7%

PUEFC

$0.8

4%

Business Banking

$1.1

5% |

14

Connecticut

$6.6

31%

Massachusetts

$4.0

18%

New York

$2.9

13%

Vermont

$1.8

8%

New Hampshire

$1.3

6%

New Jersey

$0.6

3%

Other

$3.2

15%

Pennsylvania

$0.2

1%

Maine

$0.9

4%

Maryland

$0.2

1%

Loans by Geography

Notes: Reporting is based on the collateral property address for the

following: SNE Residential Mortgage, Consumer

Home

equity,

Consumer

Other

and

CRE.

Reporting

is

based

on

borrower

address

for

the

following: C&I, Residential construction and NNE loans.

4Q12 Total Loan Portfolio

$21.7 BN

Excluding

equipment

finance loans,

~95% of our

3Q12 loan

portfolio is within

the Northeast |

15

Revenue Opportunities

Large

new

markets

–

NYC

and

Boston

MSAs

Under-represented asset classes ramping up

Asset-based lending: focused on in-footprint companies with sales of

$15MM-$250MM; credit needs range from $5MM-$35MM; $600BN market, 70%

of which is located in the Northeast Mortgage Warehouse lending: ~$700MM in

commitments, and $447MM in outstandings; estimated market size is over $28BN

in outstandings New York Commercial Real Estate: hiring talent in the New York

metro area, which is a $30BN annual market with a population of 18.9MM, 6.9MM

housing units, and 3.4MM rental units Private Banking: hired senior executive

from mega-cap bank with ~20 years managing private banking in the

Northeast with initial focus on CT, metro New York and metro Boston Enhancing

wealth management offering Proprietary asset allocation and risk management

strategies are implemented with a suite of external managers who represent

our "best in class" recommendations •

Proprietary asset allocation allows us to “rent”

intellectual capital –

no customer funds leave the bank

Hired executive from PNC as Senior Vice President and Chief Investment Officer

Increasing momentum in fee income penetration

Commercial

insurance:

revamped

systems

and

combined

all

agencies

into

a

single

entity;

focused on our deep commercial customer base as well as the education sector

Hired executive from TD to lead cash management business

Growing merchant and payroll services |

16

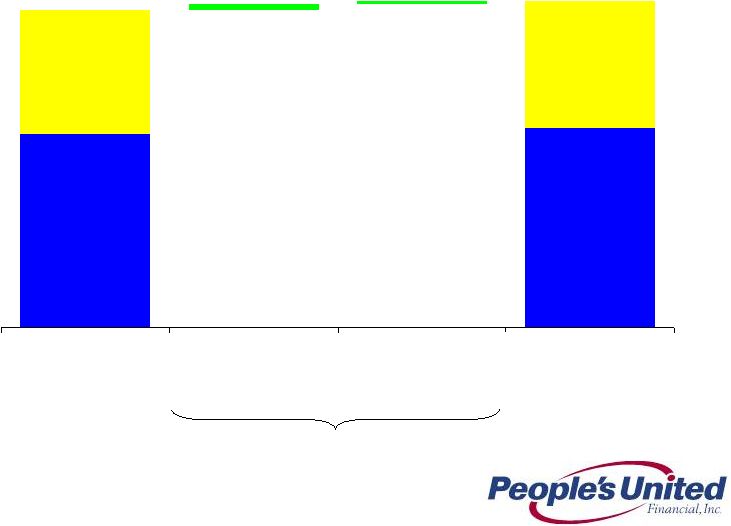

Expense Progress

Estimated Cost Savings Analysis

Our Q4 2012 operating expense base of $204.5MM reflects $35MM (~$140MM

annualized) savings from successfully-executed expense initiatives

Source: SNL Financial

Note: “Pro

Forma

/

Actual”

represents

PBCT

operating

noninterest

expense

and

the

actual

expenses

at

the

acquired

institutions.

Acquisition target costs fall away as the acquisitions are completed.

“Without

Expense

Initiatives”

represents

PBCT

operating

noninterest

expense

and

the

actual

expenses

at

the

acquired

institutions in 4Q09, and then applies the peer median expense growth rate in each subsequent

quarter. Operating Noninterest Expense ($MM)

205

240

200

210

220

230

240

250

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Pro Forma / Actual

Without Expense Initiatives

$35MM

Cost

Savings |

17

Expense Progress

Estimated Cost Savings Analysis

The $35MM in quarterly cost reductions is attributable to efforts related to

acquisition cost savings and other initiatives

Source: SNL Financial

Note:

“Pro

Forma

/

Actual”

represents

PBCT

operating

noninterest

expense

and

the

actual

expenses

at

the

acquired

institutions.

Acquisition target costs fall away as the acquisitions are completed

“Without

Expense

Initiatives”

represents

PBCT

operating

noninterest

expense

and

the

actual

expenses

at

the

acquired

institutions in 4Q09, and then applies the peer median expense growth rate in each subsequent

quarter Operating Noninterest Expense ($MM)

240

205

7

28

$0

$50

$100

$150

$200

$250

Without Expense

Initiatives

Announced Acquisition

Savings

Other Initiatives

Pro Forma / Actual |

18

Non-Operating

Operating

Total

Non-Interest Expense

Linked Quarter Change

(in $ millions)

208.9

207.4

(0.3)

205.7

(2.4)

(1.8)

1.9

1.5

(0.4)

204.5

2.9

3.2

3Q 2012

Non-

Operating

REO

Expense

Vesting-

Initial

RRP/SOP

Grant

Occupancy

& Equip

Prof &

Outside Svc

Other

4Q 2012 |

19

0.9

63.1

(0.4)

(0.4)

0.8

1.4

(0.6)

61.4

3Q 2012

Acquired

Loan

Accretion

Cost

Recovery

Income

Other net

interest

income

Non

interest

income

Operating

expense

REO/

Gains/

other adjs

4Q 2012

Efficiency Ratio (%)

Linked Quarter Change

Notes:

1.

Expense

items

classified

as

“other”

and

deducted

from

non-interest

expense

for

purposes

of

calculating

the

efficiency ratio include, as applicable, certain franchise taxes, REO expenses,

contract termination costs and non-recurring expenses

Revenue

items

classified

as

“other”

and

added

to

(deducted

from)

total

revenues

for

purposes

of

calculating

the

efficiency ratio include, as applicable, asset write-offs and gains associated

with the sale of branch locations 1 |

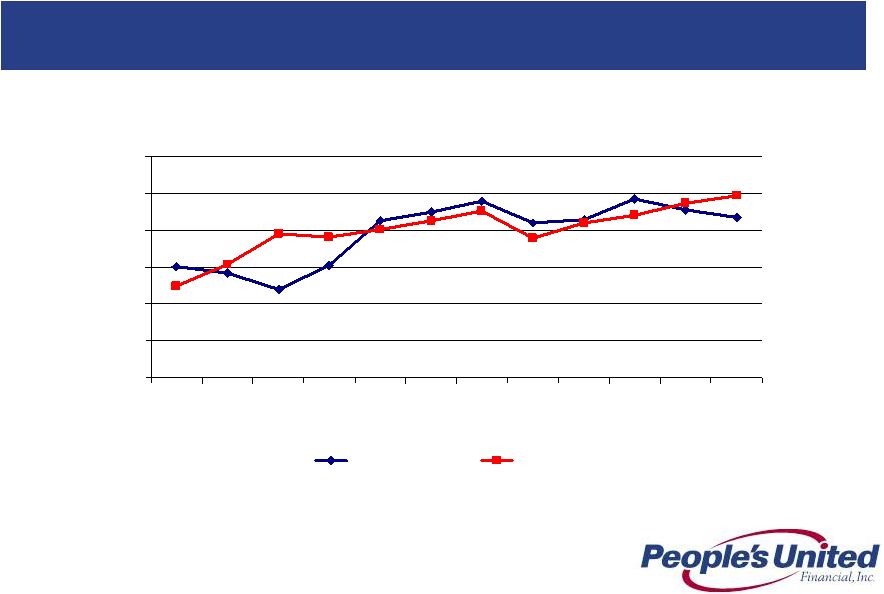

20

Efficiency Ratio (%)

Since 1Q 2010

76.1%

73.1%

72.4%

71.9%

66.0%

65.5%

62.4%

62.3%

63.6%

61.5%

61.4%

63.1%

1Q

2010

2Q

2010

3Q

2010

4Q

2010

1Q

2011

2Q

2011

3Q

2011

4Q

2011

1Q

2012

2Q

2012

3Q

2012

4Q

2012 |

21

EMOC has been fully operational since November 2011

Three person committee comprised of the CFO, Chief Administrative Officer and

Chief HR Officer EMOC oversees PBCT’s noninterest expense management,

implements strategies to ensure attainment of expense management targets and

oversees revenue initiatives that require expenditures

Provides a horizontal view of the organization

Expense Management Units (EMUs) established to facilitate EMOC functions

Defined EMUs include:

•

Technology

•

Operations

•

Real Estate Services

Spending requests above $25,000 are submitted by EMU owners for approval

Staffing models, staffing replacements and additions for mid-level positions and

above require approval by the Committee

Introduction to EMOC

Expense Management Oversight Committee (EMOC)

•

Employment/Benefits

•

Marketing

•

Regulatory/Institutional

•

Depreciation/Equipment

•

Decentralized

•

Intangible Amortization |

22

Operating Net Interest Margin (%) -

Decrease from 3Q 2012

3.82%

3.63%

(0.07%)

(0.02%)

0.03%

(0.02%)

(0.05%)

(0.04%)

(0.02%)

3Q 2012

Margin

New loan

volume

Acquired

loan

accretion

Loan

repricing/

amortization

Investments

Senior Notes

Danvers CD

FV Adj

Deposit

Rates/ Mix

4Q 2012

Margin |

23

Net Interest Margin (%)

4.03

3.97

3.88

3.82

3.63

4.12

3.97

3.96

3.89

3.63

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

Margin- Operating

Margin- GAAP |

24

Acquired Loan Portfolio

Acquired loans initially recorded at fair value (inclusive of related credit mark)

without carryover of historical ALLL

Accounting model is cash-flow based:

Contractual

cash

flows

(principal

&

interest)

less

Expected

cash

flows

(principal

&

interest)

=

non-accretable

difference (effectively utilized to absorb actual portfolio losses)

Expected cash flows (principal & interest) less fair value = accretable

yield Expected cash flows are regularly reassessed and compared to actual cash

collections As of 12/31/2012

(in $ millions)

Carrying

Amount

a, b

Carrying

Amount

Component

b

NPLs

Non-Accretable

Difference/NPLs

Charge-offs

Incurred Since

Acquisition

Accretable

Yield

Non-Accretable

Difference

FinFed (2/18/10)

$150.5

$11.8

$7.7

$28.2

27%

$11.3

Butler (4/16/10)

60.4

22.6

13.7

8.0

171%

7.9

RiverBank (11/30/10)

237.8

98.2

10.5

22.9

46%

4.5

Smithtown (11/30/10)

768.5

428.6

117.3

74.7

157%

126.1

Danvers (7/1/11)

1,020.9

329.0

18.6

47.8

39%

17.5

Total

$2,238.1

$890.2

$167.8

$181.6

(a)

Initial carrying amounts of acquired portfolios are as follows: FinFed, $1.2BN;

Butler, $141MM; RiverBank, $518MM; Smithtown, $1.6BN; and Danvers,

$1.9BN. (b)

Carrying amount and related components reflect loan sale, settlement and payoff

activity which have occurred since acquisition. (c)

Represent contractual amounts; loans meet People’s United Financial’s

definition of a non-performing loan but are not subject to

classification as non-accrual in the same manner as originated loans. Rather,

these loans are considered to be accruing loans because their interest

income relates to the accretable yield recognized at the pool level and not to contractual interest payments

at the loan level.

c |

25

Acquired Loan Portfolio

Amortization of Original Discount on Acquired Loan Portfolio

Note:

1.

Excluding FinFed, the weighted average coupon on the acquired loan portfolio is

4.98% 2.

Represents

the

difference

between

the

outstanding

balance

of

the

acquired

loan

portfolio

and

the

carrying

amount

of

the

acquired loan portfolio

$ in millions, except per share data

Impact on Net Interest Margin

Impact on Earnings Per Share

4Q12 Total Accretion (All interest income on acquired loans)

42

Interest Income from Amortization of Original Discount on Acq. Loan

Portfolio 9.7

3Q12 Acquired Loan Portfolio Carrying Amount

2,634

4Q12 Effective Tax Rate

32%

4Q12 Acquired Loan Portfolio Carrying Amount

2,238

4Q12 Average Acquired Loan Portfolio

2,436

4Q12 Earnings from Amortiz. of Original Discount on Acq. Loan Portfolio

6.6

Effective Yield on Acquired Loan Portfolio

6.86%

4Q12 Weighted Average Shares Outstanding

331.4

Weighted Average Coupon on Acquired Loan Portfolio

5.27%

4Q12 EPS Impact from Amortiz. of Discount on Acq. Loan Portfolio

$0.02

Incremental Yield Attributable to Amortiz. of Discount on Acq. Loan Portfolio

1.59%

Incremental Interest Income from Amortiz. of Discount on Acq. Loan Portfolio

9.7

4Q12 Average Earning Assets

25,206

Add: Average unamortized loan discount

2

72

Adjusted 4Q12 Average Earning Assets

25,278

Impact on Overall Net Interest Margin (bps)

15

Operating Net Interest Margin

3.63%

Adjusted Net Interest Margin

3.48%

Amortization of Original Discount on Acquired Loan Portfolio

Amortization of Original Discount on Acquired Loan Portfolio

1 |

26

Summary of Acquired Loan Accounting Events

(in $ millions)

Period

Cost Recovery

Income

Gain (Loss) on Sale

of Acquired Loans

Acquired Loan

Impairment

Net Impact

2011

Q1

0.0

5.5

0.0

5.5

Q2

0.0

7.2

0.0

7.2

Q3

0.0

(4.8)

0.0

(4.8)

Q4

5.0

(0.4)

(7.4)

(2.8)

2012

Q1

0.0

0.0

(0.3)

(0.3)

Q2

4.7

0.7

0.2

5.6

Q3

4.1

0.0

(5.7)

(1.6)

Q4

0.0

0.3

0.0

0.3

Total

$13.8

$8.5

($13.2)

$9.1

Since 2010, we have acquired $5.4BN of loans, over 40% of which

remain in our portfolio. We did not recognize cost recovery income,

gains (losses) on sale or impairment in 2010. Since 1Q 2011, the

net

impact of such activity is +$9.1MM |

27

Loans

Linked Quarter Change

(in $ millions)

Annualized Linked QTD change

13.3%

1,075

(396)

18

21,040

21,737

Sep 30, 2012

Commercial Banking

Retail

Acquired

Dec 31, 2012 |

28

Deposits

Linked Quarter Change

(in $ millions)

Total

21,363

21,751

Commercial

Retail

Annualized linked QTD change

6.7%

8.8%

Annualized Linked QTD change- Total

7.3%

15,742

16,006

5,745

5,621

264

124

Sep 30, 2012

Retail

Commercial

Dec 31, 2012 |

29

Non-Interest Income

Linked Quarter Change

(in $ millions)

81.4

84.3

(1.6)

(2.8)

0.8

0.3

0.7

2.7

2.8

3Q 2012

Insurance

Bank

Service

Charges

Gain on

Loan Sales

Loan

Prepayment

Fees

Gain on

Branch Sale

Trust &

Brokerage

Fees

Other

4Q 2012 |

30

1.48

2.00

2.34

1.00

2.00

3.00

4.00

1Q 2010

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

PBCT

Peer Group Median

Top 50 Banks by Assets

Since 1Q 2010

Asset Quality

NPAs / Loans & REO* (%)

*

Non-performing

assets

(excluding

acquired

non-performing

loans)

as

a

percentage

of

originated

loans

plus

all

REO

and

repossessed

assets;

acquired

non-performing

loans

excluded

as

risk

of

loss

has

been

considered

by

virtue

of

(i)

our

estimate

of acquisition-date fair value, (ii) the existence of an FDIC loss sharing agreement, and/or

(iii) allowance for loan losses established subsequent to acquisition

Peer Group Median represents 15 of 20 peers reporting

Top 50 Banks by Assets represents 32 of 50 banks reporting

Source: SNL Financial and Company filings |

31

Since 1Q 2010

0.19

0.33

0.51

0.00

0.50

1.00

1.50

2.00

1Q 2010

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

PBCT

Peer Group Median

Top 50 Banks

Asset Quality

Net Charge-Offs / Avg. Loans (%)

Source: SNL Financial and Company filings |

32

Historical Charge-off Experience

2007 –

2012

0.10%

0.10%

0.29%

0.40%

0.28%

0.21%

0.0%

0.5%

1.0%

1.5%

2.0%

2007

2008

2009

2010

2011

2012 |

33

Return on Assets

Operating ROAA (%)

Return on assets has remained in-line with peers, supported by organic

loan and deposit growth and the integration of recent acquisitions

0.87

0.99

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

PBCT

Peers |

34

8.6

12.4

11.8

0

3

6

9

12

15

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

PBCT

Peers

PBCT - Normalized Equity

High levels of equity produce below industry ROATE. Normalizing

our

equity base shows that the core bank is performing in-line with peers. As

we continue to efficiently deploy capital actual ROATE will improve

further Return on Tangible Equity

1

Operating ROATE (%)

Notes:

1.

PBCT –

Normalized Equity shows Operating ROATE pro forma for normalized Tangible

Common Equity of 7.75%, in line with peers (see Appendix) and excludes the income related

to cash & securities above the normalized 7.75% TCE/TA level

2.

Peer Group Median represents 18 of 20 peers reporting |

35

Operating Dividend Payout Ratio

Since 1Q 2010

175%

180%

209%

157%

104%

98%

87%

96%

93%

82%

84%

85%

1Q

2010

2Q

2010

3Q

2010

4Q

2010

1Q

2011

2Q

2011

3Q

2011

4Q

2011

1Q

2012

2Q

2012

3Q

2012

4Q

2012 |

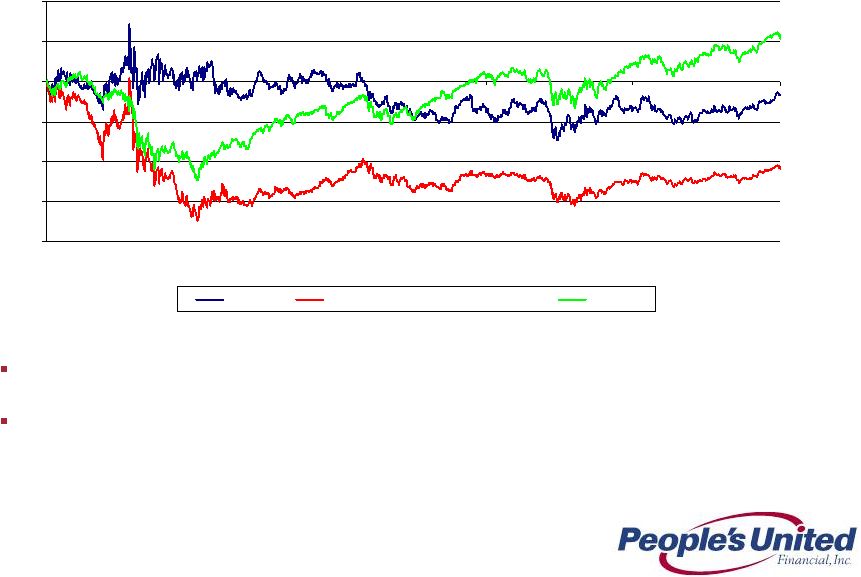

36

Substantial Progress in the Midst of a Financial Crisis

Total Shareholder Return -

Past 5 Years

Source: SNL Financial

April 2007 we raised $3.4BN in our second step conversion

Our conservative credit culture and funding structure coupled with industry

leading capital levels provided significant strength throughout the crisis

(7.0)

(43.6)

21.3

(80.0)

(60.0)

(40.0)

(20.0)

0.0

20.0

40.0

Feb-08

Feb-09

Feb-10

Feb-11

Feb-12

Feb-13

PBCT

SNL Mid Cap U.S. Bank & Thrift

S&P 500 |

37

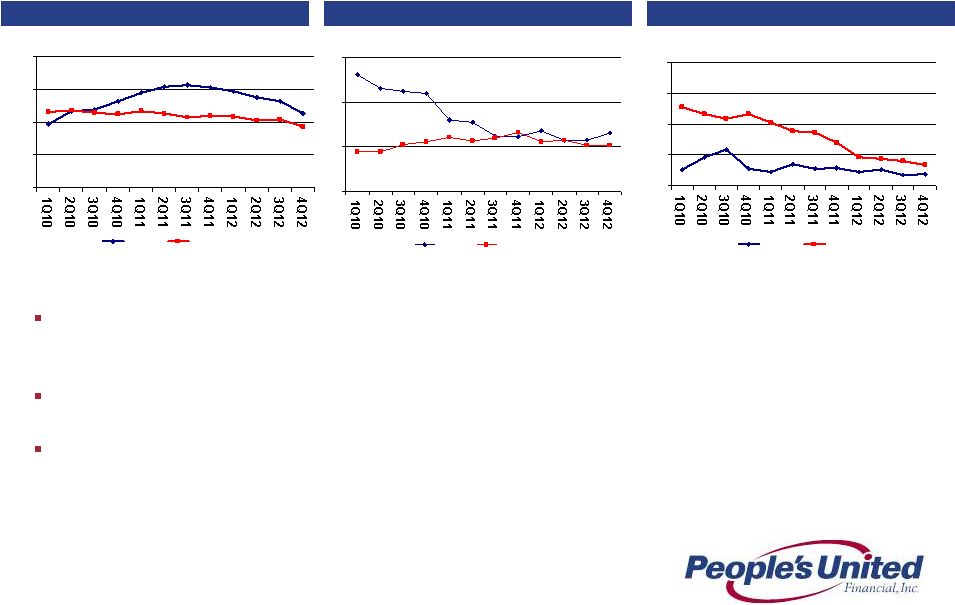

Substantial Progress in the Midst of a Financial Crisis

Key Performance Metrics Since 1Q 2010

Our margin remains well above peers as we thoughtfully deployed capital in

acquisitions and deepened our presence in the Boston and New York metro areas

Under new management we have made considerable progress on our efficiency ratio

Our exceptional credit quality throughout the financial crisis has allowed us to

manage our business with a long-term view

Efficiency Ratio (%)

Operating NIM (%)

Net Charge-offs/Avg. Loans (%)

3.63

3.43

2.50

3.00

3.50

4.00

4.50

PBCT

Peers

63.1

60.3

50

60

70

80

PBCT

Peers

0.19

0.33

0.0

0.5

1.0

1.5

2.0

PBCT

Peers |

38

Substantial Progress in the Midst of a Financial Crisis

Growing Loans, Deposits and Returning Capital to Shareholders

Growth has far outstripped peers on the key metrics of loans per

share

and deposits per share

This has occurred while we have returned $1.9BN to shareholders

during this period. Returns of capital were in the form of both

dividends ($1.1BN) and share repurchases ($0.8BN) which represents

nearly 45% of our current market capitalization

Line Item

PBCT

Peer

Median

PBCT Vs.

Peers

5-Year Loans Per Share CAGR

17.1%

-1.3%

+18.4%

5-Year Deposits Per Share CAGR

17.7%

2.0%

+15.7%

Notes:

5-Year CAGR figures based on 4Q 2007 to 4Q 2012 data

|

39

Loans

Deposits

Growing Future Earnings Per Share

Loans and Deposits per Share

$65.59

$14

$15

$16

$17

$18

$19

$20

$21

$22

$23

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

$40

$45

$50

$55

$60

$65

$70

Gross Loans ($BN)

Loans per Share

$65.64

$14

$15

$16

$17

$18

$19

$20

$21

$22

$23

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

$40

$45

$50

$55

$60

$65

$70

Deposits ($BN)

Deposits per Share

Over the past two years, loans per share and deposits per share have grown at

compound annual rates of 16% and 14% |

40

Strong Sources of Liquidity

PBCT maintains high levels of liquidity and is 90% funded by deposits, retail

repurchase agreements, senior debt and common equity

Strong branch franchise and commercial customer base predominantly funds loan

base without use of brokered borrowings

Citizens transaction added $325MM in deposits and provides a significant

long- term opportunity to grow customer relationships in southern New York,

specifically on Long Island and in Westchester County

Additional

liquidity

of

$2.4BN

exists

in

the

form

of

unpledged

U.S.

Agency

MBS

&

CMO’s

Federal Home Loan Bank (FHLB) relationship enables up to $2.5BN of additional

borrowings |

41

Notes:

1.

Leverage

(core)

Capital

represents

Tier

1

Capital

(total

stockholder’s

equity,

excluding:

(i)

after-tax

net

unrealized

gains

(losses)

on

certain

securities

classified

as

available

for

sale;

(ii)

goodwill

and

other

acquisition-related

intangibles;

and

(iii)

the

amount

recorded

in

accumulated

other

comprehensive

income

(loss)

relating

to

pension

and

other

postretirement benefits), divided by Adjusted Total Assets (period end total assets

less goodwill and other acquisition-related intangibles) 2.

Tier 1 Common represents total stockholder’s equity, excluding goodwill and

other acquisition-related intangibles, divided by Total Risk-Weighted Assets

3.

Tier 1 Risk-Based Capital represents Tier 1 Capital divided by Total

Risk-Weighted Assets 4.

Total

Risk-Based

Capital

represents

Tier

1

Capital

plus

subordinated

notes

and

debentures,

up

to

certain

limits,

and

the

allowance

for

loan

losses,

up

to

1.25%

of

total

risk

weighted assets, divided by Total Risk-Weighted Assets

5.

Well capitalized limits for the Bank are: Leverage Ratio, 5%; Tier 1 Risk-Based

Capital, 6%; and Total Risk-Based Capital, 10% Capital Ratios

Since 1Q 2010

1Q 2010

1Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

People’s United Financial

Tang. Com. Equity/Tang. Assets

18.7%

13.9%

11.7%

11.4%

11.2%

10.2%

Leverage Ratio

1, 5

19.2%

14.5%

12.1%

11.8%

11.5%

10.6%

Tier 1 Common ²

23.1%

17.1%

13.9%

13.6%

13.6%

12.7%

Tier 1 Risk-Based Capital

3, 5

23.9%

17.9%

14.4%

14.1%

14.1%

13.2%

Total Risk-Based Capital

4, 5

25.6%

19.4%

16.0%

15.6%

15.6%

14.7%

People’s United Bank

Leverage Ratio

1, 5

12.3%

11.4%

11.0%

10.9%

10.8%

9.8%

Tier 1 Risk-Based Capital

3, 5

15.4%

13.9%

13.1%

13.0%

13.2%

12.2%

Total Risk-Based Capital

4,5

16.3%

14.8%

14.0%

14.0%

14.1%

13.1% |

42

Summary

Sustainable Competitive Advantage

Premium brand built over 170 years

High quality Northeast footprint characterized by wealth, density and

commercial activity

Strong leadership team

Solid net interest margin

Superior asset quality

Focus on relationship-based banking

Growing

loans

and

deposits

within

footprint

-

in

two

of

the

largest

MSAs

in

the country (New York City, #1 and Boston, #10)

Improving profitability

Returning capital to shareholders

Strong capital base as evidenced by robust Tier 1 Risk-Based and Tier 1

Common ratios |

Appendix |

Allowance for Loan Losses

Originated Portfolio Coverage Detail

(in $ millions)

1.20%

1.13%

0.00%

0.50%

1.00%

1.50%

2.00%

NPLs:Loans

ALLL:Loans

Commercial

Banking

1.54%

0.36%

0.00%

0.50%

1.00%

1.50%

2.00%

NPLs:Loans

ALLL:Loans

Retail Banking

Commercial ALLL -

$157.5 million

95% of Commercial NPLs

Retail ALLL -

$20.0 million

23% of Retail NPLs

Total ALLL -

$177.5 million

70% of Total NPLs

1.30%

0.91%

0.00%

0.50%

1.00%

1.50%

2.00%

NPLs:Loans

ALLL:Loans

Total |

For

3Q 2012 we were more than twice as asset sensitive as the estimated median of our peer

group

Currently for an immediate parallel increase of 100bps, our net interest income is

projected to increase by ~$48MM on an annualized basis

Yield curve twist scenarios confirm that we are reasonably well protected from bull

flattener (short rates are unchanged, long rates fall) and benefit

considerably from bear flattener environments (short rates rise, long rates

are unchanged) Notes:

1.

Analysis is as of 9/30/12 filings

2.

Data as of 9/30/12 SEC filings; where exact +100bps shock up scenario data was not

provided, PBCT interpolated based on data disclosed 3.

Data as of 9/30/12 SEC filings; where exact +200bps shock up scenario data was not

provided, PBCT interpolated based on data disclosed Current Asset

Sensitivity Net

Interest

Income

at

Risk

1

Analysis involves PBCT estimates, see notes below

Change in Net Interest Income

Scenario

Lowest

Amongst Peers

Highest

Amongst Peers

Peer Median

PBCT Multiple to

Peer Median

Shock Up

100bps

2

-3.6%

6.7%

2.7%

2.8x

Shock Up

200bps

3

-6.2%

13.4%

4.5%

3.4x |

46

Name

Position

Years in

Banking

Professional

Experience

Jack Barnes

President & CEO, Director

30+

People’s United Bank (SEVP, CAO),

Chittenden, FDIC

Kirk Walters

SEVP & CFO, Director

25+

People’s United Bank, Santander, Sovereign,

Chittenden, Northeast Financial

Jeff Tengel

SEVP Commercial Banking

30+

People’s United Bank, PNC, National City

Bob D’Amore

SEVP Retail & Business Banking

30+

People’s United Bank

Louise Sandberg

SEVP Wealth Management

30+

People’s United Bank, Chittenden

Lee Powlus

SEVP & Chief Administrative Officer

25+

People’s United Bank, Chittenden, Alltel

Chantal Simon

SEVP & Chief Risk Officer

20+

People’s United Bank, Merrill Lynch US Bank,

Lazard Freres & Co.

Dave Norton

SEVP & Chief HR Officer

2+

People’s United Bank, New York Times,

Starwood, PepsiCo

Bob Trautmann

SEVP & General Counsel

20+

People’s United Bank, Tyler Cooper & Alcorn

Management Committee |

47

Peer Group

Firm

Ticker

City

State

1

Associated

ASBC

Green Bay

WI

2

BancorpSouth

BXS

Tupelo

MS

3

City National

CYN

Los Angeles

CA

4

Comerica

CMA

Dallas

TX

5

Commerce

CBSH

Kansas City

MO

6

Cullen/Frost

CFR

San Antonio

TX

7

East West

EWBC

Pasadena

CA

8

First Niagara

FNFG

Buffalo

NY

9

FirstMerit

FMER

Akron

OH

10

Fulton

FULT

Lancaster

PA

11

Huntington

HBAN

Columbus

OH

12

M&T

MTB

Buffalo

NY

13

New York Community

NYCB

Westbury

NY

14

Signature

SBNY

New York

NY

15

Susquehanna

SUSQ

Lititz

PA

16

Synovus

SNV

Columbus

GA

17

Valley National

VLY

Wayne

NJ

18

Webster

WBS

Waterbury

CT

19

Wintrust

WTFC

Lake Forest

IL

20

Zions

ZION

Salt Lake City

UT |

48

In addition to evaluating People’s United Financial’s results of operations in accordance

with U.S. generally accepted accounting principles (“GAAP”), management routinely

supplements this evaluation with an analysis of certain non-GAAP financial measures, such

as the efficiency and tangible equity ratios, tangible book value per share and operating

earnings metrics. Management believes these non-GAAP financial measures provide information

useful to investors in understanding People’s United Financial’s underlying operating performance

and trends, and facilitates comparisons with the performance of other banks and thrifts. Further, the

efficiency ratio and operating earnings metrics are used by management in its assessment of

financial performance, including non-interest expense control, while the tangible equity

ratio and tangible book value per share are used to analyze the relative strength of

People’s United Financial’s capital position. The

efficiency

ratio,

which

represents

an

approximate

measure

of

the

cost

required

by

People’s

United

Financial

to

generate

a

dollar

of

revenue,

is

the

ratio

of

(i)

total

non-interest

expense

(excluding

goodwill

impairment charges, amortization of other acquisition-related intangible assets, losses on real

estate assets and

non-recurring

expenses)

(the

numerator)

to

(ii)

net

interest

income

on

a

fully

taxable

equivalent

("FTE")

basis plus total non-interest income (including the FTE adjustment on bank-owned life

insurance ("BOLI") income, and excluding gains and losses on sales of assets other than

residential mortgage loans, and non- recurring income) (the denominator). People’s

United Financial generally considers an item of income or expense to be non-recurring if it

is not similar to an item of income or expense of a type incurred within the last two years and

is not similar to an item of income or expense of a type reasonably expected to be incurred

within the following two years.

Non-GAAP Financial Measures and Reconciliation to GAAP

|

49

Operating earnings exclude from net income those items that management considers to be of such a

non- recurring or infrequent nature that, by excluding such items (net of income taxes),

People’s United Financial’s results can be measured and assessed on a more consistent

basis from period to period. Items excluded from operating earnings, which include, but are not

limited to, merger-related expenses, charges related to executive-level management

separation costs, severance-related costs and writedowns of banking house assets, are

generally also excluded when calculating the efficiency ratio. Operating earnings per share is

derived by determining the per share impact of the respective adjustments to arrive at operating

earnings and adding (subtracting) such amounts to (from) GAAP earnings per share. Operating

return on average assets is calculated by dividing operating earnings (annualized) by average

assets. Operating return on average tangible stockholders' equity is calculated by dividing

operating earnings (annualized) by average tangible stockholders' equity. The operating

dividend payout ratio is calculated by dividing dividends paid by operating earnings for the

respective period. Operating net interest margin excludes from the net interest margin those

items that management considers to be of such a discrete nature that, by excluding such items,

People’s United Financial’s net interest margin can be measured and assessed on a

more consistent basis from period to period. Items excluded from operating net interest margin

include cost recovery income on acquired loans and changes in the accretable yield on acquired

loans stemming from periodic cash flow reassessments. Operating net interest margin is calculated

by dividing operating net interest income (annualized) by average earning assets.

Non-GAAP Financial Measures and Reconciliation to GAAP

|

50

The

tangible

equity

ratio

is

the

ratio

of

(i)

tangible

stockholders’

equity

(total

stockholders’

equity

less

goodwill

and

other

acquisition-related

intangible

assets)

(the

numerator)

to

(ii)

tangible

assets

(total

assets

less

goodwill

and

other

acquisition-related

intangible

assets)

(the

denominator).

Tangible

book

value

per

share

is calculated

by

dividing

tangible

stockholders’

equity

by

common

shares

(total

common

shares

issued,

less

common shares classified as treasury shares and unallocated Employee Stock Ownership Plan

("ESOP") common shares).

In light of diversity in presentation among financial institutions, the methodologies used by

People’s United Financial for determining the non-GAAP financial measures discussed

above may differ from those used by other financial institutions. Please refer to People’s

United Financial’s latest Form 10-Q regulatory filing for detailed reconciliations to

GAAP figures. Non-GAAP Financial Measures and Reconciliation to GAAP

|

For

more information, investors may contact: Peter Goulding, CFA

203-338-6799

peter.goulding@peoples.com |