Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SONIC AUTOMOTIVE INC | d489055d8k.htm |

| EX-99.3 - EX-99.3 - SONIC AUTOMOTIVE INC | d489055dex993.htm |

| EX-99.1 - EX-99.1 - SONIC AUTOMOTIVE INC | d489055dex991.htm |

Sonic Automotive, Inc.

1

Q4 2012 Earnings Review

February 20, 2013

Exhibit 99.2 |

Sonic Automotive, Inc.

These forward-looking statements, risks, uncertainties and additional factors speak only as of the

date of this presentation. We undertake no obligation to update any such statements.

You are cautioned that these forward-looking statements are not guarantees of future performance,

involve risks and uncertainties and actual results may differ materially from those projected

in the forward-looking statements as a result of various factors. These risks and

uncertainties include, among other things, (a) economic conditions in the markets in which we

operate, (b) the success of our operational strategies, (c) our relationships with the

automobile manufacturers and (d) new and pre-owned vehicle sales volume. These risks and

uncertainties, as well as additional factors that could affect our forward-looking

statements, are described in our Form 10-K for the year ending December 31, 2011 and our

Form 10-Q for the quarter ended September 30, 2012. 2

Forward-Looking Statements

This presentation contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements relate to future

events, are not historical facts and are based on our current expectations and assumptions

regarding our business, the economy and other future conditions. These statements can

generally be identified by lead-in words such as “believe”, “expect”,

“anticipate”, “intend”, “plan”, “foresee”, “may” ,”will” and other similar words.

Statements that describe our Company’s objectives, plans or goals are also forward-looking

statements. Examples of such forward-looking information we may be discussing in this

presentation include, without limitation, further implementation of our operational strategies

and playbooks, future debt retirement, capital expenditures, operating margins and revenues,

inventory levels and new vehicle industry sales volume. |

Sonic Automotive, Inc.

3

Sonic Automotive Q4 2012

o

Quarter in Review

o

Financial Results

o

Operations Recap

o

Summary and Outlook |

Sonic Automotive, Inc.

4

Overall Results

Revenue Growth –

up 10.4%

New

retail

vehicle

revenue

up

15.7%

-

volume

up

14.5%

-

exceeds industry retail volume growth

Pre-owned unit volume up 6.3%

F&I revenue up 19.0%

Fixed Operations revenue up 3.0%

SG&A

at

75.4%

for

quarter

and

76.8%

for

the

year

–

beating

our

target of 78.0%

Income from continuing operations of $28.8 million, up 13.2% from

an adjusted balance in the prior year quarter*

Q4 2012 diluted EPS from continuing operations was $0.52 per

share

vs.

$0.43*

in

prior

year

period

–

up

21%

* -

Q4 2011 adjusted amounts exclude a pretax charge of $6.8M (after-tax of $4.2M),

or $0.07 per diluted share related to debt repurchase activity. See

Appendix for reconciliation to GAAP amounts. |

Sonic Automotive, Inc.

Results (1)

B/(W) than Q4

2011

B/(W) than

FY 2011

(amounts in millions, except per share data)

Q4 2012

$

%

FY 2012

$

%

Revenue

$ 2,189

$ 205

10%

$ 8,365

$ 845

11%

Gross Profit

$ 314

$ 20

7%

$ 1,235

$ 77

7%

Operating Profit

$ 65

$ 3

5%

$ 240

$ 14

6%

Interest & Other

($ 20)

$ 2

8%

($ 78)

$ 8

9%

Continuing Ops:

Profit (after tax)

$ 29

$ 3

13%

$ 100

$ 15

17%

Diluted EPS

$ 0.52

$ 0.09

21%

$ 1.71

$ 0.28

20%

SG&A as % of Gross

75.4%

(10) bps

76.8%

20 bps

5

(1)

–

See

appendix

for

reconciliation

of

Q4

2011

adjusted

amounts

and

FY

2012

and

FY

2011

adjusted

amounts

to

GAAP

amounts.

Q4 2012 contained no adjusted amounts. |

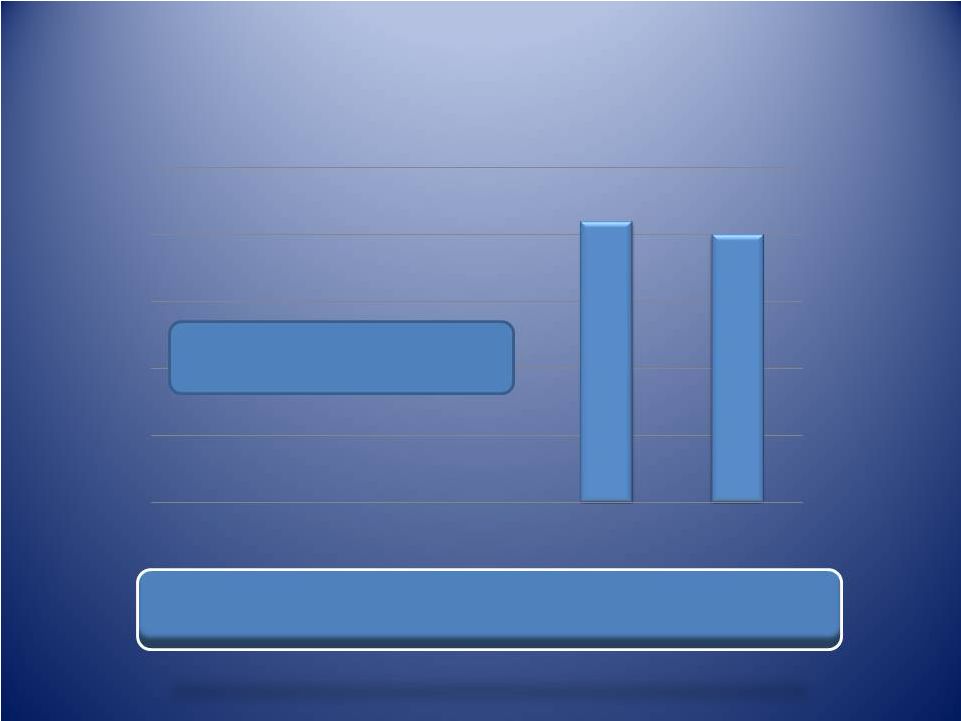

Better than Full Year Target of 78%

(1) –

See appendix for reconciliation to GAAP amounts.

Sonic Automotive, Inc.

Q4 2011

Q4 2012

FY 2011

FY 2012

75.3%

75.4%

77.0%

76.8%

SG&A to Gross (1) |

7

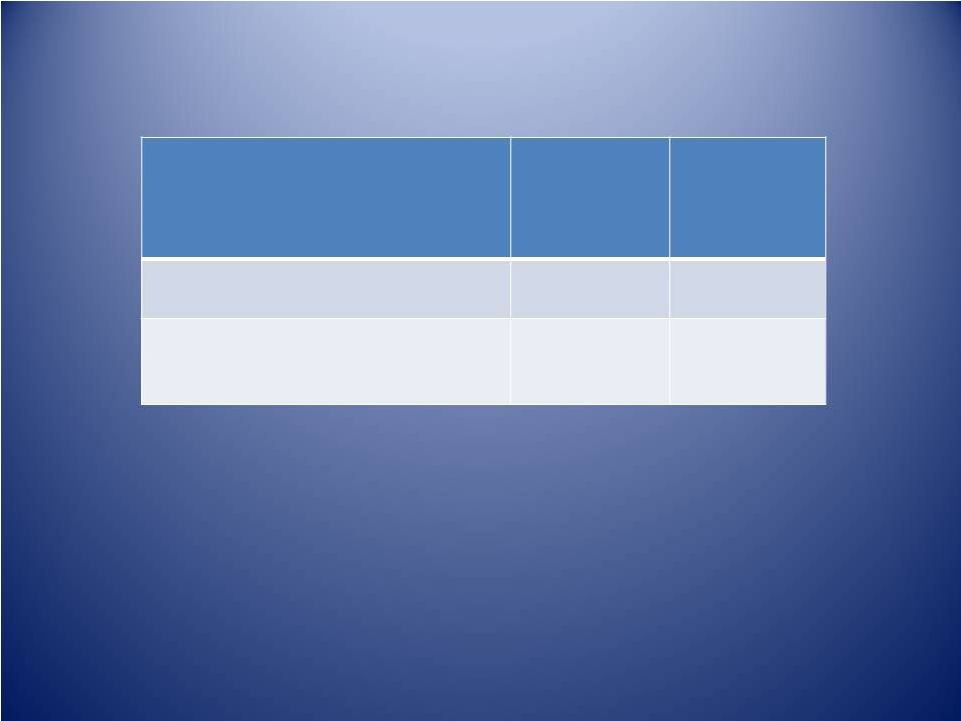

(amounts in millions)

YTD 2012

Estimated

2013

Real Estate Acquisitions

$ 14.6

$ 59.7

All Other Cap Ex

80.8

102.6

Subtotal

$ 95.4

$ 162.3

Less: Mortgage Funding

(25.7)

(65.6)

Total Cash Used –

Cap Ex

$ 69.7

$ 96.6

Capital Spending

Sonic Automotive, Inc. |

8

Debt Covenants

Compliant with all Covenants

Covenant

Actual Q4

2012

Liquidity Ratio

>= 1.05

1.15

Fixed Charge Coverage Ratio

>= 1.20

1.69

Total Lease Adjusted Leverage

Ratio

<= 5.50

3.94

Sonic Automotive, Inc. |

9

Public Debt Maturities

(amounts in millions)

9%

Notes

Sonic Automotive, Inc.

No Near Term Maturities

7%

Notes

$210

$200

2013

2014

2015

2018

2022

$0

$0

$0

The Converts are Gone! |

Sonic Automotive, Inc.

Stock Repurchases

10

(shares in thousands)

Shares

Average

Price

Q4 2012 Activity

3,454

$19.27

Total 2012 Activity

4,364

$19.00

•

Approximately $50 million repurchase authorization remaining at

12/31/2012

•

Approval granted for an additional $100 million subsequent to year-end

for total unused authorization of approximately $144 million today

|

Sonic Automotive, Inc.

Share Count

11

(amounts in thousands)

YTD

2011

YTD

2012

Expected

2013

Fully Diluted Share

Count

65,464

60,406

54,000

Decline of

17.5% |

Sonic Automotive, Inc.

New Retail Vehicles

Q4 2012

Q4 2011

B/(W)

Volume

33,767

29,482

15%

Selling Price

$ 37,312

$ 36,946

1.0%

Gross Margin %

6.1%

6.3%

(20 bps)

GPU

$2,260

$ 2,327

($67)

Gross Profit

$76 million

$69

million

11.2%

SAAR (includes fleet)

15.0 million

13.5

million

11.1%

12 |

Sonic Automotive, Inc.

Used Retail Vehicles

Q4 2012

Q4 2011

B/(W)

Retail Volume

23,943

22,520

6%

Used Retail GPU

$ 1,369

$ 1,461

($ 92)

Used Related Retail Gross*

$ 73

million

$ 70

million

$ 3 million

Used to New

0.71 : 1

0.76 : 1

(0.05)

Vehicles / store / month

80

75

5

13

* - Includes front-end gross plus F&I related gross and fixed operations related gross

|

Sonic Automotive, Inc.

Fixed Operations

14

QTD YOY Gross Profit Change Breakdown:

B/(W) than Q4

2011

(amounts in millions)

Q4 2012

$

%

Revenue

$ 287

$ 8.4

3.0%

Gross Profit

$ 141

$ 3.7

2.7%

•

Customer Pay Up 1.0%

•

Whsl. Parts Down 1.0%

•

Internal & Sublet Up 8.8%

•

Warranty Up 3.9% |

Sonic Automotive, Inc.

15

Summary

Record Q4 income from continuing operations

Record full year 2012 retail units of 231,192

Revenue growth continues at double digit rates

Continued investment in the base business while beating

our cost target for SG&A as a percent of gross for full year

Inventory levels back to normal

Effects of the elimination of the 5% Converts beginning to

show through

Poised to opportunistically repurchase shares with

additional Board authorization |

Sonic Automotive, Inc.

16

2013 Outlook

•

Expect New Vehicle SAAR of 15.0 to 15.5 Million

•

Pre-Owned Vehicle Growth in Mid-Single Digits

•

Property Purchases to Continue

•

Expect SG&A to be Below 77%

•

Targeting 2013 Diluted EPS from Continuing

Operations

of

$1.93

-

$2.03 |

Sonic Automotive, Inc.

17 |

Sonic Automotive, Inc.

Predictable

Repeatable

Sustainable

•

Grow the Base Business

-

Developing

Predictable

-

Repeatable

-

Sustainable

Business

Model

•

Playbooks -

Uniform Best Practices

•

People

-

Culture

of

Customer-Centric

Organization

•

Systems -

Stable, Flexible and Secure Delivery Systems

•

Data -

Use to Drive Business Decisions Throughout the Organization

-

Grow Through Knowledge in Core Competencies

•

Own Our Properties

-

Create Value on the Balance Sheet

-

Lower Cost Option

•

Opportunistically Grow through Acquisitions

–

Tuck in acquisitions

–

Open points

•

Improve Capital Structure

-

Buy Back Stock Opportunistically

-

Manage Debt Levels

-

Offer Dividend to Reward Shareholders

Strategic Focus

18 |

Sonic Automotive, Inc.

Reconciliation of Non-GAAP Financial Information

19

Fourth Quarter Ended December 31,

Adjusted 2012 B/(W)

2012

2011

than Adjusted 2011

($ in millions, shares in

thousands, except per share data)

As

Reported

Adjustments

As

Adjusted

As

Reported

Adjustments

As

Adjusted

$

%

Revenues

2,188.7

$

-

$

2,188.7

$

1,983.4

$

-

$

1,983.4

$

205.3

$

10.4%

Gross profit

314.1

-

314.1

293.7

-

293.7

20.4

7.0%

Gross margin

14.4%

14.4%

14.8%

14.8%

(40) bps

SG&A

(236.8)

-

(236.8)

(227.9)

6.8

(1)

(221.1)

(15.7)

(7.1%)

SG&A as % of gross profit

75.4%

75.4%

77.6%

75.3%

(10) bps

Impairment charges

(0.4)

-

(0.4)

(0.0)

-

(0.0)

(0.3)

(857.5%)

Depreciation and amortization

(11.9)

-

(11.9)

(10.3)

-

(10.3)

(1.6)

(15.9%)

Operating income

65.1

-

65.1

55.5

6.8

62.3

2.8

4.5%

Operating margin

3.0%

3.0%

2.8%

3.1%

(10) bps

Interest expense, floor plan

(5.5)

-

(5.5)

(4.6)

-

(4.6)

(0.9)

(20.6%)

Interest expense, other, net

(14.2)

-

(14.2)

(16.3)

-

(16.3)

2.1

12.9%

Other income (expense), net

0.2

-

0.2

(0.3)

-

(0.3)

0.4

169.1%

Income (loss) from continuing operations

28.8

-

28.8

21.2

4.2

25.4

3.4

13.2%

Income (loss) from discontinued operations

1.6

-

1.6

(0.7)

(0.4)

(2)

(1.1)

2.7

245.9%

Net income (loss)

30.4

$

-

$

30.4

$

20.5

$

3.8

$

24.4

$

6.0

$

24.8%

Diluted earnings (loss) per common share:

Earnings (loss) per share

from continuing operations

0.52

$

-

$

0.52

$

0.36

$

0.07

$

0.43

$

0.09

$

20.9%

Earnings (loss) per share from

discontinued operations

0.03

-

0.03

(0.01)

(0.01)

(0.02)

0.05

250.0%

Earnings (loss) per common share

0.55

$

-

$

0.55

$

0.35

$

0.06

$

0.41

$

0.14

$

34.1%

Weighted average shares outstanding

54,763

54,763

64,467

64,467

(1) Represents lease exit adjustments and legal settlement charges.

(2) Represents tax-effected amounts related to lease exit

adjustments. This

release

contains

certain

non-GAAP

financial

measures

(the

"Adjusted"

columns)

as

defined

under

SEC

rules,

such

as,

but

not

limited

to,

adjusted

income

from

continuing

operations

and

related

earnings

per

share

data.

The

Company

has

reconciled

these

measures

to

the

most

directly

comparable

GAAP

measures

(the

"Reported"

columns)

in

the

release.

The

Company

believes

that

these

non-GAAP

financial

measures

improve

the

transparency

of

the

Company’s

disclosure

by

providing

period-to-period

comparability

of

the

Company’s

results

from

operations. |

Sonic Automotive, Inc.

Reconciliation of Non-GAAP Financial Information

20

Year Ended December 31,

Adjusted 2012 B/(W)

2012

2011

than Adjusted 2011

($ in millions, shares in

thousands, except per share data)

As

Reported

Adjustments

As

Adjusted

As

Reported

Adjustments

As

Adjusted

$

%

Revenues

8,365.5

$

-

$

8,365.5

$

7,520.8

$

-

$

7,520.8

$

844.7

$

11.2%

Gross profit

1,235.2

-

1,235.2

1,158.6

-

1,158.6

76.5

6.6%

Gross margin

14.8%

14.8%

15.4%

15.4%

(60) bps

SG&A

(949.0)

-

(949.0)

(899.4)

6.8

(3)

(892.6)

(56.4)

(6.3%)

SG&A as % of gross profit

76.8%

76.8%

77.6%

77.0%

20

bps

Impairment charges

(0.4)

-

(0.4)

(0.2)

-

(0.2)

(0.2)

(120.0%)

Depreciation and amortization

(45.3)

-

(45.3)

(39.4)

-

(39.4)

(5.8)

(14.8%)

Operating income

240.4

-

240.4

219.5

6.8

226.4

14.0

6.2%

Operating margin

2.9%

2.9%

2.9%

3.0%

(10) bps

Interest expense, floor plan

(19.5)

-

(19.5)

(18.4)

-

(18.4)

(1.0)

(5.7%)

Interest expense, other, net

(60.1)

1.2

(1)

(58.9)

(66.9)

-

(66.9)

7.9

11.9%

Other income (expense), net

(19.6)

19.7

(2)

0.1

(1.0)

-

(1.0)

1.1

108.7%

Income (loss) from continuing operations

91.3

9.2

100.4

81.5

4.2

85.7

14.7

17.1%

Income (loss) from discontinued operations

(2.2)

-

(2.2)

(5.3)

(0.4)

(4)

(5.7)

3.5

61.9%

Net income (loss)

89.1

$

9.2

$

98.3

$

76.3

$

3.8

$

80.1

$

18.2

$

22.7%

Diluted earnings (loss) per common share:

Earnings (loss) per share

from continuing operations

1.56

$

0.15

$

1.71

$

1.37

$

0.06

$

1.43

$

0.28

$

19.6%

Earnings (loss) per share from

discontinued operations

(0.03)

-

(0.03)

(0.08)

-

(0.08)

0.05

62.5%

Earnings (loss) per common share

1.53

$

0.15

$

1.68

$

1.29

$

0.06

$

1.35

$

0.33

$

24.4%

Weighted average shares outstanding

60,406

60,406

65,464

65,464

(1) Represents double-carry interest in July 2012.

(2) Represents debt extinguishment charges related to the 5% Convertible

Notes. (3) Represents lease exit adjustments and legal settlement

charges. (4) Represents tax-effected amounts related to lease

exit adjustments. This release contains certain non-GAAP

financial measures (the "Adjusted" columns) as defined under SEC rules, such as, but not limited to, adjusted income from continuing operations and related earnings

per

share

data.

The

Company

has

reconciled

these

measures

to

the

most

directly

comparable

GAAP

measures

(the

"Reported"

columns)

in

the

release.

The

Company

believes

that

these

non-GAAP

financial

measures improve the transparency of the Company’s disclosure by

providing period-to-period comparability of the Company’s results from operations. |

Sonic Automotive, Inc.

Reconciliation of Non-GAAP Financial Information

21

Fourth Quarter Ended December 31, 2012

Continuing Operations

Discontinued Operations

Total Operations

($ in millions, shares in

thousands, except per share data)

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Reported basic

28.8

$

54,289

1.6

$

54,289

30.4

$

54,289

Effect of dilutive securities:

Two class method

(0.4)

-

-

-

(0.4)

-

Stock compensation plans

-

474

-

474

-

474

Reported

diluted 28.4

54,763

0.52

$

1.6

54,763

0.03

$

30.0

54,763

0.55

$

Adjusted diluted

28.4

$

54,763

0.52

$

1.6

$

54,763

0.03

$

30.0

$

54,763

0.55

$

Fourth Quarter Ended December 31, 2011

Continuing Operations

Discontinued Operations

Total Operations

($ in millions, shares in

thousands, except per share data)

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Reported basic

21.2

$

52,194

(0.7)

$

52,194

20.5

$

52,194

Effect of dilutive securities:

Two class method

(0.2)

-

-

-

(0.2)

-

Contingently convertible debt

2.3

11,713

-

11,713

2.3

11,713

Stock compensation plans

-

560

-

560

-

560

Reported

diluted 23.3

64,467

0.36

$

(0.7)

64,467

(0.01)

$

22.6

64,467

0.35

$

Adjustments (tax-effected):

Lease exit adjustments

0.7

-

(0.4)

-

0.3

-

Legal settlement charges

3.5

-

-

-

3.5

-

Adjusted diluted

27.5

$

64,467

0.43

$

(1.1)

$

64,467

(0.02)

$

26.4

$

64,467

0.41

$ |

Sonic Automotive, Inc.

Reconciliation of Non-GAAP Financial Information

22

Year Ended December 31, 2012

Continuing Operations

Discontinued Operations

Total Operations

($ in millions, shares in

thousands, except per share data)

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Reported basic

91.3

$

53,550

(2.2)

$

53,550

89.1

$

53,550

Effect of dilutive securities:

Two class method

(1.4)

-

-

-

(1.4)

-

Contingently convertible debt

4.6

6,411

0.1

6,411

4.7

6,411

Stock compensation plans

-

445

-

445

-

445

Reported

diluted 94.5

60,406

1.56

$

(2.1)

60,406

(0.03)

$

92.4

60,406

1.53

$

Adjustments (tax-effected):

Double-carry interest

0.7

-

-

-

0.7

-

Debt extinguishment charges

12.1

-

-

-

12.1

-

Settlement of state tax examination

(3.6)

-

-

-

(3.6)

-

Adjusted diluted

103.7

$

60,406

1.71

$

(2.1)

$

60,406

(0.03)

$

101.6

$

60,406

1.68

$

Year Ended December 31, 2011

Continuing Operations

Discontinued Operations

Total Operations

($ in millions, shares in

thousands, except per share data)

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Net Income

(Loss):

Numerator

Share

Count:

Denominator

Diluted

EPS

Reported basic

81.5

$

52,358

(5.2)

$

52,358

76.3

$

52,358

Effect of dilutive securities:

Two class method

(1.0)

-

-

-

(1.0)

-

Contingently convertible debt

9.1

12,517

0.2

12,517

9.3

12,517

Stock compensation plans

-

589

-

589

-

589

Reported

diluted 89.6

65,464

1.37

$

(5.0)

65,464

(0.08)

$

84.6

65,464

1.29

$

Adjustments (tax-effected):

Lease exit adjustments

0.7

-

(0.4)

-

0.3

-

Legal settlement charges

3.5

-

-

-

3.5

-

Adjusted diluted

93.8

$

65,464

1.43

$

(5.4)

$

65,464

(0.08)

$

88.4

$

65,464

1.35

$ |