Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TMS International Corp. | d486830d8k.htm |

| EX-99.1 - EX-99.1 - TMS International Corp. | d486830dex991.htm |

Fourth Quarter and Full Year 2012

Earnings Call and Webcast

February 14, 2013

Exhibit 99.2 |

This

presentation includes forward-looking statements within the meaning of Section 27A of the Securities

Act

of

1933,

(the

“Exchange

Act”),

as

amended,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934, as

amended, with respect to our financial condition, results of operations and

business and our expectations or beliefs concerning future events. Such

forward-looking statements include the discussions of our business

strategies, estimates of future global steel production, trends toward outsourcing

and other market metrics and our expectations concerning future operations,

margins, profitability, liquidity and capital resources, among others.

Although we believe that such forward-looking statements are reasonable, there can be no assurance

that any forward-looking statements will prove to be correct. Such

forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause our actual results, performance or

achievements

to

be

materially

different

from

any

future

results,

performance or achievements expressed or

implied by such forward-looking statements.

Certain areas of this presentation depict Revenue After Raw Materials Costs, EBITDA

and Discretionary Cash Flow, which are non-GAAP

financial measures. Revenue After Raw Materials Costs, EBITDA and

Discretionary Cash Flow are not and should not be considered alternatives to

revenues or net income or any other financial measure under U.S. GAAP. We

reconcile these measurements to GAAP in our quarterly and annual reports on

forms 10-Q and 10-K, filed with the S.E.C. pursuant to the Exchange Act. Our calculation of

Revenue

After

Raw

Materials

Costs,

EBITDA

and

Discretionary

Cash

Flow

may

differ

from

methods

used

by

other companies.

When

we

use

the

term

“North

America”

in

this

presentation,

we

are

referring

to

the

United

States

and

Canada;

when

we

use

the

term

“International,”

we

are

referring

to

countries

other

than

the

United

States and

Canada;

when

we

use

the

term

“Latin

America,”

we

are

referring

to

Mexico,

Central

America,

South

America

and the Caribbean, including Trinidad & Tobago.

Safe harbor provision

1 |

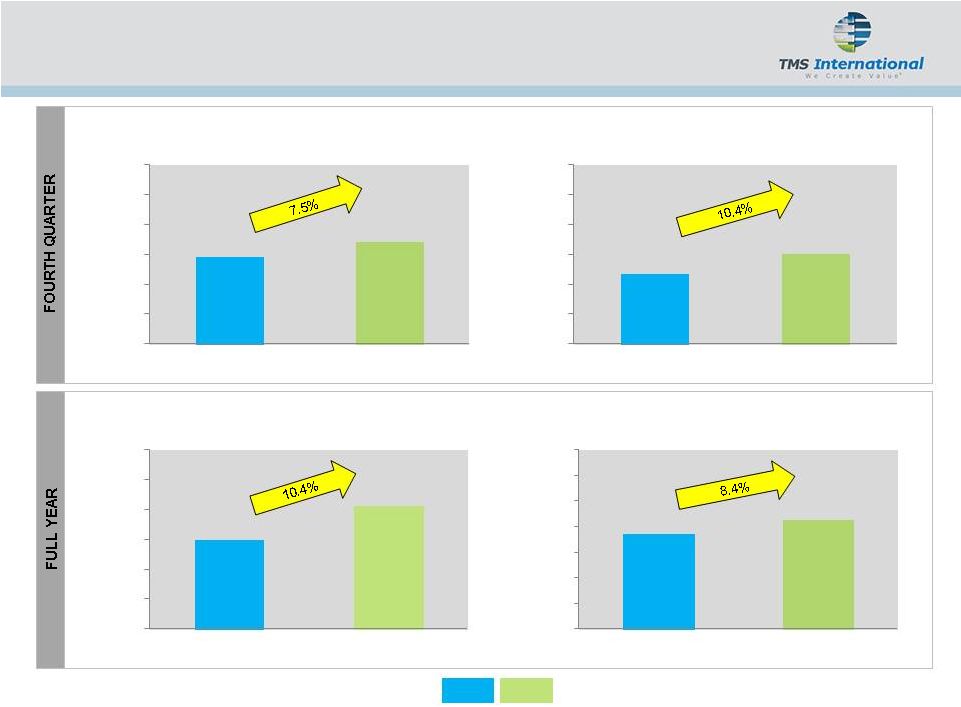

REVENUE AFTER RAW MATERIALS COSTS ($MM)

ADJUSTED EBITDA ($MM)

Fourth quarter and full year 2012 results

REVENUE AFTER RAW MATERIALS COSTS ($MM)

ADJUSTED EBITDA ($MM)

2

2011

2012

$549.5

$606.7

$400

$450

$500

$550

$600

$650

$700

2011

2012

$134.0

$145.3

$60

$80

$100

$120

$140

$160

$180

$200

2011

2012

$137.9

$148.3

$80

$100

$120

$140

$160

$180

$200

2011

2012

$31.7

$35.0

$20

$25

$30

$35

$40

$45

$50

2011

2012 |

Operating environment summary

2012

2011

TMS CUSTOMERS BY REGION

TMS CUSTOMERS BY REGION

3

70.3

70.8

66.7

78.9

67.1

70.4

63.8

84.0

0

20

40

60

80

100

TMS Global

North America

Europe

Latin America

73.5

73.4

72.1

81.8

73.2

75.2

71.1

82.5

0

20

40

60

80

100

TMS Global

North America

Europe

Latin America

75.7

74.8

0

20

40

60

80

100

U.S. Industry

74.4

71.7

0

20

40

60

80

100

U.S. Industry |

2012

2013 YTD

# of MSG contract wins

17

3

Cross-sells

15

2

International

7

2

Growth capital commitment

$37MM

$50-55MM

Additional revenue backlog

$308MM

$266MM

New countries penetrated

South Africa

Poland

Malaysia

MSG operational highlights

4

Continued success winning contracts in targeted regions

|

5

RMOG operational highlights

VOLUME BY CHANNEL

3.3

NORTH AMERICA

INTERNATIONAL

AGENCY

NON-AGENCY

VOLUME BY GEOGRAPHY

3.2

3.3

3.2

13.4

13.4

13.4

13.4

REVENUE AFTER RAW

MATERIALS COSTS ($MM)

10% revenue growth despite flat volumes

$0

$5

$10

$15

$20

$25

2011

2012

$16.2

$17.8

$67.2

$71.8

$0

$25

$50

$75

$100

2011

2012

8.5

8.4

4.9

5.0

0

4

8

12

16

2011

2012

2.0

2.0

1.3

1.2

0

1

2

3

4

2011

2012

2.8

2.8

0.5

0.4

0

1

2

3

4

2011

2012

11.0

11.6

2.4

1.8

0

4

8

12

16

2011

2012 |

Fourth Quarter

($MM)

Full Year

($MM)

2012

2011

%

Change

2012

2011

%

Change

Revenue after raw

materials costs

$148.3

$137.9

+7.5%

$606.7

$549.5

+10.4%

Adjusted EBITDA

$35.0

$31.7

+10.4%

$145.3

$134.0

+8.4%

Discretionary

cashflow

(1)

$20.6

$18.4

+12.0%

$102.6

$92.1

+11.3%

Growth capital

$11.6

$18.1

$68.1

$41.4

Leverage ratio

2.0x

2.1x

2.0x

2.1x

(1) Adjusted EBITDA less Maintenance Capital Expenditures.

Fourth quarter and full year financial highlights

6

Continued global expansion drives year-over-year growth

|

Concluding remarks

7

Investment highlights

Market-leading global industrial services provider

Significant growth profile

Long-term contracted revenue and variable cost structure

Experienced and proven management team

Superior financial strength and liquidity

Strong cash flow generation drives earnings growth

Factors driving growth

Global steel production growing

Increased demand for outsourcing globally

Increased global market share

2013 Adjusted EBITDA guidance of $152 - $160 MM |

|