Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALLEGHANY CORP /DE | d486935d8k.htm |

Alleghany

Exhibit 99.1 |

| FORWARD-LOOKING STATEMENTS

This

presentation

contains

“forward-looking

statements”

within

the

meaning

of the Private Securities Litigation Reform Act of 1995. These forward-looking

statements are not historical facts but instead represent only Alleghany’s

belief regarding future events, many of which, by their nature, are inherently

uncertain and outside Alleghany’s control. Except for Alleghany’s ongoing

obligation to disclose material information as required by federal securities

laws, Alleghany is not under any obligation (and expressly disclaims any

obligation) to update or alter any projections, goals, assumptions, or other

statements, whether written or oral, that may be made from time to time,

whether as a result of new information, future events or otherwise. Factors

that could cause Alleghany’s actual results and experience to differ, possibly

materially, from those expressed in the forward-looking statements include

the factors set forth in Alleghany’s most recent Annual Report on Form 10-K

and Quarterly Reports on Form 10-Q filed with the United States Securities

and Exchange Commission.

Alleghany |

Timeline

Otis & Mantis Van Sweringen (1929)

Robert Young (1937)

Allan Kirby (1958)

F.M. Kirby (1967)

John J. Burns, Jr. (1992)

Weston M. Hicks (2004)

Alleghany |

| A Rich

History Nickel Plate Railroad

Chesapeake & Ohio Railroad

New York Central

MSL Industries

Jones Motor

World Minerals

Investors Diversified Services

Chicago Title & Trust

Sacramento Savings Bank

Underwriters Re

Alleghany |

Alleghany 10

Years Ago ($ bn) Capitol Transamerica

$ 0.2

15%

World Minerals

0.2

15

Other

0.1

6

Operating subsidiaries

$ 0.5

36%

Parent investments

$ 1.0

71%

Parent debt, other

(0.1)

-

Parent, net

$ 0.9

64%

Stockholders’

equity

$ 1.4

100%

Alleghany |

Alleghany

Reinvented: 2002-2012 (2002)

(2003)

(2006)

(2007)

(2012)

Alleghany |

Alleghany Today

($ bn) TransRe

$ 4.3

67%

RSUI Group

1.5

23

Other

0.5

9

(Re)insurance

$ 6.3

99%

Parent investments

$ 0.9

14%

Parent debt, other

(0.8)

(13)

Parent, net

$ 0.1

1%

Stockholders’

equity

$ 6.4

100%

Alleghany |

| TransRe

•

Acquired March 6, 2012 for $3.5 billion in cash

and stock

•

Leading specialty professional reinsurer with

49% of premium outside of US

•

Produced an underwriting profit in first ten

months of Alleghany ownership

•

Expect combined ratio of ~ 96% absent

unusual large catastrophes

Alleghany |

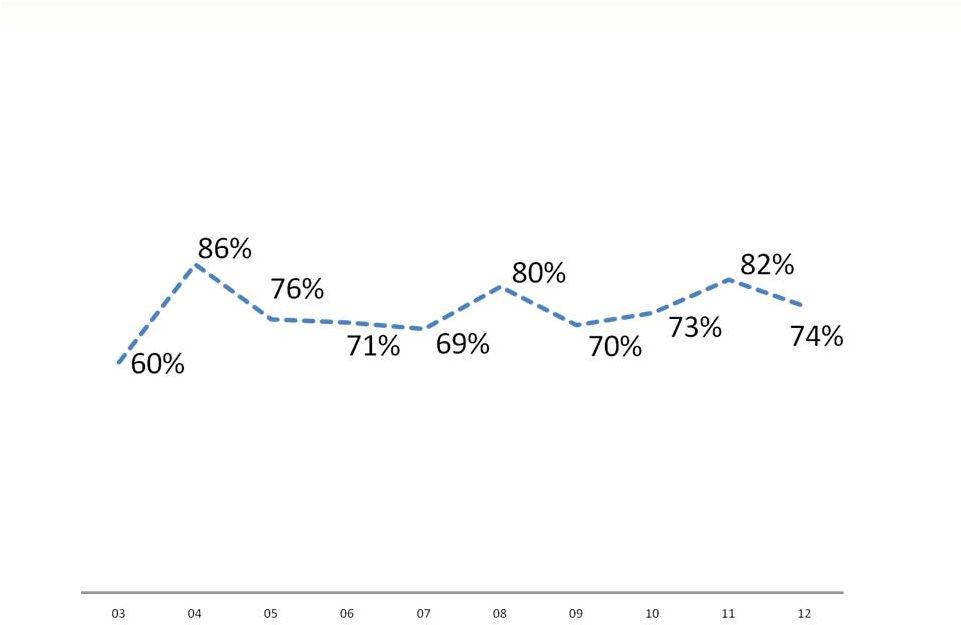

| RSUI Group

•

Acquired July 1, 2003 from Royal & Sun

Alliance; initial investment $626 million

•

Cumulative underwriting profits of $1.1 billion

under Alleghany ownership

•

Stockholder’s equity now $1.5 billion at the

end of 2012 …

after net upstream cash flows

of $300 million

•

Long-term average combined ratio of 81%

including

Katrina

and

Sandy

Alleghany |

RSUI’s

Combined Ratio Alleghany

60%

86%

122%

71%

69%

80%

70%

73%

82%

99%

03

04

05

06

07

08

09

10

11

12 |

RSUI’s

Combined Ratio Ex Katrina (2005) and Sandy (2012)

Alleghany |

| Other Insurance

Operations •

Capitol Insurance Companies –

Small

commercial property-casualty and surety

•

PacificComp

–

California workers’

compensation

•

Homesite

(33% ownership) –

Mono-line

homeowners specialty insurer

Alleghany |

| Alleghany

Capital Partners •

Bourn & Koch (80%) –

machine tools and

grinders

•

Stranded Oil Resources (80%) –

oil recovery

•

ORX Exploration (38%) –

high impact oil and

gas exploration

•

Article One Partners (40%) –

crowd-sourced

patent validation

Alleghany |

| Opportunities

•

Better underlying economy = exposure growth

•

Improving pricing in property lines and select

casualty lines

•

Standard market dislocation = E&S

opportunity

•

Improved competitive position at Capitol and

PacificComp

•

Share repurchases at discount to book value

Alleghany |

| Challenges

•

Negative real interest rates hurts economics

of the business

•

Observed increase in frequency of severe

weather events

•

Relentless claims inflation in California

workers’

compensation

Alleghany |

Alleghany |

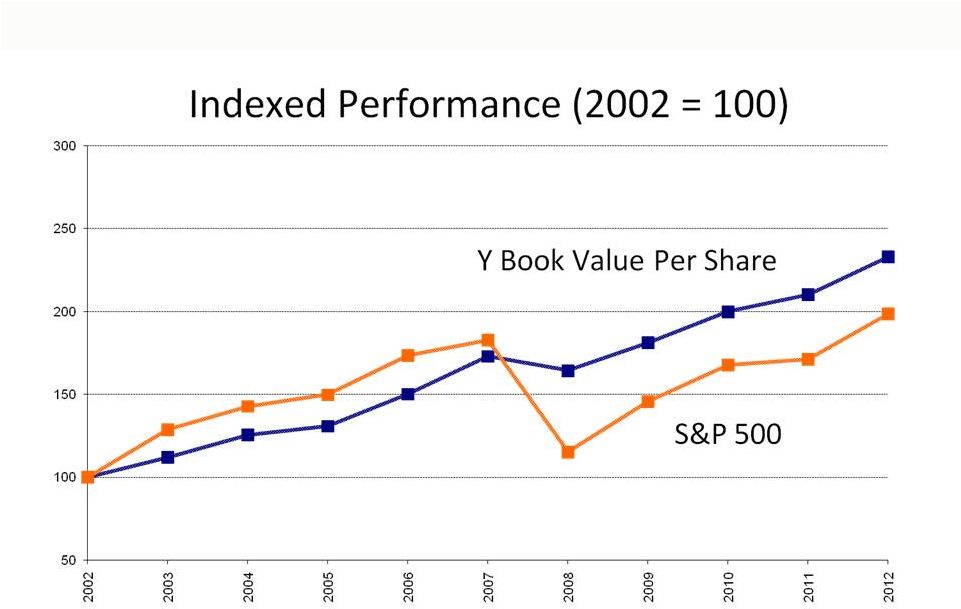

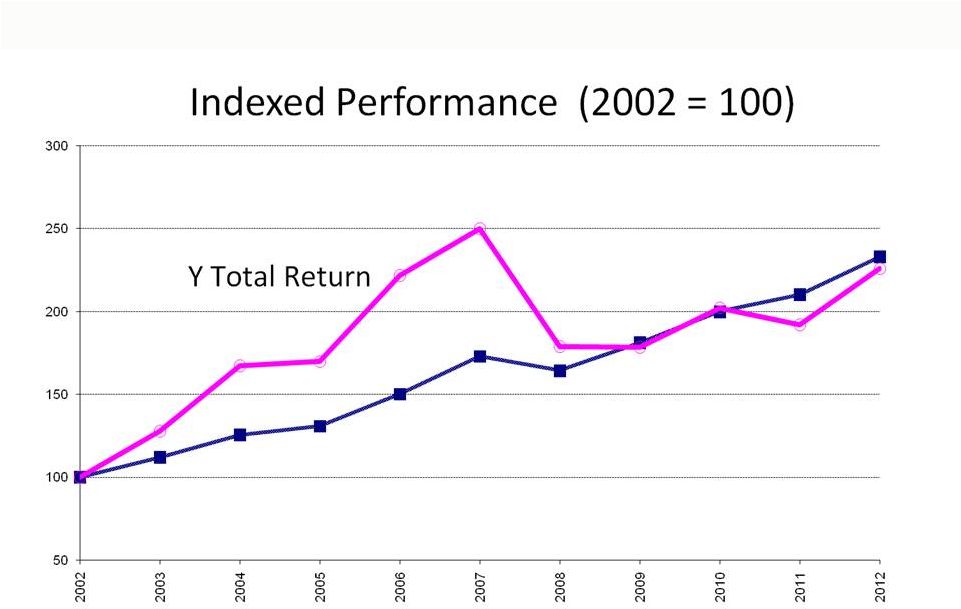

Y Book Value

Per Share Alleghany |