Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MYERS INDUSTRIES INC | d485955d8k.htm |

| EX-99.1 - EX-99.1 - MYERS INDUSTRIES INC | d485955dex991.htm |

| EX-99.3 - EX-99.3 - MYERS INDUSTRIES INC | d485955dex993.htm |

Earnings

Presentation Fourth Quarter & Full Year 2012

February 13, 2013

Exhibit 99.2 |

Safe Harbor

Statement 2

Statements in this presentation concerning the Company’s goals, strategies, and

expectations for business and financial results may be "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform

Act

of

1995

and

are

based

on

current

indicators

and

expectations.

Whenever

you

read

a

statement that is not simply a statement of historical fact (such as when we describe what

we "believe," "expect," or "anticipate" will occur, and

other similar statements), you must remember that our expectations may

not

be

correct,

even

though

we

believe

they

are

reasonable.

We

do

not

guarantee

that

the

transactions

and

events

described

will

happen

as

described

(or

that

they

will

happen

at

all). You

should

review

this

presentation with the understanding that actual future results may be materially different

from what we expect.

Many

of

the

factors

that

will

determine

these

results

are

beyond

our

ability

to

control

or

predict. You

are

cautioned

not

to

put

undue

reliance

on

any

forward-looking

statement.

We

do

not

intend,

and

undertake

no obligation, to update these forward-looking statements. These statements involve a

number of risks and uncertainties that could cause actual results to differ

materially from those expressed or implied in the applicable statements. Such risks

include: (1) Fluctuations in product demand and market acceptance

(2) Uncertainties associated with the general economic conditions in domestic and

international markets (3) Increased competition in our markets

(4) Changes in seasonality

(5)

Difficulties

in

manufacturing

operations,

such as

production

outages

or

maintenance

programs

(6) Raw material availability

(7)

Fluctuations

in

raw

material

costs;

fluctuations

outside

the

“normal”

range

of

industry

cycles

(8) Changes in laws and regulations and approvals and decisions of courts, regulators, and

governmental bodies

Myers Industries, Inc. encourages investors to learn more about these risk factors. A

detailed explanation of these factors is available in the Company’s publicly

filed quarterly and annual reports, which

can

be

found

online

at

www.myersind.com

and

at

the

SEC.gov

web

site. |

Full Year 2012

Highlights •

Achieved 40% increase in adjusted EPS

•

$0.94 compared to $0.67 in 2011

•

Completed two strategic acquisitions which were accretive

•

Novel & Jamco

3

•

6% of total sales in 2012 came from products, services or markets

developed in the last three years.

•

Realized $16 million in Operations Excellence savings

•

3% of Cost of Goods sold

•

Increased capital spending by $5.1 million to $27 million

•

55% was for growth oriented projects

•

Returned cash to shareholders through dividend increase of 14% and

300k share buyback

•

As part of Innovation initiative more than 40 new products and services

were introduced (see next slide for examples) |

4

New Products in 2012

Bin Clip

(Patented)

18”

Deep

Pick Rack

Extra-Duty Bulk

Box

Electronic Testing

Equipment for Truck

Fleets

Preset Gauge

Inflator

Water Based

Tread Cement

New Sizes Co-Ex

Pots & Trays

True Size

Nursery

Containers

360 Cell

Plug Tray

Slope-It

Bin Insert

Lean Panel -

Industry First

Tilt-View

The Grow Box

Decorative

Containers

Sloped

Louvered Panel |

Full Year 2012

Financial Summary 5

•

Sales increased 4.7%

•

Strategic initiative centered on

Innovation

generated

6% of

total sales

•

Novel acquisition contributed

to sales increase in Material

Handling

•

Gross margin expanded to

27.2% from 26.2%

•

Operations Excellence

initiatives drove productivity

improvements and cost

savings

•

Adjusted EPS increased 40%

P&L

FY

FY

Highlights

2012

2011

B/(W)

Net sales

$791.2

$755.7

4.7%

Gross

margin

27.2%

26.2%

3.9%

SG&A

$163.4

$159.9

-2.2%

Net

income -

adjusted*

$32.1

$23.4

37.2%

Effective

tax rate

36.7%

---

EPS -

adjusted*

$0.94

$0.67

40.3%

*See Reconciliation of Non-GAAP measures on slide 19

Note: All figures except ratios and percents are $Millions

|

Full Year 2012

Financial Summary 6

Notes: All figures except ratios and percents are $Millions

Free

Cash

Flow

=

Cash

flow

from

Operations –

Capital

Expenditures

Twelve Months Ended

Twelve Months Ended

Cash

December 31,

December 31,

Highlights

2012

2011

Free Cash Flow

$33.8

$42.2

Capital

expenditures

$27.0

$21.9

Dividends

$13.0

$9.5

Balance Sheet

December 31,

December 31,

Highlights

2012

2011

Long-term debt

(less current

portion)

$92.8

$73.7

Debt

-

net

of

cash

$88.9

$67.2

Net Debt to

Total Capital

27.9%

24.6%

Debt-to-EBITDA

1.1

1.0 |

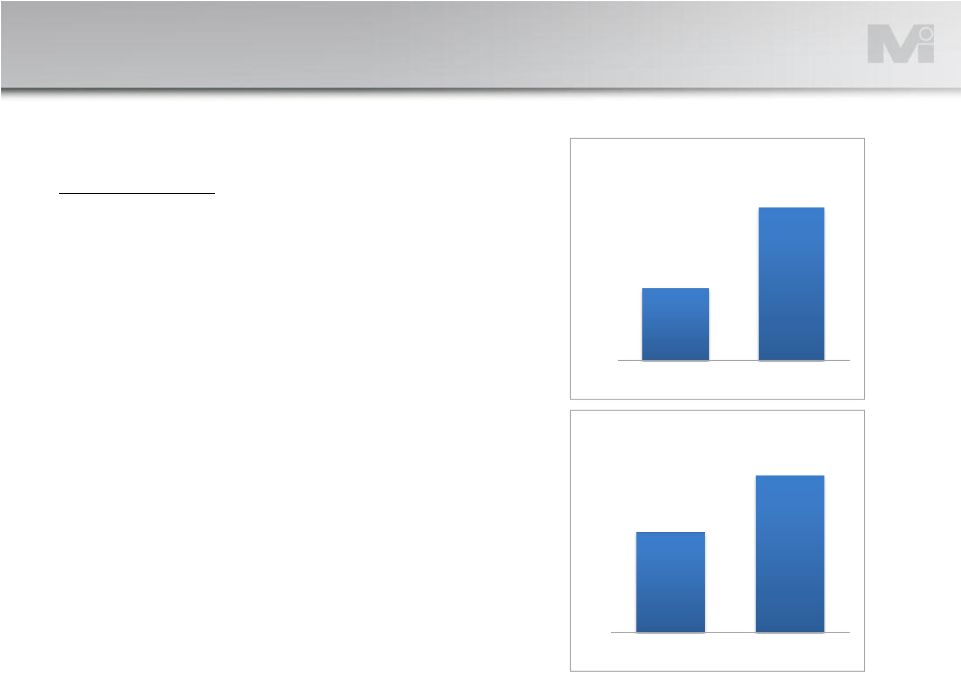

FY Results

•

Sales increase of 9% due

mostly to Novel & Jamco

acquisitions and sales of

new products

•

Increased sales and

Operations Excellence

savings led to 39%

increase in adjusted EBIT

Segment

Review

–

Material

Handling

7

$ Millions

See Reconciliation of Non-GAAP measures on

slide 19

$261.8

$286.0

$240

$250

$260

$270

$280

$290

Full Year 2011

Full Year 2012

Net Sales

$34.1

$47.7

$10

$15

$20

$25

$30

$35

$40

$45

$50

Full Year 2011

Full Year 2012

EBIT -

Adjusted |

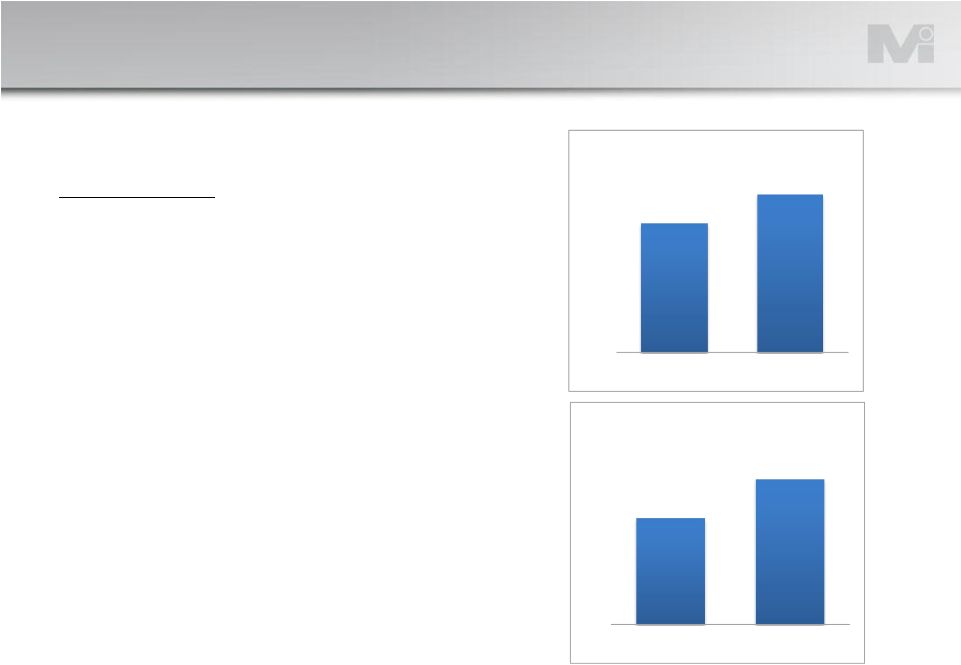

FY Results

•

Sales decline a result of:

•

Customers depleting

inventory and limiting

production during 2012

planting season

•

Delay in customer demand

from Q4 2012 to Q1 2013

•

Productivity and material

cost savings partially offset

income decline resulting

from lower sales

Segment

Review

–

Lawn

&

Garden

8

$ Millions

See Reconciliation of Non-GAAP measures on

slide 19

$217.1

$205.8

$198

$201

$204

$207

$210

$213

$216

$219

Full Year 2011

Full Year 2012

Net Sales

$4.6

$3.5

$0

$3

$6

Full Year 2011

Full Year 2012

EBIT -

Adjusted |

FY Results

•

A decline in replacement

tire shipments combined

with lower equipment

sales led to decreased

sales

•

Lower sales led to

decrease in adjusted

EBIT

Segment

Review

–

Distribution

9

$ Millions

See Reconciliation of Non-GAAP measures on

slide 19

$183.7

$176.6

$170

$175

$180

$185

Full Year 2011

Full Year 2012

Net Sales

$17.0

$14.7

$12

$15

$18

Full Year 2011

Full Year 2012

EBIT -

Adjusted |

FY

Results •

Strong sales in all end-

markets generated 22%

increase in sales

•

Higher sales led to the

increase in adjusted EBIT

of 36%

Segment

Review

–

Engineered

Products

10

$ Millions

See Reconciliation of Non-GAAP measures on

slide 19

$116.2

$141.7

$0

$15

$30

$45

$60

$75

$90

$105

$120

$135

$150

Full Year 2011

Full Year 2012

Net Sales

$11.5

$15.7

$0

$3

$6

$9

$12

$15

$18

Full Year 2011

Full Year 2012

EBIT -

Adjusted |

Q4

2012

Financial

Highlights

11

•

Sales increased 11.1%

•

Very strong sales in

Material Handling more

than offset sales decreases

in the other three

segments

•

Gross margin decreased

from 27.0% to 26.7%

•

Change in sales mix across

the business segments led

to decline

•

Adjusted EPS increased

36.8%

Note:

All

figures

except

ratios

and

percents

are

$Millions

P&L

Q4

Q4

Highlights

2012

2011

B/(W)

Net sales

$214.0

$192.5

11.1%

Gross

margin

26.7%

27.0%

-0.8%

SG&A

$42.2

$41.8

-1.0%

Net

income -

adjusted*

$8.9

$6.4

39.1%

Effective

tax rate

38.2%

34.6%

EPS -

adjusted*

$0.26

$0.19

36.8%

*See Reconciliation of Non-GAAP measures on slide 19

|

Q4

Results •

Delay in shipments from

earlier in the year to the

fourth quarter along with

sales from Novel & Jamco

acquisitions led to 48%

increase in sales

•

Higher sales combined with

productivity improvements

and lower manufacturing

costs resulted in 94%

increase in adjusted EBIT

Segment

Review

–

Material

Handling

12

$ Millions

See Reconciliation of Non-GAAP measures on

slide 19

$57.0

$84.4

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

Q4 2011

Q4 2012

Net Sales

$6.6

$12.8

$0

$3

$6

$9

$12

$15

Q4 2011

Q4 2012

EBIT -

Adjusted |

Q4

Results •

Shift in customer demand

from Q4 2012 to Q1 2013

led to sales decrease

during the quarter

•

Income decline from lower

sales was more than offset

by productivity efficiencies

and material substitution

cost savings during the

quarter

Segment

Review

–

Lawn

&

Garden

13

$ Millions

See Reconciliation of Non-GAAP measures on

slide 19

$62.3

$58.8

$50

$53

$56

$59

$62

$65

Q4 2011

Q4 2012

Net Sales

$3.7

$3.8

$2

$3

$3

$4

$4

Q4 2011

Q4 2012

EBIT -

Adjusted |

Q4

Results •

Continued and stronger

decline in replacement

tire shipments resulted

in sales decrease during

the quarter

•

Sales decrease led to the

decrease in adjusted

EBIT

Segment Review –

Distribution

14

$ Millions

See Reconciliation of Non-GAAP measures on

slide 19

$47.2

$44.7

$40

$45

$50

Q4 2011

Q4 2012

Net Sales

$4.7

$3.2

$0

$3

$6

Q4 2011

Q4 2012

EBIT -

Adjusted |

Q4

Results •

Sales increases in RV and

marine were more than

offset by a decline in

sales of custom products

during the quarter

•

Sales decrease led to

decline in adjusted EBIT

Segment Review –

Engineered Products

15

$ Millions

See Reconciliation of Non-GAAP measures on

slide 19

$31.1

$30.1

$20

$25

$30

$35

Q4 2011

Q4 2012

Net Sales

$2.9

$2.4

$0

$5

Q4 2011

Q4 2012

EBIT -

Adjusted |

Lawn &

Garden Update •

Announcing internal project to drive out costs,

increase productivity and improve profitability

•

Anticipated to yield annual savings of approximately $5

million by 2014

•

Addresses sub-segments of the business individually

•

Nursery –

various cost reduction efforts to improve

profitability

•

Greenhouse –

take actions to simplify, consolidate and

balance capacity with demand

16

•

Continue to look at further options including

external opportunities |

Q1 & Full

Year 2013 Outlook Q1 Outlook

•

Material Handling

•

Seasonality in Brazil will unfavorably impact the quarter

•

Lawn & Garden

•

Solid order activity quarter-to-date on top of the delay in customer demand

from Q4 2012 to Q1 2013 should benefit the quarter

•

Distribution

•

Anticipate capturing greater shares of both equipment and supplies sales in a continued weak

marketplace

•

Engineered Products

•

Demand in transplant auto will be at normal levels during Q1 resulting in a decline in sales

in that market year-over-year

Full Year Outlook

•

Slow Q1 impacted by IT investments; but then good year-over-year improvement

•

Overall expect another year of good performance improvement

17 |

Appendix

18 |

MYERS INDUSTRIES, INC. RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

INCOME (LOSS) BEFORE TAXES BY SEGMENT (UNAUDITED)

(Dollars in millions)

19

Reconciliation of Non-GAAP Measures

Quarter Ended

Twelve Months Ended

December 31

December 31

2012

2011

2012

2011

Material Handling

Income before taxes as reported

$

12.6

$

6.6

$

47.5

$

34.1

Restructuring expenses

0.2

0.0

0.2

0.0

Income before taxes as adjusted

12.8

6.6

47.7

34.1

Lawn & Garden

Income before taxes as reported

3.6

3.4

2.9

4.2

Restructuring expenses

0.2

0.3

0.6

0.4

Income before taxes as reported

3.8

3.7

3.5

4.6

Distribution

Income before taxes as reported

3.7

4.1

14.8

15.7

Restructuring expenses

0.0

0.9

0.7

2.0

Gain on building sale

(0.5)

(0.3)

(0.8)

(0.7)

Income before taxes as adjusted

3.2

4.7

14.7

17.0

Engineered Products

Income before taxes as reported

2.3

2.4

14.5

10.8

Restructuring expenses

0.1

0.5

1.2

0.7

Income before taxes as adjusted

2.4

2.9

15.7

11.5

Corporate and interest expense

Income (loss) before taxes as reported

(8.4)

(7.5)

(32.4)

(31.1)

Severance and other

0.3

0.0

1.8

0.3

Environmental

0.0

0.0

0.0

1.9

Income (loss) before taxes as adjusted

(8.1)

(7.5)

(30.6)

(28.9)

13.8

9.0

47.3

33.7

0.3

1.4

3.7

4.6

Income before taxes as adjusted

14.1

10.4

51.0

38.3

Income taxes

5.2

4.0

18.9

14.9

Net income as adjusted

$

8.9

$

6.4

$

32.1

$

23.4

Adjusted earnings per share

0.26

0.19

0.94

0.67

Consolidated

Income before taxes as reported

Restructuring expenses and other adjustments

Note:

Numbersin

the

Corporate

and

interest

expensesection

above

maybe

rounded

for

presentation

purposes.

Note

on

Reconciliation

of

Income

and

Earnings

Data:

Income

(loss)

excluding

the

items

mentioned

above

in

the

text

of

this

release

and

in

this

reconciliation

chartis

a

non-GAAP

financial

measure

that

Myers

Industries,

Inc.

calculates

according

to

theschedule

above,using

GAAP

amounts

from

the

unaudited

Consolidated

Financial

Statements.

The

Company

believes

that

the

excluded

items

arenot

primarily

related

to

core

operational

activities.

The

Company

believes

that

income

(loss)

excluding

items

that

are

not

primarily

related

to

core

operating

activities

these

items

as

well

as

other

financial

measures

in

connection

with

itsdecision-making

activities.

Income

(loss)

excluding

these

items

should

is

generally

viewed

as

providing

useful

information

regarding

a

company's

operating

profitability.

Management

uses

income

(loss)

excluding

not

be

considered

in

isolation

or

as

a

substitute

for

net

income

(loss),

income

(loss)

before

taxes

or

other

consolidated

income

data

prepared

in

accordance

with

GAAP.

The

Company‘s

method

for

calculating

income

(loss)

excluding

these

items

may

not

be

comparable

to

methods

used

by

other

companies. |

Market

Indicators Material Handling

MHEM Index

Lawn & Garden

Housing Starts

Consumer Sentiment

Distribution

Miles Driven

Replacement Tire Shipments,

Gasoline Sales

Engineered Products

RVIA

Auto Market Forecasts

Source: Material Handling Industry Jan 2013

Forecast Source: National Association of

Home Builders (NAHB); Dec 2012 Thomson Reuters/University of Michigan

Source: JP Morgan, RMA, Energy Information

Administration Sources: RVIA Forecasts, Dec

2012; FRB G17 Release (Jan

2013); MAPI Forecast , Dec

2012 20 |

|