Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ROWAN COMPANIES PLC | v333742_8k.htm |

Investor Presentation February, 2013 RIGS PEOPLE PRIORITIES 90 YEARS STRONG - -

Investor Presentation January, 2013 RIGS PEOPLE PRIORITIES 90 YEARS STRONG - -

Forward - Looking Statements 2 This report contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements about the proposed change in corporate structure as well as statements as to the expectations, beliefs and future expected financial performance of the Company that are based on current expectations and are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected by the Company. Among the factors that could cause actual results to differ materially include oil and natural gas prices, the level of offshore expenditures by energy companies, energy demand, the general economy, including inflation, weather conditions in the Company’s principal operating areas and environmental and other laws and regulations, including changes in tax laws and whether the Company achieves the benefits it expects from the change in Rowan's corporate structure. Other relevant factors have been and will be disclosed in the Company’s filings with the SEC.

Rowan’s Transitions And Achievements 3 for $1.1bn in cash SOLD MANUFACTURING BUSINESS COMPLETED REDOMESTICATION TO UK WITH CLASS A SHARES PURCHASED 3.9M SHARES UNDER STOCK REPURCHASE PROGRAM for $510m in cash SOLD LAND BUSINESS ENTERED ULTRA - DEEPWATER MARKET 4 drillships for $2.7bn COMPLETED JACK - UP NEWBUILD PROGRAM 11 jack - ups for $3bn

Rowan Has The Right … Mission Values Goals Action Plans 4 Rigs People Priorities • Industry leading position in high - spec jack - ups • One of the youngest fleets in the industry • Leading provider of demanding drilling services • Industry leading day rates and highest utilization • 90 year history of operational excellence • Strong jack - up drilling skills transferable to deepwater activities • Key deepwater operations and technical managers in place • Goal of highest customer satisfaction – • Safety • Reliability • Focused on financial discipline – • Cost effectiveness • Rigorous IRR analysis on CapEx

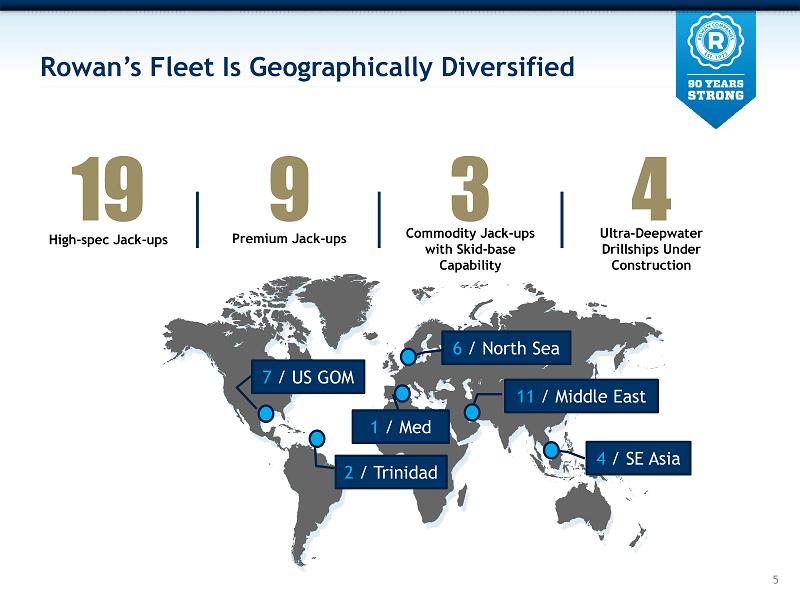

Rowan’s Fleet Is Geographically Diversified 5 6 / North Sea 11 / Middle East 4 / SE Asia 19 High - spec Jack - ups 9 Premium Jack - ups 3 Commodity Jack - ups with Skid - base Capability 7 / US GOM 2 / Trinidad 4 Ultra - Deepwater Drillships Under Construction 1 / Med

6 Rowan’s Record $3.8 Billion Backlog Is Diversified $1.2 Bn $1.5 Bn 2010 2011 2012 Current $2.2 Bn $3.8 Bn 34% 21% 18% 11% 5% 4% 4% 2% Norway Middle East Deepwater UK SEA Egypt GOM Trinidad Growing Backlog Distributed By Geography Rowan’s Diverse Customer Base

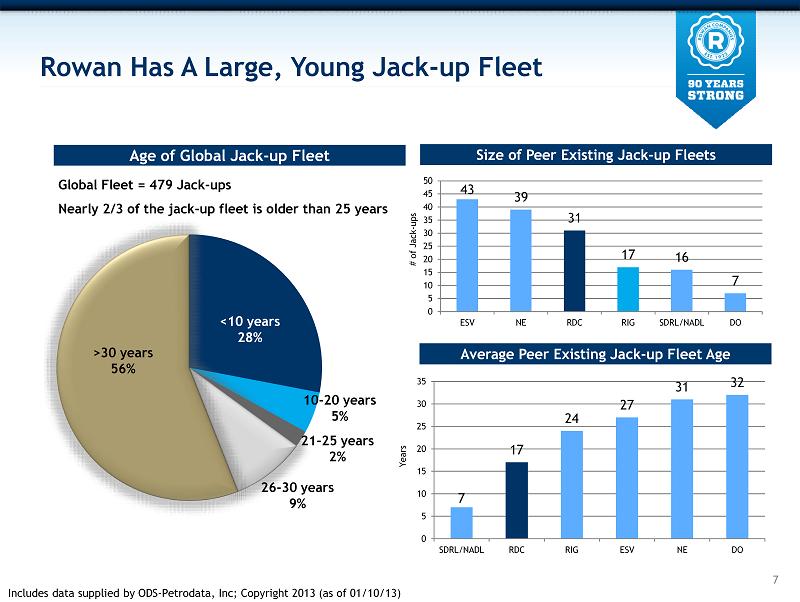

Rowan Has A Large, Young Jack - up Fleet 7 Age of Global Jack - up Fleet Global Fleet = 479 Jack - ups Nearly 2/3 of the jack - up fleet is older than 25 years <10 years 28% >30 years 56% 26 - 30 years 9% 10 - 20 years 5% 21 - 25 years 2% Size of Peer Existing Jack - up Fleets 43 39 31 17 16 7 0 5 10 15 20 25 30 35 40 45 50 ESV NE RDC RIG SDRL/NADL DO # of Jack - ups Average Peer Existing Jack - up Fleet Age 7 17 24 27 31 32 0 5 10 15 20 25 30 35 SDRL/NADL RDC RIG ESV NE DO Years Includes data supplied by ODS - Petrodata, Inc; Copyright 2013 (as of 01/10/13)

Rowan Is The Leader In High - spec Jack - ups 8 Number of High - Spec Jack - ups 0 2 4 6 8 10 12 14 16 18 20 Current By YE 2015 19 Rowan High - spec Jack - ups

Rowan’s Fleet Achieves Above Average Day Rates and Highest Utilization vs. Peer Group Comparison of Current Day Rates: Rowan vs. Peers (000s) Comparison of Utilization: Rowan vs. Peers 0 20 40 60 80 100 Rowan Peers (1) 1) Peers include DO, RIG, NE, SDRL/ NADL, and ESV $258 $145 $120 $119 $152 $123 $116 $103 $0 $50 $100 $150 $200 $250 $300 N. Sea S.E. Asia U.S. GOM Mid East Rowan Peers (1) 9 Includes data supplied by ODS - Petrodata , Inc; Copyright 2013 (as of 01/24/13)

Global Jack - up Fleet Totals 479 rigs 10 US GOM Indian Ocean North Sea Mediterranean Middle East Southeast Asia Mexico C&S America West Africa Australia 60% 62 Rigs 93% 41 Rigs 77% 13 Rigs 93% 28 Rigs 100% 30 Rigs 100% 2 Rigs 88% 67 Rigs 85% 135 Rigs 82% 17 Rigs 95% 43 Rigs Includes data supplied by ODS - Petrodata , Inc; Copyright 2012 (as of 01/11/13)

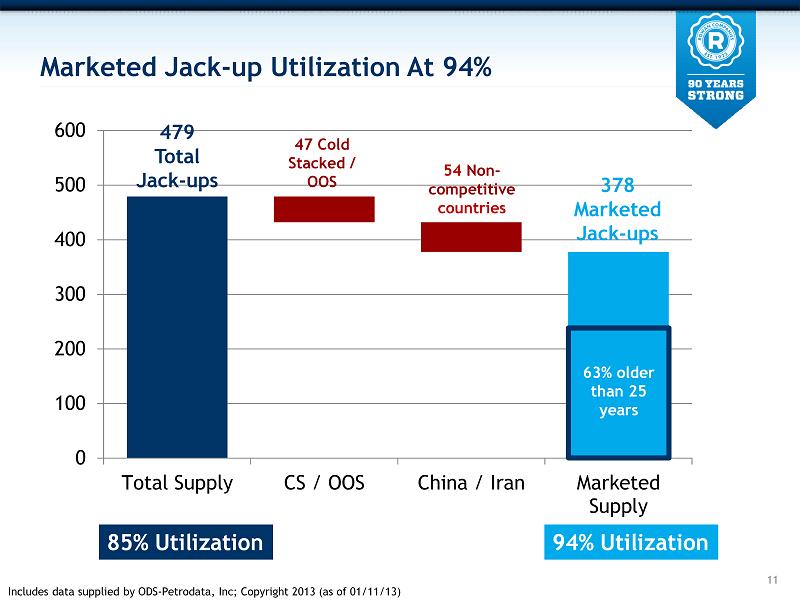

Marketed Jack - up Utilization At 94% 11 0 100 200 300 400 500 600 Total Supply CS / OOS China / Iran Marketed Supply 479 Total Jack - ups 47 Cold Stacked / OOS 54 Non - competitive countries 378 Marketed Jack - ups Includes data supplied by ODS - Petrodata , Inc ; Copyright 2013 (as of 01/11/13) 63% older than 25 years 94% Utilization 85% Utilization

Jack - up Market Continues To Bifurcate 12 20 40 60 80 100 IS, MS, MC <300'IC 300'IC 350'+ IC(including High Spec) High Spec* Worldwide Utilization By Rig Class % Includes data supplied by ODS - Petrodata , Inc; Copyright 2013 (as of 01/24/13) * Excludes Chinese Rig, Master Driller

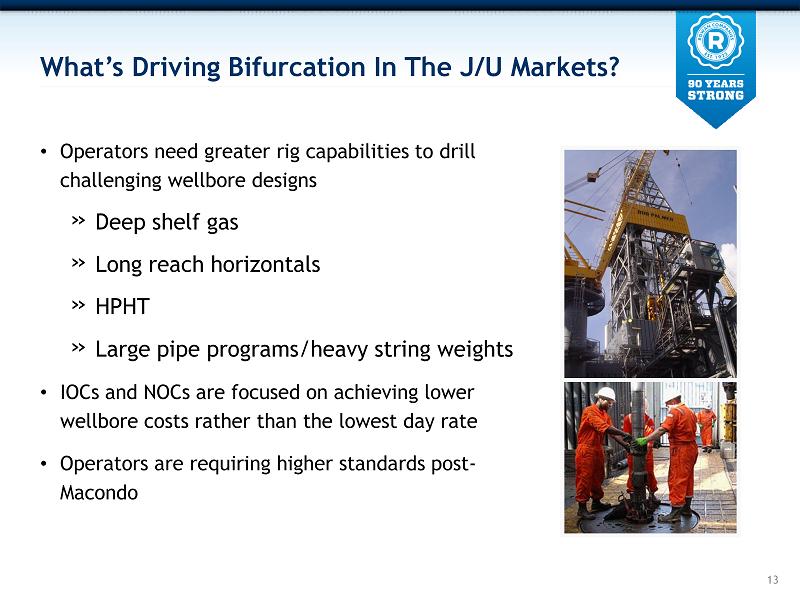

What’s Driving Bifurcation In The J/U Markets? • Operators need greater rig capabilities to drill challenging wellbore designs » Deep shelf gas » Long reach horizontals » HPHT » Large pipe programs/heavy string weights • IOCs and NOCs are focused on achieving lower wellbore costs rather than the lowest day rate • Operators are requiring higher standards post - Macondo 13

0 10 20 30 40 50 60 70 80 90 312 JACK - UPS OVER 25 YEARS 218 JACK - UPS IN LATEST CYCLE Newbuilds Needed To Replace Aging Fleet 14 Jack - ups by Year Built Includes data supplied by ODS - Petrodata , Inc; Copyright 2013 (as of 01/24/13)

A Wave Of Jack - up Retirements Is Coming 15 World jack - up rig population over 40 years old is growing… 1 1 1 2 2 3 3 4 6 9 9 12 14 18 28 41 55 67 77 97 136 193 273 0 50 100 150 200 250 300 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 14 rigs that are 40+ years old today: Almost half are stacked or being converted to non - drilling

Rowan Is Entering UDW Market – With Advantages • Long standing brand reputation for operational excellence and customer satisfaction • Very high specification drillship design with built - in redundancies • Core team of highly experienced and respected deepwater professionals already in place • Strong global marketing coverage • Long history of contracting newbuilds before delivery 16

UDW Drillships Under Construction 17 4 Delivery December 2013 2013 2014 2015 Contract Commences March 2014 Rowan Renaissance 1 Delivery June 2014 2 Rowan Resolute Delivery October 2014 3 Rowan Reliance Delivery March 2015 4 Rowan Relentless $655 M $655 M $650 M $695 M NB: Cost excludes capitalized interest and estimate for project contingencies.

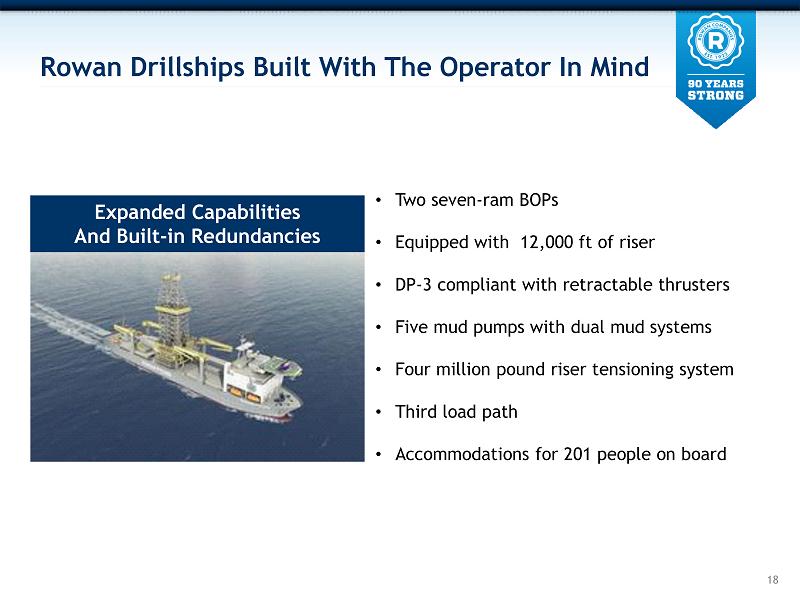

Rowan Drillships Built With The Operator In Mind • Two seven - ram BOPs • Equipped with 12,000 ft of riser • DP - 3 compliant with retractable thrusters • Five mud pumps with dual mud systems • Four million pound riser tensioning system • Third load path • Accommodations for 201 people on board 18 Expanded Capabilities And Built - in Redundancies

Worldwide Drillship Utilization=93% Worldwide Drillship Fleet At 84 Rigs 19 USA Indian Ocean North Sea Mediterranean Far East Southeast Asia S America West Africa Australia 95% 18 Rigs 100% 29Rigs 100% 13 Rigs 100% 12 Rigs 100% 1 Rig 20% 5 Rigs 100% 1 Rigs 0% 1 Rig 100% 2 Rigs Includes data supplied by ODS - Petrodata , Inc; Copyright 2012 (as of 10/04/12)

$0 $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 1 Year or Less >1 Year and < 3 Years 3 Years or More 20 Day Rate Fixtures for 10,000’+ Drillships : January 2005 - Current Rowan Enters UDW Market Renaissance Contract $619K Strong Demand For UDW Steady Growth In Day Rates Includes data supplied by ODS - Petrodata , Inc; Copyright 2013 (as of 01/21/13)

16 1 3 24 5 18 5 0 5 10 15 20 25 30 2013 2014 2015 2016+ Contracted Not Contracted UDW Newbuilds Being Absorbed By Strong Market 21 72 - 10,000’+ Drillship Newbuilds Under Construction 8 21 19 Includes data supplied by ODS - Petrodata , Inc; Copyright 2013 (as of 01/24/13) • Five uncontracted 2013 drillships believed to be committed • Operators now focusing on 2014 availability • 22 contracted units in 2016 and beyond are committed to Petrobras

Deepwater GOM Activity Expected To Accelerate 22 Historical & Forecasted US GOM Floating Rig Count Deepwater GOM Wells Drilled By Exploration & Development (>1,000 ft) • GOM deepwater rig count forecast to grow from 36 to as many as 60 rigs by 2015 • Development wells forecast to triple to about 70 wells/year by 2015 • Exploration wells forecast to double to over 60 wells/year by 2015 Source: U.S. Gulf of Mexico Deepwater Outlook, ISI Group, December 2012

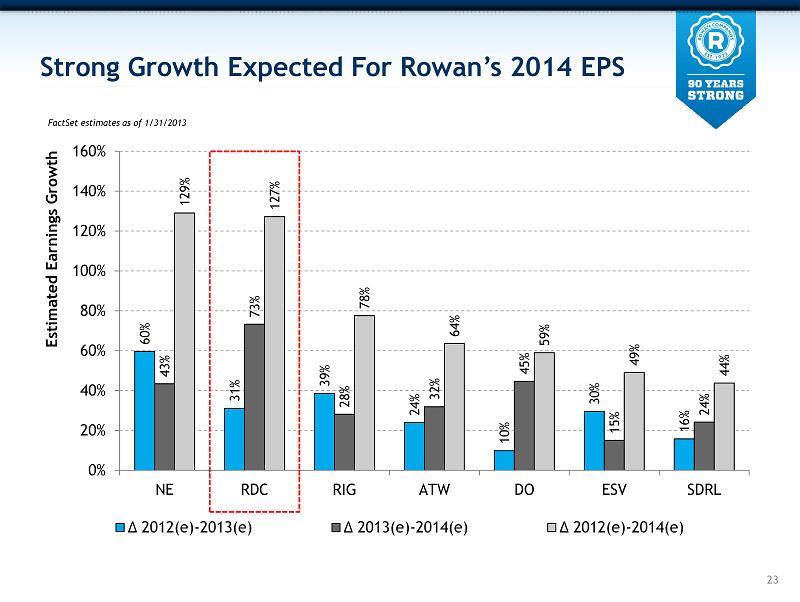

60% 31% 39% 24% 10% 30% 16% 43% 73% 28% 32% 45% 15% 24% 129% 127% 78% 64% 59% 49% 44% 0% 20% 40% 60% 80% 100% 120% 140% 160% NE RDC RIG ATW DO ESV SDRL Estimated Earnings Growth Δ 2012( e) - 2013(e) Δ 2013( e) - 2014(e) Δ 2012( e) - 2014(e) FactSet e stimates as of 1/31/2013 Strong Growth Expected For Rowan’s 2014 EPS 23

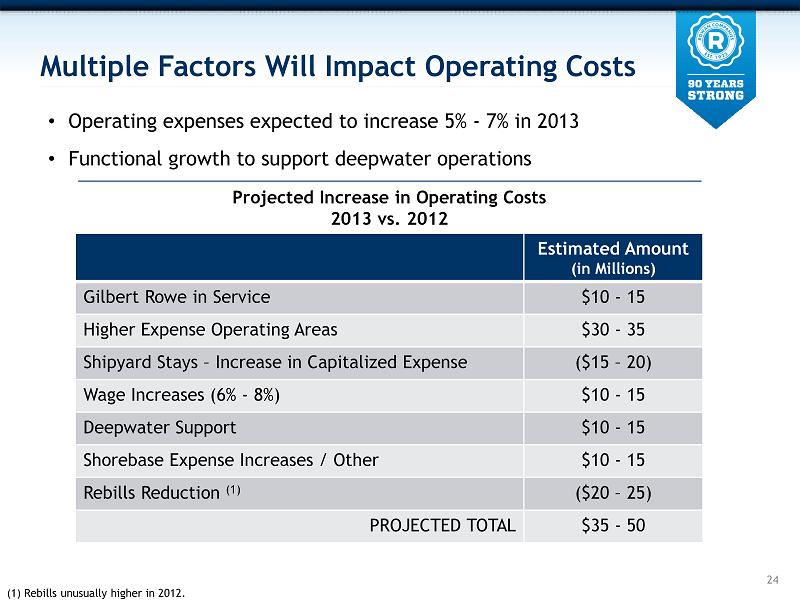

Multiple Factors Will Impact Operating Costs Estimated Amount (in Millions) Gilbert Rowe in Service $10 - 15 Higher Expense Operating Areas $30 - 35 Shipyard Stays – Increase in Capitalized Expense ($15 – 20) Wage Increases (6% - 8%) $10 - 15 Deepwater Support $10 - 15 Shorebase Expense Increases / Other $10 - 15 Rebills Reduction (1) ($20 – 25) PROJECTED TOTAL $35 - 50 24 • Operating expenses expected to increase 5% - 7% in 2013 • Functional growth to support deepwater operations Projected Increase in Operating Costs 2013 vs. 2012 (1) Rebills unusually higher in 2012.

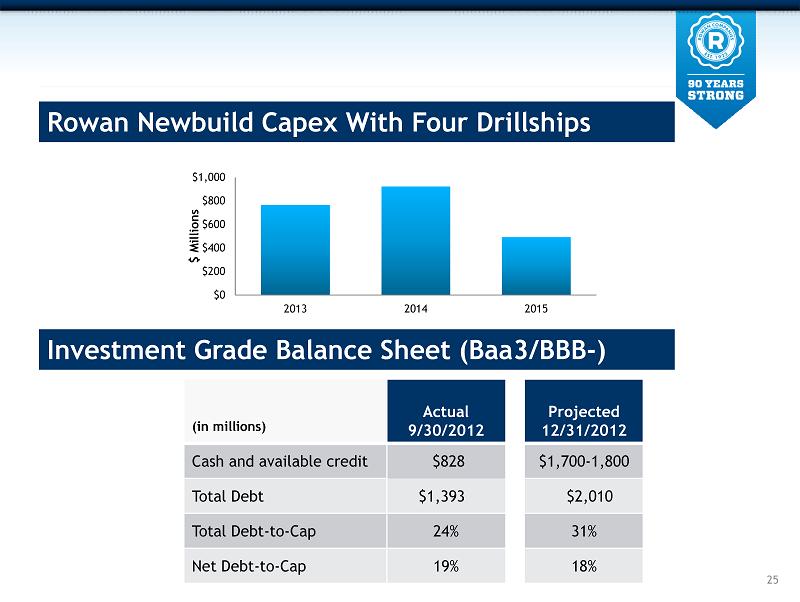

(in millions) Actual 9/30/2012 Projected 12/31/2012 Cash and available credit $828 $1,700 - 1,800 Total Debt $1,393 $2,010 Total Debt - to - Cap 24% 31% Net Debt - to - Cap 19% 18% 25 Investment Grade Balance Sheet (Baa3/BBB - ) Rowan Newbuild Capex With Four Drillships $0 $200 $400 $600 $800 $1,000 2013 2014 2015 $ Millions

Rowan’s Approach To Allocation Of Capital • Return on investment analysis drives all capital decisions » Sensitivity analysis – Capital cost, Operating Cost, Day Rate, Tax Rate • Regular consideration of all options for available capital • Committed to maintaining investment grade balance sheet 26

Appendix 28

Current Rowan Avg. Regional Offshore Rig Operating Costs Region Jack - ups Gulf of Mexico High 30s – Mid $50s Egypt Mid - High $70s Middle East Low $50s – High $70s U.K. North Sea Mid $70s – Mid $80s Norway North Sea Low - Mid $140s Southeast Asia Low $50s – Low $60s Trinidad Low – Mid $60s 29 (000’s per day) Region Drillships Gulf of Mexico $140s - $160s West Africa $180s - $200s As of 09/30/2012. Ranges exclude mobilization amortization and rebills . Daily operating costs vary by rig class and region. Higher capable rigs generally earn higher day rates and typically have higher operating costs per day. During shipyard stays, crew and other pe rso nnel - related costs are usually capitalized rather than expensed.

Glossary of Terms Blowout Preventer (BOP): An emergency shut - off device comprised of a series, or “stack”, of valves that shut the wellbore in the event that hydrocarbons enter the wellbore and pressure containment is compromised. The BOP is intended to serve as a pressure control system of last resort. Cold - stacked Rig: An offshore rig that is not actively marketed and is completely down - manned. Cold stacked rigs generally require significant time and capital expenditures to reactivate. Day rate Contract : A contractual agreement where a drilling contractor is paid a daily rate. Customer carries majority of the operating risk so long as the drilling contractor meets the basic standards of equipment and personnel specified by the contract. Estimated Planned Off Rate Time : Defined by Rowan as those days where a rig will not be available to earn any revenue due to shipyard, transit, inspection periods, or suspension of operations. High - specification Rig : Defined by Rowan as rigs with a two million pound or greater hook - load capacity. Hook - load: A commonly used metric to define the lifting capacity of a rigs drawworks and derrick system. Operational Downtime : When a rig is unable to conduct planned operations due to equipment breakdowns or procedural failures. Operational downtime may or may not result in a related revenue reduction. Out of Service Rig: An offshore rig that is n ot capable of re - entering service without major equipment upgrade/renewal taking minimum 6 - 12 months. Utilization : A rate that specifies the percentage of time that a rig (or fleet of rigs) earned day rate in a specified period. 30

Investor Contact: Suzanne M. Spera Director, Investor Relations sspera@rowancompanies.com Rowan Companies 2800 Post Oak Blvd. Suite 5450 Houston, TX 77056 713.621.7800 www.rowancompanies.com