Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BRINKS CO | form_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - BRINKS CO | exhibit_99-1.htm |

The Brink’s Company

Fourth-Quarter 2012 Earnings

Conference Call

NYSE:BCO

February 1, 2013

Exhibit 99.2

Forward-Looking Statements

These materials contain forward-looking statements. Actual

results could differ materially from projected or estimated

results. Information regarding factors that could cause such

differences is available in today's release and in The Brink’s

Company’s most recent SEC filings.

results could differ materially from projected or estimated

results. Information regarding factors that could cause such

differences is available in today's release and in The Brink’s

Company’s most recent SEC filings.

Information discussed today is representative as of today

only and Brink's assumes no obligation to update any

forward-looking statements. These materials are

copyrighted and may not be used without written permission

from Brink's.

only and Brink's assumes no obligation to update any

forward-looking statements. These materials are

copyrighted and may not be used without written permission

from Brink's.

2

The Brink’s Company

Ed Cunningham

Director - Investor Relations

Today’s Announcements

• 4th Quarter and Full-Year Earnings

• GAAP and non-GAAP

• Europe Divestitures in Discontinued Operations

• $104 Million Revenue

• $16 Million Operating Loss ($.31 per share)

on non-GAAP basis

Note: See reconciliation to GAAP results in Appendix

4

Summary of 2012 Non-GAAP Results

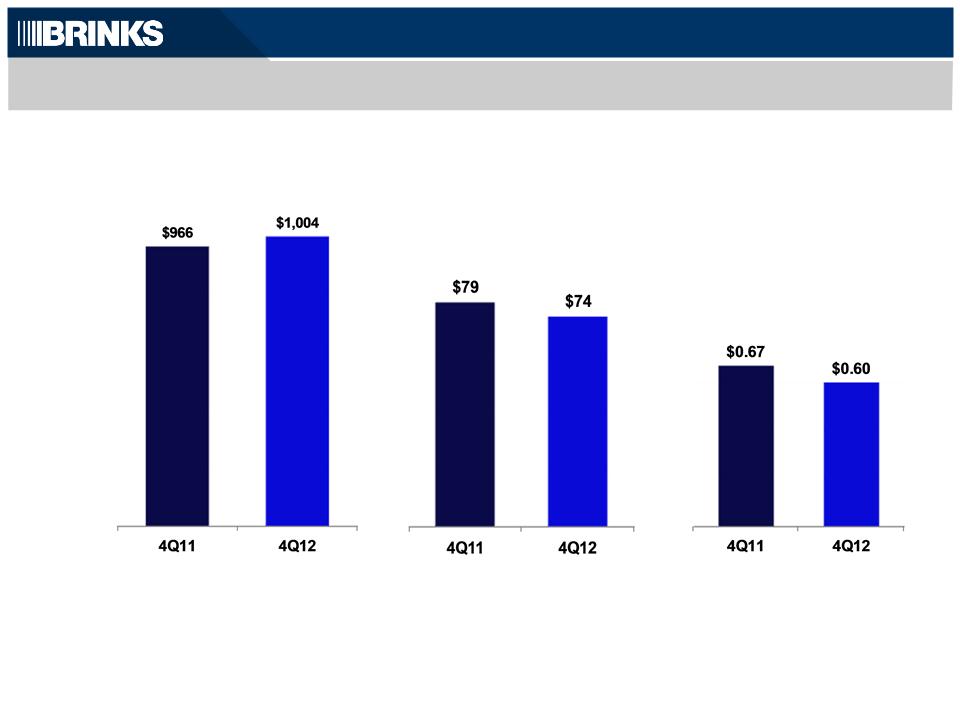

Fourth Quarter

• Non-GAAP EPS $.60 vs $.67

• Revenue up 4% (6% organic increase)

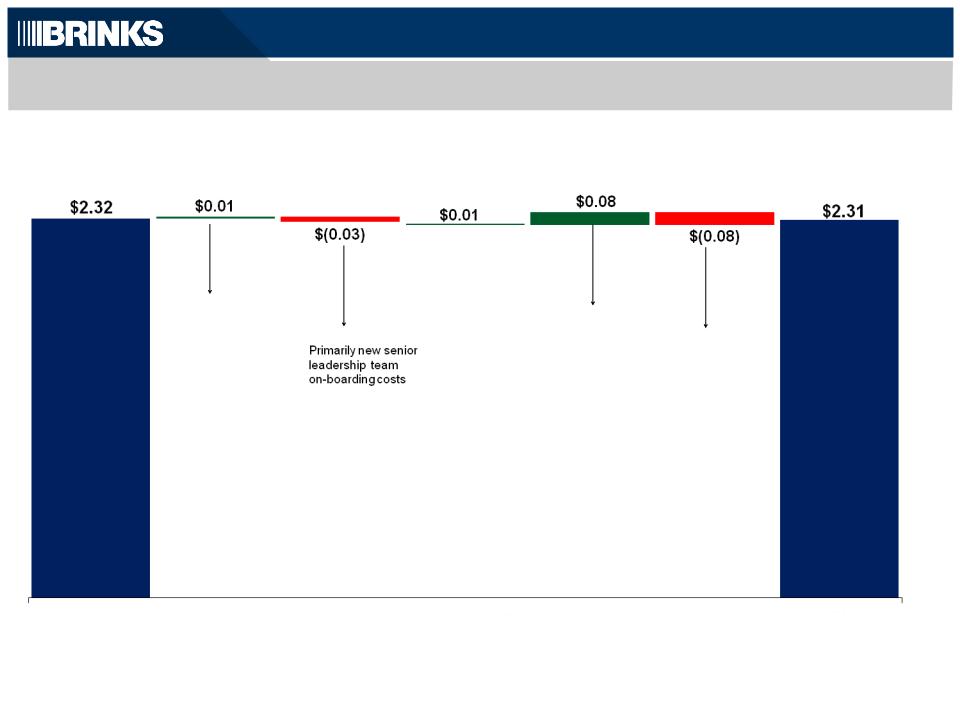

Full Year

• Non-GAAP EPS $2.31 vs $2.32

• Revenue up 2% (7% organic increase)

Impact of Europe Restructure

• Lifts full-year 2012 EPS by $.31; $.09 lift in 4Q

Note: See reconciliation to GAAP results in Appendix

5

The Brink’s Company

Tom Schievelbein

Chairman, President and

Chief Executive Officer

CEO Overview

Fourth Quarter

• North America and Europe profits improve

• Latin America profit down

2013

• Segment Margin Outlook: 6.0% - 6.5% on a non-GAAP basis

• Productivity investments

• Devaluation in Venezuela

7

Note: See reconciliation to GAAP results in Appendix

Strategy Update

• Maximize profits in North America and Europe

• 7% Margin goal achieved in Europe in 2012

• Margin improves in North America to 4.4%

• Grow in Latin America

• 2013 Segment margin rate outlook positive

• Continued productivity investments

• Enter adjacent markets

• Brink’s Money ™ Card, Redetrel Acquisition

• New leadership team in place

8

The Brink’s Company

Joe Dziedzic

Vice President and Chief

Financial Officer

Financial Officer

Review and Outlook

4Q12 Non-GAAP Results

($ millions, except EPS)

Segment

Operating Profit

Operating Profit

Revenue

|

|

|

|

|

|

Margin

|

8.1%

|

|

7.4%

|

EPS

Note: See reconciliation to GAAP results in Appendix

|

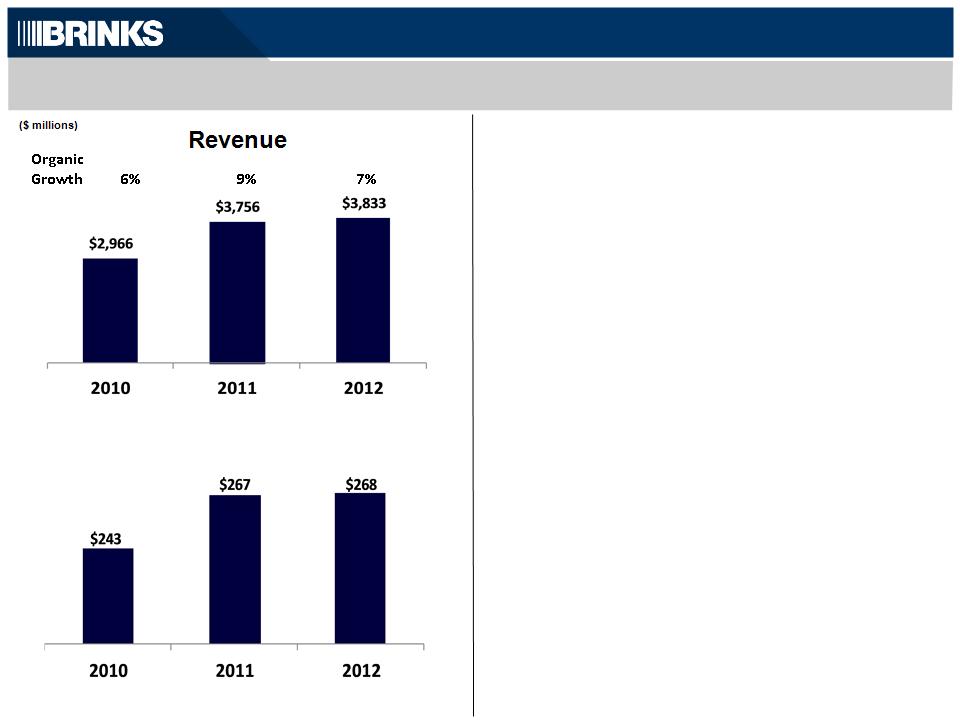

Full Year

|

$3,756

|

$3,833

|

|

$267

|

$268

|

|

$2.32

|

$2.31

|

|

|

|

Margin

|

7.1%

|

7.0%

|

|

|

|

10

Non-GAAP EPS: 2011 Versus 2012

Segment

Operating

Profit

Operating

Profit

Non-Segment

Expense

Expense

Interest

Expense,

Net

Expense,

Net

Non-

Controlling

Interest

Controlling

Interest

Tax

Rate/Diluted

Shares

Rate/Diluted

Shares

2011

2012

Note: See reconciliation to GAAP results in Appendix

$0.50 Profit increase

excluding items

below

excluding items

below

$(0.20) Foreign

currency

$(0.21) Venezuela

profit decline

$(0.08) Argentina

industry

subsidy

subsidy

termination

Amounts may not add due to rounding

$0.08 Venezuela

$(0.02) Diluted Shares

$(0.06) Tax Rate

11

Full Year 2012 Non-GAAP Segment Results

Revenue

Segment Operating Profit

|

|

|

|

|

|

|

|

Margin

|

|

8.2%

|

7.1%

|

7.0%

|

|

Segment Operating Profit

— 7% Organic growth, 5% unfavorable

currency

currency

— 15% Organic growth in Latin America

— 2% Organic decline in North America

— Unfavorable currency impact of $15

— North America up $6 from cost actions

— International down $6 as Latin America

decline partially offset by Europe

improvement

decline partially offset by Europe

improvement

12

Note: See reconciliation to GAAP results in Appendix

Capital

Expenditures

and Capital

Leases(b)

Expenditures

and Capital

Leases(b)

Non-GAAP Cash Flow, Capital Investment and Net Debt

13

($ millions)

(a) See reconciliation to GAAP results in Appendix

(b) From continuing operations

Non-GAAP

CFOA(a) (b)

CFOA(a) (b)

$203

$235

North

America

America

International

Net Debt (a)

13

$232

$246

$232

$270

2012 Results versus Guidance

— Organic growth 5% to 8%

— Unfavorable currency impact 3%

to 5%

Actual Results

14

Outlook as of February 2, 2012

Revenue

Non-GAAP Segment Margin Rate

— North America 4.5% to 5.5%

— International 7.0% to 8.0%

— Total segment 6.5% to 7.0%

Other Metrics

— Non-segment expense $41

— Interest expense $23 to $26

— Non-controlling interest $24 to $28

— Tax rate 37% to 40%

— 7% Growth driven by Latin America

— 5% Unfavorable from Euro, Brazilian Real & Mexican

Peso

Peso

— 4.4% as price/volume pressure more difficult than planned

— 7.8% Continuing ops, 7.0% including discontinued ops…

negatively impacted by Venezuela & Argentina

Government actions

negatively impacted by Venezuela & Argentina

Government actions

— 7.0% Continuing ops, 6.3% including discontinued ops

— $42 - Slight increase versus estimate

— $24 - Within estimated range

— $19 - Venezuela earnings decline

— 37% - Continuing ops, 40% including discontinued ops

— $203 - Rigorous allocation process, aligned with earnings

Note: See reconciliation to GAAP results in Appendix

2013 Outlook

2013 Outlook

— Organic growth 5% to 8%

— Unfavorable currency impact 1% to 3%

Assumptions

16

February 1, 2013

Revenue

Non-GAAP Segment Margin Rate

— North America 4.0% to 4.5%

— International 7.0% to 7.5%

— Total segment 6.0% to 6.5%

Other Metrics

— Non-segment expense $43

— Interest expense $27 to $29

— Non-controlling interest $17 to $20

— Tax rate 36% to 39%

— Capital expenditures / leases flat at $205

— Growth in Latin America, North America and Europe flat

— Venezuela devaluation 2Q13 impact of $130 million, 3%

of total revenue

of total revenue

— Continued price/volume pressure offset by cost actions

— Decline from productivity spend, Venezuela devaluation

and slight decline in Europe

and slight decline in Europe

— Slight increase

— Increase from recent acquisitions

— Venezuela decrease offset by Colombia growth

— Continued focus on returns

Note: See reconciliation to GAAP results in Appendix

The Brink’s Company

Fourth-Quarter 2012 Earnings

Conference Call

NYSE:BCO

February 1, 2013

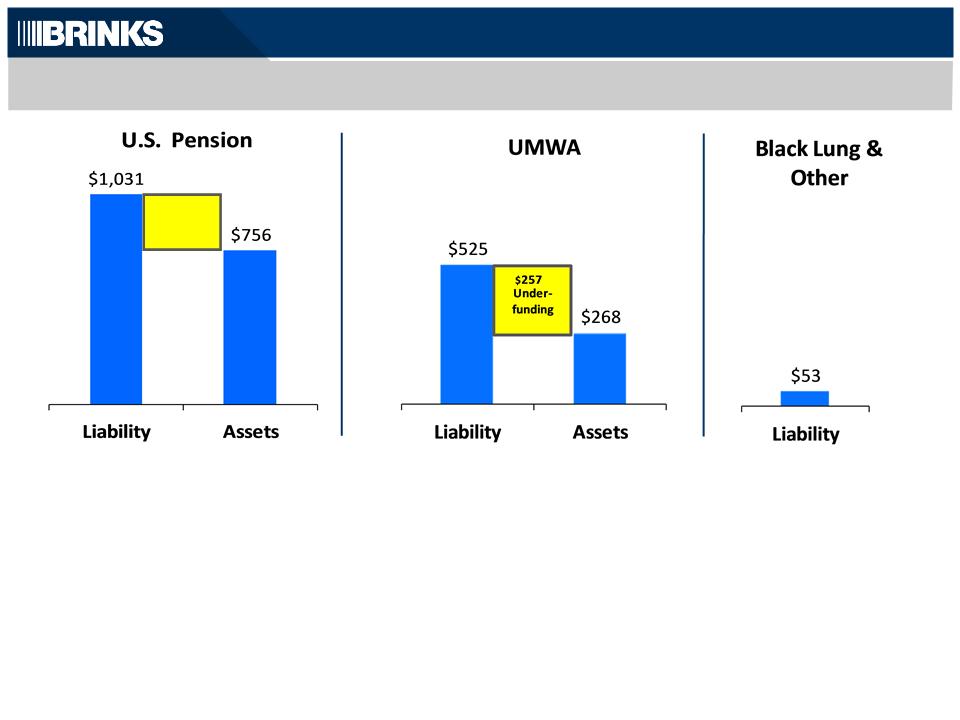

Appendix - Legacy Liabilities

Legacy Liabilities

|

|

Estimated Contributions to U.S. Plans

|

|

||||||||||||

|

|

|

2012A

|

2013

|

2014

|

2015

|

2016

|

2017

|

|||||||

|

|

US Pension

|

$ 37

|

|

14

|

|

29

|

|

42

|

|

44

|

|

38

|

|

|

|

|

UMWA

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

|

|

|

Black Lung/Other

|

7

|

|

5

|

|

5

|

|

5

|

|

4

|

|

4

|

|

|

|

|

Total

|

$ 44

|

|

19

|

|

34

|

|

47

|

|

48

|

|

42

|

|

|

($ millions)

$275

Under-

funding

Under-

funding

Note: Above amounts based on actuarial assumptions at December 31, 2012.

19

(a) Under GAAP, the funded status of a benefit plan is reduced by the fair market value of plan assets at the balance sheet date, and the present value

of the projected earnings on plan assets does not reduce the funded status at the balance sheet date. The non-GAAP measure presented above

additionally reduces the funded status as computed under GAAP by the present value of projected earnings of plan assets using the expected return

on asset assumptions of the respective plan.

of the projected earnings on plan assets does not reduce the funded status at the balance sheet date. The non-GAAP measure presented above

additionally reduces the funded status as computed under GAAP by the present value of projected earnings of plan assets using the expected return

on asset assumptions of the respective plan.

(b) For the primary U.S. pension plan, we are required by ERISA regulations to maintain minimum funding levels, and as a result, we estimate we will

be required to make minimum required contributions from 2012 to 2021. We have estimated that we will achieve the required funded ratio after the

2021 contribution.

be required to make minimum required contributions from 2012 to 2021. We have estimated that we will achieve the required funded ratio after the

2021 contribution.

(c) There are no minimum funding requirements for the UMWA plans because they are not covered by ERISA funding regulations. Using assumptions

at the end of 2012, we project that the plan assets plus expected earnings on those investments will cover the benefit payments for these plans until

2022. We project that Brink’s will be required to contribute cash to the plan beginning in 2022 to pay beneficiaries.

at the end of 2012, we project that the plan assets plus expected earnings on those investments will cover the benefit payments for these plans until

2022. We project that Brink’s will be required to contribute cash to the plan beginning in 2022 to pay beneficiaries.

Discounted cash flows at plan discount rates are supplemental financial measures that are not required by, or presented in accordance with GAAP. The

purpose of the discounted cash flows at plan discount rate is to present our retirement obligations after giving effect to the benefit of earning a return on

purpose of the discounted cash flows at plan discount rate is to present our retirement obligations after giving effect to the benefit of earning a return on

plan assets. We believe this measure is helpful in assessing the present value of future funding requirements of the company in order to meet plan

benefit obligations. Discounted cash flows at plan discount rates should not be considered as an alternative to the funded status of the U.S. retirement

plans at December 31, 2012, as determined in accordance with GAAP and should be read in conjunction with our consolidated balance sheets.

Non-GAAP Reconciliations - U.S. Retirement Plans Obligation

|

DISCOUNTED CASH FLOWS AT PLAN DISCOUNT RATES - RECONCILED TO AMOUNTS REPORTED UNDER U.S. GAAP

|

|||||||||||

|

|

|

|

December 31, 2012

|

||||||||

|

|

|

|

|

|

Primary U.S.

pension plan (b) |

|

UMWA plans

(c) |

|

Other unfunded

U.S. plans |

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Funded status of U.S. retirement plans - GAAP

|

|

$

|

263

|

|

257

|

|

65

|

|

585

|

|

|

|

Present value of projected earnings of plan assets (a)

|

|

|

(65)

|

|

(15)

|

|

-

|

|

(80)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discounted cash flows at plan discount rates - Non-GAAP

|

|

$

|

198

|

|

242

|

|

65

|

|

505

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plan discount rate

|

|

|

4.20%

|

|

3.90%

|

|

|

|

|

|

|

|

Expected return of assets

|

|

|

8.00%

|

|

8.25%

|

|

|

|

|

20

Appendix

Non-GAAP Reconciliations

Non-GAAP Reconciliations

GAAP

Basis

Basis

Additional

European

Operations

to be

Exited (a)

European

Operations

to be

Exited (a)

Gains on

Acquisitions

and Asset

Dispositions (b)

Acquisitions

and Asset

Dispositions (b)

Employee Benefit

Settlement &

Severance Losses (c)

Settlement &

Severance Losses (c)

U.S.

Retirement

Plans (d)

Retirement

Plans (d)

Tax Benefit on Change

in Health Care Funding

Strategy(e)

in Health Care Funding

Strategy(e)

Adjust

Income Tax

Rate (f)

Income Tax

Rate (f)

Non-

GAAP

Basis

GAAP

Basis

First Quarter 2012

Revenue:

Latin America

$

386.3

−

−

−

−

−

−

386.3

EMEA

280.4

(2.4)

−

−

−

−

−

278.0

Asia Pacific

37.6

−

−

−

−

−

−

37.6

International

704.3

(2.4)

−

−

−

−

−

701.9

North America

236.4

−

−

−

−

−

−

236.4

Revenues

$

940.7

(2.4)

−

−

−

−

−

938.3

Operating profit:

International

$

65.2

0.6

−

0.8

−

−

−

66.6

North America

5.8

−

−

−

2.2

−

−

8.0

Segment operating profit

71.0

0.6

−

0.8

2.2

−

−

74.6

Non-segment

(24.3)

−

−

−

14.7

−

−

(9.6)

Operating profit

$

46.7

0.6

−

0.8

16.9

−

−

65.0

Amounts attributable to Brink’s:

Income from continuing operations

$

20.9

0.7

(1.2)

0.6

10.2

−

0.8

32.0

Diluted EPS - continuing operations

0.43

0.01

(0.02)

0.01

0.21

−

0.02

0.66

Non-GAAP Reconciliations - 1Q12

Amounts may not add due to rounding. See page 27 for notes.

22

GAAP

Basis

Basis

Additional

European

Operations

to be

Exited (a)

European

Operations

to be

Exited (a)

Gains on

Acquisitions

and Asset

Dispositions (b)

Acquisitions

and Asset

Dispositions (b)

Employee Benefit

Settlement &

Severance Losses (c)

Settlement &

Severance Losses (c)

U.S.

Retirement

Plans (d)

Retirement

Plans (d)

Tax Benefit on Change

in Health Care Funding

Strategy(e)

in Health Care Funding

Strategy(e)

Adjust

Income Tax

Rate (f)

Income Tax

Rate (f)

Non-

GAAP

Basis

GAAP

Basis

Second Quarter 2012

Revenue:

Latin America

$

375.9

−

−

−

−

−

−

375.9

EMEA

289.4

(2.2)

−

−

−

−

−

287.2

Asia Pacific

38.5

−

−

−

−

−

−

38.5

International

703.8

(2.2)

−

−

−

−

−

701.6

North America

237.6

−

−

−

−

−

−

237.6

Revenues

$

941.4

(2.2)

−

−

−

−

−

939.2

Operating profit:

International

$

40.5

0.7

−

0.3

−

−

−

41.5

North America

11.4

−

−

−

2.2

−

−

13.6

Segment operating profit

51.9

0.7

−

0.3

2.2

−

−

55.1

Non-segment

(21.3)

−

(0.9)

−

10.5

−

−

(11.7)

Operating profit

$

30.6

0.7

(0.9)

0.3

12.7

−

−

43.4

Amounts attributable to Brink’s:

Income from continuing operations

$

33.8

0.7

(0.9)

0.2

7.6

(20.9)

2.4

22.9

Diluted EPS - continuing operations

0.69

0.01

(0.02)

−

0.16

(0.43)

0.05

0.47

Non-GAAP Reconciliations - 2Q12

Amounts may not add due to rounding. See page 27 for notes.

23

GAAP

Basis

Basis

Additional

European

Operations

to be

Exited (a)

European

Operations

to be

Exited (a)

Gains on

Acquisitions

and Asset

Dispositions (b)

Acquisitions

and Asset

Dispositions (b)

Employee Benefit

Settlement &

Severance Losses (c)

Settlement &

Severance Losses (c)

U.S.

Retirement

Plans (d)

Retirement

Plans (d)

Tax Benefit on Change

in Health Care Funding

Strategy(e)

in Health Care Funding

Strategy(e)

Adjust

Income Tax

Rate (f)

Income Tax

Rate (f)

Non-

GAAP

Basis

GAAP

Basis

Third Quarter 2012

Revenue:

Latin America

$

385.2

−

−

−

−

−

−

385.2

EMEA

294.6

(2.3)

−

−

−

−

−

292.3

Asia Pacific

39.1

−

−

−

−

−

−

39.1

International

718.9

(2.3)

−

−

−

−

−

716.6

North America

234.6

−

−

−

−

−

−

234.6

Revenues

$

953.5

(2.3)

−

−

−

−

−

951.2

Operating profit:

International

$

56.9

2.1

(7.2)

2.0

−

−

−

53.8

North America

8.3

−

−

−

2.2

−

−

10.5

Segment operating profit

65.2

2.1

(7.2)

2.0

2.2

−

−

64.3

Non-segment

(22.0)

−

0.1

−

11.5

−

−

(10.4)

Operating profit

$

43.2

2.1

(7.1)

2.0

13.7

−

−

53.9

Amounts attributable to Brink’s:

Income from continuing operations

$

19.5

2.2

(3.0)

1.4

8.2

−

(0.3)

28.0

Diluted EPS - continuing operations

0.40

0.04

(0.06)

0.03

0.17

−

(0.01)

0.58

Non-GAAP Reconciliations - 3Q12

Amounts may not add due to rounding. See page 27 for notes.

24

Non-GAAP Reconciliations - 4Q12

GAAP

Basis

Basis

Additional

European

Operations

to be

Exited (a)

European

Operations

to be

Exited (a)

Gains on

Acquisitions

and Asset

Dispositions (b)

Acquisitions

and Asset

Dispositions (b)

Employee Benefit

Settlement &

Severance Losses (c)

Settlement &

Severance Losses (c)

U.S.

Retirement

Plans (d)

Retirement

Plans (d)

Tax Benefit on Change

in Health Care Funding

Strategy(e)

in Health Care Funding

Strategy(e)

Adjust

Income Tax

Rate (f)

Income Tax

Rate (f)

Non-

GAAP

Basis

GAAP

Basis

Fourth Quarter 2012

Revenue:

Latin America

$

432.0

−

−

−

−

−

−

432.0

EMEA

294.0

(2.3)

−

−

−

−

−

291.7

Asia Pacific

43.7

−

−

−

−

−

−

43.7

International

769.7

(2.3)

−

−

−

−

−

767.4

North America

236.8

−

−

−

−

−

−

236.8

Revenues

$

1,006.5

(2.3)

−

−

−

−

−

1,004.2

Operating profit:

International

$

65.0

0.2

(1.3)

0.8

−

−

−

64.7

North America

7.0

−

−

−

2.2

−

−

9.2

Segment operating profit

72.0

0.2

(1.3)

0.8

2.2

−

−

73.9

Non-segment

(21.3)

−

−

−

10.7

−

−

(10.6)

Operating profit

$

50.7

0.2

(1.3)

0.8

12.9

−

−

63.3

Amounts attributable to Brink’s:

Income from continuing operations

$

32.6

0.3

(8.9)

0.6

7.8

(0.2)

(2.9)

29.3

Diluted EPS - continuing operations

0.67

0.01

(0.18)

0.01

0.16

−

(0.06)

0.60

Amounts may not add due to rounding. See page 27 for notes.

25

Non-GAAP Reconciliations FY 2012

GAAP

Basis

Basis

Additional

European

Operations

to be

Exited (a)

European

Operations

to be

Exited (a)

Gains on

Acquisitions

and Asset

Dispositions (b)

Acquisitions

and Asset

Dispositions (b)

Employee Benefit

Settlement &

Severance Losses (c)

Settlement &

Severance Losses (c)

U.S.

Retirement

Plans (d)

Retirement

Plans (d)

Tax Benefit on Change

in Health Care Funding

Strategy(e)

in Health Care Funding

Strategy(e)

Adjust

Income Tax

Rate (f)

Income Tax

Rate (f)

Non-

GAAP

Basis

GAAP

Basis

Full Year 2012

Revenue:

Latin America

$

1,579.4

−

−

−

−

−

−

1,579.4

EMEA

1,158.4

(9.2)

−

−

−

−

−

1,149.2

Asia Pacific

158.9

−

−

−

−

−

−

158.9

International

2,896.7

(9.2)

−

−

−

−

−

2,887.5

North America

945.4

−

−

−

−

−

−

945.4

Revenues

$

3,842.1

(9.2)

−

−

−

−

−

3,832.9

Operating profit:

International

$

227.6

3.6

(8.5)

3.9

−

−

−

226.6

North America

32.5

−

−

−

8.8

−

−

41.3

Segment operating profit

260.1

3.6

(8.5)

3.9

8.8

−

−

267.9

Non-segment

(88.9)

−

(0.8)

−

47.4

−

−

(42.3)

Operating profit

$

171.2

3.6

(9.3)

3.9

56.2

−

−

225.6

Amounts attributable to Brink’s:

Income from continuing operations

$

106.8

3.9

(14.0)

2.8

33.8

(21.1)

−

112.2

Diluted EPS - continuing operations

2.20

0.08

(0.29)

0.06

0.70

(0.43)

−

2.31

Amounts may not add due to rounding. See page 27 for notes.

26

Non-GAAP Reconciliations - 2012 Footnotes

27

(a) To eliminate results of additional European operations we intend to exit in 2013. Operations do not currently meet

requirements to be classified as discontinued operations.

requirements to be classified as discontinued operations.

(b) To eliminate:

• Gains related to the sale of investments in mutual fund securities ($1.9 million in the first quarter and $0.5 million in

the third quarter). Proceeds from the sales were used to fund the settlement of pension obligations related to our

former chief executive officer and chief administrative officer.

the third quarter). Proceeds from the sales were used to fund the settlement of pension obligations related to our

former chief executive officer and chief administrative officer.

• Gains and losses related to business acquisitions and dispositions. A $0.9 million gain was recognized in the second

quarter and a $0.1 million loss was recognized in the third quarter. In the fourth-quarter of 2012, tax expense

included a benefit of $7.5 million related to a reduction in an income tax accrual established as part of the 2010

acquisition of subsidiaries in Mexico, and pretax income included a $2.1 million favorable adjustment to the local

profit sharing accrual as a result of the change in tax expectation.

quarter and a $0.1 million loss was recognized in the third quarter. In the fourth-quarter of 2012, tax expense

included a benefit of $7.5 million related to a reduction in an income tax accrual established as part of the 2010

acquisition of subsidiaries in Mexico, and pretax income included a $2.1 million favorable adjustment to the local

profit sharing accrual as a result of the change in tax expectation.

• Third quarter gain on the sale of real estate in Venezuela ($7.2 million).

• Selling costs related to certain operations expected to be sold in the near term and cost related to an acquisition

completed in first quarter 2013. A $0.8 million loss was recognized in the fourth quarter.

completed in first quarter 2013. A $0.8 million loss was recognized in the fourth quarter.

(c) To eliminate employee benefit settlement and acquisition-related severance losses (Mexico and Argentina). Employee

termination benefits in Mexico are accounted for under FASB ASC Topic 715, Compensation - Retirement Benefits.

termination benefits in Mexico are accounted for under FASB ASC Topic 715, Compensation - Retirement Benefits.

(d) To eliminate expenses related to U.S. retirement plans.

(e) To eliminate tax benefit related to change in retiree health care funding strategy.

(f) To adjust effective income tax rate in the interim period to be equal to the full-year non-GAAP effective income tax rate.

The full-year non-GAAP effective tax rate for 2012 is 36.6%.

The full-year non-GAAP effective tax rate for 2012 is 36.6%.

Non-GAAP Reconciliations - 4Q11 and FY 2011

28

Amounts may not add due to rounding. See page 29 for notes.

GAAP

Basis

Basis

Additional European

Operations to be

Exited(a)

Operations to be

Exited(a)

Gains on

Acquisitions and

Asset

Dispositions(b)

Acquisitions and

Asset

Dispositions(b)

Mexico Employee

Benefit Settlement

Losses (c)

Benefit Settlement

Losses (c)

CEO Retirement

Costs (d)

Costs (d)

U.S.

Retirement

Plans (e)

Retirement

Plans (e)

Adjust

Income Tax

Rate (f)

Income Tax

Rate (f)

Non-GAAP

Basis

Basis

Fourth Quarter 2011

Revenue:

Latin America

$

392.8

−

−

−

−

−

−

392.8

EMEA

291.6

(2.7)

−

−

−

−

−

288.9

Asia Pacific

40.0

−

−

−

−

−

−

40.0

International

724.4

(2.7)

−

−

−

−

−

721.7

North America

243.9

−

−

−

−

−

−

243.9

Revenues

$

968.3

(2.7)

−

−

−

−

−

965.6

Operating Profit:

International

$

71.3

0.4

−

0.4

−

−

−

72.1

North America

5.5

−

−

−

−

0.9

−

6.4

Segment operating profit

76.8

0.4

−

0.4

−

0.9

−

78.5

Non-segment

(21.0)

−

−

−

4.1

6.2

−

(10.7)

Operating profit

$

55.8

0.4

−

0.4

4.1

7.1

−

67.8

Amounts attributable to Brink’s:

Income from continuing operations

$

23.3

0.5

−

0.3

2.6

4.5

0.9

32.1

Diluted EPS - continuing operations

0.48

0.01

−

0.01

0.05

0.09

0.02

0.67

Full Year 2011

Revenue:

Latin America

$

1,460.7

−

−

−

−

−

−

1,460.7

EMEA

1,177.7

(10.8)

−

−

−

−

−

1,166.9

Asia Pacific

153.7

−

−

−

−

−

−

153.7

International

2,792.1

(10.8)

−

−

−

−

−

2,781.3

North America

974.2

−

−

−

−

−

−

974.2

Revenues

$

3,766.3

(10.8)

−

−

−

−

−

3,755.5

Operating Profit:

International

$

227.9

2.6

−

2.1

−

−

−

232.6

North America

31.4

−

−

−

−

3.2

−

34.6

Segment operating profit

259.3

2.6

−

2.1

−

3.2

−

267.2

Non-segment

(59.8)

−

(9.7)

−

4.1

24.8

−

(40.6)

Operating profit

$

199.5

2.6

(9.7)

2.1

4.1

28.0

−

226.6

Amounts attributable to Brink’s:

Income from continuing operations

$

96.5

2.9

(9.6)

1.5

2.6

17.7

−

111.6

Diluted EPS - continuing operations

2.01

0.06

(0.20)

0.03

0.05

0.37

−

2.32

Non-GAAP Reconciliations - 2011 Footnotes

(c) To eliminate employee benefit settlement loss related to Mexico. Portions of Brink’s Mexican subsidiaries’ accrued employee

termination benefit were paid in the second and third quarters of 2011. The employee termination benefit is accounted for under

FASB ASC Topic 715, Compensation - Retirement Benefits. Accordingly, the severance payments resulted in settlement losses.

termination benefit were paid in the second and third quarters of 2011. The employee termination benefit is accounted for under

FASB ASC Topic 715, Compensation - Retirement Benefits. Accordingly, the severance payments resulted in settlement losses.

(d) To eliminate the costs related to the retirement of the former chief executive officer.

(e) To eliminate expenses related to U.S. retirement liabilities.

(f) To adjust effective income tax rate to be equal to the full-year non-GAAP effective income tax rate. The non-GAAP effective tax rate

for 2011 is 35.1%.

for 2011 is 35.1%.

(a) To eliminate results of additional European operations we intend to exit in 2013. Operations do not currently meet requirements to be

classified as discontinued operations.

classified as discontinued operations.

(b) To eliminate gains as follows:

|

|

|

|

Full Year 2011

|

|

||

|

|

|

|

Operating

|

|

EPS

|

|

|

|

Sale of U.S. Document Destruction business

|

$

|

(6.7)

|

|

(0.09)

|

|

|

|

Gains on available-for-sale equity and debt securities

|

|

−

|

|

(0.05)

|

|

|

|

Acquisition of controlling interests

|

|

(2.5)

|

|

(0.05)

|

|

|

|

Sale of former operating assets

|

|

(0.5)

|

|

(0.01)

|

|

|

|

|

$

|

(9.7)

|

|

(0.20)

|

|

29

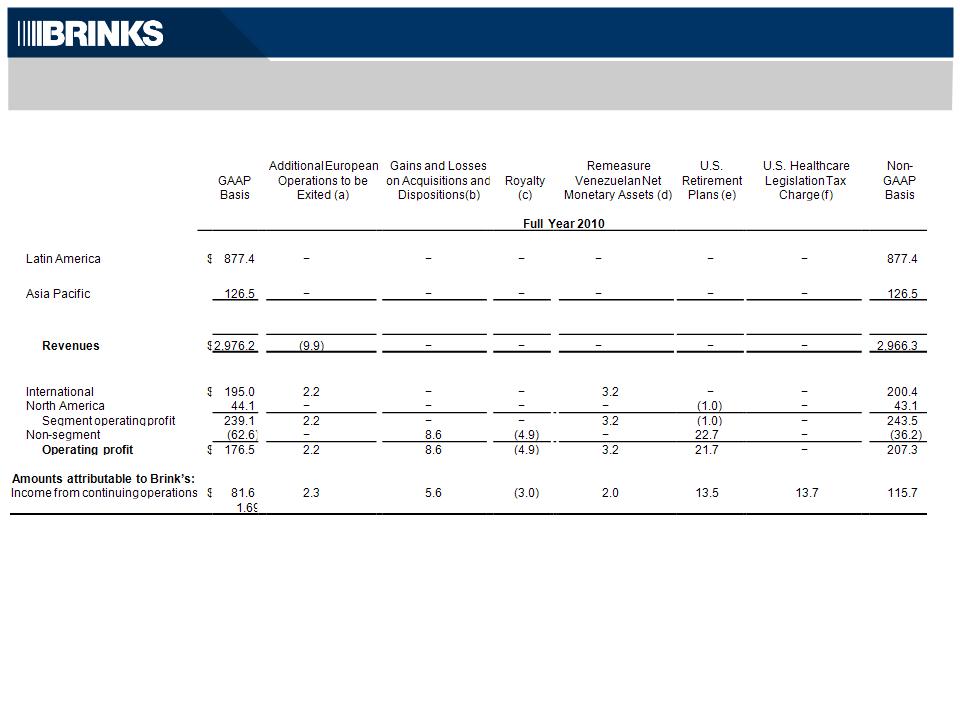

Non-GAAP Reconciliations - Full Year 2010

30

Amounts may not add due to rounding. See page 31 for notes.

Revenue:

EMEA

1,054.5

(9.9)

−

−

−

−

−

1,044.6

International

2,058.4

(9.9)

−

−

−

−

−

2,048.5

North America

917.8

−

−

−

−

−

−

917.8

Operating profit:

Diluted EPS - continuing operations

0.05

0.12

(0.06)

0.04

0.28

0.29

2.39

Non-GAAP Reconciliations - 2010 Footnotes

31

(a) To eliminate results of additional European operations we intend to exit in 2013. Operations do not currently meet

requirements to be classified as discontinued operations.

requirements to be classified as discontinued operations.

(b) To eliminate:

• Loss recognized related to acquisition of controlling interest in subsidiary previously accounted for as cost method

investment and bargain purchase gain in Mexico.

investment and bargain purchase gain in Mexico.

• Exchange of marketable equity securities.

(c) To eliminate royalty income from former home security business.

(d) To reverse remeasurement gains and losses in Venezuela. For accounting purposes, Venezuela is considered a highly

inflationary economy. Under U.S. GAAP, subsidiaries that operate in Venezuela record gains and losses in earnings for the

remeasurement of bolivar fuerte-denominated net monetary assets.

inflationary economy. Under U.S. GAAP, subsidiaries that operate in Venezuela record gains and losses in earnings for the

remeasurement of bolivar fuerte-denominated net monetary assets.

(e) To eliminate expenses related to U.S. retirement liabilities.

(f) To eliminate $13.7 million of tax expense related to the reversal of a deferred tax asset as a result of U.S. healthcare

legislation.

legislation.

Non-GAAP Reconciliations - Cash Flows

32

(a) To the change in the balance of customer obligations related to cash received and processed in certain of our secure cash logistics

operations. The title to this cash transfers to us for a short period of time. The cash is generally credited to customers’ accounts the following

day and we do not consider it as available for general corporate purposes in the management of our liquidity and capital resources.

operations. The title to this cash transfers to us for a short period of time. The cash is generally credited to customers’ accounts the following

day and we do not consider it as available for general corporate purposes in the management of our liquidity and capital resources.

(b) To eliminate cash flows related to our discontinued operations.

Non-GAAP cash flows from operating activities are supplemental financial measures that are not required by, or presented in accordance with

GAAP. The purpose of the non-GAAP cash flows from operating activities is to report financial information excluding the impact of cash received

GAAP. The purpose of the non-GAAP cash flows from operating activities is to report financial information excluding the impact of cash received

and processed in certain of our secure cash logistics operations and without cash flows from discontinued operations. Brink’s believes these

measures are helpful in assessing cash flows from operations, enable period-to-period comparability and are useful in predicting future operating

cash flows. Non-GAAP cash flows from operating activities should not be considered as an alternative to cash flows from operating activities

determined in accordance with GAAP and should be read in conjunction with our consolidated statements of cash flows.

|

NON-GAAP CASH FLOWS FROM OPERATING ACTIVITIES - RECONCILED TO AMOUNTS REPORTED UNDER U.S. GAAP

|

||||||

|

|

|

|

2012

|

|

|

2011

|

|

Cash flows from operating activities - GAAP

|

$

|

250.5

|

|

$

|

247.0

|

|

|

Decrease (increase) in certain customer obligations (a)

|

|

(15.7)

|

|

|

11.7

|

|

|

Discontinued operations (b)

|

|

11.3

|

|

|

11.4

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities - Non-GAAP

|

$

|

246.1

|

|

$

|

270.1

|

|

NET DEBT RECONCILED TO GAAP

|

|

|

December 31,

|

|||||

|

|

|

|

2012

|

|

2011

|

|||

|

Debt:

|

|

|

|

|

||||

|

|

Short-term debt

|

|

$

|

26.7

|

|

25.4

|

||

|

|

Long-term debt

|

|

|

362.6

|

|

364.0

|

||

|

|

|

|

|

|

||||

|

Less:

|

|

|

|

|

|

|

||

|

Cash and cash equivalents

|

|

|

201.7

|

|

182.9

|

|||

|

|

|

|

||||||

|

|

|

|

Cash and cash equivalents available for general corporate purposes

|

|

|

157.7

|

|

157.8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Debt

|

|

$

|

231.6

|

|

231.6

|

|

(a) Title to cash received and processed in certain of our secure cash logistics operations transfers to us for a short period of time. The cash is

generally credited to customers’ accounts the following day and we do not consider it as available for general corporate purposes in the

management of our liquidity and capital resources and in our computation of Net Debt.

Net Debt is a supplemental financial measure that is not required by, or presented in accordance with GAAP. We use Net Debt as a measure of

our financial leverage. We believe that investors also may find Net Debt to be helpful in evaluating our financial leverage. Net Debt should not be

our financial leverage. We believe that investors also may find Net Debt to be helpful in evaluating our financial leverage. Net Debt should not be

considered as an alternative to Debt determined in accordance with GAAP and should be reviewed in conjunction with our consolidated balance

sheets. Set forth above is a reconciliation of Net Debt, a non-GAAP financial measure, to Debt, which is the most directly comparable financial

measure calculated and reported in accordance with GAAP. Net Debt excluding cash and debt in Venezuelan operations was $280 million at

December 31, 2012, and $242 million at December 31, 2011.

Non-GAAP Reconciliations - Net Debt

33