Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - IBERIABANK CORP | d473365d8k.htm |

| EX-99.1 - EXHIBIT 99.1 - IBERIABANK CORP | d473365dex991.htm |

4Q12 Earnings Conference Call

4Q12 Earnings Conference Call

Supplemental Presentation

Supplemental Presentation

January 24, 2013

January 24, 2013

Exhibit 99.2 |

| 2

Safe Harbor Language

Safe Harbor Language

To the extent that statements in this presentation and the accompanying press release relate to future

plans, objectives, financial results or performance of IBERIABANK Corporation, these statements

are deemed to be forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. Such statements, which are based on management’s

current information, estimates and assumptions and the current economic environment, are

generally identified by the use of the words “plan”, “believe”, “expect”, “intend”,

“anticipate”, “estimate”, “project” or similar expressions.

IBERIABANK Corporation’s actual strategies and results in future periods may differ

materially from those currently expected due to various risks and uncertainties.

Actual results could differ materially because of factors such as the level of market volatility, our

ability to execute our growth strategy, including the availability of future FDIC-assisted

failed bank opportunities, unanticipated losses related to the integration of, and refinements

to purchase accounting adjustments for, acquired businesses and assets and assumed liabilities

in these transactions, adjustments of fair values of acquired assets and assumed liabilities

and of deferred taxes in acquisitions, credit risk of our customers, effects of the on-going

correction in residential real estate prices and reduced levels of home sales, sufficiency of our

allowance for loan losses, changes in interest rates, access to funding sources, reliance on

the services of executive management, competition for loans, deposits and investment dollars,

reputational risk and social factors, changes in government regulations and legislation,

increases in FDIC insurance assessments, geographic concentration of our markets and economic

conditions in these markets, rapid changes in the financial services industry, dependence on our

operational, technological, and organizational systems or infrastructure and those of third-party

providers of those services, hurricanes and other adverse weather events, the modest trading

volume of our common sock, and valuation of intangible assets. These and other factors

that may cause actual results to differ materially from these forward-looking statements

are discussed in the Company’s Annual Report on Form 10-K and other filings with the

Securities and Exchange Commission (the “SEC”), available at the SEC’s website,

http://www.sec.gov, and the Company’s website, http://www.iberiabank.com, under the

heading “Investor Information.” All information in this presentation and the

accompanying press release is as of the date of this release. The Company undertakes no

duty to update any forward-looking statement to conform to the statement to actual results or

changes in the Company’s expectations. Certain tabular presentations may not

reconcile because of rounding.

|

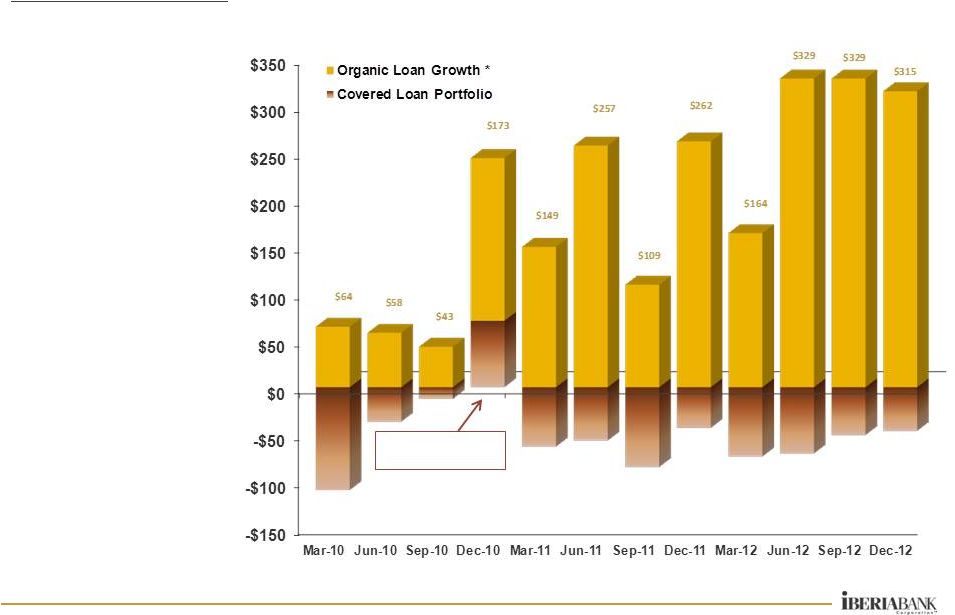

33 Organic loan

growth: Core deposit growth:

Very modest 3-basis point net interest margin decline

Tax-equivalent revenues up $7 million, or 5% (20% annualized)

Good growth in service charge income and fee income businesses

Service

Charges

–

up

5%

compared

to

3Q12

Mortgage

–

second

highest

quarterly

production

level

in

our

history

Title

Insurance

–

second

highest

quarterly

revenue

in

past

five

years

Capital

Markets

–

good

profitability

in

fourth

quarter,

revenue

up

$1.2

million

Other influences on fourth quarter performance:

Closed/consolidated 8 branches (11 for the year)

Opened 7 branches (14 for the year)

Growth

in

excess

liquidity

–

Cash

&

Equivalents

of

$1

billion,

up

56%

Strong

asset

quality

in

our

legacy

franchise

and

capital

remains

stout

Non-operating: $2.2 million gain and $2.6 million in non-operating

expenses Introductory Comments

Introductory Comments

Fourth

Quarter

2012

–

Summary

Comments

$315 million since September 30, 2012 (+18% annualized)

$1.1 billion since year-end 2011 (+19% annualized)

$912 million since September 30, 2012 (+48% annualized)

$1.6 billion since year-end 2011 (+24% annualized)

|

4

Financial Overview

Financial Overview

Performance Metrics –

Yields and Costs

•

Investment yield declined 13

bps due to 2.09%

•

Net covered loan yield up 13

bps as base yield improved;

offset the 3 bps decline in

non-covered loan yield

•

Interest bearing deposit

costs declined 5 bps;

continued future re-pricing

opportunities (next slide)

•

Average noninterest bearing

deposits up $155 million

(+9%)

•

Margin declined 3 basis

points to 3.55%

•

Decline due primarily to

investment portfolio roll-

down and excess liquidity

9/30/2012

12/31/2012

Investment Securities

2.22%

2.09%

(13)

bps

Covered Loans & Loss Share Receivable

5.42%

5.55%

13

bps

Noncovered Loans

4.55%

4.52%

(3)

bps

Loans & Loss Share Receivable

4.71%

4.70%

(1)

bps

Mortgage Loans Held For Sale

3.21%

2.96%

(25)

bps

Other Earning Assets

0.85%

0.61%

(24)

bps

Total Earning Assets

4.14%

4.06%

(8)

bps

Interest Bearing Deposits

0.58%

0.53%

(5)

bps

Short-Term Borrowings

0.21%

0.21%

(0)

bps

Long-Term Borrowings

3.10%

3.17%

7

bps

Total Interest Bearing Liabilities

0.69%

0.65%

(4)

bps

Net Interest Spread

3.45%

3.41%

(4)

bps

Net Interest Margin

3.58%

3.55%

(3)

bps

* Earning asset yields are shown on a fully taxable equivalent basis.

%/Basis Point

Change

For Quarter Ended: |

5

Financial Overview

Financial Overview

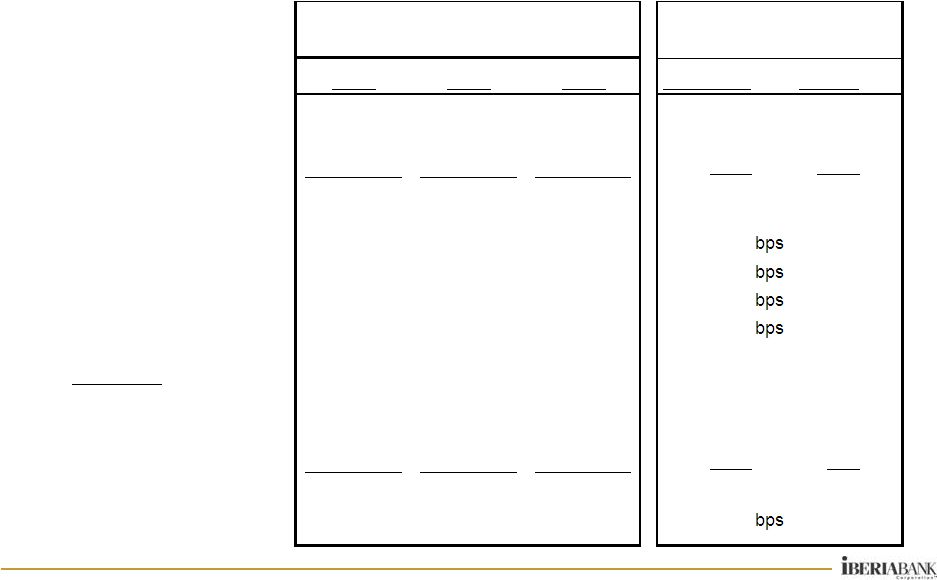

Quarterly Re-pricing Schedule

•

$1.5 Billion in time deposits re-price over next 12 months at weighted average

0.74% rate •

During 4Q12, new and re-priced time deposits were booked at an average cost of

0.54% •

In 2012, retention rate of time deposits was 90% with average reduction in

rate of 46 basis points $ in millions

Note: Amounts exclude re-pricing of assets and liabilities from prior

quarters 1Q13

2Q13

3Q13

4Q13

1Q14

Cash Equivalents

Balance

771.9

$

-

$

-

$

-

$

-

$

Rate

0.46%

0.00%

0.00%

0.00%

0.00%

Investments

Balance

112.0

$

139.7

$

109.1

$

118.5

$

93.1

$

Rate

3.15%

2.56%

2.99%

2.70%

2.79%

Loans

Balance

4,164.7

$

425.6

$

378.2

$

321.4

$

276.7

$

Rate

3.68%

5.20%

5.11%

4.98%

4.41%

Time Deposits

Balance

450.8

$

425.9

$

368.3

$

292.8

$

144.8

$

Rate

0.73%

0.63%

0.75%

0.91%

1.32%

Borrowed Funds

Balance

437.1

$

37.7

$

2.3

$

1.0

$

0.5

$

Rate

1.17%

3.44%

4.48%

4.28%

3.72% |

6

Financial Overview

Financial Overview

Interest Rate Risk Simulations

Source: Bancware model, as of December 31, 2012

* Assumes instantaneous and parallel shift in interest rates based on static

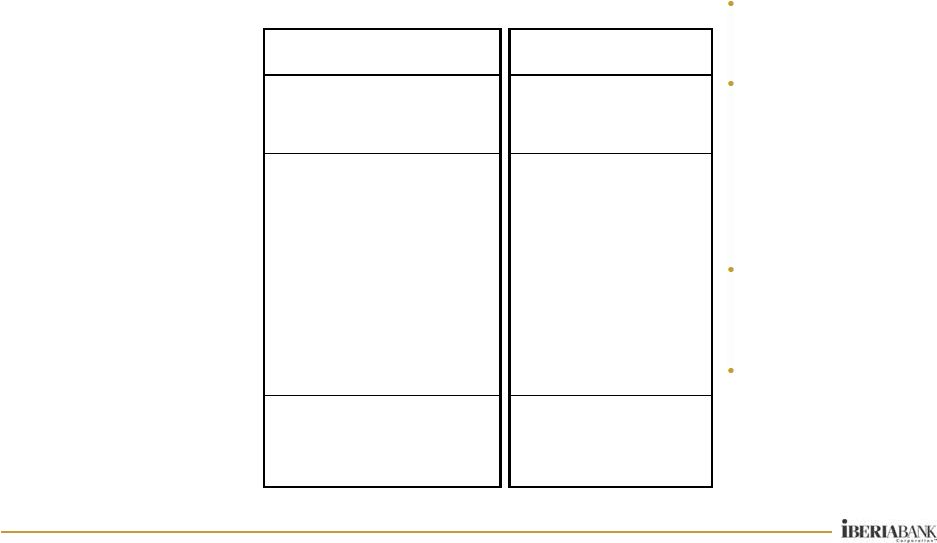

balance sheet •

Asset sensitive from an interest rate risk position

•

The degree of asset sensitivity is a function of the reaction of

competitors to changes in deposit pricing

•

Forward curve has a positive impact over 12 months

Base

Blue

Forward

Change In:

-200 bp*

-100 bp*

Case

+100 bp*

+200 bp*

Chip

Curve

Net Interest

Income

-1.7%

-0.8%

0.0%

3.8%

7.9%

-0.1%

0.6%

Economic

Value of

Equity

-9.4%

-9.2%

0.0%

8.5%

13.6%

-0.2%

-0.4% |

7

Financial Overview

Financial Overview

Performance Metrics –

Quarterly Trends

•

Relatively stable

margin

•

Average earning

assets up $480

million (+4%)

•

T/E net interest

income up $3

million (+3%)

•

Provision of $5

million:

•

Net charge-offs:

$0.1 million (0.00%

annualized rate)

•

Covered and

acquired impaired

loan provision:

$4.5 million

•

All other provision

expense: $0.4

million

Legacy asset quality measures generally improved in 4Q12

Strong capital position compared to peers

Repurchased no shares in 4Q12; 46,692 shares remain under current

authorized program

12/31/2011

3/31/2012

6/30/2012

9/30/2012

12/31/2012

Net Income ($ in thousands)

17,357

$

19,393

$

12,560

$

21,234

$

23,208

$

9%

Per Share Data:

Fully Diluted Earnings

0.59

$

0.66

$

0.43

$

0.73

$

0.79

$

8%

Operating Earnings (Non-GAAP)

0.67

0.69

0.54

0.83

0.80

-4%

Pre-provision Operating Earnings (Non-GAAP)

0.77

0.68

0.73

0.92

0.91

-2%

Tangible Book Value

36.80

37.23

37.28

37.07

37.34

1%

Key Ratios:

Return on Average Assets

0.59%

0.67%

0.43%

0.69%

0.73%

4

bps

Return on Average Common Equity

4.65%

5.21%

3.36%

5.56%

6.02%

46

bps

Return on Average Tangible Common Equity (Non-GAAP)

6.72%

7.43%

4.86%

7.91%

8.62%

71

bps

Net Interest Margin (TE)*

3.62%

3.59%

3.59%

3.58%

3.55%

(3)

bps

Tangible Efficiency Ratio (TE)* (Non-GAAP)

75.2%

74.6%

78.2%

74.3%

73.2%

(110)

bps

Tangible Common Equity Ratio (Non-GAAP)

9.52%

9.64%

9.37%

9.01%

8.66%

(35)

bps

Tier 1 Leverage Ratio

10.45%

10.51%

10.42%

10.01%

9.70%

(31)

bps

Tier 1 Common Ratio (Non-GAAP)

13.55%

13.48%

12.97%

12.04%

11.74%

(30)

bps

Total Risk Based Capital Ratio

16.21%

16.10%

15.54%

14.54%

14.19%

(35)

bps

Net Charge-Offs to Average Loans**

0.31%

0.09%

0.07%

0.11%

0.01%

(10)

bps

Nonperforming Assets to Total Assets**

0.86%

0.83%

0.84%

0.81%

0.85%

4

bps

* Fully taxable equivalent basis.

** Excluding FDIC Covered Assets and acquired impaired loans.

%/Basis Point

Change

For Quarter Ended: |

8

Financial Overview

Financial Overview

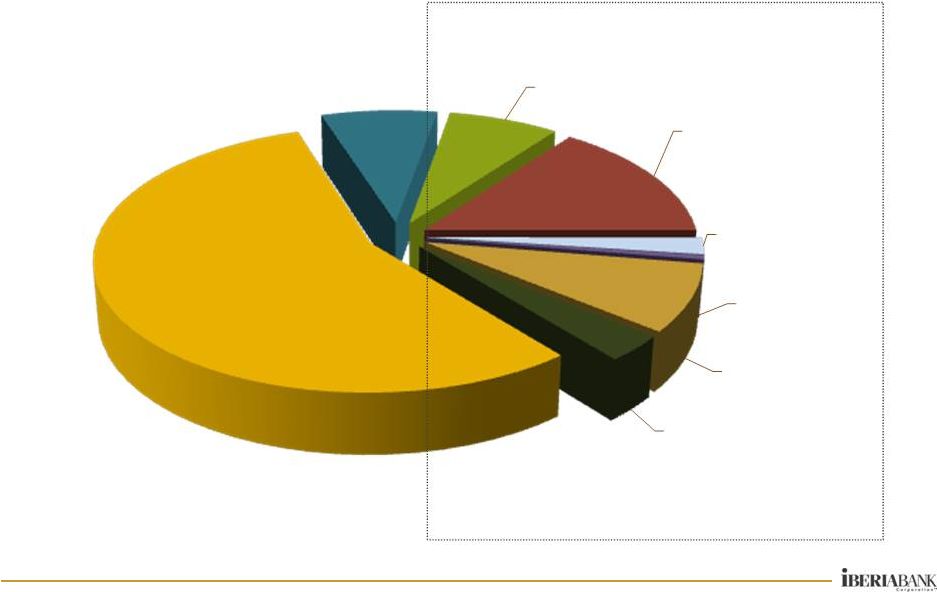

Low Risk Balance Sheet At December 31, 2012

36% Of Balance Sheet In Very Low Risk Components

8

Cash and

Equivalents,

7%

Investment

Securities,

15%

Mortgage

Loans Held

For Sale, 2%

Acquired

Loans

-

Fair

Value, 0.5%

Loans

-

FDIC

Covered, 8%

FDIC Loss

Share

Receivable,

3%

Loans -

Noncovered,

56%

Other Assets,

8% |

9

Financial Overview

Financial Overview

Non-Interest Income Trends

Strong mortgage loan income continued in 4Q12

IBERIA Capital Partners revenues up $1.2 million

Continued rebound in service charge income (+5%)

Title insurance revenue continued to be solid

$2.2 million OMNI investment redemption gain

Total originations of $2.4 billion in

2012 (+46%)

4Q12 originations down 4%

Sales down 7% and 2012 total up

45% over 2011

$78 million annual revenues (up

73%); 4Q12 revenues down 1%

Small buyback costs

Pipeline of $241 million at year-end

and $256 million on January 11th

$21 million annual revenues (+16%)

Profitability up 12-fold over 2011

4Q12 revenues down 2%

Noninterest Income ($000s)

4Q11

1Q12

2Q12

3Q12

4Q12

$ Change

% Change

Service Charges on Deposit Accounts

6,613

$

5,980

$

6,625

$

6,952

$

7,295

$

343

$

5%

ATM / Debit Card Fee Income

1,997

2,024

2,166

2,377

2,412

35

$

1%

BOLI Proceeds and CSV Income

899

951

905

916

909

(7)

$

-1%

Mortgage Income

13,274

13,718

18,185

23,215

22,935

(280)

$

-1%

Gain (Loss) on Sale of Investments, Net

793

2,836

901

41

(4)

(45)

$

-110%

Title Revenue

4,846

4,533

5,339

5,623

5,492

(131)

$

-2%

Broker Commissions (includes Capital Markets)

2,457

3,060

3,102

3,092

4,192

1,100

$

36%

Other Noninterest Income

4,576

4,294

4,471

4,337

4,928

591

$

14%

Noninterest income excluding non-operating income

35,455

37,396

41,694

46,553

48,158

1,605

$

3%

Non-operating income

-

-

-

-

2,196

2,196

$

100%

Total Noninterest Income

35,455

$

37,396

$

41,694

$

46,553

$

50,354

$

3,801

$

8%

4Q12 vs. 3Q12 |

10

Financial Overview

Financial Overview

Non-Interest Expense

•

Total expenses up $4 million, or 3%, in

4Q12

•

Merger-related costs of $1.2 million (-60%)

•

Other non-operating expenses of $1.4

million (down 10% compared to 3Q12 of

$1.6 million)

Linked

Quarter

increases

of:

Multiple loan and deposit campaigns

1.2

$

mil.

Business development

0.7

Seasonal property tax expense

0.4

FDIC insurance

0.4

Salary

expense

-

added

Houston

producers

0.4

Health care expense

0.3

Extra month of Florida Gulf salaries & occupancy

0.4

3.8

$

mil.

Noninterest Expense ($000s)

4Q11

1Q12

2Q12

3Q12

4Q12

$ Change

% Change

Mortgage Commissions

3,922

$

3,229

$

5,612

$

6,006

$

5,747

$

(259)

$

-4%

Hospitalization Expense

3,349

3,817

3,404

3,773

4,005

232

6%

Other Salaries and Benefits

44,039

47,522

48,011

49,270

50,675

1,405

3%

Salaries and Employee Benefits

51,310

$

54,568

$

57,028

$

59,049

$

60,426

$

1,377

$

2%

Credit/Loan Related

4,094

4,027

4,835

4,846

4,386

(460)

-9%

Occupancy and Equipment

12,498

12,677

12,852

13,500

14,413

914

7%

Amortization of Acquisition Intangibles

1,384

1,290

1,289

1,287

1,285

(2)

0%

All Other Noninterest Expense

25,987

26,373

27,105

26,611

30,328

3,717

14%

Nonint. Exp. (Ex-Non-Operating Exp.)

95,272

$

98,935

$

103,109

$

105,293

$

110,838

$

5,544

$

5%

Severance

206

219

1,053

712

370

(341)

$

-48%

Occupancy and Branch Closure Costs

-

-

2,743

284

711

427

150%

Consulting and Professional

193

220

1,661

574

339

(235)

-41%

Nonint. Exp. excluding Merger-Related

95,671

$

99,374

$

108,566

$

106,864

$

112,258

$

5,395

$

5%

Merger-Related Expenses

4,055

$

500

$

456

$

2,985

$

1,183

$

(1,802)

$

-60%

Total Noninterest Expense

99,726

$

99,873

$

109,022

$

109,848

$

113,441

$

3,592

$

3%

Tangible

Efficiency

Ratio

-

excluding

Non-op.

Exp.

72.2%

75.5%

74.4%

71.2%

72.5%

4Q12 vs. 3Q12 |

11

Financial Overview

Financial Overview

Non-Operating Items –

4Q12

Acquisition and conversion-related costs of $1.2 million in 4Q12 ($0.03 EPS)

4Q12 Other non-operating expenses of $1.4 million ($0.03 EPS)

4Q12 Covered and acquired impaired loan provision of $4.5 million ($0.10

EPS),

all

other

provision

expense

equated

to

$0.4

million

($0.01

EPS)

Pre-tax

After-tax

Per share

Pre-tax

After-tax

Per share

Pre-tax

After-tax

Per share

Net Income (GAAP)

24,024

$

17,357

$

0.59

$

29,378

$

21,234

$

0.73

$

32,037

$

23,208

$

0.79

$

Merger-related expenses

4,055

2,636

0.09

2,985

1,940

0.07

1,183

769

0.03

Severance expenses

206

134

0.00

712

463

0.02

370

241

0.01

Occupancy expenses and branch closure expenses

-

-

-

284

185

0.01

711

462

0.02

Professional expenses and litigation settlements

193

125

0.00

574

373

0.01

339

220

0.01

Other noninterest income

-

-

-

-

-

-

(2,196)

(1,427)

(0.05)

Loss (Gain) on sale of investments

(793)

(515)

(0.02)

(41)

(27)

(0.00)

4

3

-

Operating earnings (Non-GAAP)

27,685

19,737

0.67

33,892

24,168

0.83

32,448

23,476

0.80

Covered and acquired impaired loan provision for credit losses

1,659

1,078

0.04

2,318

1,507

0.05

4,504

2,928

0.10

Other provision for credit losses

2,620

1,703

0.06

1,735

1,128

0.04

362

235

0.01

Pre-provision operating earnings (Non-GAAP)

31,964

$

22,518

$

0.77

$

37,945

$

26,802

$

0.92

$

37,314

$

26,639

$

0.91

$

(1) Per share amounts may not appear to foot due to rounding

(dollars in thousands)

For The Quarter Ended

December 31, 2011

September 30, 2012

December 31, 2012

Dollar Amount

Dollar Amount

Dollar Amount

(1)

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES |

12

•

Improve long-term operating efficiency, risk-

adjusted profitability, and long-term growth

prospects of franchise

Long-Term Initiatives

Long-Term Initiatives

Update

3Q12 cost of $1.3

million, or $0.03 EPS

4Q12 cost of $1.4

million, or $0.03 EPS

Benefit of $6 million

annually, or $0.13 EPS

Acquisition and

conversion related

costs of $1.2 million

pre-tax in 4Q12

Acquisition and

conversion related

costs are expected to

be immaterial in 1Q13

$ in millions

Expenses

2Q12

3Q12

4Q12

1Q13

Total

Branch Closure Cost - Phase 1

2.7

$

0.3

$

0.7

$

-

$

3.7

$

Branch Closure Cost - Phase 2

0.5

0.5

$

Severance Expense - Phase 1

1.0

0.4

0.3

-

1.7

$

Severance Expense - Phase 2

0.1

0.1

0.2

$

Professional Services

1.7

0.6

0.3

0.1

2.7

Total Expense

5.4

$

1.3

$

1.4

$

0.7

$

8.8

$

Benefits

2Q12

3Q12

4Q12

1Q13

Full Year

2013

Facilities Expense - Phase 1

0.0

$

0.2

$

0.2

$

0.9

$

Salary and Benefits - Phase 1

0.4

0.7

0.6

2.5

Facilities Expense - Phase 2

0.4

Salary and Benefits - Phase 2

0.3

Other

0.7

0.8

0.4

1.8

Total Benefits

1.1

$

1.6

$

1.2

$

5.9

$

2Q12

3Q12

4Q12

1Q13

Total

Merger Related Expenses

0.5

$

3.0

$

1.2

$

-

$

4.7

$ |

13

Asset Quality

Asset Quality

Legacy Portfolio

Asset Quality Summary

(Excludes FDIC covered assets and acquired impaired loans)

NPAs equated to 0.85%

of total assets, up 4 bps

compared to 3Q12

Total criticized loans

equal $354 million (25%

of Tier1 capital plus

ALLL); $231 million in

classified (-7% from

3Q12) and $122 million

special mention (-12%

from 3Q12)

Net Charge-offs of only

$91,000, or an

annualized rate of

0.01% of average loans

$0.4 million provision

for legacy franchise in

4Q12

($ thousands)

12/31/2011

9/30/2012

12/31/2012

Year/Year

Qtr/Qtr

Nonaccrual Loans

60,303

$

66,201

$

70,354

$

17%

6%

OREO

20,001

18,467

26,380

32%

43%

Accruing Loans 90+ Days Past Due

3,580

3,786

1,776

-50%

-53%

Nonperforming Assets

83,884

88,454

98,510

17%

11%

Past Due Loans

83,338

91,016

93,358

12%

3%

Classified Assets

205,920

247,923

231,586

12%

-7%

Nonperforming Assets/Assets

0.86%

0.81%

0.85%

(1)

bps

4

bps

NPAs/(Loans + OREO)

1.39%

1.26%

1.34%

(5)

bps

8

bps

Classified Assets/Total Assets

4.21%

3.62%

3.05%

(116)

bps

(59)

bps

(Past Dues & Nonaccruals)/Loans

1.38%

1.30%

1.27%

(11)

bps

(3)

bps

Provision For Credit Losses

2,620

$

1,735

$

362

$

-86%

-79%

Net Charge-Offs/(Recoveries)

4,622

1,923

91

-98%

-95%

Provision Less Net Charge-Offs

(2,002)

$

(188)

$

271

$

-114%

-244%

Net Charge-Offs/Average Loans

0.31%

0.11%

0.01%

(30)

bps

(10)

bps

Reserve For Credit Losses/Loans

1.24%

1.13%

1.08%

(16)

bps

(5)

bps

For Quarter Ended:

% or Basis Point Change |

14

Asset Quality

Asset Quality

Total Portfolio Trends

($thousands)

Nonaccruals

719,236

$

567,006

$

540,867

$

-25%

-5%

OREO & Foreclosed

125,046

129,173

121,536

-3%

-6%

90+ Days Past Due

29,003

5,538

4,404

-85%

-20%

Nonperforming Assets

873,285

$

701,717

$

666,807

$

-24%

-5%

NPAs/Assets

7.43%

5.60%

5.08%

(235)

(52)

bps

NPAs/(Loans + OREO)

11.62%

8.39%

7.74%

(388)

(65)

bps

LLR/Loans

2.62%

2.45%

2.96%

34

51

bps

Net Charge-Offs/Loans

0.29%

0.10%

0.00%

(29)

(10)

bps

Past Dues:

30-89 Days Past Due

86,467

$

59,063

$

47,899

$

-45%

-19%

90+ days Past Due

29,003

5,538

4,404

-85%

-20%

Nonaccual Loans

719,236

567,006

540,867

-25%

-5%

Total 30+ Past Dues

834,706

$

631,607

$

593,170

$

-29%

-6%

% Loans

11.30%

7.67%

6.98%

(432)

(69)

bps

Qtr/Qtr

% or Basis Point Change

Total Portfolio

4Q11

3Q12

4Q12

Year/Year |

15

Markets

Markets

Loan Growth

Organic Loan Growth

$ in millions

4th Quarter 2012:

Sterling Bank FDIC-

Assisted Acquisition

•

•

•

•

$315 million, or

+4% (+18%

annualized)

Year of 2012:

$1.1 billion, or

+19%

Past 3 years:

$2.3 billion, or +55%

(+18% annualized)

The FDIC covered

loan portfolio

declined 35%, or

$578 million (a 12%

annualized rate)

* Organic loan growth excludes the outstanding balance of loans acquired in non-covered

transactions (e.g., OMNI, Cameron, and Florida Gulf) at the date of the acquisition in the respective acquisition periods |

16

Markets

Markets

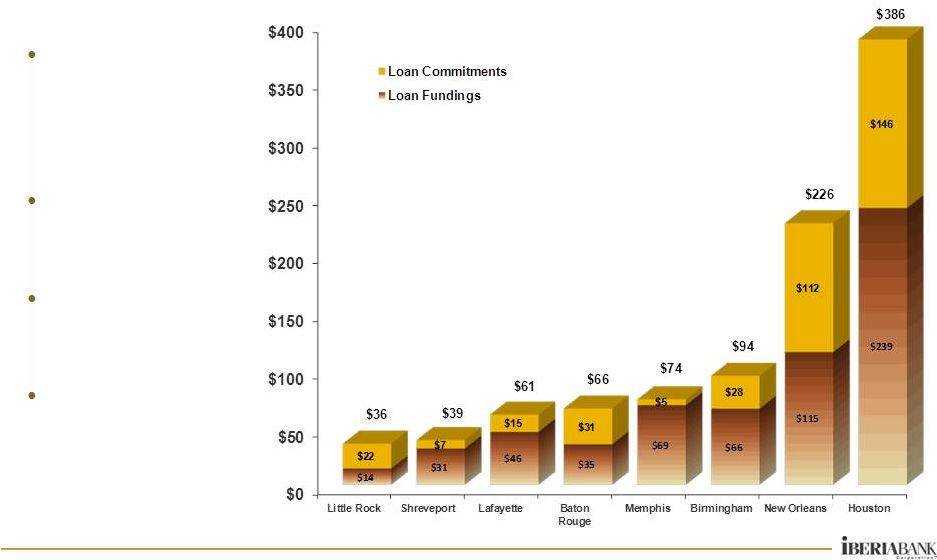

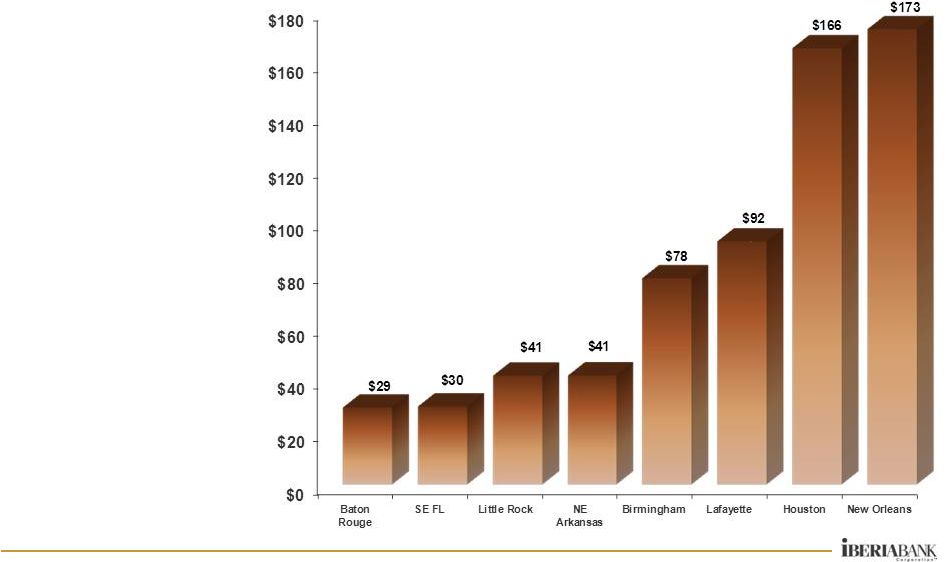

Loan Originations 4Q12 –Top Markets

$ in millions

$1.2 billion in total

funded loans and

unfunded loan

commitments

originated in 4Q12

Tremendous growth

in Houston and New

Orleans

Recently added new

team members in

Houston

Exceptional growth

in other markets in

which we have

invested heavily |

17

Markets

Markets

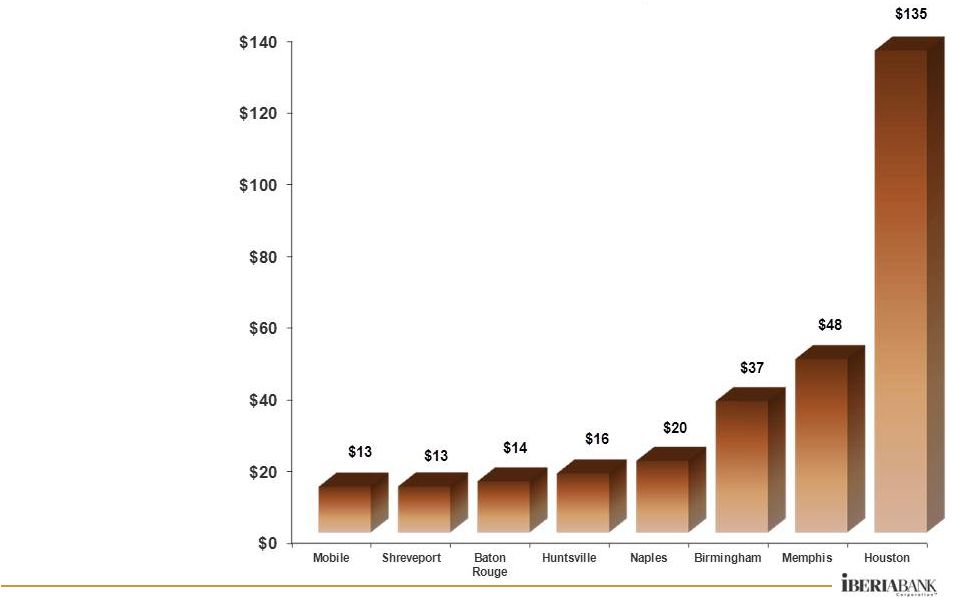

Net Loan Growth 4Q12 –Top Markets

$ in millions

•

Diversified strength

throughout our

franchise

•

Strong growth net

of loan pay-downs

•

Strongest markets

are Houston,

Memphis, and

Birmingham

•

Small business

lending is a

potential growth

engine |

18

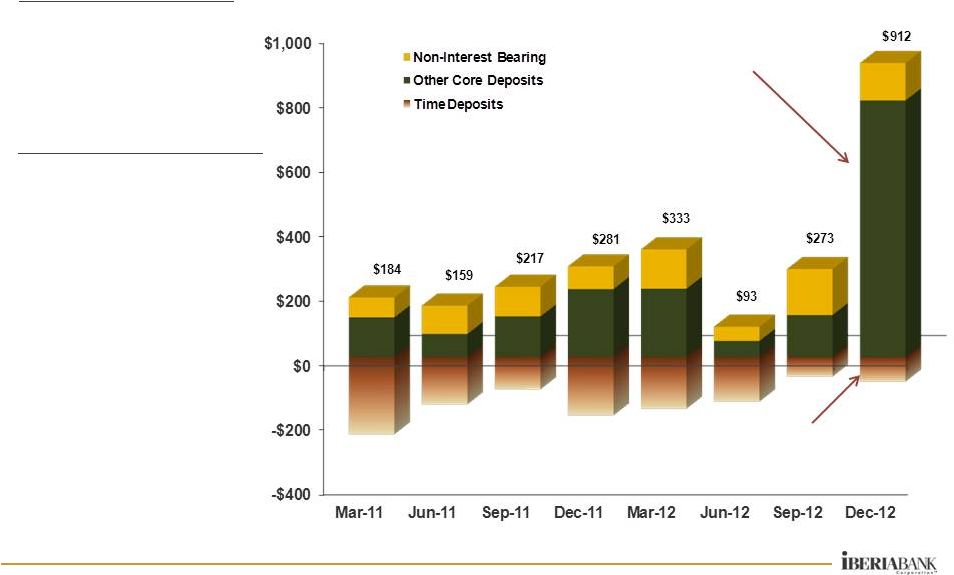

Excludes acquired deposits

Markets

Markets

Organic Deposit Growth

$ in millions

Organic Deposit Growth

4th Quarter 2012:

•

Excluding wholesale

and seasonal

deposits, growth of

$525 million, or +5%

(+21% annualized)

Year of 2012:

•

$1.2 billion, or +13%

Past 3 years:

•

$1.4 billion, or +19 %

(+6 % annualized)

•

In 4Q12, $835

million, or +8%

(+34%

annualized)

Total Deposit Growth

Very strong transaction

account growth

Time deposit reduction

tempered by wholesale

deposit growth in 4Q12 |

19

Markets

Markets

Core Deposit Growth 4Q12 –Top Markets

$ in millions

•

Balanced core

deposit growth

•

Extraordinary

strength in New

Orleans and

Houston

•

Good core deposit

growth throughout

the legacy franchise

and many newer

markets

•

Deposit pricing

remains favorable |

20

Markets

Markets

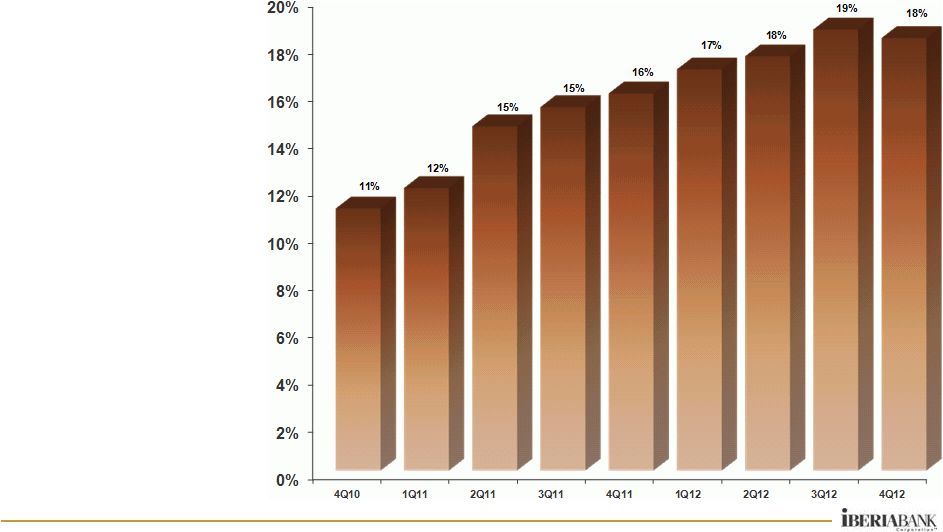

Non-Interest Bearing Deposit Growth

% of Total Deposits

•

Since 2010, total non-

interest bearing

deposits have

increased $1.1 billion

or +124% (+62%

annualized rate)

•

$116 million increase

in 4Q12, or +6%

(+25% annualized

rate)

•

Top 4Q12 noninterest

bearing deposit growth

markets include New

Orleans, Houston,

Southeast Florida,

Florida Keys,

Lafayette,

Birmingham, and

Shreveport |

| 21

Markets

Markets

4Q12 Highlights

•

Exceptional loan and deposit growth continues

•

Non-FDIC loan growth of $315 million came from a number of

markets and in both commercial and retail markets

•

Houston, New Orleans, Memphis and Baton Rouge showed strong

commercial

growth

–

concentrated

in

our

C&I

clients

•

Commercial loans originated and funded in 4Q12 totaled $503 million

with a mix of 33% fixed and 67% floating ($810 in commercial loan

commitments during the quarter)

•

Strong commercial pipeline of $527 million at year-end

•

Retail growth driven by increases in indirect lending and home equity

lines of credit –

arising from recent improvements in these businesses

•

Period-end core deposit growth of $912 million, with non-interest

bearing deposits up $116 million ($155 million linked quarter growth

on an average balance basis). |

| 22

Retail and Small Business

Retail and Small Business

4Q12 Progress

•

Completed closure and consolidation of 11 branches planned for

2012 and are on track to close 4 additional branches in the first

quarter of 2013

•

Since September 30, 2012, we opened seven new branch locations

in New Orleans (3), Birmingham, Houston, Baton Rouge, and Naples

•

Enhanced IBKC’s digital banking tools to better serve clients with the

launch of our online consumer deposit account opening process in

the fourth quarter of 2012

•

Experienced increases in both new small business clients and

checking account openings in 4Q12

•

Successful deposit campaign

•

Continued focused effort on direct and indirect consumer and small

business lending |

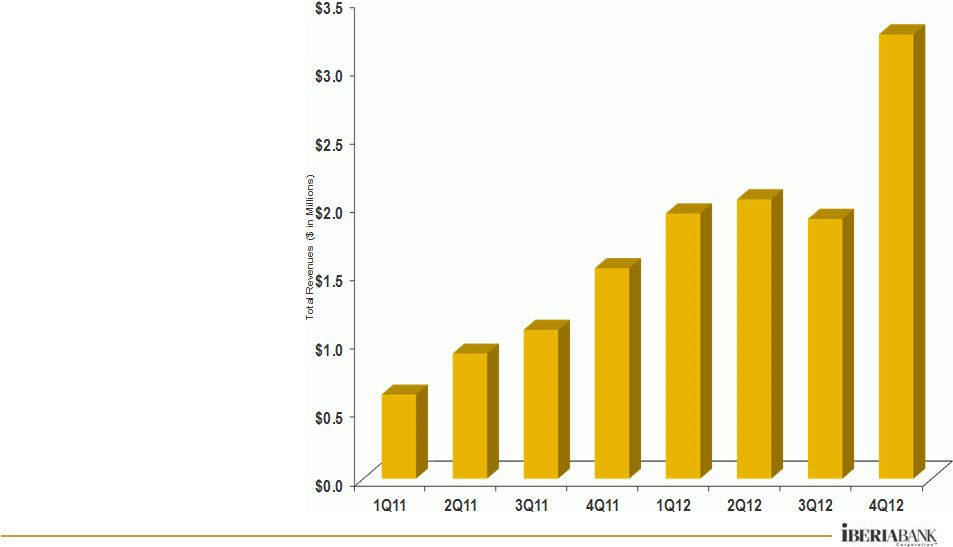

23

Wealth And Capital Markets

Wealth And Capital Markets

4Q12 Progress

•

ICP/IWA revenues of

$3.3 million (up 71%

compared to 3Q12)

•

IWA assets under

management increased

6%, to $955 million at

December 31, 2012

•

ICP investment banking

activity set a record in

4Q12, while brokerage

commissions continued

to grow

•

Research coverage on

61 public energy

companies

•

IFS revenue down 5%,

to $2.2 million,

compared to 3Q12

Total Quarterly Revenues |

Appendix

Appendix

24 |

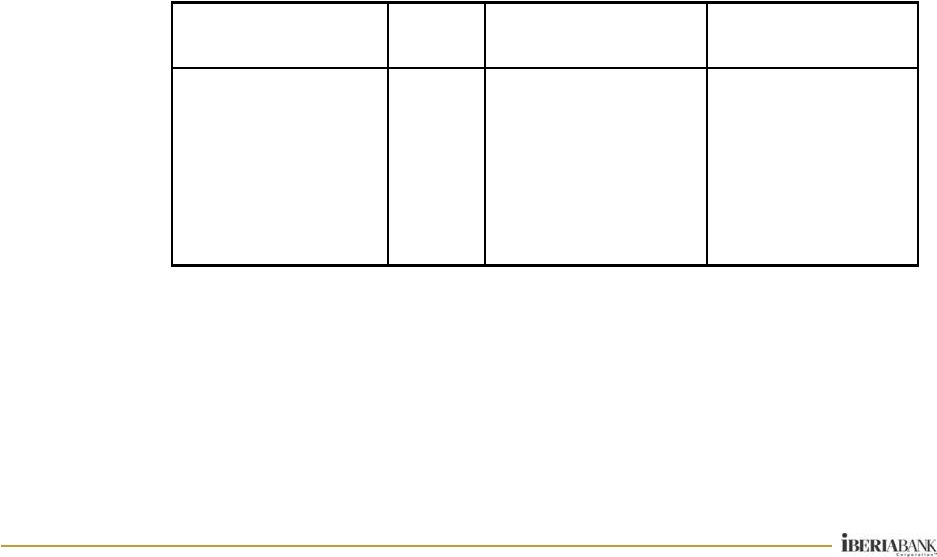

25

Appendix

Appendix

FDIC Covered Loan Portfolio Roll Forward

25

Average

Income /

Expense

Average

Yield

Average

Income /

Expense

Average

Yield

Average

Income /

Expense

Average

Yield

Average

Income /

Expense

Average

Yield

Covered Loans

1,293,160

52,019

15.968%

1,218,933

51,150

16.661%

1,153,954

55,400

18.878%

1,112,153

49,550

17.528%

Mortgage Loans

211,640

4,946

9.347%

196,969

5,128

10.414%

169,580

5,306

12.517%

155,989

5,318

13.636%

Indirect Automobile

-

-

0.000%

-

-

0.000%

(0)

-

0.000%

(0)

-

0.000%

Credit Card

901

14

6.199%

862

14

6.629%

853

14

6.746%

860

14

6.664%

Consumer

155,406

3,895

10.080%

150,236

4,324

11.577%

149,877

5,282

14.020%

148,001

5,308

14.267%

Line Of Credit-Consumer Loans

75,164

2,927

15.663%

72,370

2,953

16.410%

72,598

3,462

18.971%

69,910

3,661

20.831%

Commercial & Business Banking

850,519

40,238

18.719%

798,767

38,731

19.186%

761,048

41,335

21.257%

737,394

35,250

18.706%

Loans in Process

(469)

-

0.000%

(272)

-

0.000%

(3)

-

0.000%

(1)

-

0.000%

Overdrafts

0

-

0.000%

0

-

0.000%

0

-

0.000%

0

-

0.000%

FDIC Loss Share Receivable

573,776

(27,927)

-19.255%

508,443

(28,484)

-22.163%

448,746

(33,488)

-29.201%

411,328

(28,201)

-26.828%

Net Covered Loan Portfolio

1,866,937

24,092

5.142%

1,727,375

22,666

5.234%

1,602,700

21,912

5.416%

1,523,481

21,349

5.552%

Average

Income /

Expense

Average

Yield

Average

Income /

Expense

Average

Yield

Average

Income /

Expense

Average

Yield

Average

Income /

Expense

Average

Yield

Covered Loans

1,293,160

52,019

15.968%

1,218,933

51,150

16.661%

1,153,954

55,400

18.878%

1,112,153

49,550

17.528%

CapitalSouth Bank

198,491

6,203

12.416%

187,742

7,077

14.966%

169,584

6,480

15.034%

150,872

6,737

17.537%

Orion Bank

710,111

34,820

19.448%

673,068

33,586

19.801%

651,176

35,154

21.221%

641,252

29,720

18.235%

Century Bank

264,864

6,697

10.080%

255,610

6,134

10.080%

244,874

8,047

12.967%

232,967

7,137

12.108%

Sterling Bank

119,694

4,299

14.239%

102,513

4,353

16.829%

88,322

5,718

25.371%

87,063

5,956

26.806%

FDIC Loss Share Receivable

573,776

(27,927)

-19.255%

508,443

(28,484)

-22.163%

448,746

(33,488)

-29.201%

411,328

(28,201)

-26.828%

CapitalSouth Bank

49,433

(1,917)

-15.338%

44,503

(3,285)

-29.204%

40,443

(3,213)

-31.088%

35,811

(3,431)

-37.492%

Orion Bank

349,685

(21,626)

-24.466%

306,347

(21,149)

-27.311%

271,457

(22,983)

-33.130%

251,749

(17,944)

-27.892%

Century Bank

136,205

(2,380)

-6.913%

119,445

(1,911)

-6.329%

101,167

(3,875)

-14.987%

92,076

(3,200)

-13.601%

Sterling Bank

38,453

(2,004)

-20.621%

38,148

(2,139)

-22.181%

35,680

(3,417)

-37.472%

31,691

(3,625)

-44.761%

Net Covered Loan Portfolio

1,866,937

24,092

5.142%

1,727,375

22,666

5.234%

1,602,700

21,912

5.416%

1,523,481

21,349

5.552%

CapitalSouth Bank

247,924

4,286

6.882%

232,245

3,792

6.493%

210,027

3,267

6.133%

186,682

3,305

6.964%

Orion Bank

1,059,796

13,194

4.952%

979,415

12,436

5.033%

922,633

12,171

5.160%

893,002

11,776

5.121%

Century Bank

401,069

4,317

4.309%

375,055

4,224

4.495%

346,041

4,173

4.766%

325,044

3,937

4.804%

Sterling Bank

158,148

2,294

5.763%

140,661

2,214

6.236%

124,002

2,301

7.255%

118,754

2,331

7.681%

1Q2012

2Q2012

3Q2012

4Q2012

1Q2012

2Q2012

3Q2012

4Q2012 |