Attached files

| file | filename |

|---|---|

| 8-K - BLUEGREEN VACATIONS CORP | i00008_bxg-8k.htm |

| EX-99.2 - BLUEGREEN VACATIONS CORP | i00008_ex99-2.htm |

|

|

|

|

|

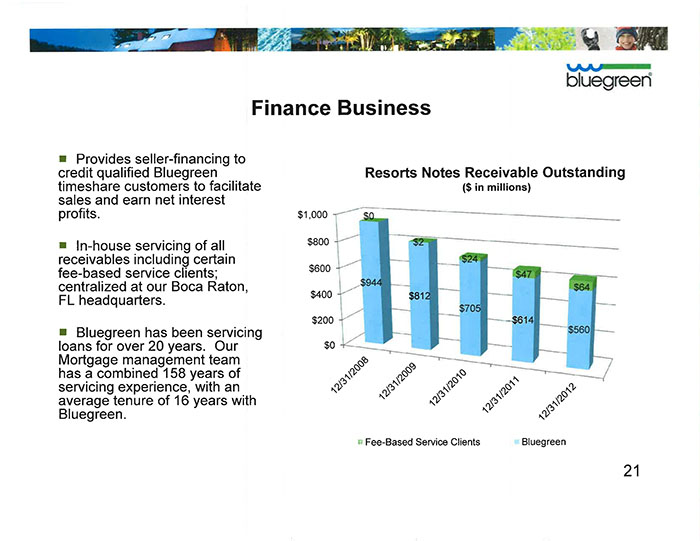

Finance Business • Provides seller-financing to credit qualified Bluegreen timeshare customers to facilitate sales and earn net interest profits. • In-house servicing of all receivables including certain fee-based service clients; centralized at our Boca Raton, FL headquarters. • Bluegreen has been servicing loans for over 20 years. Our Mortgage management team has a combined 158 years of servicing experience, with an average tenure of 16 years with Bluegreen. Resorts Notes Receivable Outstanding ($ in millions) Fee-Based Service Clients Bluegreen 21 |

|

|

|

|

|

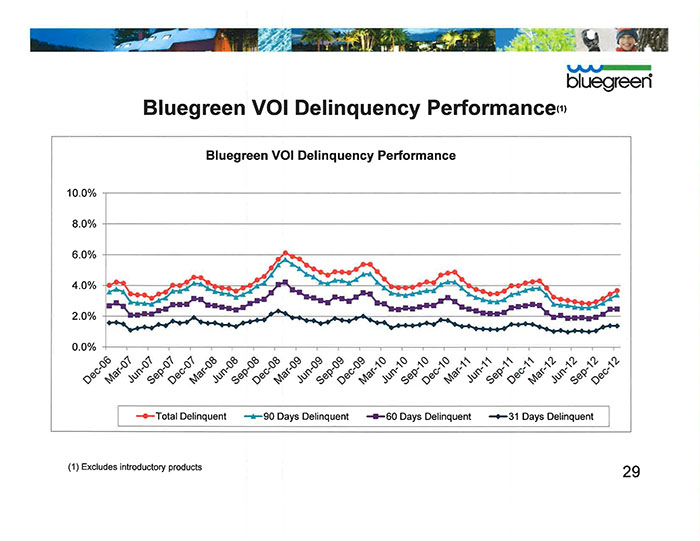

Bluegreen VOI Delinquency Performance(1) Bluegreen VOI Delinquency Performance (1) Excludes introductory products 29 |

|

|

|

|

|

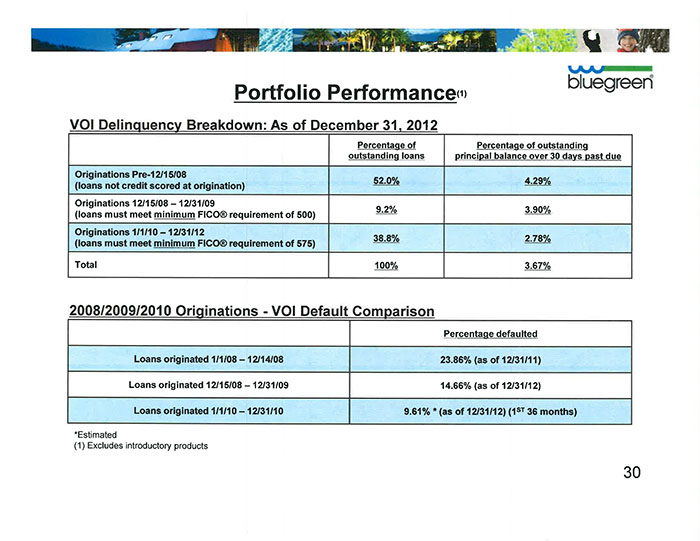

Portfolio Performance(1) VOI Delinquency Breakdown: As of December 31, 2012 Percentage of bluegreer Percentage of outstanding Originations Pre-12/15/08 (loans not credit scored at origination) Originations 12/15/08 12/31/09 (loans must meet minimum FICO® requirement of 500) Originations 1/1/10 12/31/12 (loans must meet minimum FICO® requirement of 575) Total outstanding loans principal balance over 30 days past due 52.0% 4.29% 9.2% 3.90% 38.8% 2.78% 100% 3.67% 2008/2009/2010 Originations - VOI Default Comparison Percentage defaulted Loans originated 1/1/08 12/14/08 23.86% (as of 12/31/11) Loans originated 12/15/08 12/31/09 14.66% (as of 12/31/12) Loans originated 1/1/10 12/31/10 9.61% * (as of 12/31/12) (1ST 36 months) *Estimated (1) Excludes introductory products 30 |

|

|

|

|

|

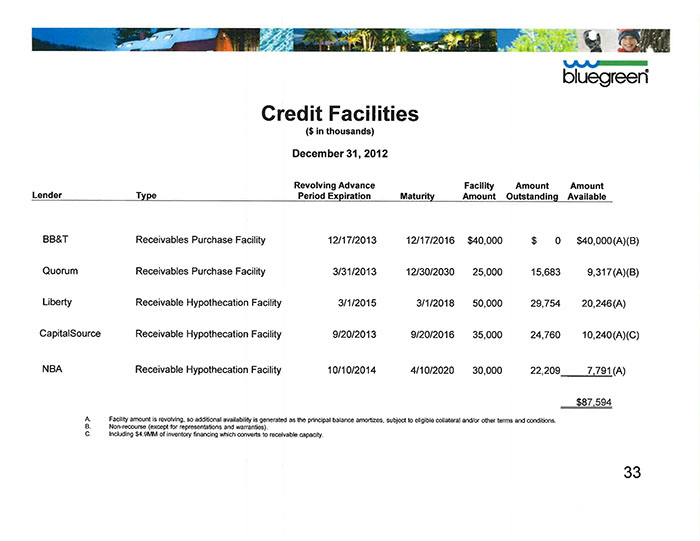

Credit Facilities ($ in thousands) December 31, 2012 Revolving Advance Facility Amount Amount Lender Type Period Expiration Maturity Amount Outstanding Available BB&T Receivables Purchase Facility 12/17/2013 12/17/2016 $40,000 $ 0 $40,000(A)(B) Quorum Receivables Purchase Facility 3/31/2013 12/30/2030 25,000 15,683 9,317(A)(B) Liberty Receivable Hypothecation Facility 3/1/2015 3/1/2018 50,000 29,754 20,246(A) Capital Source Receivable Hypothecation Facility 9/20/2013 9/20/2016 35,000 24,760 10,240(A)(C) NBA Receivable Hypothecation Facility 10/10/2014 4/10/2020 30,000 22,209 7,791 (A) $87,594 A. Facility amount is revolving, so additional availability is generated as the principal balance amortizes, subject to eligible collateral and/or other terms and conditions. B. Non-recourse (except for representations and warranties). C. Including $4.9 MM of inventory financing which converts to receivable capacity. 33 |