Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WEX Inc. | d470565d8k.htm |

| EX-99.3 - SELECTED HISTORICAL FINANCIAL AND OPERATING INFORMATION - WEX Inc. | d470565dex993.htm |

| EX-99.2 - RISK FACTORS - WEX Inc. | d470565dex992.htm |

| EX-99.4 - UNAUDITED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME - WEX Inc. | d470565dex994.htm |

Exhibit 99.1

Our Company

WEX Inc. (formerly Wright Express Corporation) is a leading provider of corporate card payment solutions. From our roots as a pioneer in fleet card payments in 1983, WEX Inc. has expanded the scope of its business into a multi-channel provider of corporate payment solutions. WEX has been publicly traded since February 16, 2005 (NYSE:WXS) and currently operates in two business segments: Fleet Payment Solutions and Other Payment Solutions. Our business model enables us to provide exceptional payment security and control across a spectrum of payment sectors. The Fleet Payment Solutions segment provides customers with fleet vehicle payment processing services specifically designed for the needs of commercial and government fleets. Fleet Payment Solutions revenue, which represented approximately 75% of our total revenue during the nine months ended September 30, 2012, is earned primarily from payment processing, account servicing and transaction processing, with the majority generated by payment processing. As of September 30, 2012, the Fleet Payment Solutions segment serviced over 6.9 million vehicles. Management estimates that WEX fleet cards are accepted at over 90% of fuel locations in each of the United States and Australia. The Other Payment Solutions segment provides customers with payment processing solutions for their corporate purchasing and transaction monitoring needs through our payment products. Other Payment Solutions revenue is earned primarily from payment processing revenue with operations in North and South America, Europe and Australia.

The Company’s U.S. operations include WEX Inc., and our wholly-owned subsidiaries Fleet One (acquired on October 4, 2012), WEX Bank, rapid! PayCard, and Pacific Pride. Our international operations include our wholly-owned subsidiaries Wright Express Fuel Cards Australia, Wright Express Prepaid Cards Australia, Wright Express New Zealand, and CorporatePay Limited, located in England, and a majority equity position in UNIK S.A., a Brazil-based company.

Prior to our IPO, the Company’s growth had been primarily organic. Our growth in the past several years has been supplemented by acquisitions. Our recent acquisitions include the following transactions:

| • | On October 4, 2012, we acquired Fleet One, a provider of fleet cards and fleet-related payment solutions to the heavy truck or over-the-road segment of the fleet market. |

| • | On August 30, 2012, we acquired a 51% controlling interest in UNIK S.A., a provider of payroll cards, private label and processing services in Brazil, specializing in the retail, government and transportation sectors. We have an option to acquire the remaining shares of UNIK S.A. |

| • | On May 11, 2012, we acquired CorporatePay Limited, England, a provider of corporate prepaid solutions to the travel industry in the United Kingdom. CorporatePay offers direct, co-branded and private label solutions including virtual cards, currency cards and expense management solutions. |

| • | On September 10, 2010, we acquired the Australian assets of Retail Decisions, a provider of fleet and prepaid cards in the Australian market. Operating today as Wright Express Fuel Cards Australia and Wright Express Prepaid Cards Australia, this acquisition supports our long-term strategy of providing both payment and processing of card issuance services internationally. |

WEX Bank, a Utah industrial bank incorporated in 1998, is a Federal Deposit Insurance Corporation (“FDIC”)-insured depository institution. WEX Bank’s primary regulators are the Utah Department of Financial Institutions and the FDIC. WEX Bank is required to maintain elements of independence from the rest of our business to comply with its charter and applicable banking regulations, and is required to file separate financial statements with the FDIC. The activities performed by WEX Bank are integrated into the operations of both of the Company’s segments. The functions performed at WEX Bank contribute to the operations of both of WEX’s segments by providing a funding mechanism, among other services. With our ownership of WEX Bank, we have access to low-cost sources of capital. WEX Bank raises capital primarily through the issuance of brokered deposits and NOW accounts and provides the financing and makes the credit decisions that enable both segments to extend credit to their customers. WEX Bank approves customer applications, maintains appropriate credit lines for each customer, is the account issuer, provides

1

funding and is the counterparty for the customer relationships for most of our programs. Operations such as sales, marketing, merchant relations, customer service, software development and IT are performed within our organization but outside of WEX Bank.

Competitive Strengths

We believe the following strengths distinguish us from our competitors:

Fleet Payment Solutions

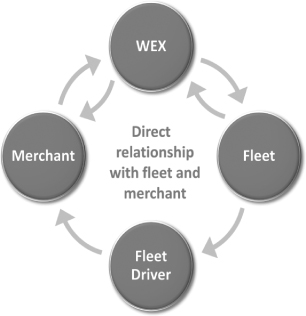

| • | We believe our closed-loop fuel networks in the United States and Australia are among the largest in each country. We describe our fleet payment processing networks as “closed-loop” as we have a direct contractual relationship with both the merchant and the fleet, and only WEX transactions can be processed on these networks. We have built a network that management believes provides over 90% fuel location coverage in each of the United States and Australia, which provides our customers the convenience of broad acceptance. |

| • | Our proprietary closed-loop fuel networks also afford us access to a higher level of fleet-specific information and control than is widely available on open-loop networks. This allows us to improve and refine the information reporting we provide to our fleet customers and strategic relationships. |

| • | We offer a differentiated set of products and services, including security and purchase controls, to allow our customers and the customers of our strategic relationships to better manage their vehicle fleets. We provide customized analysis and reporting on the efficiency of fleet vehicles and the purchasing behavior of fleet vehicle drivers. We make this data available to fleet customers through both traditional reporting services and sophisticated web-based data analysis tools. |

| • | Our proprietary software facilitates the collection of information and affords us a high level of control and flexibility in allowing fleets to restrict purchases and receive automated alerts. |

| • | Our long-standing strategic relationships, multi-year contracts and high contract renewal rates have contributed to the stability and recurring nature of our revenue base. We believe that we offer a compelling value to our customers relative to our competitors given the breadth and quality of our products and services and our deep understanding of our customers’ operational needs. We have a large installed customer base, with more than 6.9 million vehicles serviced as of September 30, 2012 and co-branded strategic relationships with six of the largest U.S. fleet management companies and with numerous oil companies that use our private label solutions. Our wide site acceptance, together with our private-label portfolios and value-added product and service offerings, drive high customer satisfaction levels, with a U.S. fleet retention rate in excess of 97% (based on the 2012 rate of voluntary customer attrition). |

| • | Our proprietary closed-loop network is a significant barrier to entry because a competitor would need to establish a direct relationship with each of the merchants that comprise the network. |

| • | With the Fleet One acquisition, we have accelerated our entrance into the over-the-road segment of the market in the United States and Canada, blending the small fleet and private label businesses for greater scale and enhancing our ability to serve fleet customers who operate both heavy duty trucks and cars or light duty vehicles. |

Other Payment Solutions

| • | Our virtual products offer corporate customers enhanced security and control for complex payment needs. Our strategic relationships include three of the largest United States-based online travel agencies. Our operations in the United Kingdom provide corporate prepaid solutions to the travel industry. Additionally, we offer virtual products in the insurance/warranty and healthcare markets. |

2

| • | We offer paycard products in the United States and Brazil. These products include payroll cards which are used to replace paper payroll checks. This is a service offered by businesses to individuals who often do not have a bank account. |

Other Competitive Strengths

| • | Strong Track Record of Revenue Growth and High Margins. The demand for our payment processing, account servicing and transaction processing services combined with significant operating leverage has historically driven strong revenue growth with consistently high margins. From 2008 through the twelve months ended September 30, 2012, our revenue and adjusted EBITDA grew at compound annual growth rates of 12% and 19%, respectively, and our adjusted EBITDA margin increased from 38% in 2008 to 48% for the twelve months ended September 30, 2012. For the twelve months ended September 30, 2012, revenue was $594.0 million and adjusted EBITDA was $282.6 million. We have a strong track record of organic revenue growth driven by our various marketing channels, our extensive network of fuel and service providers, and our consistent growth in transaction volume and card placement. Further, we have completed a number of strategic acquisitions to expand our product and service offerings which have contributed to our revenue growth and diversification. |

| • | Effective Risk Management. We have an enterprise-wide risk management program that helps us to effectively address inherent risks related to funding and liquidity, fuel price volatility, our extension of credit and interest rates. Our ownership of WEX Bank provides us with access to low cost sources of capital (primarily through brokered deposits and NOW accounts issued by WEX Bank), which provide liquidity to fund our short-term domestic card receivables. We use fuel price derivatives to manage a portion of our U.S. fuel-price-related earnings exposure, as described below under “Fuel Price Derivatives.” We have historically maintained a long record of low credit losses due to the short-term, non-revolving credit issued to our customer base, which is typically due within 30 days of payment. Our credit risk management program is enhanced by our proprietary scoring model, reducing credit lines and early suspension policy. As of September 30, 2012, 97.2% of accounts receivables were less than 30 days past due and 99.2% were less than 60 days past due. Interest rate risk is managed through diversified funding sources at WEX Bank with significant non-interest bearing liabilities and merchant contracts that include some ability to raise rates if interest rates rise. |

| • | Seasoned Management Team. We have an experienced and committed management team that has substantial industry knowledge and a proven track record of financial success. Our executive management team has significant industry experience and an average of over 13 years of tenure with us. The team has been successful in driving strong growth in our business and establishing a track record of strong, consistent operating performance. We believe that our management team positions us well to continue to successfully implement our growth strategy and capture operating efficiencies. |

Strategy

We have a multi-pronged growth strategy that includes the following:

| • | Expanding our core U.S. fleet business. We intend to continue to grow our business organically through the use of our various marketing channels, leveraging our competitive advantages and continuing to explore new strategies that bring innovative new products to market. |

| • | Diversifying our products. We plan to build upon the opportunities we see in the Other Payment Solutions segment, including expanding our virtual card product into new markets and expanding our paycard product offerings. |

| • | Growing our business internationally. Through our acquisitions, we have established an international presence and extended our product suite. We intend to continue to focus on expanding our international business by capitalizing on opportunities that enable us to leverage our competitive strengths in the Fleet Payment Solutions and Other Payment Solutions segments. As we |

3

| continue to expand into foreign geographies, we expect investments in joint ventures to be an important element of our strategy to take advantage of existing infrastructure in markets where we do not currently have a presence. |

FLEET PAYMENT SOLUTIONS SEGMENT

The Fleet Payment Solutions segment provides customers with fleet vehicle payment processing services specifically designed for the needs of commercial and government fleets. We are a leading provider of fleet vehicle payment processing services with over 6.9 million vehicles using our fleet payment solutions to purchase fuel and maintenance services. We believe we have an approximately 13% market share in the United States. Our competitive advantages in the fleet market include brand strength and product offerings, commitment to customer satisfaction and a unique financing model with attractive credit terms. Our fleet products are based upon proprietary technology with closed-loop networks in the United States and Australia, and wide site acceptance.

As part of our value proposition, we deliver security through individualized driver identification and real-time transaction updates, purchase controls and sophisticated reporting tools. We collect a broad array of information at the point of sale, including the amount of the expenditure, the identity of the driver and vehicle, the odometer reading, the identity of the fuel or vehicle maintenance provider and the items purchased. We use this information to provide customers with analytical tools to help them effectively manage their vehicle fleets and control costs. We deliver value to our customers by providing customized offerings for accepting merchants, processing payments and providing information management products and services to fleets.

Our proprietary closed-loop networks allow us to provide our customers with highly detailed, fleet-specific information and customized controls that are not typically available on open-loop networks, such as limiting purchases to fuel only and restricting the time of day and day of week when fuel purchased. Our network also enables us to avoid dependence on third-party processors. In addition, our relationships with both fleets and merchants enable us to provide security and controls and provide customizable reporting.

The following illustrates our proprietary closed-loop network:

4

Products and Services

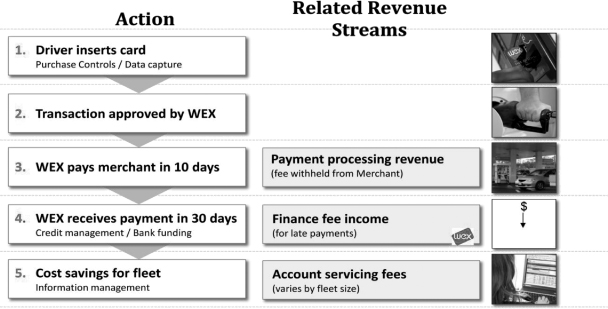

Payment processing transactions represent a majority of the revenue stream in the Fleet Payment Solutions segment. In a payment processing transaction, we extend short-term credit to the fleet customer and pay the purchase price for the fleet customer’s transaction, less the payment processing fees we retain, to the merchant. We collect the total purchase price from the fleet customer, normally within one month from the billing date.

Payment processing fees are based on a percentage of the aggregate dollar amount of the customer’s purchase, a fixed amount per transaction or a combination of both. In 2011, we processed approximately 233 million U.S. payment processing transactions and approximately 15 million Australian payment processing transactions. In the first nine months of 2012, we processed approximately 179 U.S. payment processing transactions and approximately 12 million Australian payment processing transactions.

Additionally, we receive revenue from account servicing fees and finance fees.

We offer the following account management services:

| • | Customer service, account activation and account retention: We offer customer service, account activation and account retention services to fleets and fleet management companies and the fuel and vehicle maintenance providers on our network. Our services include promoting the adoption and use of our products and programs and account retention programs on behalf of our customers. |

| • | Authorization and billing inquiries and account maintenance: We handle authorization and billing questions, account changes and other issues for fleets through our dedicated customer contact centers, which are available 24 hours a day, seven days a week. Fleet customers also have self service options available to them through our websites. |

| • | Premium fleet services: We assign designated account managers to businesses and government agencies with large fleets. These representatives have in-depth knowledge of both our programs and the operations and objectives of the fleets they service. |

| • | Credit and collections services: We have developed proprietary account approval, credit management and fraud detection programs. Our underwriting model produces a proprietary score, which we use to predict the likelihood of an account becoming delinquent within 12 months of activation. We also use a credit maintenance model to manage ongoing accounts, which helps us to predict the likelihood of account delinquency over an ongoing 18-month time horizon. We have developed a collections scoring model that we use to rank and prioritize past due accounts for collection activities. We also employ fraud specialists who monitor accounts, alert customers and provide case management expertise to minimize losses and reduce program abuse. |

| • | Merchant services: Our representatives work with fuel and vehicle maintenance providers to enroll them in our network, test all network and terminal software and hardware, and train them on our sale, transaction authorization and settlement processes. |

Information Management

We provide standard and customized information to customers through monthly vehicle analysis reports, custom reports and our websites. We also alert the customer to unusual transactions or transactions that fall outside of pre-established parameters. Customers can access their account information, including account history and recent transactions, and download the details. In addition, through our websites, fleet managers can elect to be notified by email when limits are exceeded in specified purchase categories, including limits on transactions within a time range and gallons per day.

5

The following illustration depicts our business process for a typical payment processing transaction:

Marketing Channels

We market our fleet products and services directly to commercial and government vehicle fleet customers with small, medium and large fleets, and over-the-road long haul fleets. Our product suite includes payment processing and transaction processing services, WEX-branded fleet cards in North America and MotorPass/Motorcharge-branded fleet cards in Australia. Our direct line of business services 3.1 million vehicles.

We also market our products and services indirectly through co-branded and private label relationships. With a co-branded relationship product, we market our products and services for, and in collaboration with, fleet management companies using their brand names and our logo on a co-branded fleet card. These companies seek to offer our payment processing and information management services as a component of their total offering to their fleet customers. Our co-branded marketing channel includes over 100 strategic relationships and services 1.6 million vehicles.

Our private label programs market our product and services for, and in collaboration with, fuel retailers, using only their brand names. The fuel retailers with which we have formed strategic relationships offer our payment processing and information management products and services to their fleet customers in order to establish and enhance customer loyalty. These fleets use these products and services to purchase fuel at locations of the fuel retailer with whom we have the private label relationship. Our private label marketing channel includes over 20 strategic relationships and services 2.2 million vehicles.

Fuel Price Derivatives

In 2011, approximately 47% of our total revenue resulted from fees paid to us by fuel providers based on a negotiated percentage of the purchase price of fuel purchased by our customers and accordingly was impacted by fuel prices. To address these fluctuations, we intend to hedge approximately 60% of our U.S. fuel-price-related earnings exposure, excluding our Fleet One operations, to improve management of cash flow volatility created by changes in U.S. fuel prices and to enhance the visibility and predictability of our future cash flows. Prior to 2012 when we lowered our targeted hedging percentage to 60%, we entered into hedges intended to cover approximately 80% of our U.S. fuel-price-related earnings exposure.

6

Our hedging program uses put and call option contracts with monthly settlement provisions that create a “costless collar” based upon both the U.S. Department of Energy’s weekly diesel fuel price index and the NYMEX unleaded gasoline contracts. When entering into these options, our intent is to effectively lock in a range of prices during any given quarter on a portion of our U.S. forecasted earnings that are subject to fuel price variations. Differences between the indices underlying the options and the actual retail prices may create a disparity between the actual revenues we earn and the gains or losses realized on the options.

Our derivative instruments do not qualify for hedge accounting under current accounting guidance. Accordingly, gains and losses on our fuel price-sensitive derivative instruments, whether they are realized or unrealized, affect our current period earnings.

The options are intended to limit the impact fuel price fluctuations have on our cash flows. The options that we have entered into:

| • | Create a floor price. When the current month put option contract settles, we receive cash payments from the counterparties if the average price for the current month (as defined by the option contract) is below the strike price of the option. |

| • | Create a ceiling price. When the current month call option contract settles, we make cash payments to the counterparties if the average price for the current month (as defined by the option contract) is above the strike price of the option. |

When the current month put and call option contracts settle and the average price for the current month (as defined by the option contract) is between the strike price of the put option contract and the strike price of the call option contract, no cash is exchanged between the counterparties and us.

The following table presents information about the options as of December 31, 2012. The approximate percentage of exposure to fuel price-sensitive related earnings exposure does not include any impact from our Fleet One operations:

| Q4 2012 |

Q1 2013 |

Q2 2013 |

Q3 2013 |

Q4 2013 |

Q1 2014 |

Q2 2014 |

||||||||||||||||||||||

| Average low end of range of fuel prices per gallon |

$ | 3.46 | $ | 3.42 | $ | 3.44 | $ | 3.47 | $ | 3.36 | $ | 3.34 | $ | 3.26 | ||||||||||||||

| Average top end of range of fuel prices per gallon |

$ | 3.52 | $ | 3.48 | $ | 3.50 | $ | 3.53 | $ | 3.42 | $ | 3.40 | $ | 3.32 | ||||||||||||||

| Approximate % of exposure locked in |

80 | % | 80 | % | 80 | % | 60 | % | 60 | % | 40 | % | 20 | % | ||||||||||||||

OTHER PAYMENT SOLUTIONS SEGMENT

Our Other Payment Solutions segment is comprised of our virtual and paycard products. We provide innovative corporate purchasing capabilities through our virtual and paycard products, which can be integrated with our customers’ internal systems to streamline their payroll, accounts payable and reconciliation processes.

Products and Services

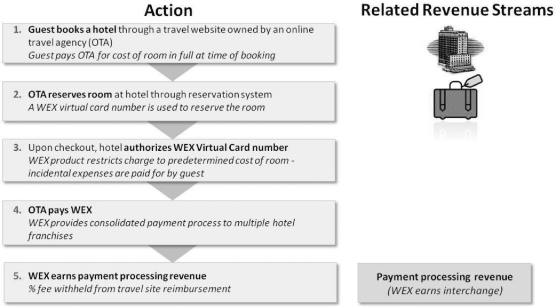

Virtual Card Products

The WEX virtual card product suite allows businesses to centralize purchasing, simplify complex supply chain processes and eliminate the paper check writing associated with traditional purchase order programs. Our virtual card is used for transactions where no card is presented, including, for example, transactions conducted over the telephone, by mail, by fax or on the Internet. Our virtual card also can be used for transactions that require pre-authorization, such as hotel reservations. Under our virtual card program, each transaction is assigned a unique account number with a customized credit limit and expiration date. These controls are in place to limit fraud and unauthorized spending. The unique account number limits purchase amounts and tracks, settles and reconciles purchases more easily, creating

7

efficiencies and cost savings for our customers. The virtual card products offer both credit and debit options.

Paycard Products

Paycard products are an emerging product line for WEX. The rapid! PayCard product, a pre-paid payroll card, provides a comprehensive paycard benefit and ePayroll program designed for employers choosing to convert to electronic delivery of payroll in the United States, replacing paper employee payroll checks. Additionally, in August 2012 we acquired a 51% controlling interest in UNIK S.A., a leading provider of payroll cards, private label and processing services in Brazil, specializing in the retail, government and transportation sectors.

We also have several other product offerings, including corporate purchase cards and pre-paid and gift cards.

Marketing Channels

We market our Other Payment Solutions segment products and services directly to our customers in conjunction with our fleet offerings, as well as to potential new clients with whom we have no existing relationship. Our corporate purchase products are marketed to commercial and government organizations and we use existing open loop networks. Our rapid! PayCard product is marketed to small- and medium-sized business in the United States.

OTHER ITEMS

Employees

As of December 31, 2012, WEX Inc. and its subsidiaries had 1,302 employees, of which 1,028 were located in the United States. Within the United States, our subsidiaries Pacific Pride Services, LLC, WEX Bank, and FleetOne Holdings, LLC and its subsidiaries have 15, 29 and 256 employees, respectively, and WEX Inc. employs the remainder. Internationally, our UK subsidiaries have 41 employees and our Australian subsidiaries have 120 employees. None of our employees are subject to a collective bargaining agreement.

8

Competition

We have a strong competitive position in our Fleet Payment Solutions and Other Payment Solutions segments. Our product features and extensive account management services are key factors behind our position in the fleet industry. We face competition in both of our segments. Our competitors vie with us for prospective direct fleet customers as well as for companies with which to form strategic relationships. We compete with companies that perform payment and transaction processing or similar services. Financial institutions that issue Visa, MasterCard and American Express credit and charge cards currently compete against us primarily in the small fleet category of our Fleet Payment Solutions segment and in the corporate purchase card category of our Other Payment Solutions segment.

The most significant competitive factors are breadth of features, functionality, servicing capability and price. For more information regarding risks related to competition, see the information under the heading “Our industry continues to become increasingly competitive, which makes it more difficult for us to maintain profit margins at historical levels” in Exhibit 99.2 to this current report on Form 8-K.

Technology

We believe investment in technology is a crucial step in maintaining and enhancing our competitive position in the marketplace. In the United States, our closed loop proprietary software captures detailed information from the fuel and maintenance locations within our network. Operating a proprietary network not only enhances our value proposition, it enables us to avoid dependence on third-party processors and to respond rapidly to changing customer needs with system upgrades, while maintaining a secure environment. Our infrastructure has been designed around industry-standard architectures to reduce downtime in the event of outages or catastrophic occurrences.

In Australia, New Zealand, Brazil and England, we operate standalone platforms to support operations. All of the development, maintenance and support of each card management system are performed within the respective business. We continue to invest in our infrastructures.

We are continually improving our technology to enhance our customer relationships and to increase efficiency and security. We also review technologies and services provided by others in order to maintain the high level of service expected by our customers. For information regarding technology-related risks, see the information under the headings “Our failure to effectively implement new technology could jeopardize our position as a leader in our industry” , “We are dependent on technology systems and electronic communications networks managed by third parties, which could result in our inability to prevent service disruptions”, and “We may not be able to adequately protect the data we collect about our customers, which could subject us to liability and damage our reputation” in Exhibit 99.2 to this current report on Form 8-K.

Intellectual Property

We rely on a combination of patents, copyright, trade secret and trademark laws, confidentiality procedures, contractual provisions and other similar measures to protect proprietary information and technology used in our business. We generally enter into confidentiality or license agreements with our consultants and corporate partners and control access to and distribution of our technology, documentation and other proprietary information. Despite the efforts to protect our proprietary rights, unauthorized parties may attempt to copy or otherwise obtain the use of our products or technology that we consider proprietary and third parties may attempt to develop similar technology independently. We pursue registration and protection of our trademarks in the United States and other countries in which we operate or plan to operate. Wright Express Fuel Cards Australia and Wright Express Prepaid Cards Australia hold patents that are registered in Australia, as well as in the United Kingdom, Hong Kong and New Zealand. We market our products and services using the WEX brand names in the United States and the MotorPass and Motorcharge brand names in Australia.

9

Regulation — United States

The Company and WEX Bank are subject to certain state and federal laws and regulations governing insured depository institutions and their affiliates. WEX Bank is subject to supervision and examination by both the Utah Department of Financial Institutions and the FDIC. WEX Bank, including the Company and its other subsidiaries, is also subject to certain restrictions on transactions with affiliates set forth in the Federal Reserve Act (“FRA”). The Company is subject to anti-tying provisions in the Bank Holding Company Act. State and Federal laws and regulations limit the loans WEX Bank may make to one borrower and the types of investments WEX Bank may make.

Set forth below is a description of the material elements of the laws, regulations, policies and other regulatory matters affecting the U.S. operations of WEX.

Exemption from certain requirements of the Bank Holding Company Act

As an industrial bank organized under the laws of Utah that does not accept demand deposits that may be withdrawn by check or similar means, WEX Bank meets the criteria for exemption from the definition of “bank” under the Bank Holding Company Act. As a result, the Company is generally not subject to the Bank Holding Company Act.

Restrictions on intercompany borrowings and transactions

Sections 23A and 23B of the FRA and the implementing regulations limit the extent to which the Company can borrow or otherwise obtain credit from or engage in other “covered transactions” with WEX Bank. “Covered transactions” include loans or extensions of credit, purchases of or investments in securities, purchases of assets, including assets subject to an agreement to repurchase, acceptance of securities as collateral for a loan or extension of credit, or the issuance of a guarantee, acceptance, or letter of credit. Although the applicable rules do not serve as an outright bar on engaging in “covered transactions,” they do require that the Company engage in such transactions with WEX Bank only on terms and under circumstances that are substantially the same, or at least as favorable to WEX Bank, as those prevailing at the time for comparable transactions with nonaffiliated companies. Furthermore, with certain exceptions, each loan or extension of credit by WEX Bank to the Company or its other affiliates must be secured by collateral with a market value ranging from 100% to 130% of the amount of the loan or extension of credit, depending on the type of collateral.

The Consumer Financial Protection Bureau

The Dodd-Frank Act established the CFPB to regulate the offering of consumer financial products or services under the federal consumer financial laws. In addition, the CFPB was granted general authority to prevent covered persons or service providers from committing or engaging in unfair, deceptive or abusive acts or practices under federal law in connection with any transaction with a consumer for a consumer financial product or service, or the offering of a consumer financial product or service. The CFPB has broad rulemaking authority for a wide range of consumer protection laws, including the authority to prohibit “unfair, deceptive or abusive” acts and practices. The legislation also gives the state attorneys general the ability to enforce applicable federal consumer protection laws.

Brokered Deposits

Under FDIC regulations, depending upon their capital classification, banks may be restricted in their ability to accept brokered deposits. “Well capitalized” banks are permitted to accept brokered deposits, but banks that are not “well capitalized” are not permitted to accept such deposits. The FDIC may, on a case-by-case basis, permit banks that are “adequately capitalized” to accept brokered deposits if the FDIC determines that acceptance of such deposits would not constitute an unsafe or unsound banking practice.

10

Other Regulatory Requirements

WEX Bank must monitor and report unusual or suspicious account activity, as well as transactions involving amounts in excess of prescribed limits, as required by the Bank Secrecy Act and Internal Revenue Service regulations. The USA PATRIOT Act of 2001 substantially broadened the scope of U.S. anti-money laundering laws and regulations by imposing significant new compliance and due diligence obligations, identifying new crimes and penalties and expanding the extra-territorial jurisdiction of the United States. The U.S. Treasury Department has proposed and, in some cases, issued a number of implementing regulations which impose obligations on financial institutions to maintain appropriate policies, procedures and controls to detect, prevent and report money laundering and terrorist financing and to verify the identity of their customers. Certain of those regulations impose specific due diligence requirements on financial institutions that maintain correspondent or private banking relationships with non-U.S. financial institutions or persons. Failure of a financial institution to maintain and implement adequate programs to combat money laundering and terrorist financing could have serious legal and reputational consequences for the institution.

The federal government has imposed economic sanctions that affect transactions with designated foreign countries, nationals and others. These sanctions, which are administered by the U.S. Treasury’s Office of Foreign Assets Control (“OFAC”), take many different forms but generally include one or more of the following elements: (i) restrictions on trade with or investment in a sanctioned country, including prohibitions against direct or indirect imports from and exports to a sanctioned country and prohibitions on “U.S. persons” engaging in financial transactions relating to making investments in, or providing investment-related advice or assistance to, a sanctioned country; and (ii) a blocking of assets in which the government or specially designated nationals of the sanctioned country have an interest, by prohibiting transfers of property subject to U.S. jurisdiction (including property in the possession or control of U.S. persons). Blocked assets (for example, property and bank deposits) cannot be paid out, withdrawn, set off or transferred in any manner without a license from OFAC. Failure to comply with these sanctions could have serious legal and reputational consequences.

Under GLBA, the Company and WEX Bank are required to maintain a comprehensive written information security program that includes administrative, technical and physical safeguards relating to customer information. However, this requirement does not generally apply to information about companies or about individuals who obtain financial products or services for business, commercial, or agricultural purposes. The GLBA also requires the Company and WEX Bank to provide initial and annual privacy notices to customers that describe in general terms their information sharing practices. If the Company and WEX Bank intend to share nonpublic personal information about customers with affiliates and/or nonaffiliated third parties, they must provide customers with a notice and a reasonable period of time for each consumer to “opt out” of any such disclosure. In addition to U.S. federal privacy laws, states also have adopted statutes, regulations and other measures governing the collection and distribution of nonpublic personal information about customers. In some cases these state measures are preempted by federal law, but if not, the Company and WEX Bank must monitor and comply with the laws in the conduct of its business.

Restrictions on dividends

WEX Bank is subject to various regulatory requirements relating to the payment of dividends, including requirements to maintain capital above regulatory minimums. A banking regulator may determine that the payment of dividends would be inappropriate and could prohibit payment. Further, WEX Bank may not pay a dividend if it is undercapitalized or would become undercapitalized as a result of paying the dividend. Utah law permits WEX Bank to pay dividends out of the net profits of the industrial bank after providing for all expenses, losses, interest, and taxes accrued or due, but if WEX Bank’s surplus account is less than 100% of its capital stock, WEX Bank must transfer up to 10% of its net profits to the surplus account prior to the payment of any dividends.

11

Company obligations to WEX Bank

Any non-deposit obligation of WEX Bank to the Company is subordinate, in right of payment, to deposits and other indebtedness of WEX Bank. In the event of the Company’s bankruptcy, any commitment by the Company to a federal bank regulatory agency to maintain the capital of WEX Bank will be assumed by the bankruptcy trustee and entitled to priority of payment.

Further, until July 21, 2013, Section 603 of the Dodd-Frank Act restricts the acquisition of industrial banks by commercial firms. A company is a “commercial firm” if the annual gross revenues derived by the company and all of its affiliates from activities that are “financial in nature” (as defined by the Bank Holding Company Act) represent less than 15% of the company’s consolidated gross revenue. There are exceptions to the change-in-control restriction, including where: the industrial bank is in danger of default; the change-in-control results from a merger or whole acquisition by a commercial firm in a bona fide merger or acquisition; or where the change-in-control results from an acquisition of voting shares of a publicly traded company that controls an industrial bank and the acquiring shareholder holds less than 25 percent of any class of the voting shares of the company.

Restrictions on ownership of WEX common stock

WEX Bank, and therefore the Company, is subject to bank regulations that impose requirements on entities that control 10% or more of WEX common stock. These requirements are discussed in the Risk Factors section of the Company’s annual report on Form 10-K for the year ended December 31, 2011 under the heading “If any entity controls 10% or more of our common stock and such entity has caused a violation of applicable banking laws by its failure to obtain any required approvals prior to acquiring that common stock, we have the power to restrict such entity’s ability to vote shares held by it.”

Regulation — Australia

The Company’s Australian operations are subject to laws and regulations of the Commonwealth of Australia governing banking and payment systems, financial services, consumer credit and money laundering. Because neither Wright Express Fuel Cards Australia nor Wright Express Prepaid Cards Australia holds an Australian Financial Services License or credit license or is an authorized deposit-taking institution, they operate within a framework of regulatory relief and exemptions afforded them on the basis that they satisfy the requisite conditions.

Segments and Geographic Information

For an analysis of financial information about our segments, as well as our geographic areas, see Item 8 — Note 20 of our consolidated financial statements incorporated by reference from the Company’s Form 10-K for the year ended December 31, 2011.

12