Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Jefferies Group LLC | d465068d8k.htm |

Exhibit 99

Jefferies – A Global Investment Banking Firm

January 2013

| Jefferies & Company, Inc. Member SIPC |

|

Note on Forward Looking Statements

This document contains “forward looking statements” within the meaning of the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward looking statements include statements about Jefferies’ and Leucadia’s future and statements that are not historical facts. These forward looking statements are usually preceded by the words “expect,” “intend,” “may,” “will,” or similar expressions. All information and estimates relating to the merger of Leucadia and Jefferies and the combination of our businesses constitute forward looking statements. Forward looking statements may contain expectations regarding post-merger activities, financial strength, operations, synergies, and other results, and may include statements of future performance, plans, and objectives. Forward looking statements also include (i) statements pertaining to our strategies for the future development of our businesses, (ii) the spin-out of Leucadia’s Crimson Wine Group, and (iii) Jefferies’ intention to remain subject to the filing requirements under the Securities Exchange Act of 1934. Forward looking statements represent only our belief regarding future events, many of which by their nature are inherently uncertain or subject to change. It is possible that the actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements. Information regarding important factors that could cause actual results to differ, perhaps materially, from those in our forward looking statements is contained in reports we file and will file with the SEC. You should read and interpret any forward looking statement together with such reports.

| i |

|

Important Information for Investors and Shareholders

Leucadia National Corporation (Leucadia) has filed with the SEC a Registration Statement on Form S-4 in connection with the proposed transaction, and Leucadia and Jefferies Group, Inc. (Jefferies) will mail to their respective shareholders a Joint Proxy/Prospectus in connection with the proposed transaction. THE REGISTRATION STATEMENT AND THE JOINT PROXY/PROSPECTUS WILL CONTAIN IMPORTANT INFORMATION ABOUT LEUCADIA, JEFFERIES, THE PROPOSED TRANSACTION AND RELATED MATTERS. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY/PROSPECTUS CAREFULLY WHEN THEY BECOME AVAILABLE. Investors and security holders will be able to obtain free copies of the Registration Statement and the Joint Proxy/Prospectus and other documents filed with the SEC by Leucadia and Jefferies through the web site maintained by the SEC at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the Registration Statement and the Joint Proxy/Prospectus by phone, e-mail or written request by contacting the investor relations department of Jefferies and Leucadia at the following:

| Jefferies | Leucadia | |

| 520 Madison Avenue, New York, NY 10022 | 315 Park Avenue South, New York, NY 10010 | |

| Attn: Investor Relations | Attn: Investor Relations | |

| 203-708-5975 | 212-460-1900 | |

| info@jefferies.com |

Participants in the Solicitation

Leucadia and Jefferies, and their respective directors and executive officers, may be deemed to be participants in the solicitation of proxies in respect of the proposed transactions contemplated by the merger agreement. Information regarding Leucadia’s directors and executive officers is contained in Leucadia’s proxy statement dated April 13, 2012, which has been filed with the SEC. Information regarding Jefferies’ directors and executive officers is contained in Jefferies’ proxy statement dated March 28, 2012, which has been filed with the SEC. A more complete description will be available in the Registration Statement and the Joint Proxy/Prospectus.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or dealer participating in the offering will arrange to send you the prospectus if you request it by calling Jefferies & Company, Inc. at (201) 761-7610.

| ii |

|

Note on Financial Presentation and Assumptions

This document contains financial information of Leucadia and Jefferies on a combined basis. The presentation makes certain stated assumptions including (i) the spin-out of Leucadia’s Crimson Wine Group, (ii) the assumptions made pertaining to the financial reporting of the redemption of the Fortescue note and Pershing Square interest held by Leucadia and Leucadia’s sale of Keen Energy, and (iii) the increase in Jefferies’ book value calculated using the exchange ratio in the proposed transaction. These as well as other assumptions are made for presentation purposes only and may differ materially from actual results.

The presentation of combined information does not conform to or apply all of the requirements of acquisition method of accounting under FASB Accounting Standards Codification (ASC) 805, Business Combinations. Under the acquisition method of accounting, the acquirer recognizes, separately from goodwill, any identifiable assets acquired, including intangible assets, liabilities assumed and any noncontrolling interests in the acquiree at their fair values. To the extent the acquisition consideration exceeds or is less than the net fair value of the identifiable assets acquired and liabilities assumed, goodwill or a bargain purchase gain, respectively, is recognized.

The financial information concerning the proposed combined company presented herein will be superseded by financial information to be contained in Leucadia’s Registration Statement and Leucadia’s and Jefferies’ Joint Proxy/Prospectus.

Additionally, Jefferies’ 4Q 2012 and fiscal year end 2012 financial information is unaudited and subject to change in connection with year end procedures and audit.

| iii |

|

Table of Contents

| Executive Summary |

1 | |||

| Leucadia – Jefferies |

6 | |||

| Jefferies Overview |

10 | |||

| Appendix |

24 | |||

| iv |

|

Executive Summary

| 1 |

|

Jefferies – A Global Investment Banking Firm

| • | Full-Service Capital Markets Platform: expertise and depth across equities, fixed income, commodities and investment banking |

| • | Client-Focused: providing investor and issuer clients with the highest quality advice and execution |

| • | Global Footprint: sales & trading and investment banking presence across the United States, Europe and Asia |

| • | Strong, Stable Foundation: robust long-term capital base, comparatively low leverage and free from dependence upon government support |

| • | Positioned to Seize Market Share: having broadened our product offering and hired additional key talent during the downturn, Jefferies is growing rapidly |

| 2 |

|

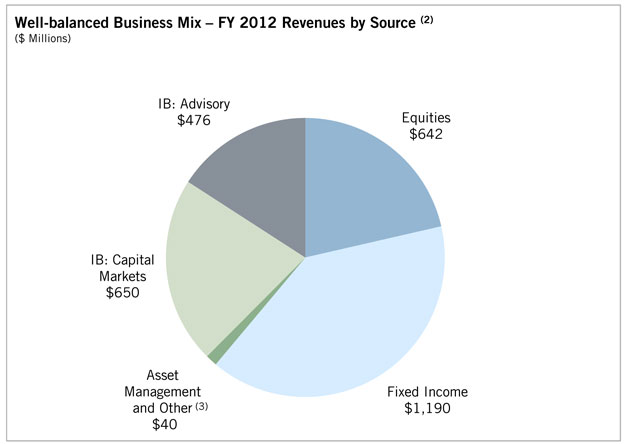

Jefferies – FY 2012 Earnings Update

| • | Jefferies has just recorded a very strong fiscal year (1): |

| • | Record adjusted net revenues: $2,990 million (versus FY 2011 $2,476 million) |

| • | Adjusted pre-tax earnings: $523 million (versus FY 2011 $366 million) |

| • | Adjusted net earnings: $302 million (versus FY 2011 $232 million) |

| (1) | The selected financial information for the year ended November 30, 2012 and 2011 excluding the effects of purchases and sales of our debt in November and December 2011, certain items identified and recognized in connection with the acquisition of Hoare Govett from The Royal Bank of Scotland Group plc on February 1, 2012 and the acquisition of the Global Commodities Group (the “Bache entities”) from Prudential Financial, Inc. (“Prudential”) on July 1, 2011, the impairment of certain intangible assets in the three months ended May 31, 2012, donations to Hurricane Sandy relief in November 2012 and transaction costs associated with the announced merger with Leucadia National Corporation incurred in the third and fourth fiscal quarter of 2012, are non-GAAP financial measures. |

| (2) | Revenues by Source are based on GAAP and do not include adjustments noted above. |

| (3) | Other includes debt accounting gains and bargain purchase gains of $13.2 million. |

| 3 |

|

Jefferies – Financial Performance

Financial Summary

| ($ Millions) |

11 Months Fiscal Year 2010 |

Fiscal Year 2011 |

Fiscal Year 2012 |

|||||||||

| Equities |

$ | 557 | $ | 594 | $ | 642 | ||||||

| Fixed Income |

728 | 715 | 1,190 | |||||||||

|

|

|

|

|

|

|

|||||||

| Securities |

1,285 | 1,309 | 1,833 | |||||||||

| Equity |

126 | 187 | 194 | |||||||||

| Debt |

347 | 385 | 456 | |||||||||

|

|

|

|

|

|

|

|||||||

| Capital Markets |

474 | 572 | 650 | |||||||||

| Advisory |

417 | 550 | 476 | |||||||||

|

|

|

|

|

|

|

|||||||

| Investment Banking |

890 | 1,123 | 1,126 | |||||||||

| Asset Management and Other (1) |

17 | 118 | 40 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net Revenues |

$ | 2,192 | $ | 2,549 | $ | 2,999 | ||||||

| Adjusted Net Revenues (2) |

2,177 | 2,476 | 2,990 | |||||||||

| Adjusted Operating Earnings (2) |

397 | 366 | 523 | |||||||||

| Adjusted Net Income (2) |

$ | 224 | $ | 232 | $ | 302 | ||||||

| (1) | Other includes debt accounting gains and bargain purchase gains of $13.2 million in FY 2012 and $73.6 million in FY 2011. |

| (2) | The selected financial information for the year ended November 30, 2012 and 2011 excluding the effects of purchases and sales of our debt in November and December 2011, certain items identified and recognized in connection with the acquisition of Hoare Govett from The Royal Bank of Scotland Group plc on February 1, 2012 and the acquisition of the Global Commodities Group (the “Bache entities”) from Prudential Financial, Inc. (“Prudential”) on July 1, 2011, the impairment of certain intangible assets in the three months ended May 31, 2012, donations to Hurricane Sandy relief in November 2012 and transaction costs associated with the announced merger with Leucadia National Corporation incurred in the third and fourth fiscal quarter of 2012, are non-GAAP financial measures. |

| 4 |

|

Jefferies – Balance Sheet

As of August 31, 2012

($Millions)

Jefferies Group, Inc.

Balance Sheet as of 08/31/12

| 5 |

|

Leucadia – Jefferies

| 6 |

|

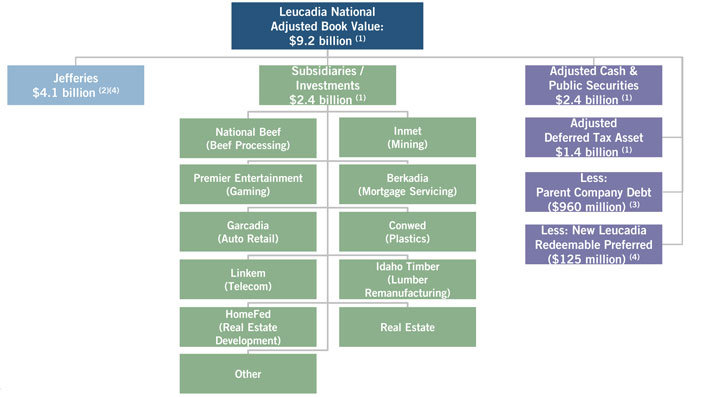

Leucadia – Jefferies

Source: Jefferies as of 08/13/12 and Leucadia as of 09/30/12.

| (1) | Through 12/31/11. |

| (2) | Adjusted for October 2012 redemption / sale of Fortescue note, Keen Energy and Pershing Square. See pages 26–28 for further detail. |

| (3) | See page 29 for further detail of Parent Company Debt. |

| (4) | Adjusted for spin-out of Crimson Wine Group (estimated $197 million reduction in book value) and October 2012 redemption / sale of Fortescue note, Keen Energy and Pershing Square. See pages 26 and 28 for further detail. |

| 7 |

|

Leucadia – Jefferies

Leucadia – Jefferies merger creates a unique combination

| • | Leucadia will be in the business of merchant investing and owning Jefferies, an investment banking firm |

| • | Jefferies will continue its over 50-year focus in the capital markets and maintain a highly liquid balance sheet |

| • | Future acquisitions and investments will leverage the knowledge base, opportunity flow and execution capabilities of Leucadia and Jefferies’ management team and businesses |

Source: Jefferies as of 08/31/12 and Leucadia as of 09/30/12.

| (1) | Adjusted for spin-out of Crimson Wine Group (estimated $197 million reduction in book value) and October 2012 redemption / sale of Fortescue note, Keen Energy and Pershing Square. See pages 26–28 for further detail. |

| (2) | Reflects Jefferies’ common shareholders’ equity adjusted to fair value per announced exchange ratio, plus Leucadia interest in Jefferies High Yield Holdings. See page 26 for further detail. |

| (3) | See page 29 for reconciliation. |

| (4) | Assumes exchange of Jefferies Mandatorily Redeemable Convertible Preferred Stock into comparable Leucadia Redeemable Preferred Stock. |

| 8 |

|

Jefferies – Leucadia

Post-merger, Jefferies will be in a position to more rapidly build its equity capital base through retention of a greater proportion of earnings, and will enjoy potential access to additional capital from the Leucadia holding company, ensuring greater balance sheet flexibility and resilience

| • | No required Jefferies High Yield Holdings (“JHYH”) mandatorily redeemable preferred interest and non-controlling interest distributions |

| • | Jefferies expensed $84 MM of distributions relating to JHYH in FY 2012 (1)(2) |

| • | No required public company stock dividends |

| • | Jefferies paid out $62 MM in common stock dividends in FY 2012 (1) |

| • | Jefferies would have the ability to defer Federal income tax payments to Leucadia, if needed, at management’s discretion (Leucadia has an adjusted deferred tax asset of $1.4 billion (3)) |

| • | Jefferies’ expensed Federal income taxes of $142 MM in FY 2012 (1) |

| • | Assuming the merger occurred on January 1, 2012, the net effect would be an incremental $124 MM in cash (4), as well as potential Federal income tax savings of $142 MM (5), in aggregate representing 2.2x Jefferies’ FY 2012 net income, less common stock dividends |

| ($ Millions) | Fiscal Year Ending, 11/30/12 (1) |

|||

| Net Income to Common |

$ | 282 | ||

| Less: Common Stock Dividends |

(62 | ) | ||

|

|

|

|||

| Net Income to Common, less Common Stock Dividends |

$ | 221 | ||

|

|

|

|||

| Plus: Common Stock Dividends |

62 | |||

| Plus: JHYH Minority Interest (After-Tax) (2) |

84 | |||

| Less: Incremental Interest Expense (4) |

(22 | ) | ||

|

|

|

|||

| Incremental Cash (6) |

124 | |||

|

|

|

|||

| Net Income to Common, less Common Stock Dividends, plus Incremental Cash (6) |

$ | 344 | ||

| Plus: Federal Income Tax Expense |

142 | |||

|

|

|

|||

| Net Income to Common, less Common Stock Dividends, plus Incremental Cash, including Federal Income Tax savings (6) |

$ | 486 | ||

|

|

|

|||

| Multiple of FY 2012 Net Income to Common, less Common Stock Dividends |

2.2x | |||

| (1) | Includes Q4 2012 estimate. |

| (2) | Reflects interest on mandatorily redeemable preferred interests of consolidated subsidiaries of $43 million and net earnings to noncontrolling interests of $41 million. |

| (3) | See page 27 for further detail. |

| (4) | Assumes incremental interest expense of $22 million based on $338 million of debt at 6.5% interest. |

| (5) | Based on estimated Jefferies’ FY 2012 Federal income tax expense of $142 million. |

| (6) | Non-GAAP financial measure. |

| 9 |

|

Jefferies Overview

| 10 |

|

Core Operating Principles

Jefferies is focused on the following core principles to manage risk and deliver across-the-cycle revenue and earnings growth:

| • | Strong Liquidity |

| • | Jefferies’ maintains a very liquid, financeable and low-risk balance sheet |

| • | Limited Leverage |

| • | Jefferies maintains a consistent, carefully managed leverage ratio, and has demonstrated the operational and financial flexibility to reduce leverage in times of stress |

| • | Consistent Profitability |

| • | Jefferies has remained solidly profitable despite the volatile trading environment in global markets since 2009 |

| • | Driving Productivity |

| • | Following two years of significant investment, Jefferies continues to rapidly increase investment banker productivity |

| • | Recent hires have begun reaching targeted productivity levels |

| • | Aside from recent hires, investment banker productivity continues to substantially improve due to Jefferies’ increasingly prominent market presence |

| • | Taking Market Share |

| • | Since 2008, Jefferies has substantially grown market share by: |

| • | Taking advantage of market dislocation and our competitors’ ongoing struggles to enter new business and regions and expand existing capabilities |

| • | Delivering broader and better capabilities to our clients |

| • | Culture |

| • | Jefferies is transparent, not arrogant, client focused and creditor friendly |

| 11 |

|

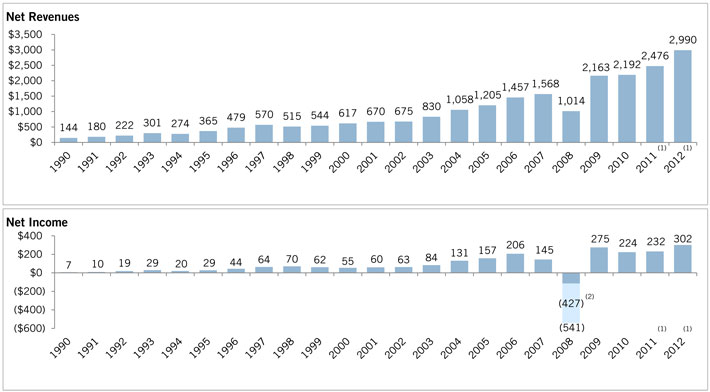

Jefferies Revenues & Net Income – Since 1990

($ Millions)

| • | With the exception of our results during the global financial crisis in 2007-2008, Jefferies has not had a single loss quarter dating back to 1990 |

| • | Jefferies raised $433 million of equity from Leucadia in 2008, more than mitigating the impact of our operating loss |

| (1) | Adjusted to exclude debt extinguishment gains, amortization of debt discounts, donations to Hurricane Sandy relief, transaction costs associated with the announced merger with Leucadia National Corporation and certain historical acquisition items. |

| (2) | Includes post-tax losses of $427 million related to the modification of the terms of our employee stock awards in Q4 2008, such that previously granted awards were written off and current year employee stock compensation awards were expensed in the year in which service was provided. |

| 12 |

|

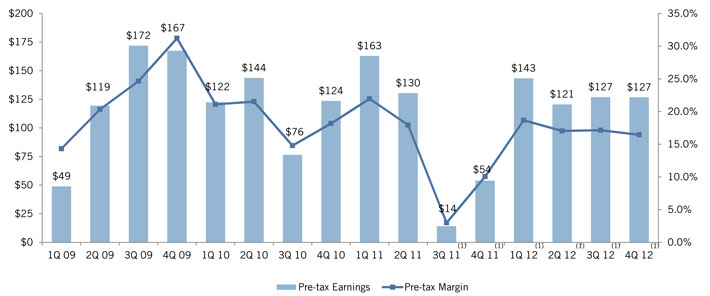

Consistent Profitability Across the Cycle

($Millions)

| • | Jefferies has generated pre-tax earnings of $1.85 billion since 2009 |

| • | Average pre-tax margin of 18.0% |

| (1) | Adjusted to exclude debt extinguishment gains, amortization of debt discounts, donations to Hurricane Sandy relief, transaction costs associated with the announced merger with Leucadia National Corporation and certain historical acquisition items. |

| 13 |

|

Substantial Investment in Human Capital, Including Infrastructure Support

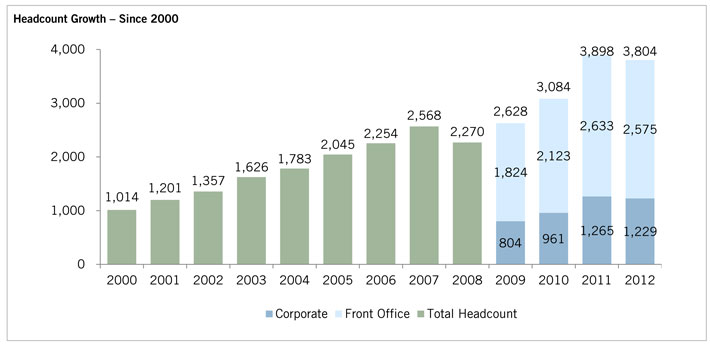

| • | Jefferies headcount has grown 275% since 2000 |

| • | Jefferies Corporate headcount is up 53% since 2009 vs. 41% for the front office, enhancing support and controls |

| 14 |

|

Liquidity and Funding Principles

Jefferies’ long-standing liquidity and funding principles have maintained the strength and soundness of our platform across market cycles:

| • | Owning inventory that is composed of liquid assets that turn over regularly, with a minimal amount of Level 3 Assets |

| • | Maintaining a sound, long-term capital base and reasonable leverage relative to our business activity |

| • | No reliance on unsecured funding or customer balances |

| • | Short term secured funding that is readily and consistently available through clearing houses, or fixed for periods of time that exceed the expected tenure of the inventory they are funding |

| • | Assessing capital reserves and maintaining liquidity (including intraday liquidity) to withstand adverse changes in the trading or financing markets |

| • | Where appropriate, entering into partnerships and joint ventures with complementary long-term partners to pursue business opportunities that otherwise will exceed our capital capacity or risk tolerance |

| 15 |

|

Balance Sheet

Strong Capital Structure and Ample Liquidity

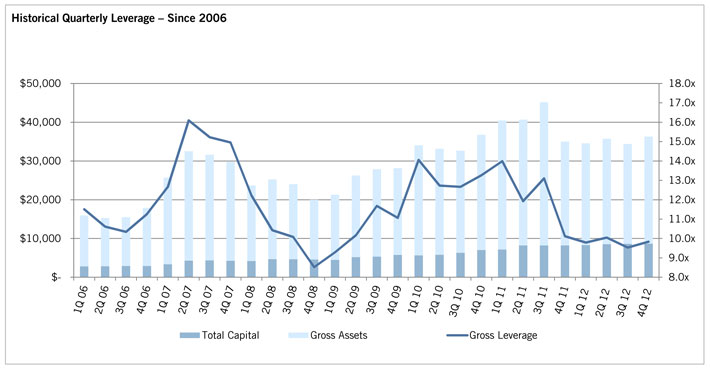

| • | Jefferies maintains a highly liquid balance sheet, with low gross leverage and exposure to illiquid assets, and significant structural liquidity |

| • | Jefferies continues to manage the size of its balance sheet in response to market conditions and volatility |

| • | Total assets at 11/30/12: $36.3 billion |

| • | Reduced by ~20% since peak in Q3 2011 |

| • | Gross leverage at 11/30/12: 9.6x |

| • | Reduced by ~25% since Q3 2011 |

| • | Long-term capital of $8.6 billion as of 08/31/12, including $4.5 billion of long-term debt with a weighted average maturity of 8.3 years |

| ($ Millions) |

As of Aug. 31, 2012 | |||

| Long Term Debt (excluding current portion) |

$ | 4,451 | ||

| Mandatorily Redeemable Preferred Interest (1) |

340 | |||

| Series A Convertible Preferred (2) |

125 | |||

| Total Stockholders’ Equity |

3,707 | |||

|

|

|

|||

| Total Capitalization |

$ | 8,622 | ||

|

|

|

|||

| (1) | Prior to the effective time of the second merger, Jefferies and Leucadia will take actions necessary to amend the limited liability company agreement of Jefferies High Yield Holdings, LLC with respect to Leucadia’s equity interest in Jefferies High Yield Holdings, LLC so that (i) the maturity date of Leucadia’s interest is extended to at least three years and (ii) Leucadia’s interest qualifies as Jefferies equity for generally accepted accounting principles purposes. |

| (2) | On November 9, 2012, Jefferies received confirmation from Mass Mutual that it would agree either to accept Leucadia mirror preferred stock, on terms to be determined, instead of its Jefferies preferred stock, or to redeem its Jefferies preferred stock. |

| 16 |

|

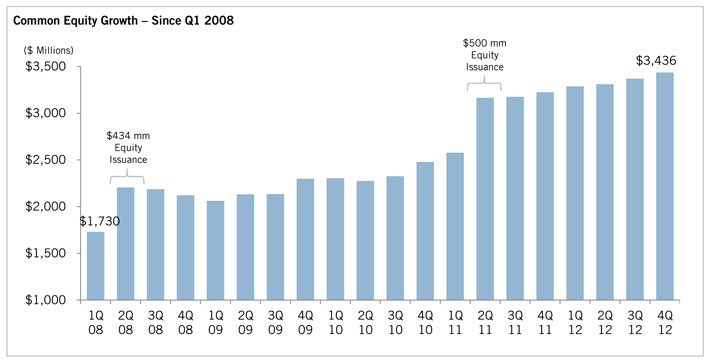

Consistent Common Equity Growth

| • | Jefferies has grown common equity by $1.7 billion, or 99%, since the financial crisis began in Q1 2008 |

| • | Jefferies’ proactive equity capital raises have helped the firm navigate the global financial crisis and capitalize on growth opportunities |

| 17 |

|

Limited Leverage

($Millions)

| • | Jefferies has a long-standing policy of carefully managing balance sheet leverage |

| • | In periods of stress, Jefferies has demonstrated the ability to rapidly reduce leverage without unduly impacting our business |

| 18 |

|

Strong Liquidity

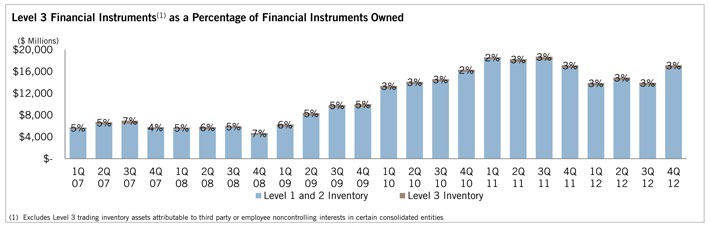

| • | Jefferies’ trading inventory is liquid and low-risk, rapidly turning in order to serve client flow |

| • | Very liquid inventory |

| • | 77% of financial instruments owned are readily and consistently financeable at haircuts of 10% or less |

| • | Level 3 assets represent only 3% of long inventory – consistent over past 11 quarters |

| • | Reliable secured funding |

| • | 90% of Jefferies’ assets financed through repos are eligible for central clearing |

| • | No reliance on short-term unsecured funding |

| • | Client-focused |

| • | Fee and flow based businesses represent preponderance of net revenues |

| 19 |

|

Level 3 Trading Assets Overview

| • | 97% of inventory is Levels 1 and 2, with a minimal amount of Level 3 trading assets |

| • | Level 3 Trading Assets (1) represent only 13% of common equity |

| 20 |

|

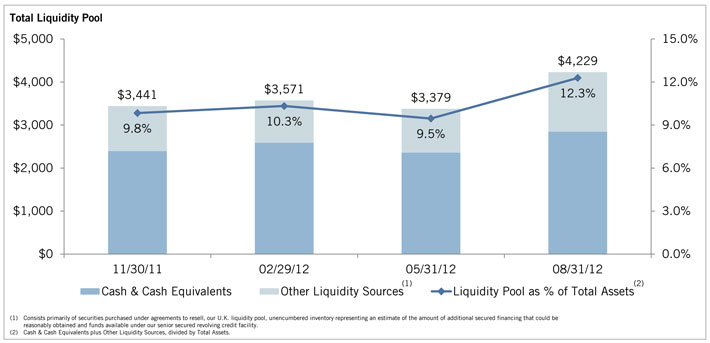

Liquidity Pool

($Millions)

| • | Jefferies maintains significant excess liquidity on hand |

| • | Liquidity Pool has increased 23% since 11/30/11 |

| 21 |

|

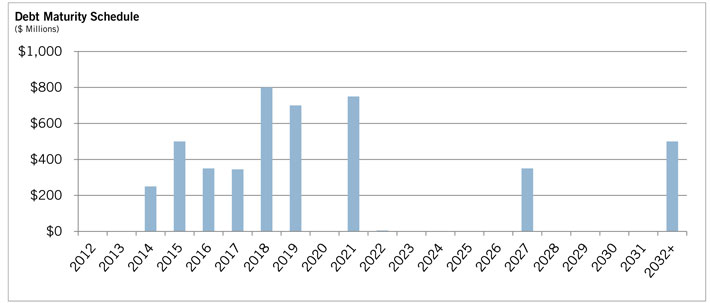

Long-Term Debt Profile

| • | As of 08/31/12, our $4.5 billion of long-term debt has a weighted average maturity of 8 years |

| • | No scheduled debt maturities until 2014 |

| • | No maturity of long-term debt in a single year is greater than 20% of outstanding long-term debt |

| 22 |

|

Value-at-Risk (VaR)

($Millions)

Daily VaR

| Risk Category |

Average VaR for the 3-month period ended 08/31/12 |

|||

| Adjusted Firmwide (1) |

$ | 8.35 | ||

| Interest Rates |

7.31 | |||

| Equity Prices |

4.32 | |||

| Currency Rates |

0.68 | |||

| Commodity Prices |

1.31 | |||

| Diversification Effect |

(3.09 | ) | ||

|

|

|

|||

| Firmwide |

$ | 10.53 | ||

| (1) | Excluding investment in Knight Capital, average VaR for the three months ended August 31, 2012 was $8.35 million. |

| 23 |

|

Appendix

| 24 |

|

Leucadia – Jefferies Combined Balance Sheet

($Millions)

Leucadia National Corporation – Unaudited Pro Forma Condensed Combined Balance Sheet

Balance Sheet as of 09/30/12

Source: Leucadia Form S-4 as filed with the Securities and Exchange Commission on December 6, 2012. Balance sheet figures may differ from those presented on pages 7–9 due to adjustments for events subsequent to 09/30/12. See pages 26 – 28 for further detail.

| 25 |

|

Reconciliations

| 26 |

|

Reconciliations

| 27 |

|

Reconciliations

| 28 |

|

Reconciliations

Leucadia Parent Company Debt Reconciliation

| 29 |

|