Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BRADY CORP | projectnurseform8-k.htm |

| EX-2.1 - EXHIBIT 2.1 - AGREEMENT AND PLAN OF MERGER - BRADY CORP | exhibit21-agreement.htm |

| EX-99.1 - EXHIBIT 99.1 - PRESS RELEASE OF BRADY CORPORATION - BRADY CORP | exhibit991-pressrelease.htm |

Acquisition of Precision Dynamics Corporation December 31, 2012

FORWARD-LOOKING STATEMENTS 2 In this presentation, statements that are not reported financial results or other historic information are “forward-looking statements.” These forward-looking statements relate to, among other things, the Company’s future financial position, business strategy, targets, projected sales, costs, earnings, capital expenditures, debt levels and cash flows, and plans and objectives of management for future operations. The use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “project” or “plan” or similar terminology are generally intended to identify forward-looking statements. These forward-looking statements by their nature address matters that are, to different degrees, uncertain and are subject to risks, assumptions, and other factors, some of which are beyond Brady’s control, that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. For Brady, uncertainties arise from: the length or severity of the current worldwide economic downturn or timing or strength of a subsequent recovery; increased usage of e-commerce allowing for ease of price transparency; future financial performance of major markets Brady serves, which include, without limitation, telecommunications, hard disk drive, manufacturing, electrical, construction, laboratory, education, governmental, public utility, computer, and transportation; future competition; changes in the supply of, or price for, parts and components; increased price pressure from suppliers and customers; Brady’s ability to retain significant contracts and customers; fluctuations in currency rates versus the U.S. dollar; risks associated with international operations; difficulties associated with exports; risks associated with obtaining governmental approvals and maintaining regulatory compliance; Brady’s ability to develop and successfully market new products; difficulties in making and integrating acquisitions; risks associated with newly acquired businesses; risks associated with restructuring plans; environmental, health and safety compliance costs and liabilities; technology changes and potential security violations to the Company’s information technology systems; Brady’s ability to maintain compliance with its debt covenants; increase in our level of debt; potential write-offs of Brady’s substantial intangible assets; unforeseen tax consequences; and numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive, and regulatory nature contained from time to time in Brady’s U.S. Securities and Exchange Commission filings, including, but not limited to, those factors listed in the “Risk Factors” section within Item 1A of Part I of Brady’s Form 10-K for the year ended July 31, 2012. These uncertainties may cause Brady’s actual future results to be materially different than those expressed in its forward- looking statements. Brady does not undertake to update its forward-looking statements except as required by law.

Strategic Overview & Rationale 3 PDC is a core identification-market adjacency and is supportive of our mission to Identify and Protect Premises, Products and People Sizeable platform acquisition of a market leader in an attractive healthcare segment with positive macro trends Attractive opportunity to leverage capabilities in high-performance materials, labels, specialty printers and safety applications Largest acquisition in Brady’s history - $300 million purchase price with $173 million in estimated calendar 2012 net sales Compelling value creation

Precision Dynamics Corporation (“PDC”) Overview A market leader in domestic patient ID/wristbands and hospital ID/labels Headquartered in Valencia, California, with facilities in: Port Orange, Florida; Tijuana, Mexico; and Nivelles, Belgium 85% of business is in healthcare related markets; remaining 15% is related to the sale of ID products to the leisure and entertainment, and law enforcement markets Diverse product offering, customer base, and channels to market Contracts with all major group purchasing organizations (“GPO”s) 4 Precision Dynamics Corporation:

Experienced Management Team 5 We will manage PDC as a global business, reporting to Matt Williamson, President – Americas. PDC Management structure primarily remains in tact. PDC’s deep team of industry experts will report directly to Tracey Carpentier, President – Precision Dynamics. Functional leaders (finance, HR, IT, operations) will have dotted-line reporting to the President - Precision Dynamics. Structure is designed to allow the President, Tracey Carpentier, to focus on: Developing innovative new products Growing the core North American business Accelerating growth internationally

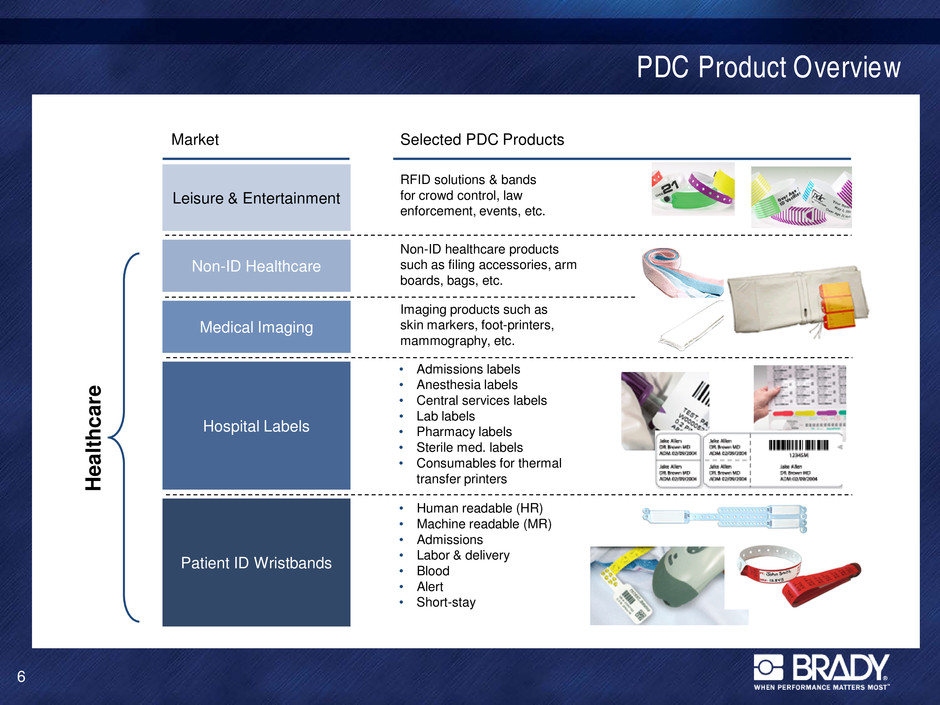

PDC Product Overview 6 Leisure & Entertainment Hospital Labels Patient ID Wristbands Non-ID Healthcare Selected PDC Products Market • Human readable (HR) • Machine readable (MR) • Admissions • Labor & delivery • Blood • Alert • Short-stay • Admissions labels • Anesthesia labels • Central services labels • Lab labels • Pharmacy labels • Sterile med. labels • Consumables for thermal transfer printers RFID solutions & bands for crowd control, law enforcement, events, etc. Heal th ca re Medical Imaging Imaging products such as skin markers, foot-printers, mammography, etc. Non-ID healthcare products such as filing accessories, arm boards, bags, etc.

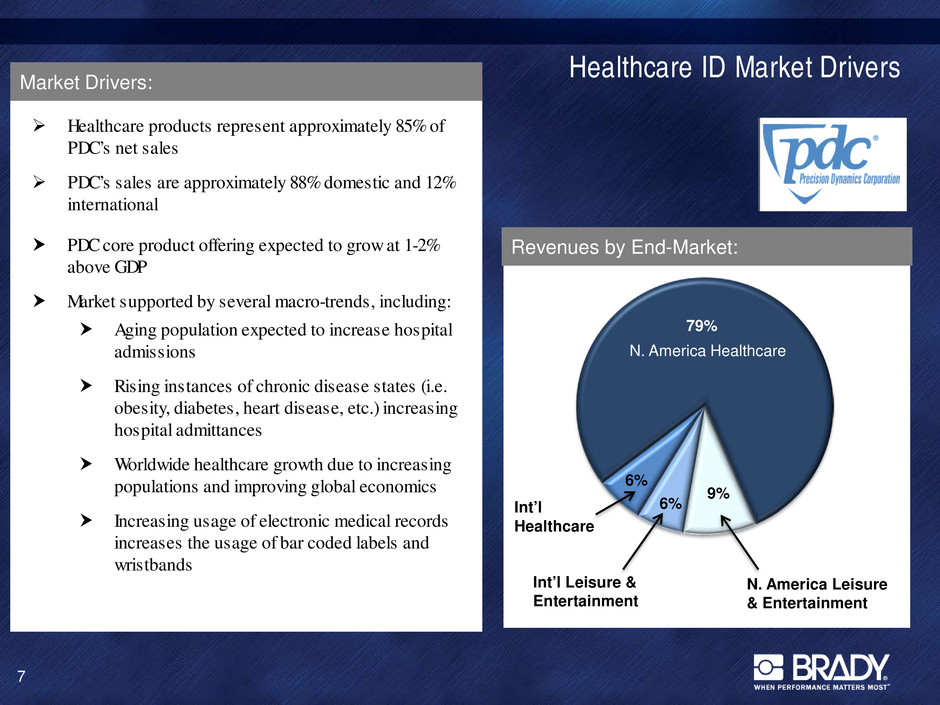

Healthcare ID Market Drivers Healthcare products represent approximately 85% of PDC’s net sales PDC’s sales are approximately 88% domestic and 12% international PDC core product offering expected to grow at 1-2% above GDP Market supported by several macro-trends, including: Aging population expected to increase hospital admissions Rising instances of chronic disease states (i.e. obesity, diabetes, heart disease, etc.) increasing hospital admittances Worldwide healthcare growth due to increasing populations and improving global economics Increasing usage of electronic medical records increases the usage of bar coded labels and wristbands 7 Market Drivers: 79% 9% 6% 6% Revenues by End-Market: N. America Healthcare Int’l Healthcare N. America Leisure & Entertainment Int’l Leisure & Entertainment

Brady’s Strategy – Expanding Healthcare ID 8 PDC gives Brady a market-leading, high-margin consumable healthcare identification platform with opportunities for accelerated growth and enhanced profitability. PDC has a leading market position Ability to combine Brady’s Laboratory and People ID product offerings with PDC’s broad label product range Hospital Labels PDC has a leading market position Ability to expand PDC’s wristband offering internationally due to Brady’s extensive geographic presence Patient ID Wristbands Ability to bring Brady's printing system capabilities (printers, materials, software) to PDC's broad set of customers to develop new solutions for healthcare Healthcare Printing Solutions BSP 31 Label Attachment System LABXPERT Labeling Printers

PDC Strategic Rationale & Synergies 9 Near-in identification market that is consistent with Brady’s growth strategy Leadership position in the Healthcare ID market Sizeable acquisition provides an anchor position in an end-market with favorable macro long-term growth trends Runway of organic and inorganic growth opportunities Acquisition leverages Brady’s expertise in high- performance materials and specialty printers Strategic Rationale: Organic growth opportunities: New products – Materials and printing systems Cross sales of Brady products through PDC channels Geographic expansion outside of the U.S. Cost Synergies: Sourcing savings, including reduced freight G&A efficiencies Tijuana facility consolidation opportunities (PDC and Brady together have three facilities in Tijuana, Mexico) Acquisition Synergies:

PDC Acquisition Financial Summary Estimated Calendar 2012 Financial Results: • Revenues = $173M • Adjusted EBITDA = $33M (19.1% of sales) • Gross profit margin percentages in the low 40s • Capital expenditure characteristics consistent with Brady (average of approximately 2% of sales) Purchase Price: • $300M purchase price • $22M NPV of acquired tax-deductible amortization • Nearly 2/3rds of the purchase price funded with cash Non-recurring Acquisition- and Integration-related costs: • The non-recurring acquisition-related costs are expected to include a non-cash tax charge of $25 to $30 million related to the repatriation of cash to the U.S. in financing this acquisition and $8 to $12 million of other acquisition- and integration-related expenses. Anticipated Diluted EPS Accretion (excl. non-routine acquisition- and integration-related charges): • Remainder of Fiscal 2013 - Slightly accretive • Fiscal 2014 - $0.10 - $0.15/share Remaining Financial Flexibility: • Brady will maintain the financial flexibility to fund future growth, with pro-forma post-acquisition leverage of 1.8x gross debt / TTM Adjusted EBITDA. 10

INVESTOR RELATIONS Brady Contact: Aaron Pearce Investor Relations 414-438-6895 Aaron_Pearce@Bradycorp.com See our web site at www.investor.bradycorp.com 11