Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CU Bancorp | d453763d8k.htm |

United in Our Dedication to Relationships

|

2

Forward-Looking Statements

This presentation contains certain forward-looking information about CU Bancorp

and California United Bank (collectively the “Company”) that is

intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995.

All statements other than statements of historical fact are forward-looking

statements. Such statements involve inherent risks and uncertainties, many

of which are difficult to predict and are generally beyond the control of the Company. There are a number of important factors that could

cause actual results to differ materially from those expressed in, implied or

projected by, such forward-looking statements. Risks and uncertainties

include but are not limited to lower than expected revenues; credit quality deterioration which could cause an increase in the

allowance for loan losses and a reduction in net earnings; increased competitive

pressure among depository institutions; a change in the interest rate

environment which reduces interest margins; asset/liability repricing risks and liquidity risks; general economic conditions, either nationally

or in the market areas in which the Company does or anticipates doing business are

less favorable than expected; environmental conditions, including natural

disasters, may disrupt our business, impede our operations, negatively impact the values of collateral security for the

Company’s loans or impair the ability of our borrowers to support their debt

obligations; the economic and regulatory effects of the continuing war on

terrorism and other events of war; legislative or regulatory requirements or changes adversely affecting the Company’s business; and

changes in the securities markets. If any of these risks or uncertainties

materializes or if any of the assumptions underlying such forward-looking

statements proves to be incorrect, the Company’s results could differ

materially from those expressed in, implied or projected by such forward-

looking statements. The Company assumes no obligation to update such

forward-looking statements. For a more complete discussion of risks and

uncertainties, read the Bank’s annual report on Form 10-K, quarterly

reports on Form 10-Q and other reports filed by the Bank with the FDIC

and by CU Bancorp with the SEC. The documents filed with the FDIC and the SEC may

be obtained at California United Bank’s website at www.cunb.com. These documents may also be obtained free of charge from CU Bancorp by directing a request to CU Bancorp, 15821

Ventura Boulevard, Suite 100, Encino, California 91436, Attention: Investor

Relations. Telephone 818 257-7700. United in Our Dedication

to Relationships |

Investment Highlights

3

•

Emerging business banking franchise reaching an inflection point

in

profitability

•

Attractive low-cost core deposit base

Non-interest bearing deposits comprise 48% of total deposits

Cost of deposits was 18 bps in Q3 2012

•

Demonstrated ability to grow both organically and through

acquisitions •

Experienced management team with an established track record of

delivering results

•

Recent acquisition of Premier Commercial Bank (PCB) provides

near-term catalyst for earnings growth (excluding

merger-related expenses) •

Growing awareness in local markets and the investment community

Surpassed $1 billion in total assets in July 2012

Transferred listing to Nasdaq Capital Market in October 2012

United in Our Dedication to Relationships

|

Corporate Overview

4

•

Established by local business owners and entrepreneurs in 2005

•

Eight full-service offices in Los Angeles, San Fernando Valley,

Conejo Valley, Santa Clarita Valley, Simi Valley, South Bay, and

Orange County (Anaheim and

Irvine/Newport Beach)

•

Servicing businesses, non-profit organizations, entrepreneurs,

professionals, and high-net worth individuals

•

Total assets of $1.3 billion

•

California United Bank grew total assets at a 41.0% CAGR and total

deposits at a 50.5% CAGR since inception in 2005 through December

31, 2011 United in Our Dedication to Relationships

California United Bank is a premier community-based

commercial bank servicing the Metropolitan Los Angeles,

Orange County and Ventura County markets

|

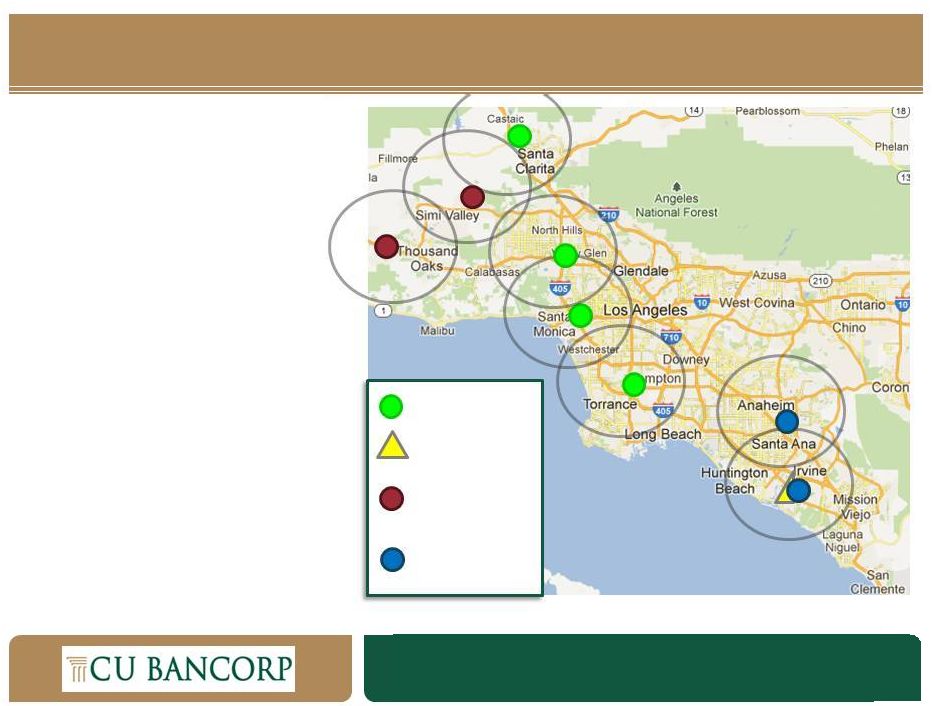

•

Encino

(2005)

–

Headquarters

•

Los Angeles (2006)

•

Santa Clarita Valley (2007)

•

South

Bay

(2009)

–

Converted

to

a

branch

in 2010

•

Orange

County

(2010)

–

Loan

Production

Office

•

Simi

Valley

(2010)

–

Acquired

from

California Oaks State Bank

•

Thousand

Oaks

(2010)

–

Acquired

from

California Oaks State Bank

•

Anaheim

(2012)

–

Acquired

from

Premier

Commercial Bank

•

Irvine/Newport

Beach

(2012)

–

Acquired

from Premier Commercial Bank

CUNB Branch

CUNB LPO

Former COSB

Branch

Former PCB

Branch

Strategic Geographic Locations

5

United in Our Dedication to Relationships

California United Bank has a footprint

that spans the most attractive markets

in Southern California: |

Why We Are Different

6

•

CUNB has been engaged in the successful practice of business banking

since its inception

Strong growth combined with stellar asset quality

•

We have the ability to do larger, more complex financings than similar

sized banks Formula lines of credit

Asset-based lending

•

Executive team has extensive experience building high performing

banks

•

Demonstrated ability to identify, acquire and successfully integrate

banks •

Proven ability to attract top bankers

Multiple experienced banking teams added from competitors since

2010 •

Local advisory boards guide the Bank in its respective business

communities United in Our Dedication to Relationships

California United Bank sets itself apart

from other banks in the following ways: |

Our Customers

7

•

Majority of customers participate in the manufacturing, distribution and

services industries

•

Typical customer has between $10 million and $60 million in annual

sales (excluding SBA borrowers)

•

Typical loan commitment ranges between $1 million and $5 million

(excluding SBA loans)

•

Majority of new customers come from larger banks

•

Most new business generation results from warm leads provided by

referral sources

Our customer base reflects the diversity

of industries in Southern California

United in Our Dedication to Relationships

|

8

•

CUNB employees are involved in their local communities

•

Strong

cultural

value

demonstrates

that

supporting

the

community

is

also

good

business

•

CUNB supports over 75 charities throughout Southern California

financially and with volunteer hours

•

Utilize local advisory boards to help guide the Bank in its respective

markets •

“Outstanding”

CRA

Rating

United in Our Dedication to Relationships

Dedicated to the Community |

9

*Formerly EVP at Premier Commercial Bank, N.A.

David Rainer

President

Chief Executive Officer

32 years

7 years

Anne Williams

EVP

Chief Operating Officer & Chief Credit

Officer

32 years

7 years

Karen Schoenbaum

EVP

Chief Financial Officer

19 years

3 years

Anita Wolman

EVP

General Counsel

35 years

7 years

Sam Kunianski

EVP

Executive Manager –

Commercial and

Private Banking

28 years

6 years

William Sloan

EVP

Executive Manager –

Real Estate and

Santa Clarita Regional Manager

28 years

7 years

Stephen Pihl

EVP

Executive Manager –

SBA and Orange

County Regional Manager

25 years

New addition*

Name

Title

Functional

Banking Exp

CUB Tenure

Experienced Management

United in Our Dedication to Relationships

|

10

The

Management

Team

at

California

United

Bank

has

. The

same

Executive

Team

that

created

success

at

the

banks

below

are now

in

charge

at California United Bank.

–

Grew to $1 billion in assets

–

Sold to Bank of Hawaii in 1997

–

Sold to U.S. Bancorp in 2000

–

Opened in 2005

–

Acquired Cal Oaks State Bank December 31, 2010

–

Merged with Premier Commercial Bancorp July 31, 2012

–

$1.3 billion in total assets at September 30, 2012

A History of Success

•

Wells

Fargo/Security

Pacific

–

1980s

•

California

United

Bank

(1992

–

1997)

•

Santa

Monica

Bank

•

U.S.

Bank

(2001

–

2004)

•

California

United

Bank

(Current)

United in Our Dedication to Relationships

three

decades

of

banking

experience

in

the

Southern

California

Market |

Our Growth Strategy

11

Organic

Acquisitions

De novo regional offices with strong local leadership

Hire “in market”

talent

Offer sophisticated products/solutions

Expertise in C&I and Commercial Real Estate lending

Relationship based business

Distinguish by service

New SBA lending expertise provided by PCB

California Oaks State Bank (12/31/10)

Premier Commercial Bank (7/31/12)

United in Our Dedication to Relationships

|

Q3 2012 Highlights

12

•

Pre-tax earnings before merger-related expenses of $1.13 million,

an increase of 6.5% over prior year

•

Net interest income of $9.8 million, an increase of 42% over prior

year •

Net interest margin increased to 3.57% from 3.37% in prior quarter

Accretion of purchase accounting discount enhanced loan yields by 29 bps

•

Net organic loan growth of $51 million, or 10% from the end of the prior

quarter

•

Net

organic

deposit

growth

of

$24

million,

or

3%

from

the

end

of

the

prior

quarter

•

Net charge-offs of $44,000

•

Integration

of

Premier

Commercial

Bank

completed

in

less

than

30

days

after close

United in Our Dedication to Relationships

|

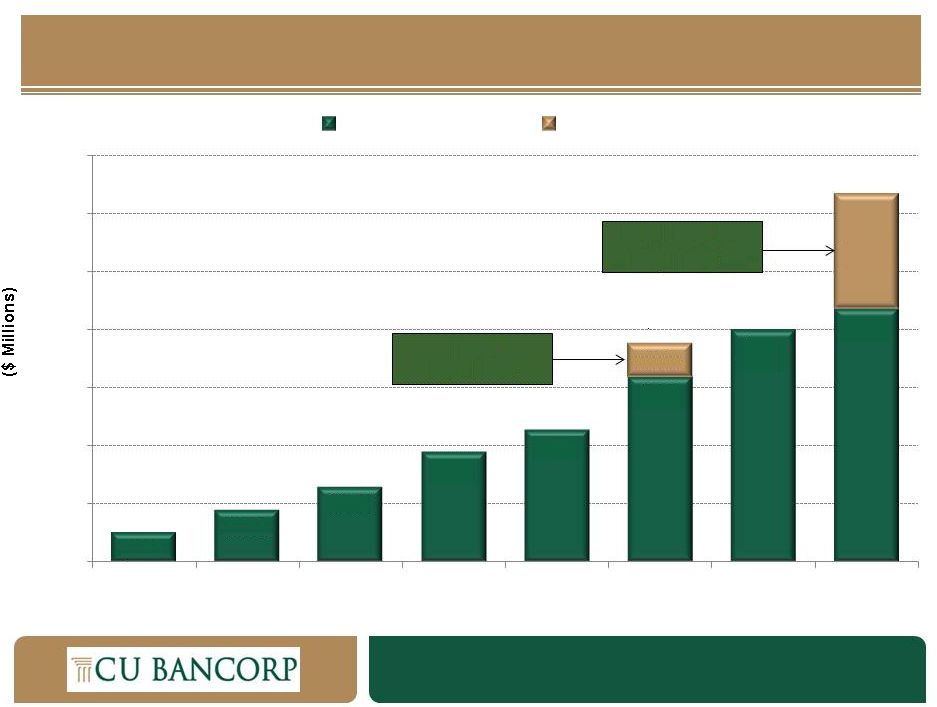

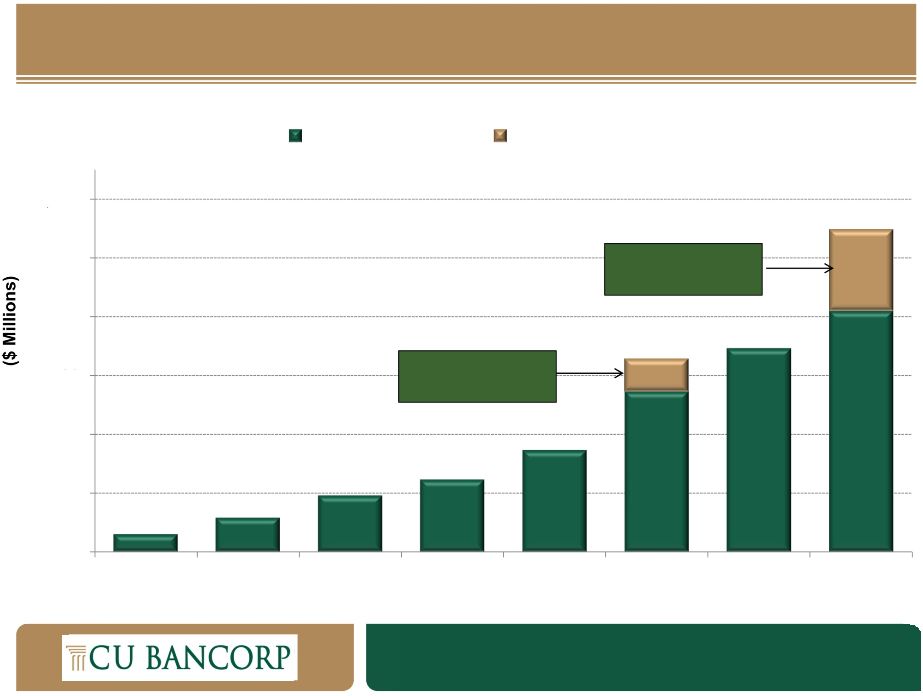

*Represents the assets acquired from Premier

Commercial Bancorp on July 31, 2012

Consistent Asset Growth

United in Our Dedication to Relationships

$102

$178

$260

$379

$457

$638

$800

$871

$118

$397*

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

2005

2006

2007

2008

2009

2010

2011

9/30/2012

CUB Organic

Acquisitions

$1,268

PCB

acquisition

COSB

acquisition

13

$756 |

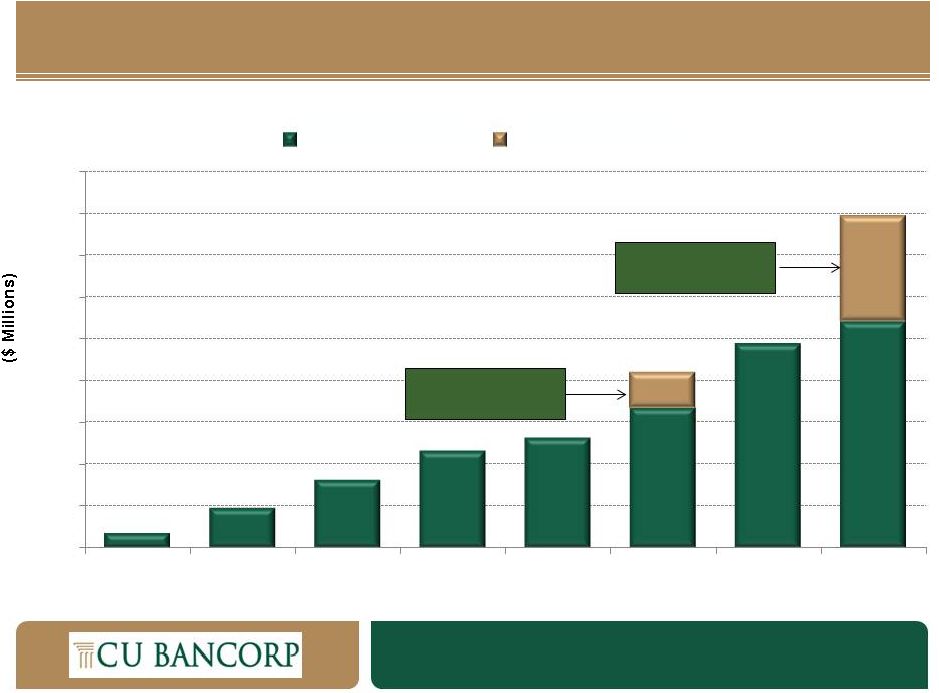

Loan Growth

14

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

2005

2006

2007

2008

2009

2010

2011

9/30/2012

$795

$421

CUB Organic

Acquisitions

$35

$96

$162

$232

$263

$334

$489

$540

$87

$255

PCB

acquisition

COSB

acquisition

United in Our Dedication to Relationships

|

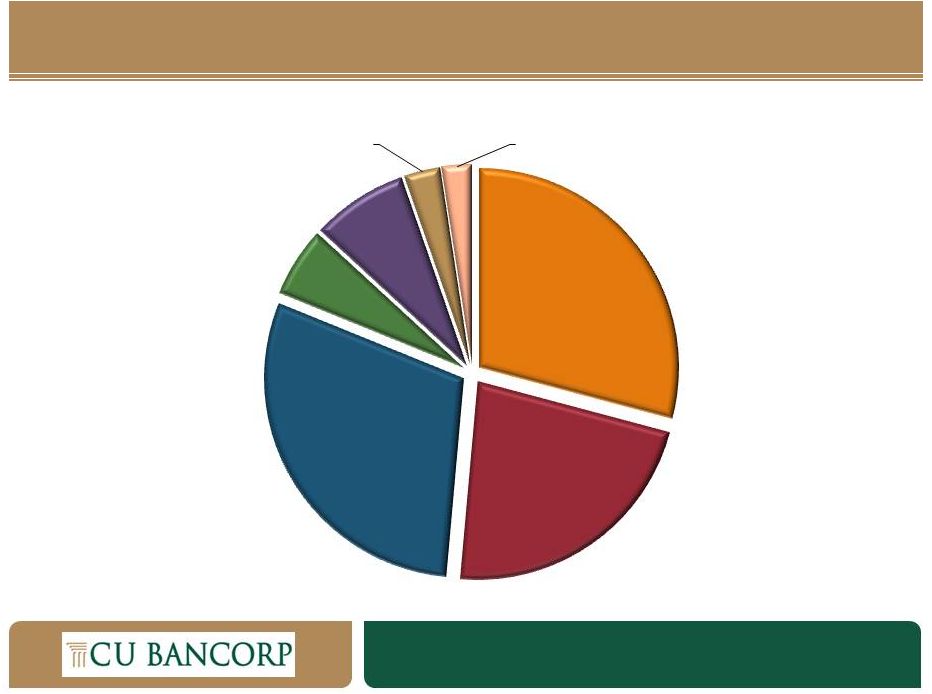

Loan Portfolio Composition

(September 30, 2012)

15

Multi-Family

Other

C&I

Owner-Occupied

CRE

Non-Owner

Occupied CRE

Construction

3%

2%

6%

8%

29%

22%

30%

1-4

Family

United in Our Dedication to Relationships

|

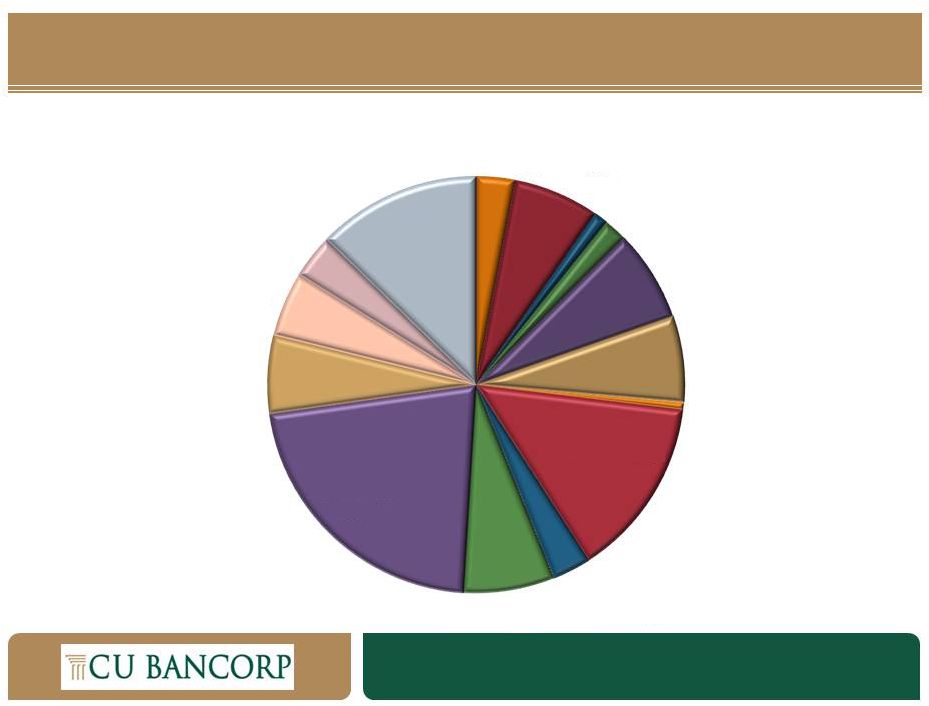

Loans by Industry (C&I and Owner-Occupied)

(September 30, 2012)

16

Transportation

Restaurant/Lodging

Retail

Admin Mgmt

Construction

Education

Entertainment

Finance

Healthcare

Information

Other Services

Professional Svces

Real Estate

Wholesale

Manufacturing

14%

22%

6%

5%

3%

3%

13%

7%

1%

2%

7%

7%

1%

3%

7%

United in Our Dedication to Relationships |

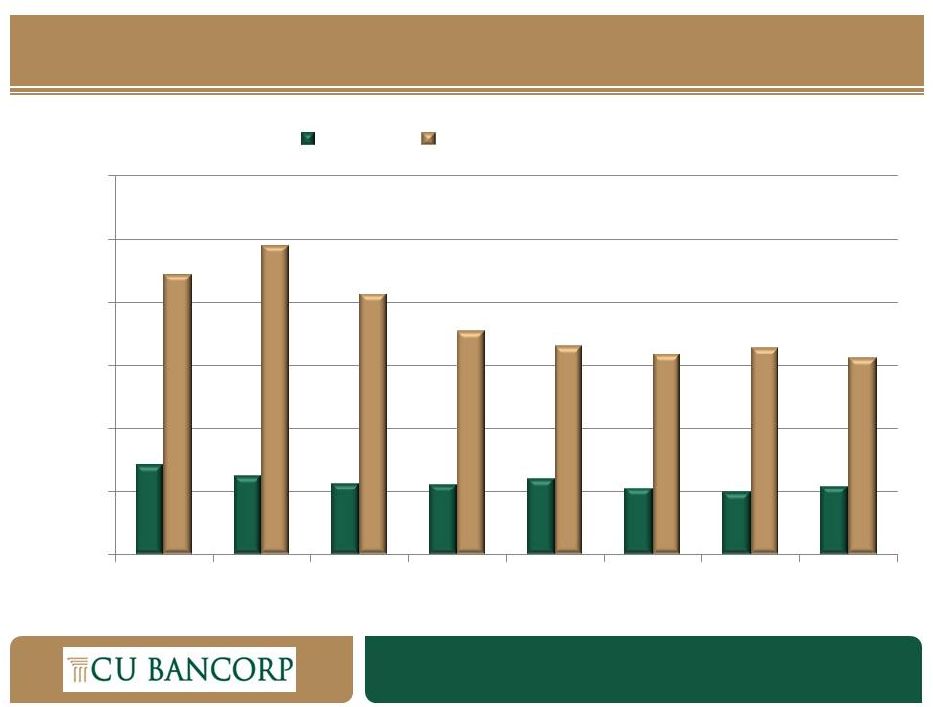

NPAs/Total Assets

17

Peer

Group

includes

public

banks

in

California

with

total

assets

between

$1.0-$1.5

billion

United in Our Dedication to Relationships

1.42%

1.24%

1.12%

1.10%

1.19%

1.05%

0.98%

1.07%

4.44%

4.90%

4.12%

3.54%

3.31%

3.18%

3.27%

3.11%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

CUNB

Peer Group Avg. |

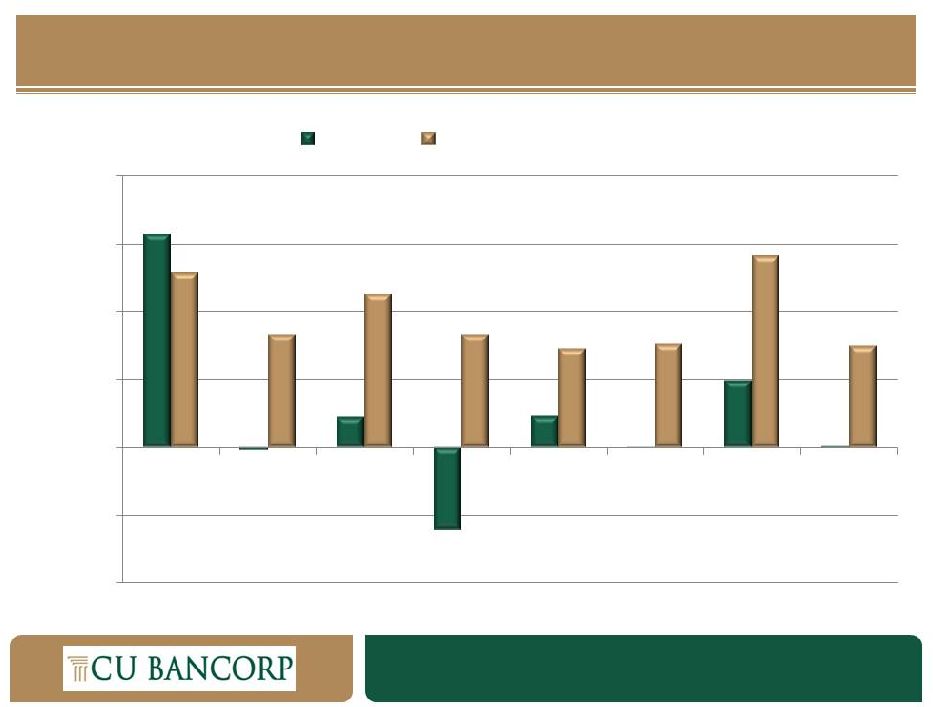

18

Peer

Group

includes

public

banks

in

California

with

total

assets

between

$1.0-$1.5

billion

United in Our Dedication to Relationships

1.57%

-

0.02%

0.22%

-

0.61%

0.23%

-

0.01%

0.49%

0.01%

1.29%

0.83%

1.13%

0.83%

0.73%

0.76%

1.41%

0.75%

-

1.00%

-

0.50%

0.00%

0.50%

1.00%

1.50%

2.00%

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

CUNB

Peer Group Avg.

NCOs/Avg. Loans |

19

CUB Organic

Acquisitions

$1,200

$1,000

$800

$600

$400

$200

$0

2005

2006

2007

2008

2009

2010

2011

9/30/2012

$658

$1,097

$278

$819

$691

$113

$545

$346

$246

$191

$116

$60

$60

COSB

acquisition

PCB

acquisition

United in Our Dedication to Relationships

Strong Deposit Growth |

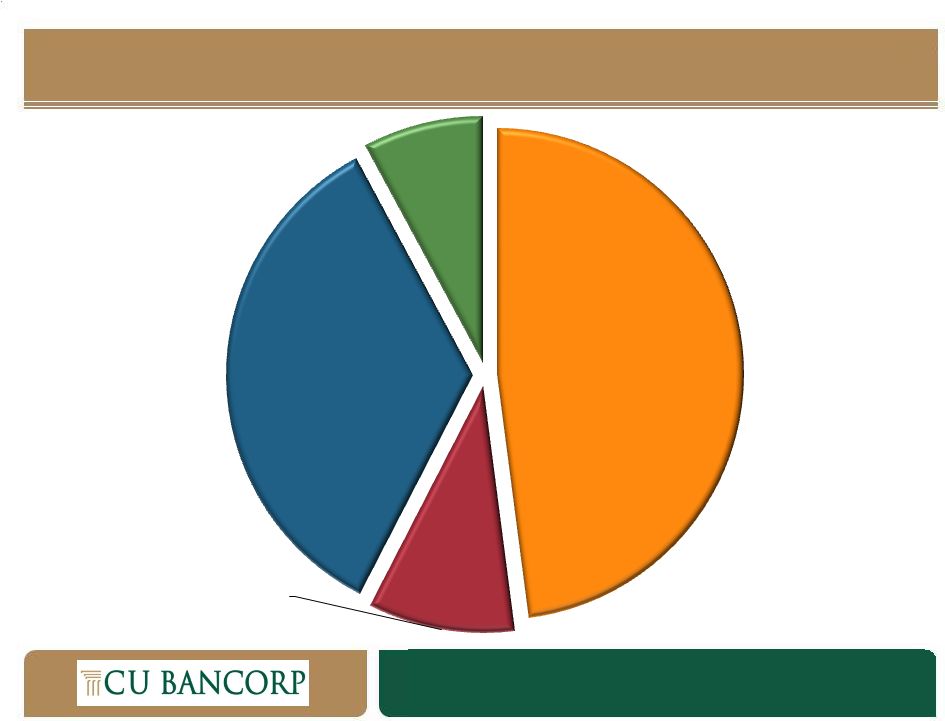

CDs

7.8%

Non-Int. Bearing

Demand

47.9%

MM and Savings

34.6%

Interest Bearing

Transaction

9.6%

United in Our Dedication to Relationships

Deposit Composition

(September 30, 2012)

20 |

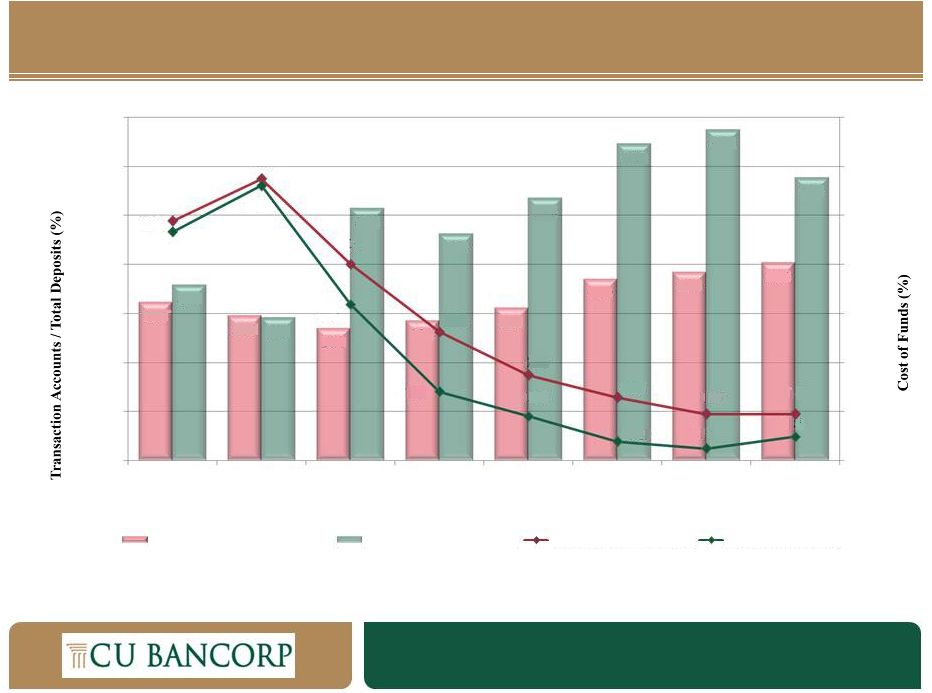

Transaction Accounts and Cost of Funds

21

70.0

60.0

50.0

40.0

30.0

20.0

10.0

0.0

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0.0

2006Y

2007Y

2008Y

2009Y

2010Y

2011Y

Q2 2012

Q3 2012

Peer Median (Transaction Accounts)

CUNB (Transaction Accounts)

CUNB (Cost of Funds)

Peer Median (Cost of Funds)

2.87

2.44

2.33

2.80

51.4

2.00

46.2

32.2

35.7

29.5

29.1

1.59

26.8

28.4

0.70

1.31

31.1

36.9

38.4

40.3

0.87

0.45

0.64

0.19

0.47

0.12

57.6

0.47

0.24

53.5

64.5

67.5

United in Our Dedication to Relationships

Peer Group includes public banks in California with total assets between

$1.0-$1.5 billion |

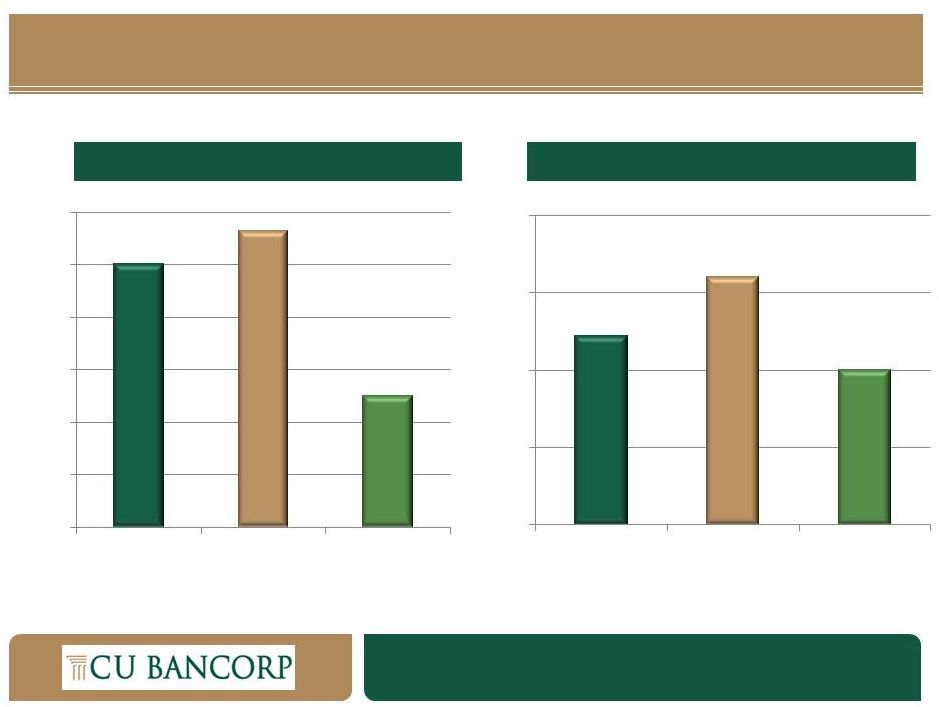

United in Our Dedication to Relationships

CU Bancorp Capital Ratios

22

Tier 1 Leverage Capital Ratio (%)

Total Risk Based Capital Ratio (%)

10.01%

11.30%

5.00%

0%

2%

4%

6%

8%

10%

12%

CUNB

Peer Group

Avg.

FDIC Well

Capitalized

12.24%

16.04%

10.00%

0%

5%

10%

15%

20%

CUNB

Peer Group

Avg.

FDIC Well

Capitalized

United in Our Dedication to Relationships

Peer Group includes public banks in California with total assets between

$1.0-$1.5 billion |

Merger Overview

23

Creates one of Los Angeles/Orange County’s largest independent

commercial banking franchises focused exclusively in the

market Partnered two of Southern California’s strongest

commercial banks; strengthening the franchise for long-term

earnings growth and value creation The critical mass of a larger

institution will enable the bank to expand available services

and penetrate additional markets The transaction will be

beneficial for stakeholders in both organizations: creating

value for shareholders, employees, customers, and the Southern

California communities

Southern California’s

Preeminent Business Bank

United in Our Dedication to Relationships

|

Merger of Two Attractive Franchises

24

Low Cost Deposits

C&I Lending Expertise

Attractive Locations

Strong Credit Quality

Experienced Management Team

SBA Expertise

Real Estate Lending Expertise

Attractive Orange County Market

Strong Credit Quality

Experienced Management Team

United in Our Dedication to Relationships

|

United in Our Dedication to Relationships

An Abundance of Synergies

25

Combined breadth of products and services will increase business

development capabilities throughout footprint

PCB’s award-winning SBA lending platform will be leveraged

throughout CUB’s markets

Improving PCB’s deposit mix and reducing funding costs

Elimination of redundancies will provide meaningful cost savings

and enhance efficiencies

Greater scale will enable better absorption of increasing regulatory

compliance costs |

Shifting from Growth to High Performance

26

•

Capture synergies from PCB merger

•

Expand non-interest income through increased SBA

loan production and sales

•

Continue attracting high performing bankers

•

Further penetrate existing footprint

•

Enhance efficiencies as we continue to scale

United in Our Dedication to Relationships

|

Contact Information

27

•

For more information, please contact:

–

Karen Schoenbaum, CFO

(818) 257-7700

kschoenbaum@cunb.com

United in Our Dedication to Relationships

|