Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CNO Financial Group, Inc. | form8-k11272012fbrpresenta.htm |

2012 FBR Fall Investor Conference November 27, 2012 Exhibit 99.1

CNO Financial Group 2

CNO Financial Group 3 Forward-Looking Statements Certain statements made in this presentation should be considered forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These include statements about future results of operations and capital plans. We caution investors that these forward- looking statements are not guarantees of future performance, and actual results may differ materially. Investors should consider the important risks and uncertainties that may cause actual results to differ, including those included in our Quarterly Reports on Form 10-Q, our 2011 Annual Report on Form 10-K and other filings we make with the Securities and Exchange Commission. We assume no obligation to update this presentation, which speaks as of today’s date.

CNO Financial Group 4 Non-GAAP Measures This presentation contains financial measures that differ from the comparable measures under Generally Accepted Accounting Principles (GAAP). Reconciliations between those non-GAAP measures and the comparable GAAP measures are included in the Appendix. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com.

CNO Financial Group 5 CNO Fundamentals Well positioned in the growing and underserved senior and middle income market Strong risk management Track record of strong execution Building core value drivers Well capitalized and generating significant excess capital

CNO Financial Group 6 • Fixed and Fixed-Index Life and Annuity Products • Long-Term Care • Medicare Supplement • Whole and Universal life products • Final expense • Supplemental Health CNO can access consumers across multiple channels • With an Agent (Retail) • Bankers Career Force • Washington National • PMA (CNO-owned) • Independents • Without an Agent (Direct) • Colonial Penn • At Work (Worksite Marketing) • PMA Worksite Division • Washington National - Independents • Rising medical costs • Decline of societal safety nets (government and employer) • Increased longevity • Greater awareness of need for retirement planning CNO has expertise across important middle-market products Strong trends are driving middle-market consumers CNO: The right products and the right channels for today’s middle-market consumer

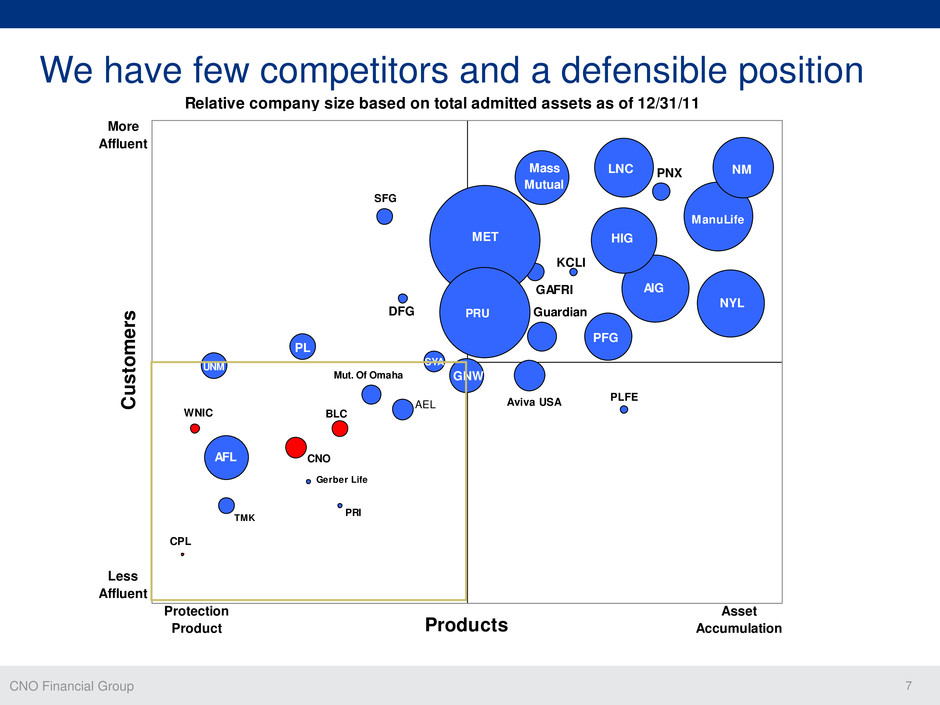

CNO Financial Group 7 AEL AFL AIG Aviva USA DFG Gerber Life GAFRI GNW Guardian HIG ManuLife KCLI LNCMass Mutual MET Mut. Of Omaha NM NYL PFG PL PNX PLFE PRU WNIC SFG TMK UNM BLC CPL CNO PRI SYA Products C us to m er s More Affluent Less Affluent Protection Product Asset Accumulation Relative company size based on total admitted assets as of 12/31/11 We have few competitors and a defensible position

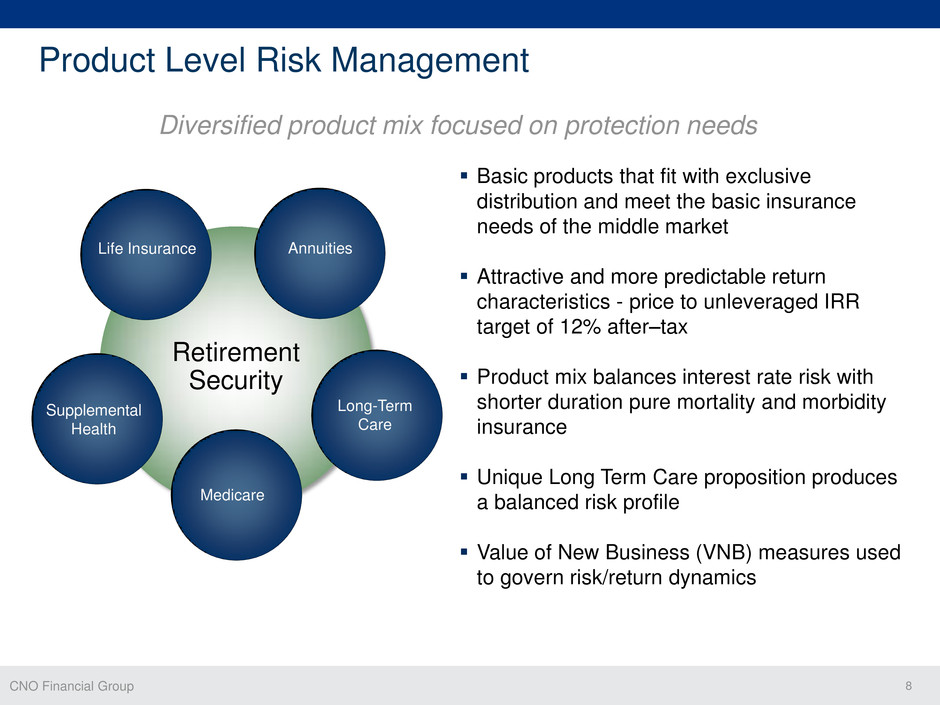

CNO Financial Group 8 Product Level Risk Management Retirement Security Medicare Annuities Supplemental Health Long-Term Care Life Insurance Basic products that fit with exclusive distribution and meet the basic insurance needs of the middle market Attractive and more predictable return characteristics - price to unleveraged IRR target of 12% after–tax Product mix balances interest rate risk with shorter duration pure mortality and morbidity insurance Unique Long Term Care proposition produces a balanced risk profile Value of New Business (VNB) measures used to govern risk/return dynamics Diversified product mix focused on protection needs

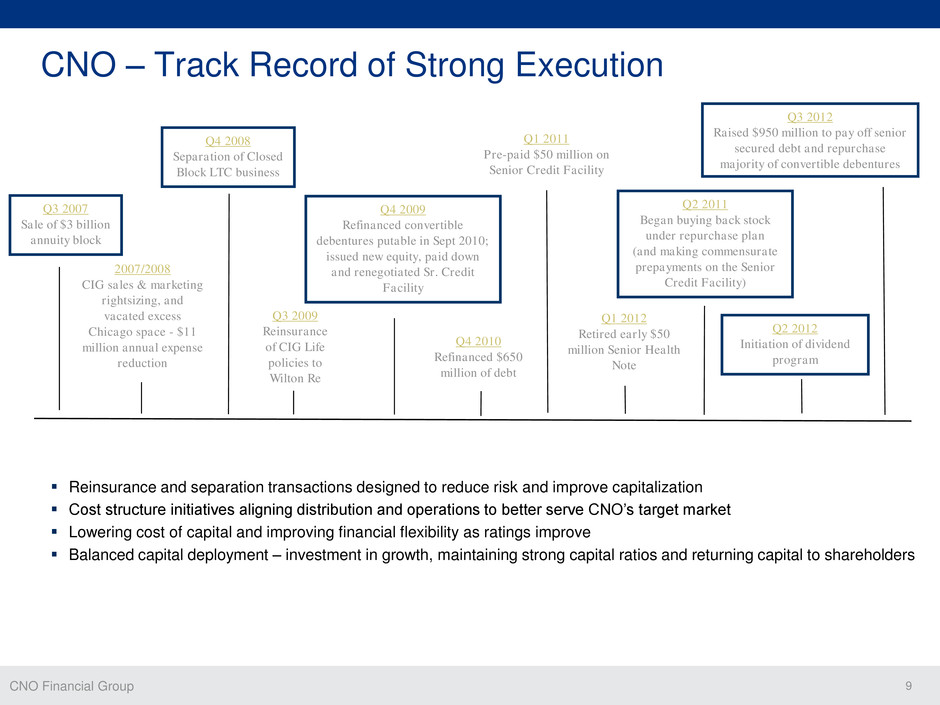

CNO Financial Group 9 Q2 2012 Initiation of dividend program CNO – Track Record of Strong Execution Q4 2008 Separation of Closed Block LTC business 2007/2008 CIG sales & marketing rightsizing, and vacated excess Chicago space - $11 million annual expense reduction Q3 2007 Sale of $3 billion annuity block Q3 2009 Reinsurance of CIG Life policies to Wilton Re Q4 2010 Refinanced $650 million of debt Q4 2009 Refinanced convertible debentures putable in Sept 2010; issued new equity, paid down and renegotiated Sr. Credit Facility Q1 2011 Pre-paid $50 million on Senior Credit Facility Q1 2012 Retired early $50 million Senior Health Note Q2 2011 Began buying back stock under repurchase plan (and making commensurate prepayments on the Senior Credit Facility) Q3 2012 Raised $950 million to pay off senior secured debt and repurchase majority of convertible debentures Reinsurance and separation transactions designed to reduce risk and improve capitalization Cost structure initiatives aligning distribution and operations to better serve CNO’s target market Lowering cost of capital and improving financial flexibility as ratings improve Balanced capital deployment – investment in growth, maintaining strong capital ratios and returning capital to shareholders

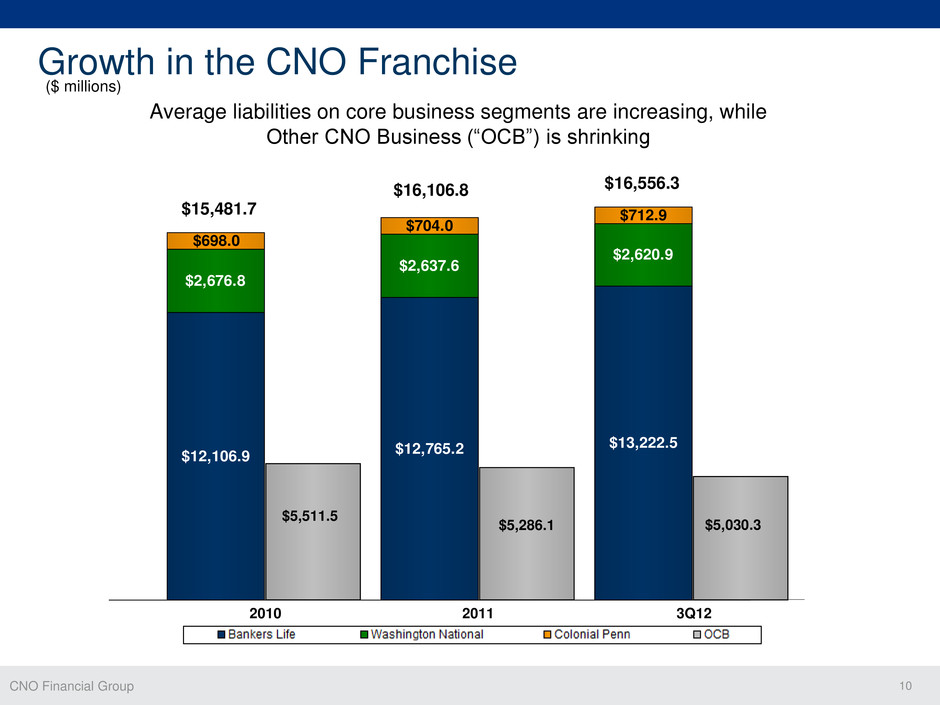

CNO Financial Group 10 $12,106.9 $12,765.2 $13,222.5 $2,676.8 $2,637.6 $2,620.9 $704.0 $712.9 $698.0 Growth in the CNO Franchise ($ millions) $16,556.3 Average liabilities on core business segments are increasing, while Other CNO Business (“OCB”) is shrinking $15,481.7 $16,106.8 2010 2011 3Q12 $5,511.5 $5,286.1 $5,030.3

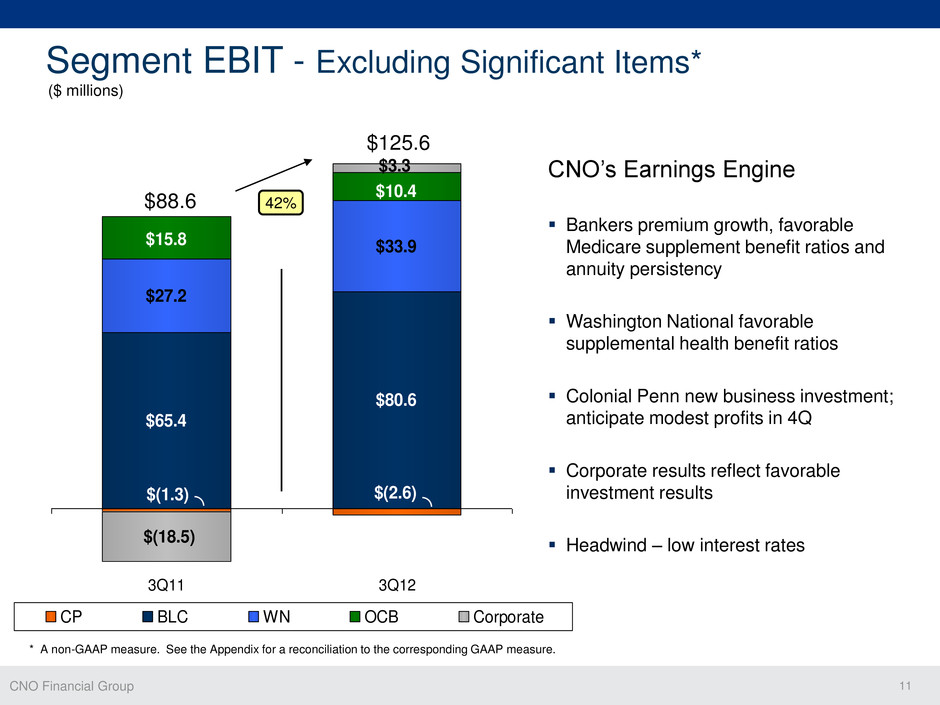

CNO Financial Group 11 $65.4 $80.6 $27.2 $33.9 $(18.5) $(2.6)$(1.3) $10.4 $15.8 $3.3 3Q11 3Q12 CP BLC WN OCB Corporate ($ millions) * A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure. $125.6 $88.6 42% Segment EBIT - Excluding Significant Items* CNO’s Earnings Engine Bankers premium growth, favorable Medicare supplement benefit ratios and annuity persistency Washington National favorable supplemental health benefit ratios Colonial Penn new business investment; anticipate modest profits in 4Q Corporate results reflect favorable investment results Headwind – low interest rates

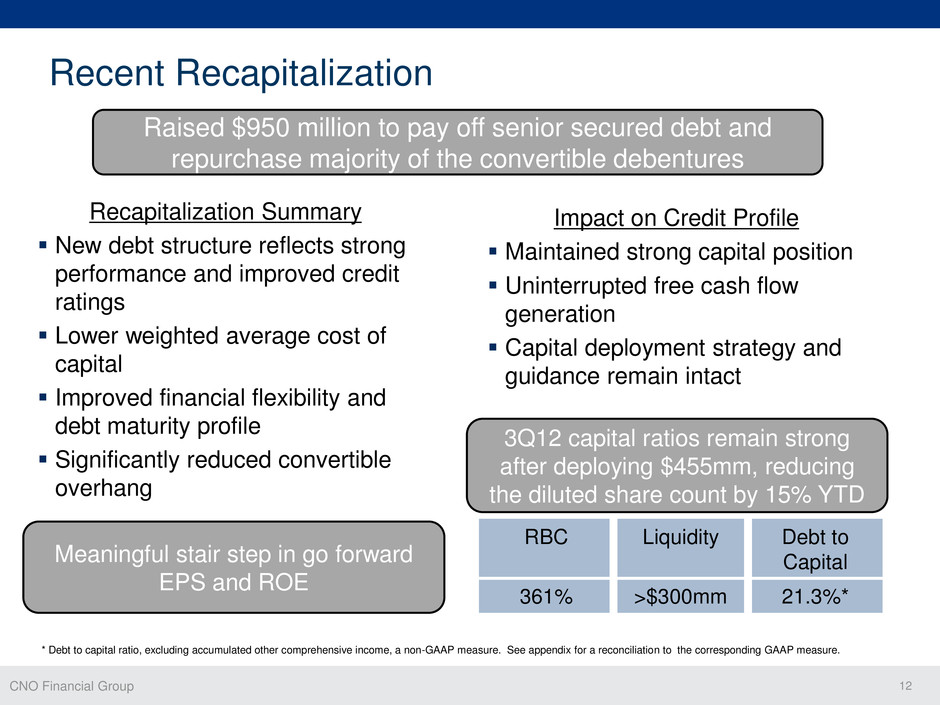

CNO Financial Group 12 Recent Recapitalization Recapitalization Summary New debt structure reflects strong performance and improved credit ratings Lower weighted average cost of capital Improved financial flexibility and debt maturity profile Significantly reduced convertible overhang Raised $950 million to pay off senior secured debt and repurchase majority of the convertible debentures Meaningful stair step in go forward EPS and ROE Impact on Credit Profile Maintained strong capital position Uninterrupted free cash flow generation Capital deployment strategy and guidance remain intact 3Q12 capital ratios remain strong after deploying $455mm, reducing the diluted share count by 15% YTD RBC Liquidity Debt to Capital 361% >$300mm 21.3%* * Debt to capital ratio, excluding accumulated other comprehensive income, a non-GAAP measure. See appendix for a reconciliation to the corresponding GAAP measure.

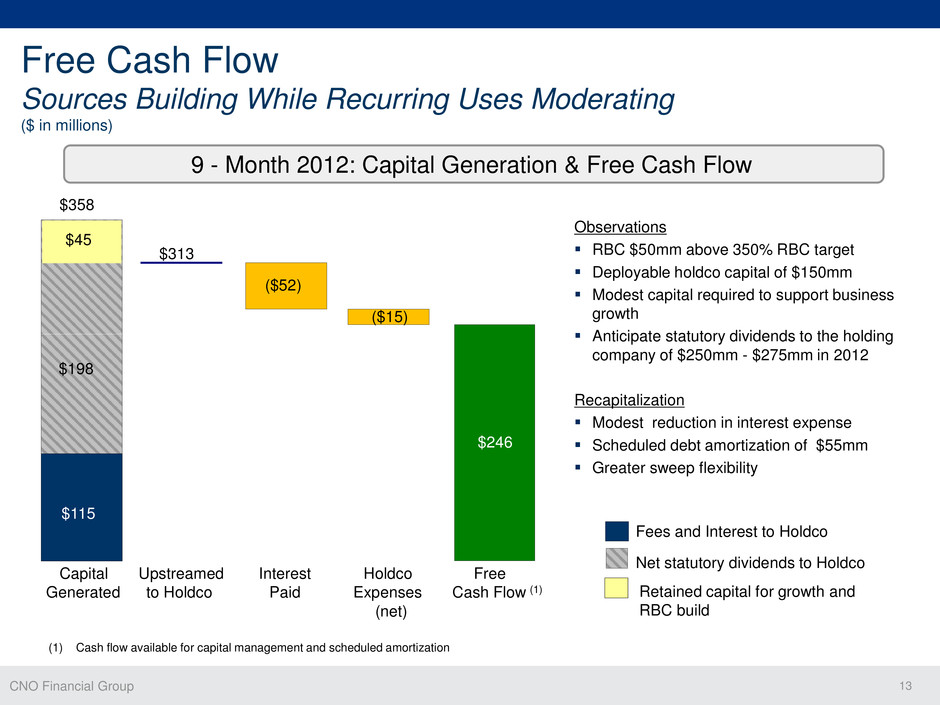

CNO Financial Group 13 Free Cash Flow Sources Building While Recurring Uses Moderating ($ in millions) Fees and Interest to Holdco Net statutory dividends to Holdco Retained capital for growth and RBC build $358 ($52) ($15) Capital Upstreamed Interest Holdco Free Generated to Holdco Paid Expenses Cash Flow (1) (net) $246 $198 $45 $313 $115 Observations RBC $50mm above 350% RBC target Deployable holdco capital of $150mm Modest capital required to support business growth Anticipate statutory dividends to the holding company of $250mm - $275mm in 2012 Recapitalization Modest reduction in interest expense Scheduled debt amortization of $55mm Greater sweep flexibility 9 - Month 2012: Capital Generation & Free Cash Flow (1) Cash flow available for capital management and scheduled amortization

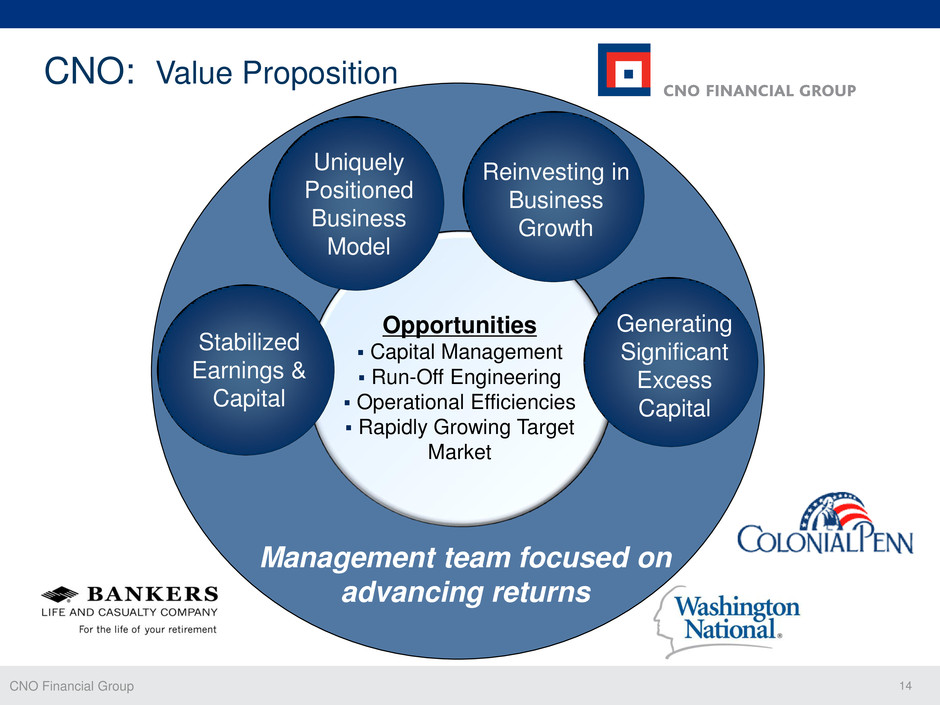

CNO Financial Group 14 Opportunities Capital Management Run-Off Engineering Operational Efficiencies Rapidly Growing Target Market CNO: Value Proposition Stabilized Earnings & Capital Uniquely Positioned Business Model Reinvesting in Business Growth Generating Significant Excess Capital Management team focused on advancing returns

CNO Financial Group 15 Q&A

CNO Financial Group 16 Appendix

CNO Financial Group 17 The following provides additional information regarding certain non-GAAP measures used in this presentation. A non-GAAP measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts that are normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered as substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investor – SEC Filings” section of our website, www.CNOinc.com. Information Related to Certain Non-GAAP Financial Measures

CNO Financial Group 18 3Q12 Significant Items CNO ($ millions) The table below summarizes the financial impact of significant items on our 3Q12 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results during 3Q12. Net Operating Income: Bankers Life $ 80.6 $ - $ 80.6 Washington National Colonial Penn Other CNO Business EBIT from business segments Corporate Operations, excluding corporate interest expense EBIT Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 25.6 $ 44.3 $ 69.9 Net operating income per diluted share * $ 0.11 $ 0.15 $ 0.26 35.3 74.0 109.3 9.7 29.7 39.4 51.6 74.0 125.6 (16.3) - (16.3) 58.3 64.0 122.3 (6.7) 10.0 3.3 (2.6) - (2.6) (53.6) 64.0 10.4 33.9 - 33.9 Three months ended September 30, 2012 Actual results Significant items Excluding significant items * A non-GAAP measure. See page 21 and 22 for reconciliations to the corresponding GAAP measures. ** Operating earnings per share, excluding significant items is calculated based on the weighted average diluted shares outstanding, including the dilutive effect of all common stock equivalents. Such common stock equivalents are dilutive in this calculation. **

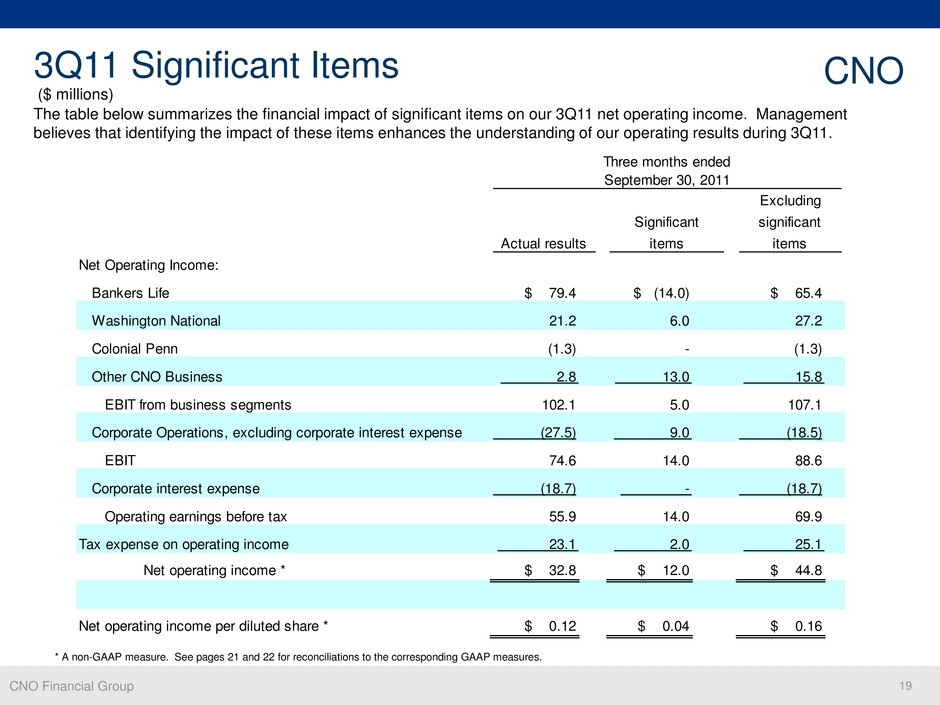

CNO Financial Group 19 3Q11 Significant Items CNO ($ millions) The table below summarizes the financial impact of significant items on our 3Q11 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results during 3Q11. Net Operating Income: Bankers Life $ 79.4 $ (14.0) $ 65.4 Washington National Colonial Penn Other CNO Business EBIT from business segments Corporate Operations, excluding corporate interest expense EBIT Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 32.8 $ 12.0 $ 44.8 Net operating income per diluted share * $ 0.12 $ 0.04 $ 0.16 55.9 14.0 69.9 23.1 2.0 25.1 74.6 14.0 88.6 (18.7) - (18.7) 102.1 5.0 107.1 (27.5) 9.0 (18.5) (1.3) - (1.3) 2.8 13.0 15.8 21.2 6.0 27.2 Three months ended September 30, 2011 Actual results Significant items Excluding significant items * A non-GAAP measure. See pages 21 and 22 for reconciliations to the corresponding GAAP measures.

CNO Financial Group 20 Quarterly Earnings CNO *Management believes that an analysis of earnings before net realized investment gains (losses), corporate interest, loss on extinguishment of debt, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities and taxes (“EBIT,” a non-GAAP financial measure) provides a clearer comparison of the operating results of the company quarter-over-quarter because it excludes: (1) corporate interest expense; (2) loss on extinguishment of debt; (3) net realized investment gains (losses); and (4) fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities that are unrelated to the company’s underlying fundamentals. The table above provides a reconciliation of EBIT to net income. 3Q11 3Q12 Bankers Life 79.4$ 80.6$ Washington National 21.2 33.9 Colonial Penn (1.3) (2.6) Other CNO Business 2.8 (53.6) EBIT* from business segments 102.1 58.3 Corporate operations, excluding interest expense (27.5) (6.7) Total EBIT 74.6 51.6 Corporate interest expense (18.7) (16.3) 55.9 35.3 Tax expense on period income 23.1 9.7 Net operating income 32.8 25.6 Net realized investment gains 17.3 4.8 Fair value changes in embedded derivative liabilities (12.9) (2.0) Loss on extinguishment of debt, net of income taxes (0.7) (176.4) Net income (loss) before valuation allowance for deferred tax assets 36.5 (148.0) Decrease in valuation allowance for deferred tax assets 143.0 143.0 Net income (loss) 179.5$ (5.0)$ Net income (loss) per diluted share 0.61$ (0.02)$ Income before net realized investment gains, fair value changes in embedded derivative liabilities and taxes ($ millions)

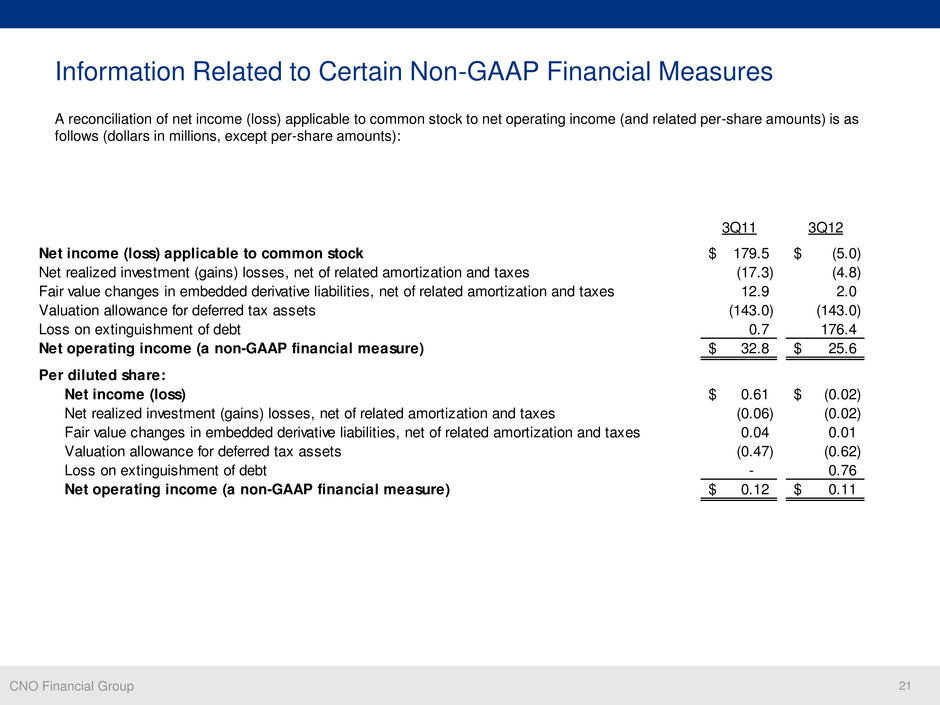

CNO Financial Group 21 Information Related to Certain Non-GAAP Financial Measures A reconciliation of net income (loss) applicable to common stock to net operating income (and related per-share amounts) is as follows (dollars in millions, except per-share amounts): 3Q11 3Q12 Net income (loss) applicable to common stock 179.5$ (5.0)$ Net realized investment (gains) losses, net of related amortization and taxes (17.3) (4.8) Fair value changes in embedded derivative liabilities, net of related amortization and taxes 12.9 2.0 Valuation allowance for deferred tax assets (143.0) (143.0) Loss on extinguishment of debt 0.7 176.4 Net operating income (a non-GAAP financial measure) 32.8$ 25.6$ Per diluted share: Net income (loss) 0.61$ (0.02)$ N t realiz d investment (gains) losses, net of related amortization and taxes (0.06) (0.02) F ir value changes in embedded derivative liabilities, net of related amortization and taxes 0.04 0.01 Valuation allowance for deferred tax assets (0.47) (0.62) Loss on extinguishment of debt - 0.76 Net operating income (a non-GAAP financial measure) 0.12$ 0.11$

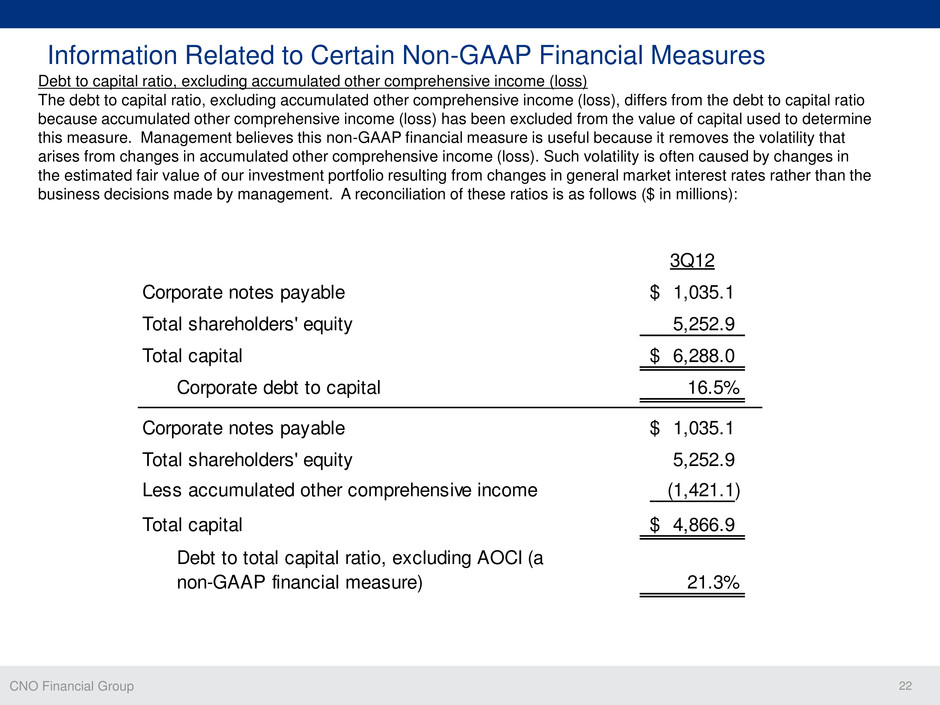

CNO Financial Group 22 Information Related to Certain Non-GAAP Financial Measures 3Q12 Corporate notes payable 1,035.1$ Total shareholders' equity 5,252.9 Total capital 6,288.0$ Corporate debt to capital 16.5% Corporate note payable 1,035.1$ Total shareholders' equity 5,252.9 Less accumulated other comprehensive income (1,421.1) Total capital 4,866.9$ Debt to total capital ratio, excluding AOCI (a non-GAAP financial measure) 21.3% Debt to capital ratio, excluding accumulated other comprehensive income (loss) The debt to capital ratio, excluding accumulated other comprehensive income (loss), differs from the debt to capital ratio because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Suc volatility is often caus d by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. A reconciliation of these ratios is as follows ($ in millions):