Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Adaptive Medias, Inc. | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - Adaptive Medias, Inc. | v328033_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Adaptive Medias, Inc. | v328033_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - Adaptive Medias, Inc. | v328033_ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Adaptive Medias, Inc. | v328033_ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the quarterly period ended: September 30, 2012 | |

|

Commission File Number: 000-54074 | |

MIMVI, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 26-0685980 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 440 North Wolfe Road, | |

| Sunnyvale, CA | 94085 |

| (Address of principal executive offices) | (Zip Code) |

818-483-3583

(Registrant's telephone number, including area code)

Copies To:

Conner, LLP

100 Park Avenue, Suite 1600

New York, New

York 10017

Telephone: 917-860-1425

Fax: 215-860-3653

email: kconner@connercpa.com

Indicate by check mark whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨ |

Accelerated filer ¨ | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ¨ No x

As of November 12, 2012, there were 59,254,828 shares of common stock, par value $0.001 per share, of the Registrant issued and outstanding.

TABLE OF CONTENTS

| Page | ||

| PART I – FINANCIAL INFORMATION | ||

| Item 1. |

Financial Statements - Unaudited Financial Statements |

1 |

| Balance Sheets | 1 | |

| Statements of Operations | 2 | |

| Statements of Cash Flows | 3 | |

| Notes to Financial Statements | 4 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Plan of Operations | 11 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 15 |

| Item 4. | Controls and Procedures | 15 |

| PART II – OTHER INFORMATION | ||

| Item 1. | Legal Proceedings | 15 |

| Item 1A. | Risk Factors | 16 |

| Item 2. | Unregistered Sale of Equity Securities and Use of Proceeds | 16 |

| Item 3. | Defaults Upon Senior Securities | 16 |

| Item 4. | Mine Safety Disclosures | 16 |

| Item 5. | Other Information | 16 |

| Item 6. | Exhibits | 17 |

| SIGNATURES | 17 | |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

| MIMVI, INC. |

| (A Development Stage Company) |

| Balance Sheets |

| (Unaudited) |

| September 30, | December 31, | |||||||

| 2012 | 2011 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash | $ | 300,136 | $ | - | ||||

| Prepaid expenses | 260,750 | 329,467 | ||||||

| Total current assets | 560,886 | 329,467 | ||||||

| Total assets | $ | 560,886 | $ | 329,467 | ||||

| Liabilities and Stockholders' Deficit | ||||||||

| Current liabilities | ||||||||

| Accounts payable and accrued expenses | $ | 1,058,004 | $ | 909,122 | ||||

| Accrued expenses due to related parties | 28,600 | 1,126 | ||||||

| Book overdraft | - | 382 | ||||||

| Convertible notes payable | 100,000 | 75,000 | ||||||

| Notes payable due to related party | - | 25,000 | ||||||

| Total current liabilities | 1,186,604 | 1,010,630 | ||||||

| Total liabilities | $ | 1,186,604 | $ | 1,010,630 | ||||

| Stockholders' deficit | ||||||||

| Preferred stock, $0.001 par value, 50,000,000 shares authorized; zero outstanding as of September 30, 2012 and December 31, 2011 | - | - | ||||||

| Common stock, $0.001 par value, 300,000,000 shares authorized; 56,934,828 and 42,554,985 shares issued and outstanding as of September 30, 2012 and December 31, 2011, respectively | 56,935 | 42,555 | ||||||

| Additional paid-in capital | 8,880,835 | 6,697,834 | ||||||

| Common stock escrowed as collateral for note payable | - | (62,500 | ) | |||||

| Loan receivable | (79,000 | ) | - | |||||

| Deficit accumulated during development stage | (9,484,488 | ) | (7,359,052 | ) | ||||

| Total stockholders' deficit | (625,718 | ) | (681,163 | ) | ||||

| Total liabilities and stockholders' deficit | $ | 560,886 | $ | 329,467 | ||||

The accompanying notes are an integral part of these financial statements.

| 1 |

| MIMVI, INC. |

| (A Development Stage Company) |

| Statements of Operations |

| Unaudited |

| Inception | ||||||||||||||||||||

| Three Months Ended | Nine Months Ended | (August 7, 2007) | ||||||||||||||||||

| September 30, | September 30, | to September 30, | ||||||||||||||||||

| 2012 | 2011 | 2012 | 2011 | 2012 | ||||||||||||||||

| Revenue | $ | - | $ | 10,055 | $ | - | $ | 61,375 | $ | 89,175 | ||||||||||

| Operating expenses | ||||||||||||||||||||

| Executive compensation | 58,150 | - | 177,440 | - | 222,440 | |||||||||||||||

| Legal & professional fees | 172,004 | 280,734 | 549,967 | 2,174,361 | 2,063,461 | |||||||||||||||

| Stock compensation expense | 316,721 | 90,234 | 948,581 | 877,428 | 6,260,194 | |||||||||||||||

| Loss on disposal of equipment | - | - | - | - | 8,341 | |||||||||||||||

| General and administrative expenses | 63,231 | 68,467 | 162,850 | 126,541 | 702,120 | |||||||||||||||

| Total operating expenses | 610,106 | 439,435 | 1,838,838 | 3,178,330 | 9,256,556 | |||||||||||||||

| Loss from operations | (610,106 | ) | (429,380 | ) | (1,838,838 | ) | (3,116,955 | ) | (9,167,381 | ) | ||||||||||

| Other expenses | ||||||||||||||||||||

| Loss on extinguishment of debt | 224,969 | 224,969 | - | 224,969 | ||||||||||||||||

| Interest expense | 25,099 | - | 61,629 | - | 92,138 | |||||||||||||||

| Total other expenses | 250,068 | - | 286,598 | - | 317,107 | |||||||||||||||

| Net loss | $ | (860,174 | ) | $ | (429,380 | ) | $ | (2,125,436 | ) | $ | (3,116,955 | ) | $ | (9,484,488 | ) | |||||

| Weighted average number of common shares outstanding – basic | 50,534,583 | 39,198,750 | 46,878,967 | 36,715,718 | ||||||||||||||||

| Net loss per share - basic | $ | (0.02 | ) | $ | (0.01 | ) | $ | (0.04 | ) | $ | (0.08 | ) | ||||||||

The accompanying notes are an integral part of these financial statements.

| 2 |

| MIMVI, INC. |

| (A Development Stage Company) |

| Statements of Cash Flows |

| Unaudited |

| Inception | ||||||||||||

| For the nine months ended | (August 7, 2007) | |||||||||||

| September 30, | to September 30, | |||||||||||

| 2012 | 2011 | 2012 | ||||||||||

| Cash flows from operating activities: | ||||||||||||

| Net loss | $ | (2,125,436 | ) | $ | (3,116,955 | ) | $ | (9,484,488 | ) | |||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||||||

| Depreciation | - | 3,706 | 7,450 | |||||||||

| Loss on extinguishment of debt | 224,969 | - | 224,969 | |||||||||

| Loss on disposal of equipment | - | - | 8,341 | |||||||||

| Non-cash interest expense | 36,439 | - | 36,439 | |||||||||

| Debt discount on notes payable | 2,500 | - | 7,500 | |||||||||

| Common stock issued for interest | 11,000 | - | 33,800 | |||||||||

| Stock based compensation for services | 926,759 | 2,692,809 | 6,368,745 | |||||||||

| Changes in operating assets and liabilities: | ||||||||||||

| Accounts receivable | - | 15,600 | - | |||||||||

| Prepaid expenses and deposits | 34,472 | 27,569 | 34,472 | |||||||||

| Accrued interest | 2,528 | - | 2,528 | |||||||||

| Accrued expenses due to related parties | 28,600 | - | 28,600 | |||||||||

| Accounts payable and accrued expenses | 197,687 | 87,511 | 1,107,935 | |||||||||

| Net cash flows used in operating activities | (660,482 | ) | (289,760 | ) | (1,623,707 | ) | ||||||

| Cash flows from investing activities: | ||||||||||||

| Loan to targeted merger candidate | (79,000 | ) | (79,000 | ) | ||||||||

| Purchase of property and equipment | - | - | (15,791 | ) | ||||||||

| Net cash flows used in investing activities | (79,000 | ) | - | (94,791 | ) | |||||||

| Cash flows from financing activities: | ||||||||||||

| Donated capital | - | - | 37,629 | |||||||||

| Stock payable | - | - | 30,000 | |||||||||

| Book overdraft | (382 | ) | (1,109 | ) | - | |||||||

| Proceeds from notes payable | 32,000 | 25,000 | 129,000 | |||||||||

| Proceeds from convertible notes | 107,300 | - | 107,300 | |||||||||

| Payments of notes payable | (39,300 | ) | - | (66,300 | ) | |||||||

| Proceeds from note payable - related party | - | - | 25,000 | |||||||||

| Proceeds from issuance of common stock | 940,000 | 287,505 | 1,756,005 | |||||||||

| Net cash flows provided by financing activities | 1,039,618 | 311,396 | 2,018,634 | |||||||||

| Net increase in cash | 300,136 | 21,636 | 300,136 | |||||||||

| Cash and cash equivalents, beginning of period | - | - | - | |||||||||

| Cash and cash equivalents, end of period | $ | 300,136 | $ | 21,636 | $ | 300,136 | ||||||

| Supplemental cash flow disclosures: | ||||||||||||

| Interest paid | $ | - | $ | - | $ | - | ||||||

| Income taxes paid | $ | - | $ | - | $ | - | ||||||

| Supplemental non-cash investing and financing activities: | ||||||||||||

| (Decrease) Increase in prepaid stock compensation | $ | 34,245 | $ | - | $ | 235,750 | ||||||

| Unamortized discount on convertible notes | $ | 5,110 | $ | - | $ | 5,110 | ||||||

| Retirement of 275,000,000 shares of common stock | $ | - | $ | 14,000 | $ | 14,000 | ||||||

| Fair value of shares issued for executive compensation | $ | 73,600 | $ | - | $ | 83,600 | ||||||

| Common shares issued for executive compensation | 800,000 | - | 30,800,000 | |||||||||

| Common shares issued for extinguishment of debt | 1,334,843 | - | 1,334,843 | |||||||||

| Common shares issued for interest | 95,000 | - | 95,000 | |||||||||

The accompanying notes are an integral part of these financial statements.

| 3 |

| MIMVI, INC. |

| (A Development Stage Company) |

| Notes to Financial Statements |

| Unaudited |

| September 30, 2012 |

Note 1 – Organization and Nature of Business

Mimvi, Inc. (the “Company”) was organized on August 7, 2007 (date of inception) under the laws of the State of Nevada. The Company is a technology company that develops advanced algorithms and technology for mobile applications and mobile Internet related technology and personalized search, recommendation and discovery services to consumers and business enterprise. The Company’s personalization technology automates the organization of mobile content.

As of September 30, 2012, the Company is a development stage company. A development stage enterprise is a company that is devoting substantially all of its efforts to establishing a new business and either planned principal operations have not commenced or planned principal operations have commenced but there has been no significant revenue. From August 7, 2007 (date of inception) through September 30, 2012, the Company realized revenues of $89,175 primarily from enterprise consulting services.

Note 2 – Basis of Presentation and Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited financial statements have been prepared by the Company pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in the financial statements prepared in accordance with generally accepted accounting principles have been condensed or omitted in accordance with such rules and regulations. The interim unaudited financial statements should be read in conjunction with the financial statements included in the Form 10-K for the year ended December 31, 2011. In the opinion of management, all adjustments considered necessary for the fair presentation consisting solely of normal recurring adjustments, have been made. Operating results for the nine months ended September 30, 2012 are not necessarily indicative of the results that may be expected for the year ended December 31, 2012.

Use of Estimates

The preparation of financial information in conformity with US GAAP requires management to make estimates and assumptions that affect the amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial information and reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Going Concern

The Company’s financial statements are prepared using generally accepted accounting principles in the United States of America applicable to a going concern which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company has not yet established an ongoing source of revenues sufficient to cover its operating costs and allow it to continue as a going concern.

As of September 30, 2012, the Company had an accumulated deficit during its development stage of $9,484,488. The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital to fund operating losses until it becomes profitable. If the Company is unable to obtain adequate capital, it could be forced to cease operations. In order to continue as a going concern, the Company will need, among other things, additional capital resources.

The Company is dependent upon its ability, and will continue to attempt, to secure equity and/or debt financing. There are no assurances that the Company will be successful and without sufficient financing it would be unlikely for the Company to continue as a going concern. The ability of the Company to continue as a going concern is dependent upon its ability to successfully secure other sources of financing and attain profitable operations.

These financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts, or amounts and classification of liabilities that might result from this uncertainty.

Cash and cash equivalents

For purposes of the statement of cash flows, the Company considers highly liquid financial instruments purchased with an original maturity of three months or less to be cash equivalents. As of September 30, 2012, the Company had no cash equivalents.

| 4 |

| MIMVI, INC. |

| (A Development Stage Company) |

| Notes to Financial Statements |

| Unaudited |

| September 30, 2012 |

Note 2 – Basis of Presentation and Summary of Significant Accounting Policies, (Continued)

Earnings (loss) per common share

Basic earnings (loss) per share includes no dilution and is computed by dividing income available to common stockholders by the weighted average number of common shares outstanding for the period. Dilutive earnings (loss) per share reflect the potential dilution of securities that could share in the earnings of the Company. Dilutive earnings (loss) per share are equal to that of basic earnings (loss) per share as the effects of stock options and warrants have been excluded as they are anti-dilutive.

Fair Value of Financial Instruments

The carrying amounts of the financial instruments, including cash and cash equivalents, accounts payable and accrued liabilities, approximate fair value due to the short maturities of these financial instruments. The notes payable are also considered financial instruments whose carrying amounts approximate fair values.

Fair Value Assumptions

Share-based compensation cost is measured based on the closing fair market value of the Company’s common stock on the date of grant. Share-based compensation cost for stock options is estimated at the grant date and offering date, respectively, based on the fair-value as calculated by the Black-Scholes Merton (“BSM”) option-pricing model. The BSM option-pricing model incorporates various assumptions including expected volatility, expected life and interest rates. The expected volatility is based on the historical volatility of the Company’s common stock over the most recent period commensurate with the estimated expected life of the Company’s stock options and other relevant factors including implied volatility in market traded options on the Company’s common stock. The Company bases its expected life assumption on its historical experience and on the terms and conditions of the stock awards it grants to employees and consultants. The Company recognizes share-based compensation cost as expense on a straight-line basis over the requisite service period.

Revenue Recognition

The Company recognizes revenue and gains when earned and related costs of sales and expenses when incurred. The Company recognizes revenue in accordance with Accounting Standards Codification Section 605-10-599, Revenue Recognition, Overall, SEC Materials ("Section 605-10-599"). Section 605-10-599 requires that four basic criteria must be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred or services rendered; (3) the fee is fixed and determinable; and (4) collectability is reasonably assured. Cost of products sold consists of the cost of the purchased goods and labor related to the corresponding sales transaction. When a right of return exists, the Company defers revenues until the right of return expires. The Company recognizes revenue from services at the time the services are completed.

Note 3 – Notes Payable

For the three months ended September 30, 2012

During the three months ended September 30, 2012, the Company satisfied all the outstanding notes payable and the judgment that were outstanding as of June 30, 2012. The Company issued 1,234,843 of its common stock at a per share price of $.28 resulting in a loss on the settlement of debt of $246,969 based on the fair value measurement of the shares on the date of issuance.

On April 12, 2012, the Company entered into a promissory note in the amount of $12,000 with total interest of $1,000 due on September 18, 2012. As of September 30, 2012, this note has been repaid.

For the nine months ended September 30, 2012

In April 2012, a holder of a note due in January 2012 obtained a judgment against the Company for payment of principal of $57,500 plus accrued interest and legal fees totaling $17,403. As of September 30, 2012, this note has been satisfied and the judgment was released. The Company satisfied this judgment by issuing 936,283 shares of the Company's common stock valued at $262,159.

On January 19, 2012, the Company entered into a promissory note in the amount of $20,000 with a 10% interest rate due on February 19, 2012. As of September 30, 2012, this note has been satisfied.

During the nine months ended September 30, 2012, the Company issued 25,000 shares of its Common Stock valued at $5,700 to each of two note holders in consideration for an extension on the maturity dates to September 2012. As of September 30, 2012, both of these notes are satisfied.

For the three and nine months ended September 30, 2012, the Company recognized interest expense of $25,099 and $61,629, respectively.

Note 4 - Convertible Notes

As of September 30, 2012, the Company maintained a $100,000 convertible note payable with a term of one-hundred days at an annual interest rate of 10%. The note is due on October 10, 2012 As of November 12, 2012, the Company is currently in negotiations with this noteholder to extend the term of this note.

Effective February 29, 2012, the Company issued two convertible notes in the aggregate principal amount of $7,300. The Company has determined the notes, with a face value of $7,300, to have a beneficial conversion feature of $5,110. The beneficial conversion feature has been accreted and is being amortized over two years. The beneficial conversion feature is valued under the intrinsic value method. As of September 30, 2012, these notes were paid in full.

Note 5 - Related Parties

On August 16, 2012, the short term note payable to a related party of $25,000 and accrued interest of $3,370, collateralized by 250,000 shares of common stock of the Company matured. Effective August 16, 2012, the shares that were being held in escrow valued at $62,500 were released to the note holder. The fair value of the common shares issued as of the date of settlement was $37,500. The difference between the fair value of the shares and the debt settled was recorded as a reduction of additional paid-in capital in the amount of $25,000 and additional interest expense of $9,130.

| 5 |

| MIMVI, INC. |

| (A Development Stage Company) |

| Notes to Financial Statements |

| Unaudited |

| September 30, 2012 |

Note 5 - Related Parties, (continued)

During the nine months ended September 30, 2012, a related party advanced $5,000 to the Company. In June 2012, the Company issued 25,000 shares of Common Stock at a per share price of $.10 for repayment of $2,500 of these advances. In August 2012, the Company issued 25,000 shares of Common Stock at a per share price of $.10 in exchange for the balance of these advances.

As of September 30, 2012, accounts payable and accrued expenses – related parties was $28,600.

Note 6 – Stockholders’ Deficit

Preferred Stock

As of September 30, 2012, the Company had no preferred shares outstanding. The Company's articles of incorporation authorize the Company to issue up to 50,000,000 shares of $0.001 par value, preferred shares having preferences to be determined by the board of directors for dividends, and liquidation of the Company's assets.

Common Stock

As of September 30, 2012, the Company had 300,000,000, $0.001 par value, shares of common stock authorized. The holders are entitled to one vote for each share on matters submitted to a vote to shareholders, and to share pro rata in all dividends payable on common stock after payment of dividends on any preferred shares having preference in payment of dividends.

For the nine months ended September 30, 2012

On January 24, 2012, the Company issued 20,000 shares of its common stock for interest to a note holder with a fair value of $1,800.

On February 01, 2012, the Company issued 50,000 shares of its common stock for interest to a note holder with a fair value of $3,500.

On March 12, 2012, the Company issued 2,500,000 shares of its common stock to one investor in exchange for an aggregate purchase price of $250,000. In addition, the investor was granted a warrant to purchase 2,500,000 shares of the Company’s Common Stock at $.25 per share.

On March 12, 2012, the Company issued 800,000 shares of its common stock to the CEO of the Company in exchange for services rendered with a fair value of $73,600.

On March 12, 2012, the Company issued 250,000 shares of its common stock to a consultant in exchange for services to be rendered with a fair value of $142,500. These shares are to be earned ratable over a six month period subject to forfeiture. An adjustment was made on a quarterly basis in order to recognize their fair value. As of September 30, 2012, these have been fully earned and expensed. A total of $83,670 was recognized as expense and additional paid-in capital was decreased by $58,830.

On March 28, 2012, the Company issued 50,000 shares of its common stock to a consultant in exchange for services rendered with a fair value of $25,000.

On March 28, 2012, the Company issued 50,000 shares of its common stock to an employee as a bonus in 2012 with a fair value of $25,000.

On May 1, 2012, the Company issued and sold 25,000 shares of its common stock to one accredited investor for an aggregate purchase price of $2,500.

On May 18, 2012, the Company issued 200,000 shares of its common stock to a consultant for consideration of an extension for payment of accounts payable with a fair value of $56,000.

On May 21, 2012, the Company issued and sold 500,000 shares of its common stock to one accredited investor for an aggregate purchase price of $50,000. In addition, the investor was granted a warrant to purchase 500,000 shares of the Company’s Common Stock at $.25 per share.

| 6 |

| MIMVI, INC. |

| (A Development Stage Company) |

| Notes to Financial Statements |

| Unaudited |

| September 30, 2012 |

Note 6 – Stockholders’ Deficit, (continued)

On June 8, 2012, the Company issue 10,000 shares of its common stock to a current note holder for consideration of extending the due date through September 2012. The total value of $2,250 has been recorded as interest expense as of September 30, 2012.

On June 18, 2012, the Company issue 15,000 shares of its common stock to a current note holder for consideration of extending the due date through September 2012. The total value of $3,450 has been recorded as interest expense as of September 30, 2012.

On July 2, 2012, the Company issued 50,000 shares of its common stock to a consultant in exchange for services rendered with a fair value of $14,000.

On July 5, 2012, the Company issued 1,000,000 shares of its common stock to a consultant in exchange for services rendered with a fair value of $230,000.

On July 10, 2012, the Company issued 100,000 shares of its common stock to a vendor to satisfy its outstanding accounts payable for a fair value of $28,000.

On July 18, 2012, the Company issued and sold 100,000 shares of its common stock to one accredited investor for an aggregate purchase price of $10,000. On July 23, 2012, the Company issued and sold 250,000 shares of its common stock to one accredited investor for an aggregate purchase price of $25,000.

On July 31, 2012, the Company issued and sold 1,000,000 shares of its common stock to two accredited investors for an aggregate purchase price of $50,000.

On August 6, 2012, the Company issued and sold 25,000 shares of its common stock to one accredited investor for an aggregate purchase price of $2,500.

On August 6, 2012, the Company issued 300,000 shares of its common stock to a consultant in exchange for services rendered with a fair value of $75,000.

On August 13, 2012, the Company issued and sold 500,000 shares of its common stock to one accredited investor for an aggregate purchase price of $25,000.

On August 15, 2012, the Company issued and sold 1,100,000 shares of its common stock to one accredited investor for an aggregate purchase price of $110,000. On August 15, 2012, the Company issued 100,000 shares of its common stock to a consultant in exchange for services rendered with a fair value of $15,000.

On September 5, 2012, the Company issued and sold 1,000,000 shares of its common stock to one accredited investor for an aggregate purchase price of $100,000.

On September 20, 2012, the Company issued and sold 1,234,843 shares of its common stock to one accredited investor for an aggregate purchase price of $345,756. These shares were issued in conjunction with a transaction that satisfied two term notes and the outstanding judgment.

On September 24, 2012, the Company issued and sold 500,000 shares of its common stock to one accredited investor for an aggregate purchase price of $50,000.

On September 28, 2012, the Company issued and sold 2,650,000 shares of its common stock to three accredited investors for an aggregate purchase price of $265,000.

| 7 |

| MIMVI, INC. |

| (A Development Stage Company) |

| Notes to Financial Statements |

| Unaudited |

| September 30, 2012 |

Note 6 – Stockholders’ Deficit, (continued)

For the nine months ended September 30, 2012, the Company issued the following common shares:

| Common shares issued for: | Number of Common | Value of Common | ||||||

| Shares Issued | Shares | |||||||

| Interest | 95,000 | $ | 11,000 | |||||

| Cash | 10,150,000 | $ | 940,000 | |||||

| Services | 2,800,000 | $ | 566,100 | |||||

| Debt | 1,334,843 | $ | 373,756 | |||||

| Total | 14,379,843 | $ | 1,890,856 | |||||

Note 7 – Warrants and Options

Warrants

In January 2010, the Company issued 5,000,000 warrants to consultants with the weighted average exercise price of the grants of $0.50 per share. The vesting period on these grants was immediate. The fair value of these warrants was determined to be a nominal value. The value of these warrants estimated by using the Black-Scholes option pricing model with the following assumptions: expected life of 5 years; risk free interest rate of 2.44%; dividend yield of 0% and expected volatility of 25%. To account for such grants to non-employees, we recorded nominal stock compensation expense of $535.

| Weighted | ||||||||

| Warrants for | Average | |||||||

| Shares | Exercise Price | |||||||

| Outstanding as of December 31, 2011 | 5,000,000 | $ | 0.50 | |||||

| Granted | 11,850,000 | $ | 0.29 | |||||

| Exercised | - | - | ||||||

| Forfeited | - | - | ||||||

| Cancelled | - | - | ||||||

| Expired | - | - | ||||||

| Exercisable outstanding as of September 30, 2012 | 16,850,000 | $ | 0.35 | |||||

| Weighted Average fair value price granted during 2012 | 11,850,000 | $ | 0.29 | |||||

During the nine months ended September 30, 2012, the Company issued warrants to purchase 11,850,000 shares of its common stock at an average exercise price of $.29.

As of September 30, 2012, the Company maintained total outstanding warrants to purchase 16,850,000 shares of its common stock at an average exercise price of $0.35 per share.

| 8 |

| MIMVI, INC. |

| (A Development Stage Company) |

| Notes to Financial Statements |

| Unaudited |

| September 30, 2012 |

Stock Option Plans

The Company's employee stock option plan (the "Plan") dated November 2010 provides for the grant of non-statutory or incentive stock options to the Company's employees, officers, directors or consultants.

| Weighted | ||||||||

| Options for | Average | |||||||

| Shares | Exercise Price | |||||||

| Outstanding as of December 31, 2011 | 7,187,500 | $ | 0.45 | |||||

| Granted | 600,000 | $ | 0.17 | |||||

| Exercised | - | - | ||||||

| Forfeited | - | - | ||||||

| Cancelled | - | - | ||||||

| Expired | - | - | ||||||

| Exercisable outstanding as of September 30, 2012 | 7,787,500 | $ | 0.43 | |||||

| Weighted Average fair value price granted during 2012 | 600,000 | $ | 0.17 | |||||

On November 3, 2010, the Company granted 7,187,500 stock options to certain officers and consultants of the Company at $0.45 per share. The term of these options are ten years. A total of 3,750,000 stock options valued at $1,632,810 vest immediately and 3,437,500 valued at $1,496,743 vest quarterly over a four year period.

On May 3, 2012, the Company granted 250,000 stock options to a consultant valued at $50,000 using the Black-Scholes option model with the following assumptions: estimated expected life of 5 years; risk free interest rate of 0.82%; dividend yield of 0% and expected volatility of 350%. These options vest over an 18 month period.

On August 28, 2012, the Company granted 350,000 stock options to two consultants valued at $49,000 using the Black Scholes option model with the following assumptions: estimated expected life of 5 years; risk free interest rate of 0.69%; dividend yield of 0% and expected volatility of 350%. A total of 250,000 stock options valued at $35,000 vest over a two year period. A total of 100,000 stock options valued at $14,000 vest over a one year period.

For the three and nine months ended September 30, 2012, the Company recorded $114,776 and $295,244, in stock based compensation for these options, respectively.

Note 8 – Commitments and Contingencies

Rental Agreements

The Company leases two offices under signed agreements. The monthly rental payments under the agreements are approximately $675. The terms of the agreements are for one year through December 31, 2012.

| 9 |

| MIMVI, INC. |

| (A Development Stage Company) |

| Notes to Financial Statements |

| Unaudited |

| September 30, 2012 |

Note 9 - Agreement and Plan of Merger

On August 6, 2012, Mimvi, Inc. (the “Company”), and Wolf Acquisition Corporation, a California corporation and wholly-owned subsidiary of the Company (“Merger Sub”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Lone Wolf, Inc., a California corporation (“Lone Wolf”), Eric Rice and DFM Agency, LLC as the Principal Shareholders and Eric Rice as the representative of the equity holders of Lone Wolf.

Pursuant to the terms of the Merger Agreement, and subject to the conditions thereof, Merger Sub will merge with and into Lone Wolf with Lone Wolf continuing as the surviving corporation and wholly-owned subsidiary of the Company in the merger (the “Merger”). At the effective time of the Merger, each share of Lone Wolf Common and Preferred Stock that is issued and outstanding immediately prior to the effective time of the Merger, other than issued and outstanding Lone Wolf Capital Stock that is owned by (i) the Company or Merger Sub, (ii) Lone Wolf as treasury stock or any direct or indirect wholly-owned subsidiary of Lone Wolf or (iii) shareholders that have perfected appraisal rights under California law, will be automatically converted into the right to receive aggregate consideration of 3,800,000 shares of Common Stock of the Company (the “Stock Merger Consideration”). In addition, at the effective time of the Merger, each outstanding option, warrant or other right to acquire Lone Wolf Common Stock, whether or not then vested or exercisable, will be automatically canceled and shall cease to be outstanding, and no consideration shall be delivered in exchange therefor. Fifty percent (50%) of the Merger Consideration shall be placed in escrow for twenty-four (24) months as security for the indemnification obligations of Lone Wolf’s shareholders under the Merger Agreement.

The Merger Agreement contains customary representations, warranties and covenants of the Company, and Merger Sub on the one hand and of Lone Wolf and the Principal Shareholders on the other hand, including, among other things, covenants regarding: (i) the conduct of the business of Lone Wolf and its subsidiaries prior to the consummation of the Merger; (ii) the use of the parties’ reasonable best efforts to cause the Merger to be consummated, including the abstention by Lone Wolf from soliciting, providing information or entering into discussions concerning alternative acquisition proposals relating to Lone Wolf and the solicitation of the consent of the shareholders of Lone Wolf to the Merger.

The representations, warranties, covenants and agreements of the Company and Lone Wolf contained in the Merger Agreement have been made (i) only for purposes of the Merger Agreement, (ii) have been qualified by confidential disclosures made to the other party in disclosure letters delivered in connection with the Merger Agreement, (iii) are subject to materiality qualifications contained in the Merger Agreement which may differ from what may be viewed as material by investors, (iv) were made only as of the date of the Merger Agreement or such other date as is specified in the Merger Agreement and (v) have been included in the Merger Agreement for the purpose of allocating risk between the parties rather than establishing matters as fact. Accordingly, the Merger Agreement is included as an exhibit to this Current Report on Form 8-K only to provide investors with information regarding the terms of the Merger Agreement, and not to provide investors with any other factual information regarding the Company or its business. Investors should not rely on the representations, warranties, covenants and agreements, or any descriptions thereof, as characterizations of the actual state of facts or condition of the Company or any of its subsidiaries or affiliates. In addition, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures. As of September 30, 2012, the merger was not completed.

As of September 30, 2011, the Company advanced Lone Wolf, $79,000 under a promissory note with 10% interest that matures on December 31, 2012.

Note 10 – Subsequent Events

Issuances of Common Stock

On October 11, 2012, the Company issued 100,000 shares of its common stock to consultant in exchange for services rendered with a fair value of $48,000.

On October 23, 2012, the Company issued 575,000 shares of its common stock to two investors in exchange for an aggregate purchase price of $57,500.

On October 24, 2012, the Company issued 1,425,000 shares of its common stock to two investors in exchange for an aggregate purchase price of $142,500.

On October 29, 2012, the Company issued 120,000 shares of its common stock to consultant in exchange for services rendered with a fair value of $43,200.

On November 01, 2012, the Company issued 100,000 shares of its common stock to a consultant in exchange for services rendered with a fair value of $34,500.

Amendment to the 2010 Stock Option Plan

In October 2012, the Company’s board of directors approved an amendment to the 2010 Stock Option Plan to increase the number of common shares for issuance thereunder to 15 million common shares.

| 10 |

ITEM 2.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Statements

This report contains forward-looking statements that involve risks and uncertainties. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology including, "could" "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "predict", "potential" and the negative of these terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested in this Quarterly Report.

Critical Accounting Policies

The preparation of financial statements and related disclosures in conformity with accounting principles generally accepted in the United States requires estimates and assumptions that affect the reported amounts of assets and liabilities, revenues and expenses and related disclosures of contingent assets and liabilities in the financial statements and accompanying notes. The SEC has defined a company's critical accounting policies as the ones that are most important to the portrayal of the company's financial condition and results of operations, and which require the company to make its most difficult and subjective judgments, often as a result of the need to make estimates of matters that are inherently uncertain. We believe that our estimates and assumptions are reasonable under the circumstances; however, actual results may vary from these estimates and assumptions. We have identified in Note 2 - "Basis of Presentation and Summary of Significant Accounting Policies" to the Financial Statements contained in Part I of this Form 10-Q document certain critical accounting policies that affect the more significant judgments and estimates used in the preparation of the financial statements.

Recent Developments

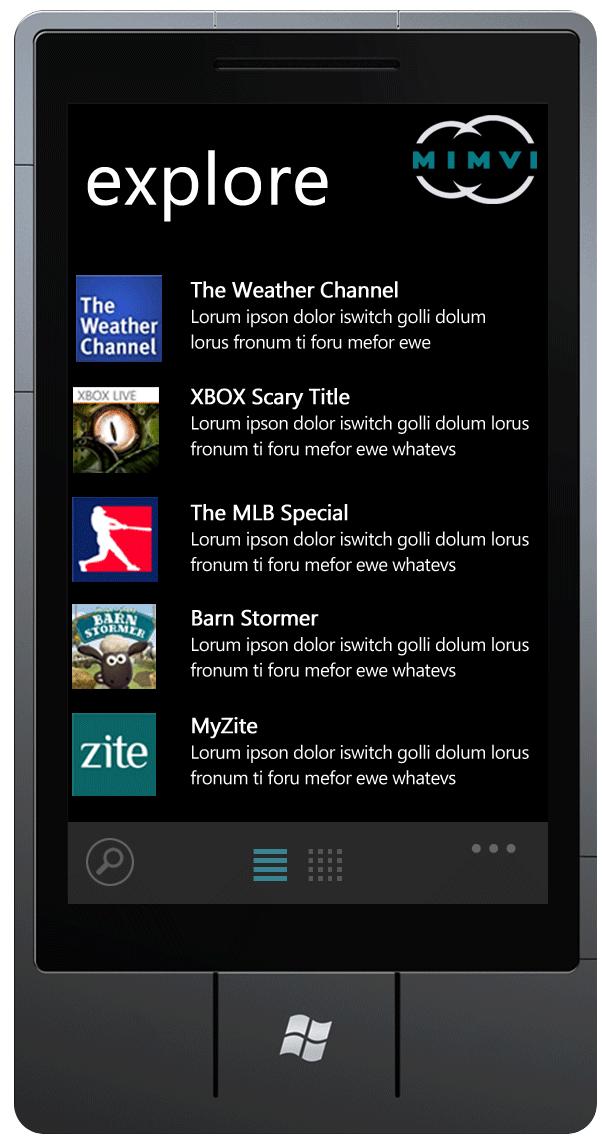

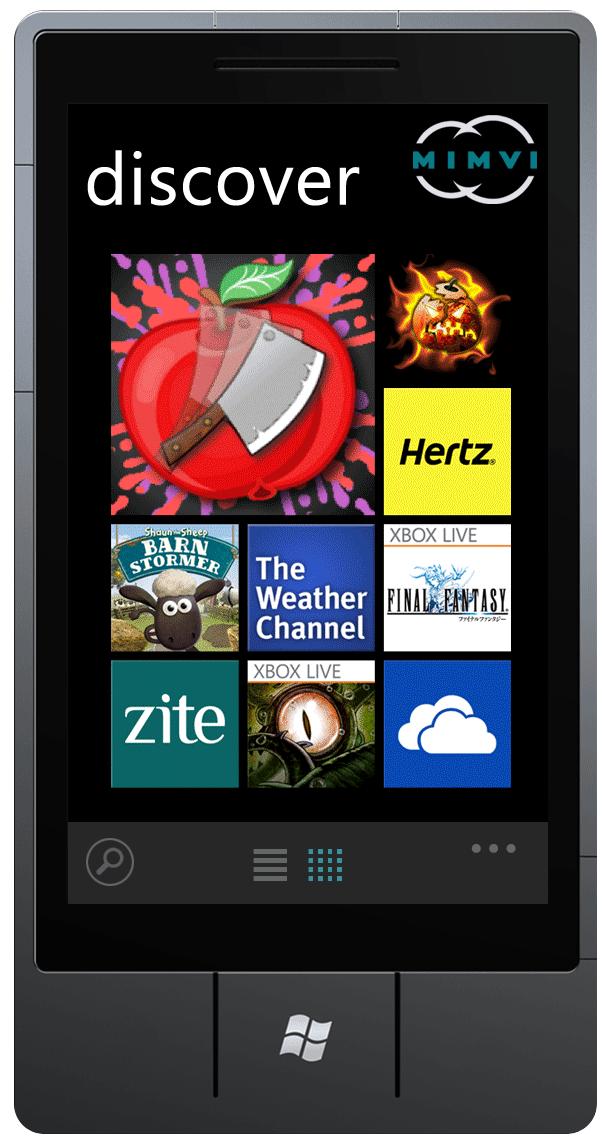

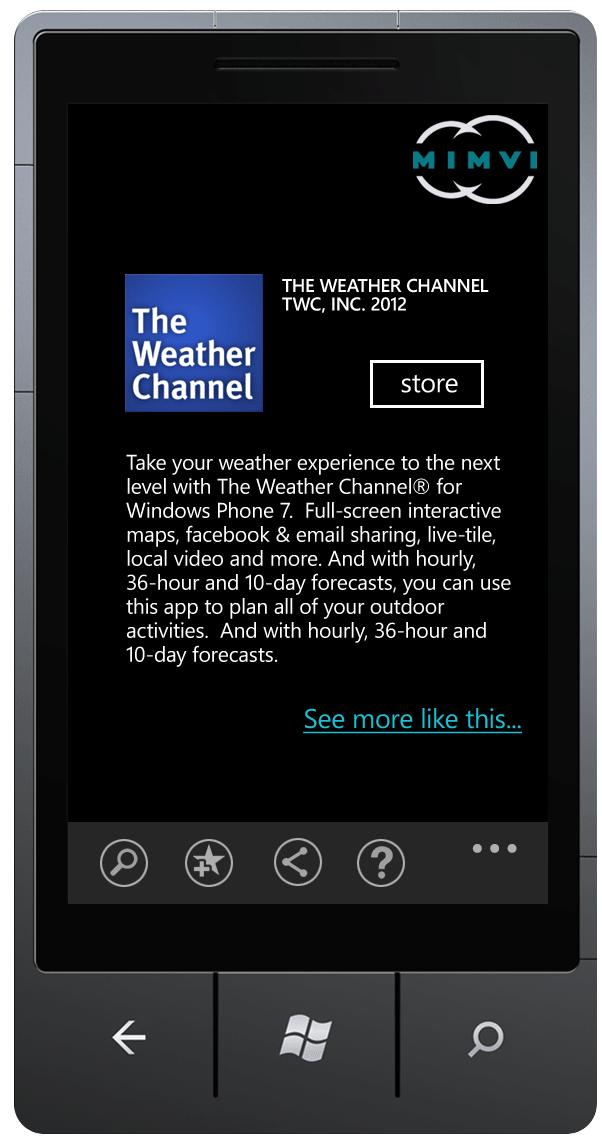

Mimvi has initiated

several development, marketing and engineering efforts with Microsoft Corp. that we expect will combine Mimvi's

proprietary search and discovery technology with Microsoft's Azure Cloud platform, Windows 8 and Windows Phone 8 product

lines - including Microsoft Surface tablets and other devices.

The first of these initiatives is the development

of "Mimvi Mobile App Search" for Windows Phone 8, a mobile app that enables Microsoft consumers to search,

discover and receive recommendations for mobile apps, mobile content, and mobile products. In addition, Microsoft and Mimvi

are jointly promoting the Microsoft Azure Cloud Platform in hosting and delivery services for mobile apps. Below are

screenshots of Mimvi Mobile App Search which the Company expects to release in late November.

Mimvi is also working

with other groups within Microsoft to develop search, discovery, recommendation and social media technologies for

applications on a wider range of Microsoft products and platforms. This collaboration we believe will help other

developers migrate their solutions to the Microsoft Phone 8 and Windows Azure platforms opening up

their applications to run on over 400 million Microsoft desktops and tablets worldwide.

| 11 |

Agreement and Plan of Merger

On August 6, 2012, Mimvi, Inc. (the “Company”), and Wolf Acquisition Corporation, a California corporation and wholly-owned subsidiary of the Company (“Merger Sub”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Lone Wolf, Inc., a California corporation (“Lone Wolf”), Eric Rice and DFM Agency, LLC as the Principal Shareholders and Eric Rice as the representative of the equity holders of Lone Wolf.

Pursuant to the terms of the Merger Agreement, and subject to the conditions thereof, Merger Sub will merge with and into Lone Wolf with Lone Wolf continuing as the surviving corporation and wholly-owned subsidiary of the Company in the merger (the “Merger”). At the effective time of the Merger, each share of Lone Wolf Common and Preferred Stock that is issued and outstanding immediately prior to the effective time of the Merger, other than issued and outstanding Lone Wolf Capital Stock that is owned by (i) the Company or Merger Sub, (ii) Lone Wolf as treasury stock or any direct or indirect wholly-owned subsidiary of Lone Wolf or (iii) shareholders that have perfected appraisal rights under California law, will be automatically converted into the right to receive aggregate consideration of 3,800,000 shares of Common Stock of the Company (the “Stock Merger Consideration”). In addition, at the effective time of the Merger, each outstanding option, warrant or other right to acquire Lone Wolf Common Stock, whether or not then vested or exercisable, will be automatically canceled and shall cease to be outstanding, and no consideration shall be delivered in exchange therefore. Fifty percent (50%) of the Merger Consideration shall be placed in escrow for twenty-four (24) months as security for the indemnification obligations of Lone Wolf’s shareholders under the Merger Agreement.

The Merger Agreement contains customary representations, warranties and covenants of the Company, and Merger Sub on the one hand and of Lone Wolf and the Principal Shareholders on the other hand, including, among other things, covenants regarding: (i) the conduct of the business of Lone Wolf and its subsidiaries prior to the consummation of the Merger; (ii) the use of the parties’ reasonable best efforts to cause the Merger to be consummated, including the abstention by Lone Wolf from soliciting, providing information or entering into discussions concerning alternative acquisition proposals relating to Lone Wolf and the solicitation of the consent of the shareholders of Lone Wolf to the Merger.

| 12 |

The representations, warranties, covenants and agreements of the Company and Lone Wolf contained in the Merger Agreement have been made (i) only for purposes of the Merger Agreement, (ii) have been qualified by confidential disclosures made to the other party in disclosure letters delivered in connection with the Merger Agreement, (iii) are subject to materiality qualifications contained in the Merger Agreement which may differ from what may be viewed as material by investors, (iv) were made only as of the date of the Merger Agreement or such other date as is specified in the Merger Agreement and (v) have been included in the Merger Agreement for the purpose of allocating risk between the parties rather than establishing matters as fact. Accordingly, the Merger Agreement is included as an exhibit to this Current Report on Form 8-K only to provide investors with information regarding the terms of the Merger Agreement, and not to provide investors with any other factual information regarding the Company or its business. Investors should not rely on the representations, warranties, covenants and agreements, or any descriptions thereof, as characterizations of the actual state of facts or condition of the Company or any of its subsidiaries or affiliates. In addition, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures. As of November 19, 2012, the merger has yet to be completed.

As of September 30, 2012, the Company advanced Lone Wolf $79,000 under a promissory note that matures December 31, 2012.

Three Months Ended September 30, 2012 compared with Three Months Ended September 30, 2011

Revenue

For the three months ended September 30, 2012, we realized revenue of $0 compared to $10,055 for the three months ended September 30, 2011, a decrease of $10,055 or 100%. The decrease was primarily due to termination of the enterprise consulting contract with one customer.

Operating Expenses

For the three months ended September 30, 2012, our operating expenses increased to $610,106 compared to $439,435 for the three months ended September 30, 2011, an increase of $170,671 or 39%. This increase in the operating expenses was primarily due to the increase in stock compensation paid to various consultants that provided legal, management, accounting, and technology consulting services on behalf of the Company. All of the restricted common shares issued were priced at fair value based on the trading price of our stock on the date of issuance or revalued at the end of the quarter as the shares were earned ratably over a six month period beginning in March 2012.

For the three months ended September 30, 2012, legal and professional fees decreased to $172,004 compared to $280,734 for the three months ended September 30, 2011, a decrease of $108,730 or 31%.

For the three months ended September 30, 2012, executive compensation increased to $58,150 compared to $0 for the three months ended September 30, 2011, an increase of $58,150 or 100% primarily due to the addition of the Founder/Chief Visionary Officer and our Chief Executive Officer as employees of the Company in the fourth quarter of 2011.

For the three months ended September 30, 2012, general and administrative expenses decreased to $63,231 compared to $68,467 for the three months ended September 30, 2011, a decrease of $5,236 or 8% primarily due to an decrease in investor relations expenses,

For the three months ended September 30, 2012, interest expense increased to $25,099 compared to $0 for the three months ended September 30, 2011, an increase of $25,099 or 100% primarily due to the accrued interest requirements on our outstanding notes payable.

For the three months ended September 30, 2012, loss on the extinguishment of debt increased to $224,969 compared to $0 for the three months ended September 30, 2011, an increase of $224,969 or 100% primarily due to settlement agreements we entered into to satisfy our term notes and the outstanding judgment. All these transactions were subject to fair value measurements on the date of the settlement agreement and the related date we issued our common stock.

Net Loss

For the three months ended September 30, 2012, we incurred a net loss of $860,174, or ($0.02) per share compared to a net loss of $429,380 or ($0.01) per share for the three months ended September 30, 2011. The increase was primarily due to the increase in stock based compensation, and the changes in the operating expenses as described above.

Nine Months Ended September 30, 2012 compared with Nine Months Ended September 30, 2011

Revenue

For the nine months ended September 30, 2012, we realized revenue of $0 compared to $61,375 for the nine months ended September 30, 2011, a decrease of $61,375 or 100%. The decrease was primarily due to termination of the enterprise consulting contract with one customer.

Operating Expenses

For the nine months ended September 30, 2012, our operating expenses decreased to $1,838,838 compared to $3,178,330 for the three months ended September 30, 2011, a decrease of $1,339,492 or 42%. This decrease in operating expenses was primarily due to the decrease in legal/professional fees and stock compensation paid to various consultants that provided legal, management, accounting, and technology consulting services on behalf of the Company. All of the restricted common shares issued were priced at fair value based on the trading price of our stock on the date of issuance or revalued at the end of the quarter as to certain restricted common shares that were earned ratably over a nine month period starting in March 2012.

| 13 |

For the nine months ended September 30, 2012, legal and professional fees decreased to $549,967 compared to $2,174,361 for the nine months ended September 30, 2011, a decrease of $1,624,394 or 75% primarily due a change in legal counsel in 2012 and because we ceased accruing significant consulting fees in 2011 for consultants that no longer provide services to the Company.

For the nine months ended September 30, 2012, executive compensation increased to $177,440 compared to $0 for the nine months ended September 30, 2011, an increase of $177,440 or 100% primarily due to the addition of the Founder/Chief Visionary Officer and our Chief Executive Officer as employees of the Company in the fourth quarter of 2011.

For the nine months ended September 30, 2012, general and administrative expenses increased to $162,850 compared to $126,541 for the nine months ended September 30, 2011, an increase of $36,309 or 29%. This increase is primarily due to an increase in investor relations expenses and technology services expenses as we continue to expand our website.

For the nine months ended September 30, 2012, interest expense increased to $61,629 compared to $0 for the nine months ended September 30, 2011, an increase of $61,629 or 100%. This increase is due to the accrued interest requirements on our outstanding notes payable.

For the three months ended September 30, 2012, loss on the extinguishment of debt increased to $224,969 compared to $0 for the three months ended September 30, 2011, an increase of $224,969 or 100% primarily due to settlement agreements we entered into to satisfy our term notes and the outstanding judgment. All these transactions were subject to fair value measurements on the date of the settlement agreement and the related date we issued our common stock.

Net Loss

For the nine months ended September 30, 2012, we incurred a net loss of $2,125,436 or ($0.04) per share compared to a net loss of $3,116,955 or ($0.08) per share for the nine months ended September 30, 2011. The decrease was primarily due to the decrease in legal/professional fees and stock compensation, and the changes in the operating expenses as described above.

Liquidity and Capital Resources

As of September 30, 2012, we had total current assets of $560,886 consisting of $300,136 in cash and $260,750 of prepaid stock compensation. We had total current liabilities of $1,186,604 consisting of accounts payable/accrued expenses of $1,058,004; due to related parties of $28,600 and notes payable of $100,000. All other term notes payable and the judgment that was outstanding as of June 30, 2012 have been satisfied.

We currently have limited funds to pay our current liabilities. Should one or more of our creditors seek or demand payment, we are not likely to have the resources to pay or satisfy any such claims. Thus, we face risk of defaulting on our obligations to our creditors with consequential legal and other costs adversely impacting our ability to continue our existence as a corporate enterprise.

In April 2012, the Company received the final determination that on November 18, 2011 a money award in the amount of $21,532 (including interest and costs) was issued against the Company by the Labor Commissioner of California. This has been recorded as accounts payable as of September 30, 2012.

Our insolvent financial condition also may create a risk that we may be forced to file for protection under applicable bankruptcy laws or state insolvency statutes. We also may face the risk that a receiver may be appointed. We face that risk and other risks resulting from our current financial condition.

During the nine months ended September 30, 2012, we raised $940,000 in equity financing and $100,000 in debt financing (net of repayments); however, this does not alleviate our current financial position, nor does it enable us to sustain our current operations.

For these and other reasons, we anticipate that unless we can obtain sufficient capital from an outside source and do so in the very near future, we may be unable to continue to operate as a corporation, continue to meet our filing obligations under the Securities Exchange Act of 1934, or otherwise satisfy our obligations to our stock transfer agent, our accountants, our legal counsel, our EDGAR filing agent, and many others.

For these and other reasons, our management recognizes the adverse difficulties and continuing severe challenges we face. Apart from the limited funds that we have received there can be no assurance that we will receive any financing or funding from any source or if any financing should be obtained, that existing shareholders will not incur substantial, immediate, and permanent dilution of their existing investment.

The following is a summary of the Company's cash flows provided by (used in) operating, investing, and financing activities for the nine months ended September 30, 2012 and 2011:

| Nine months ended | ||||||||

| September 30, | ||||||||

| 2012 | 2011 | |||||||

| Operating activities | $ | (660,482 | ) | $ | (289,760 | ) | ||

| Investing activities | (79,000 | ) | - | |||||

| Financing activities | 1,039,618 | 311,396 | ||||||

| Net increase in cash | $ | 300,136 | $ | 21,636 | ||||

| 14 |

Going Concern Uncertainties

As of September 30, 2012, we have no sources of operating revenue, and have only limited working capital with which to pursue our business plan. The amount of capital required to sustain operations until we achieve positive cash flow from operations is subject to future events and uncertainties. It will be necessary for us to secure additional working capital through loans or sales of common stock, and there can be no assurance that such funding will be available in the future. These conditions raise substantial doubt about our ability to continue as a going concern.

Our auditor has issued a going concern qualification as part of their opinion in their audit report contained in Form 10-K filed with the SEC for the years ended December 31, 2011 and 2010.

Capital Expenditures

For the nine months ended September 30, 2012, we have not incurred any material capital expenditures.

Commitments and Contractual Obligations

As a "smaller reporting company" as defined by Item 10 of Regulation S-K, the Company is not required to provide this information.

Off-Balance Sheet Arrangements

We have not entered into any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that would be considered material to investors.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

As a "smaller reporting company" as defined by Item 10 of Regulation S-K, the Company is not required to provide information required by this Item.

Item 4. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our Chief Executive Officer and our Chief Financial Officer, carried out an evaluation of the effectiveness of our "disclosure controls and procedures" (as defined in the Securities Exchange Act of 1934 (the "Exchange Act") Rules 13a-15(e) and 15-d-15(e)) as of the end of the period covered by this report (the "Evaluation Date"). Based upon that evaluation, our Chief Executive Officer and our Chief Financial Officer concluded that, as of the Evaluation Date, our disclosure controls and procedures are not effective to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act (i) is recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms and (ii) is accumulated and communicated to our management, including our Chief Executive Officer and our Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

Changes in Internal Control over Financial Reporting

In March 2012, the Company retained the services of a new Chief Financial Officer. We are in an on-going process of establishing disclosure controls and procedures so our Chief Executive Officer and our Chief Financial Officer will be provided an appropriate amount of time to allow them to be able to make timely decisions regarding required disclosure in the Company’s future securities filings.

During the three months ended September 30, 2012 there were no changes in the Company’s internal control over financial reporting that occurred that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting

PART II - OTHER INFORMATION

Item 1. Legal Proceedings.

There are presently no material pending legal proceedings to which the Company, any executive officer, any owner of record or beneficially of more than five percent of any class of voting securities is a party or as to which any of its property is subject, and no such proceedings are known to the Company to be threatened or contemplated against it.

| 15 |

Item 1A. Risk Factors.

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide information required by this Item.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

On July 2, 2012, the Company issued 50,000 shares of its common stock to a consultant in exchange for services rendered with a fair value of $14,000.

On July 5, 2012, the Company issued 1,000,000 shares of its common stock to a consultant in exchange for services rendered with a fair value of $230,000.

On July 10, 2012, the Company issued 100,000 shares of its common stock to a vendor to satisfy its outstanding accounts payable for a fair value of $28,000.

On July 18, 2012, the Company issued and sold 100,000 shares of its common stock to one accredited investor for an aggregate purchase price of $10,000. On July 23, 2012, the Company issued and sold 250,000 shares of its common stock to one accredited investor for an aggregate purchase price of $25,000.

On July 31, 2012, the Company issued and sold 1,000,000 shares of its common stock to two accredited investors for an aggregate purchase price of $50,000.

On August 6, 2012, the Company issued and sold 25,000 shares of its common stock to one accredited investor for an aggregate purchase price of $2,500.

On August 6, 2012, the Company issued 300,000 shares of its common stock to a consultant in exchange for services rendered with a fair value of $75,000.

On August 13, 2012, the Company issued and sold 500,000 shares of its common stock to one accredited investor for an aggregate purchase price of $25,000.

On August 15, 2012, the Company issued and sold 1,100,000 shares of its common stock to one accredited investor for an aggregate purchase price of $110,000. On August 15, 2012, the Company issued 100,000 shares of its common stock to a consultant in exchange for services rendered with a fair value of $15,000.

On September 5, 2012, the Company issued and sold 1,000,000 shares of its common stock to one accredited investor for an aggregate purchase price of $100,000.

On September 20, 2012, the Company issued and sold 1,234,843 shares of its common stock to one accredited investor for an aggregate purchase price of $345,756. These shares were issued in conjunction with a transaction that satisfied two term notes and the outstanding judgment.

On September 24, 2012, the Company issued and sold 500,000 shares of its common stock to one accredited investor for an aggregate purchase price of $50,000.

On September 28, 2012, the Company issued and sold 2,650,000 shares of its common stock to three accredited investors for an aggregate purchase price of $265,000.

The securities referenced herein were issued in reliance upon the exemption from registration afforded by the provisions of Section 4(2) of the Securities Act of 1933, as amended, (“Securities Act”) and/or Rile 506 of Regulation D, as promulgated by the U.S. Securities and Exchange Commission under the Securities Act, based upon the following:

(a) Each of the persons to whom the shares of Common Stock were issued (each such person, an “Investor”) confirmed to the Company that such Investor is an “Accredited Investor,” as defined in Rule 501 of Regulation D promulgated under the Securities Act,

(b) There was no general solicitation with respect to the offering of the securities,

(c) Each investor acknowledged that all securities were being purchased for investment intent and were “restricted securities” for purposes of the Securities Act, and agreed to transfer such securities only in a transaction registered under the Securities Act or exempt from registration under the Securities Act, and

(d) A legend has been, or will be, placed on the certificates representing each such security stating that it was restricted and could only be transferred if subsequently registered under the Securities Act or transferred in a transaction exempt from registration under the Securities Act.

Item 3. Defaults Upon Senior Securities.

None.

Item 4. Mine Safety Disclosures.

Not applicable

Item 5. Other Information.

None.

| 16 |

Item 6. Exhibits

| 31.1 | Section 302 Certification of Chief Executive Officer |

| 31.2 | Section 302 Certification of Chief Financial Officer |

| 32.1 | Section 906 Certification of Chief Executive Officer |

| 32.2 | Section 906 Certification of Chief Financial Officer |

| 101.INS** | XBRL Instance Document |

| 101.SCH** | XBRL Schema Document |

| 101.CAL** | XBRL Calculation Linkbase Document |

| 101.DEF** | XBRL Definition Linkbase Document |

| 101.LAB** | XBRL Label Linkbase Document |

| 101.PRE** | XBRL Presentation Linkbase Document |

** Pursuant to Rule 406T of Regulation S-T, the interactive data files on Exhibit 101 hereto are deemed not filed or part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, are deemed not filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and otherwise are not subject to liability under those sections.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| MIMVI, INC. | ||

| Date: November 19, 2012 | ||

| By: | /s/ Michael Poutre | |

| Michael Poutre, Chief Executive Officer | ||

| 17 |