Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GULFMARK OFFSHORE INC | d439338d8k.htm |

GulfMark Offshore, Inc

GulfMark Offshore, Inc

2012 Bank of America Merrill Lynch Energy Conference

2012 Bank of America Merrill Lynch Energy Conference

Exhibit

99.1 |

Forward Looking Statements

Forward Looking Statements

2

Cautionary Statement Regarding Forward-Looking Statements

Certain

statements

and

information

in

this

presentation

may

constitute

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

The

words

“believe,”

“expect,”

“anticipate,”

“plan,”

“intend,”

“foresee,”

“should,”

“would,”

“could”

or

other

similar

expressions

are

intended

to

identify

forward-looking

statements,

which

are

generally

not

historical

in

nature.

These

forward-looking

statements

are

based

on

our

current

expectations

and

beliefs

concerning

future

developments

and

their

potential

effect

on

us.

While

management

believes

that

these

forward-looking

statements

are

reasonable

as

and

when

made,

there

can

be

no

assurance

that

future

developments

affecting

us

will

be

those

that

we

anticipate.

All

comments

concerning

our

expectations

for

future

revenues

are

based

on

our

forecasts

for

our

existing

operations.

Our

forward-looking

statements

involve

significant

risks

and

uncertainties

(some

of

which

are

beyond

our

control)

and

assumptions

that

could

cause

actual

results

to

differ

materially

from

our

historical

experience

and

our

present

expectations

or

projections.

Among

the

important

factors

that

could

cause

actual

results

to

differ

materially

from

those

in

the

forward-looking

statements

include,

but

are

not

limited

to:

the

price

of

oil

and

gas

and

its

effect

on

offshore

drilling,

vessel

utilization

and

day

rates;

industry

volatility;

fluctuations

in

the

size

of

the

offshore

marine

vessel

fleet

in

areas

where

the

Company

operates;

changes

in

competitive

factors;

delays

or

cost

overruns

on

construction

projects,

and

other

material

factors

that

are

described

from

time

to

time

in

the

Company’s

filings

with

the

SEC,

including

the

registration

statement

and

the

Company’s

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2011,

Quarterly

Reports

on

Form

10-Q

and

Current

Reports

on

Form

8-K.

Consequently,

the

forward-looking

statements

contained

herein

should

not

be

regarded

as

representations

that

the

projected

outcomes

can

or

will

be

achieved.

These

forward-looking

statements

speak

only

as

of

the

date

hereof.

We

undertake

no

obligation

to

publicly

update

or

revise

any

forward-looking

statements

after

the

date

they

are

made,

whether

as

a

result

of

new

information,

future

events

or otherwise.

NYSE:

GLF

www.GulfMark.com |

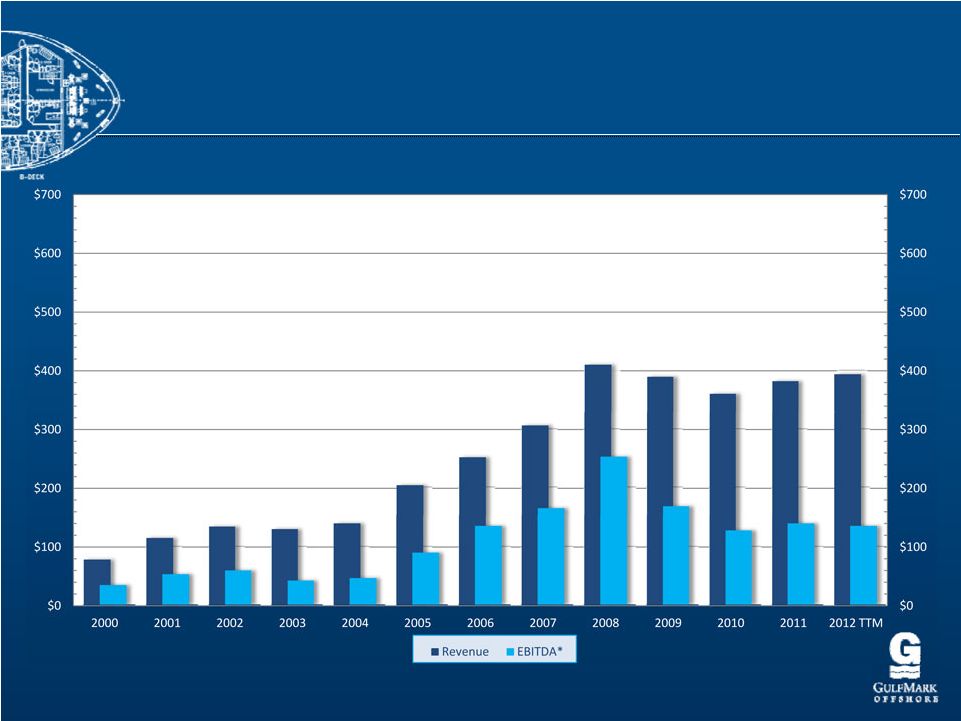

Long Term Revenue & EBITDA

Long Term Revenue & EBITDA

(in millions of dollars)

(in millions of dollars)

3

* Note: Adjusted for Special Items, See Supporting Information at the end of this

Presentation |

Pro

Forma Prior Peak Revenue & EBITDA Pro Forma Prior Peak Revenue &

EBITDA (in millions of dollars)

(in millions of dollars)

4

* Note: Adjusted for Special Items, See Supporting Information at the end of this

Presentation |

5

Total Revenue in Backlog

Total Revenue in Backlog

(in thousands of dollars)

(in thousands of dollars) |

6

Global Vessel Diversification

Global Vessel Diversification

4

West Africa

AHTS 2

Mexico

AHTS

2 Trinidad

PSV

2

FSV

1 North Sea

PSV

21

AHTS

1

SpV

1 Worldwide

PSV

48

AHTS

17

FSV

3

SpV

2

Total

70 SE Asia

PSV

4

AHTS 12

Revenue Breakout by Region

–

Twelve Months Ended

September 30, 2012

North Sea

43%

Southeast

Asia

16%

14%

27%

Gulf of Mexico

Gulf of Mexico

Gulf of Mexico

Rest of Americas

Americas

41%

Brazil

PSV

SpV

1 |

The GulfMark Fleet

The GulfMark Fleet

7 |

Young & Versatile Fleet

Young & Versatile Fleet

8

Number of Vessels GulfMark Built Per Year |

Building For Our Future

Building For Our Future

9

Significant number of new generation rigs on order

Increasing Activity both in the North Sea and New Frontiers

Industry call for higher specification vessels to meet increasing regulatory

demands:

•

Deeper Waters and Harsher Environments

•

Increased cargo carrying capacity and flexibility

•

Enhanced Green

Footprint and offering greater safety support |

10

New Build Program Overview

New Build Program Overview

Two MMC 887 300 Class DP 2 (Europe)

One MMC 879 280 Class DP2 (Europe)

Two UT 755 XL 250 Class DP2 (Europe)

Two ST-216 300 Class Arctic DP2 (Europe)

Two 280 Class PSV DP2 (US)

Two 300 Class PSV DP2 (US) |

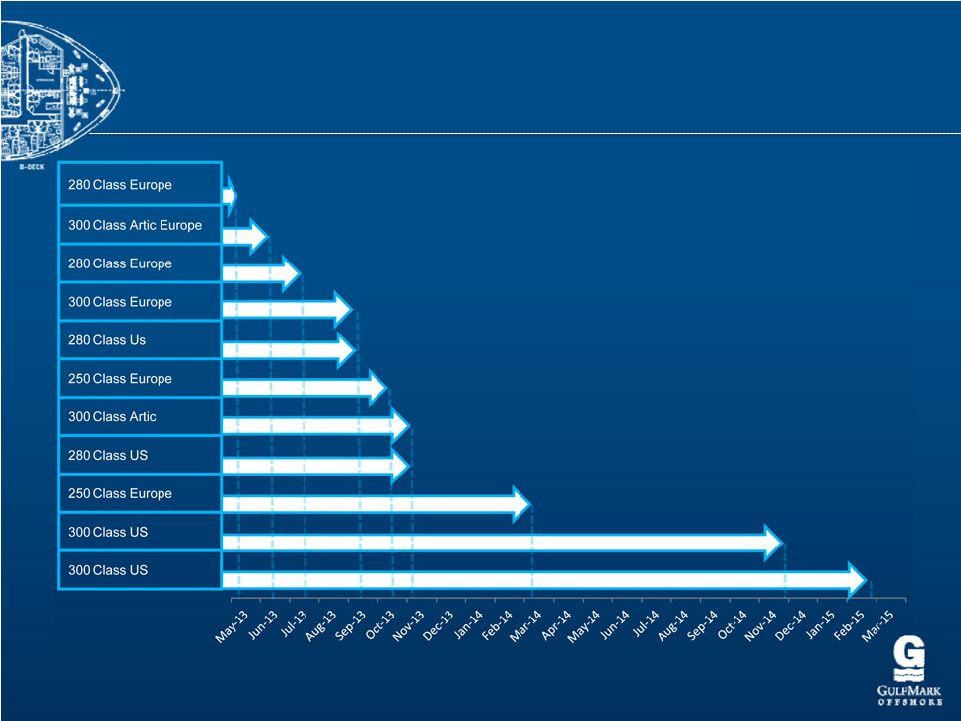

New Build and Vessel Enhancement

New Build and Vessel Enhancement

Program Summary

Program Summary

11

•

North Sea

•

7 Newbuild Vessels

•

North Sea vessels hedged in EUR

•

DP2 Green PSVs (300 Class (2), 300 Class Arctic (2), 280 Class (1), 250 Class (2),

240 Class (1))

•

Staggered delivery of Newbuilds-

2Q 2013 through 1Q 2014

•

U.S. GOM

•

4 Newbuild US Flagged Vessels for Approximately $170 million

•

DP2 Green PSVs (280 Class(2), 300 Class (2))

•

Staggered delivery -

3Q 2013 through 1Q 2015

•

U.S. GOM –

Stretch Program

•

3

More

Vessels

(190

Class

230

Class)

•

Anticipated Completion Q2 2013

•

Next Steps –

210 Class

260 Class |

Building For Our Future: 2013 & Beyond

Building For Our Future: 2013 & Beyond

(U.S. dollars, in millions)

(U.S. dollars, in millions)

12

Vessels Under

Construction

Vessel Type

Initial

Operating

Region

Estimated

Construction

Cost

Estimated

Average Annual

EBITDA

Implied EBITDA

Multiple

300 Class

PSV

North Sea

$37.0

$8.2

4.5x

300 Class

PSV

North Sea

$37.0

$8.2

4.5x

280 Class

PSV

North Sea

$34.0

$7.7

4.4x

300 Class Arctic

PSV

North Sea

$58.0

$10.8

5.4x

300 Class Arctic

PSV

North Sea

$60.0

$10.8

5.6x

250 Class

PSV

North Sea

$31.0

$7.4

4.2x

250 Class

PSV

North Sea

$31.0

$7.4

4.2x

US 280 Class

PSV

Americas

$36.0

$6.5

5.5x

US 280 Class

PSV

Americas

$36.0

$6.5

5.5x

US 300 Class

PSV

Americas

$48.0

$8.8

5.5x

US 300 Class

PSV

Americas

$48.0

$8.8

5.5x

Total

$456.0

$91.1

5.0x |

New Build Delivery Schedule

New Build Delivery Schedule

13 |

GulfMark Stretch Program

GulfMark Stretch Program

14 |

Market

Market

Drivers

Drivers

15 |

Rig Growth in the North Sea

Rig Growth in the North Sea

16

Source: IHS Petrodata , Carnegie Research

Floating Rigs

Active

35

Scheduled

Arrivals/Activations

(by 2014)

16

% Increase

46%

Jackups

Active

41

Scheduled Arrivals

(by 2014)

8

% Increase

20% |

Rig Growth in the North Sea

Rig Growth in the North Sea

17

Source: IHS Petrodata |

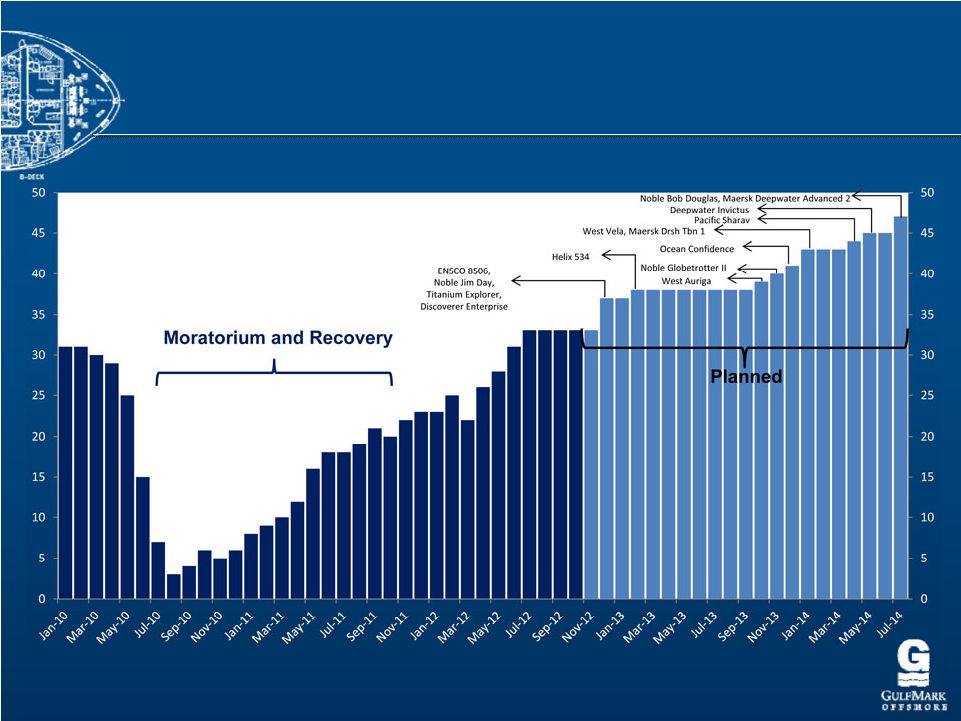

Floating Rig Growth in the U.S. GOM

Floating Rig Growth in the U.S. GOM

18

Source: IHS Petrodata –

August 2012

Floating Rigs in U.S. GOM

Active

33

Scheduled Arrivals

(by 2014)

14

% Increase

42% |

Floating Rig Growth in the U.S. GOM

Floating Rig Growth in the U.S. GOM

19

Source: Barclays, IHS Petrodata |

Worldwide Sub Sea –

Worldwide Sub Sea –

Driving the Future

Driving the Future

20

Sub Sea Activity is Continuing to Expand

•

Subsea Demand Expected to Increase 33% and

Annual Expenditure double to $20.3 Billion by 2016

•

Set to Top $77 Billion Over Next Five Years

•

Increase of 63% Over Previous Five Year Period

•

Sub Sea Work Requires Newer, More Specialized

Vessels and Support Equipment

Sub Sea Activity is Continuing to Expand

•

Subsea Demand Expected to Increase 33% and

Annual Expenditure double to $20.3 Billion by 2016

•

Set to Top $77 Billion Over Next Five Years

•

Increase of 63% Over Previous Five Year Period

•

Sub Sea Work Requires Newer, More Specialized

Vessels and Support Equipment

Source: Douglas-Westwood’s World Subsea

Vessel Operations Market Forecast 2012-2016 |

Financial Information

Financial Information

21 |

22

Consistent Reduction in

Consistent Reduction in

Net Debt Position

Net Debt Position |

23

Investment Highlights

Investment Highlights

Industry Leaders in QHSE Performance & People Development

Global Presence and Diverse Operations Expertise

Financial Stability & Flexibility to Pursue Opportunities

Growth through Both Acquisition and New Construction

Young, Versatile, High-Specification Fleet |

Reconciliation of Adjusted EBITDA

Reconciliation of Adjusted EBITDA

24

EBITDA

is

defined

as

net

income

(loss)

before

interest

expense,

net,

income

tax

provision,

and

depreciation

and

amortization,

which

includes

impairment.

Adjusted

EBITDA

is

calculated

by

adjusting

EBITDA

for

certain

items

that

we

believe

are

non-cash

or

unusual,

consisting

of:

(i)

loss

from

unconsolidated

ventures;

(ii)

minority

interest;

and

(iii)

other

(income)

expense,

net.

EBITDA

and

Adjusted

EBITDA

are

not

measurements

of

financial

performance

under

GAAP

and

should

not

be

considered

as

an

alternative

to

cash

flow

data,

a

measure

of

liquidity

or

an

alternative

to

income

from

operations

or

net

income

as

indicators

of

our

operating

performance

or

any

other

measures

of

performance

derived

in

accordance

with

GAAP.

EBITDA

and

Adjusted

EBITDA

are

presented

because

we

believe

they

are

used

by

security

analysts,

investors

and

other

interested

parties

in

the

evaluation

of

companies

in

our

industry.

However,

since

EBITDA

and

Adjusted

EBITDA

are

not

measurements

determined

in

accordance

with

GAAP

and

are

thus

susceptible

to

varying

calculations,

EBITDA

and

Adjusted

EBITDA

as

presented

may

not

be

comparable

to

other

similarly

titled

measures of other companies.

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012 TTM

Net (loss) income

$24.0

$0.5

($4.6)

$38.4

$89.7

$99.0

$183.8

$50.6

($34.7)

$49.9

$47.8

Interest expense, net

10.9

12.8

17.0

18.4

14.4

4.8

12.8

19.9

20.7

21.6

22.6

Income tax (benefit)

3.0

0.2

(6.5)

3.4

3.0

30.2

11.7

(2.1)

(12.7)

4.7

5.5

Depreciation & Amortization

21.4

28.0

26.1

28.9

28.5

30.6

44.3

53.0

57.0

59.6

59.6

EBITDA

59.3

$

41.5

$

32.0

$

89.1

$

135.6

$

164.6

$

252.6

$

121.5

$

30.2

$

135.8

$

135.5

$

Adjustments:

Impairment

-

-

-

-

-

-

-

46.2

97.7

1.8

2.7

Debt refinancing costs

-

-

6.5

-

-

-

-

-

-

-

3.8

Accounting Change

-

-

7.3

-

-

-

-

-

-

-

-

Other

(2.5)

1.3

(1.5)

(0.5)

0.1

0.3

(1.6)

1.2

(0.1)

2.3

0.5

Adjusted EBITDA

$56.8

$42.8

$44.3

$88.6

$135.7

$164.9

$251.0

$168.8

$127.8

$139.9

$142.5 |