Attached files

| file | filename |

|---|---|

| 8-K - CALGON CARBON CORPORATION 8-K - CALGON CARBON Corp | a50465789.htm |

Exhibit 99.1

Calgon Carbon Corporation Baird‘s 2012 Industrial Conference Chicago, IL November 5, 2012 1

2 Forward-Looking Information Safe Harbor This presentation contains historical information and forward-looking statements. Forwardlooking statements typically contain words such as “expect,” “believe,” “estimate,” “anticipate,” or similar words indicating that future outcomes are uncertain. Statements looking forward in time, including statements regarding future growth and profitability, price increases, cost savings, broader product lines, enhanced competitive posture and acquisitions, are included in the company’s most recent Annual Report pursuant to the “safe harbor” provision of the Private Securities Litigation Reform Act of 1995. They involve known and unknown risks and uncertainties that may cause the company’s actual results in future periods to be materially different from any future performance suggested herein. Further, the company operates in an industry sector where securities values may be volatile and may be influenced by economic and other factors beyond the company’s control. Some of the factors that could affect future performance of the company are higher energy and raw material costs, costs of imports and related tariffs, labor relations, capital and environmental requirements, changes in foreign currency exchange rates, borrowing restrictions, validity of patents and other intellectual property, and pension costs. In the context of the forward-looking information provided in this presentation, please refer to the discussions of risk factors and other information detailed in, as well as the other information contained in the company’s most recent Annual Report.

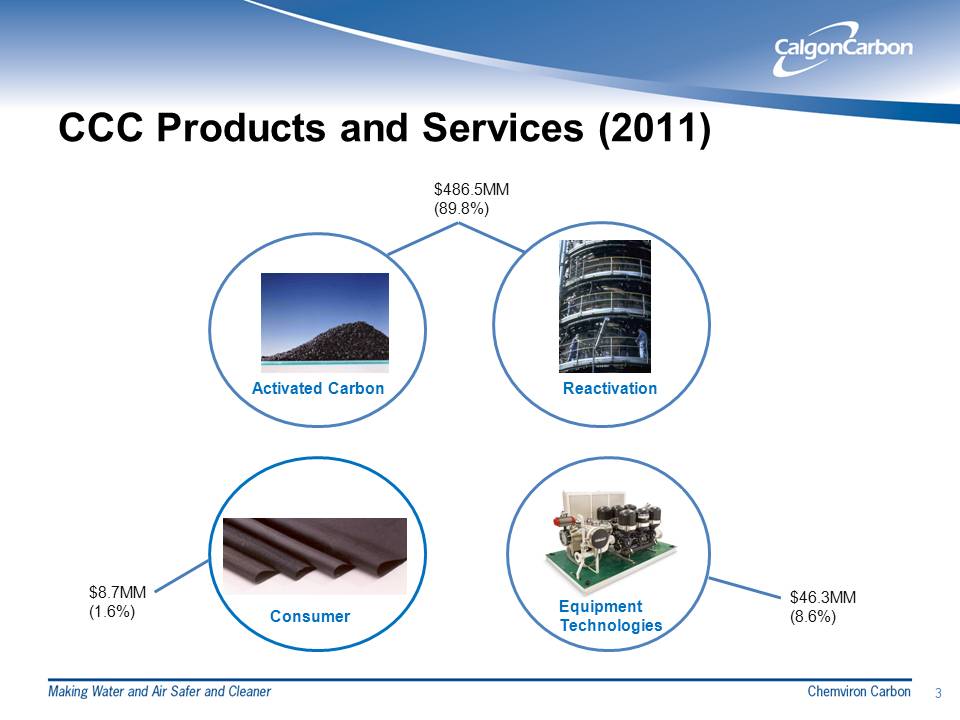

CCC Products and Services (2011) 3 Activated Carbon Reactivation Equipment Technologies Consumer $486.5MM (89.8%) $46.3MM (8.6%) $8.7MM (1.6%)

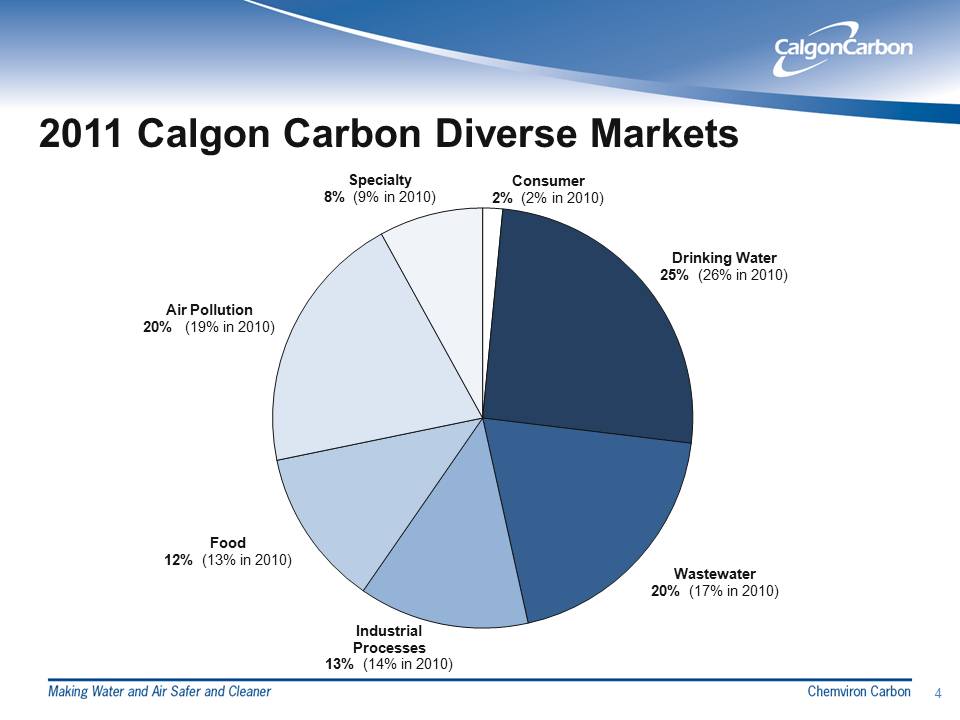

4 2011 Calgon Carbon Diverse Markets Consumer 2% (2% in 2010) Drinking Water 25% (26% in 2010) Wastewater 20% (17% in 2010) Industrial Processes 13% (14% in 2010) Food 12% (13% in 2010) Air Pollution 20% (19% in 2010) Specialty 8% (9% in 2010)

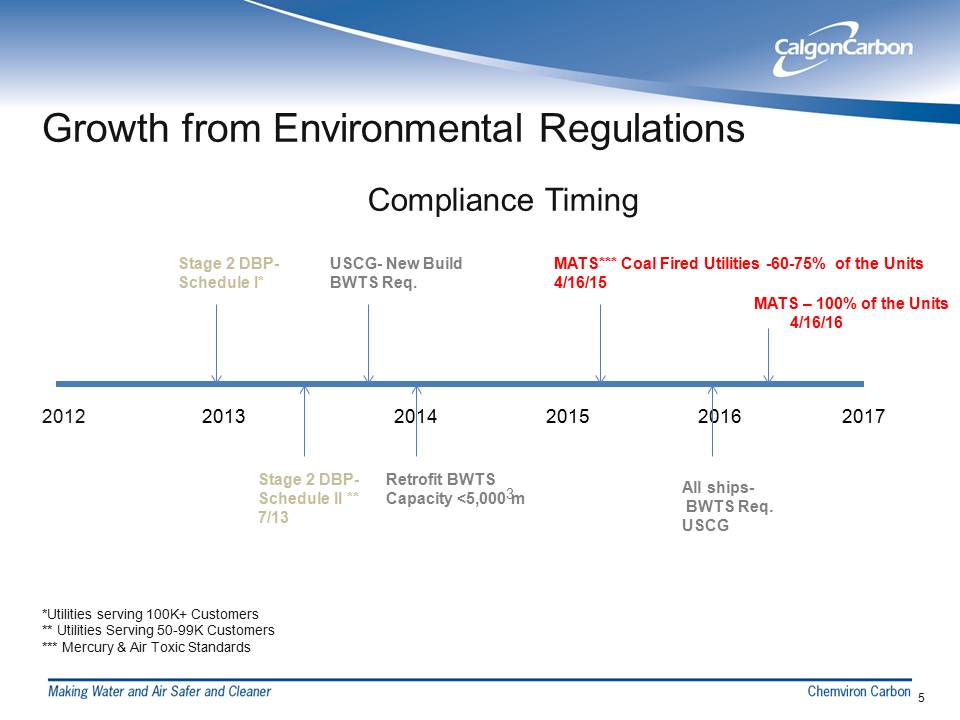

2012 2015 2013 2014 2016 2017 Compliance Timing Stage 2 DBPSchedule I* Stage 2 DBPSchedule II ** 7/13 USCG- New Build BWTS Req. Retrofit BWTS Capacity <5,000 m 3 MATS*** Coal Fired Utilities -60-75% of the Units 4/16/15 All ships- BWTS Req. USCG MATS – 100% of the Units 4/16/16 *Utilities serving 100K+ Customers ** Utilities Serving 50-99K Customers *** Mercury & Air Toxic Standards 5 Growth from Environmental Regulations

Profitability Improvement is 2012 Top Priority • Improve balance in top- and bottom-line growth • 2009 – 2011 Revenue CAGR = 14.7% • 2009 – 2011 Net Income CAGR = 0.1% • Organizational realignment for company unification • Q2 12 initiated Cost Improvement Program 6

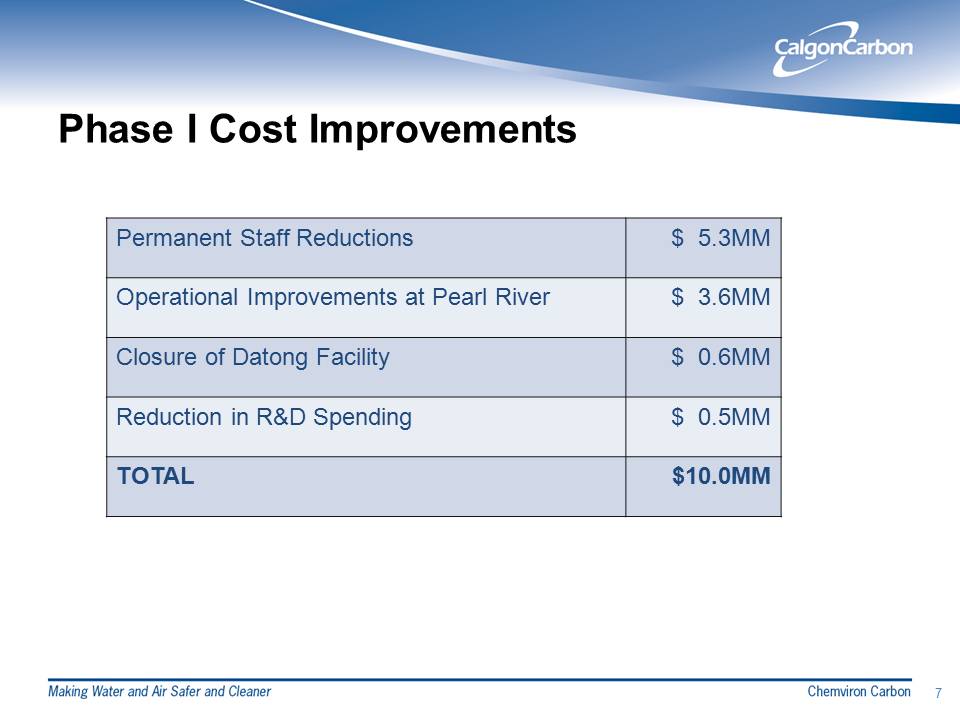

Phase I Cost Improvements Permanent Staff Reductions $ 5.3MM Operational Improvements at Pearl River $ 3.6MM Closure of Datong Facility $ 0.6MM Reduction in R&D Spending $ 0.5MM TOTAL $10.0MM 7

Phase II Cost Improvements • Plant Process Improvements • Product Rationalization • Asset Optimization • Organization/Staffing • Global Procurement • Calgon Carbon Japan, Pearl River Plants • 50% Reduction in Products • Warehousing/Transportation Costs 8

Thank You! 9