Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - JDA SOFTWARE GROUP INC | d432599d8k.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - JDA SOFTWARE GROUP INC | d432599dex21.htm |

JDA and RedPrairie

Hamish Brewer, JDA President & CEO

Mike Mayoras, RedPrairie CEO

Exhibit 99.1 |

Copyright 2012 JDA

Software Group, Inc. - CONFIDENTIAL

Forward-Looking Statements

Disclaimer

This PRESENTATION may contain forward-looking statements. These forward-looking statements

involve significant risks and uncertainties. All statements other than statements of historical

fact are statements that could be deemed forward-looking statements, including all

statements regarding information regarding the intent, belief or current expectation of JDA Software Group, Inc. (the

“Company”) and members of its senior management team. Forward-looking statements

include, without limitation, statements regarding prospective performance and opportunities and

the outlook for the Company’s businesses, performance and opportunities and regulatory

approvals, the anticipated timing of filings and approvals relating to the transaction; the expected

timing of the completion of the transaction; the ability to complete the transaction

considering the various closing conditions; and any assumptions underlying any of the

foregoing. Investors are cautioned that any such forward-looking statements are not guarantees of

future performance and involve risks and uncertainties and are cautioned not to place undue

reliance on these forward-looking statements. Actual results may differ materially from

those currently anticipated due to a number of risks and uncertainties. Risks and uncertainties that could cause the actual results to

differ from expectations contemplated by forward looking statements include: uncertainties as to the

timing of the tender offer and merger; uncertainties as to how many of the Company stockholders

will tender their stock in the offer; the possibility that competing offers will be made; the

possibility that various closing conditions for the transaction may not be satisfied or waived, including that a governmental entity

may prohibit, delay or refuse to grant approval for the consummation of the transaction; the effects

of disruption from the transaction making it more difficult to maintain relationships with

employees, customers, other business partners or governmental entities; other business effects,

including the effects of industry, economic or political conditions outside of the Company’s control; transaction costs;

actual or contingent liabilities; and other risks and uncertainties discussed in the Company’s

filings with the U.S. Securities and Exchange Commission (the “SEC”), including its

Annual Report on Form 10-K for the fiscal year ended December 31, 2011, filed with the SEC on

August 6, 2012, its Quarterly Reports on Form 10-Q, its Current Reports on Form 8-K, the

Tender Offer Statement on Schedule TO and other tender offer documents to be filed by an

affiliate (the “Merger Sub”) of RP Crown Parent, LLC (the “Parent”), the

Solicitation/Recommendation Statement on Schedule 14D-9 to be filed by the Company and the Proxy

Statement on Schedule 14A to be filed by the Company. All of the materials related to the

transaction (and all other transaction documents filed with the SEC) will be available at no

charge from the SEC through its website at www.sec.gov. Investors and security holders may also obtain free copies of

the documents filed by the Company with the SEC by contacting Company Investor Relations at 14400 N.

87th Street, Scottsdale, Arizona 85260, telephone number (480-308-3392) or

mike.burnett@jda.com. You are cautioned not to place undue reliance on these forward-

looking statements, which speak only as of the date hereof. The Company does not undertake any

obligation to update any forward- looking statements as a result of new information, future

developments or otherwise, except as expressly required by law.

|

Copyright 2012 JDA

Software Group, Inc. - CONFIDENTIAL

Forward-Looking Statements

Disclaimer

Notice to Investors

Pursuant to the terms of an Agreement and Plan of Merger (the “Merger

Agreement”), dated as of November 1, 2012, by and among the Company,

Parent and Merger Sub, Merger Sub will commence a tender offer within the

time period specified in the Merger Agreement to acquire all of the outstanding

shares of common stock, $0.01 par value per share, of the Company. The

tender offer has not yet commenced. This PRESENTATION is neither an offer to

purchase nor a solicitation of an offer to sell any securities. The solicitation and the offer to buy shares of

Company common stock will be made pursuant to an offer to purchase and related

materials that Merger Sub intends to file with the SEC. At the time the

offer is commenced, Merger Sub will file a Tender Offer Statement on

Schedule

TO

with

the

SEC,

and

thereafter

the

Company

will

file

a

Solicitation/Recommendation

Statement

on

Schedule 14D-9 with respect to the offer. THE TENDER OFFER STATEMENT (INCLUDING

AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND OTHER OFFER

DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN

IMPORTANT INFORMATION, AND INVESTORS AND STOCKHOLDERS OF THE COMPANY ARE

URGED TO READ CAREFULLY AND CONSIDER THESE MATERIALS WHEN THEY BECOME

AVAILABLE BEFORE MAKING ANY DECISION WITH RESPECT TO THE TENDER OFFER. All

of these materials (and all other materials filed by the Company with the SEC) will be

available at no charge from the SEC through its website at www.sec.gov. Investors

and stockholders may also obtain free copies of the documents filed by the

Company with the SEC by contacting Company Investor Relations at 14400

N. 87th Street, Scottsdale, Arizona 85260, telephone number (480-308-3392) or

mike.burnett@jda.com. |

Copyright 2012 JDA

Software Group, Inc. - CONFIDENTIAL

Forward-Looking Statements

Disclaimer

Additional Information about the Merger and Where to Find It

Contact Information

Media:

Beth Elkin 469-357-4225

Investors:

Mike Burnett 480-308-3392

This communication may be deemed to be proxy solicitation material in respect of the proposed

acquisition of the Company by an affiliate of Parent. In connection with the potential

one-step merger, the Company will file a Proxy Statement on Schedule 14A with the SEC.

Additionally, the Company will file other relevant materials with the SEC in connection with the proposed acquisition of

the Company pursuant to the terms of the Merger Agreement. THE PROXY STATEMENT AND OTHER RELEVANT

MATERIALS WILL CONTAIN IMPORTANT INFORMATION, AND INVESTORS AND STOCKHOLDERS OF THE COMPANY ARE

URGED TO READ CAREFULLY AND CONSIDER THESE MATERIALS WHEN THEY BECOME AVAILABLE BEFORE MAKING

ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION. The materials to be

filed by the Company with the SEC may be obtained free of charge at the SEC’s web site at

www.sec.gov. After the Company’s filing thereof, investors and stockholders will also be

able to obtain free copies of the Proxy Statement from the Company by contacting Company

Investor Relations at 14400 N. 87th Street, Scottsdale, Arizona 85260, telephone number (480-308-3392) or

mike.burnett@jda.com.

The Company and its directors, executive officers and other members of their management and employees,

under the SEC rules, may be deemed to be participants in the solicitation of proxies of the

Company’s stockholders in connection with the proposed transaction. Investors and

stockholders may obtain more detailed information regarding the names, affiliations and interests of

certain of the Company’s executive officers and directors in the solicitation by reading the

Company’s proxy statement for its 2012 Annual Meeting of Stockholders, which was filed

with the SEC on October 4, 2012, the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2011, which was filed with the SEC on August, 6, 2012, and the proxy statement and other

relevant materials which may be filed with the SEC in connection with the transaction when and if they

become available. Information concerning the interests of the Company’s potential

participants, which may, in some cases, be different than those of the Company’s

stockholders generally, will be set forth in the proxy statement relating to the transaction when it becomes

available.

beth.elkin@jda.com

mike.burnett@jda.com |

Copyright 2012 JDA

Software Group, Inc. - CONFIDENTIAL

Agenda

About JDA

About RedPrairie

The Combined Company Vision

Q&A |

Copyright 2012 JDA

Software Group, Inc. - CONFIDENTIAL

JDA’s Mission

6

Enabling supply chain, merchandising and pricing

excellence through superior solutions and domain

expertise that empower our customers to make optimal

decisions

that

achieve

real

results. |

Copyright 2012 JDA

Software Group, Inc. - CONFIDENTIAL

Major Strategic Decisions

1996

Acquisition Strategy

2012

JDA Cloud

Timeline of

Strategic Decisions

Create a Retail

Software Business

1985

Supply Chain

2000 |

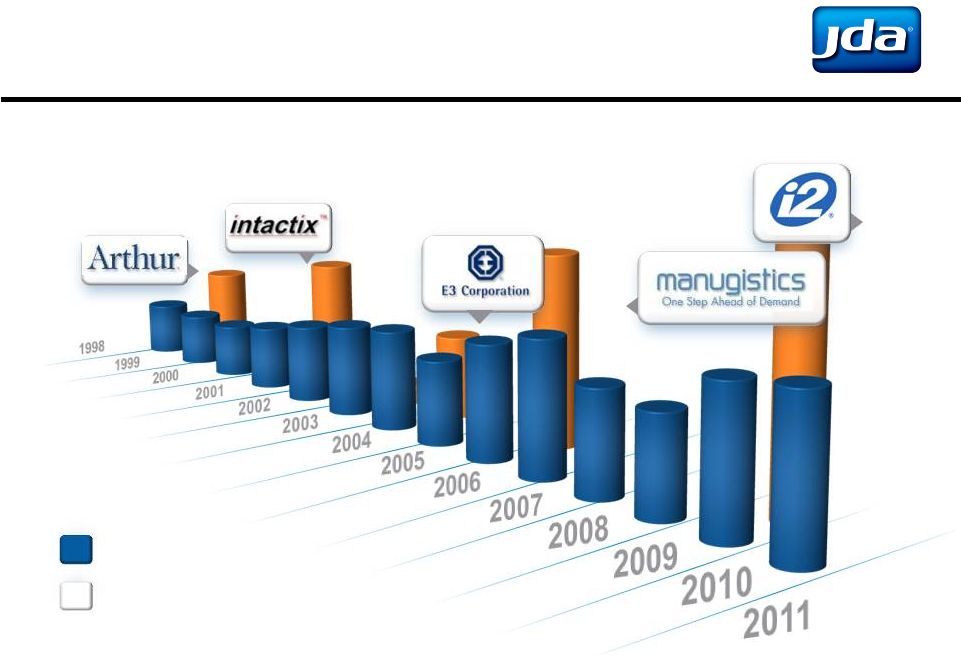

Copyright 2012 JDA

Software Group, Inc. - CONFIDENTIAL

Investing in Innovation

More

than

$1

Billion

Invested

Internal R&D

Acquisitions

8 |

Copyright 2012 JDA

Software Group, Inc. - CONFIDENTIAL

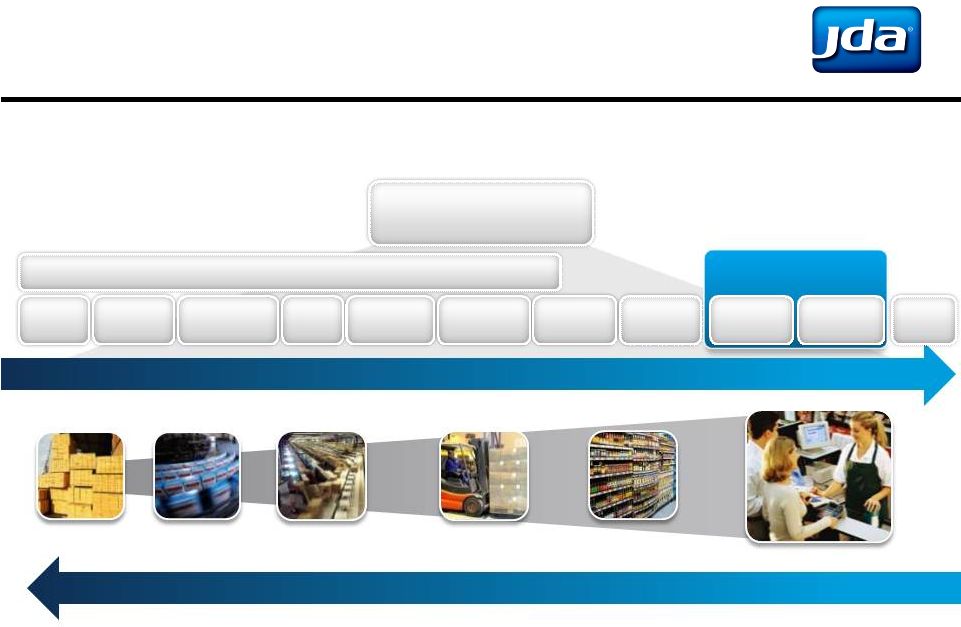

Supplier

Factory

Manufacturer DC

Retail DC

Manufacturing

Supply Chain

Account

Management & Planning

(Retail Supply Chain)

Store

Order Promising, Inventory Deployment & Transportation

An Example of JDA’s Innovation -

JDA Shelf-Connected Cloud

9

Procurement Orders

Production Orders

Shipments

Customer Orders

DC Withdrawals

Assortments

POS Sales

S&OP

Network, Sourcing and Inventory Optimization

Raw

Material

Planning

Demand

Planning

Replenishment

Planning

Collaborative

Planning

Production

Planning &

Scheduling

Store

Forecasting

Pricing &

Promotional

Planning

Shelf-Driven

Supply Chain

Plans &VMI

Orders

Shelf

Analytics

Assortment

Management

Planogram

Management

Optimized Local

Assortments

From

Shelf to Raw Materials |

Copyright 2012 JDA

Software Group, Inc. - CONFIDENTIAL

An Example of JDA’s Innovation -

JDA Customer Engagement Cloud

General availability December 2012

Balance Profitability and

Customer Satisfaction

–

Mobile empowerment of store associates

–

Real-time, multi-echelon inventory optimization

Converting shopper to buyer

Transform store into an asset

Consistent customer experience

JDA patented profitable promising algorithm |

Copyright 2012 JDA

Software Group, Inc. - CONFIDENTIAL

JDA’s Accolades

•

82 of the top 100

consumer goods

manufacturers use JDA*

•

73 of the top 100 retailers

use JDA**

19 of

the Supply Chain Top 25 Use JDA Solutions****

•

Serving customers for

25+ years

•

Every 12 hours a

customer goes live

with a JDA solution***

•

Largest community of

industry experts

•

3,100+ associates

•

261 U.S. patents, 87

pending

Enabling Winners

Commitment to Success

Expertise

* Top 100: The Consumer Goods Registry, 2011

** Top 100 Retailers, STORES, 2011

*** JDA and its implementation partners record an estimated

650 go-lives each year

**** According to JDA’s independent analysis of Gartner’s

2012 list

11

ARC Advisory Group, May 4, 2012

“As supply chain solutions become increasingly functionally rich, differentiation

shifts from features and functions to other areas. JDA has a new cloud strategy

designed to improve time to value for the company’s customers.” |

Copyright 2012 JDA

Software Group, Inc. - CONFIDENTIAL

Manufacturers

Retailers

Wholesaler-

distributors

Services

Transportation

& Logistics

JDA’s

Customers

Define

Our

Success

Sample Listing |

Agenda

About JDA

About RedPrairie

The Combined Company Vision

Q&A

Copyright 2012 JDA Software Group, Inc. - CONFIDENTIAL

|

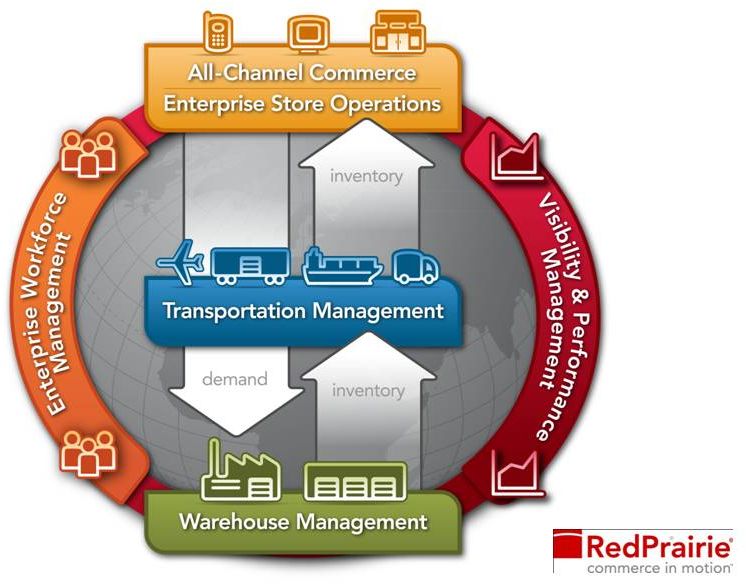

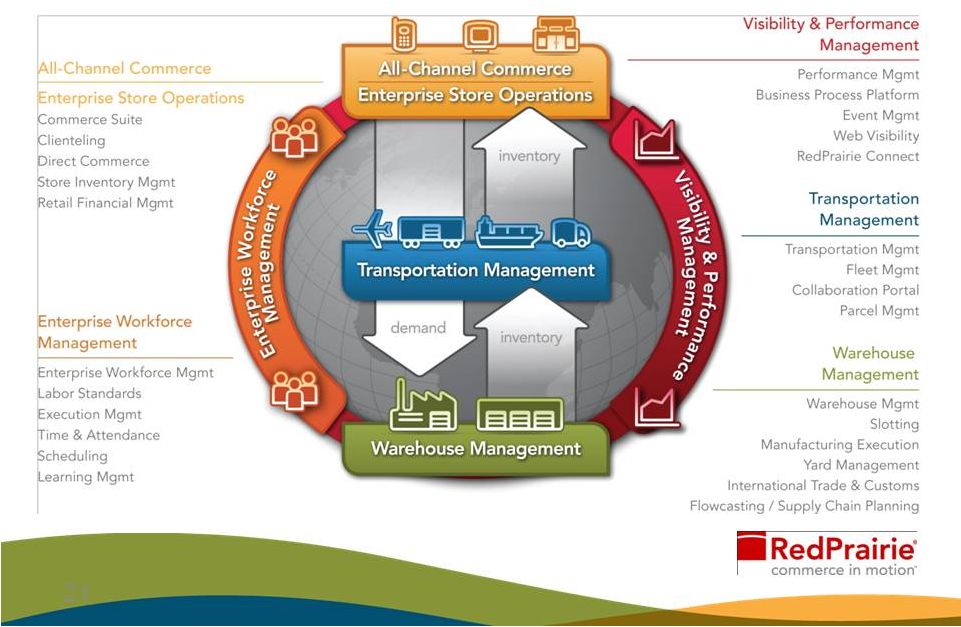

RedPrairie Overview

14

RedPrairie is a leading provider of supply chain

and retail technology

solutions that enable

manufacturers, distributors, and retailers to

synchronize and optimize the management of

inventory, transportation, and

workforce across

multiple selling channels with the goals of achieving

high customer satisfaction and maximizing

returns on investment |

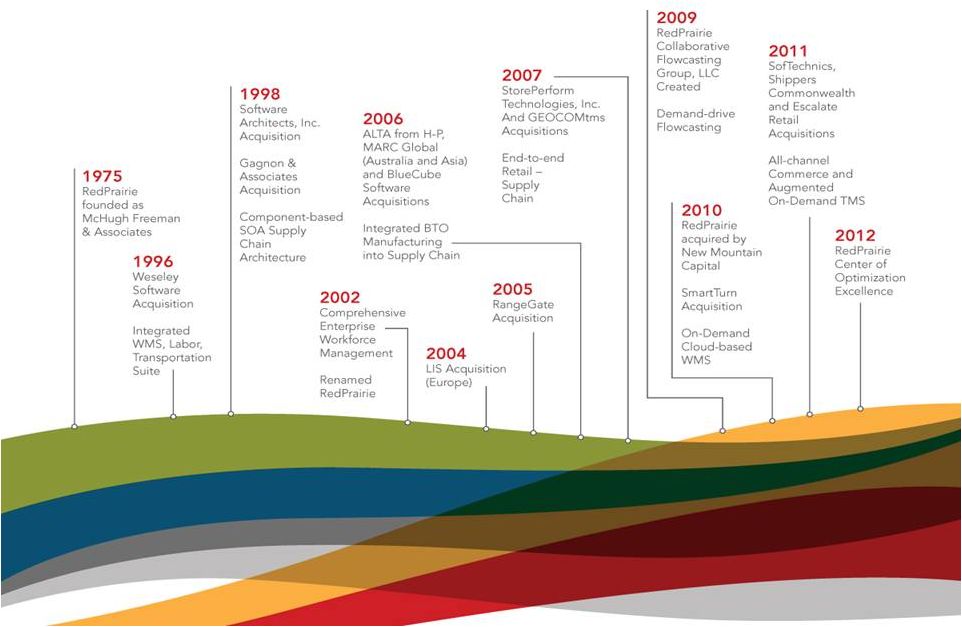

15

37 Years of Thought Leadership

RedPrairie:

People & Products You Trust |

Commerce in Motion

is in Our DNA |

Keeping Commerce in Motion for Global

Leaders Across Industries

17 |

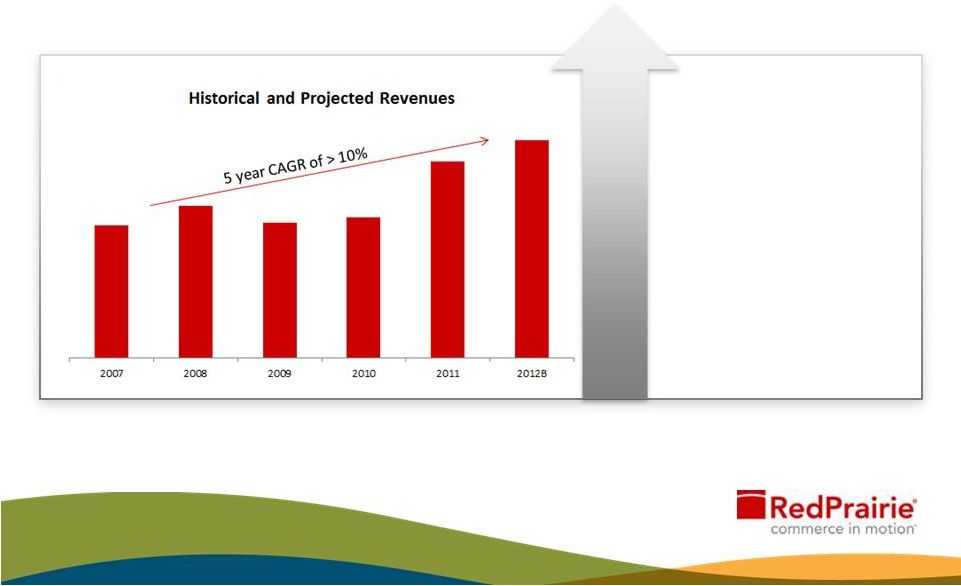

A

Growth Company 18

License Revenue

Service Revenue

Maintenance Revenue

New Markets

Every Product |

Unprecedented Transformation

19 |

20

Putting Commerce in Motion |

A

Platform for Commerce in Motion 21 |

Agenda

About JDA

About RedPrairie

The Combined Company Vision

Q&A

Copyright 2012 JDA Software Group, Inc. - CONFIDENTIAL

|

Creates the FIRST global

enterprise software and

services company providing

integrated supply chain

planning and execution

solutions for manufacturers

and retailers

Our companies’

combined solution

breadth, commitment to innovation

and

world-class

associate

base

will

allow us to deliver differentiated

solutions that enable companies to

achieve a greater command of

commerce from raw materials to

finished product and into the hands

of consumers through any channel.

The Combined Company

23

The

FIRST

Our Companies

COMBINED

Copyright 2012 JDA Software Group, Inc. - CONFIDENTIAL

|

Copyright 2012 JDA

Software Group, Inc. - CONFIDENTIAL

A Unique Combination

•

JDA’s market-leading supply chain planning, merchandising and

pricing solutions

are a perfect strategic fit with RedPrairie’s rich heritage

in warehousing, workforce management, store operations and

e-commerce •

Supports the all-channel capabilities that retailers and

manufacturers must have to meet the needs of today’s hyper-connected consumers

•

Immediately represents a $1 billion+ powerhouse

with a compelling value proposition for

success today and continued growth in the

future

The Combined Company

24 |

Copyright 2012 JDA

Software Group, Inc. - CONFIDENTIAL

The biggest and the best run companies

•

JDA

currently

has

more than

2,700

customers

•

Red

Prairie

has

more than

1,400

customers

Sharing customers in retail and manufacturing:

•

82

of the Stores Magazine global top 100 retailers

•

87

of the Consumer Goods Technology global top 100

•

22

of the Gartner Supply Chain Top 25

The Combined Company

25 |

Copyright 2012 JDA

Software Group, Inc. - CONFIDENTIAL

•

Over

4,900

associates in total

•

Over 500 sales & marketing

associates in the field

•

Over 1,200

associates in global

R&D organization

•

A global solutions delivery capability

enabled by a world-class consulting

organization of over 2,100

associates

The Combined Company

26

A

dedicated

team

focused

on

delivering

value

to

customers

globally with innovative solutions and services including:

|

Copyright 2012 JDA

Software Group, Inc. - CONFIDENTIAL

The Combined Company

27

A heritage of innovation

and global thought leadership

A global cloud delivery platform

More than 300 patents granted and pending

Capable of enabling thousands of

customers to operate

their mission

critical supply chain systems and

processes with faultless quality

|

The combined company

•

•

–

Supply chain planning

and execution

–

Labor management

–

Omni-channel commerce

capabilities

The Opportunities:

Omni-Channel Retailing

28

Poised to be the omni-channel

retail solutions leader

Uniquely positioned to deliver the

real solutions needed to make

omni-channel retiling a reality

including:

Copyright 2012 JDA Software Group, Inc. - CONFIDENTIAL

|

Copyright 2012 JDA

Software Group, Inc. - CONFIDENTIAL

The Opportunities: Retail

Supply Chain & Distribution

29

Combined retail footprint

and penetration in Tier 1 retailing

•

Best-in-class

•

Makes it a leading solution provider for retail distribution

Transportation, warehousing

and labor management

capabilities from one vendor, the combined company

will

be

a

compelling

logical

choice

for

retail

leaders |

Combined

•

The company is the gold standard in consumer products

supply chain planning and execution

•

The client roster is a who’s who of consumer products

manufacturers

The Opportunities:

Consumer Manufacturing

30

Innovative Solutions

30

Shelf Connected Cloud and Advanced Inventory

Shelf Connected Cloud and Advanced Inventory

Planning will provide continued opportunity to drive

Planning will provide continued opportunity to drive

best practices

best practices

Combined

Copyright 2012 JDA Software Group, Inc. - CONFIDENTIAL

|

Copyright 2012 JDA

Software Group, Inc. - CONFIDENTIAL

Fulfill the promise of

A TRUE DEMAND DRIVEN SUPPLY CHAIN

Profitably orchestrating tradeoffs between supply, demand and products

through best in class supply chain planning and execution solutions

Materials

Production

Shipping

Distribution

Retail

Consumer

The Opportunities: B2B

& Industrial Manufacturers

31 |

Copyright 2012 JDA

Software Group, Inc. - CONFIDENTIAL

32

Looking Forward |

Agenda

About JDA

About RedPrairie

The Combined Company Vision

Q&A

Copyright 2012 JDA Software Group, Inc. - CONFIDENTIAL

|