Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - STAAR SURGICAL CO | v327040_ex99-1.htm |

| 8-K - FORM 8-K - STAAR SURGICAL CO | v327040_8k.htm |

Q3 2012 RESULTS Q3 2012 RESULTS Investor Presentation Investor Presentation October 31, 2012 October 31, 2012

SAFE HARBOR SAFE HARBOR All statements in this presentation that are not statements of historical fact are forward-looking statements, including any projections of earnings, revenue, sales, profit margins, expenses, cash or other financial items, any statements of the plans, strategies, and objectives of management for future operations, or prospects for achieving such plans, including but not limited to, expectations for success of the ICL, nanoFLEX, KS-SP or other products in U.S. or international markets, any statements concerning proposed new products and government approval of new products or developments, or other future actions of the FDA or other regulators, the outcome of product research and development or any clinical study, any statements regarding future economic conditions or performance, the size of market opportunities statements of belief and any statements of assumptions underlying any of the foregoing. These statements are based on expectations and assumptions as of the date of this presentation and are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. The risks and uncertainties include our limited capital resources and limited access to financing, the broad discretion of the FDA and other regulators in approving any medical device and the inherent uncertainty that new devices will be approved, the likelihood of administrative delays, the risk that our global consolidation plans will not yield the expected savings in taxes or cost of goods or expose us to supply interruptions, the negative effect of global economic conditions on sales of products, especially products like the ICL used in non- reimbursed elective procedures, the challenge of managing our foreign subsidiaries, the risk that research and development efforts will not be successful or may be delayed in delivering for launch, the willingness of surgeons and patients to adopt a new product and procedure, and the potential effect of negative publicity about LASIK on the demand for refractive surgery in general in the U.S., and the other factors discussed under the heading “Risk Factors”in our Annual Report on Form 10-K filed with the SEC on August 7, 2012 and in today’s press release. STAAR assumes no obligation to update its forward-looking statements to reflect future events or actual outcomes and does not intend to do so. ®

AGENDA AGENDA Q3 Revenue Q3 Revenue Results Results Barry G. Caldwell Barry G. Caldwell 2012 Key Metric Review 2012 Key Metric Review Chief Executive Officer Chief Executive Officer Financial Review Financial Review Deborah Andrews Deborah Andrews Project Comet Update Project Comet Update Chief Financial Officer Chief Financial Officer Operational Updates Operational Updates Barry G. Caldwell Barry G. Caldwell Chief Executive Officer Chief Executive Officer Q&A Session Q&A Session Your Questions Your Questions ®

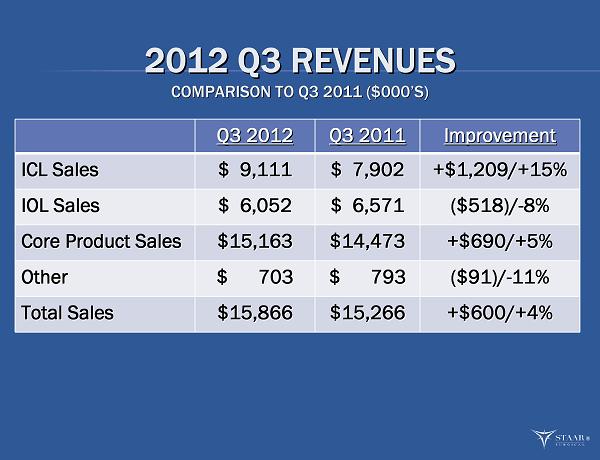

2012 Q3 REVENUES 2012 Q3 REVENUES COMPARISON TO Q3 2011 ($000 COMPARISON TO Q3 2011 ($000 ’ ’ S) S) Q3 2012 Q3 2012 Q3 2011 Q3 2011 Improvement Improvement ICL Sales ICL Sales $ 9,111 $ 9,111 $ 7,902 $ 7,902 +$1,209/+15% +$1,209/+15% IOL Sales IOL Sales $ 6,052 $ 6,052 $ 6,571 $ 6,571 ($518)/ ($518)/ - - 8% 8% Core Product Sales Core Product Sales $15,163 $15,163 $14,473 $14,473 +$690/+5% +$690/+5% Other Other $ 703 $ 703 $ 793 $ 793 ($91)/ ($91)/ - - 11% 11% Total Sales Total Sales $15,866 $15,866 $15,266 $15,266 +$600/+4% +$600/+4% ®

VISIAN ICL REVENUE GAINS VISIAN ICL REVENUE GAINS RECORD VISIAN ICL QUARTER RECORD VISIAN ICL QUARTER Milli Milli ons $ ons $ ®

TARGETED ICL MARKET RESULTS TARGETED ICL MARKET RESULTS Q3 RESULTS 2010 Q3 RESULTS 2010 - - 12 12 ® Overall growth of 17% in targeted markets. Overall growth of 17% in targeted markets. - - 15% 15% +52% +52% +11% +11% +56% +56% +72% +72% +24% +24% - - 7% 7% +4% +4% - - 8% 8% +64% +64% +17% +17%

CHINA ICL YOY REVENUE GROWTH RATE CHINA ICL YOY REVENUE GROWTH RATE 2010 2010 2011 2011 2012 2012 ®

TARGETED ICL MARKET RESULTS TARGETED ICL MARKET RESULTS Q3 RESULTS 2010 Q3 RESULTS 2010 - - 12 12 ® Overall growth of 17% in targeted markets. Overall growth of 17% in targeted markets. - - 15% 15% +52% +52% +11% +11% +56% +56% +72% +72% +24% +24% - - 7% 7% +4% +4% - - 8% 8% +64% +64% +17% +17%

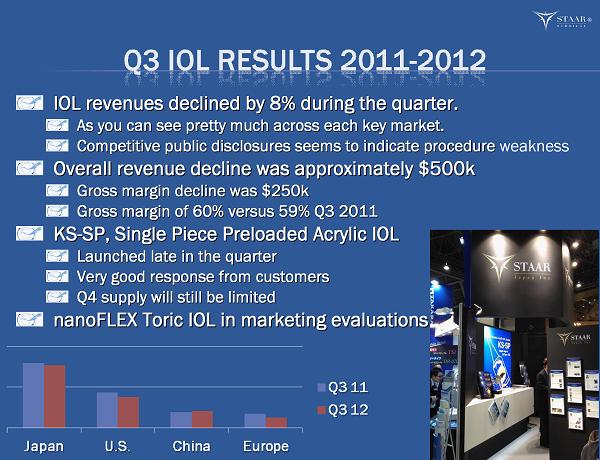

IOL revenues declined by 8% during the quarter. IOL revenues declined by 8% during the quarter. As you can see pretty much across each key market. As you can see pretty much across each key market. Competitive public disclosures seems to indicate procedure Competitive public disclosures seems to indicate procedure weakness Overall revenue decline was approximately $500k Overall revenue decline was approximately $500k Gross margin decline was $250k Gross margin decline was $250k Gross margin of 60% versus 59% Q3 2011 Gross margin of 60% versus 59% Q3 2011 KS KS - - SP, Single Piece Preloaded Acrylic IOL SP, Single Piece Preloaded Acrylic IOL Launched late in the quarter Launched late in the quarter Very good response from customers Very good response from customers Q4 supply will still be limited Q4 supply will still be limited nanoFLEX Toric IOL in marketing evaluations nanoFLEX Toric IOL in marketing evaluations ®

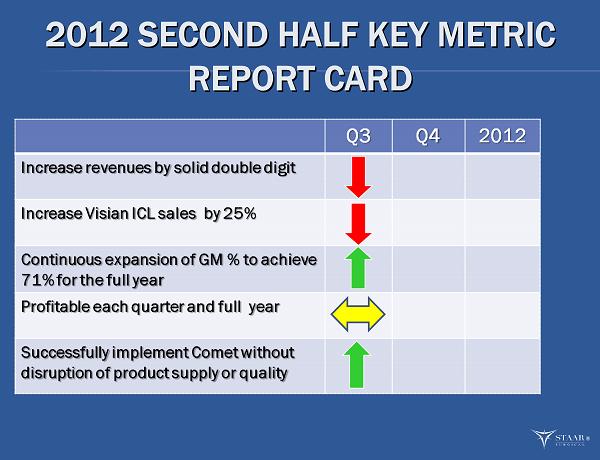

2012 SECOND HALF KEY METRIC 2012 SECOND HALF KEY METRIC REPORT CARD REPORT CARD ®

Deborah Andrews Deborah Andrews Chief Financial Officer Chief Financial Officer FINANCIAL REVIEW FINANCIAL REVIEW MANUFACTURING CONSOLIDATION UPDATE MANUFACTURING CONSOLIDATION UPDATE ®

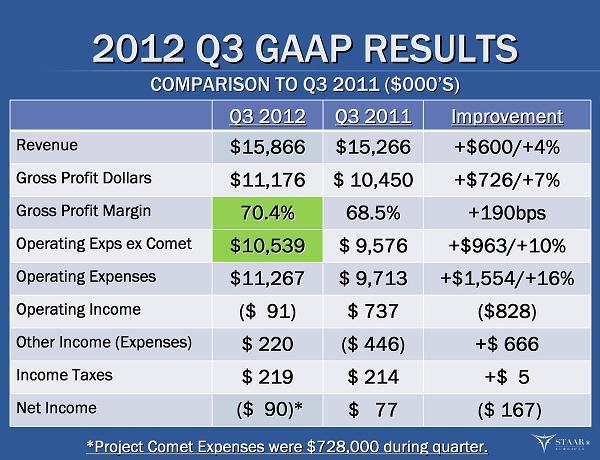

2012 Q3 GAAP RESULTS 2012 Q3 GAAP RESULTS COMPARISON TO Q3 2011 ($000 COMPARISON TO Q3 2011 ($000 ’ ’ S) S) Q3 2012 Q3 2012 Q3 2011 Q3 2011 Improvement Improvement Revenue Revenue $15,866 $15,866 $15,266 $15,266 +$600/+4% +$600/+4% Gross Profit Dollars Gross Profit Dollars $11,176 $11,176 $ 10,450 $ 10,450 +$726/+7% +$726/+7% Gross Profit Margin Gross Profit Margin 70.4% 70.4% 68.5% 68.5% +190bps +190bps Operating Exps ex Comet Operating Exps ex Comet $10,539 $10,539 $ 9,576 $ 9,576 +$963/+10% +$963/+10% Operating Expenses Operating Expenses $11,267 $11,267 $ 9,713 $ 9,713 +$1,554/+16% +$1,554/+16% Operating Income Operating Income ($ 91) ($ 91) $ 737 $ 737 ($828) ($828) Other Income (Expenses) Other Income (Expenses) $ 220 $ 220 ($ 446) ($ 446) +$ 666 +$ 666 Income Taxes Income Taxes $ 219 $ 219 $ 214 $ 214 +$ 5 +$ 5 Net Income Net Income ($ 90) ($ 90) * * $ 77 $ 77 ($ 167) ($ 167) ® * * Project Comet Expenses were $728,000 during quarter. Project Comet Expenses were $728,000 during quarter.

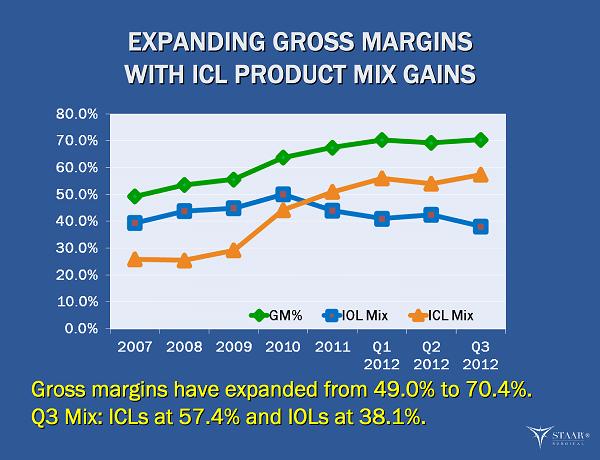

EXPANDING GROSS MARGINS EXPANDING GROSS MARGINS WITH ICL PRODUCT MIX GAINS WITH ICL PRODUCT MIX GAINS Gross margins have expanded from 49.0% to 70.4%. Gross margins have expanded from 49.0% to 70.4%. Q3 Mix: ICLs at 57.4% and IOLs at 38.1%. Q3 Mix: ICLs at 57.4% and IOLs at 38.1%. ®

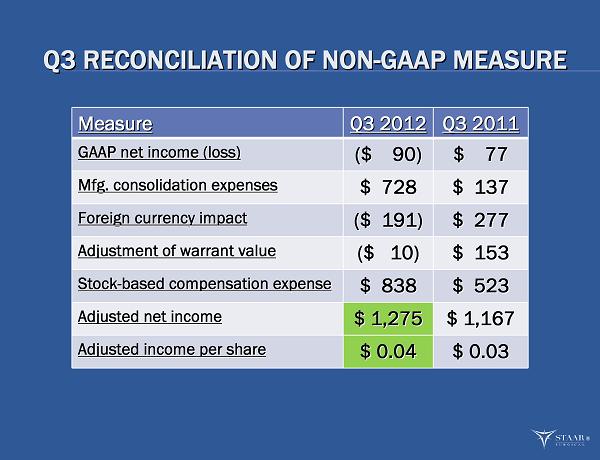

Q3 RECONCILIATION OF NON Q3 RECONCILIATION OF NON - - GAAP MEASURE GAAP MEASURE Measure Measure Q3 2012 Q3 2012 Q3 2011 Q3 2011 GAAP net income (loss) GAAP net income (loss) ($ 90) ($ 90) $ 77 $ 77 Mfg. consolidation expenses Mfg. consolidation expenses $ 728 $ 728 $ 137 $ 137 Foreign currency impact Foreign currency impact ($ 191) ($ 191) $ 277 $ 277 Adjustment of warrant value Adjustment of warrant value ($ 10) ($ 10) $ 153 $ 153 Stock Stock - - based compensation expense based compensation expense $ 838 $ 838 $ 523 $ 523 Adjusted net income Adjusted net income $ 1,275 $ 1,275 $ 1,167 $ 1,167 Adjusted income per share Adjusted income per share $ 0.04 $ 0.04 $ 0.03 $ 0.03 ®

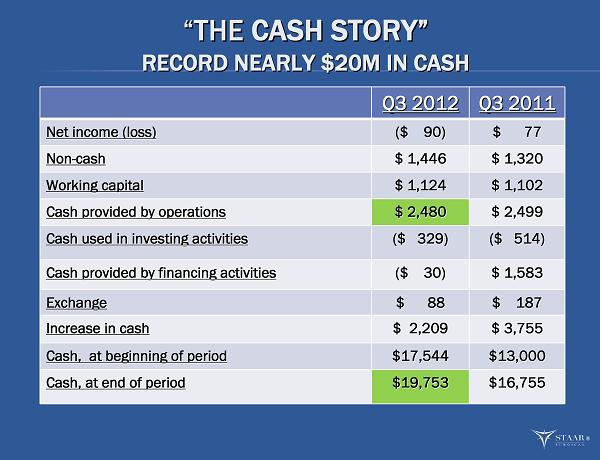

“ “ THE THE CASH STORY CASH STORY ” ” RECORD NEARLY $20M IN CASH RECORD NEARLY $20M IN CASH Q3 2012 Q3 2012 Q3 2011 Q3 2011 Net income (loss) Net income (loss) ($ 90) ($ 90) $ 77 $ 77 Non Non - - cash cash $ 1,446 $ 1,446 $ 1,320 $ 1,320 Working capital Working capital $ 1,124 $ 1,124 $ 1,102 $ 1,102 Cash provided by operations Cash provided by operations $ 2,480 $ 2,480 $ 2,499 $ 2,499 Cash used in investing activities Cash used in investing activities ($ 329) ($ 329) ($ 514) ($ 514) Cash provided by financing activities Cash provided by financing activities ($ 30) ($ 30) $ 1,583 $ 1,583 Exchange Exchange $ 88 $ 88 $ 187 $ 187 Increase in cash Increase in cash $ 2,209 $ 2,209 $ 3,755 $ 3,755 Cash, at beginning of period Cash, at beginning of period $17,544 $17,544 $13,000 $13,000 Cash, at end of period Cash, at end of period $19,753 $19,753 $16,755 $16,755 ®

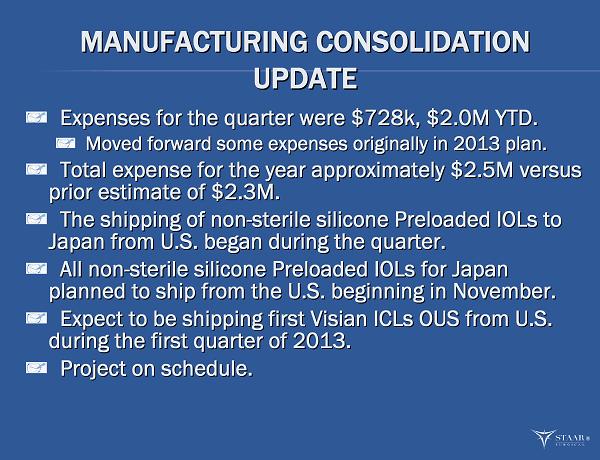

MANUFACTURING CONSOLIDATION MANUFACTURING CONSOLIDATION UPDATE UPDATE Expenses for the quarter were $728k, $2.0M YTD. Expenses for the quarter were $728k, $2.0M YTD. Moved forward some expenses originally in 2013 plan. Moved forward some expenses originally in 2013 plan. Total expense for the year approximately $2.5M versus Total expense for the year approximately $2.5M versus prior estimate of $2.3M. prior estimate of $2.3M. The shipping of non The shipping of non - - sterile silicone Preloaded IOLs to sterile silicone Preloaded IOLs to Japan from U.S. began during the quarter. Japan from U.S. began during the quarter. All non All non - - sterile silicone Preloaded IOLs for Japan sterile silicone Preloaded IOLs for Japan planned to ship from the U.S. beginning in November. planned to ship from the U.S. beginning in November. Expect to be shipping first Visian ICLs OUS from U.S. Expect to be shipping first Visian ICLs OUS from U.S. during the first quarter of 2013. during the first quarter of 2013. Project on schedule. Project on schedule. ®

Barry G. Caldwell Barry G. Caldwell Chief Executive Officer Chief Executive Officer OTHER KEY OPERATIONAL UPDATES OTHER KEY OPERATIONAL UPDATES ®

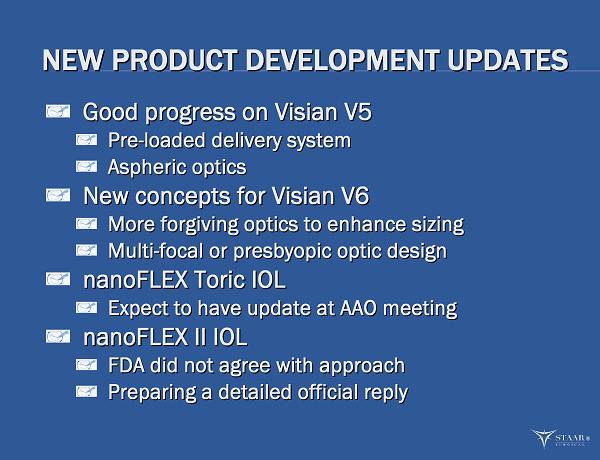

NEW PRODUCT DEVELOPMENT UPDATES NEW PRODUCT DEVELOPMENT UPDATES Good progress on Visian V5 Good progress on Visian V5 Pre Pre - - loaded delivery system loaded delivery system Aspheric optics Aspheric optics New concepts for Visian V6 New concepts for Visian V6 More forgiving optics to enhance sizing More forgiving optics to enhance sizing Multi Multi - - focal or presbyopic optic design focal or presbyopic optic design nanoFLEX Toric IOL nanoFLEX Toric IOL Expect to have update at AAO meeting Expect to have update at AAO meeting nanoFLEX II IOL nanoFLEX II IOL FDA did not agree with approach FDA did not agree with approach Preparing a detailed official reply Preparing a detailed official reply ®

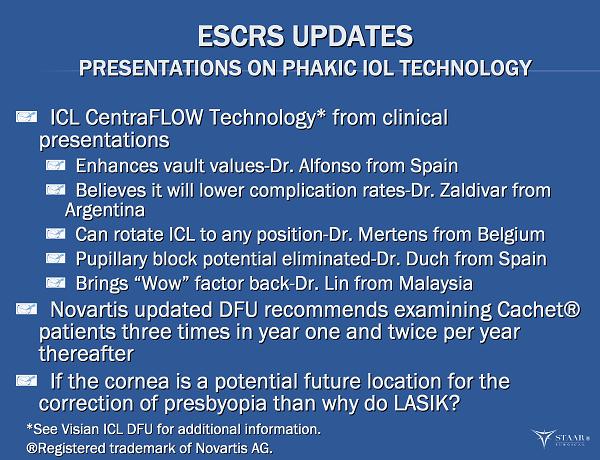

ESCRS UPDATES ESCRS UPDATES PRESENTATIONS ON PHAKIC IOL TECHNOLOGY PRESENTATIONS ON PHAKIC IOL TECHNOLOGY ICL ICL CentraFLOW CentraFLOW Technology Technology * * from clinical from clinical presentations presentations Enhances vault values Enhances vault values - - Dr. Alfonso from Spain Dr. Alfonso from Spain Believes it will lower complication rates Believes it will lower complication rates - - Dr. Dr. Zaldivar Zaldivar from from Argentina Argentina Can rotate ICL to any position Can rotate ICL to any position - - Dr. Dr. Mertens Mertens from Belgium from Belgium Pupillary Pupillary block potential eliminated block potential eliminated - - Dr. Dr. Duch Duch from Spain from Spain Brings Brings “ “ Wow Wow ” ” factor back factor back - - Dr. Lin from Malaysia Dr. Lin from Malaysia Novartis updated DFU recommends examining Cachet Novartis updated DFU recommends examining Cachet ® ® patients three times in year one and twice per year patients three times in year one and twice per year thereafter thereafter If the cornea is a potential future location for the If the cornea is a potential future location for the correction of correction of presbyopia presbyopia than why do LASIK? than why do LASIK? * * See See Visian Visian ICL DFU for additional information. ICL DFU for additional information. ® ® Registered trademark of Novartis AG. Registered trademark of Novartis AG. ®

ORGANIZATIONAL UPDATES ORGANIZATIONAL UPDATES Hired 14 new sales and marketing personnel Hired 14 new sales and marketing personnel Plan to hire 3 additional before year Plan to hire 3 additional before year - - end end New Business Development position New Business Development position Allows a focused approach to outside opportunities Allows a focused approach to outside opportunities V.P. of R&D & Regulatory appointment V.P. of R&D & Regulatory appointment Designed to get new products to market more quickly Designed to get new products to market more quickly V.P. of Global Marketing appointment V.P. of Global Marketing appointment Experienced ophthalmic executive bringing fresh Experienced ophthalmic executive bringing fresh approach to global marketing approach to global marketing ®

THANK YOU! THANK YOU! YOUR QUESTIONS PLEASE YOUR QUESTIONS PLEASE ®