Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - JDA SOFTWARE GROUP INC | d428841d8k.htm |

| EX-99.1 - PRESS RELEASE ISSUED BY THE COMPANY - JDA SOFTWARE GROUP INC | d428841dex991.htm |

Q3

2012 Earnings Conference Call NASDAQ: JDAS

November 1, 2012

Exhibit 99.2 |

Copyright 2011 JDA Software Group, Inc. -

CONFIDENTIAL

Forward Looking Statements

Forward-Looking Statements

Except for historical information, this presentation contains forward-looking

statements which include words such as “believe”,

“anticipate” and “expect.”

These forward-looking statements

involve risks and uncertainties that may cause our actual results to differ materially

from those expressed or implied by these statements. Factors that may

affect our results are

summarized in our annual report on Form 10-K filed on August 6, 2012 as well as

our subsequent quarterly reports on Form 10-Q. JDA assumes no obligation

and does not intend to update forward-looking statements made in this

presentation. Non-GAAP Information

A non-GAAP reconciliation of information and definitions of terms such

as “Adjusted

EBITDA”, “Adjusted Non-GAAP EPS”, and other non-GAAP financial

measures contained in this presentation can be found in the appendix of this

presentation. |

Copyright 2011 JDA Software Group, Inc. -

CONFIDENTIAL

Q3 2012 Highlights

•

Revenue of $164.5 million

–

Software and Subscription revenue of $31.5 million

•

Closed 37 software deals, 6 deals in excess of $1 million

–

Maintenance revenue increased 2% versus prior year with strong retention rates

–

Consulting services revenue of $64.3 million

•

Earnings and margins

–

Adjusted EBITDA of $44.5 million

–

Adjusted EBITDA margin of 27%

–

Adjusted non-GAAP EPS of $0.53

•

Excellent cash flow

–

Cash flow from operations

1

of $40 million

–

Free cash flow

1

of $36 million

–

$412 million cash balance

2

; $138 million net cash

Notes:

1.

Includes the impact of the revenue recognition investigation and restatement costs

of $1.7 million in Q3’12 2.

Equals cash and cash equivalents plus restricted cash

|

Copyright 2011 JDA Software Group, Inc. -

CONFIDENTIAL

YTD September 30, 2012 Highlights

•

Revenue of $495 million

–

Closed152 software deals (24 in excess of $1 million) versus 172

deals (29 in excess of $1

million) in the year ago period

–

Maintenance retention rates remain strong with a 95.3% retention

rate

–

Consulting services revenue increased 1% versus prior year

•

Earnings and margins

–

Adjusted EBITDA of $128 million

–

Adjusted EBITDA margin of 26%

–

Adjusted non-GAAP EPS of $1.51

•

Excellent cash flow

–

Cash

flow

from

operations

1

of

$118

million

–

Free

cash

flow

1

of

$109

million

–

$412

million

cash

balance

2

;

$138

million

net

cash

1. Includes the impact of the revenue recognition investigation and restatement costs of $5.2 million,

$5.5 million and $1.7 million in Q1’12, Q2’12 and Q3’12, respectively

2. Equals cash and cash equivalents plus restricted cash Notes:

|

Copyright 2011 JDA Software Group, Inc. -

CONFIDENTIAL

Q3 Results

Notes:

1.

Includes

the

impact

of

the

revenue

recognition

investigation

and

restatement

costs

of

$5.5

million

and

$1.7

million

in

Q2’12

and

Q3’12,

respectively

2.

Equals cash and cash equivalents plus restricted cash

3.

Amounts may not add due to rounding

($'s in millions, except per share data)

Revenues

Q3

2011

Q2

2012

Q3

2012

Y/Y

Growth

Seq

Growth

Software & Subscriptions

38.5

$

35.8

$

31.5

$

-18%

-12%

Maintenance

67.6

66.8

68.8

2%

3%

Total Product Revenue

106.1

102.6

100.2

-6%

-2%

Services

67.0

66.1

64.3

-4%

-3%

Total Revenue

173.1

$

168.8

$

164.5

$

-5%

-3%

Performance

Metrics

Adjusted EBITDA

52.9

$

44.2

$

44.5

$

-16%

1%

% of Revenue

31%

26%

27%

-4%

1%

Adjusted Non-GAAP EPS

0.67

$

0.54

$

0.53

$

-21%

-2%

Operating

Cash

Flow

1

36.9

$

28.9

$

40.4

$

9%

40%

Free

Cash

Flow

1

34.1

$

27.0

$

36.4

$

7%

35%

Cash

Balance

2

326.8

$

366.4

$

411.7

$

26%

12% |

Copyright 2011 JDA Software Group, Inc. -

CONFIDENTIAL

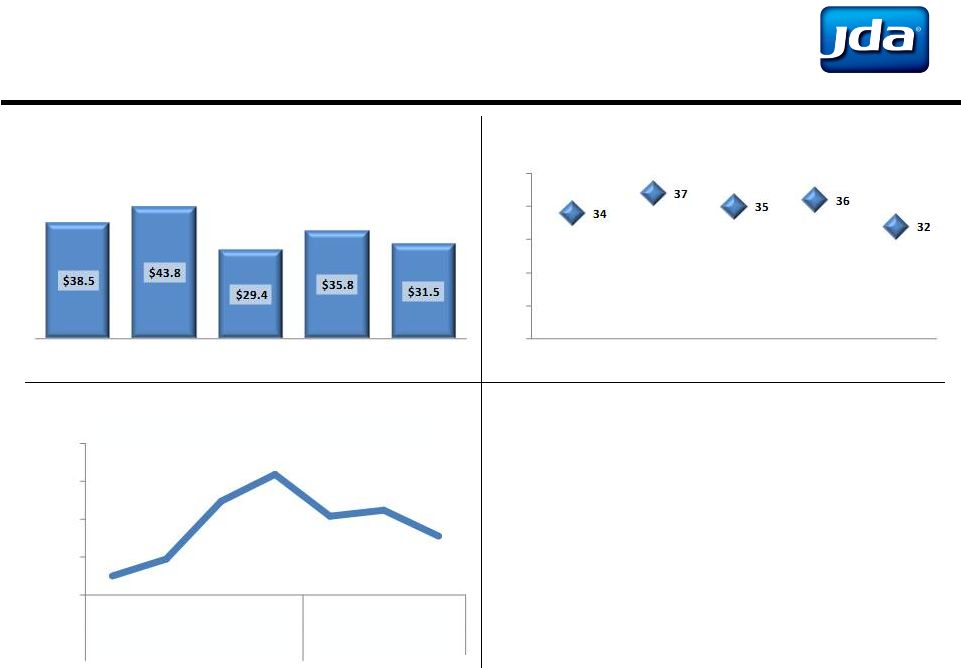

•

Closed 6 large (>$1 million) software deals

in Q3 compared to 10 in Q3 2011

•

Average sales price was $724,000

Software Sales

Notes:

1.Trailing-twelve months

2.Total software revenue includes both license and subscription revenue

3.

Large deals include deals greater than $1 million

Q3'11

Q4'11

Q1'12

Q2'12

Q3'12

2

($ in millions)

15

20

25

30

35

40

Q3'11

Q4'11

Q1'12

Q2'12

Q3'12

Large Deals

3

(TTM

1

)

$125

$135

$145

$155

$165

Q1

Q2

Q3

Q4

Q1

Q2

Q3

2011

2012

TTM

1

Total Software Revenue

($ in millions)

Total Software Revenue

2 |

Copyright 2011 JDA Software Group, Inc. -

CONFIDENTIAL

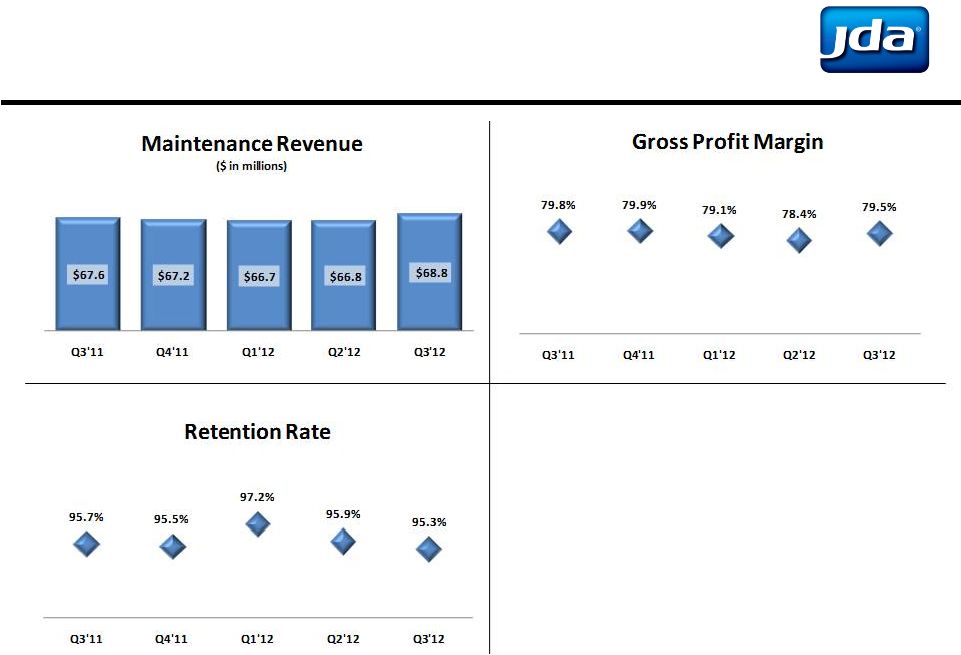

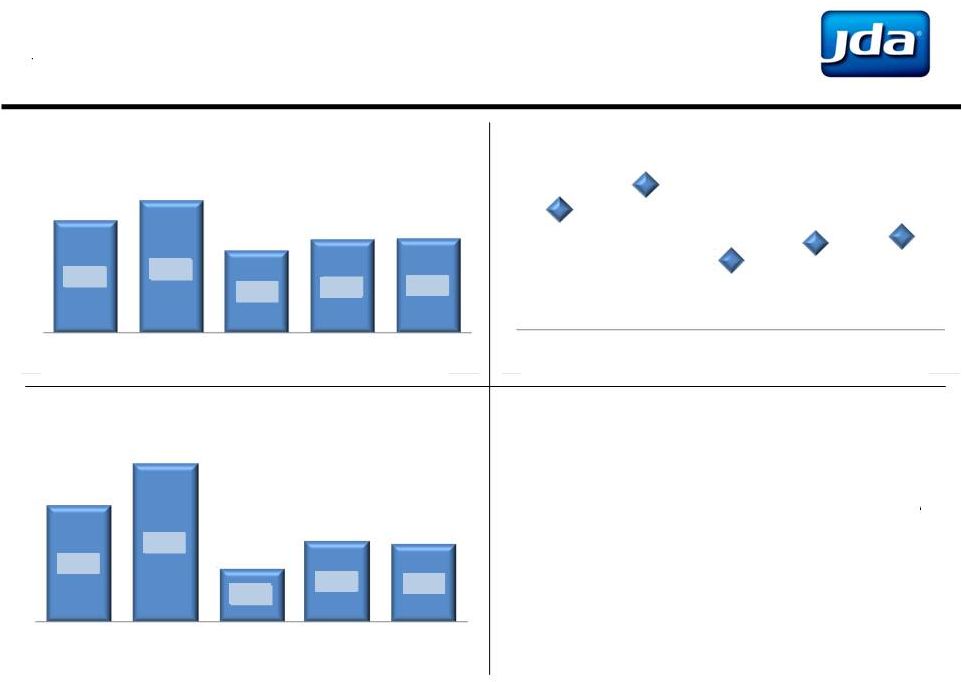

Improving Maintenance Performance

•

Consistent, predictable source of

revenue and cash flow

•

Continued strong maintenance

retention rate

•

Excellent gross profit margins |

Copyright 2011 JDA Software Group, Inc. -

CONFIDENTIAL

Steady Services Performance

•

Strong margins on substantial revenue

$67.0

$74.1

$66.0

$66.1

$64.3

Q3'11

Q4'11

Q1'12

Q2'12

Q3'12

Services Revenue

($ in millions)

24.6%

33.7%

22.1%

21.6%

20.8%

Q3'11

Q4'11

Q1'12

Q2'12

Q3'12

Gross Profit Margin |

Copyright 2011 JDA Software Group, Inc. -

CONFIDENTIAL

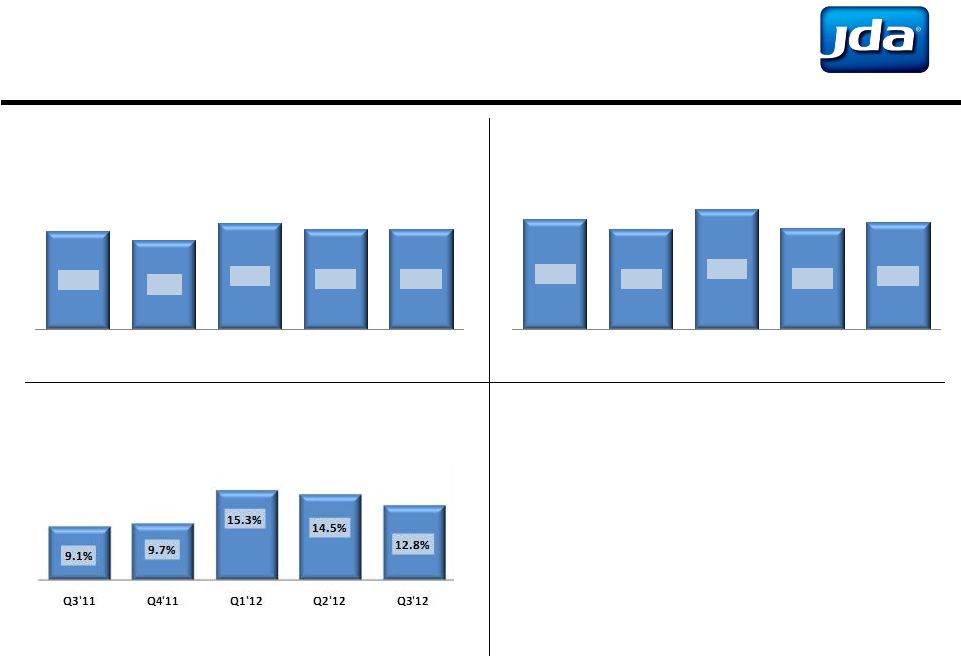

Operational Excellence

•

Proven consistency in operating

cost discipline

•

G&A costs include $5.2 million of

revenue recognition investigation and

restatement costs in Q1 2012, $5.5

million in Q2 2012, and $1.7 million in

Q3 2012

10.8%

9.9%

11.8%

11.1%

11.1%

Q3'11

Q4'11

Q1'12

Q2'12

Q3'12

Product Development

(As % Total Revenue)

14.9%

14.5%

15.3%

14.5%

14.7%

Q3'11

Q4'11

Q1'12

Q2'12

Q3'12

Sales and Marketing

(As % Total Revenue)

General & Administrative

(As % Total Revenue) |

Strong

EBITDA & EPS Performance •

Sequential EBITDA and EBITDA Margin

growth

$52.9

$62.6

$38.9

$44.2

$44.5

Q3'11

Q4'11

Q1'12

Q2'12

Q3'12

Adjusted EBITDA

($ in millions)

30.6%

33.8%

24.0%

26.2%

27.1%

Q3'11

Q4'11

Q1'12

Q2'12

Q3'12

Adjusted EBITDA Margin

$0.67

$0.82

$0.44

$0.54

$0.53

Adjusted Non-

GAAP Diluted EPS

Copyright 2011 JDA Software Group, Inc. -

CONFIDENTIAL

Q3'11

Q4'11

Q1'12

Q2'12

Q3'12 |

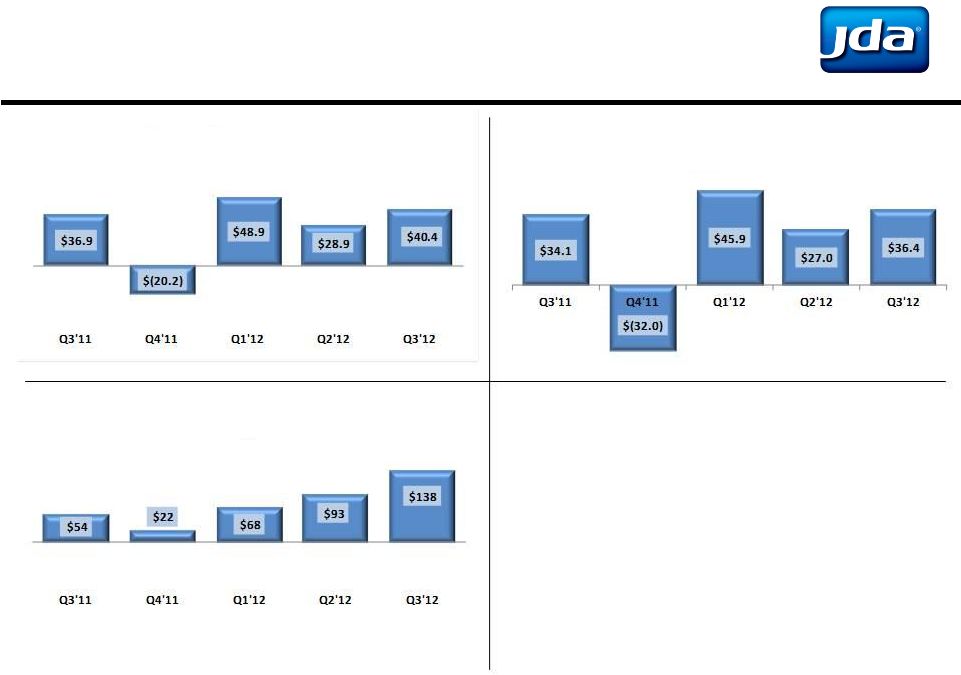

Robust

Cash Flow •

Cash balance of $412 million

•

Strong, expanding cash flow

Copyright 2011 JDA Software Group, Inc. -

CONFIDENTIAL

Operating Cash Flow

1

($ in millions)

Free Cash Flow

1

($ in millions)

Net Cash

2

($ in millions)

Q4’11 includes the net cash payment of $54.0 million for the Dillard’s

litigation settlement; Q1’12 , Q2’12 and Q3’12 include the

impact of the revenue recognition investigation and restatement costs of

$5.2 million, $5.5 million, and $1.7 million respectively

Net cash equals cash and cash equivalents plus restricted cash less total

debt. Net cash includes the impact of the Dillard’s litigation

settlement and revenue recognition investigation and restatement

costs Notes:

1.

2. |

Copyright 2011 JDA Software Group, Inc. -

CONFIDENTIAL

2012 Q3 Highlights

•

Continued strength in maintenance

•

Operating cost containment

•

Excellent cash flow

•

$412 million of cash on hand

•

Enhanced focus on shareholder value |

APPENDIX |

Copyright 2011 JDA Software Group, Inc. -

CONFIDENTIAL

Non-GAAP Reconciliations¹

Actual Results

Notes:

1. Amounts may not add due to rounding

($'s in millions, except per share data)

Q3 2011

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Net Income

18.3

$

3.6

$

4.7

$

10.6

$

11.1

$

Income tax provision (benefit)

11.4

(1.4)

2.8

6.3

7.4

Interest expense & amortization of loan fees

6.4

6.4

6.4

6.5

6.6

Amortization of acquired software technology

1.7

1.7

1.7

1.7

1.7

Amortization of intangibles

9.6

9.5

9.5

9.5

9.5

Depreciation

3.2

3.3

3.7

3.8

3.8

EBITDA

50.7

$

23.2

$

28.8

$

38.5

$

40.1

$

Restructuring charges

0.8

0.6

2.2

0.2

(0.2)

Stock-based compensation

2.1

0.9

2.9

1.7

4.2

Litigation provision and settlements, net

-

39.0

-

-

-

Investigation and restatement costs

-

-

5.2

5.5

1.7

Interest income and other non-operating income, net

(0.6)

(1.2)

(0.3)

(1.6)

(1.3)

Adjusted EBITDA

52.9

$

62.6

$

38.9

$

44.2

$

44.5

$

Income Before Taxes

29.7

$

2.2

$

7.5

$

16.9

$

18.5

$

Amortization of acquired software technology

1.7

1.7

1.7

1.7

1.7

Amortization of intangibles

9.6

9.5

9.5

9.5

9.5

Restructuring charges

0.8

0.6

2.2

0.2

(0.2)

Stock-based compensation

2.1

0.9

2.9

1.7

4.2

Litigation provision and settlements, net

-

39.0

-

-

-

Investigation and restatement costs

-

-

5.2

5.5

1.7

Adjusted Income Before Income Taxes

43.9

$

54.0

$

29.1

$

35.5

$

35.4

$

Adjusted Income Tax Expense

(15.4)

(18.9)

(10.2)

(12.4)

(12.4)

Adjusted Net Income

28.5

$

35.1

$

18.9

$

23.1

$

23.0

$

Adjusted Non-GAAP Diluted EPS

0.67

$

0.82

$

0.44

$

0.54

$

0.53

$ |