Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CAMDEN NATIONAL CORP | v326893_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - CAMDEN NATIONAL CORP | v326893_ex99-1.htm |

Third Quarter Report -2012CamdenNational.com800-860-8821Dear Fellow Shareholders,By the time you receive this letter, Camden National Corporation will have completed the acquisition of 15 branches from Bank of America, which was announced on April 24, 2012. Since that time, the employees of Camden National have dedicated themselves to fulfilling two important objectives: successfully executing the branch acquisition and maintaining Camden National’s top-tier financial performance. I’m pleased to report that we have met these two objectives, which positions our Company for continued success in an increasingly challenging period.In our view, the three most important challenges that the financial services industry is facing today are: keeping pace with new technologies to better serve customers; delivering strong financial results despite historically low interest rates; and meeting the demands of the evolving regulatory environment. Camden National is uniquely positioned to address these three challenges, as well as the many other challenges facing our industry, by leveraging our current franchise with our expanding footprint in Maine.Adopting new technologies to better serve our customers is exciting; we’re proud of the recent advancements in our web and mobile banking products and look forward to introducing more new features in the future. Camden National is a unique community organization in that we are large enough to have the talent and expertise to keep pace with the changing demands of some customers, while also small enough to provide the local touch other customers enjoy today. Expanding our customer base enables us to deliver new products and technology, such as Smart ATMs and our enhanced web and mobile services, to those customers who want them while at the same time supporting and strengthening our traditional branch franchise.The second major challenge facing our industry is the impact of the historically low interest rate environment, which is expected to continue for several more quarters. This has negatively impacted all banking organizations. As higher yielding loans and investments have been paid off or refinanced and replaced with new loans and investments at today’s lower interest rates, funding yields have declined at a slower pace, resulting in “margin compression.” The yields on the deposits acquired through the Bank of America branches are actually more favorable than those on existing Camden National Bank deposits, which provides an additional source of stability for the Company.The third major challenge facing our industry is the rapidly evolving and expanding regulatory environment. The implementation of various regulations of the Dodd-Frank Act has imposed additional compliance expense throughout the industry, and Camden National is no exception. We have expanded our staff to include more compliance and risk management personnel, and have incurred additional expenses to meet these requirements. Even more significant is the recent proposal by the Federal Reserve to have most U.S. banks adhere to the international Basel III capital requirements. If adopted, increased capital requirements will limit our ability to make loans and decrease the flexibility of our capital management policies.From a regulatory perspective, we support and recognize the need for continued industry review and improvement in various regulations, as the financial system is very complex. However, we also believe that such regulations should recognize the vast differences between extremely large international banks and local community banks such as Camden National.Meeting these challenges requires us to continue to differentiate ourselves as local decision makers and trusted partners to our customers and prospective customers. Doing so allows our organization to achieve top-tier financial performance, which we define as being in the top 25% of our peer group of mid-size banking organizations. Based on prior quarter comparative information, we believe our third quarter 2012 financial performance meets that objective.During the third quarter of 2012, Camden National Corporation earned $6.3 million, or $0.82 earnings per diluted share (“EPS”), compared to $6.4 million, or $0.83 EPS, in the second quarter of 2012 and $6.9 million, or $0.90 EPS, in the third quarter of 2011. We recorded approximately $396,000 and $308,000 of non-recurring expenses related to the acquisition in the third and second quarters of 2012, respectively. The third quarter of 2011 included $550,000 of non-recurring income resulting from proceeds from a bank-owned life insurance policy.Our performance ratios remain favorable to our peer group but are below our historic levels, which reflects the impact of the low interest rate environment. During the third quarter of 2012, return on average assets was 1.03% and return on average equity was 10.90%, compared to 1.19% and 12.44%, respectively, reported during the third quarter of 2011. Our net interest margin, which represents the difference between income received on earning assets and the expense of deposits and other funding sources as a percentage of average earning assets, was 3.30% during the third quarter of 2012, compared to 3.51% during the third quarter of 2011.Asset quality for the third quarter was stable, with a 12% reduction in non-performing assets from the previous quarter. At September 30, 2012, non- performing assets were $26.3 million, or 1.06% of total loans, compared to $29.7 million, or 1.24% of total loans, at June 30, 2012. Annualized net charge offs increased to 0.33% from 0.15% in the second quarter of 2012, reflecting two large consumer related charge offs.Our capital levels remain strong as indicated by a total risk based capital ratio of 16.39% at September 30, 2012, which is well above the current Federal Reserve requirement of 10.0% in order to be considered “well capitalized.” The tangible capital to tangible asset ratio was 7.86% at September 30, 2012, compared to 7.67% at September 30, 2011.During the third quarter, the board of directors approved a $0.25 dividend per common share and renewed the Company’s annual common stock repurchase program. We strive to manage capital based on a variety of factors, including our economic outlook and the regulatory environment. Our goal is to balance the needs of all shareholders while at the same time positioning the Company to meet regulatory requirements and making strategic investments for the long-term benefit of the Company.Over the past several months, many employees of the Company have worked long hours and weekends in order to meet our objectives of successfully executing the branch acquisition while at the same time maintaining our top-tier financial performance. Their focus has been and continues to be providing excellent service to our current and future customers, as well as supporting the owners of our Company, our shareholders. Their dedication is simply remarkable. I encourage all shareholders to experience Camden National, as a customer of Camden National Bank, Acadia Trust, or Camden Financial Consultants. Our organization, which consists of over 500 employees, serves our customers at 50 locations, 62 ATMs, a Customer Assistance Center, and worldwide through the web and mobile devices. Camden National is a comprehensive community bank that we all are proud to be a part of.Thank you for your support.PresidentandChiefExecutiveOfficer Karen W. Stanley, Chairman Gregory A. Dufour John W. Holmes John M. RohmanBoard ofAnn W. Bresnahan David C. Flanagan Rendle A. Jones, Esq. Robin A. Sawyer, CPADirectorsRobert J. Campbell Craig S. Gunderson James H. Page, Ph.D.Assets: $2.5 Billion Locations: 50 Employees: 542 NASDAQ® Ticker: CAC

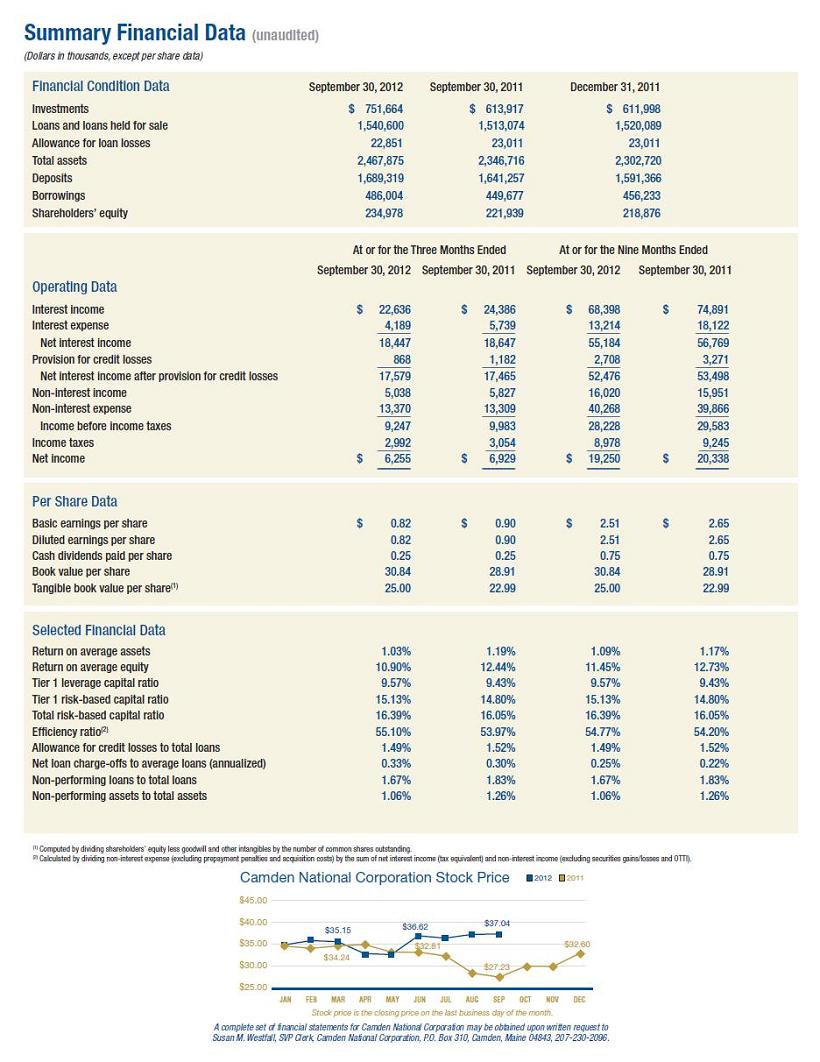

Summary Financial Data (unaudited)(Dollars in thousands, except per share data)Financial Condition Data September 30, 2012 September 30, 2011 December 31, 2011 Investments $ 751,664 $ 613,917 $ 611,998 Loans and loans held for sale 1,540,600 1,513,074 1,520,089 Allowance for loan losses 22,851 23,011 23,011 Total assets 2,467,875 2,346,716 2,302,720 Deposits 1,689,319 1,641,257 1,591,366 Borrowings 486,004 449,677 456,233 Shareholders’ equity 234,978 221,939 218,876At or for the Three Months Ended At or for the Nine Months Ended September 30, 2012 September 30, 2011 September 30, 2012 September 30, 2011 Operating Data Interest income $ 22,636 $ 24,386 $ 68,398 $ 74,891 Interest expense 4,189 ---------------------------------------- 5,739 ---------------------------------------- 13,214 ---------------------------------------- 18,122 ---------------------------------------- Net interest income 18,447 18,647 55,184 56,769 Provision for credit losses 868 1,182 2,708 3,271 ---------------------------------------- ---------------------------------------- ---------------------------------------- ---------------------------------------- Net interest income after provision for credit losses 17,579 17,465 52,476 53,498 Non-interest income 5,038 5,827 16,020 15,951 Non-interest expense 13,370 ---------------------------------------- 13,309 ---------------------------------------- 40,268 ---------------------------------------- 39,866 ---------------------------------------- Income before income taxes 9,247 9,983 28,228 29,583 Income taxes 2,992 3,054 8,978 9,245 ---------------------------------------- ------------------------------------ ---------------------------------------- ------------------------------------ Net income $ 6,255 $ 6,929 $ 19,250 $ 20,338 ---------------------------------------- ---------------------------------------- ---------------------------------------- ---------------------------------------- ---------------------------------------- ---------------------------------------- ---------------------------------------- ----------------------------------------Per Share DataBasic earnings per share $ 0.82 $ 0.90 $ 2.51 $ 2.65 Diluted earnings per share 0.82 0.90 2.51 2.65 Cash dividends paid per share 0.25 0.25 0.75 0.75 Book value per share 30.84 28.91 30.84 28.91 Tangible book value per share(1) 25.00 22.99 25.00 22.99Selected Financial Data Return on average assets 1.03% 1.19% 1.09% 1.17% Return on average equity 10.90% 12.44% 11.45% 12.73% Tier 1 leverage capital ratio 9.57% 9.43% 9.57% 9.43% Tier 1 risk-based capital ratio 15.13% 14.80% 15.13% 14.80% Total risk-based capital ratio 16.39% 16.05% 16.39% 16.05% Efficiency ratio(2) 55.10% 53.97% 54.77% 54.20% Allowance for credit losses to total loans 1.49% 1.52% 1.49% 1.52% Net loan charge-offs to average loans (annualized) 0.33% 0.30% 0.25% 0.22% Non-performing loans to total loans 1.67% 1.83% 1.67% 1.83% Non-performing assets to total assets 1.06% 1.26% 1.06% 1.26%(1) Computed by dividing shareholders’ equity less goodwill and other intangibles by the number of common shares outstanding. (2) Calculated by dividing non-interest expense (excluding prepayment penalties and acquisition costs) by the sum of net interest income (tax equivalent) and non-interest income (excluding securities gains/losses and OTTI). 20122011Camden National Corporation Stock Price$45.00$40.00 $37.04$36.62$35.00 $30.00$35.15 $34.24 $32.81 $27.23 $32.60 $25.00JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DECStock price is the closing price on the last business day of the month.A complete set of financial statements for Camden National Corporation may be obtained upon written request to Susan M. Westfall, SVP Clerk, Camden National Corporation, P.O. Box 310, Camden, Maine 04843, 207-230-2096.