Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PACIFIC CONTINENTAL CORP | d425845d8k.htm |

| EX-99.1 - PRESS RELEASE - PACIFIC CONTINENTAL CORP | d425845dex991.htm |

Exhibit 99.2

Acquisition of Century Bank

October 23, 2012

This release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). Such forward-looking statements include but are not limited to statements about the benefits of the business combination transaction involving Pacific Continental and Century Bank, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions, and other statements that are not historical facts. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those projected, including but not limited to the following: the possibility that the merger does not close when expected or at all because required regulatory, shareholder or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all; the risk that the benefits from the transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which PCBK and Century Bank operate; the ability to promptly and effectively integrate the businesses of Pacific Continental Bank and Century Bank; the reaction to the transaction of the companies’ customers, employees, and counterparties; and the diversion of management time on merger-related issues. Readers are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date on which they are made and reflect management’s current estimates, projections, expectations and beliefs. Pacific Continental Corporation undertakes no obligation to publicly revise or update the forward-looking statements to reflect events or circumstances that arise after the date of this release. This statement is included for the express purpose of invoking PSLRA’s safe harbor provisions.

Transaction Details

| Purchase Price | $13.4 million (including options and warrants) | |

| $13.13 per share for common shareholders | ||

| Consideration Mix | 100% cash | |

| Required Approvals | Customary regulatory approvals and approval of Century Bank shareholders | |

| Due Diligence | Comprehensive due diligence completed, including preliminary 3rd party fair value assessment of the loan portfolio | |

| Anticipated Closing | Q1 2013 | |

Overview of Valuation and Deal Assumptions (as of 9/30/2012)

| Price / Tangible Book Value | 109.2% | |

| Price / Earnings (Last Twelve Months) | 11.5x | |

| Core Deposit Premium | 1.70% | |

| Fair Value Adjustment on Loan Portfolio (Preliminary Estimate) | 6.00% | |

| One-Time Deal Costs (Preliminary Estimate) | $2.3 million | |

| EPS Impact | Immediately accretive (excluding one-time deal costs) | |

| Tangible Book Value Per Share Impact | Less than 3.00% dilution | |

| Internal Rate of Return | Greater than 15.00% | |

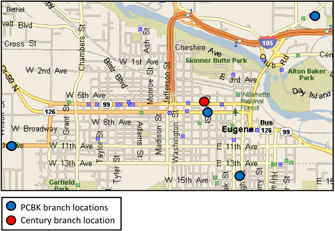

| • | PCBK management knows Century Bank’s niche markets well. |

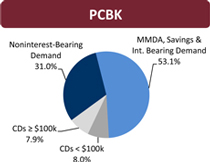

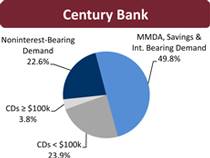

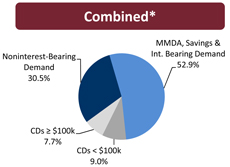

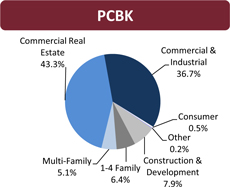

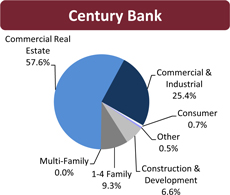

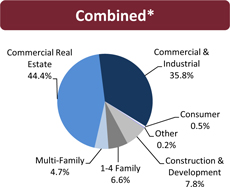

| • | Attractive core deposit base and loan portfolio focused on C&I and CRE. |

| • | Compelling deal economics and conservative modeling assumptions. |

| • | Significant cost savings opportunity from redundant overhead expenses. |

| • | Strategic acquisition which furthers PCBK’s capital deployment strategy. |

| • | PCBK will continue to evaluate acquisition opportunities which are a strategic fit and which make financial sense. |