Attached files

| file | filename |

|---|---|

| 8-K - BODY OF 8K - PARKER HANNIFIN CORP | a8k1qfy13.htm |

| EX-99.1 - PRESS RELEASE AND TABLES - PARKER HANNIFIN CORP | exhibit991.htm |

1st Quarter FY2013 Earnings Release Parker Hannifin Corporation October 19, 2012 Exhibit 99.2

Forward-Looking Statements Forward-looking statements contained in this and other written and oral reports are made based on known events and circumstances at the time of release, and as such, are subject in the future to unforeseen uncertainties and risks. All statements regarding future performance, earnings projections, events or developments are forward-looking statements. It is possible that the future performance and earnings projections of the company, including its individual segments, may differ materially from current expectations, depending on economic conditions within its mobile, industrial and aerospace markets, and the company's ability to maintain and achieve anticipated benefits associated with announced realignment activities, strategic initiatives to improve operating margins, actions taken to combat the effects of the current economic environment, and growth, innovation and global diversification initiatives. A change in the economic conditions in individual markets may have a particularly volatile effect on segment performance. Among other factors which may affect future performance are: changes in business relationships with and purchases by or from major customers, suppliers or distributors, including delays or cancellations in shipments, disputes regarding contract terms or significant changes in financial condition, changes in contract cost and revenue estimates for new development programs and changes in product mix; ability to identify acceptable strategic acquisition targets; uncertainties surrounding timing, successful completion or integration of acquisitions; ability to realize anticipated cost savings from business realignment activities; threats associated with and efforts to combat terrorism; uncertainties surrounding the ultimate resolution of outstanding legal proceedings, including the outcome of any appeals; competitive market conditions and resulting effects on sales and pricing; increases in raw material costs that cannot be recovered in product pricing; the company’s ability to manage costs related to insurance and employee retirement and health care benefits; and global economic factors, including manufacturing activity, air travel trends, currency exchange rates, difficulties entering new markets and general economic conditions such as inflation, deflation, interest rates and credit availability. The company makes these statements as of the date of this disclosure, and undertakes no obligation to update them unless otherwise required by law. 2

Non-GAAP Financial Measures This presentation reconciles sales amounts reported in accordance with U.S. GAAP to sales amounts adjusted to remove the effects of acquisitions made within the prior four quarters and the effects of currency exchange rates. This presentation also reconciles cash flow from operating activities as a percent of sales in accordance with U.S. GAAP to cash flow from operating activities as a percent of sales without the effect of a discretionary pension plan contribution. The effects of acquisitions, currency exchange rates and the discretionary pension plan contribution are removed to allow investors and the company to meaningfully evaluate changes in sales and cash flow from operating activities as a percent of sales on a comparable basis from period to period. 3

Agenda 4 • CEO 1st Quarter FY2013 Highlights • Key Performance Measures & Outlook • CEO Closing Comments • Questions and Answers

Highlights 1st Quarter FY2013 • Sales • Industrial North American strength offset Industrial International softness • Total annual sales of $243m acquired in Q1 • Operating Margins • Achieved operating margins of 14.4% despite headwinds 5

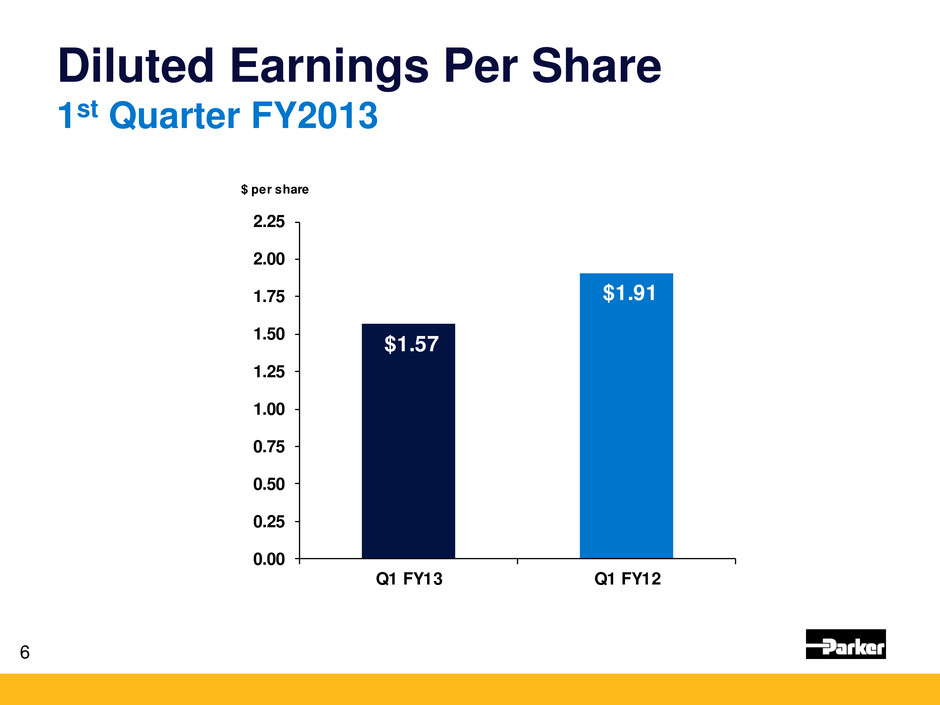

Diluted Earnings Per Share 1st Quarter FY2013 6 $1.57 $1.91 0.00 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 2.25 Q1 FY13 Q1 FY12 $ per share

Influences on Earnings 1st Quarter FY2013 Diluted Earnings Per Share of $1.57 at the low end of guidance • Industrial International • Integration & Acquisition Related Costs • Aerospace • OEM vs. MRO mix • Nonrecurring Engineering Costs 7

Sales & Operating Margin 1st Quarter FY2013 - Total Parker 8 $ in millions FY2013 % Change FY2012 Sales As reported 3,215$ (0.6)% 3,234$ Acquisitions 89 2.8 % Currency (91) (2.8)% Adjusted Sales 3,217$ (0.6)% Operating Margin As reported 463$ 520$ % of Sales 14.4 % 16.1 % 1st Quarter

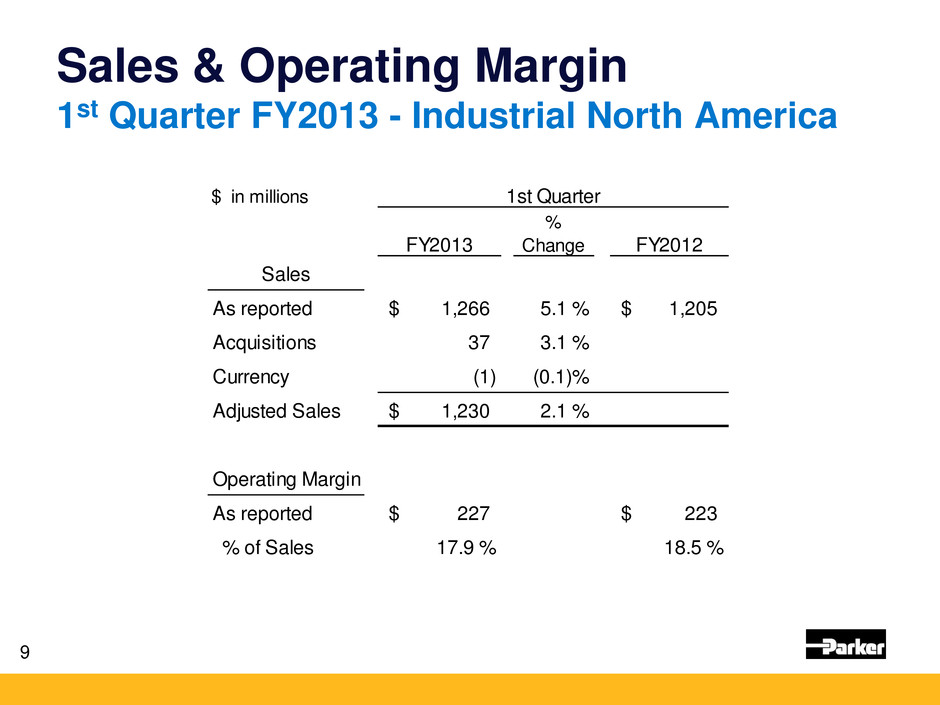

Sales & Operating Margin 1st Quarter FY2013 - Industrial North America 9 $ in millions FY2013 % Change FY2012 Sales As reported 1,266$ 5.1 % 1,205$ Acquisitions 37 3.1 % Currency (1) (0.1)% Adjusted Sales 1,230$ 2.1 % Operating Margin As reported 227$ 223$ % of Sales 17.9 % 18.5 % 1st Quarter

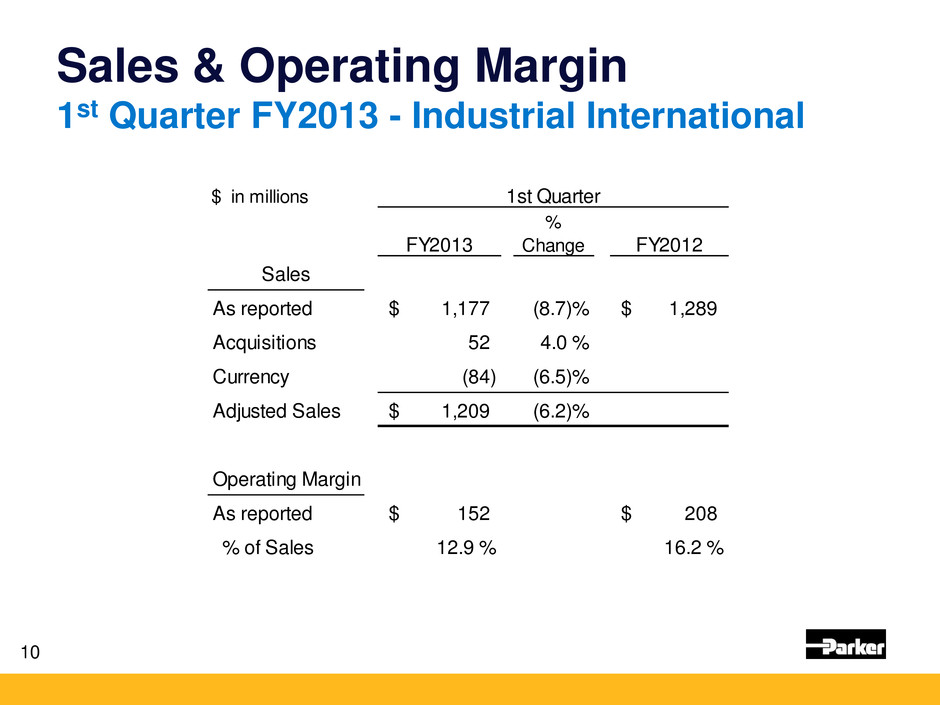

Sales & Operating Margin 1st Quarter FY2013 - Industrial International 10 $ in millions FY2013 % Change FY2012 Sales As reported 1,177$ (8.7)% 1,289$ Acquisitions 52 4.0 % Currency (84) (6.5)% Adjusted Sales 1,209$ (6.2)% Operating Margin As reported 152$ 208$ % of Sales 12.9 % 16.2 % 1st Quarter

Sales & Operating Margin 1st Quarter FY2013 - Aerospace 11 $ in millions FY2013 % Change FY2012 Sales As reported 541$ 8.8 % 498$ Acquisitions - -- % Currency (2) (0.3)% Adjusted Sales 543$ 9.1 % Operating Margin As reported 62$ 69$ % of Sales 11.4 % 13.8 % 1st Quarter

Sales & Operating Margin 1st Quarter FY2013 - Climate & Industrial Controls 12 $ in millions FY2013 % Change FY2012 Sales As reported 231$ (4.8)% 242$ Acquisitions - -- % Currency (4) (1.6)% Adjusted Sales 235$ (3.2)% Operating Margin As reported 22$ 20$ % of Sales 9.4 % 8.2 % 1st Quarter

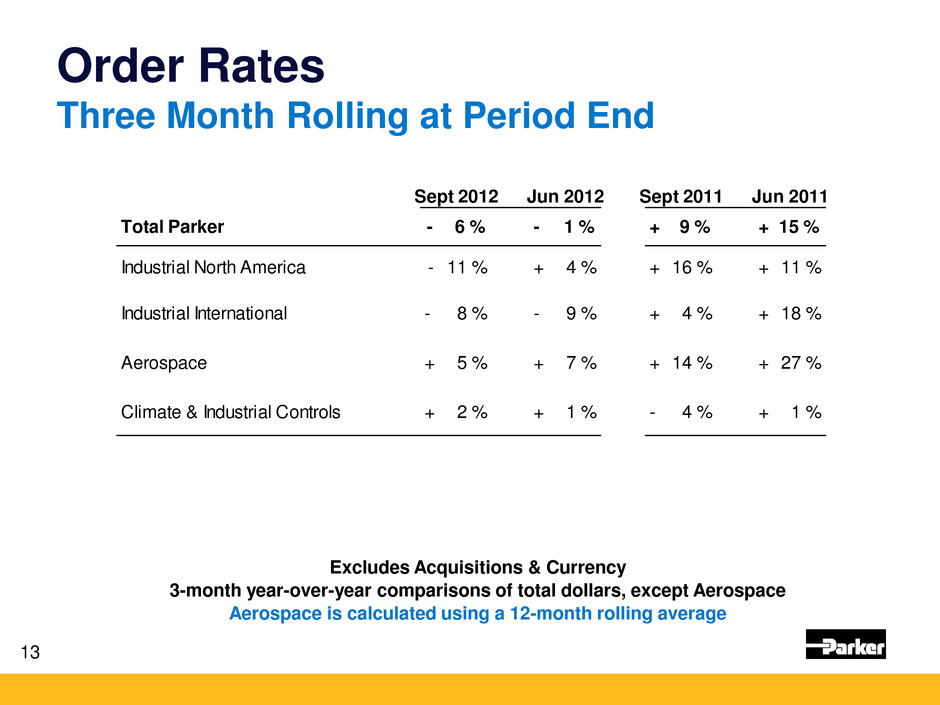

Order Rates Three Month Rolling at Period End 13 Excludes Acquisitions & Currency 3-month year-over-year comparisons of total dollars, except Aerospace Aerospace is calculated using a 12-month rolling average Sept 2012 Jun 2012 Sept 2011 Jun 2011 Total Parker 6 %- 1 %- 9 %+ 15 %+ Industrial North America 11 %- 4 %+ 16 %+ 11 %+ Industrial International 8 %- 9 %- 4 %+ 18 %+ Aerospace 5 %+ 7 %+ 14 %+ 27 %+ Climate & Industrial Controls 2 %+ 1 %+ 4 %- 1 %+

Balance Sheet Summary • Cash • Working capital • Accounts receivable • Inventory • Accounts payable 14

Cash Flow from Operating Activities 1st Quarter FY2013 15 1st Quarter FY2013 FY2012 As Reported (7.0)$ 309.5$ As Reported % Sales -0.2% 9.6% Discretionary Pension Plan Contribution 225.6$ -$ Adjusted Cash From Operating Activities 218.7$ 309.5$ Adjusted % Sales 6.8% 9.6%

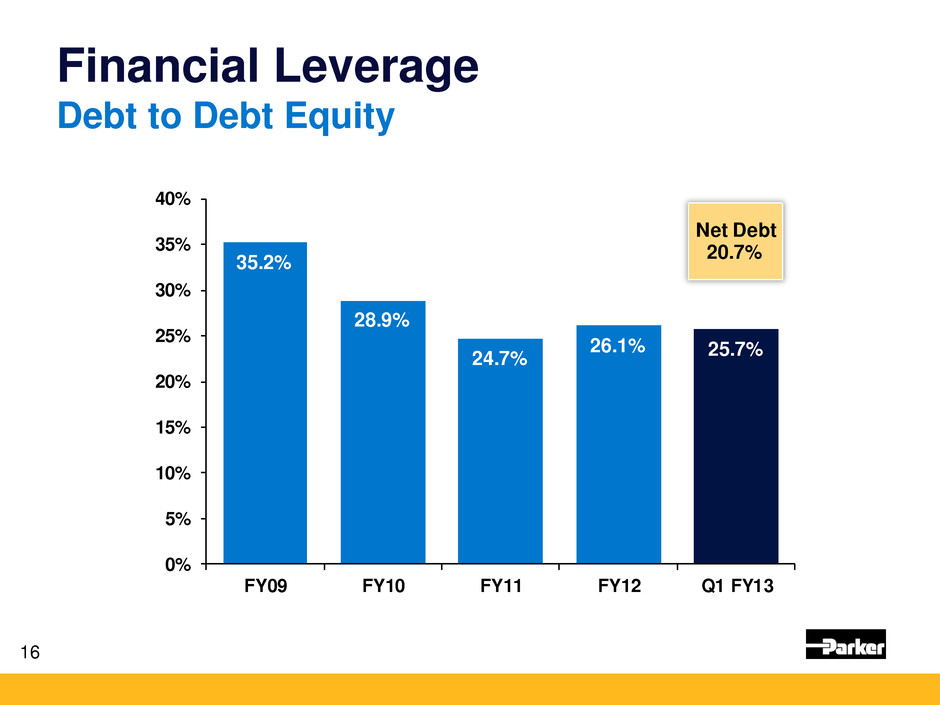

35.2% 28.9% 24.7% 26.1% 25.7% 0% 5% 10% 15% 20% 25% 30% 35% 40% FY09 FY10 FY11 FY12 Q1 FY13 Net Debt 20.7% Financial Leverage Debt to Debt Equity 16

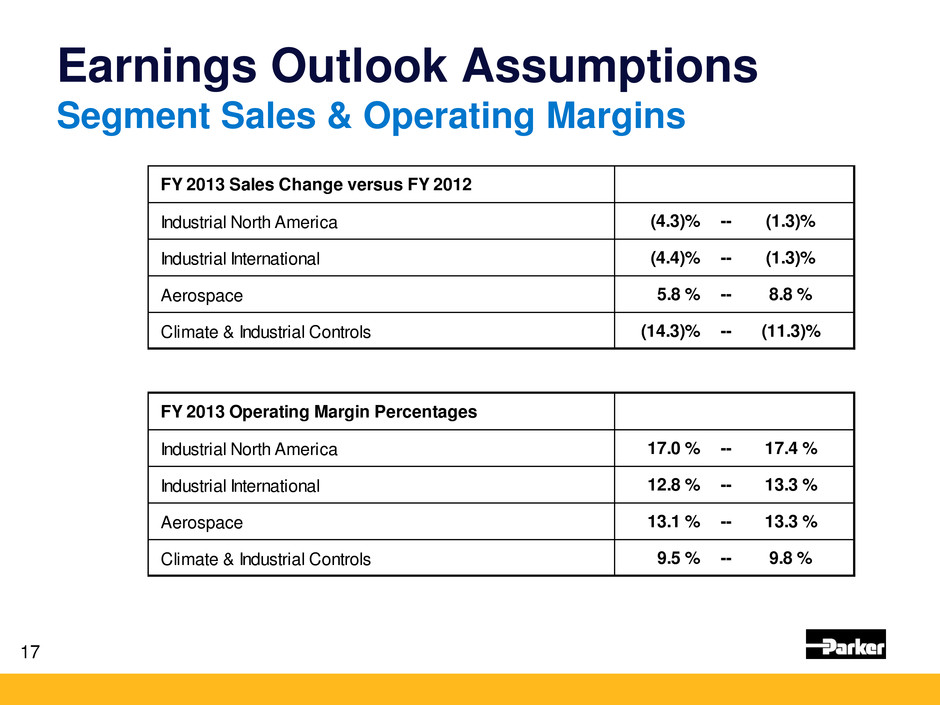

Earnings Outlook Assumptions Segment Sales & Operating Margins 17 FY 2013 Sales Change versus FY 2012 Industrial North America (4.3)% -- (1.3)% Industrial International (4.4)% -- (1.3)% Aerospace 5.8 % -- 8.8 % Climate & Industrial Controls (14.3)% -- (11.3)% FY 2013 Operating Margin Percentages Industrial North America 17.0 % -- 17.4 % Industrial International 12.8 % -- 13.3 % Aerospace 13.1 % -- 13.3 % Climate & Industrial Controls 9.5 % -- 9.8 %

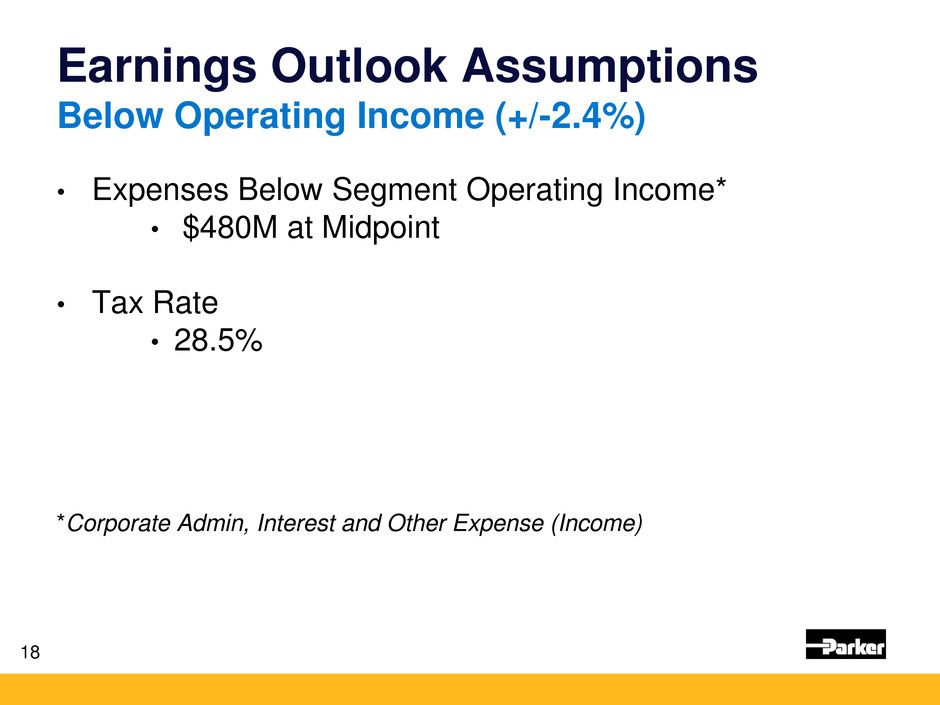

Earnings Outlook Assumptions Below Operating Income (+/-2.4%) • Expenses Below Segment Operating Income* • $480M at Midpoint • Tax Rate • 28.5% *Corporate Admin, Interest and Other Expense (Income) 18

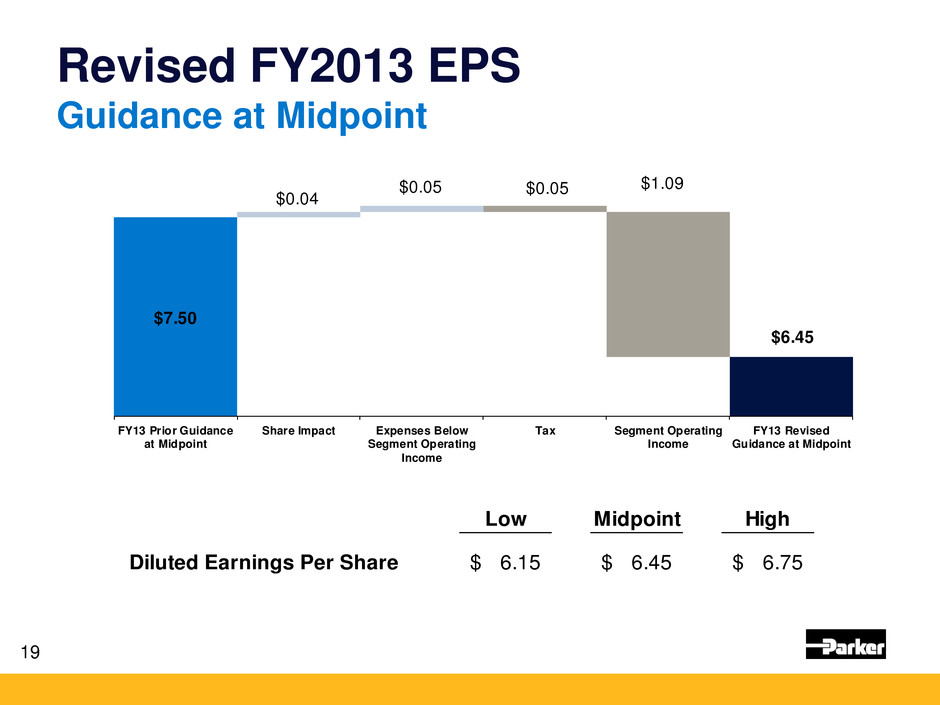

Revised FY2013 EPS Guidance at Midpoint 19 Low Midpoint High Diluted Earnings Per Share 6.15$ 6.45$ 6.75$ $7.50 $0.04 $0.05 $0.05 $1.09 $6.45 6 6 7 7 7 7 8 8 8 FY13 Prior Guidance at Midpoint Share Impact Expenses Below Segment Operating Income Tax Segment Operating Income FY13 Revised Guidance at Midpoint

Parker Hannifin Corporation The Global Leader in Motion & Control Technologies 20 • Questions and Answers

CEO Closing Comments 21 • Thank you to our Global Team • Continue to Execute Win Strategy • Manage Costs, Balance Sheet & Growth

Thank You October 19, 2012

Appendix • Consolidated Statement of Income • Business Segment Information By Industry • Consolidated Balance Sheet • Consolidated Statement of Cash Flows

Consolidated Statement of Income 24 (Unaudited) Three Months Ended September 30, (Dollars in thousands except per share amounts) 2012 2011 Net sales 3,214,935$ 3,233,881$ Cost of sales 2,477,447 2,414,442 Gross profit 737,488 819,439 Selling, general and administrative expenses 381,122 386,466 Interest expense 23,509 23,221 Other (income), net (3,201) (1,833) Income before income taxes 336,058 411,585 Income taxes 96,110 113,427 Net income 239,948 298,158 Less: Noncontrolling interests 207 1,140 Net income attributable to common shareholders 239,741$ 297,018$ Earnings per share attributable to common shareholders: Basic earnings per share 1.61$ 1.95$ Diluted earnings per share 1.57$ 1.91$ Average shares outstanding during period - Basic 149,285,849 152,439,026 Average shares outstanding during period - Diluted 152,617,110 155,429,408 Cash dividends per common share .41$ .37$

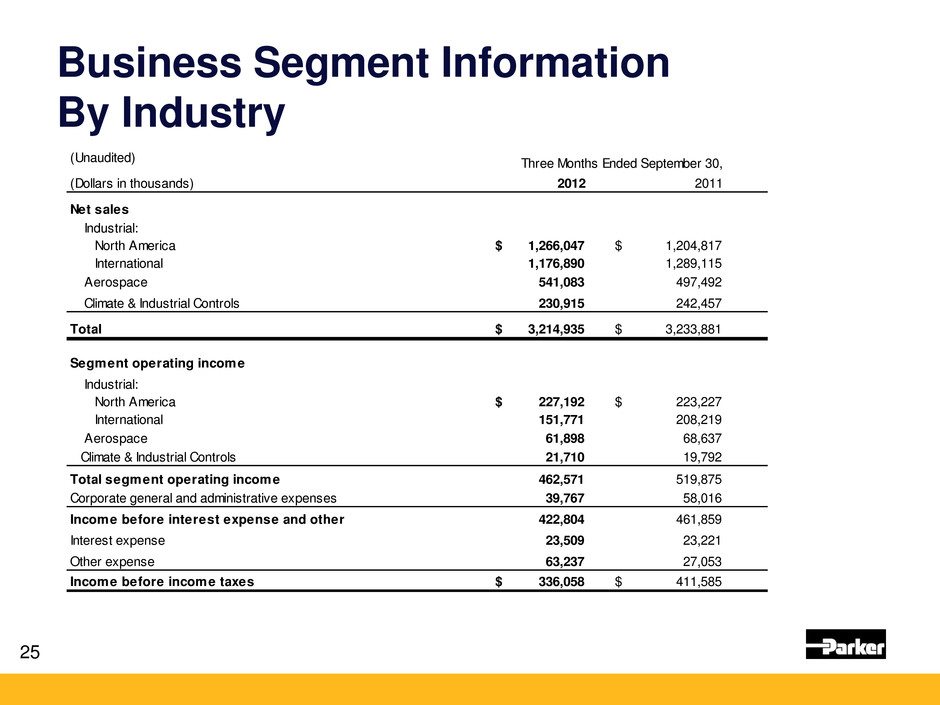

Business Segment Information By Industry 25 (Unaudited) Three Months Ended September 30, (Dollars in thousands) 2012 2011 Net sales Industrial: North America 1,266,047$ 1,204,817$ International 1,176,890 1,289,115 Aerospace 541,083 497,492 Climate & Industrial Controls 230,915 242,457 Total 3,214,935$ 3,233,881$ Segment operating income Industrial: North America 227,192$ 223,227$ International 151,771 208,219 Aerospace 61,898 68,637 Climat & Industrial Controls 21,710 19,792 Total segment operating income 462,571 519,875 Corporate general and administrative expenses 39,767 58,016 Income before interest expense and other 422,804 461,859 Interest expense 23,509 23,221 Other expense 63,237 27,053 Income before income taxes 336,058$ 411,585$

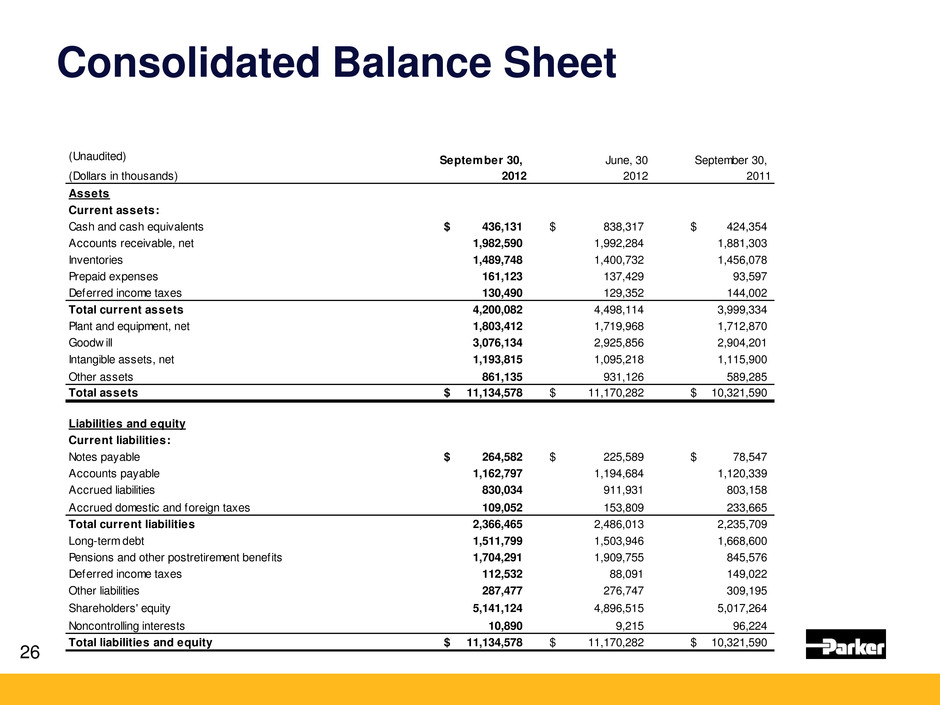

Consolidated Balance Sheet 26 (Unaudited) September 30, June, 30 September 30, (Dollars in thousands) 2012 2012 2011 Assets Current assets: Cash and cash equivalents 436,131$ 838,317$ 424,354$ Accounts receivable, net 1,982,590 1,992,284 1,881,303 Inventories 1,489,748 1,400,732 1,456,078 Prepaid expenses 161,123 137,429 93,597 Deferred income taxes 130,490 129,352 144,002 Total current assets 4,200,082 4,498,114 3,999,334 Plant and equipment, net 1,803,412 1,719,968 1,712,870 Goodw ill 3,076,134 2,925,856 2,904,201 Intangible assets, net 1,193,815 1,095,218 1,115,900 Other assets 861,135 931,126 589,285 Total assets 11,134,578$ 11,170,282$ 10,321,590$ Liabilities and equity Current liabilities: Notes payable 264,582$ 225,589$ 78,547$ Accounts payable 1,162,797 1,194,684 1,120,339 Accrued liabilities 830,034 911,931 803,158 Accrued domestic and foreign taxes 109,052 153,809 233,665 Total current liabilities 2,366,465 2,486,013 2,235,709 Long-term debt 1,511,799 1,503,946 1,668,600 Pensions and other postretirement benefits 1,704,291 1,909,755 845,576 Deferred income taxes 112,532 88,091 149,022 Other liabilities 287,477 276,747 309,195 Shareholders' equity 5,141,124 4,896,515 5,017,264 Noncontrolling interests 10,890 9,215 96,224 Total liabilities and equity 11,134,578$ 11,170,282$ 10,321,590$

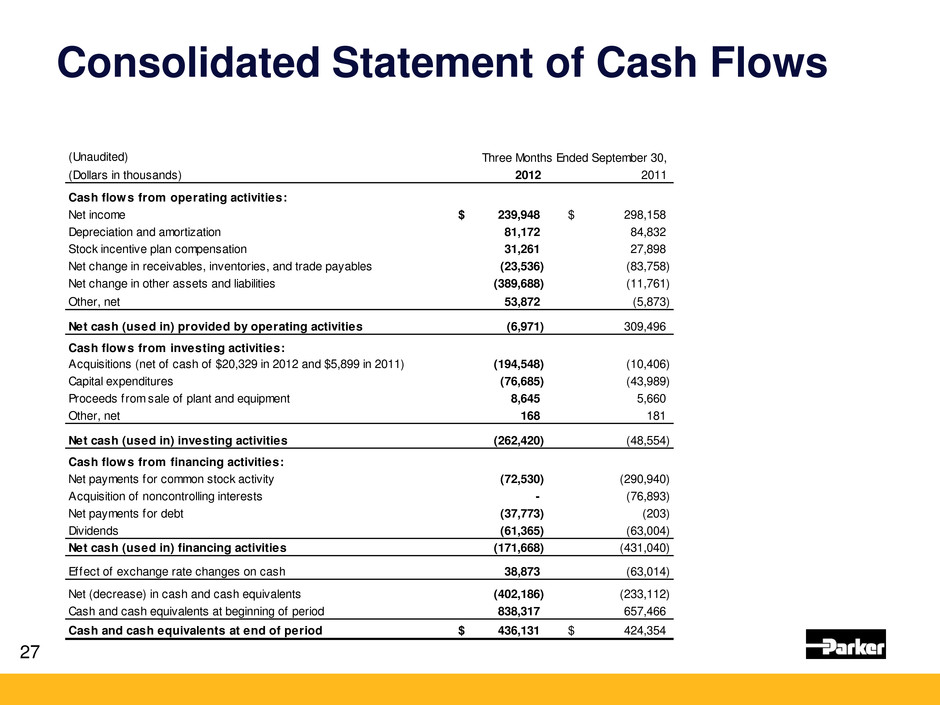

Consolidated Statement of Cash Flows 27 (Unaudited) Three Months Ended September 30, (Dollars in thousands) 2012 2011 Cash flows from operating activities: Net income 239,948$ 298,158$ Depreciation and amortization 81,172 84,832 Stock incentive plan compensation 31,261 27,898 Net change in receivables, inventories, and trade payables (23,536) (83,758) Net change in other assets and liabilities (389,688) (11,761) Other, net 53,872 (5,873) Net cash (used in) provided by operating activities (6,971) 309,496 Cash flows from investing activities: Acquisitions (net of cash of $20,329 in 2012 and $5,899 in 2011) (194,548) (10,406) Capital expenditures (76,685) (43,989) Proceeds from sale of plant and equipment 8,645 5,660 Other, net 168 181 Net cash (used in) investing activities (262,420) (48,554) Cash flows from financing activities: Net payments for common stock activity (72,530) (290,940) Acquisition of noncontrolling interests - (76,893) Net payments for debt (37,773) (203) Dividends (61,365) (63,004) Net cash (used in) financing activities (171,668) (431,040) Effect of exchange rate changes on cash 38,873 (63,014) Net (decrease) in cash and cash equivalents (402,186) (233,112) Cash and cash equivalents at beginning of period 838,317 657,466 Cash and cash equivalents at end of period 436,131$ 424,354$