Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MYERS INDUSTRIES INC | d428078d8k.htm |

| EX-99.1 - EX-99.1 - MYERS INDUSTRIES INC | d428078dex991.htm |

Earnings

Presentation Third Quarter 2012

Third Quarter 2012

October 18, 2012

Exhibit 99.2 |

Statements in this presentation concerning the Company’s goals, strategies,

and expectations for business and financial results may be

"forward-looking statements" within the meaning of the Private Securities

Litigation Reform Act of 1995 and are based on current indicators and

expectations. Whenever you read a statement that is not simply a

statement of historical fact (such as when we describe what we "believe,"

"expect," or "anticipate" will occur, and other similar

statements), you must remember that our expectations may

not

be

correct,

even

though

we

believe

they

are

reasonable.

We

do

not

guarantee

that

the

transactions

and

events

described

will

happen

as

described

(or

that

they

will

happen

at

all).

You

should

review

this

presentation with the understanding that actual future results may be materially

different from what we expect. Many of the factors that will determine

these results are beyond our ability to control or predict. You are

cautioned not to put undue reliance on any forward-looking statement. We do not intend, and undertake

no

obligation,

to

update

these

forward-looking

statements.

These

statements

involve

a

number

of

risks

and

uncertainties that could cause actual results to differ materially from those

expressed or implied in the applicable statements. Such risks

include: (1) Fluctuations in product demand and market acceptance

(2) Uncertainties associated with the general economic conditions in domestic and

international markets (3) Increased competition in our markets

(4) Changes in seasonality

(5)

Difficulties

in

manufacturing

operations,

such

as

production

outages

or

maintenance

programs

(6) Raw material availability

(7)

Fluctuations

in

raw

material

costs;

fluctuations

outside

the

“normal”

range

of

industry

cycles

(8) Changes in laws and regulations and approvals and decisions of courts,

regulators, and governmental bodies

Myers Industries, Inc. encourages investors to learn more about these risk factors.

A detailed explanation of these factors is available in the Company’s

publicly filed quarterly and annual reports, which

can

be

found

online

at

www.myersind.com

and

at

the

SEC.gov

web

site.

2 |

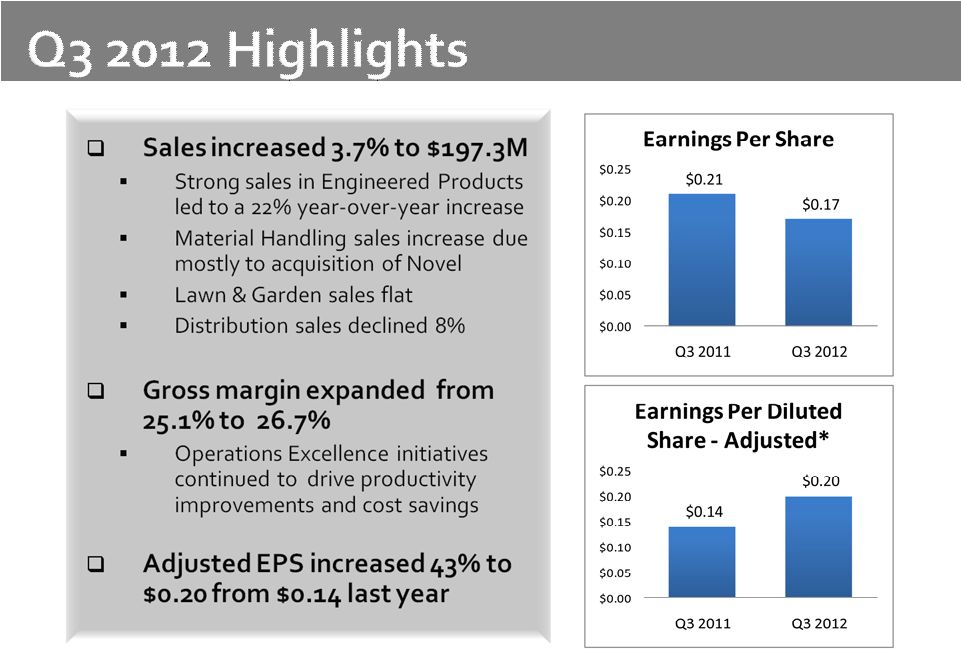

3

*See reconciliation of Non-GAAP measures

on slide 13. |

4

Myers

Industries’

business

segments

have

5

key

platforms

for

both

organic

and

acquisition

growth

Material Handling Segment

1.

Returnable Packaging

2.

Storage & Safety Products

Engineered Products Segment

3.

Tire Repair & Retread Products

4.

Specialty Molded Products

Distribution Segment

5.

Tire Supply Distribution |

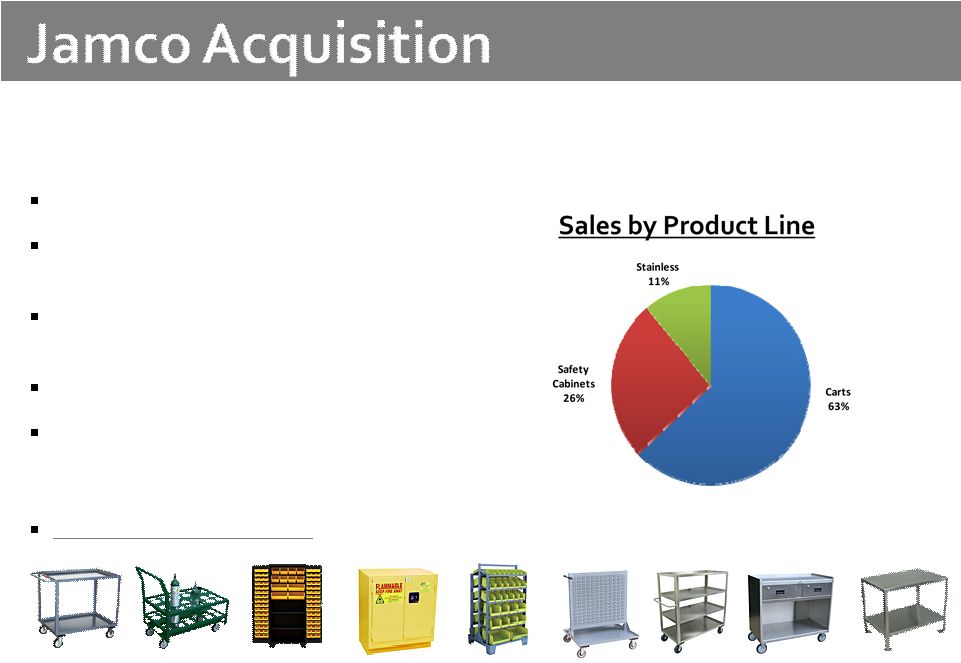

5

Jamco acquisition fits the Material Handling Segment’s Storage and Safety

Products Growth Platform

Founded in 1995

Designer and manufacturer of heavy

duty, industrial steel carts and cabinets

Three manufacturing facilities located

in South Beloit, Illinois

Approximately 75 employees

Products are sold through national

catalogs and distributors similar to our

Akro-Mils business

www.Jamcoproducts.com |

6

P&L

Q3

Q3

Highlights

2012

2011

B/(W)

Net sales

$197.3

$190.3

3.7%

Gross

margin

26.7%

25.1%

6.4%

SG&A

$43.0

$40.5

-6.0%

Net

income -

adjusted*

$6.7

$5.0

34.0%

Effective

tax rate

32.4%

---

EPS -

adjusted*

$0.20

$0.14

42.9%

*See Reconciliation of Non-GAAP measures on slide 13

Nine Months Ended

Nine Months Ended

Cash

September 30,

September 30,

Highlights

2012

2011

Operating cash

flow

$23.3

$40.2

Capital

expenditures

$15.2

$13.3

Dividends

$7.6

$7.2

Note: All figures except per share data and percents are $Millions

Balance Sheet

September 30,

December 31,

Highlights

2012

2011

Long-term debt

(less current

portion)

$96.4

$73.7

Debt - net of

cash

$90.2

$67.2

Net Debt to

Total Capital

28.2%

24.6%

Debt-to-EBITDA

1.0

1.0 |

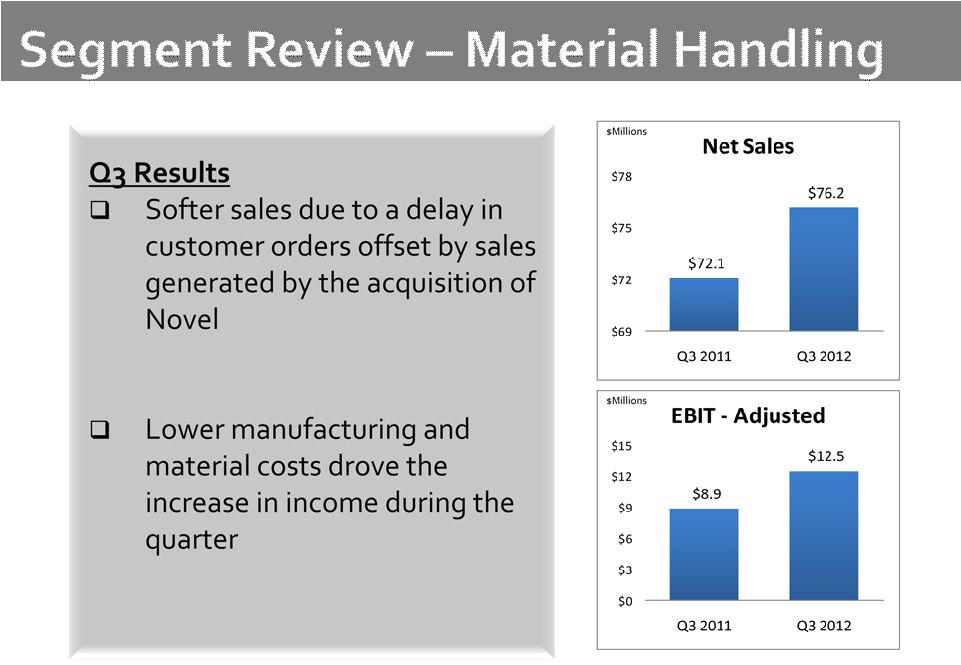

7

|

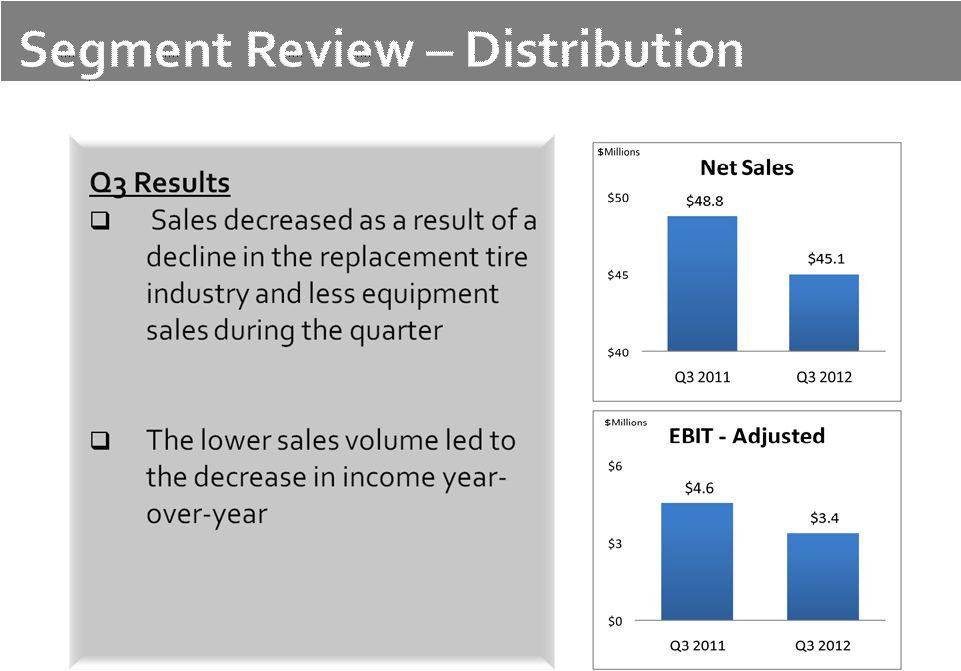

8

|

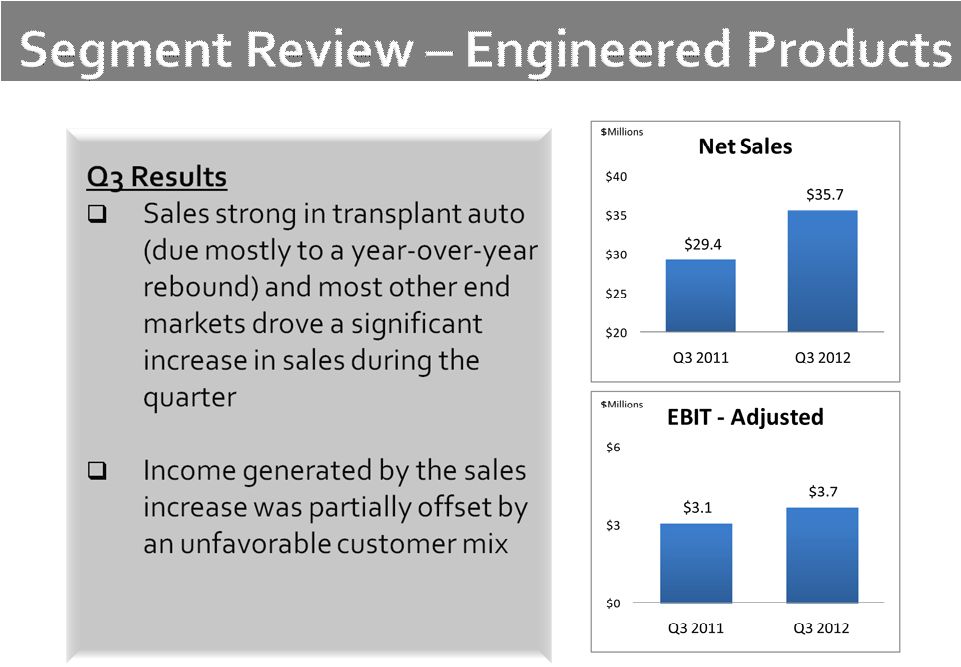

9

|

10

|

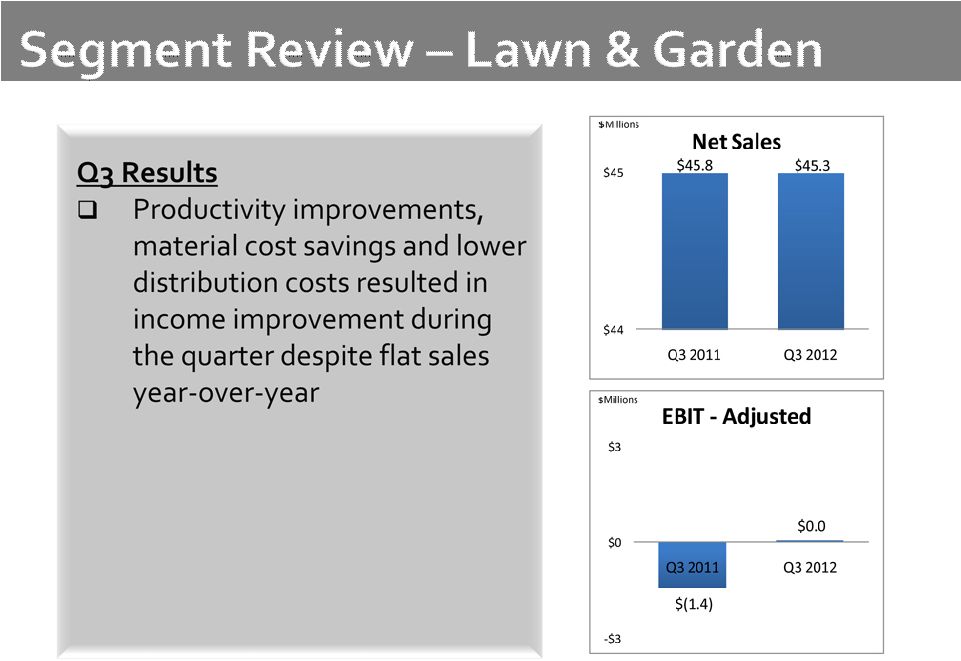

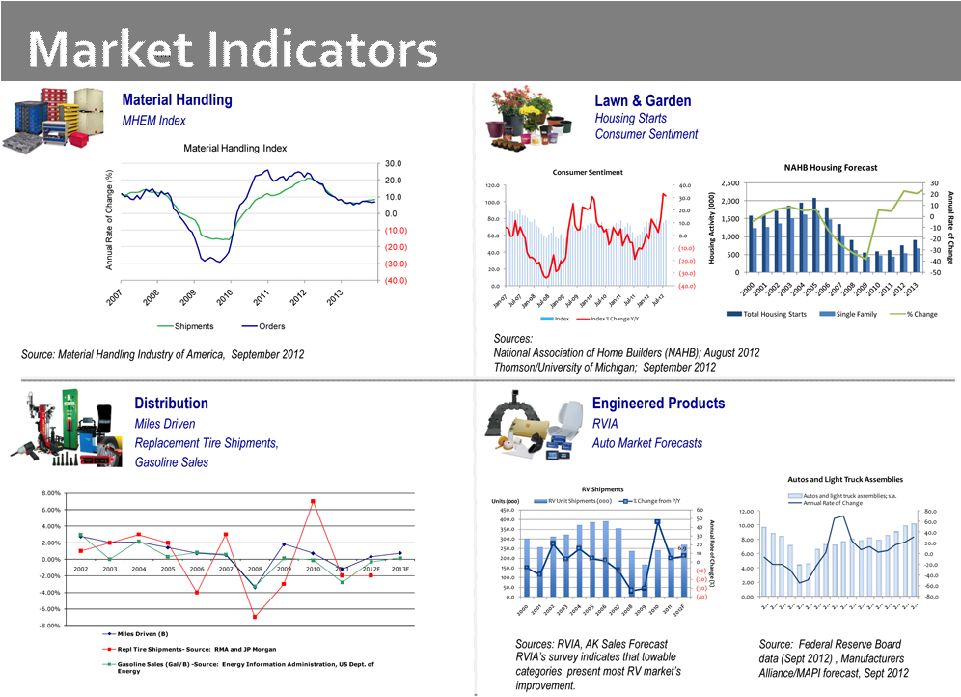

Demand in the

transplant auto market should return from elevated levels to

more normal levels

Expect some traditional softening in demand in RV and custom markets

A decline in the replacement tire industry could impact performance in

the fourth quarter

Stronger order activity and a continued focus on cost reduction should result in

improved performance in Q4

The shift in orders resulting from a delay in customer demand from earlier in the

year to the fourth quarter should benefit results during Q4

11

Overall Outlook

Anticipate overall solid performance in Q4, despite a relatively

weak industrial market

Fourth-quarter and full-year results should reflect improved performance

Our increased strategic focus should enable Myers to continue to

produce solid results

Engineered

Products

Distribution

Material

Handling

Lawn &

Garden |

|

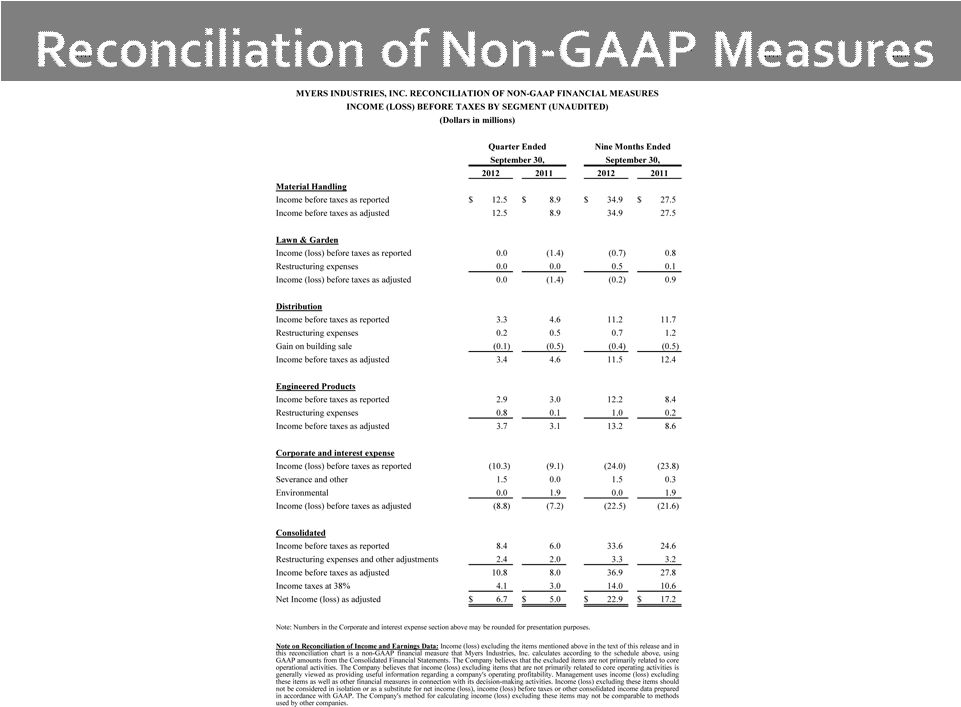

13

|

|

|