Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - IKANOS COMMUNICATIONS, INC. | d420410d8k.htm |

Ikanos

Communications, Inc. A Growth Opportunity

October 4, 2012

Exhibit 99.1 |

Safe

Harbor Statement This presentation contains, in addition to historical

information, forward-looking statements. Such forward-looking

statements are based on management’s current expectations, estimates and projections

about our industry and business, including but not limited to the expected growth

of and opportunities in the broadband market, the company’s position in

the market, any statements about historical results that may suggest trends

for our business, any statements of the plans, strategies, and objectives of

management for future operations or products, any statements of expectation or

belief regarding the performance of our technology or products, customer

demand and future technology developments, any statements of assumptions

underlying any of the foregoing, management's beliefs, and certain

assumptions, all of which are subject to change. Forward-looking statements can

often be identified by words such as "anticipates,"

"expects," "intends," "plans," "predicts," "believes," "seeks," "estimates,"

"may," "will," "should," "would," "could,"

"potential," "continue," "ongoing," similar expressions, and

variations or negatives of these words. These forward-looking statements are

not guarantees of future results and are subject to risks, uncertainties and

assumptions that could cause our actual results to differ materially and

adversely from those expressed in any forward-looking statement. For a further discussion

of

the

risks

and

uncertainties,

which

could

cause

actual

results

to

differ

from

those

contained

in

the

forward-looking statements, see the Company’s periodic filings on Forms

10-K and 10-Q, as well as other reports the Company files from

time-to-time with the Securities and Exchange Commission. For the most

current detailed risk factors, please review our Form 10-Q for the period ended

July 1, 2012. The Company cannot assure that the events and

circumstances reflected in any forward-looking statements will be

achieved or occur, nor does the Company undertake any obligation to update any forward-looking

or other statements for any reason after the date of this presentation.

©

Ikanos

Communications,

Inc.

All

rights

reserved.

Ikanos™,

NodeScale™

are

among

the

trademarks

owned by Ikanos Communications, Inc. Any other trademarks or trade names mentioned

are the property of the respective owners.

2 |

•

Focused

on

Broadband

DSL

–

End-to-End

Solution

•

Leadership Technology & IPR

•

Global Footprint -

400M Ports Shipped

•

Strong Balance Sheet

•

Strong

Market

Need

–

Bandwidth

to/from

Home

©

Ikanos Communications, Inc. All rights reserved.

Ikanos Communications, Inc. (Nasdaq: IKAN)

3 |

4

Omid

Tahernia,

CEO

and

President

Tilera, Xilinx, Motorola (Equip. and Semi)

Dennis

Bencala,

CFO

Renewable Energy Test Center, SiRF, ScanVision

Debajyoti

Pal,

CTO

GlobespanVirata, Excess Bandwidth, Amati

Syrus

Ziai,

VP

Engineering

Qspeed, Collinear, HP

Michael

Kelly,

VP

Sales/Marketing

SiRF, Alliance Semi, NEC

Jim

Murphy,

VP

HR

SiRF, LSI Logic, National

Bob

Dunnigan,

VP

Operations

Cypress, Sigmatel, Motorola Semi

Dado

Banatao,

Chairman

Tallwood, Managing Partner

George Pavlov

Tallwood, General Partner

Danial Faizullabhoy

Former BroadLogic CEO

Frederick Lax

Former CEO of Tekelec

Douglas Norby

CFO to multiple technology companies

James Smaha

Former EVP/GM of National Semi

Omid Tahernia

CEO and President

Board of Directors And New Management Team

©

Ikanos Communications, Inc. All rights reserved. |

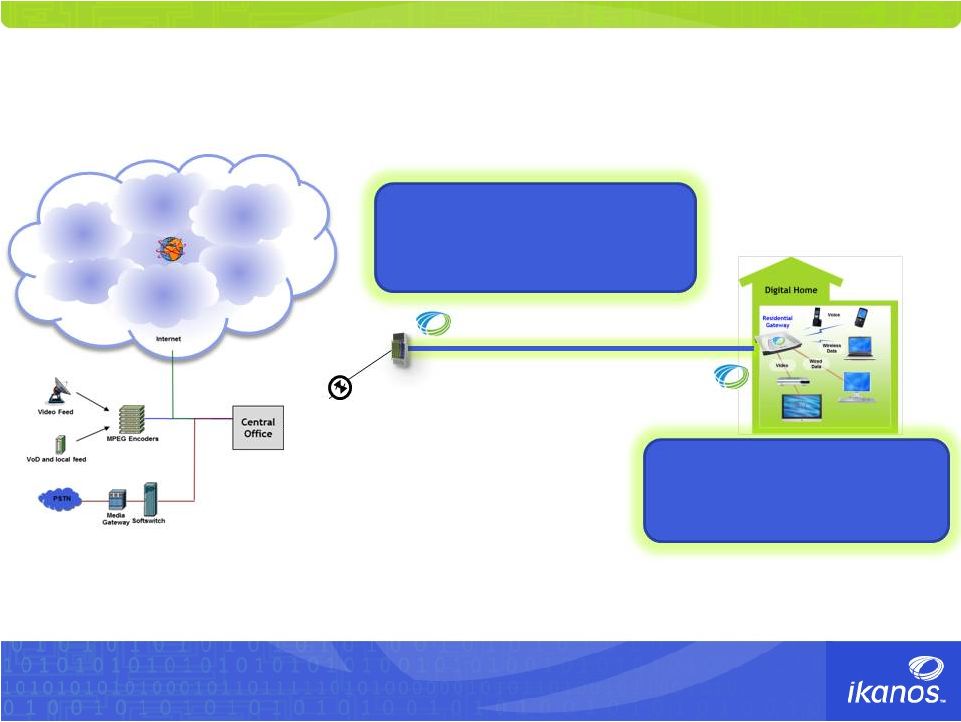

5

Ikanos Broadband Access Solutions

FTTx

Ikanos Solutions for

Broadband over Copper

enable high speed access to

the Digital Home

Ikanos delivers end-to-end Broadband Access solutions

Fiber

Copper

Photos

and

Docs

Online

Games

Services

Music

and

Media

Library

Storage &

Backup

Video

Streams

Ikanos Gateway for

Digital Home

•

Entryway for triple-play content

©

Ikanos Communications, Inc. All rights reserved. |

6

Ikanos xDSL Worldwide Footprint

400M Ports shipped

Vectored VDSL enables significant upgrade opportunities

for Copper Networks

©

Ikanos Communications, Inc. All rights reserved. |

7

Ikanos enabling major IPTV Deployments worldwide

Taiwan

ODMs

©

Ikanos Communications, Inc. All rights reserved. |

Central

Office

•

$2,500 / household

•

5+ years to deploy

•

$250 / household

•

Deployment over

existing infrastructure

vs

Source: BusinessWeek article on FTTH in USA and

OECD presentation a major US carrier on FTTN

Fiber

Fiber

Copper

Ikanos Innovative Technology Delivers

The speed of fiber at 1/10

th

the cost!

©

Ikanos Communications, Inc. All rights reserved.

Node

Node

8

Fiber to the

Neighborhood +

Copper to the Home

Fiber to the Home |

9

Ikanos NodeScale™

Vectoring will deliver

200 Mbps Data

over Copper

©

Ikanos Communications, Inc. All rights reserved. |

10

Drivers for High Rate Broadband Access

•

Carriers searching for new revenue streams, higher ARPU and lower

CAPEX

•

Subscribers demanding higher speed Internet access, more video

content and higher video resolution

•

New services and applications

•

Cloud services creating a need for higher upstream data rates

•

Carriers experiencing competition from alternative broadband

providers

©

Ikanos Communications, Inc. All rights reserved. |

200Mbps

(Bonded VDSL2) (>2013; e.g. Vectored VDSL,

Bonding) New Services and Applications

Net DVR

12-18 Mbps

(3-4 streams)

©

Ikanos Communications, Inc. All rights reserved.

Service providers now architecting for

multi-play services and require

>100Mbps

11

Email

Voice

Data

Online

Gaming

HD IPTV

Music

1-2 Mbps

6-9 Mbps

.5 Mbps

.5 Mbps

5-7 Mbps

1-2 Mbps

Online HD

Gaming

4-6 Mbps

Email

.5 Mbps

Tele-

medicine

8-10 Mbps

Security

6 Mbps

Home

Automation

2 Mbps

3D IPTV

9-12 Mbps

Video Conf.

3-5 Mbps

VoIP

.5 Mbps

Music

1-2 Mbps

Email

Music

1-2 Mbps

.5 Mbps

.5 Mbps

2 –

10 Mbps

(<2005; e.g. ADSL)

11 –

20 Mbps

(Current; e.g. VDSL)

Streaming

(OTT), Data

10-15 Mbps

HD IPTV

6-9 Mbps

Voice |

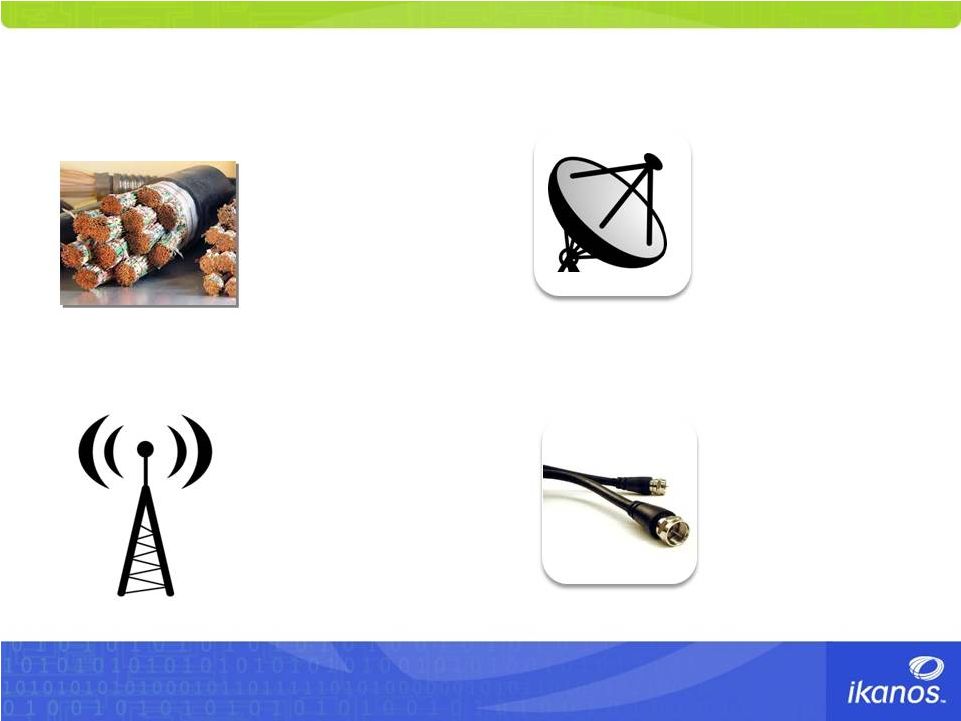

12

Carrier Landscape for Broadband Access

•

Designed for TV

•

Can provide low rate

Internet access

•

Designed for Voice

•

4G enables high data

rates, but constrained

backhaul capacity

•

Limited in access and

sustained bandwidth

•

Designed for POTS

•

VDSL enables very high

data rates

•

Extensive embedded base

of copper cables in

developed countries

•

Designed for TV

•

DOCSIS 3.0 enables high

data rates

•

North American centric

•

Upstream challenged

©

Ikanos Communications, Inc. All rights reserved.

Telcos:

Satellite:

Mobile:

Cable: |

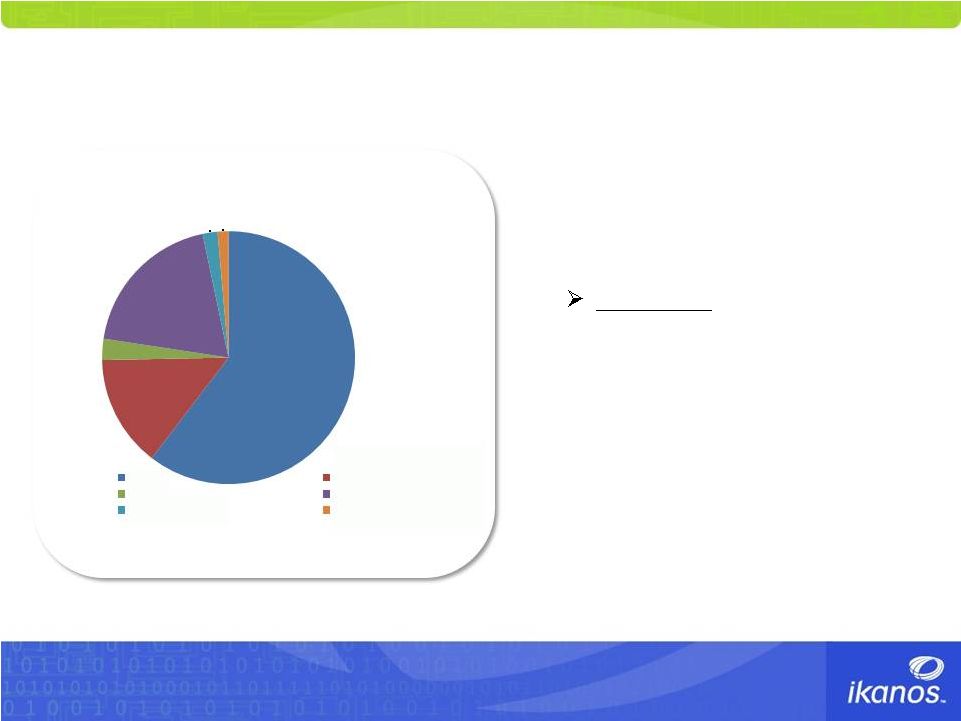

13

Telco Opportunity

•

Telcos (i.e., ADSL, FTTx and

FTTH) have majority share in

broadband lines

>77% Total

•

Deployed copper is Telco’s major

asset

•

Vectored VDSL2 will provide a

significant opportunity to deliver

broadband over copper to meet

customer demands

Source: Point Topic Global Broadband Statistics Q1 2012

©

Ikanos Communications, Inc. All rights reserved.

60%

14%

3%

19%

2%

2%

Broadband

Line

Market

Shares

-

Q1

2012

DSL

FTTx (Incl. VDSL, FTTx+Lan etc)

FTTH

Cable

Satellite/mobile

Other |

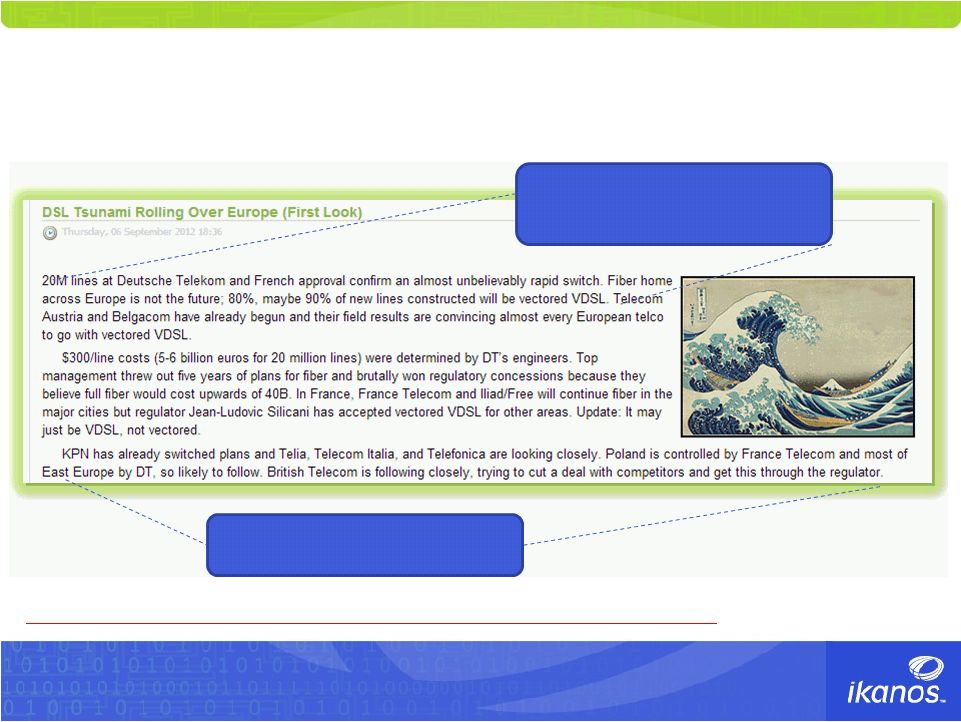

©

Ikanos Communications, Inc. All rights reserved.

DSL Tsunami

Full article can be found at:

http://fastnetnews.com/dslprime/42-d/4845-dsl-tsunami-rolling-over-europe-first-look

Germany (20M lines)

switching to Vectored

VDSL from Pure Fiber

Majority EU operators

moving to Vectored VDSL

Excerpts taken from DSL Prime Sept 2012 article..

14 |

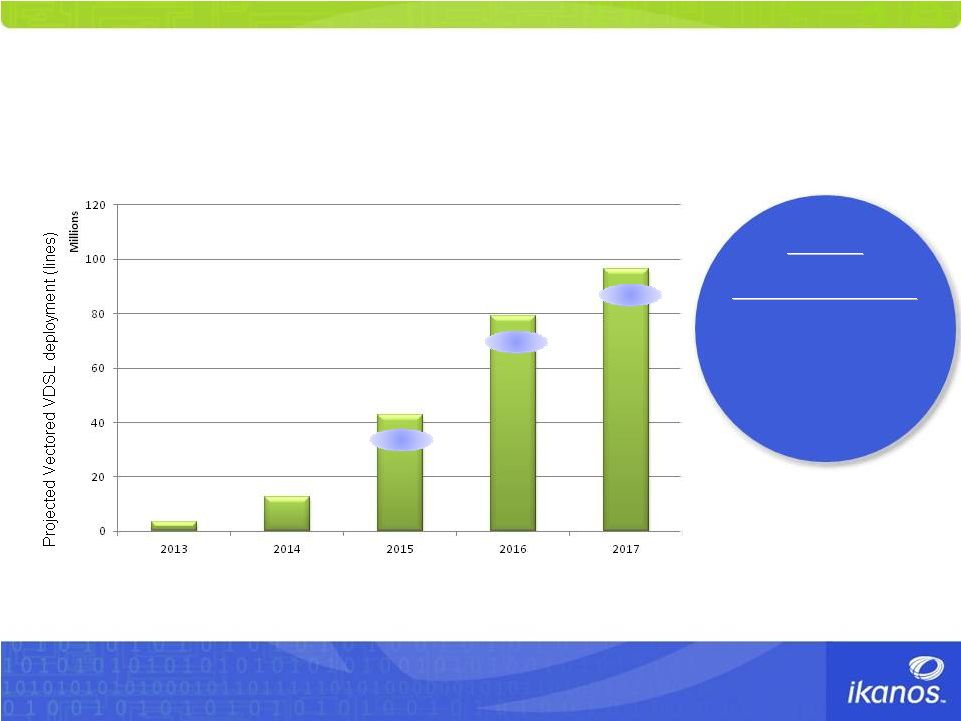

Ikanos

Market Opportunity Existing copper line creates an opportunity for upgrade

at both ends - Vector processors at the Node and Gateway processors at

Home Total

Total

Opportunity

Opportunity

One Billion

One Billion

Copper Lines

Copper Lines

Source: Projections based on Ikanos analysis of over 50 Incumbent Carrier

copper line data Carrier copper lines data from Dataxis Q2 2012 world wide

statistics Note: Total opportunity includes all

Broadband technologies over copper

~$800M

~$1.5B

~$1.8B

©

Ikanos Communications, Inc. All rights reserved.

15 |

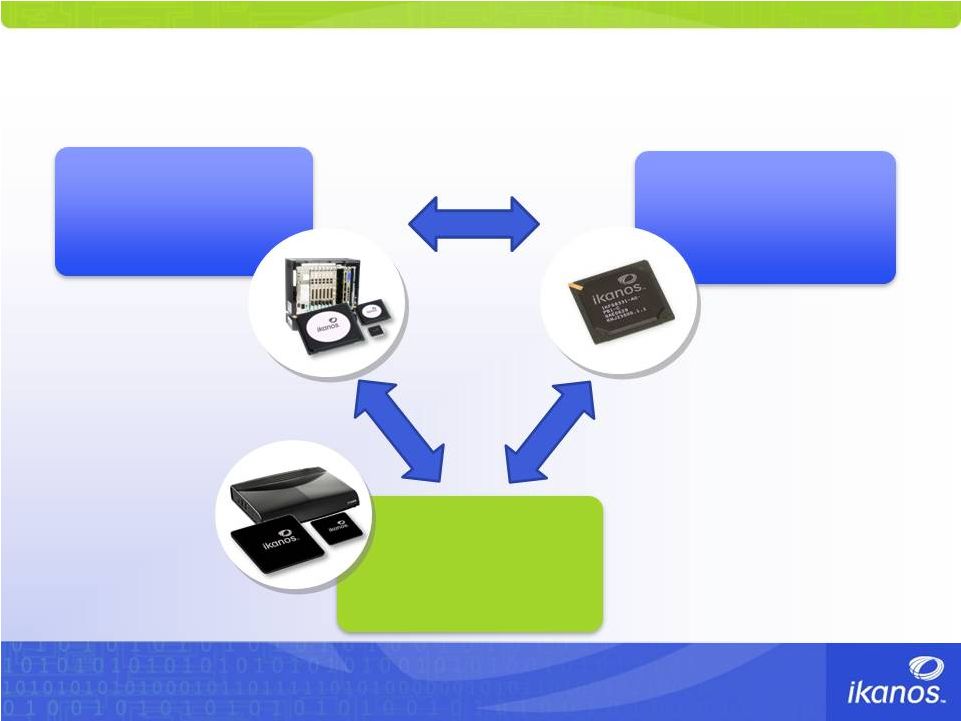

Ikanos Delivers End-to-End

Broadband Access Solutions |

Ikanos NodeScale™

Vectoring Processor

Ikanos Vectored

VDSL2 Transceivers

Ikanos Gateway

G.Vector-Compliant

Communications

Processors

Ikanos NodeScale Vectoring Solution

©

Ikanos Communications, Inc. All rights reserved.

17 |

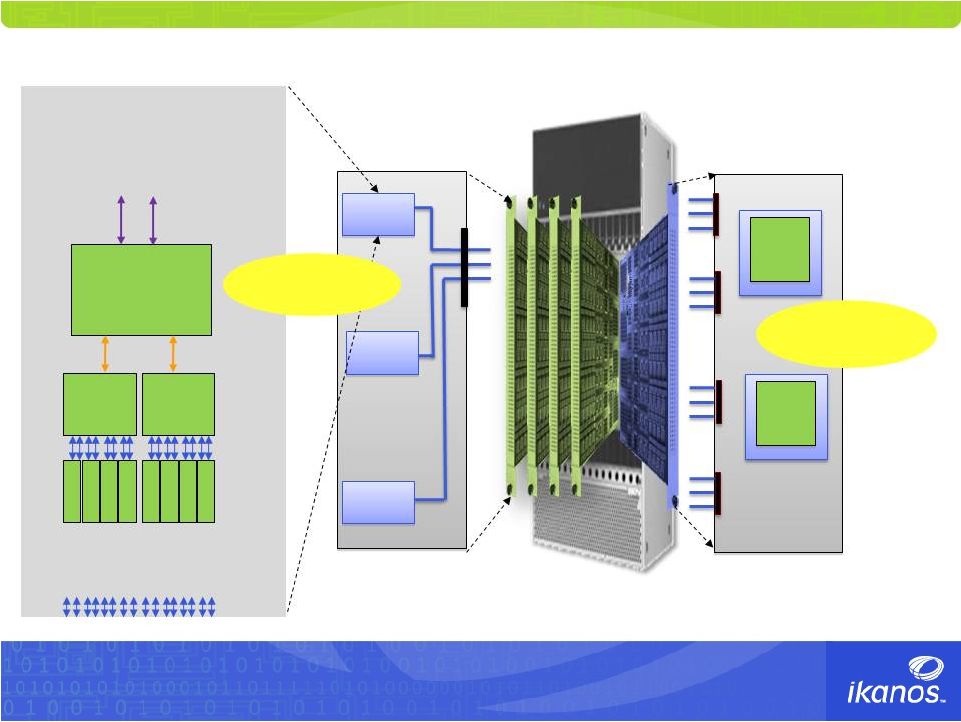

Typical

System Content for NodeScale Vectoring -

192p System shown

16 port DSP

8Port

AFE

8Port

AFE

16 Lines (to CPE)

To Backplane

(Controller Card and Vector Card)

16 port

slice

16 port

slice

16 port

slice

4x 48-port line cards

Chassis/ Backplane

©

Ikanos Communications, Inc. All rights reserved.

>75% of

Silicon content

on the line card

>95% of

Silicon content

on the vector card

Vector Card

Separate Vectoring Card

Or Controller Card

96 port

Vector

Processor

Vector

Processor

H

L

D

H

L

D

H

L

D

H

L

D

H

L

D

H

L

D

H

L

D

H

L

D

18 |

Ikanos

is Well-Positioned within the Home •

Ikanos is a major supplier of

broadband access gateway

processors for the home

•

Media Agnostic Gateway

•

Ikanos is well positioned to

address the evolution of the

digital home, leveraging:

•

Core competencies

•

Strong partnerships

•

Embedded base of legacy CPE

©

Ikanos Communications, Inc. All rights reserved.

Digital Home

Residential

Gateway

Wired

Wired

Data

Data

Video

Video

Wireless

Wireless

Data

Data

Voice

Voice

19 |

Ikanos Operating Focus

and Financials

A Growth Opportunity |

Ikanos

Operating Focus ©

Ikanos Communications, Inc. All rights reserved.

Near-term

Product Execution

Go-to-Market

Design-win Pipeline and Ramp

Mid-term

Go-to-Market

Profitability

New Product Roadmap

Longer-term

Technology Leadership

Expanding TAM

Sustainable Execution

21 |

Q3 2011

Actual

Q4 2011

Actual

Q1 2012

Actual

Q2 2012

Actual

Revenue

$35M

$35M

$31M

$32M

Gross Profit

$18M

$20M

$16M

$15M

OPEX

$20M

$18M

$20M

$17M

Net Income (Loss)

$(2)M

$1M

$(4)M

$(3)M

EPS (Loss)

$(0.03)

$0.01

$(0.05)

$(0.04)

Shares Outstanding

69M

69M

69M

70M

Income Statement Trends –

Non GAAP

©

Ikanos Communications, Inc. All rights reserved.

22 |

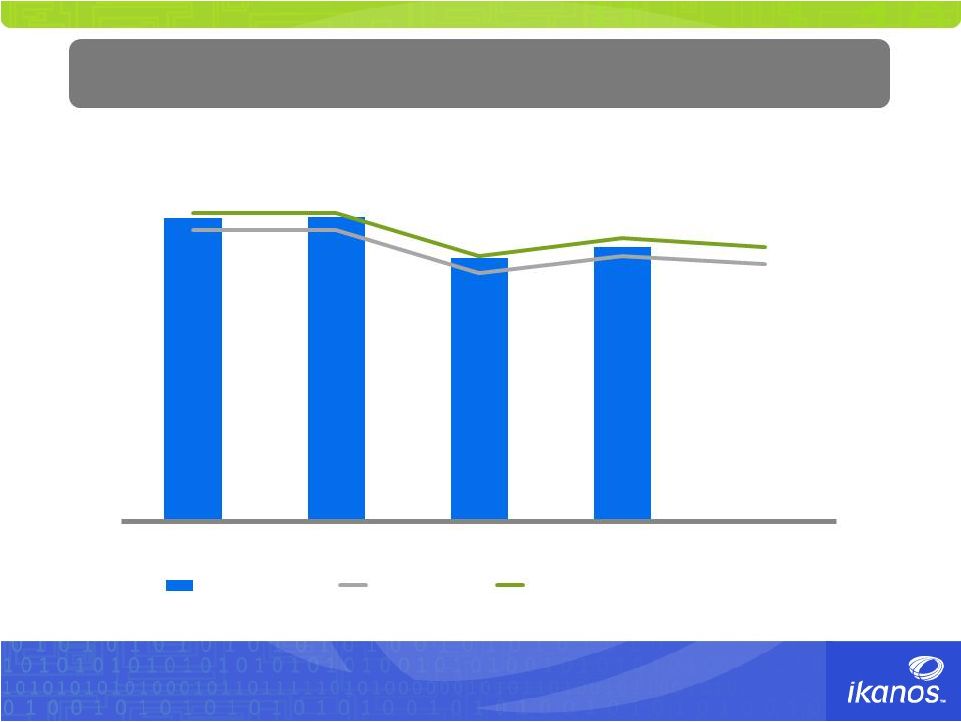

Actual Quarterly Revenue versus Guidance ($M)

Accurate, Consistent Results

Q3 Revenue

Guidance of

$30 -

$32M

©

Ikanos Communications, Inc. All rights reserved.

$35.4

$35.4

$30.8

$32.1

Q3 2011

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Actual Revenue

Low Guidance

High Guidance

23 |

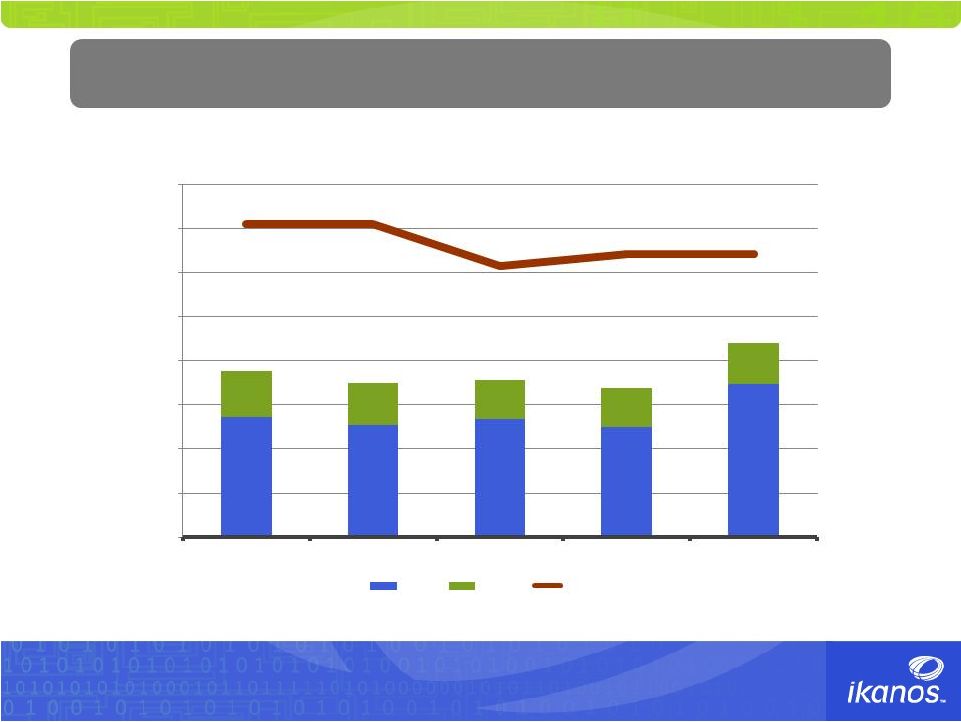

Quarterly R&D & SG&A Spending vs. Revenue ($M)

Long-term Commitment to R&D and Customers

©

Ikanos Communications, Inc. All rights reserved.

$13.6

$12.7

$13.4

$12.5

$17.4

$5.2

$4.7

$4.4

$4.4

$4.6

Rev $M

$-

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

$40.0

Q3 2011

Q4 2011

Q1 2012

Q2 2012

Q3 2012 Guidance

R&D $

SG&A $

Rev $

24 |

Q3 2011

Actual

Q4 2011

Actual

Q1 2012

Actual

Q2 2012

Actual

Cash and Investments

$36M

$35M

$40M

$33M

Accounts Receivable

$16M

$18M

$17M

$21M

Inventory

$13M

$9M

$8M

$7M

Total Assets

$81M

$78M

$78M

$79M

Long-term Debt

--

--

--

--

Total Liabilities

$22M

$17M

$20M

$23M

Resources and Positioning For Growth

Strong

Balance

Sheet

–

Zero

Long

Term

Debt

©

Ikanos Communications, Inc. All rights reserved.

25 |

•

Focused on right growth market

•

Unique Technology and Products

•

Rich in IPR: 300+ Patents and Patent Applications

•

Strong Balance Sheet

•

Positioned for Growth

Summary

©

Ikanos Communications, Inc. All rights reserved.

26 |

Thank

you! |