Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Chaparral Energy, Inc. | d420650d8k.htm |

Chaparral Energy

October, 2012

Chaparral Energy

October, 2012

Exhibit 99.1 |

2

2

This presentation contains "forward-looking statements" within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. These forward-looking statements are subject

to certain risks, trends and uncertainties that could cause actual results to differ materially

from those projected. Among those risks, trends and uncertainties are our ability to find

oil and natural gas reserves that are economically recoverable, the volatility of oil and

natural gas prices and significantly depressed natural gas prices since the middle of

2008, the uncertain economic conditions in the United States and globally, the decline in

the values of our properties that have resulted in and may in the future result in additional ceiling

test write-downs, our ability to replace reserves and sustain production, our estimate of

the sufficiency of our existing capital sources, our ability to raise additional capital

to fund cash requirements for future operations, the uncertainties involved in prospect

development and property acquisitions or dispositions and in projecting future rates of

production or future reserves, the timing of development expenditures and drilling of wells, hurricanes and

other natural disasters, including the impact of the oil spill in the Gulf of Mexico on our

present and future operations, the impact of government regulation, and the operating

hazards attendant to the oil and natural gas business. In particular, careful

consideration should be given to cautionary statements made in the various reports we have

filed with the Securities and Exchange Commission. We undertake no duty to update or revise these

forward-looking statements. |

Company Representative

Company Representative

Joe Evans

Chief Financial Officer

& Executive Vice President

3

3 |

Chaparral Overview

Chaparral Overview

Founded in 1988, Based in Oklahoma City

Core areas —

Mid-Continent (Oklahoma) and Permian Basin (W. Texas)

Oil-weighted producer (64% oil; 36% gas); R/P ratio 18 years

Second largest oil producer in Oklahoma

Stable 1P base with large potential upside –

742 MMBoe

Near-term growth potential through drilling in

conventional &

emerging plays ~ 450,000 acres Long-term growth through CO

2

EOR –

74 fields

1

As of 12/31/11 using SEC methodology

Company Statistics

Q2, 2012

Production (Boe/d)

~23,300

Proved Reserves (MMBoe)¹

156.3

Proved Reserves PV-10 ($mm)¹

$2,309

TTM EBITDA ($mm)

$305

4

4 |

5

5

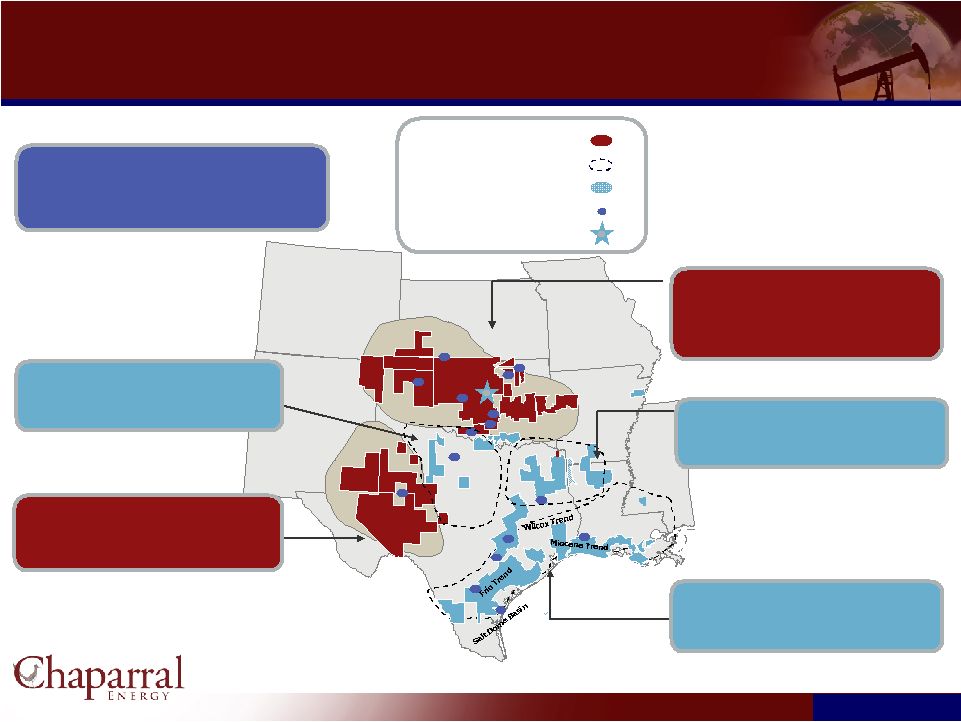

Operating Areas

Operating Areas

As of December 31, 2011 (SEC)

Core Area

Growth Area

Acreage

Field Offices

Headquarters

North Texas

Reserves: 3.9 MMBoe, 3% of total

Production: 0.5 Mboe/d, 2% of total

Permian Basin

Reserves: 19.3 MMBoe, 12% of total

Production: 3.6 MBoe/d, 15% of total

Company Total

December 2011 proved reserves –

156.3 MMBoe

2011 average daily production –

23.7

MBoe/d

Acreage (gross / net): 1,178,489 / 590,324

Val Verde

Basin

Sabine

Uplift

Midland

Basin

Delaware

Basin

Ouachita

Uplift

Arkoma

Basin

Fort

Worth

Basin

Anadarko

Woodford

Basin

OKC

Gulf Coast

Reserves: 3.2 MMBoe, 2% of total

Production: 0.9 MBoe/d, 4% of total

Mid-Continent

(Anadarko Basin & Central Oklahoma)

Reserves: 122.2 MMBoe, 78% of total

Production: 17.0 MBoe/d, 72% of total

Ark-La-Tex

Reserves: 7.2 MMBoe, 5% of total

Production: 1.3 MBoe/d, 6% of total |

Strong

Record of Reserve and Production Growth Strong Record of Reserve and Production

Growth Year-End SEC Reserves (MMBoe)

(1)

2003 –

2011 CAGR = 15%

Annual Production (MMBoe)

2003 –

2011 CAGR = 16%

Chaparral’s reserve replacement ratio averaged 422% per year since 2003

6

6

Year

Oil

Gas

2007

$96.01

$6.80

2008

$44.60

$5.62

2009

$61.18

$3.87

2010

$79.43

$4.38

2011

$96.19

$4.11

1)

Reserves as of December 31

for each year calculated

using flat SEC

pricing per the following:

6

6 |

Net

Debt / EBITDA Liquidity ($mm)

Financial Position to Execute Strategy

Financial Position to Execute Strategy

Strong Financial Position

No senior note maturities before 2020

Hedge positions in place to secure cash

flow in near term

Budget CAPEX within free cash flow

(including divestiture proceeds)

$325

$300

$400

7

7

* As of Q2, 2012 |

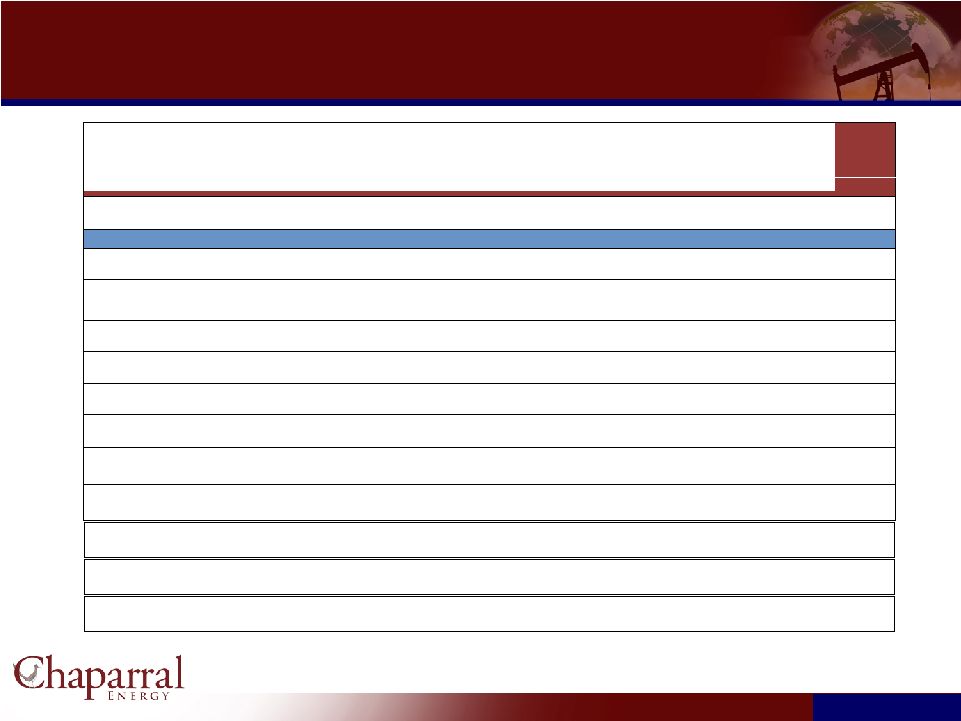

Capital Budget ($mm)

Capital Budget ($mm)

Component

2008

2009

2010

2011

2012

Budget

2012

Expanded

Budget

2012

%

Drilling

$168

$76

$196

$172

$131

$201

44%

EOR

24

14

36

86

127

168

37%

Enhancements

53

32

39

32

26

16

3%

Acquisitions

46

18

41

17

15

40

9%

Other (P&E,

Capitalized G&A, etc)

48

14

32

28

31

35

7%

Total

$339

$154

$344

$336

$330

$460

100%

Key Drilling Areas

Northern OK Mississippi

Horizontal

$73

Anadarko Cleveland Sand

46

Anadarko Granite Wash

22

Marmaton

15

Bone Spring / Avalon

10

Hogshooter

7

Other

28

Total

$201

8

8

EOR Field

N. Burbank

$104

Panhandle Area

60

Other

3

Total

$168

*99% of Capital Program is Oil Focused |

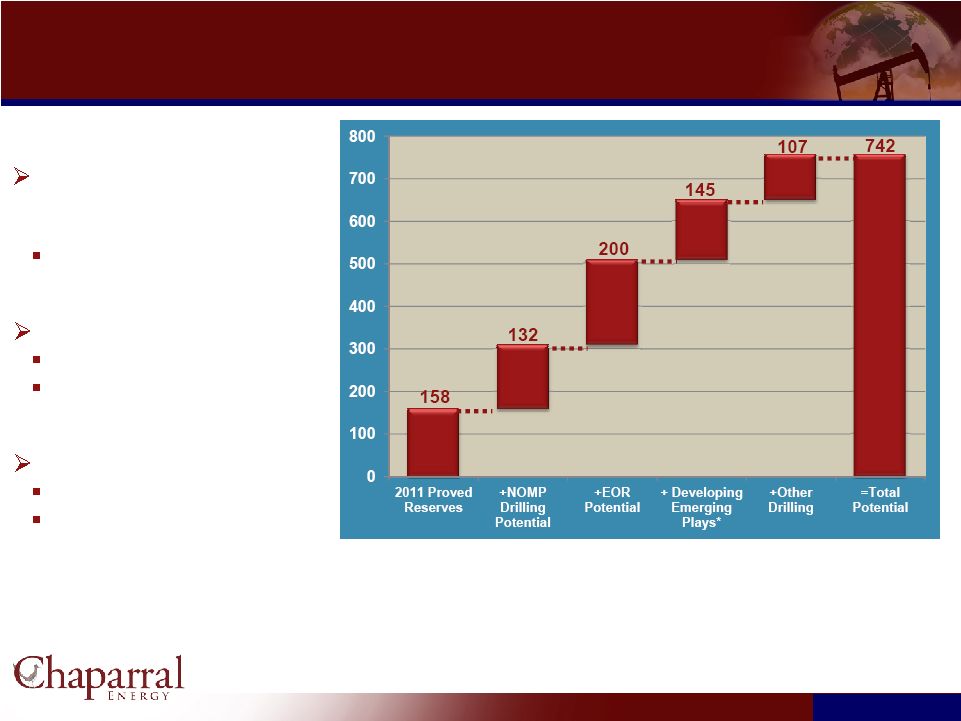

9

9

Resource Potential

Resource Potential |

10

10

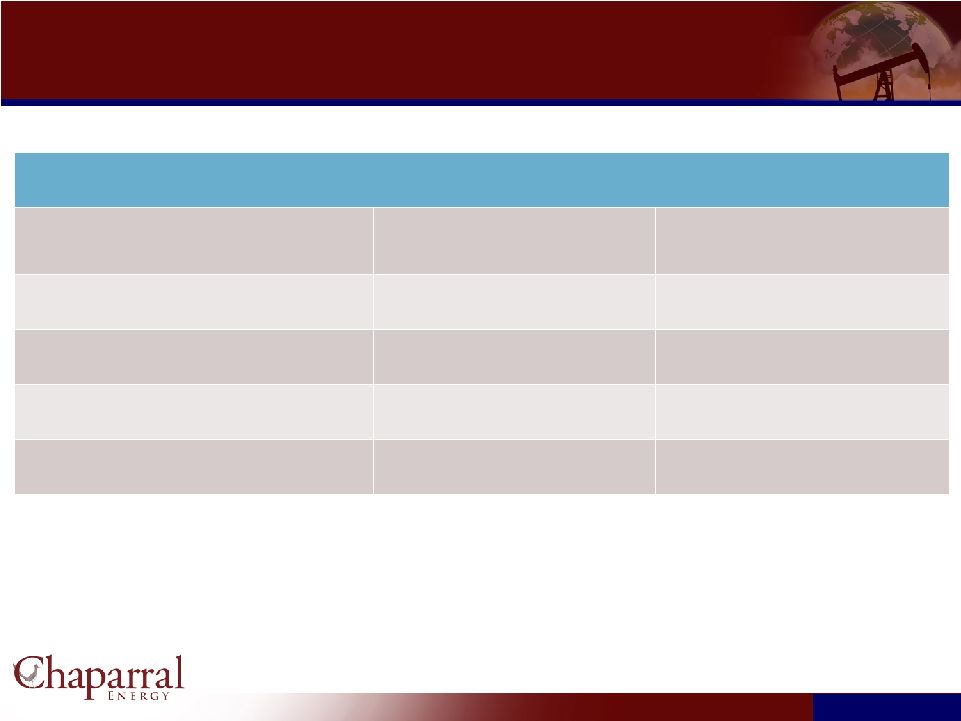

Breakdown By Significant Play

Breakdown By Significant Play

(1) Based on 03/31/12 Preliminary Reserves at SEC Pricing

Play

Net Acreage

Est Drilling

Density

Development

Success

Factor

Risked Net

Undrilled

Wells

Unrisked Net

Undrilled

Wells

Proved

Reserves

Risked

Unproven

Resource

(m acres)

(acres)

(MMBoe)

(MMBoe)

EOR

96

30

200

NOMP -Core

(210 mbo/well)

93

160

65%

378

581

1.9

77

NOMP -Emerging

(160 mbo/well)

167

160

33%

344

1,044

0.5

55

Woodford

(550 mbo/well)

23

80

45%

134

300

2.5

73

Marmaton

(125 mbo/well)

48

160

50%

150

300

0

19

Bone Spring

(320 mbo/well)

19

160

50%

59

119

0

19

Avalon

(260 mbo/well)

19

160

50%

59

119

0

15

Cleveland

(300 mbo/well)

10

160

100%

45

45

5

14

Granite Wash

(300 mbo/well)

10

160

100%

14

14

5

4

Total Drilling

in Key Plays

389

1,184

2,522

15

276

Other

113

107

Total

Resources

485

158

583

Key Drilling Plays

(1) |

11

11

Conventional

drilling

(IRR:

50%

-

75%)

—

Anadarko Granite Wash

—

Anadarko Cleveland Sand

Unconventional

resource

play

drilling

(IRR:

35%

-

75%)

—

Northern Oklahoma Mississippi Play (“NOMP”): 260,000 net acres

—

Panhandle Marmaton: ~48,000 acres

—

Anadarko Woodford Shale: ~23,000 acres

—

Bone Spring/Avalon Shale: ~19,000 acres

Chaparral owns an inventory of 76 possible candidate

CO2-EOR fields.

—

Proved reserves of 45.1 MMBoe from EOR designated fields as of

12/31/11

—

200+ MMBoe of total potential reserves

CO2

fields exhibit low-risk and stable production.

—

IRR: 25% –

40%

Chaparral is Well Positioned for

Near–Term and Long–Term Growth

Near–Term Growth Drivers

Long–Term Growth Drivers |

Northern Oklahoma Mississippi Play

The Northern Oklahoma Mississippi Play (“NOMP”) is a

key near–term focus area for Chaparral

Chaparral acreage over 260,000 net acres in the NOMP

Over 132 MMBoe of potential

1,600 unrisked drilling well inventory

Chaparral Acreage

12

12

Overview

NOMP Asset Map

NOMP Well Economics

IP Rates:

100 - 700 Boe/d

EUR:

100 - 400 MBoe

Well Cost:

$2.5 - 4.0 million

% Oil:

60% - 90%

IRR:

35% - 75%

KS

OK |

CHK –SERENITY 1-3H

IP: 1250 BOPD, 1064 MCFD

20 MONTH CUM: 177 MBO, 125 MMCF

*5 WELLS PER SECTION PROJECT

CHK –ONEIL LAND 1-15H (37.5% WI)

IP_10: 318 BOPD, 1410 MCFD

Northern Oklahoma Mississippi Play

Northern Oklahoma Mississippi Play

Chaparral Dover/Hennessey

Project

Surrounding Mississippi Vertical Production,

Very Low Drainage, Emerging Activity

Net Acres: 15,400 (11,220 Verified)

Net Potential Wells: 87.5 (70.13)

Chaparral Major/Garfield

Project

Surrounding Mississippi Vertical

Production

Net Acres: 12,000 (9,700 Verified)

Net Potential Wells: 59.81 (54.75)

*Currently Leasing*

Chaparral Perry/Polo Project

Surrounding Mississippi Vertical Production

Mississippi/WDFD Horizontal Activity

Net Acres: 7,450 (6,300 Verified)

Net Potential Wells: 46.56 (39.31)

RANGE RESOURCES CHAT PROJECT

IP_9: 122 BOPD, 330 MCFD, 177 BOEPD

SDR–KASPER 1H-2

IP: 341 BOEPD

SANDRIDGE/PANTHER/DEVON MEDFORD PROJECTS

IP_8: 327 BOPD, 1373 MCFD

SDR –KILIAN 1-7H

IP: 750 BOPD, 1014 MCFD

SANDRIDGE GIBBON PROJECT

IP_4: 227 BOPD, 863 MCFD, 371 BOEPD

DEVON PROJECT

MATTHEW 1-33H

IP: 550 BOPD, 500 MCFD

*DVN Leased ~250M Acres

SDR –SPENCER 1-25H

IP: 521 BOEPD

SANDRIDGE RINGWOOD PROJECT

IP_4: 172 BOPD, 775 MCFD, 301 BOEPD

WICKLUND & PLYMOUTH PROJECTS

IP_8: 345 BOPD, 836 MCFD , 484 BOEPD

SDR –CLO 1-16H

IP: 404 BOPD, 2813 MCFD

Chaparral Yellowstone Project

IP_30: 199 BOPD, 566 MCFD, 294 BOEPD

Net Acres: 7,000

Net Potential Wells: 43.8

2 Proposed Addnl 2012

6 Currently Operated Wells

Chaparral Dacoma Project

IP_43: 348 BOPD, 1,896 MCFD, 664 BOEPD

Net Acres: 3,500

Net Potential Wells: 21.9

1 Proposed Producer –1 Proposed SWD 2012

4 Currently Operated Wells

Several Non-Operated

EAGLE ENERGY + CHK DACOMA PROJECTS

IP_43: 348 BOPD, 1896 MCFD, 664 BOEPD

Chaparral Wildhorse

Concession

137,460 Net Acres (Over +340 Sections)

Cutthroat Gap 1H-29, Denoya 1H-5,

Blackdog’s Band, Itsike, Great White Hair,

Big Elk

KS

OK

Vitruvian -Bowling 2-32H

IP: 516 BOPD, 211 MCFD 4053 BWPD

SPYGLASS

IP_8: 212 BOEPD

TERRITORY RESOURCES

RED ROCK PROJECT

IP_5: 351 BOPD, 426 MCFD, 422 BOEPD

SPYGLASS–SOUTH BEND 1A-11H

IP (10-DAY):

696 BOPD, 506 MCFD, 780 BOEPD

EUR: 214 MBOE, 87% OIL

CALYX ENERGY AMI

Wheeler 14-1H

IP: 160 BOPD, 434 MCFD, 232 BOEPD

Spirit Creek 15-1H

IP: 180 BOPD, 177 MCFD, 210 BOEPD

State M 16-2H

IP: 302 BOPD, 588 MCFD, 400 BOEPD

Chaparral Burbank MH Project

Nabhi 1H-22

Salt Creek 1H-10

Scout 1H

New Gulf & Pablo Projects

New Gulf –QUARY 1H

IP: 130 BOPD, 300 MCFD

RF USA –

TAHARA 1-28H

IP: 240 BOPD, 260 MCFD

EAGLE –LONGHURST 3H-34

IP: 2225 BOPD, 4767 MCFD

60 DAYCUM: 106 MBO, 243 MMCF

TERRITORY RESOURCES ACTIVITY

Scouting Report: 250 BOPD

CHESAPEAKE ENERGY ACTIVITY

SLAWSON ACTIVITY

30-Day IP:

733 BOPD, 863 MCFD, 879 BOEPD

CHK -GREENLEE 16H

IP (10 DAY):

353 BOPD, 1318 MCFD, 573 BOEPD

~40% OIL CUT

SANDRIDGE ENID PROJECT

IP_4: 160 BOPD, 776 MCFD, 290 BOEPD

Chaparral Billings-West Prospect

~5,280 Leased

*Currently Leasing*

Chaparral Emerging Area

SANDRIDGE & CHESAPEAKE WAKITA PROJECT

IP_77: 167 BOPD, 890 MCFD

SHELL GULF MEXICO

ALL TIGHT HOLED

Chaparral Core Area

SANDRIDGE COMANCHE CO –MISS EXTENSION (SDT II)

IP_3: 123 BOPD, 625 MCFD, 227 BOEPD (30 DAYS)

SDR –PUFFINBARGER 2-28H

IP_30: 2221 BOPD, 1815 MCFD

43 DAYCUM: 74 MBO, 68 MMCF

Erikson 6H &

7H

Dean 2H-7

Davison

2H-3

Schupbach 1H-

20

Schultz 2H

Philips 2H

Murrow

2H

Ruby

Joachim

Elsie(s)

LeForce

Boyd

Daisy

Shire

BLUE DOLPHIN –SCHOELING 1H

IP: 650 BOPD, 4 MMCFD, 1316 BOEPD

VITRUVIAN/DEVON ACTIVITY

MAVERICK BROS FONDA PROJECT

IP_2: 92 BOPD, 1963 MCFD, 419 BOEPD

(Chaparral Hillsdale

Prospect)

SOURCE ENERGY FANNIE PROJECT

Chaparral Jefferson/Nash

Project

IP_8: 327 BOPD, 1373 MCFD, 556

BOEPD

Net Acres: 5,020

Net Potential Wells: 31.38

1 Proposed Addnl 2012

3 Currently Operated Wells

Several Non-Operated

LONGFELLOW ENERGY ACTIVITY

B&W PROJECT

13

13

NOMP Core Area

Emerging Area

Chaparral Acreage |

14

14

NOMP: Recent Results

NOMP: Recent Results

Current

Net

Production

–

4,000

Boepd

2012

Capital

-

$73

mm

NOMP Core (93,000 Net Acres)

Significant industry activity in the play

Drilled or participated in 37 wells to date (18 operated); 2 WOCU

1-3 additional wells in 2012

Average IP ~600 Boepd

Current

Net

Production

–

3,375

Boepd

45% Oil

Emerging NOMP (167,000 Net Acres)

In de-risking phase –

industry activity increasing

Drilled 6 wells to date

Average IP ~200+ Boepd

Current

Net

Production

–

625

Boepd

92% Oil |

Marmaton Shelf Play

Marmaton Shelf Play

Johnston 1H-24

IP +300 Boepd

Leatherman 1H-14

2012 Location

Lamaster 1H-23

2012 Location

Jay 1H-1098

2012 Location

Wright 1H-1099

2012 Location

Marmaton Production

Chaparral Acreage

Net Acreage

48,000

EUR/well (MBoe)

150

Cost per Well (MM$)

$3.6

Cornell 1H-30

2012 Location

Buy Area

Ochiltree Co, Tx

15

15 |

16

16

Potential in Excess of 740 MMBoe

Potential in Excess of 740 MMBoe

Near-term + Long-term

strategy yields significant

value increase

~ 70% Oil

Near-term focus on NOMP

De-risk play, unlock value

Production growth

Long-term focus on EOR

Low-risk production upside

Long-life, stable production

* Woodford, Bone Spring, Avalon, Cleveland Sand, Granite

Wash, and Marmaton

(1) |

17

17

Chaparral:

Chaparral:

A Growing Mid-Continent

CO

2

EOR Company

A Growing Mid-Continent

CO

2

EOR Company |

CO

2

EOR Focused Areas

CO

2

EOR Focused Areas

18

18

CO

2

Project Inventory

74

units

with

1P,

2P

&

3P

EOR

reserves

9 units with proved reserves

9 units with CO

2

injection

CO

2

Infrastructure –

473 Miles

318 miles of active line

68 miles under construction

87 miles of inactive line

CO

2

Supply

47

MMscf/D

of

existing

CO

2

supply

43 MMscf/D new CO

2

supply

CO2 Tertiary Recovery Projects

Panhandle Area

Permian Basin

Central

Oklahoma

Area

Burbank

Area |

19

19

Currently Owned CO

2

Development Potential and

Infrastructure

Currently Owned CO

2

Development Potential and

Infrastructure |

EOR

2012 Capital Budget (1)

EOR 2012 Capital Budget

(1)

20

20

Budget by Category

($mm)

2011

Actual

2012

Budget

2012

Expanded

Budget

Infrastructure / Pipelines

14

90

106

Drilling

17

13

24

Enhancements / CO

2

Purchases

55

24

37

Total

$86

$127

$168

2012 Field Projects ($mm)

Panhandle

Area

Permian

Basin

Central

Oklahoma

Area

Burbank

Area

(1)

Does not include Capitalized G&A |

Processing Rate: The Key to Improved Rate of

Return

Processing Rate: The Key to Improved Rate of

Return

21

21

5N/13E

2

3

4

5

8

9

10

11

14

15

16

17

20

21

22

23

26

27

28

29

32

33

34

35

WSW

WSW

WSW

WSW

WSW

WSW

WSW

WSW

WSW

WSW

WSW

WSW

3

WHMU

2-33

BEATY

9-3

PUMU

6-3

HMU

6-5

HMU

1

JEFFUS

9-6

PUMU

1-B

BOLLINGER

58

WHMU

2

WHMU

2-M

WITT

1WSW

WHMU

1

C A BLAKE

1

TALBOT

2

JULIAN

2

LANGSTON

1-5

WELSH

1-7

1-8

SHATTUCK

1

WELCH

1

HITCH

2

BLAKE

1

G W FERGUSON

1

D M WILSON

1

HAMSON `A`

1

HISER

1

4-1

HINDS A

1

COPPOCK `A`

1

HISER

1

H L WITT

1

DELONG303

1

PRICE

1

LANDERS

A-1

BOLLINGER

1-31

HOAR3-C

1-32

HAAR

1-33

BEATY

1

JULIAN

1

JEFFREY

2-32

HAAR

1-D

SPARKS

1-A

34-1

HMU

1

HAAR

37-1

HMU

1

TIM GLODEN UNIT

38-1

HMU

40-1

HMU

1

BLAKE

2-23

DIXON

35-2

HMU

3

JEFFUS

39-1

HMU

1

STEINKUEHLER

11-2

HMU

36-2

HMU

24-2

HMU

1-15

WILSON

10-2

HMU

75

WHMU

18-2

HMU

6-13WIW

HMU

82

WHMU

83

WHMU

85

WHMU

38-2

HMU

36-3

HMU

37-2

HMU

24-3

HMU

9-2

HMU

3-L 603W

POSTLE MORROW

901-S

POSTLE MORROW L-3

3-L 403W

POSTLE

3-L 404W

POSTLE MORROW

3-L 704W

POSTLE MORROW

903W

POSTLE MORROW L-3POSTLE MORROW L-3

100W

P U M U 3-L

11-6-G

EPMG

35-3

HMU

35-4

HMU

J

32-3

HMU

22-3

HMU

4-A

HARTMAN

18-3

HMU

21-3

HMU

17-4

HMU

22-4

HMU

7-3

PUMU

7-4

PUMU

105

POSTLE KEYES UNIT

13-2

HMU

98

WHMU

104

WHMU

106

WHMU

6-3

PUMU

10-3

P U M U

10-3A

POSTLE UPPER

5-8

PUMU

2-D

HAAR

7-6

PUMU

7-5

PUMU

15-2

EPMG

9-10

PUMU

14-2

EAST POSTLE

15-3

EPMG

112

WHMU

9-11

PUMU

16#1

KIRBY

7-7

PUMU

8-9

PUMU

5-9Tal

PUMU

24-4

HMU

2

260

WHMU

282

WHMU

36-4

HMU

31-2

HMU

35-5

HMU

201

WHMU

205

WHMU

17-8

HMU

22-5

HMU

21-4

HMU

30-2

HMU

32-4

HMU

207

WHMU

WHMU

301

WHMU

202

WHMU

212

WHMU

206WHMU

WHMU

17-5

HMU

17-6

HMU

19-1

HMU

17-7

HMU

39-2

HMU

6-15

JULIAN

3-A

HARTMAN

6-11

HMU

1-A

BLAKE

6-12

HMU

2-A

WELSH

9-1

HMU

5-2

HMU

60

WHMU

1-P

STATE

19-2

HMU

2 SWD

SPARKS D

2-D

HICKS

2-18

GLODEN

4-A

FINDLAY

31-1C

HMU

301W

POSTLE MORROW

2-1

HMU

2-E

HICKS

13-1

EPMG

2-D

SPARKS

501 W

POSTLE MORROW

2-276

G W FERGUSON UNIT

1-29

4 (275)

BLAKE

9-5

PUMU

7-1

PUMU

7-2

PUMU

SWD 1

JULIAN

6-4

HMU

7-6

HMU

8-7

PUMU

8-8

PUMU

4-1

HMU

6-1

PUMU

5-1

HMU

1-M

G E NELSON A

16-2

HMU

5-1

PUMU

3-M

TALBERT

12-1

HMU

2-M-A

WEEKS

12-3

HMU

4-M

WEEKS-WELCH

14-1

HMU

11-1

HMU

1

MAMIE CLINKINGBEARD

13-1

HMU

5

WHMU

7

WHMU

6

61

WHMU

1-B

JULIAN

1-C

JULIAN

9

JULIAN

6-10

HMU

59

WHMU

2

LOWERY

2

FRANKLIN LUNS

2-A-B

LUNSFORD

24-1

HMU

35-1

HMU

5

WEEKS-WELCH

14-2

HMU

15-1

HMU

18-1

HMU

01-B

GREENE

1-18

GLODEN

11-3

11-4

EPMG(BEATY4B)

10-2

1-D

HAAR

1-E

HAAR

HAAR

1-F

MILLER

3-1

HMU

21-1

HMU

30-B-1

HMU

21-2

HMU

2-B

BOLLINGER

27-1

CAVETT

2-A

CAVETT

33-1

HMU

17-1

HMU

17-2

HMU

17-3

HMU

1-A

FOWKES

401W

POSTLE MORROW

2-B

GLODEN

1-A

HARTMAN

1-D

HICKS

1-C

HINDS

601

POSTLE MORROW L-3

1001S

2-D

HINDS

1-B

HISER

22-2

HMU

1-C

SPARKS

2-C

SPARKS

1-E

SPARKS

32-1

HMU

2-B

STEWART

22-1

HMU

2-B

(BEATY

33-10

14-4

HMU

38-3

HMU_PROPOSED

41-1

HMU_PROPOSED

41-2

HMU_PROPOSED

41-3

HMU_PROPOSED

6-20

Julian_Proposed

8-10

JULIAN

10-4

PUMU

9-12

PUMU

WHMU_PROPO

Hovey Morrow Unit (HMU)

Time

25% hcpv Inj./Yr

10% hcpv Inj./Yr

HMU Model: Processing Rate v. Reserve Recovery

•

CO

2

Injection initiated Sep’07

•

Processing Rates Average 25% hcpv Inj./Yr |

22

22

North Burbank CO

2

Development

North Burbank CO

2

Development |

North

Burbank Unit – Overview

North Burbank Unit –

Overview

Chaparral’s

North

Burbank

Unit

is

its

largest

EOR

field

and

plans

to

introduce

CO

2

injection

into

the

North

Burbank Unit in 1Q 2013

Chaparral

anticipates

that

it

will

spend

$800

million

associated

with

this

EOR

project

throughout

the

life

of

the field

23

23

23

23

Total OOIP

1,163 MMBbls

Primary Production

239 MMBbls

Secondary Recovery

211 MMBbls

Tertiary Potential

119 MMBbls

Net Tertiary Potential

100 MMBbls |

Burbank in Perspective

Burbank in Perspective

24

24

110 Years |

Coffeyville CO

2

System

Coffeyville CO

2

System

25

25

The Coffeyville CO

2

System

$84 million of total capital expenditures

23,500 HP compression facility

68.3-mile 8-inch pipeline with potential

capacity of approximately 60 MMcf/d.

CO

2

is sourced from the CVR Partners

fertilizer plant in Coffeyville, KS.

Online and Operational in January

2013

Oklahoma

Kansas

Coffeyville CO2 System

Asset Map

Panhandle

CO2

System

Coffeyville

CO2

System |

Coffeyville CO

2

Compression Facility

Coffeyville CO

2

Compression Facility

26

26 |

Coffeyville CO

2

Facility: Foundation Construction

Coffeyville CO

2

Facility: Foundation Construction

27

27 |

Coffeyville CO

2

Pipeline: Construction

Coffeyville CO

2

Pipeline: Construction

28

28 |

29

29

Coffeyville CO

2

Pipeline: Construction

Coffeyville CO

2

Pipeline: Construction |

30

30

Other Recently Installed CO

2

Injection Projects

Other Recently Installed CO

2

Injection Projects |

Camrick CO

2

–EOR Flood

Camrick CO

2

–EOR Flood

31

31 |

32

32

North Perryton CO

2

–EOR Flood

North Perryton CO

2

–EOR Flood |

33

33

Booker Area CO

2

–EOR Flood

Booker Area CO

2

–EOR Flood |

34

34

Farnsworth Area CO

2

–EOR Flood (West Side Only)

Farnsworth Area CO

2

–EOR Flood (West Side Only) |

Monthly Incremental EOR

35

35

|

Financial Overview

Financial Overview

36

36 |

37

37

Financial Summary

Financial Summary

2009

2010

2011

1H 2012

Price

Oil & NGL –

Wellhead ($/Bbl)

$55.04

$74.53

$87.52

$84.12

Gas –

Wellhead ($/Mcf)

$3.51

$4.36

$4.08

$2.21

Production (MMBoe)

7.6

8.1

8.7

4.2

Oil & NGL (MMBbls)

3.9

4.0

5.0

2.6

Gas (Bcf)

22.6

23.7

21.6

9.4

Financial Data ($mm)

Operating Expenses:

Lease Operating Expenses

$94.1

$106.1

$121.4

$63.7

Production and Ad Valorem Taxes

20.3

26.5

34.3

15.5

General and Administrative Expenses (excludes noncash deferred

comp) 22.7

27.3

38.3

23.9

Interest Expense

$90.1

$83.6

$96.7

$48.6

EBITDA

$224

$288

$313

$153

Total Capital Expenditures

$154

$344

$336

$275 |

Financial Metrics per Boe

Financial Metrics per Boe

Production (Boe) / Day

LOE / Boe

EBITDA / Boe

G&A / Boe

38

38 |

Operating Statistics

2011 Results

2012

Guidance

Capital Expenditures

$336 million

$460 million

Production

8.7 MMBoe

8.8 -

9.0 MMBoe

General and Administrative

$4.86/Boe

$5.75 -

$6.25/Boe

Lease Operating Expense

$14.03/Boe

$14.25 -

$14.75/Boe

2011 Results and 2012 Guidance

2011 Results and 2012 Guidance

39

39 |

40

40

Hedge Portfolio

Note:

Dollars

represent

average

strike

price

of

hedges

(includes

all

derivative

instruments)

Gas Basis Hedges

YR

Price

% TP

’12

$

0.23

85%

’13

$

0.20

84%

’14

$

0.23

70%

% of Total Proved Reserves Hedged (as of September 21, 2012)

|

Question & Answer

Question & Answer

41

41 |