Attached files

| file | filename |

|---|---|

| 8-K - SHENANDOAH TELECOMMUNICATIONS COMPANY 8-K 10-2-2012 - SHENANDOAH TELECOMMUNICATIONS CO/VA/ | form8k.htm |

October 2, 2012 Shenandoah Telecommunications Exhibit 99.1

* Chris French CEO and President

1

* Agenda Introduction and Shentel Overview Overview of Wireless Overview of Cable Overview of Wireline Questions and Answers Lunch

2

* Safe Harbor Statement This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, regarding, among other things, our business strategy, our prospects and our financial position. These statements can be identified by the use of forward-looking terminology such as “believes,” “estimates,” “expects,” “intends,” “may,” “will,” “should,” “could,” or “anticipates” or the negative or other variation of these similar words, or by discussions of strategy or risks and uncertainties. These statements are based on current expectations of future events. If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could vary materially from the Company’s expectations and projections. Important factors that could cause actual results to differ materially from such forward-looking statements include, without limitation, risks related to the following: Increasing competition in the communications industry; and A complex and uncertain regulatory environment. A further list and description of these risks, uncertainties and other factors can be found in the Company’s SEC filings which are available online at www.sec.gov, www.shentel.com or on request from the Company. The Company does not undertake to update any forward-looking statements as a result of new information or future events or developments.

3

* Use of Non-GAAP Financial Measures Included in this presentation are certain non-GAAP financial measures that are not determined in accordance with US generally accepted accounting principles. These financial performance measures are not indicative of cash provided or used by operating activities and exclude the effects of certain operating, capital and financing costs and may differ from comparable information provided by other companies, and they should not be considered in isolation, as an alternative to, or more meaningful than measures of financial performance determined in accordance with US generally accepted accounting principles. These financial performance measures are commonly used in the industry and are presented because Shentel believes they provide relevant and useful information to investors. Shentel utilizes these financial performance measures to assess its ability to meet future capital expenditure and working capital requirements, to incur indebtedness if necessary, return investment to shareholders and to fund continued growth. Shentel also uses these financial performance measures to evaluate the performance of its businesses and for budget planning purposes.

4

* Shentel History Predecessor organization chartered on June 9, 1902: Farmers Mutual Telephone System of Shenandoah County Converted to a commercial stock corporation in 1960: Shenandoah Telephone Company Converted to holding company in 1981: Shenandoah Telecommunications Company Listed on NASDAQ October 23, 2000 Ticker symbol: SHEN

5

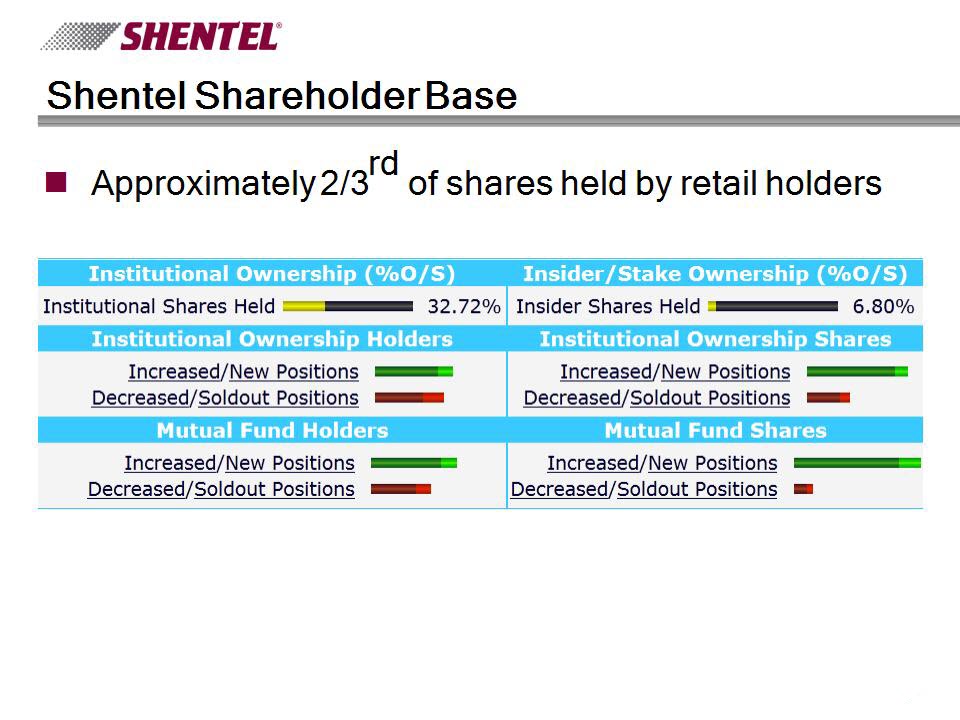

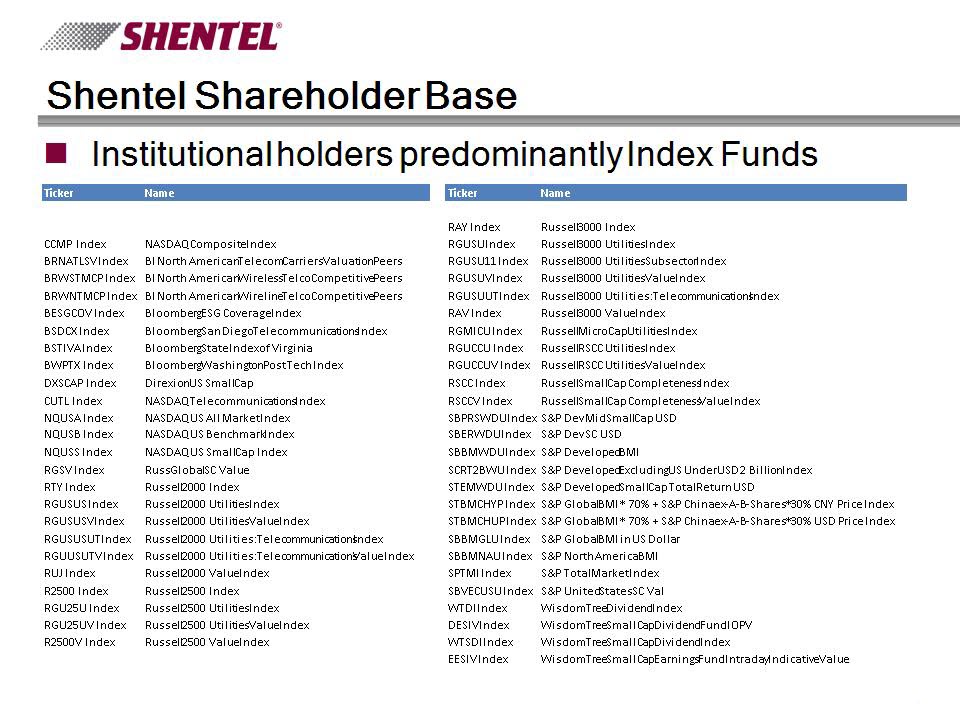

* Shentel Shareholder Base Approximately 2/3rd of shares held by retail holders

6

* Shentel Shareholder Base Institutional holders predominantly Index Funds Ticker Name Ticker Name RAY Index Russell 3000 Index CCMP Index NASDAQ Composite Index RGUSU Index Russell 3000 Utilities Index BRNATLSV Index BI North American Telecom Carriers Valuation Peers RGUSU11 Index Russell 3000 Utilities Subsector Index BRWSTMCP Index BI North American Wireless Telco Competitive Peers RGUSUV Index Russell 3000 Utilities Value Index BRWNTMCP Index BI North American Wireline Telco Competitive Peers RGUSUUT Index Russell 3000 Utilities:Telecommunications Index BESGCOV Index Bloomberg ESG Coverage Index RAV Index Russell 3000 Value Index BSDCX Index Bloomberg San Diego Telecommunications Index RGMICU Index Russell MicroCap Utilities Index BSTIVA Index Bloomberg State Index of Virginia RGUCCU Index Russell RSCC Utilities Index BWPTX Index Bloomberg Washington Post Tech Index RGUCCUV Index Russell RSCC Utilities Value Index DXSCAP Index Direxion US Small Cap RSCC Index Russell Small Cap Completeness Index CUTL Index NASDAQ Telecommunications Index RSCCV Index Russell Small Cap Completeness Value Index NQUSA Index NASDAQ US All Market Index SBPRSWDU Index S&P Dev MidSmall Cap USD NQUSB Index NASDAQ US Benchmark Index SBERWDU Index S&P Dev SC USD NQUSS Index NASDAQ US Small Cap Index SBBMWDU Index S&P Developed BMI RGSV Index Russ Global SC Value SCRT2BWU Index S&P Developed Excluding US Under USD 2 Billion Index RTY Index Russell 2000 Index STEMWDU Index S&P Developed Small Cap Total Return USD RGUSUS Index Russell 2000 Utilities Index STBMCHYP Index S&P Global BMI * 70% + S&P China ex-A-B-Shares* 30% CNY Price Index RGUSUSV Index Russell 2000 Utilities Value Index STBMCHUP Index S&P Global BMI * 70% + S&P China ex-A-B-Shares* 30% USD Price Index RGUSUSUT Index Russell 2000 Utilities:Telecommunications Index SBBMGLU Index S&P Global BMI in US Dollar RGUUSUTV Index Russell 2000 Utilities:Telecommunications Value Index SBBMNAU Index S&P North America BMI RUJ Index Russell 2000 Value Index SPTMI Index S&P Total Market Index R2500 Index Russell 2500 Index SBVECUSU Index S&P United States SC Val RGU25U Index Russell 2500 Utilities Index WTDI Index WisdomTree Dividend Index RGU25UV Index Russell 2500 Utilities Value Index DESIV Index WisdomTree SmallCap Dividend Fund IOPV R2500V Index Russell 2500 Value Index WTSDI Index WisdomTree SmallCap Dividend Index EESIV Index WisdomTree SmallCap Earnings Fund Intraday Indicative Value

7

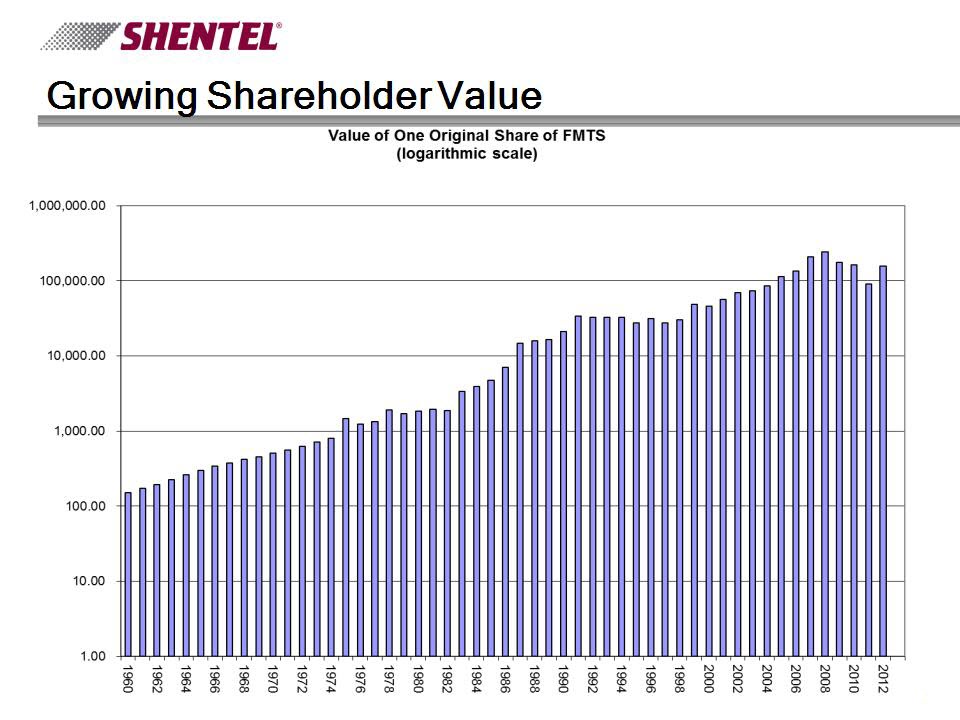

* Growing Shareholder Value

8

* Adele Skolits CFO and VP of Finance

9

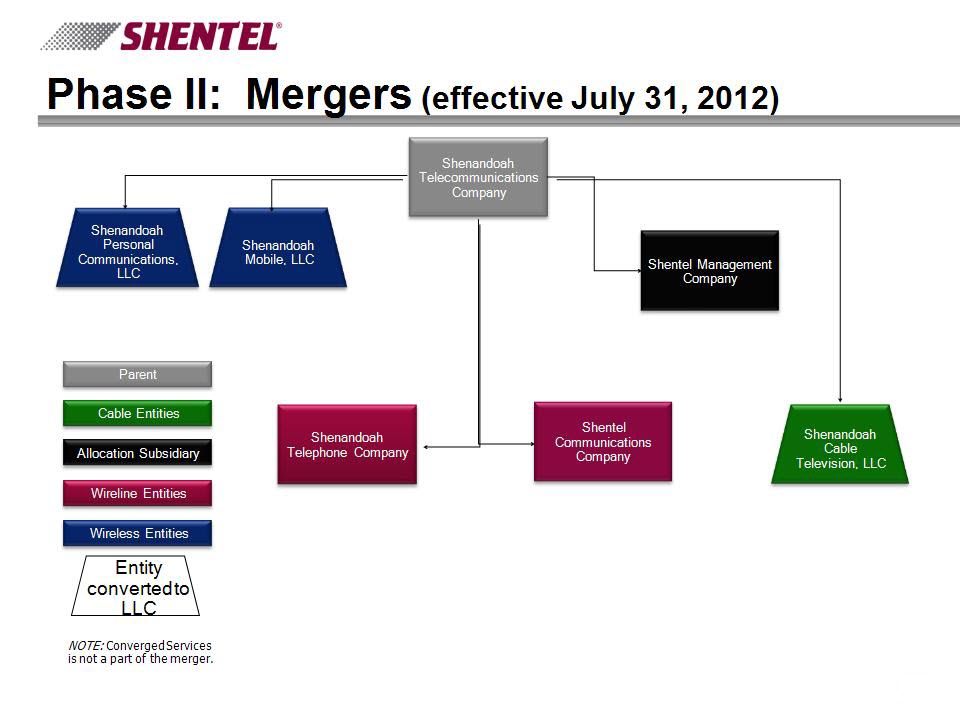

* Phase II: Mergers (effective July 31, 2012) Allocation Subsidiary Wireline Entities Wireless Entities Shenandoah Telecommunications Company Shenandoah Mobile, LLC Shenandoah Cable Television, LLC Shentel Management Company Shenandoah Personal Communications, LLC Cable Entities Parent Entity converted to LLC NOTE: Converged Services is not a part of the merger.

10

* Shentel Initiatives Diversify Cable – Improve Profitability from 2008 & 2010 Acquisitions Upgrade acquired networks to offer “Triple Play” with robust high speed data offering Increase penetration to market levels Capitalize on ILEC and satellite limitations Build clusters/streamline network to gain operating efficiencies Wireless – As a Sprint PCS affiliate of Sprint Nextel Continue to increase prepaid penetration Improve future margins with higher ARPU Upgrade to offer 4G across footprint

11

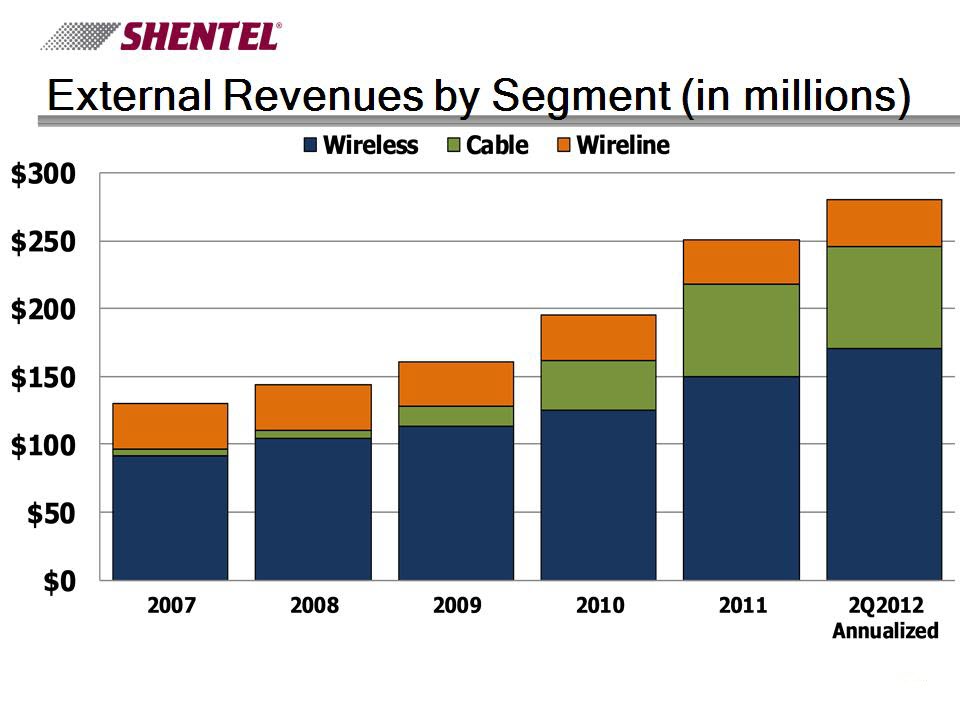

* External Revenues by Segment (in millions)

12

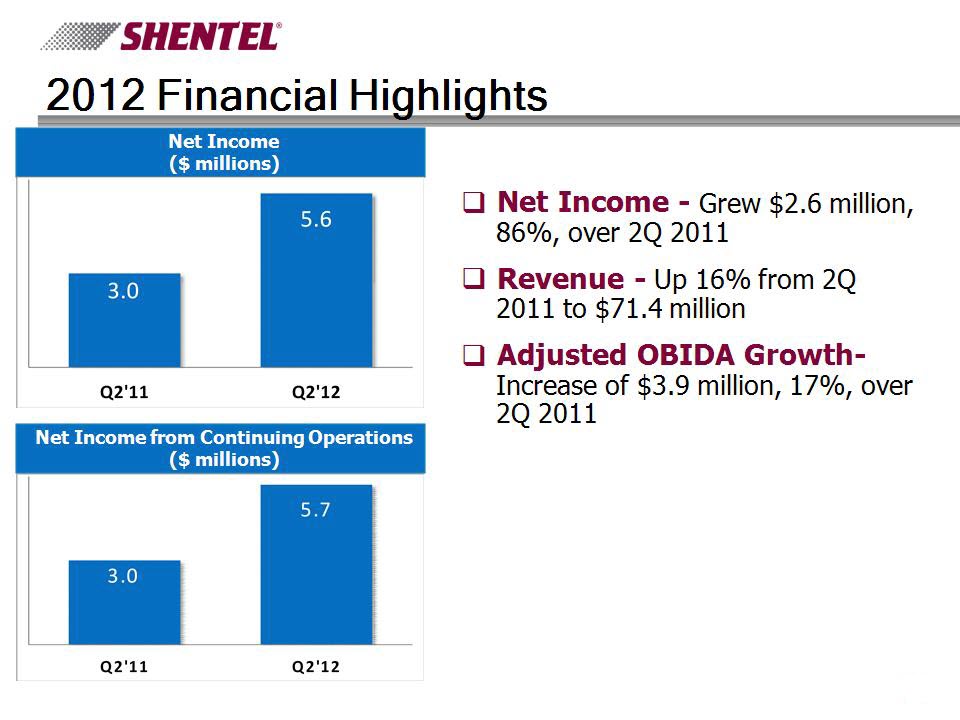

* 2012 Financial Highlights Net Income ($ millions) Net Income from Continuing Operations ($ millions) Net Income – Grew $2.6 million, 86%, over 2Q 2011 Revenue – Up 16% from 2Q 2011 to $71.4 million Adjusted OBIDA Growth- Increase of $3.9 million, 17%, over 2Q 2011

13

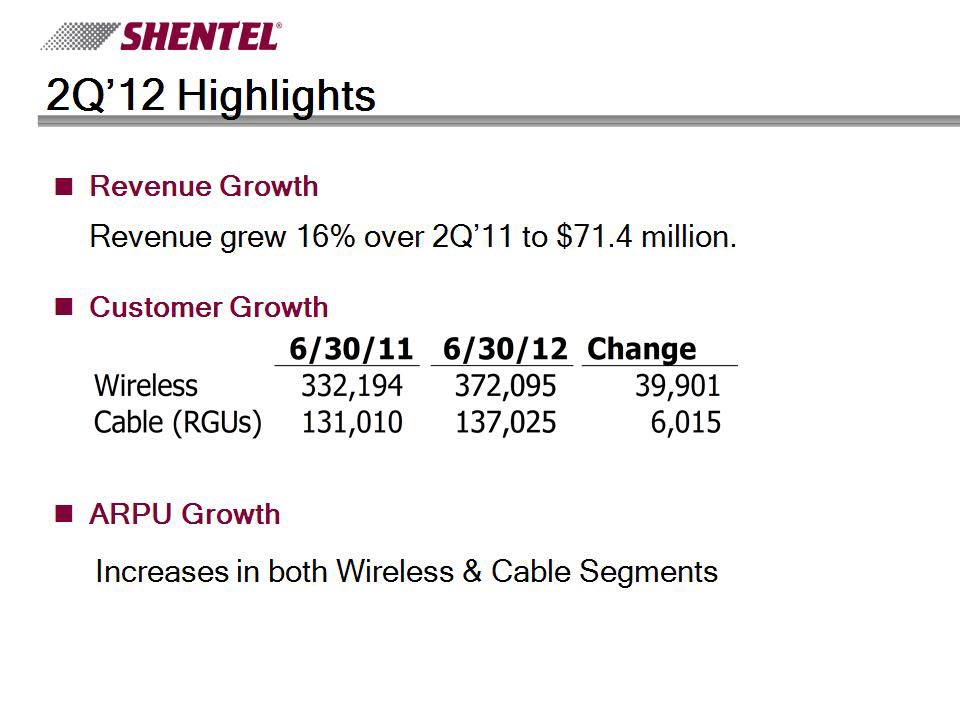

* 2Q’12 Highlights Revenue Growth Revenue grew 16% over 2Q’11 to $71.4 million. Customer Growth ARPU Growth Increases in both Wireless & Cable Segments

14

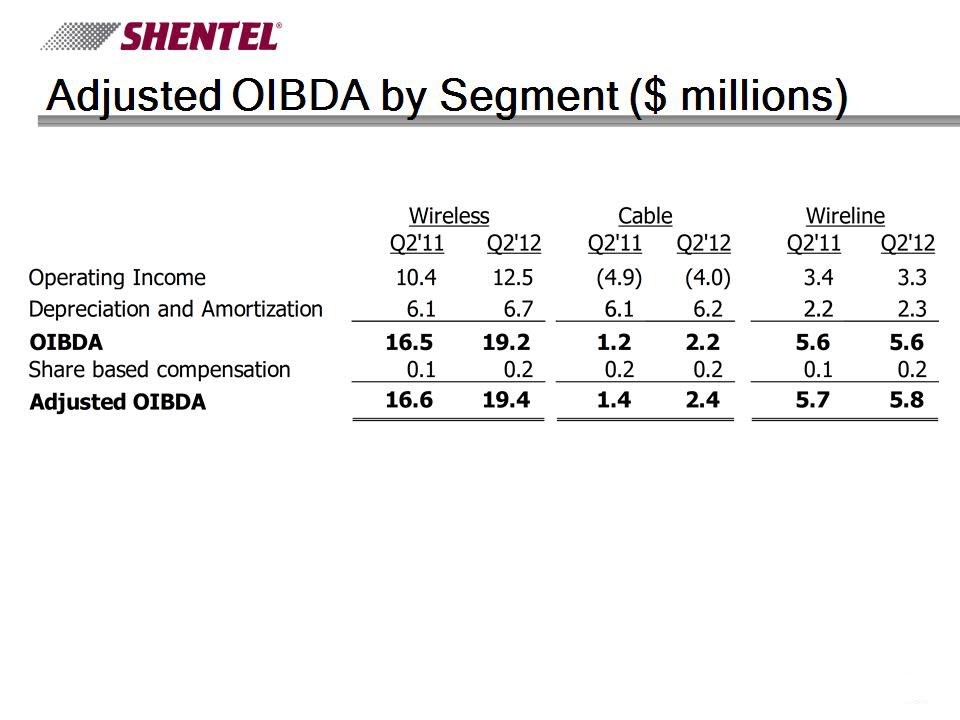

* Adjusted OIBDA by Segment ($ millions)

15

* Earle MacKenzie COO and EVP

16

* Wireless Segment

17

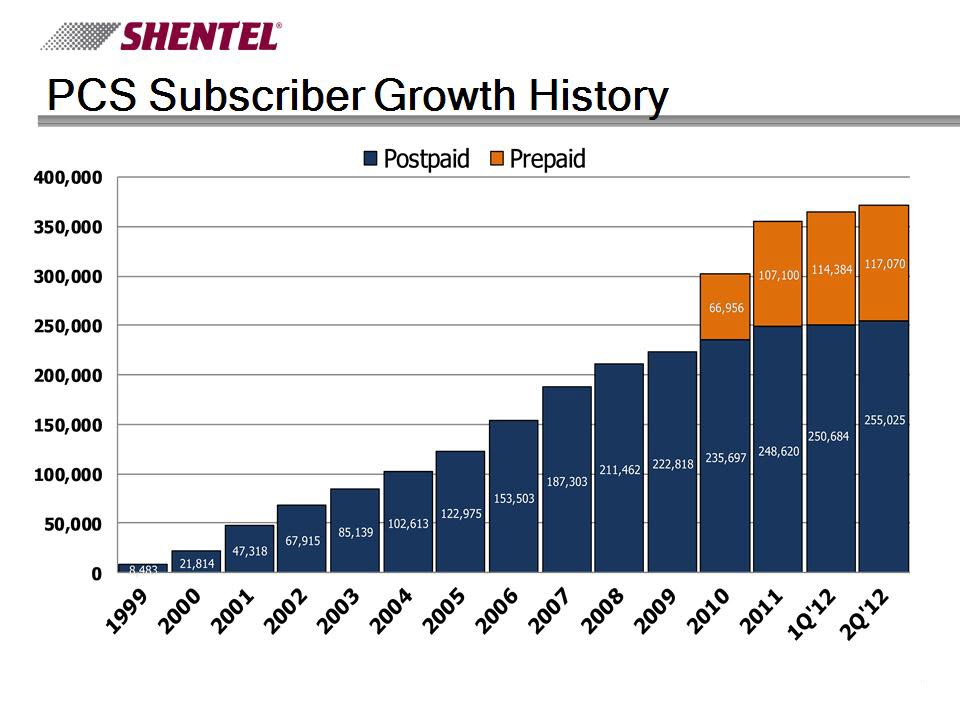

* PCS Overview One of 2 remaining Sprint Nextel affiliates 2.4 million licensed POPs 2.1 million covered POPs 372k total subscribers 18.0% penetration of covered POPs 510 CDMA base stations 434 EVDO enabled cell sites 94% EVDO covered POPs

18

* PCS Subscriber Growth History

19

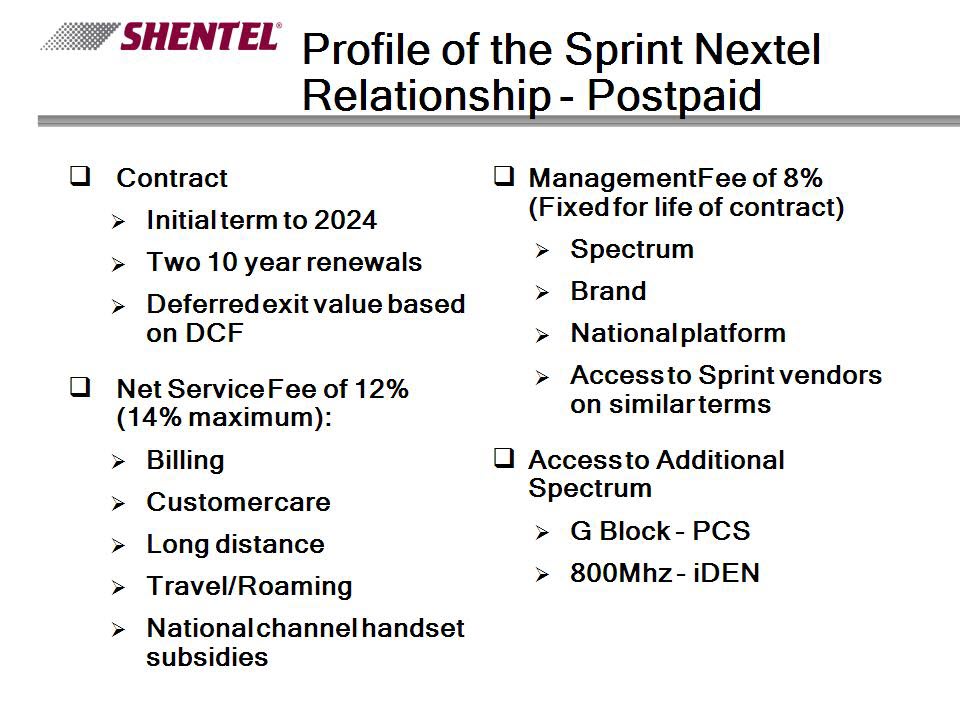

* Profile of the Sprint Nextel Relationship - Postpaid Contract Initial term to 2024 Two 10 year renewals Deferred exit value based on DCF Net Service Fee of 12% (14% maximum): Billing Customer care Long distance Travel/Roaming National channel handset subsidies Management Fee of 8% (Fixed for life of contract) Spectrum Brand National platform Access to Sprint vendors on similar terms Access to Additional Spectrum G Block – PCS 800Mhz – iDEN

20

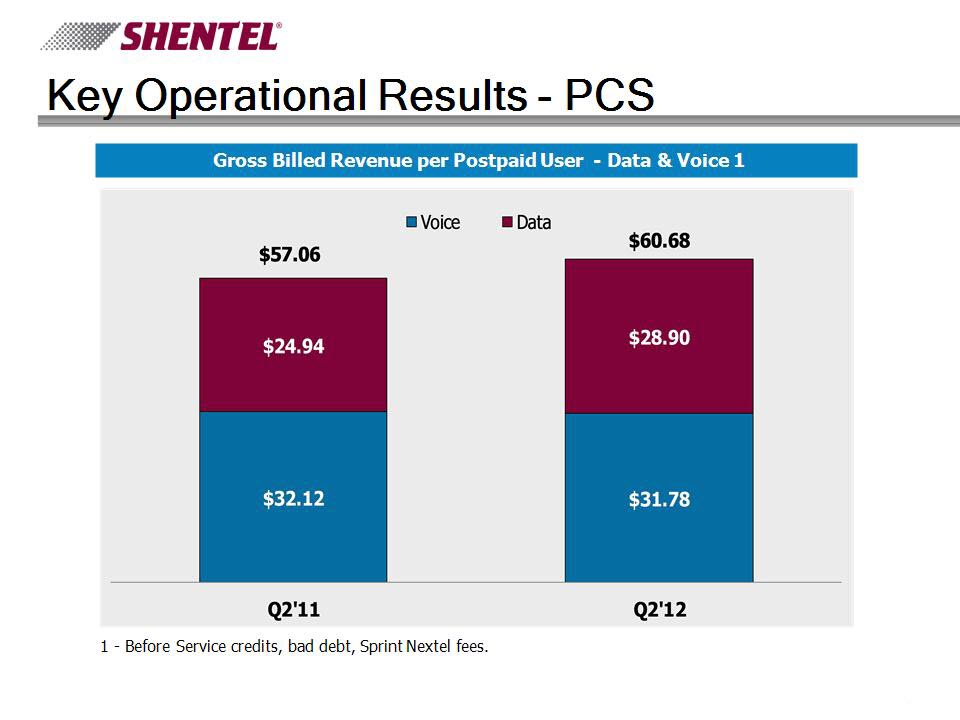

* Key Operational Results – PCS Gross Billed Revenue per Postpaid User – Data & Voice 1 1 – Before Service credits, bad debt, Sprint Nextel fees.

21

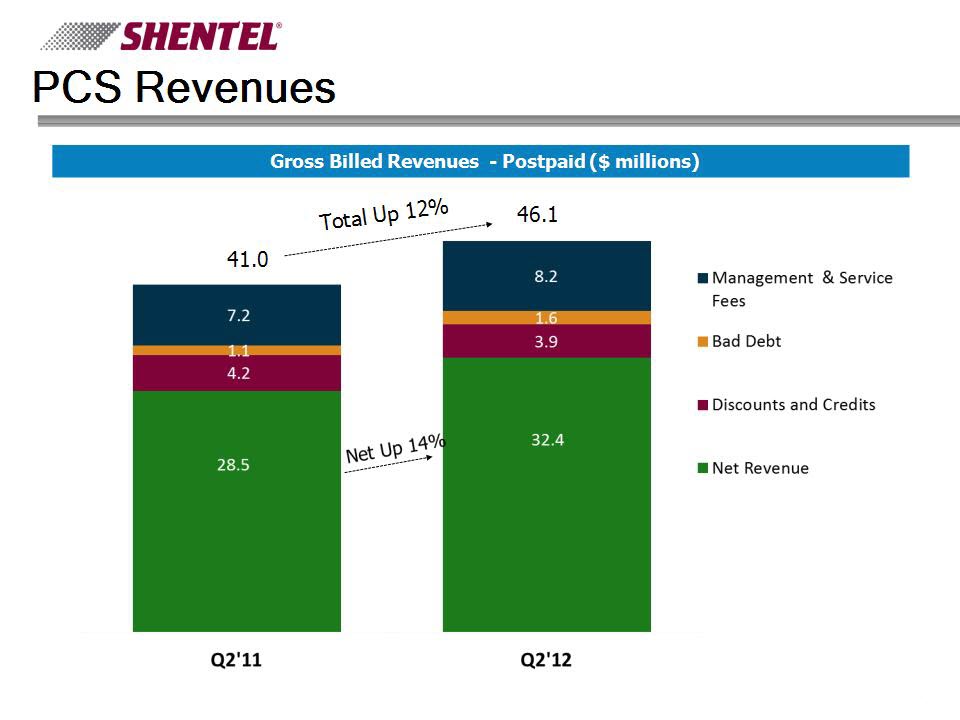

* PCS Revenues Gross Billed Revenues - Postpaid ($ millions) 41.0 46.1 Total Up 12%

22

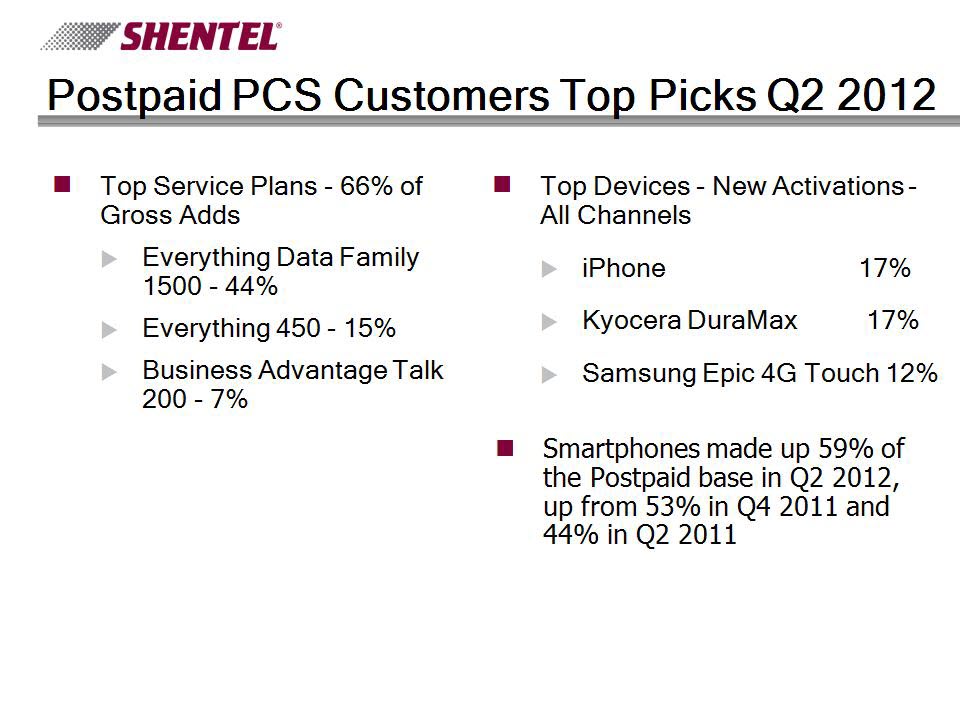

* Postpaid PCS Customers Top Picks Q2 2012 Smartphones made up 59% of the Postpaid base in Q2 2012, up from 53% in Q4 2011 and 44% in Q2 2011 Top Service Plans – 66% of Gross Adds Everything Data Family 1500 – 44% Everything 450 – 15% Business Advantage Talk 200 – 7% Top Devices – New Activations - All Channels iPhone 17% Kyocera DuraMax 17% Samsung Epic 4G Touch 12%

23

* iPhone Statistics – Q2’12 17% of Q2 Gross Adds 41% of iPhones were sold or upgraded in Shentel-controlled channels 9.8% of 6/30/2012 Postpaid customers had the iPhone, up from 6.8% at 3/31/12 59% iPhone 4S 41% iPhone 4

24

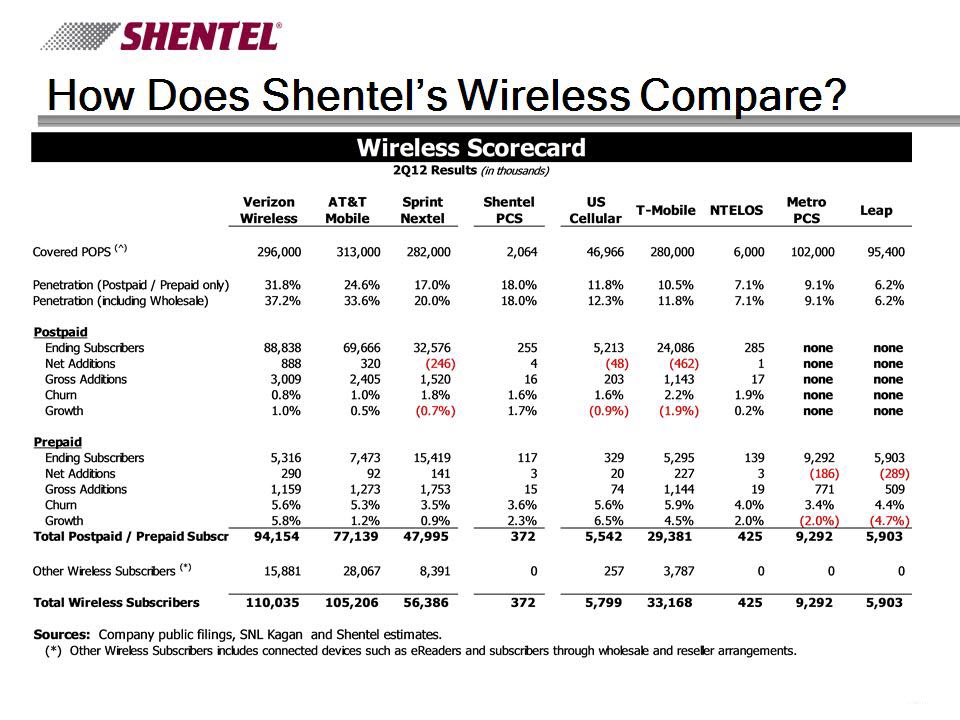

* How Does Shentel’s Wireless Compare?

25

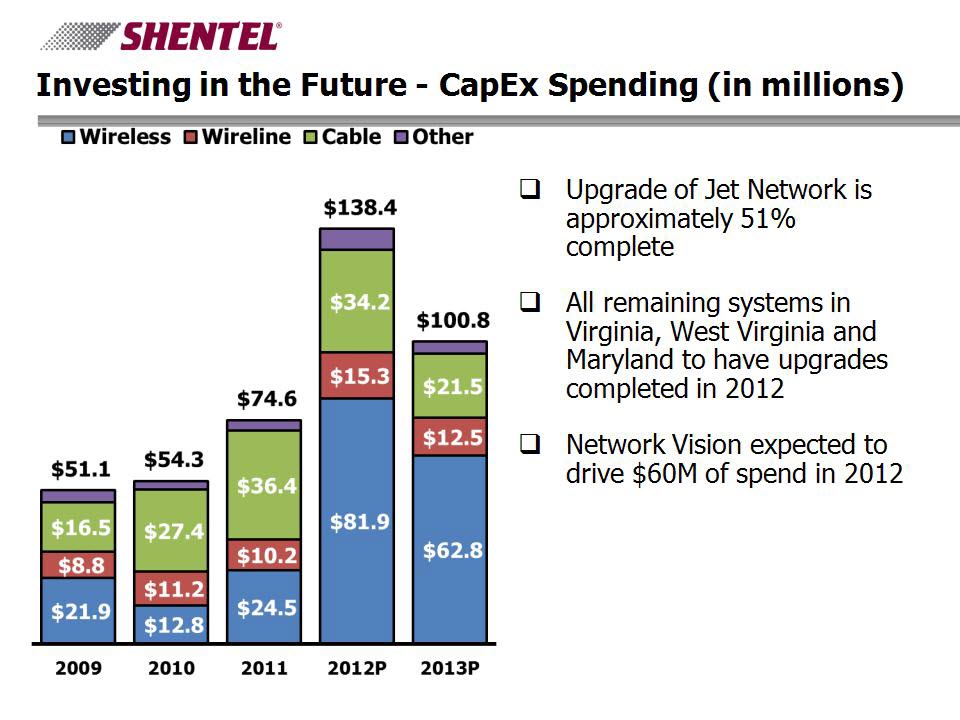

* Investing in the Future – CapEx Spending (in millions) Upgrade of Jet Network is approximately 51% complete All remaining systems in Virginia, West Virginia and Maryland to have upgrades completed in 2012 Network Vision expected to drive $60M of spend in 2012

26

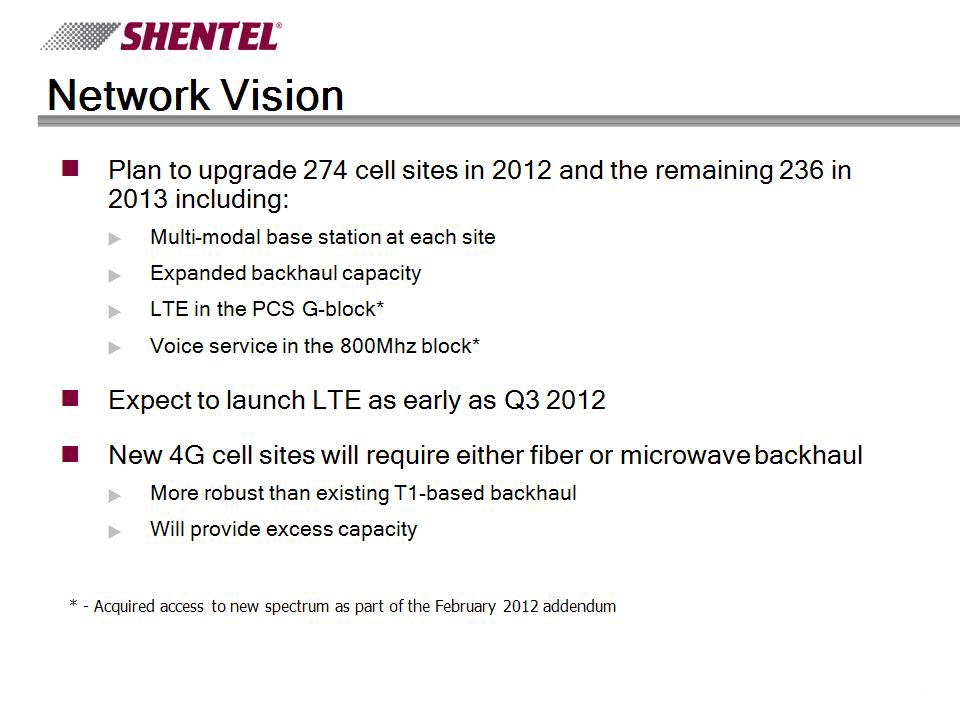

* Network Vision Plan to upgrade 274 cell sites in 2012 and the remaining 236 in 2013 including: Multi-modal base station at each site Expanded backhaul capacity LTE in the PCS G-block* Voice service in the 800Mhz block* Expect to launch LTE as early as Q3 2012 New 4G cell sites will require either fiber or microwave backhaul More robust than existing T1-based backhaul Will provide excess capacity * - Acquired access to new spectrum as part of the February 2012 addendum

27

* Network Vision: Investing in the Future Keeps Shentel’s network aligned with Sprint’s Allows Shentel to remain competitive with Verizon and AT&T Improve customers’ experience Provide 4G LTE service in entire coverage area Provide better in building and overall coverage Gives Shentel potential to leverage investment Convert existing iDEN customers to our network

28

* Cable Segment

29

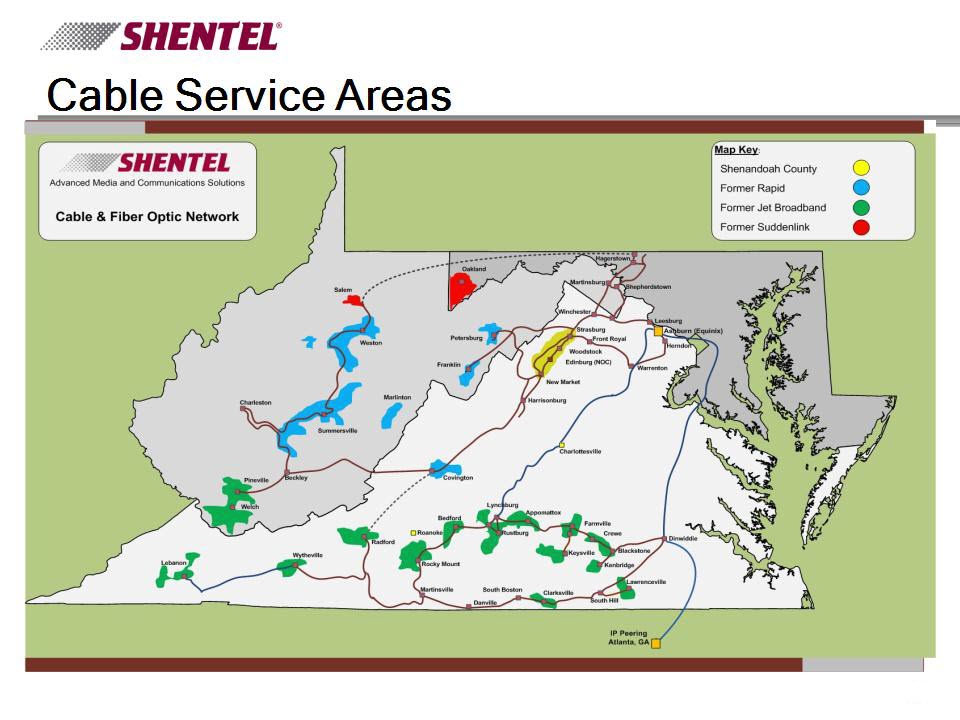

* Cable Service Areas

30

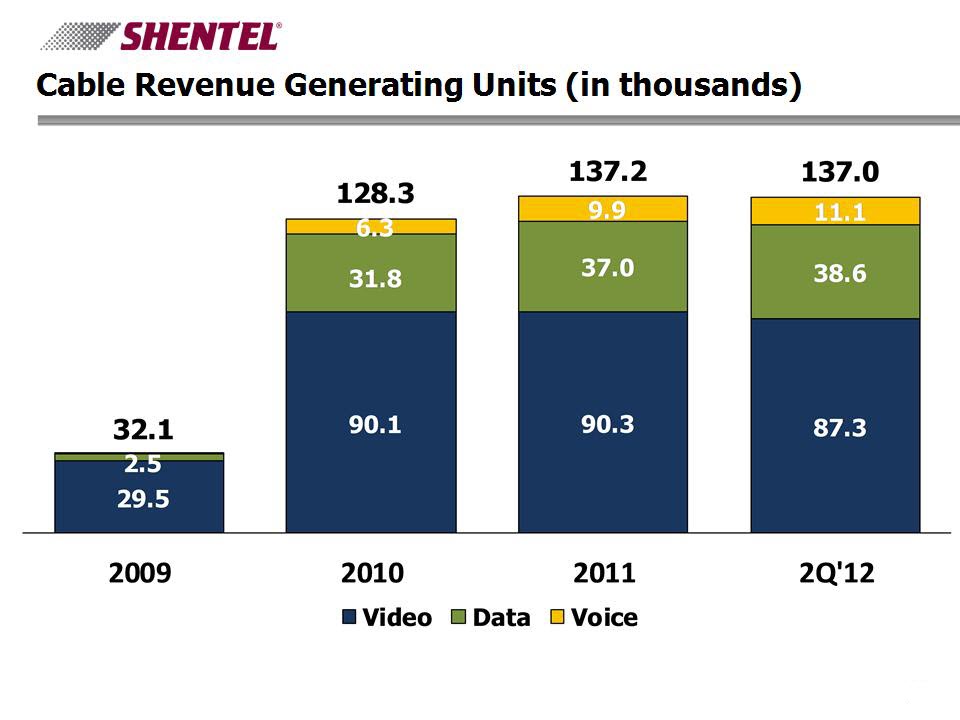

* Cable Revenue Generating Units (in thousands)

31

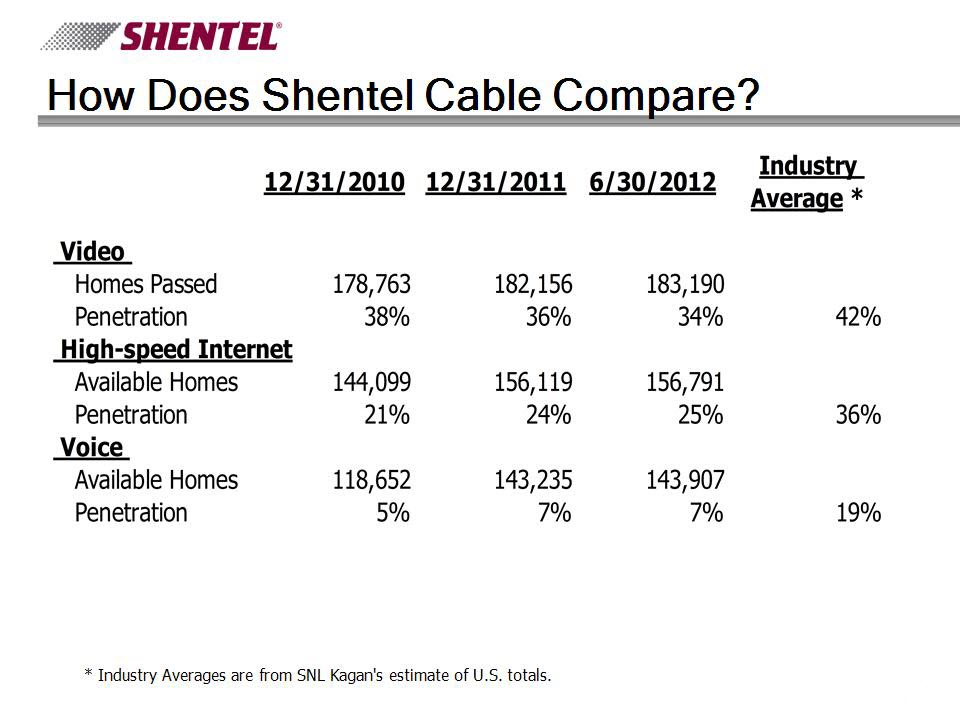

* How Does Shentel Cable Compare? * Industry Averages are from SNL Kagan's estimate of U.S. totals.

32

* Why Cable has a Competitive Advantage Issues with the Local Telephone Company Limits of DSL – Is it the new dial up? Requires significant capital investment to offer comparable Loss of cash flow from shrinking voice service Long-term pricing advantages as access revenues decrease Bundling of satellite video with their voice and DSL Issues with Satellite – Dish/DirecTV Bundling of telco DSL and voice with their video Satellite internet is fast but has limited capacity No local presence

33

* Shentel’s Cable Advantage We know Telephone – Our primary competitor Needs to spend lots of capital to match our service Unfavorable changes in economics Own/control our backbone fiber network Own our telephone switch Regional focus on small markets

34

* Wireline Segment

35

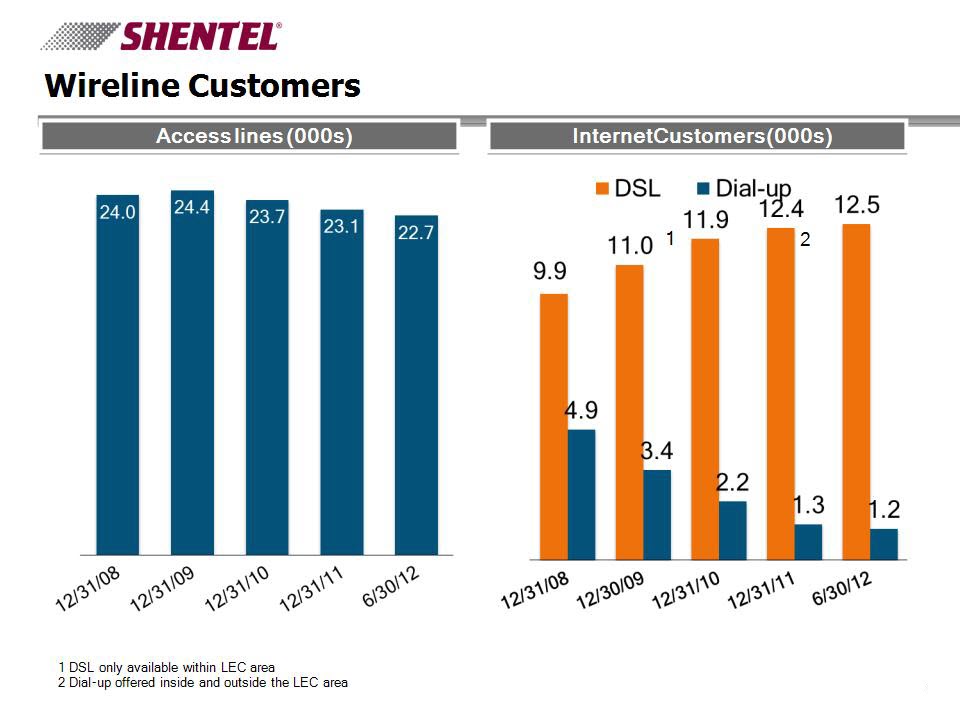

* Access lines (000s) Internet Customers (000s) 1 DSL only available within LEC area 2 Dial-up offered inside and outside the LEC area Wireline Customers 1 2

36

* Q&A

37