Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RETAIL PROPERTIES OF AMERICA, INC. | d419753d8k.htm |

INVESTOR

PRESENTATION October 2012

Exhibit 99.1 |

This

presentation

contains

“forward-looking

statements”

within

the

meaning

of

the

safe

harbor

from

civil

liability

provided

for

such

statements

by

the

Private

Securities

Litigation

Reform

Act

of

1995

(set

forth

in

Section

27A

of

the

Securities

Act

of

1933,

as

amended,

or

the

Securities

Act,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended,

or

the

Exchange

Act).

In

particular,

statements

pertaining

to

our

capital

resources,

portfolio

size,

quality

and

performance, dividend policy and results of operations contain forward-looking statements.

Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events.

Forward-looking statements depend on assumptions, data or methods which may be incorrect or

imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as

described

(or

that

they

will

happen

at

all).

You

can

identify

forward-looking

statements

by

the

use

of

forward-looking

terminology

such

as

“believes,”

“expects,”

“may,”

“should,”

“seeks,”

“intends,”

“plans,”

“pro

forma,”

“estimates,”

“focus,”

“contemplates,”

“aims,”

“continues,”

“would”

or “anticipates”

or the negative of these words and phrases or similar words or phrases. You can also identify

forward-looking statements by discussions of strategies, plans or intentions. The

following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements:

general

economic,

business

and

financial

conditions,

and

changes

in

our

industry

and

changes

in

the

real

estate

markets

in

particular;

adverse economic and other developments in the Dallas-Fort Worth-Arlington area, where

we have a high concentration of properties; general

volatility

of

the

capital

and

credit

markets

and

the

demand

for

and

market

price

of

our

Class

A

common

stock;

changes in our business strategy;

defaults on, early terminations of or non-renewal of leases by tenants;

bankruptcy or insolvency of a major tenant or a significant number of smaller tenants;

increased interest rates and operating costs;

declining real estate valuations and impairment charges;

availability, terms and deployment of capital;

our failure to obtain necessary outside financing;

our expected leverage;

decreased rental rates or increased vacancy rates;

our

failure

to

generate

sufficient

cash

flows

to

service

our

outstanding

indebtedness;

difficulties in identifying properties to acquire and completing acquisitions;

risks of real estate acquisitions, dispositions and redevelopment, including the cost of

construction delays and cost overruns; our failure to successfully operate

acquired properties and operations; our projected operating results;

our ability to manage our growth effectively;

our failure to successfully redevelop properties;

our

ability

to

successfully

transition

certain

corporate

office

functions

from

related

parties

to

third

parties

or

to

us;

estimates relating to our ability to make distributions to our shareholders in the

future; impact of changes in governmental regulations, tax law and rates and similar

matters; our failure to qualify as a REIT;

future terrorist attacks in the U.S.;

environmental

uncertainties

and

risks

related

to

natural

disasters;

lack or insufficient amounts of insurance;

availability of and our ability to attract and retain qualified personnel;

retention of our senior management team;

our understanding of our competition;

changes in real estate and zoning laws and increases in real property tax rates;

our ability to comply with the laws, rules and regulations applicable to companies; and

other risk factors, including those detailed in the sections of our most recent form 10-K

and form 10-Q filed with the SEC titled “Risk Factors.” You should not

place undue reliance on any forward-looking statements, which are based only on information currently available to us (or to third parties making the forward-looking statements). We undertake no obligation to publicly

release any revisions to such forward-looking statements to reflect events or circumstances

after the date of this presentation, except as required by applicable law. All information

presented as of 6/30/12, unless otherwise noted 2

Disclaimer |

Large,

diversified, high quality retail portfolio Significant

ability

to

enhance

portfolio

value

through

continued lease-up

Diversified base of value-oriented retail tenants

Capital structure positioned for growth

Opportunity to enhance portfolio and balance sheet through dispositions

of non-core and non-strategic assets

Attractive dividend yield of 5.9%¹

Experienced management team with proven track record

Executing a strategic growth plan to strengthen the Company’s retail

Executing a strategic growth plan to strengthen the Company’s retail

portfolio, improve its balance sheet, and

portfolio, improve its balance sheet, and

streamline its operating platform

streamline its operating platform

1

Based on September 28, 2012 closing price of $11.32 and an annualized dividend of $0.6625 per

share based on second quarter dividend of $0.165625 per share. Each dividend is

determined quarterly by the Company’s Board of Directors, at its discretion

3

Investment Highlights |

Enhancing

portfolio value. Continuing to grow value through: —

Strong leasing momentum

—

Stabilized cash flows

—

Active asset management focused on risk mitigation and tenant retention

Strengthening balance sheet. Reducing leverage and overall risk profile is a top

priority:

—

Successfully raise capital

—

Execute strategic disposition program

Streamlining operating platform. Further enhance corporate governance:

—

Terminated the majority of our service agreements with The Inland Group

—

Achieved fully independent Board of Directors (excluding an executive

director)

—

Relocating corporate headquarters off The Inland Group campus by

year-end

4

Foundations of Strategic Growth Plan

RPAI is working to deliver enhanced stockholder value and to

position the Company for long-term success |

Aon lease

renewal —

Active approach to asset management resulted in lease extensions

and prepared the asset for sale

Sold $227 M of assets YTD, most notably:

—

Mervyns 13-asset portfolio for $100 M, with proceeds used to repay the

mortgage debt related to the 23-asset portfolio

—

Cost Plus for $63 M, which reduced our non-core GLA by approximately

25%

Addressed all remaining 2012 debt maturities, as of October 1, 2012

Achieved fully independent Board of Directors (excluding an executive

director), and separation from The Inland Group through service agreement

terminations and headquarters move

Russell 1000 index inclusion in June 2012

5

Execution of strategic initiatives lead to path for growth

Execution of strategic initiatives lead to path for growth

and sustainability

and sustainability

Executing Strategic Initiatives |

Financial and Operational Goals

89.0%

90.6%¹

94% -

95%

4.1%³

0.7%²

2% at

stabilized occupancy²

Less than 10% secured

debt per year

Goal

2 Quarter 2012

Year End 2008

16%

27%

1

2.2 million square feet of GLA was returned via big box retailer bankruptcies during

2009 2

Annual, year-over-year growth rate

3

Quarterly, year-over-year growth rate

4

Ratio is as of December 31, 2009, the first period for which the metric was reported

7.6x

Reduce Combined Net Debt to

EBITDA to 6.0 –

7.0x

8.9x

4

6

Strong results represent a foundation for growth

Strong results represent a foundation for growth

Drive occupancy

Grow

same store NOI

Reduce leverage

Create staggered

debt maturity profile

Reduce share of non-

core assets (ABR%)

0%

18%

9%

nd |

Reported 2Q12

Operating FFO of $0.23 per share Reported same store NOI growth of +4.1% YOY

Increased retail portfolio percent leased 230 bps YOY to 91.0% and

increased retail portfolio occupancy 180 bps YOY to 88.1%

Executed 148 new and renewal retail leases for 707,000 square feet of

space

Executed strategic lease renewal with Aon for 819,000 square feet of office

space

Generated positive comparable cash leasing spreads, including pro rata

share of unconsolidated joint ventures, of 7.5% on new leases and 4.3% on

renewal leases, for a blended spread of 5.0%

Strong 2Q12 Financial & Operational

Performance

7

Positive results reflect successful implementation

Positive results reflect successful implementation

of strategic plans

of strategic plans |

Asset

Type Estimated Closing

Estimated Sale Proceeds

Year-to-date Q3¹

Various

Closed

$227 M

Remaining Mervyns

Assets

Single-tenant retail

Q4

$52 M -

$72 M

Aon Office Building

Non-core office

Q4

$145 M -

$160 M

Other

Various

Q4

$24 M -

$91 M

Total

$450 M -

$550 M

1

Includes pad sales, earnouts, and the GMAC deed-in-lieu transaction

2012

disposition

program

includes

$450

-

$550

M

of

non-core

and

non-strategic

dispositions, of

which $227 M has closed year-to-date

Refocusing RPAI on multi-tenant retail through the anticipated dispositions of its largest

industrial asset, its largest office asset, and over half of its single-tenant

retail portfolio Estimated

net

proceeds

of

$200

-

$300

M

will

further

de-lever

balance

sheet

and

improve

risk

profile

8

Non-Core and Non-Strategic Disposition Program

Strengthening Balance Sheet |

•Only

13.2% ¹

of our retail annualized base rent expires before 2014

•Renewed approximately 76% of expiring leases since beginning of 2009

Stable cash flows

•Currently operating at a historically wide spread between occupancy and percent leased

rate —Spread at June 30, 2012 was 290 bps, up 50 bps year-over-year

—

Strong leasing

momentum

•Consolidated

retail

operating

portfolio

percent

leased

of

91.0%²

as

compared

to

96.9%³

as

of

December

31,

2007

•The successful re-tenanting of big box space has allowed for renewed focus on small

shops, which represent 1.7 million square feet, or approximately 490 bps of potential

occupancy across the retail operating

portfolio

—94.5% leased on space over 10,000 square

feet

—81.3% leased on space under 10,000 square feet

•Over 800,000 square feet of additional space in leasing pipeline

Substantial

lease-up

opportunity

•Focus on value enhancing strategies such as risk mitigation, tenant retention,

long-term capital planning and asset sustainability initiatives

•Disciplined capital recycling through the disposition of non-core and

non-strategic assets Active asset

management

1

Includes our pro rata share of unconsolidated joint ventures

2

Includes leases signed but not commenced

3

Includes only leases commenced

Positioning RPAI for long-term value creation

Positioning RPAI for long-term value creation

9

Enhancing Portfolio Value

Maximizing NOI Through Internal Growth

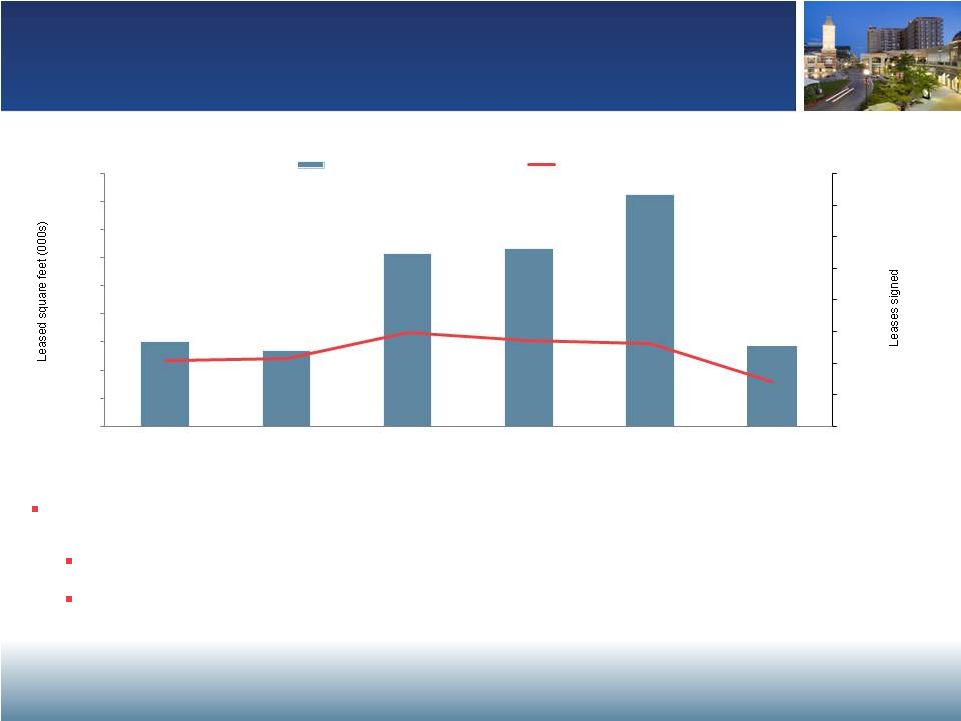

1,013,000 square feet of newly signed leases, representing $12.9 M of contractually obligated

ABR, have not yet commenced |

Over 800,000

square feet in the leasing pipeline, consisting of 550,000 square feet of anchor transactions and over

250,000 square feet of small shop transactions

Note: Consolidated retail operating portfolio; includes new and renewal leases

Robust leasing pipeline driving improving occupancy rate

Robust leasing pipeline driving improving occupancy rate

10

Capitalizing on Substantial Lease-up Opportunity

Enhancing Portfolio Value

1,503

1,352

3,085

3,171

4,121

1,424

416

426

593

545

522

286

0

200

400

600

800

1,000

1,200

1,400

1,600

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

2007

2008

2009

2010

2011

YTD Q2 2012

Leased square feet

Leases signed

Leasing pipeline contains almost 200,000 square feet of fully negotiated LOI’s

11 prospective tenants are in negotiations for multiple spaces |

Continuing to

focus on controlling costs and corporate overhead Terminating a majority of service

agreements with The Inland Group, including:

—

Investment advisory and mortgage servicing

—

Communication services

—

Insurance & risk management services

—

Property tax services

—

Personnel services

—

Technology services

Signed lease for new office space and will move off The Inland Group

campus by year-end

All non-executive Directors are qualified as independent, as of May 2012

Corporate Governance Enhancements

Streamlining Operating Platform

11

Committed to developing and maintaining integrated

Committed to developing and maintaining integrated

best-in-class real estate platform

best-in-class real estate platform |

Company

Overview 12 |

259

Number of properties

Consolidated retail operating property summary

34.9 M square feet

Gross leasable area (GLA)

Location

35 states

Average portfolio age

~10 years

Occupancy / percent leased

88.1% / 91.0%¹

Annualized base rent (ABR)²

$434.2 M / $447.1 M¹

ABR per square foot²

$14.13 / $14.09¹

Breakdown based on GLA

Number of tenants

~1,500 Tenants

Largest tenant

3.3% of ABR

Non-retail portfolio based on ABR

11 office and 3 industrial properties

13

Power Center 45%

Community/Neighborhood Center 36%

Lifestyle Center 9%

Single User 10%

Non-retail 8.5%

Retail 91.5%

Includes leases signed but not commenced for approximately 1,013,000 square feet of GLA

representing $12.9 M of annualized base rent at lease commencement

ABR excludes $1.4 million from our development properties and $0.4 M for rental

abatements for the 12 months ending June 30, 2013

1

2

RPAI at a Glance |

Large Diversified Retail Portfolio

High geographic diversity

Strong multi-tenant 3-mile demographics in top 50 MSAs

Significant presence in top MSAs

Breakdown based on GLA

68% of multi-tenant ABR located in top 50 Metropolitan

Statistical Areas (MSAs)

FL

Gross Leasable Area (GLA)

More than 5mm sq.ft.

1–5mm sq.ft.

Less than 1mm sq.ft.

2.9mm sq.ft

7.1mm sq.ft.

1.8mm sq.ft.

1.6mm sq.ft.

2.3mm sq.ft.

Strategically located assets diversified by geography, retail property type,

Strategically located assets diversified by geography, retail property type,

and tenant base

and tenant base

14

Power Center 45%

Top 50

MSAs

68%

Other

MSAs

32%

Single User 10%

Community /

Neighborhood Center

36%

Lifestyle Center 9%

—

Best Buy, Target, Home Depot, Kohl’s, Wal-Mart,

Lowe’s; or

—

A national or regional grocer

Over

90%

of

multi-tenant

assets

located

in

markets

outside

of

the top 50 MSAs are anchored by:

—

Average population of 89,626

—

Expected

population

growth

of

6.6%

over

the

next

five

years

—

Average

household

income

of

$83,152 |

Power

center –

Summerville,

SC

GLA: 272,000 sq.ft.

Occupancy: 99.2%

ABR per leased sq.ft.: $13.44

Community

center

–

Newport

News,

VA

GLA: 308,000 sq.ft.

Occupancy: 95.0%

ABR per leased sq.ft.: $17.11

Community

center

–

Denton,

TX

GLA: 339,000 sq.ft.

Occupancy: 96.8%

ABR per leased sq.ft.: $14.58

Lifestyle

center

–

Southlake,

TX

GLA:

840,000 sq.ft.

Occupancy: 86.5%

ABR per leased sq.ft.: $28.37

Power

center

–

Temecula,

CA

GLA: 293,000 sq.ft.

Occupancy: 96.3%

ABR per leased sq.ft.: $12.48

Community

center

–

Chicago,

IL

GLA: 261,000 sq.ft.

Occupancy: 95.4%

ABR per leased sq.ft.: $21.56

Power

center

–

Seattle,

WA

GLA: 303,000 sq.ft.

Occupancy: 97.3%

ABR per leased sq.ft.: $11.96

Lifestyle

center

–

Plano,

TX

GLA: 391,000 sq.ft.

Occupancy: 88.2%

ABR per leased sq.ft.: $25.74

Southlake Town Square

Denton Town Crossing

Commons at Temecula

Northgate North

The Brickyard

Azalea Square

Jefferson Commons

Shops at Legacy

Note: Occupancy figures represent economic occupancy

15

Representative Properties |

National Platform with Local Focus

Client-focused organization with significant local and regional on-the-ground

presence 19 strategically located property management offices

Over 180 employees dedicated to operations, including over 80 property managers and

senior leasing agents with an average of 15 years experience in the industry

GLA

(000s sq.ft.)

Regional breakdown

10,627

7,589

8,617

8,040

ABR

($000s)

$136,764

103,486

101,787

92,134

Total

34,873

$434,171

Note: Reflects consolidated retail operating portfolio

Experienced and talented employee base

Experienced and talented employee base

with nationwide coverage

with nationwide coverage

West

East

South

North

16 |

1

Represents retail operating portfolio including our pro rata share of unconsolidated joint

ventures Rank

Tenant

# of Stores

GLA(000s)

ABR(000s)

% of Retail ABR

1

Best Buy Co, Inc.

30

1,069

$ 14,568

3.3%

2

Ahold USA, Inc.

11

661

12,935

2.9%

3

The TJX Companies Inc.

47

1,242

11,770

2.6%

4

Rite Aid Corporation

35

425

10,399

2.3%

5

PetSmart, Inc.

39

707

9,821

2.2%

6

Ross Stores, Inc.

38

990

9,448

2.1%

7

Bed Bath & Beyond Inc.

28

726

9,232

2.1%

8

The Home Depot, Inc.

9

1,097

9,135

2.0%

9

Kohl's Corporation

14

1,143

8,095

1.8%

10

The Sports Authority, Inc.

17

690

7,952

1.8%

11

Supervalu Inc.

10

562

7,705

1.7%

12

Pier 1 Imports, Inc.

39

390

7,252

1.6%

13

Publix Super Markets Inc.

15

634

6,703

1.5%

14

Michaels Stores, Inc.

29

588

6,592

1.5%

15

Edwards Theaters, Inc.

2

219

6,558

1.5%

16

Dicks Sporting Goods, Inc.

13

568

6,525

1.5%

17

Wal-Mart Stores, Inc.

6

903

5,985

1.3%

18

Office Depot, Inc.

22

439

5,737

1.3%

19

Staples, Inc.

18

342

4,663

1.0%

20

Rave Cinemas, LLC

2

162

4,626

1.0%

Total

424

13,557

$165,701

37.0%

Approximately 1,500 tenants with

approximately 3,200 leases

32 tenants each lease space at

more than 15 of our locations,

representing 8.8 M square feet

Over 90% of our shopping centers

anchored or shadow-anchored by

retailers selling basic household

goods or clothing

Shadow anchors provide

additional stability and traffic

generation

—

For example, we have 43 Target,

18 Home Depot and 13 Wal-

Mart shadow anchors

Diversity reduces risk of overexposure

Diversity reduces risk of overexposure

17

Diversified Base of Value-Oriented

Retail Tenants

Top 20 retail tenants represent 37% of retail ABR

1 |

Portfolio has

strong line-up of grocery anchors —

74

of

our

196

multi-tenant

retail

properties

1

are

anchored

or

shadow-anchored

by a grocery store, and an additional 48 properties have a non-traditional

grocery component

2

Annual grocer sales average $25 M

3

or $501 per square foot, translating into an

estimated 18,000

4

shopper visits per week

1

Includes wholly-owned and unconsolidated joint ventures

2

Non-traditional component is defined as stores containing a Wal-Mart or Target branded

location 3

Includes only tenants that report sales

4

Estimate of shopper visits based on $26.78 sales per customer transaction (source: www.fmi.org

“FMI Facts & Figures”) 18

Dominant Grocery Anchors Drive Traffic |

CAPITAL

MARKETS 19 |

Raised $293 M

of common equity and began trading on the NYSE in early April

Closed a new $650 M unsecured credit facility in February, comprised of

a $350 M revolver and a $300 M term loan

—

Available borrowings can increase to $850 M in certain circumstances

—

In 3Q12, we entered into an interest rate swap transaction to fix the

variable rate portion of the term loan at 0.54% through February

2016 (spread on the line of credit was 2.50%, as of June 30, 2012)

Originated ten mortgages totaling $281 M at a weighted average interest

rate of 4.53% and a weighted average term of 9.4 years

As of October 1, 2012, addressed all remaining 2012 debt maturities

Providing financial flexibility to enhance balance sheet

Providing financial flexibility to enhance balance sheet

and position RPAI for growth

and position RPAI for growth

20

Strengthening Balance Sheet

Over $1.2 B of Capital Raised in 2012 |

Historical Leverage Profile

Total Consolidated Debt ($M)

Combined Net

Debt / Combined

Adjusted EBITDA

8.9x

8.5x

7.6x

8.3x

Improving our risk profile by reducing leverage

Improving our risk profile by reducing leverage

is a top priority

is a top priority

21 |

Capital Structure Positioned for Growth

Amount

Interest

Capitalization ($M)

Credit statistics

$130

Unsecured Revolving

Line of Credit

2.75%

300

Unsecured

Term

Loan

2.75%

2,562

Mortgage Debt

6.03%

139

Mezzanine

Debt

12.62%

2

Margin Debt

1.74%

$3,133

Total Debt

5.87%

(102)

Less Cash

$3,031

Net Debt

Combined Net Debt to

Combined Adjusted EBITDA

7.6x

Fixed

Rate

Debt

85.2%

Weighted Average Maturity

5.5 years

Weighted Average Interest

Rate

5.87%

Strong liquidity position, with $102 M of cash and

$220 M of availability on the unsecured line of credit

at June 30, 2012

Additional deleveraging is expected to come from the

continued lease-up of the portfolio and the execution

of the non-core and non-strategic disposition program

Objective of becoming an investment grade borrower

Objective of becoming an investment grade borrower

22

1

1

2

1

Subsequent to quarter end, we entered into an interest rate swap transaction to convert the

variable portion of $300 million of floating rate debt to a fixed rate of 0.54% through

February 2016. As a result, the all-in interest rate on the term loan would have been

3.04% and our fixed rate debt would have comprised 95% of our total debt 2 $14 million of mezzanine debt was repaid on July 2, 2012. The

remaining $125 million of mezzanine debt is open for prepayment in 1Q13, subject to a prepayment penalty |

Debt Maturity Profile ($M)

$258

8.2%

$307

9.8%

$251

8.0%

$602

19.2%

$349

11.1%

$1,367

43.7%

Weighted

average

interest rate

5.67%

5.48%

6.90%

5.11%

3.20%

6.83%

Note: Excludes mortgage discount of $1.7 million, as of 6/30/2012

23

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

$1,100

$1,200

$1,300

$1,400

2012

2013

2014

2015

2016

Thereafter

Mortgages payable

Notes payable

Credit facility

Margin payable

Manageable Near-Term Debt Maturities |

Experienced Management Team

Executive

Experience

Steven P. Grimes

President

& Chief Executive Officer

Former experience as Chief Operating Officer & Chief

Financial Officer

Director with the mortgage brokerage firm of Cohen

Financial

Senior Manager with Deloitte & Touche

Named to the Board in March 2011

Shane C. Garrison

EVP

Chief Operating Officer

& Chief Investment Officer

Vice President of Asset Management of RPAI US

Management LLC

Head of Asset Management for ECI Properties

General Manager of the Midwest region for Circuit

City

Angela Aman

EVP

Chief Financial Officer

& Treasurer

Former Director of Capital Markets

Portfolio Manager at RREEF

Investment Banker for Deutsche Bank

Niall J. Byrne

EVP

& President of

Property Management

Senior Vice President of RPAI Holdco Management LLC

Vice President of Asset Management of American

Landmark Properties, Ltd.

Senior Vice President / Director of Operations for

Providence Management Company, LLC

Dennis K. Holland

EVP

General Counsel

& Secretary

Associate Counsel for The Inland Real Estate Group,

Inc.

Deputy General Counsel with Heller Financial, Inc.

Subsequently employed by GE Capital following the

acquisition of Heller Financial

Average 22+ years of real

estate industry experience

Successfully navigated most

recent economic crisis

Senior executive focus on

operations

In-house management and

leasing

Dedicated

Management Team

Board elected annually

All non-management board

members are independent

Board of Directors

24 |

APPENDIX

NON-GAAP RECONCILIATIONS

25 |

Non-GAAP Financial Measures

A-1

A-1

As defined by the National Association of Real Estate Investment Trusts (NAREIT), an industry

trade group, Funds from Operations (FFO) means net (loss) income computed in accordance with generally accepted

accounting principles (GAAP), excluding gains (or losses) from sales of investment properties,

plus depreciation and amortization and impairment charges on investment properties, including adjustments for

unconsolidated joint ventures in which we hold an interest. We have adopted the NAREIT

definition in our computation of FFO and believe that FFO, which is a non-GAAP performance measure, provides an

additional and useful means to assess the operating performance of real estate investment

trusts (REITs). We believe that, subject to the following limitations, FFO provides a basis for comparing our performance

and operations to those of other REITs. FFO is not intended to be an alternative to "Net

Income" as an indicator of our performance, nor an alternative to "Cash Flows from Operating Activities" as determined by

GAAP as a measure of our capacity to pay distributions. Depreciation and amortization related

to investment properties for purposes of calculating FFO include loss on lease terminations, which encompasses the

write-off of tenant-related assets, including tenant improvements and in-place

lease values, as a result of early lease terminations. Loss on lease terminations included in depreciation and amortization for FFO

excludes the write-off of tenant-related above and below market lease intangibles that

are otherwise included in "Loss on lease terminations" in our condensed consolidated statements of operations.

Operating FFO is defined as FFO excluding the impact of gains and losses from the early

extinguishment of debt and other items as denoted within the calculation that we do not believe are representative of the

operating results of our core business platform. We consider Operating FFO a meaningful,

additional measure of operating performance primarily because it excludes the effects of transactions and other events

which we do not consider representative of the operating results of our core business

platform. Operating FFO does not represent an alternative to "Net Income" as an indicator of our performance, nor an

alternative to "Cash Flows from Operating Activities" as determined by GAAP as a

measure of our capacity to pay dividends. Further, comparison of our presentation of Operating FFO to similarly titled measures for

other REITs may not necessarily be meaningful due to possible differences in definition and

application by such REITs. We define Net Operating Income (NOI) as operating revenues (rental income, tenant recovery

income, other property income, excluding straight-line rental income, amortization of lease inducements and

amortization of acquired above and below market lease intangibles) less property operating

expenses (real estate tax expense and property operating expense, excluding straight-line ground rent expense and

straight-line bad debt expense). We believe that is a useful measures of our operating

performance. Other REITs may use different methodologies for calculating NOI, and accordingly, our NOI may not be

comparable to other REITs. We believe that NOI provides an operating perspective not

immediately apparent from GAAP operating income or net (loss) income. We use NOI to evaluate our performance on a

property-by-property basis because these measures allow management to evaluate the

impact that factors such as lease structure, lease rates and tenant base, which vary by property, have on our operating

results. However, these measures should only be used as an alternative measure of our

financial performance. As of June 30, 2012, Same Store NOI represents NOI from our Same Store portfolio consisting of

270 operating properties acquired or place in service prior to April 1, 2011. NOI from Other Investment Properties

represents NOI primarily from our development properties, two additional phases of existing

properties acquired during the third quarter of 2011, two non-stabilized operating properties and one property that

was partially sold to our RioCan joint venture during the third quarter of 2011, which did not

qualify for discontinued operations accounting treatment. In addition, we have included University Square, the property

for which we have ceased making the monthly debt service payment and for which we have

attempted to negotiate with the lender in “Other Investment Properties” due to the uncertainty of the timing of the

transfer of ownership of this property. Prior to this quarter, we had included University

Square in the Same Store portfolio. NOI consists of the sum of Same Store NOI and NOI from Other Investment Properties.

The Same Store portfolio as of December 31, 2008 consisted of 294 operating properties

acquired or placed into service prior to January 1, 2007. Adjusted EBITDA represents net income (loss) before interest, income taxes, depreciation and

amortization, as further adjusted to eliminate the impact of certain items that we do not consider indicative of our

ongoing performance. Combined Adjusted EBITDA represents Adjusted EBITDA plus our pro rata

share of the EBITDA adjustments from our investment property unconsolidated joint ventures, including

discontinued operations associated with those ventures. We believe that Adjusted EBITDA and

Combined Adjusted EBITDA are useful because they allow investors and management to evaluate and compare our

performance from period to period in a meaningful and consistent manner in addition to

standard financial measurements under GAAP. Adjusted EBITDA and Combined Adjusted EBITDA are not measurements of

financial performance under GAAP and should not be considered as alternatives to net income,

as an indicator of operating performance or any measure of performance derived in accordance with GAAP. Our

calculations of Adjusted EBITDA and Combined Adjusted EBITDA may be different from the

calculation used by other companies and, accordingly, comparability may be limited.

Net Debt to Adjusted EBITDA represents (i) our total debt less cash and cash equivalents

divided by (ii) Adjusted EBITDA for the prior 12 months. Combined Net Debt to Combined Adjusted EBITDA represents (i) the

sum of (A) our total debt less cash and cash equivalents plus (B) our pro rata share of our

investment property unconsolidated joint ventures' total debt less our pro rata share of these joint ventures' cash and cash

equivalents divided by (ii) Combined Adjusted EBITDA for the prior 12 months. We believe that

these ratios are useful because they provide investors with information regarding total debt net of cash and cash

equivalents, which could be used to repay debt, compared to our performance as measured using

Adjusted EBITDA and Combined Adjusted EBITDA. Funds From Operation (FFO)

Operating FFO

Net Operating Income (NOI)

Same

Store

NOI

and

NOI

from

Other

Investment

Properties

Adjusted

EBITDA

and

Combined

Adjusted

EBITDA

Net

Debt

to

Adjusted

EBITDA

and

Combined

Net

Debt

to

Combined

Adjusted

EBITDA |

Three Months

Ended June 30, Twelve Months Ended December 31,

(in thousands)

2012

2011

2008¹

2007¹

Same Store investment properties

$105,402

$101,252

$477,954

$474,628

Other investment properties

166

2,590

32,712

23,754

Total net operating

income

105,568

103,842

510,666

498,382

Other income (expense):

Straight-line rental income,

net

228

(132)

12,851

15,882

Amortization of acquired above and below market lease intangibles, net

376

426

2,504

3,200

Amortization of lease

inducements

(72)

(15)

-

-

Straight-line ground rent

expense

(910)

(948)

(5,186)

(3,806)

Straight-line bad debt

expense

-

-

(8,749)

(1,877)

Insurance captive

income

-

-

1,938

1,890

Depreciation and

amortization

(58,289)

(58,742)

(265,587)

(257,132)

Provision for impairment of investment

properties

(1,323)

-

(80,000)

(13,560)

Loss on lease

terminations

(1,177)

(3,355)

(67,092)

(11,788)

Insurance captive

expenses

-

-

(2,874)

(1,598)

General and administrative

expenses

(6,543)

(5,043)

(19,997)

(16,535)

Advisor asset management fee

-

-

-

(23,750)

Dividend

income

615

522

24,010

23,729

Interest

income

19

170

4,329

13,671

Gain on extinguishment of debt,

net

-

3,715

-

2,486

Gain on contribution of investment properties

-

-

-

11,749

Equity in (loss) income of unconsolidated joint ventures, net

(1,286)

(1,981)

(4,939)

96

Interest

expense

(40,537)

(55,644)

(224,015)

(217,771)

Co-venture obligation

expense

(397)

(1,792)

-

-

Recognized gain (loss) on marketable securities,

net 7,265

277

(160,888)

(19,967)

Impairment of goodwill

-

-

(377,916)

-

Loss on investment in unconsolidated joint venture

-

-

(5,524)

-

Loss on interest rate locks

-

-

(16,778)

-

Other income/(expense),

net

2,479

171

(1,062)

237

Total other

expense

(99,552)

(122,371)

(1,194,975)

(494,844)

Income (loss) from continuing

operations

6,016

(18,529)

(684,309)

3,538

Discontinued operations:

Operating income,

net

490

1,709

1,096

2,200

Gain on sales of investment properties,

net

6,847

702

-

37,296

Income from discontinued

operations

7,337

2,411

1,096

39,496

Gain on sales of investment

properties

4,323

2,402

-

-

Net income

(loss)

17,676

(13,716)

(683,213)

43,034

Net income attributable to noncontrolling

interests

-

(8)

(514)

(1,365)

Net income (loss) attributable to Company

shareholders $17,676

$(13,724)

$(683,727)

$41,669

1

Figures reflect properties in our same sore portfolio as of December 31, 2008 and properties

that qualified as discontinued operations through December 31, 2008. Properties that have qualified as discontinued

operations subsequent to December 31, 2008 are reflected in continuing operations

A-2

Reconciliation of NOI to Net Income |

Three Months

Ended June 30, (in thousands, except per share amounts)

2012

2011

Net income (loss) attributable to Company shareholders

$17,676

$(13,724)

Add:

Depreciation and amortization¹

62,156

64,389

Provision for impairment of investment properties¹

1,498

1,523

Less:

Gain on sales of investment properties¹

(11,170)

(3,104)

Non-controlling

interests’

share of depreciation related to consolidated joint

ventures¹ -

(96)

Funds from operations(FFO)

$70,160

$48,988

FFO per common share outstanding

$0.31

$0.25

Less:

Mortgage premium write-off

(10,295)

-

Recognized gain on marketable securities

(7,265)

(277)

Gain on extinguishment of debt

-

(3,715)

Other

(1,627)

-

Operating FFO

$50,973

$44,996

Operating FFO per common share outstanding

$0.23

$0.23

Weighted average number of common shares outstanding

226,543

192,114

1

Includes amounts from discontinued operations

A-3

Reconciliation of Operating FFO |

Twelve

Months Ended (in thousands)

June 30, 2012

December 31, 2011

December 31, 2010

December 31, 2009

Net

loss

$(17,457)

$(72,578)

$(94,707)

$(115,409)

Interest

expense

209,985

230,979

255,355

226,392

Interest expense (discontinued

operations)

958

1,911

9,561

18,101

Depreciation and

amortization

233,755

234,406

238,563

241,414

Depreciation and amortization (discontinued

operations) 1,215

3,614

9,525

17,178

Loss on partial sales of investment

properties

-

-

385

-

Gain on sales of investment

properties

(5,846)

(5,906)

-

-

Gain on sales of investment properties, net (discontinued

operations)

(28,110)

(24,509)

(23,806)

(26,383)

Gain on extinguishment of debt,

net

(6,146)

(16,705)

-

-

Loss on lease

terminations

7,621

9,704

15,523

17,550

Loss on lease terminations (discontinued

operations)

-

26

285

54

Provision for impairment of investment

properties

8,973

7,650

11,030

27,600

Provision for impairment of investment properties (discontinued

operations) 1,958

32,331

12,027

37,100

Impairment of notes

receivable

-

-

-

17,322

Recognized gain on marketable securities,

net

(7,265)

(277)

(4,007)

(18,039)

Gain on interest rate

locks

-

-

-

(3,989)

Adjusted

EBITDA

$399,641

$400,646

$429,734

$438,891

Pro rata share of adjustments from investment property unconsolidated joint

ventures:

Interest

expense

$3,863

$3,310

$2,804

$4,294

Depreciation and

amortization

9,607

7,080

3,781

3,372

Loss (gain) on sales of investment

properties

28

28

(432)

675

Loss on lease terminations

561

387

-

-

Provision for impairment of investment

properties

1,292

3,959

-

9,062

Amortization of basis (not pro

rata)

156

204

277

284

Combined Adjusted EBITDA¹

$415,148

$415,614

$436,164

$456,578

1

Combined data and ratios include our pro rata share of unconsolidated joint ventures in

addition to our wholly-owned and consolidated portfolio A-4

Reconciliation of Combined

Adjusted EBITDA |

Period

Ended (in thousands, except ratios)

June 30, 2012

December 31,

2011

December 31,

2010

December 31,

2009

Total

debt

$3,132,920

$3,481,218

$3,757,237

$4,110,985

Less: cash and cash

equivalents

(102,346)

(136,009)

(130,213)

(125,904)

Net

debt

$3,030,574

$3,345,209

$3,627,024

$3,985,081

Adjusted EBITDA¹

399,641

400,646

429,734

438,891

Net debt to Adjusted

EBITDA

7.6x

8.3x

8.4x

9.1x

Net

debt

$3,030,574

$3,345,209

$3,627,024

$3,985,081

Add: pro rata share of our investment property unconsolidated joint

ventures’

total

debt

112,071

114,382

79,475

62,998

Less: pro rata share of our investment property unconsolidated joint

ventures’

cash and cash

equivalents

(2,157)

(13,238)

(1,527)

(4,116)

Combined net debt²

$3,140,488

$3,446,353

$3,704,972

$4,043,963

Combined Adjusted EBITDA

1,2

415,148

415,614

436,164

456,578

Combined net debt to combined Adjusted EBITDA²

7.6x

8.3x

8.5x

8.9x

1

For purposes of these ratio calculations, twelve months ended figures were used

2

Combined data and ratios include our pro rata share of unconsolidated joint ventures in

addition to our wholly-owned and consolidated portfolio A-5

Reconciliation of Combined Net Debt to

Combined Adjusted EBITDA |

|