Attached files

| file | filename |

|---|---|

| 8-K - VERTEX ENERGY, INC. FORM 8-K FOR SEPTEMBER 27, 2012 - Vertex Energy Inc. | vertex8k092712.htm |

| EX-99.1 - PRESS RELEASE - Vertex Energy Inc. | ex99-1.htm |

Exhibit 99.2

Vertex Energy

Business Overview

OTCQB:VTNR

September 2012

This document may contain forward-looking statements including words such as “may,” “can,” “could,” “should,” “predict,” “aim,” “potential,” “continue,” “opportunity,” “intend,” “goal,” “estimate,” “expect,” “expectations,” “project,” “projections,” “plans,” “anticipates,” “believe,” “think,” “confident,” “scheduled,” or similar expressions, as well as information about management’s view of Vertex Energy’s future expectations, plans and prospects, within the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors which may cause the results of Vertex Energy, its divisions and concepts to be materially different than those expressed or implied in such statements. These risk factors and others are included from time to time in documents Vertex Energy files with the Securities and Exchange Commission, including but not limited to, its Form 10-Ks, Form 10-Qs and Form 8-Ks. Other unknown or unpredictable factors also could have material adverse effects on Vertex Energy’s future results. The forward-looking statements included in this presentation are made only as of the date hereof. Vertex Energy cannot guarantee future results, levels of activity, performance or achievements. Accordingly, you should not place undue reliance on these forward-looking statements. Finally, Vertex Energy undertakes no obligation to update these statements after the date of this presentation, except as required by law, and also takes no obligation to update or correct information prepared by third parties that are not paid for by Vertex Energy.

|

|

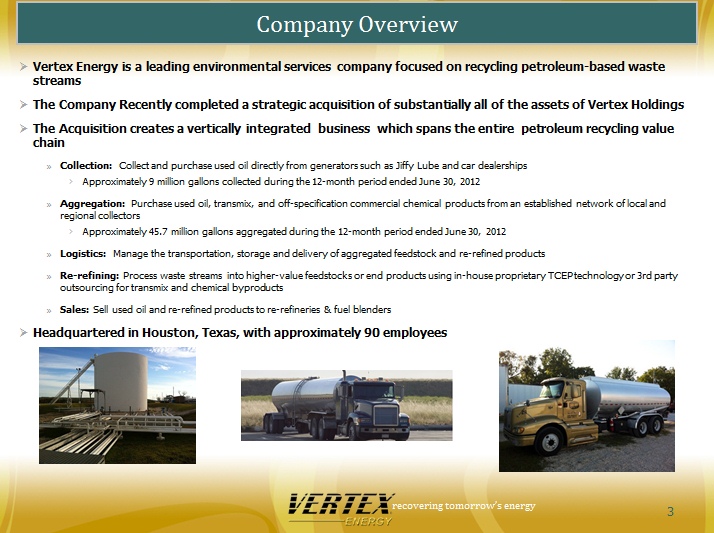

Vertex Energy is a leading environmental services company focused on recycling petroleum-based waste streams

|

|

|

The Company Recently completed a strategic acquisition of substantially all of the assets of Vertex Holdings

|

|

|

The Acquisition creates a vertically integrated business which spans the entire petroleum recycling value chain

|

|

|

Collection: Collect and purchase used oil directly from generators such as Jiffy Lube and car dealerships

|

|

|

Approximately 9 million gallons collected during the 12-month period ended June 30, 2012

|

|

|

Aggregation: Purchase used oil, transmix, and off-specification commercial chemical products from an established network of local and regional collectors

|

|

|

Approximately 45.7 million gallons aggregated during the 12-month period ended June 30, 2012

|

|

|

Logistics: Manage the transportation, storage and delivery of aggregated feedstock and re-refined products

|

|

|

Re-refining: Process waste streams into higher-value feedstocks or end products using in-house proprietary TCEP technology or 3rd party outsourcing for transmix and chemical byproducts

|

|

|

Sales: Sell used oil and re-refined products to re-refineries & fuel blenders

|

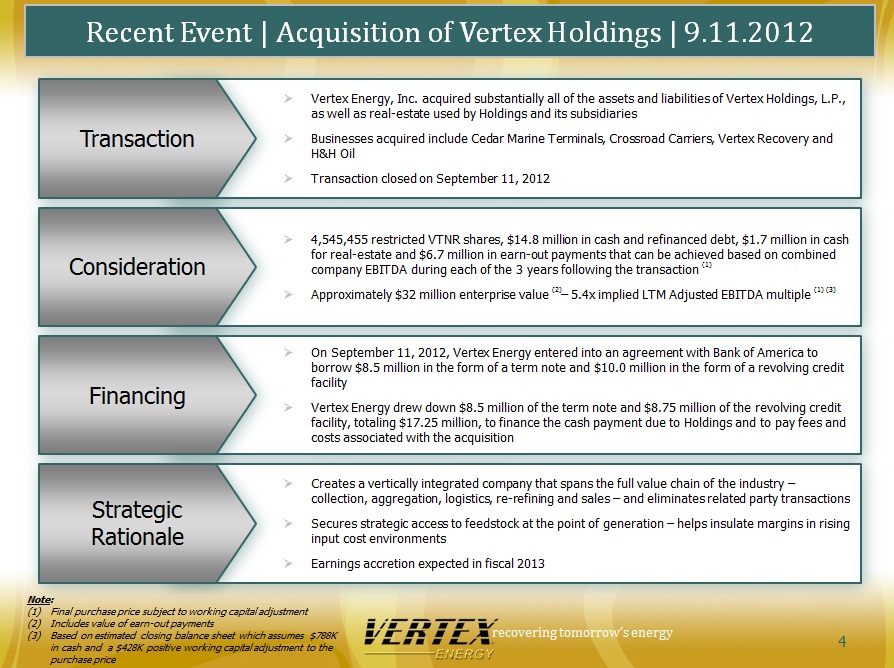

Transaction Vertex Energy, Inc. acquired substantially all of the assets and liabilities of Vertex Holdings, L.P., as well as real-estate used by Holdings and its subsidiaries

Businesses acquired include Cedar Marine Terminals, Crossroad Carriers, Vertex Recovery and H&H Oil

Transaction closed on September 11, 2012

Consideration

4,545,455 restricted VTNR shares, $14.8 million in cash and refinanced debt, $1.7 million in cash for real-estate and $6.7 million in earn-out payments that can be achieved based on combined company EBITDA during each of the 3 years following the transaction (1)

Approximately $32 million enterprise value (2)– 5.4x implied LTM Adjusted EBITDA multiple (1) (3)

Financing

On September 11, 2012, Vertex Energy entered into an agreement with Bank of America to borrow $8.5 million in the form of a term note and $10.0 million in the form of a revolving credit facility

Vertex Energy drew down $8.5 million of the term note and $8.75 million of the revolving credit facility, totaling $17.25 million, to finance the cash payment due to Holdings and to pay fees and costs associated with the acquisition

Strategic Rationale

Creates a vertically integrated company that spans the full value chain of the industry – collection, aggregation, logistics, re-refining and sales – and eliminates related party transactions

Secures strategic access to feedstock at the point of generation – helps insulate margins in rising input cost environments

Earnings accretion expected in fiscal 2013

Final purchase price subject to working capital adjustment

Includes value of earn-out payments

Based on estimated closing balance sheet which assumes $788K in cash and a $428K positive working capital adjustment to the purchase price

Provides a variety of collection, transportation, terminaling, re-refining and processing solutions for petroleum products, crudes, used lubricants and other energy resources

Owned IP relating to Thermal Chemical Extraction Process (“TCEP”), a method of re-refining used oil and other petroleum by-products

Headquartered in Houston and operates mainly throughout the Gulf States region of the US

Approximately 80 employees

Vertex Recovery aggregates and recycles used oil and residual materials from large regional and national customers throughout the US and Canada. It facilitates its services through a network of independent recyclers and franchise collectors

Cedar Marine Terminals operates a 19-acre bulk liquid storage facility on the Houston Ship Channel. The terminal serves as a truck-in, barge-out facility and provides through-put terminal operations. It is also the site of the TCEP re-refining process

Processed approximately 13.5M gallons in 2011 and 14M during the last 12 months

Crossroad Carriers is a third-party common carrier that provides transportation and logistical services for liquid petroleum products, as well as other hazardous materials and waste streams

7 transport trucks in operation

H&H Oil collects and recycles used oil, used oil filters, antifreeze, and residual materials from customers based in Austin, Baytown, and Corpus Christi, Texas

13 collection trucks in operation

9M gallons collected in 2011 and 9.1M during the last 12 months

Generators Overview

Third parties Generate used oil through core business

Jiffy Lube, car dealerships, etc

Collectors, Aggregators, Processors, End Users

Collect used oil from generators

Typically local or regional

Highly fragmented

Purchase used oil from collectors

Sell and deliver it as feedstock for processors

Process used oil

Technology upgrades input into higher value end products

End product is used as an industrial fuel, ship fuel, base oil, or refinery feedstock

Historically, an aggregator and logistics manager of used oil feedstock Acquisition gives Vertex Energy collection capabilities Used oil sold to third-party re-refineries or transferred to Refining & Marketing Division

Refining & Marketing Division

Aggregator and logistics manager of transmix and byproduct feedstocks Manage 3rd party re-refining process Manage and conduct TCEP

Sell re-refined products

Re-refineries Fuel Blenders Re-refineries Used Oil Pipeline Transmix & Chemical Byproduct Feedstock

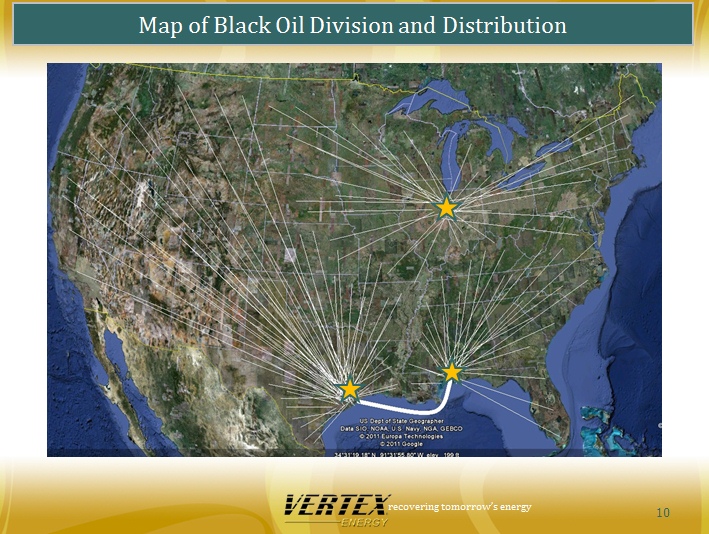

Black Oil Division is engaged in the collection and aggregation of used oil and logistics management

Direct collection of used oil from generators

Aggregation of used oil from third party collectors

In-house and third-party transportation and storage

Feedstock transferred to re-refining and marketing division or sold to third parties including re-refineries and fuel blending companies

Used oil is sourced at prices that are somewhat tied to natural gas

Traditional entities that utilize used oil as a fuel source now have the option of using natural gas

Most collectors are geographically constrained – limits client base

Used oil is sold to clients at prices indexed off of crude oil (#6 Oil)

Increasing spread between natural gas and crude improves margin

Map of Black Oil Division and Distribution

Feedstocks

Pipeline transmix

Byproducts from chemical plants and refineries

Used oil

End Products

Gasoline Blendstock raw gasoline product sold to large fuel blenders

Pygas feedstock for various chemical production processes

Marine Cutterstock cutterstock sold to oil trading companies used in fuel

Diesel Replacements sold directly to commercial end-users

Refining Feedstock higher value feedstock for re-refineries Opportunistically purchase distressed hydrocarbon feedstocks

Outsourced production allows flexibility to purchase feedstock based on demand and market pricing Thermal-Chemical Extraction Process (“TCEP”)

Refining Feedstock

Diesel Replacement

Thermal-Chemical Extraction Process (“TCEP”) is a technology within our Refining & Marketing Division that was launched in July of 2009

Process utilizes thermal and chemical dynamics to extract impurities from used oil

Developed to capture greater margin in the used oil value chain by upgrading used oil internally

Current annual capacity of approximately 30 million gallons

Converts used oil feedstock into refining feedstock and diesel replacement products that can be used in all grades of ship fuel

End product is sold into a large marine and fuel blending market at prices indexed to crude oil

Process economics are driven by feedstock vs. end product spread and throughput

Process economics are driven by feedstock vs. end product spread and throughput

Same spread dynamic as the Black Oil Division with greater margin capture through internal processing and end product sales

Opportunity to further upgrade end products to capture additional margin

Successfully leveraging our history as a value-added feedstock logistics provider to become a leading re-refiner of used petroleum products

TCEP contribution ramping up dramatically and should aid margin improvement

Acquisition of Vertex Holdings adds incremental TCEP volumes

Expand Black Oil aggregation footprint

New Aggregation facility in California, Los Angeles market

Increased reach in sourcing greater amounts of feedstock

Replicate and rollout additional TCEP facilities Locate new TCEP facility sites at marine ports to capitalize on feedstock availability

Acquire used oil collectors Greater control of feedstock in key markets coupled with new TCEP facilities Acquire other used oil collectors

Pursue further vertical integration opportunities Invest in TCEP to produce higher value end product Acquire other recycling and processing technologies for products such as oil filters and antifreeze

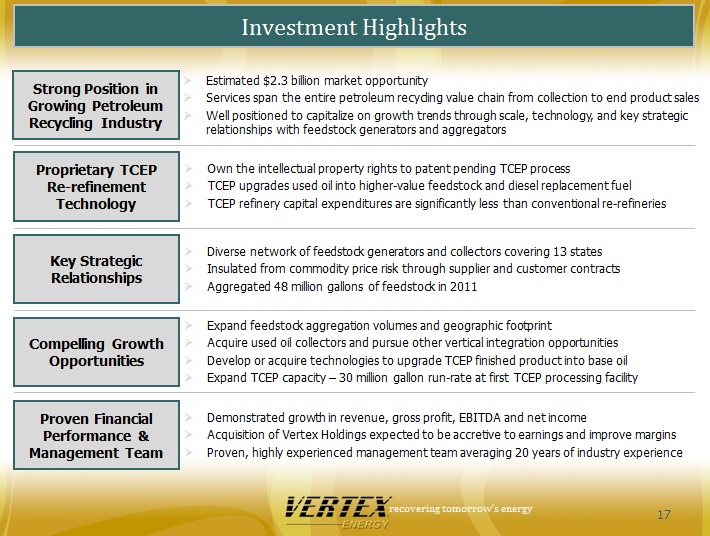

Estimated $2.3 billion market opportunity

Services span the entire petroleum recycling value chain from collection to end product sales

Well positioned to capitalize on growth trends through scale, technology, and key strategic relationships with feedstock generators and aggregators

Own the intellectual property rights to patent pending TCEP process

TCEP upgrades used oil into higher-value feedstock and diesel replacement fuel

TCEP refinery capital expenditures are significantly less than conventional re-refineries

Diverse network of feedstock generators and collectors covering [13] states

Insulated from commodity price risk through supplier and customer contracts

Aggregated 48 million gallons of feedstock in 2011

Expand feedstock aggregation volumes and geographic footprint

Acquire used oil collectors and pursue other vertical integration opportunities

Develop or acquire technologies to upgrade TCEP finished product into base oil

Expand TCEP capacity – 30 million gallon run-rate at first TCEP processing facility

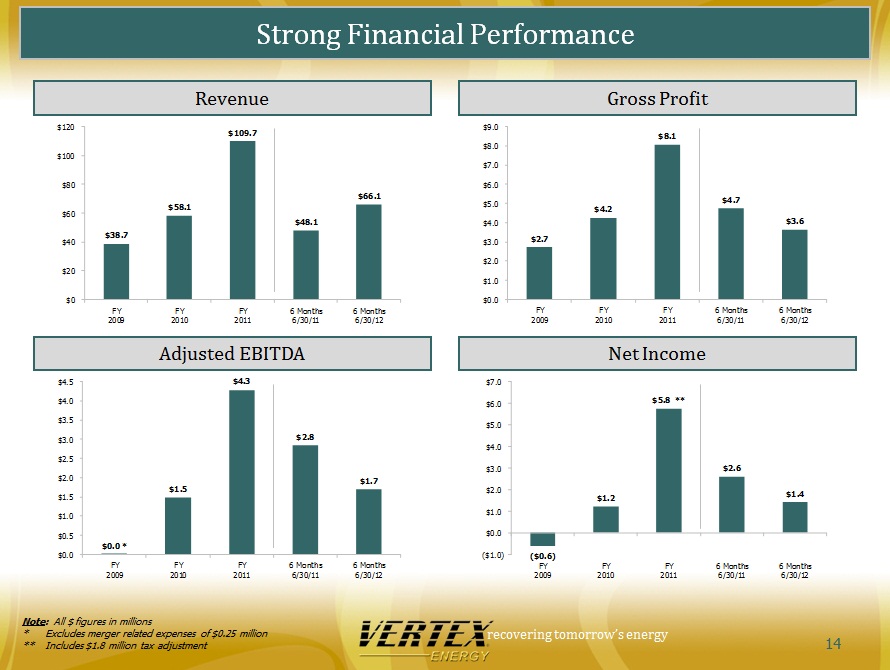

Demonstrated growth in revenue, gross profit, EBITDA and net income

Acquisition of Vertex Holdings expected to be accretive to earnings and improve margins

Proven, highly experienced management team averaging 20 years of industry experience

Benjamin P. Cowart | Chief Executive Officer, Chairman of the Board, Founder 26+ years petroleum recovery industry, pioneering the reclamation industry by developing recycling options for many hydrocarbon residual materials once managed as hazardous wastes Matthew Lieb | Chief Operating Officer 17+ years business leadership, operations, consulting expertise, 3 startups and public company experience Chris Carlson | Chief Financial Officer 12+ years financial management, energy, commodity, treasury and risk management John Strickland | Manager of Supply & Trading 27+ years management and marketing of fuels and petroleum blending operations Greg Wallace | Manager of Refining & Marketing 22+ years processing, trading and marketing of petroleum and chemicals Mike Stieneker| General Manager of H&H Oil Collections 20+ years management and operations of Used Oil Collections Mike Carter| General Manager of Operations and Regulatory Compliance 20+ years management and terminal operations

Ben Cowart

CEO

(281) 486-4182

benc@vertexenergy.com

www.vertexenergy.com